Original title: "High APY Returns, Check Out These 7 New Stablecoin Pools in Unstable Markets"

The bull market has arrived, and all yield mechanisms are amplifying interest rate differentials driven by bullish sentiment. Stablecoin deposits, withdrawals, and lending can also bring a sense of stability and happiness. BlockBeats has compiled seven high-APR pools focused on mainstream stablecoins, all with APYs above 10%. Let's take a look at them one by one:

Huma Finance

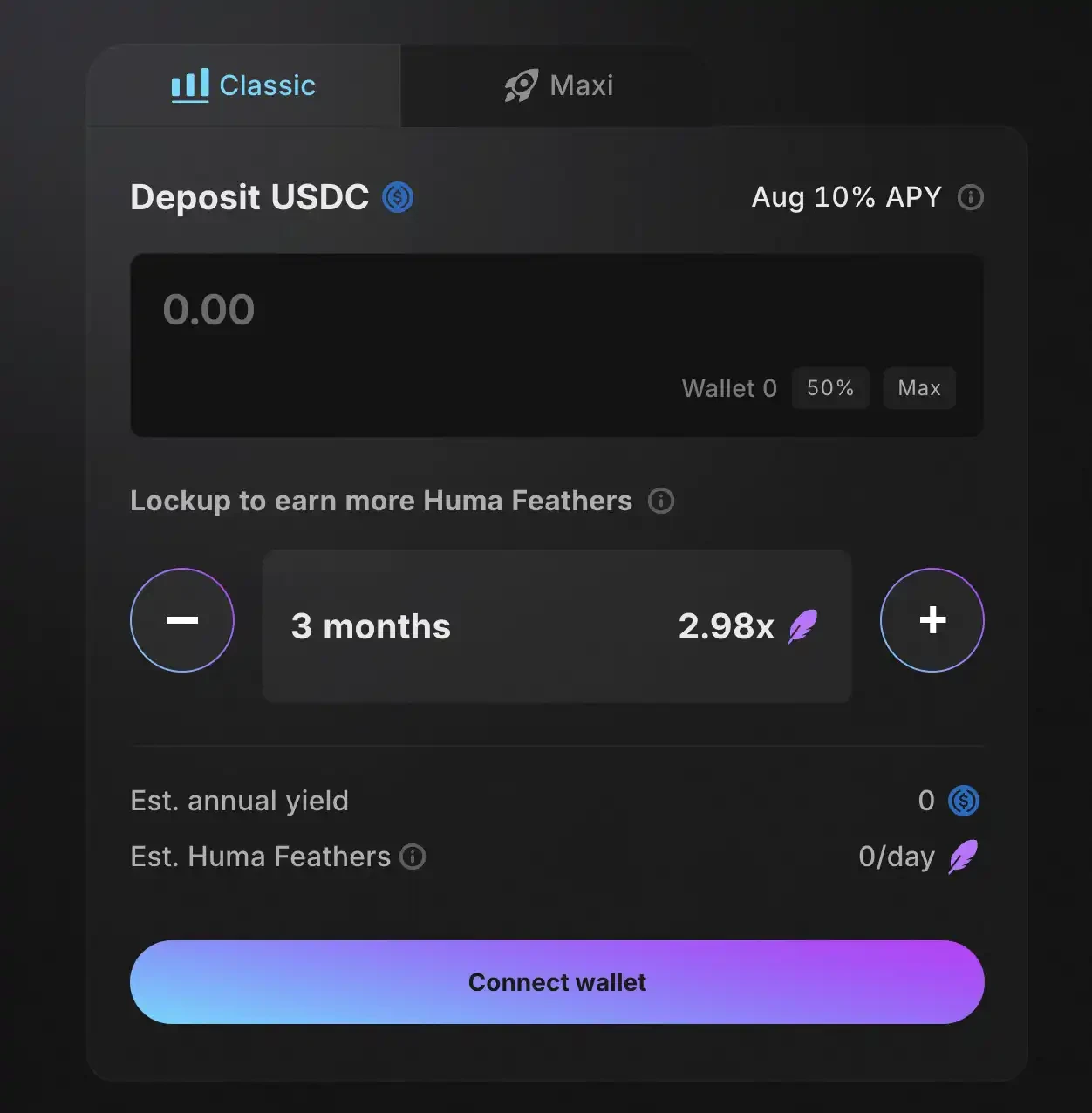

Huma Finance is a decentralized income platform running on Solana. The source of income behind it is linked to real payment and financing activities. It was launched in April 2025 and recently reopened Huma 2.0 deposits.

