Original title: "Michael Saylor: How can Bitcoin strategies avoid being liquidated?"

Original author: Steven Ehrlich

Original translation: Saoirse, Foresight News

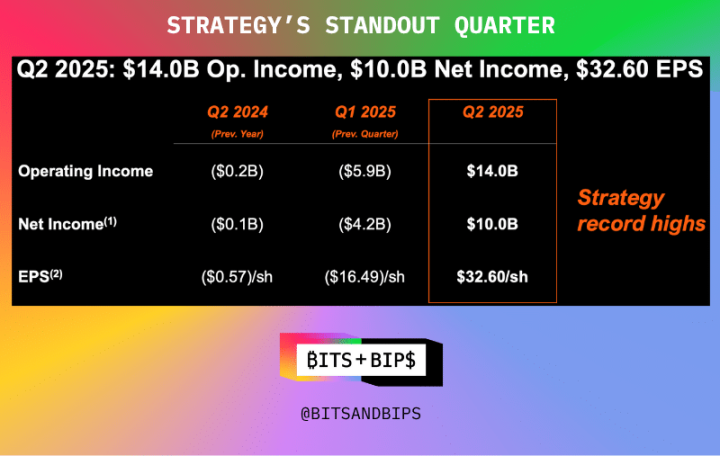

Michael Saylor, chairman of MSTR (MSTR), won widespread praise from the investment community on Friday after his company set record highs for operating revenue, net income, and earnings per share in the latest quarter (see chart below).

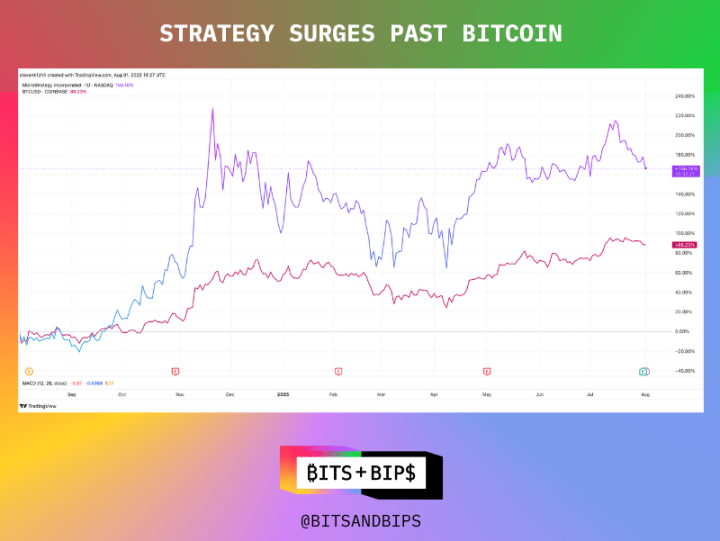

In fact, the company’s stock price has risen 166% over the past year, double the growth of Bitcoin (BTC) over the same period.

(Trading View)

By any measure, this performance is remarkable, especially given the surge in imitators that threaten to divert investor funds.

But that doesn’t mean Strategy can rest on its laurels. As a leader in the cryptocurrency fund management space, it has certain privileges, and it seems poised to capitalize on them.

