Original | Odaily Planet Daily ( @OdailyChina )

By CryptoLeo ( @LeoAndCrypto )

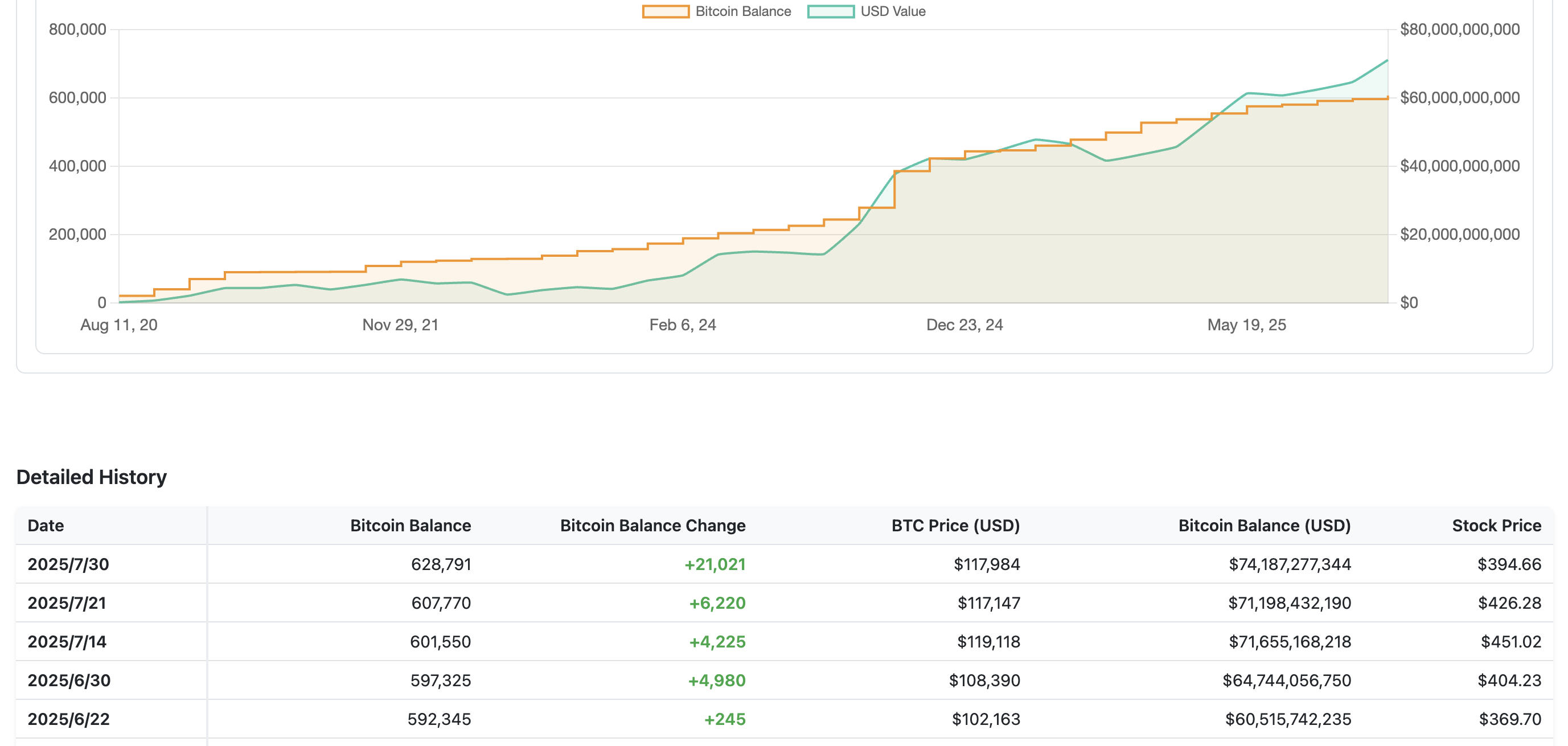

In early August, publicly traded companies began releasing their second-quarter 2025 financial reports. Strategy (MSTR) stood out among the group. Under the leadership of Michael Saylor, Strategy achieved record-breaking revenue of approximately $14.03 billion in the second quarter of 2025, a 7,106% year-over-year increase. Strategy's crypto holdings generated a $14 billion unrealized profit.