Users depositing USDC can mint LP share tokens: $PST in Classic mode, which earns approximately 10.5% annualized USDC yield and a base Huma Feathers reward. $mPST in Maxi mode offers no interest but a 19x Feathers reward multiplier. Both modes offer a choice of what you need, with a maximum deposit of 500,000 USDC per wallet.

According to the official Dune dashboard, Huma 2.0 has facilitated approximately $5.62 billion in trading volume since its launch, generating approximately $4.592 million in total user revenue and distributing 2.66 billion Feathers. Currently, the platform has approximately $150 million in active liquidity, of which approximately $104 million is invested in PayFi (payment financing), and the remaining $46.015 million is in liquid, redeemable at any time.

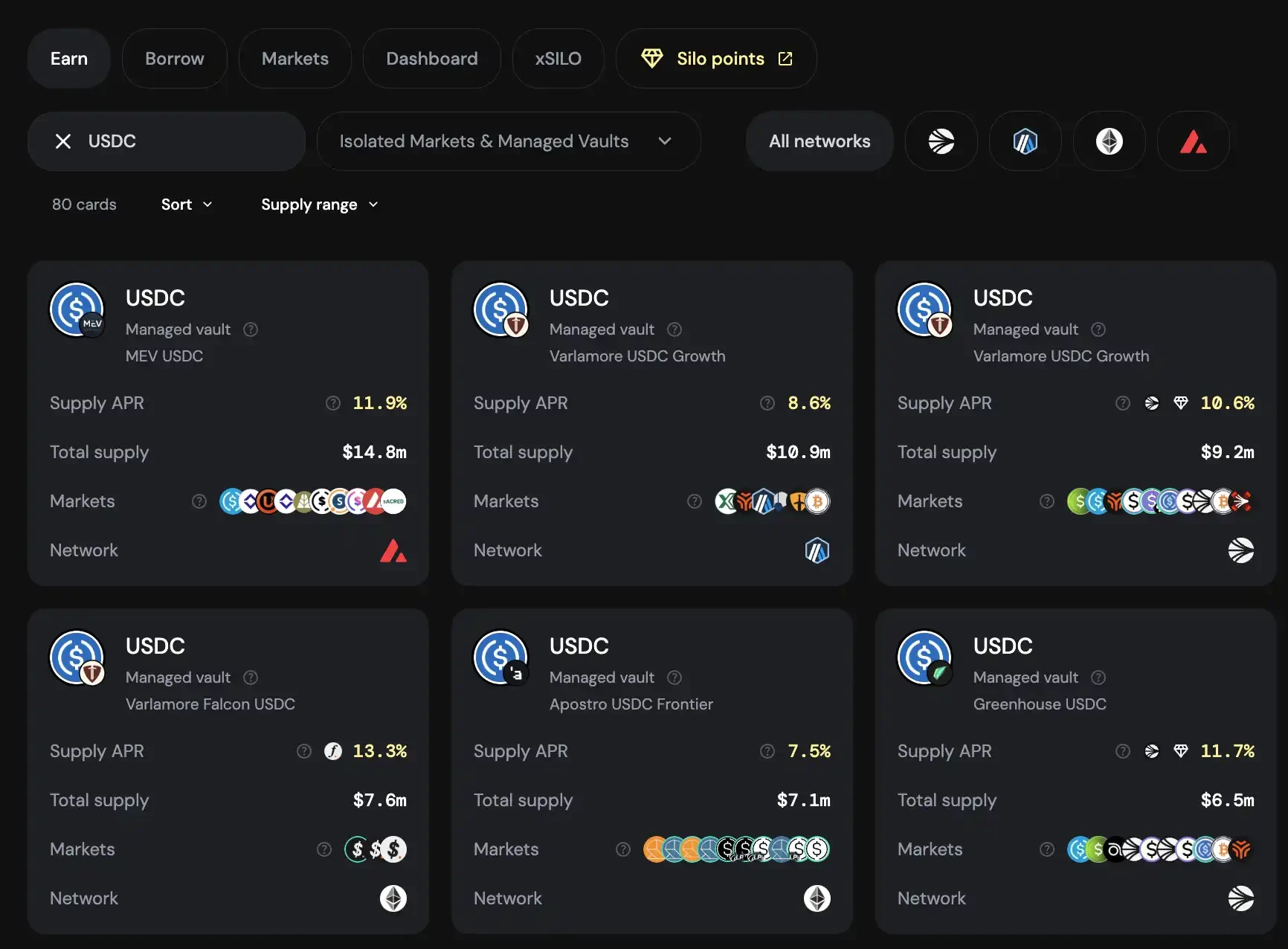

Silo Finance

Silo Finance is a risk-isolated, non-custodial lending protocol deployed across multiple chains. Each asset has its own independent market (Silo), where funding and lending are independent of each other, and risk is divided by asset. Users simply deposit supported tokens (such as USDC, ETH, WBTC, etc.) into the corresponding Silo and automatically earn interest based on market parameters.

According to DeFiLlama data, Silo Finance's total TVL is approximately $228 million, distributed across chains such as Sonic (113 million), Avalanche (46.2 million), Ethereum (44.4 million), and Arbitrum (23.53 million). Selecting the USDC Managed Vault, Silo Finance currently offers an APY of 7%-13%.

BFUSD