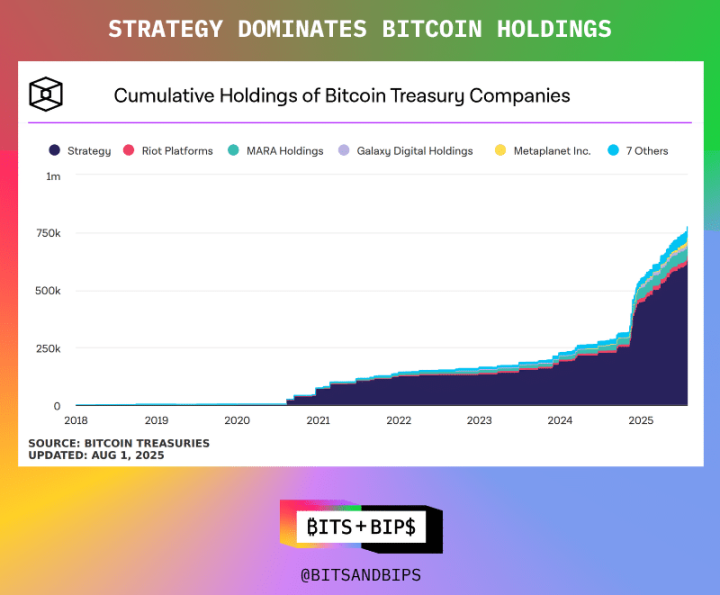

Bitcoin reserves continue to increase, but strategies have changed

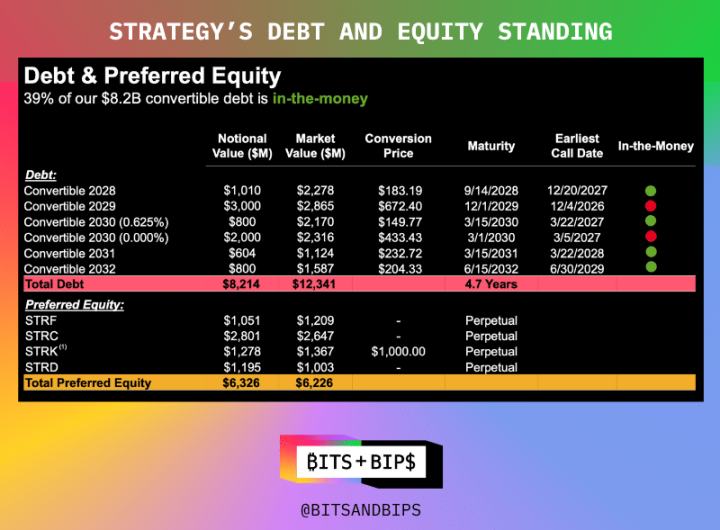

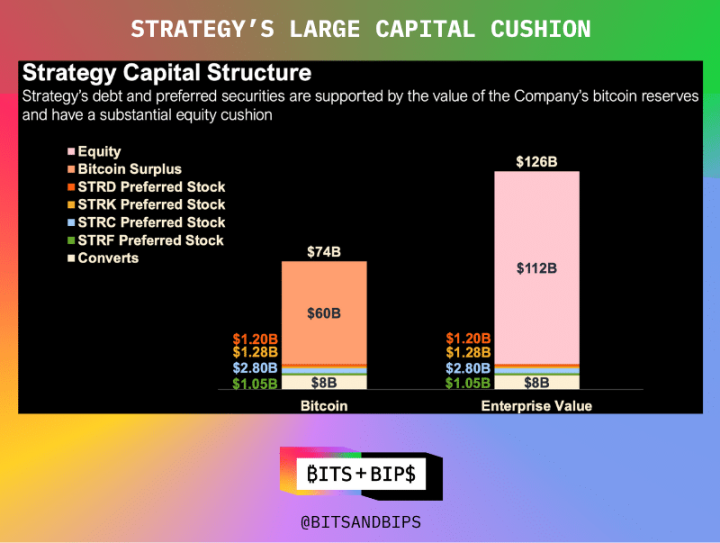

As of this writing, Strategy holds 628,791 bitcoins, valued at $71.9 billion. The company has accumulated this portfolio through various means: issuing common stock, various types of preferred stock (which offer dividends or conversion rights in future years), and convertible bonds. A breakdown of each type of preferred stock is shown in the chart below.

But now, the company plans a major shift in its financing approach—specifically, a complete divestment from debt . Despite its strong balance sheet (reported enterprise value of $126 billion and just $8.2 billion in debt), the company aims to reduce debt to zero. In a conference call with investors following the July 31st earnings release, the company announced plans to redeem its outstanding convertible bonds and instead focus on issuing multiple tranches of preferred stock.

This means that its $6.3 billion preferred stock offering is expected to grow significantly . In fact, at the investor conference, the company announced plans to raise another $4.2 billion through its latest preferred stock product, Stretch (STRC), which has a target monthly yield of 10%.

"This decision reflects the healthy development of Strategy's ability to access capital markets. The convertible bond market is rife with hedge funds and arbitrageurs who build long positions in Strategy by purchasing convertible bonds, but at the same time reduce their net exposure by shorting a significant portion of the stock (approximately 25%). In other words, for every bond they buy, they sell a significant portion of the stock, effectively taking only a mildly bullish view on Strategy," said Lance Vitanza, Managing Director at TD Cowen, in an interview with Unchained (the full discussion can be viewed on the X platform or on YouTube ). "A few years ago, convertible bonds were the company's best funding channel. However, as Strategy has grown, they have been able to access the preferred stock market, which offers better terms, greater potential for capital appreciation, and more efficient pricing."

This move further underscores why Saylor is considered a demigod in the Bitcoin community—he is respected not only for hoarding Bitcoin, but also for his responsible approach. With few exceptions, he rarely uses leveraged financing, relying primarily on the equity market.

Although its solid capital structure has prevented forced liquidation (unless the price of Bitcoin plummets by more than 80%), Saylor continues to push the limits.

Always imitated, never surpassed

But don’t expect the multitude of followers in Bitcoin, ETH, SOL, BNB, etc. to follow suit. These institutions are just getting started, and as I’ve noted in other related reports, they are eager to compete and scale quickly.

That means using all the tools of the capital markets: private placements of public companies (PIPEs), credit lines, and, of course, debt.

As I wrote in a previous report, "Each approach has its pros and cons. Private placements can raise large amounts of capital in a short period of time, helping to jump-start a reserve strategy, but they can also create significant selling pressure. Issuers can also choose to register their shares with the SEC before issuing them, but this takes longer. More companies are now adopting a hybrid model: one-third of the funds come from private placements, with the remainder raised through convertible bonds or credit instruments. While this approach can delay selling pressure, it also increases balance sheet leverage, which can be problematic if prices plummet."

This means debt is practical for financing: shareholder dilution may not materialize for years, and in today’s frothy market, coupon rates are near zero. For example, Bitcoin fund manager Twenty One raised $485 million in convertible bonds in May to launch its strategy, while Anthony Pompliano raised $235 million in convertible bonds for his Bitcoin fund manager ProCap Financial in June.

This is essentially a "buy now, pay later" model.

A unique existence

For investors, this means they should always remember that Strategy remains a unicorn in the crowded cryptocurrency fund management landscape. Currently, it's the only company with access to the preferred stock market. Its first preferred stock offering took place in January of this year, and future offerings are expected to significantly increase.

For other companies, accessing the preferred stock market and eliminating debt remains a distant dream. “Most of these companies will start in the convertible bond market, hoping that some of them will grow and eventually qualify for the preferred stock market,” Vitanza said.