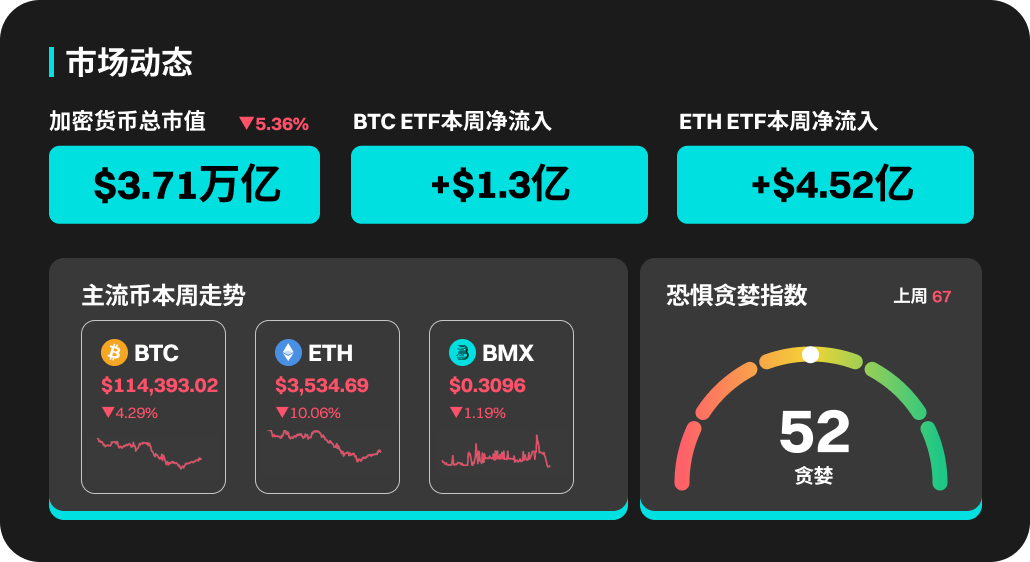

According to BitMart's market report on August 4, the total market value of cryptocurrencies in the past week was 3.71 trillion, down 5.36% from the previous week.

Crypto market dynamics this week

Last week, BTC ETFs saw a net inflow of $130 million. BTC plummeted from $120,000 to around $112,000, where it found some support. Despite this sharp drop, BTC's market share rebounded slightly to 61.2%, indicating that BTC remained resilient amidst the overall downturn, while altcoins experienced greater declines.

Last week, ETH ETFs saw net inflows of $452 million, marking the ninth consecutive week of net inflows, with inflows exceeding $7 billion in the last nine weeks. ETH briefly surged to around $3,940 last week before falling back to $3,500 as the broader market declined. ETH's gains over the past 30 days remain impressive, reaching 41%, and its market share is currently reported at 11.5%.

This week's popular currencies

Popular cryptocurrencies, including MAGIC, M, TON, WIZARD, and MEME, all performed well. MAGIC's price rose 25.06% this week, reaching a high of 0.2032 USDT. M's price rose 50.94%. WIZARD's price rose 94.41% this week, with a 24-hour trading volume of 679.99 million USDT.

U.S. market and hot news

Last week, the US stock market experienced an overall downward trend, impacted by a variety of factors. The S&P 500 fell 1.60% on Friday (August 1st), bringing its weekly decline to 2.36%. The Dow Jones Industrial Average fell 1.23% on Friday, bringing its weekly decline to 2.92%. The Nasdaq Composite fell 2.24% on Friday, bringing its weekly decline to 2.17%. Market sentiment was impacted by July's non-farm payroll data, which fell far below expectations and indicated an accelerating deterioration in the labor market. Traders increased bets on a September interest rate cut by the Federal Reserve. Furthermore, the White House announced plans to increase tariffs on trading partners with which no agreement had been reached, effective midnight on August 7th, further exacerbating market uncertainty.

Trump's reciprocal tariffs delayed by a week to August 7

Unlock popular sections and projects

DeFi

The DeFi sector was one of the hottest sectors last week, encompassing sub-sectors such as liquidity provision, stablecoins, and real-world assets (RWAs). Ethena surged 105% in July, primarily driven by its listing on Upbit and the accumulation of whales. Curve DAO surged 85%, driven by its V3 upgrade, which reduced gas fees, and its partnerships with stablecoin projects. Ondo Finance also garnered attention for its applications in the RWA space. Other projects such as PancakeSwap, Tetu.io, DIA, and MetaKujira were frequently mentioned in social media discussions, demonstrating the sector's high activity.

IOTA (IOTA) will unlock approximately 8.63 million tokens at 8:00 AM Beijing time on August 4, accounting for 0.22% of the current circulating supply and worth approximately $1.6 million.

GoGoPool (GGP) will unlock approximately 750,000 tokens at 8:00 AM Beijing time on August 4th, accounting for 10.60% of the current circulation and worth approximately US$1.2 million.

Ethena (ENA) will unlock approximately 172 million tokens at 3:00 PM Beijing time on August 5th, accounting for 2.70% of the current circulating supply and worth approximately US$95.8 million.

Immutable (IMX) will unlock approximately 24.52 million tokens at 8:00 AM Beijing time on August 8, accounting for 1.30% of the current circulating supply and worth approximately $12.2 million.

Risk Warning:

Use of BitMart services is entirely at your own risk. All cryptocurrency investments (including returns) are inherently highly speculative and involve substantial risk of loss. Past, hypothetical, or simulated performance is not necessarily indicative of future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. You should carefully consider whether trading or holding digital currencies is appropriate for you based on your personal investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.