BFUSD is a "passive income-generating margin asset" launched by Binance, specifically designed for futures traders. Users can convert USDT or USDC into BFUSD at a 1:1 ratio and store it in a U-margined futures account. Without staking or any additional steps, users automatically receive daily returns in the form of stablecoins.

According to the official website, BFUSD's income comes from three main sources: a base annual yield (APY) of 3.97%, derived from dividends generated by Binance's hedging and staking strategies; a derived APY of 4.89%, derived from additional income distribution on BFUSD under the joint margin model, which requires holders to trade at least one U-margin contract to activate; and a wealth management APY of 0.40%, derived from income allocated from Binance's wealth management products. Combined, these three factors bring the total annualized return on holding BFUSD to approximately 9.26%.

To ensure risk management, BFUSD has a system collateralization ratio of 100.87%, and Binance has allocated $10.34 million in special reserves to ensure redemption during extreme market fluctuations. Furthermore, the total supply of BFUSD is approximately 1.435 billion, with allocations based on user VIP levels. Users who require a higher allocation can obtain additional quota by opening a sub-account.

The platform charges a 0.1% handling fee for each purchase or redemption of BFUSD. Rewards are calculated based on the lowest BFUSD balance in the daily snapshot and are distributed directly to the user's U-standard contract account the following day. Users can view details in their Reward History.

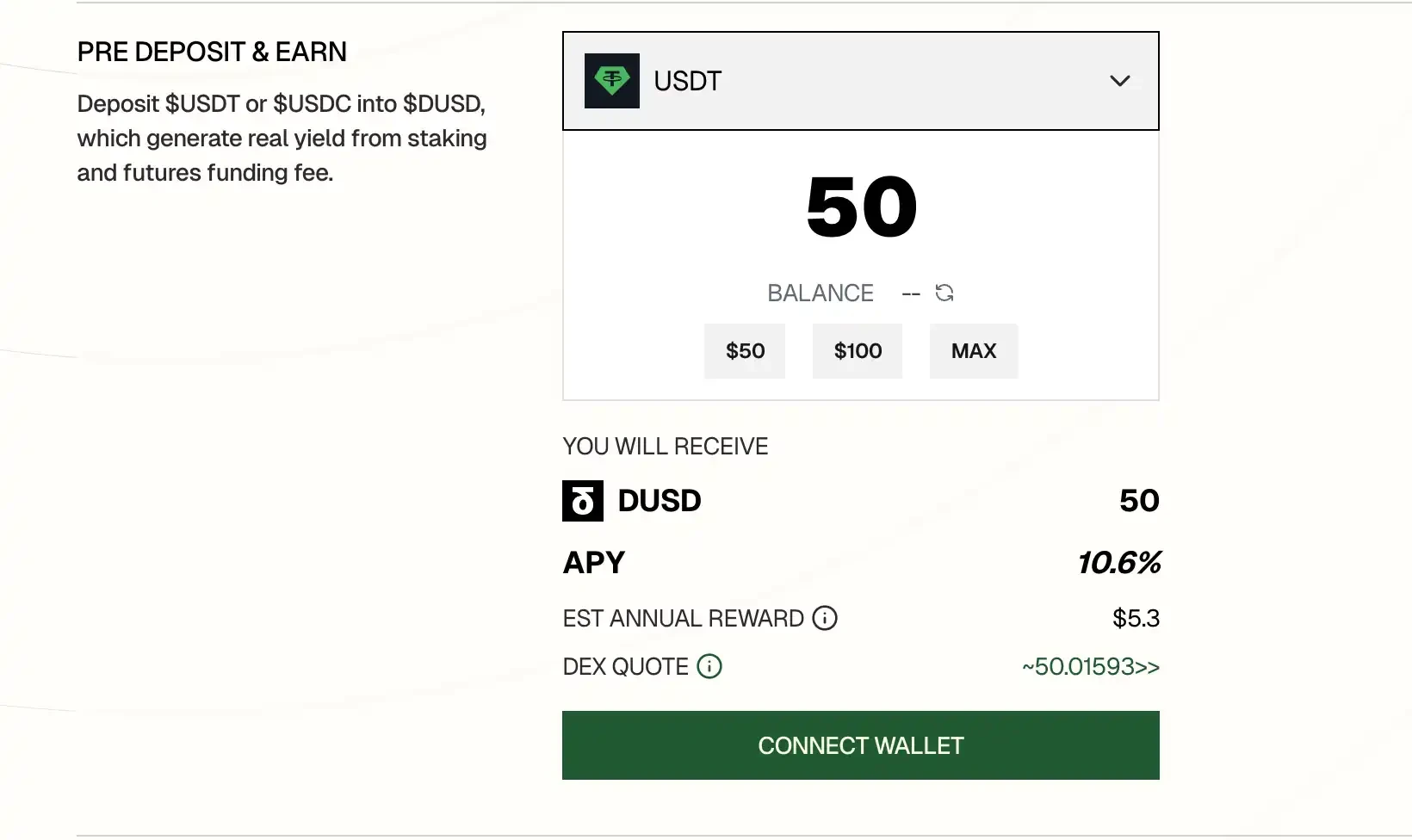

StandX

StandX is a Persistent DEX currently in Alpha testing. Founded by Aaron Gong, former head of Binance contracts, and former colleagues at Goldman Sachs, and funded by the Solana Foundation, StandX's core product is DeFi (DUSD), which users can mint at a 1:1 ratio using USDT or USDC.

On StandX's "Deposit USDT to Mint DUSD" interface, you can directly select the asset you want to deposit (e.g., USDT) and enter the amount in the input box. The system will instantly display the amount of DUSD you will receive. The current strategy calculates an annualized yield of 10.6% APY. Redemptions only incur a 0.1% handling fee.

Holding DUSD offers two main streams of income: staking income from mainstream assets like ETH and SOL, and funding income from hedging short-term perpetual contracts. DUSD's immediate annualized return once approached 13%, but the official website displays a seven-day average of approximately 7.5%.

Wasabi

Wasabi Protocol, a "CultureFi" leveraged trading platform founded in 2022, initially focused on leveraged long-short strategies for niche assets such as NFTs and memecoin, and later expanded its business to the broader DeFi leverage and market making sectors. Investors include Electric Capital, Alliance DAO, and Memeland.

Wasabi Protocol launched Wasabi Earn on the Base network. Open Finance in Coinbase's Base App and select Wasabi Earn. Deposit USDC with one click and you can automatically start enjoying an annualized return of up to 20%.

This revenue comes from Wasabi's on-chain leveraged trading strategy: your USDC is used as liquidity for up to 456 trading pairs, funding market making and leveraged lending. The interest paid by borrowers is ultimately returned to depositors. To date, it has supported $1.23 billion in total trading volume and accumulated TVL of $23.8 million.

Wildcat-KAI 2 USDC

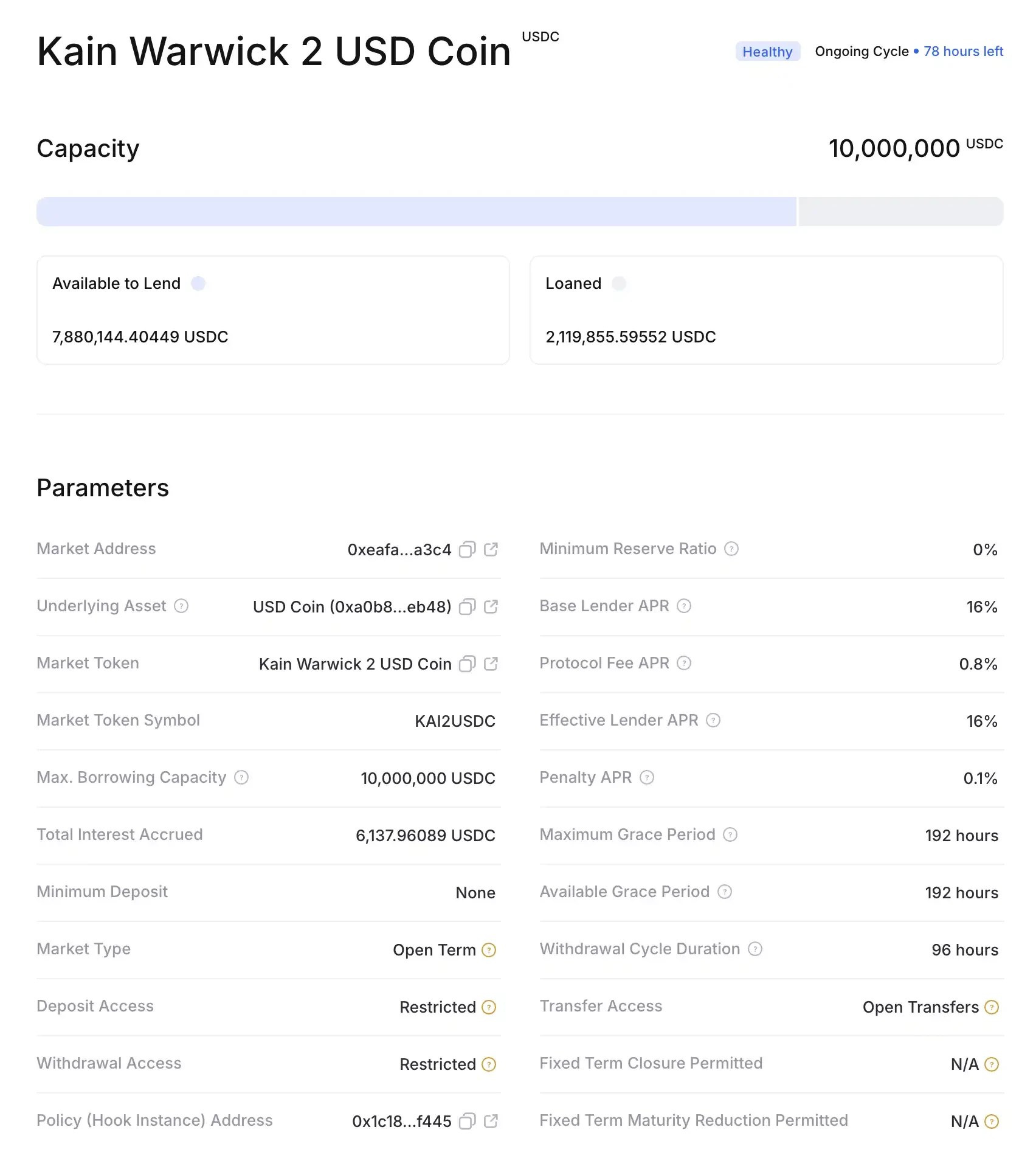

Founded in 2022 and headquartered in the UK, Wildcat Labs is a risk-isolated, unsecured lending protocol. Each silo operates independently to prevent liquidations or vulnerabilities from spreading across different silos. To date, Wildcat has accumulated over five different asset markets on mainnets such as Ethereum, with a total TVL exceeding $70 million (including its latest USDC market, which has exceeded $2.1 million in lending volume).

On August 1, 2025, Bodhi Ventures — a Web 3 venture capital firm led by Synthetix founder and Infinex co-founder Kain Warwick — opened the third USDC market on Wildcat, publicly seeking 10 million USDC quota, with a base lending APR locked at 16%, and the market is open with no maturity date.

There's no minimum deposit requirement; any address that has completed OFAC verification can deposit USDC. Deposited funds will be minted into a freely tradable debt certificate, "KAI 2 USDC." Currently, $2 million of the available quota has been used, leaving 7.8 million USDC available for 78 hours. Withdrawals are subject to a 96-hour withdrawal cycle and a maximum grace period of 192 hours. Redemptions incur a 0.1% handling fee; overdue interest is 0.1%.

Aave

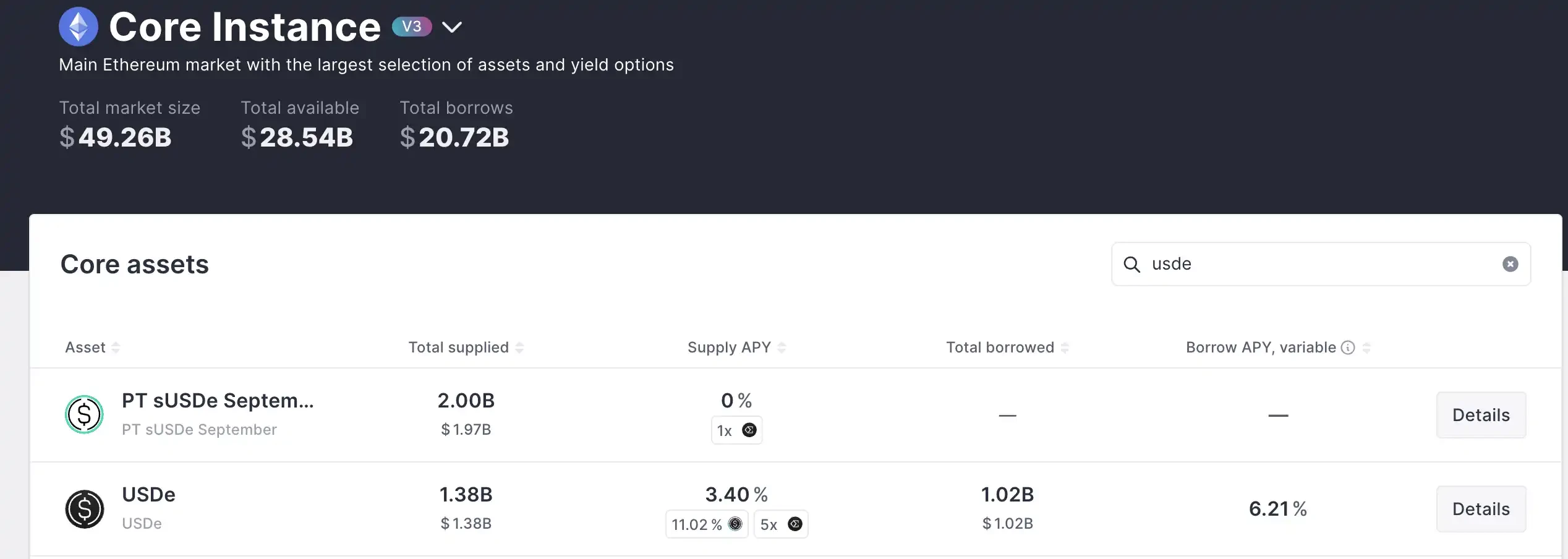

Last week, Ethena Liquid Leverage was launched on Aave. Coupled with the widening price gap between APY and lending rates driven by the bull market, the short-term APY of revolving lending on AAVE can be as high as 50%.

After depositing 50% sUSDe and 50% USDe simultaneously in Aave's stablecoin E-Mode, you can borrow USDC or USDT, then convert the borrowed stablecoin back to USDe, redeposit it again, and borrow again, repeating this cycle. Each time you complete this cycle, you'll receive an additional sUSDe native yield and the USDe funding fee difference.

Currently, the typical funding fee (Borrow APR) in the market is around 11%, while the base annualized return (Supply APR) for directly depositing USDe/sUSDe is around 12%, resulting in a spread of approximately 7%. After five cycles, the theoretically achievable APY is: 12% + 4 × (12% – 5%), or 40%. Combined with Ethena's additional incentives for Liquid Leverage (currently available until the end of August), the short-term peak APY could reach around 50%, but this will only last until the end of this month and is expected to drop significantly after the subsidies expire.