All of this is based on Saylor's decision to choose BTC as a reserve. From Strategy and Metaplanet to various companies transitioning to crypto reserves, from reserves to BTC to ETH, BNB, SOL, and SUI, and beyond, the types and companies of crypto token reserves have emerged in just a few months, just as the hot crypto space has evolved. For retail investors, in addition to investing in reserve tokens, they can also buy shares in the reserve companies . To this end, Odaily Planet Daily has compiled and reviewed commonly used websites and tools for querying crypto reserve company data, as follows:

Comprehensive query website

1. Blockworks

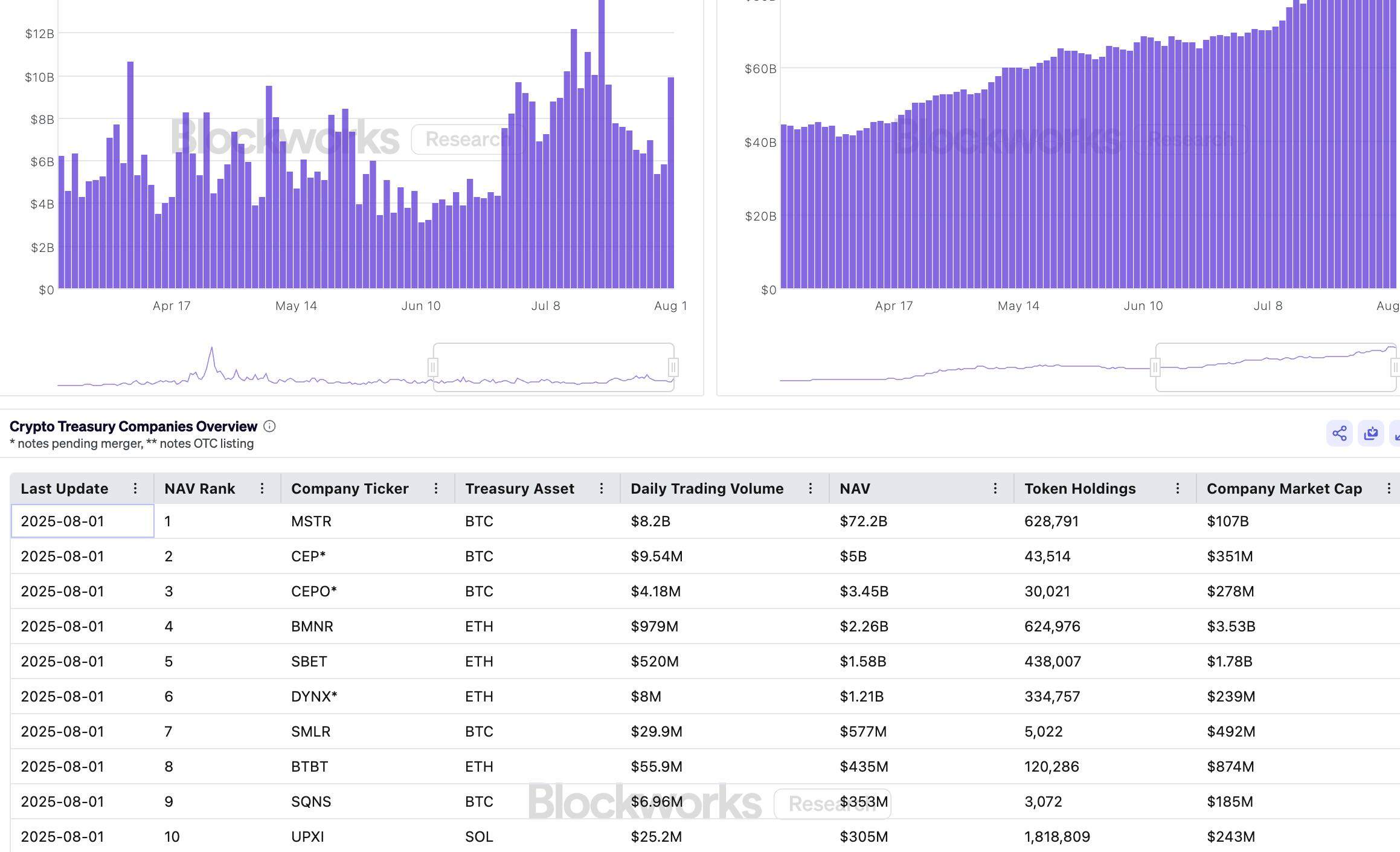

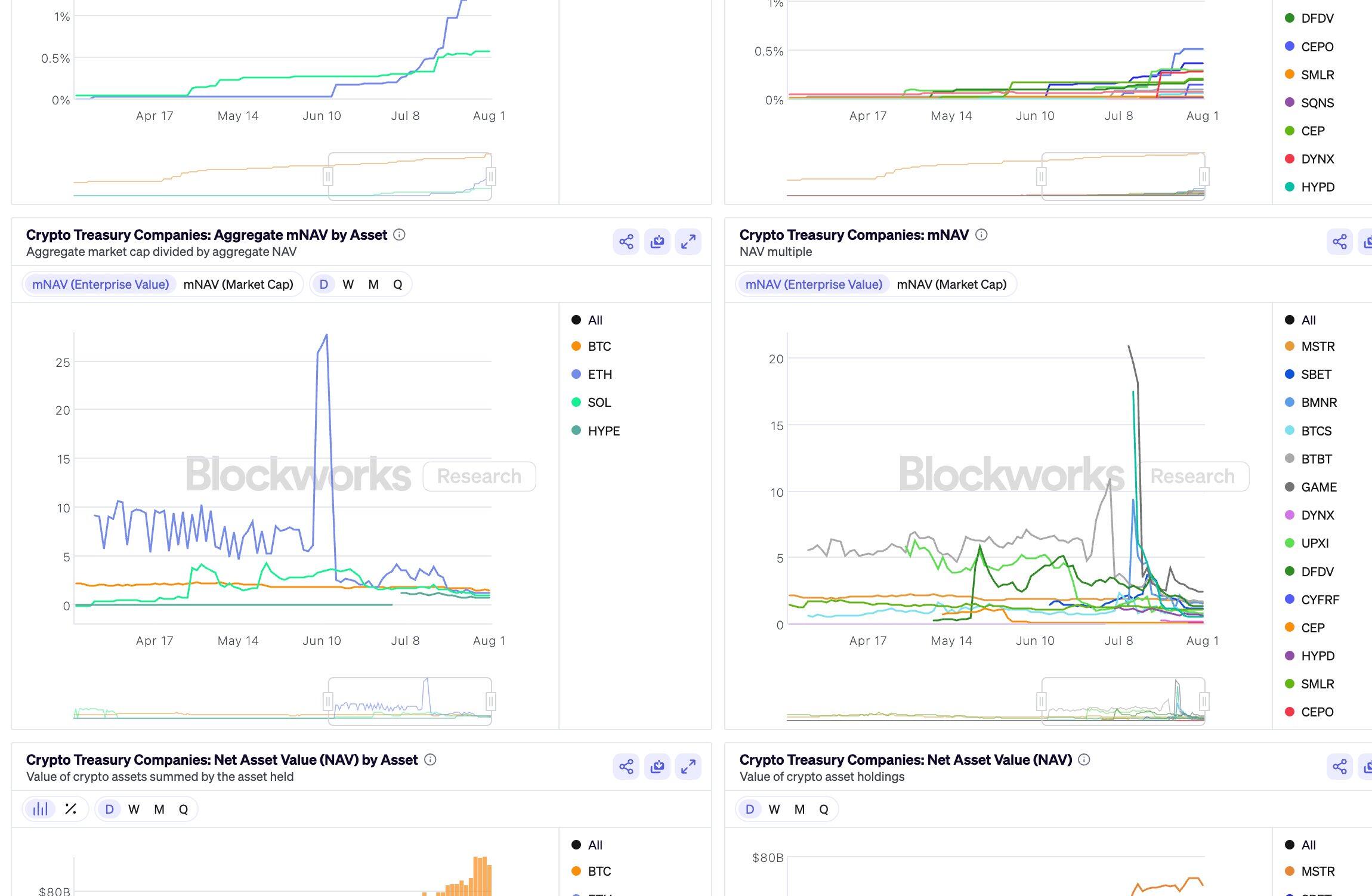

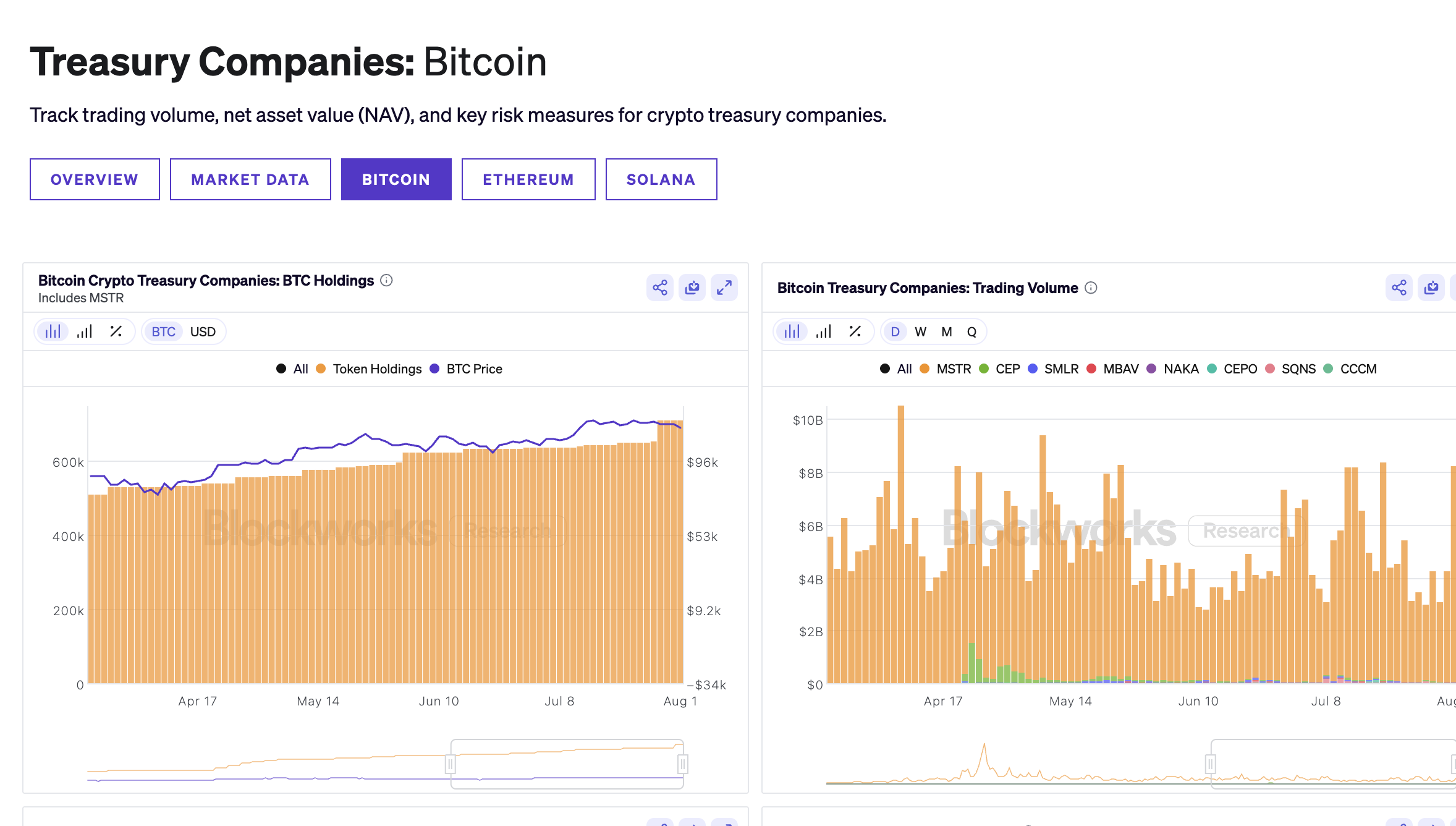

Introduction: Blockworks' crypto reserve company data covers BTC, ETH, SOL, HYPE, XRP, SUI, and multi-token reserves, with a total of 26 crypto reserve companies recorded. The data columns include key indicators such as the trading volume of crypto financial companies and the net asset value (NAV) of crypto. Users can clearly query:

Crypto reserve companies' stock ticker, reserve token name, daily stock trading volume, NAV, number of tokens held, and company market capitalization. Blockworks also ranks reserve companies based on their net asset value. (Stock data is sourced from Polygon.io, an API service that provides US stock market data.)

Blockworks also drew a data table for the above data. In addition to the data charts mentioned above, it is worth noting that Blockworks also drew an MNAV data table, which gives the data trend of the M (net asset value multiple) value, including the M value of enterprise value and company market value. M (market value) is the company's total market value divided by the value of crypto assets. M (enterprise value) is the company's market value + total debt - cash divided by the value of crypto assets. For example, Strategy's M (market value) is 1.48, and Strategy's M (enterprise value) is 1.68. M is also a risk indicator of the health of crypto reserves.

Blockworks also provides a table showing the company's net asset value premium (market capitalization minus the value of its crypto reserves) (e.g., Strategy's net asset value premium is $34.36 billion). There is also a table showing the total net asset value premium for each crypto reserve company (e.g., BTC Reserve's net asset value premium is $26.29 billion). This is because the stock value of some BTC reserve companies is less than the value of their crypto holdings, meaning their M is less than 1.

Evaluation: Overall, Blockworks provides comprehensive data, detailed individual data and risk indicators, and includes a large number of crypto reserve companies. Its Net Asset Value Premium and MNAV data tables provide a clear overview of the risk indicators of crypto reserve companies. A minor drawback is that the website only provides stock tickers, not full company names. For users unfamiliar with US stocks, they may need to first check the stock ticker before understanding the company.

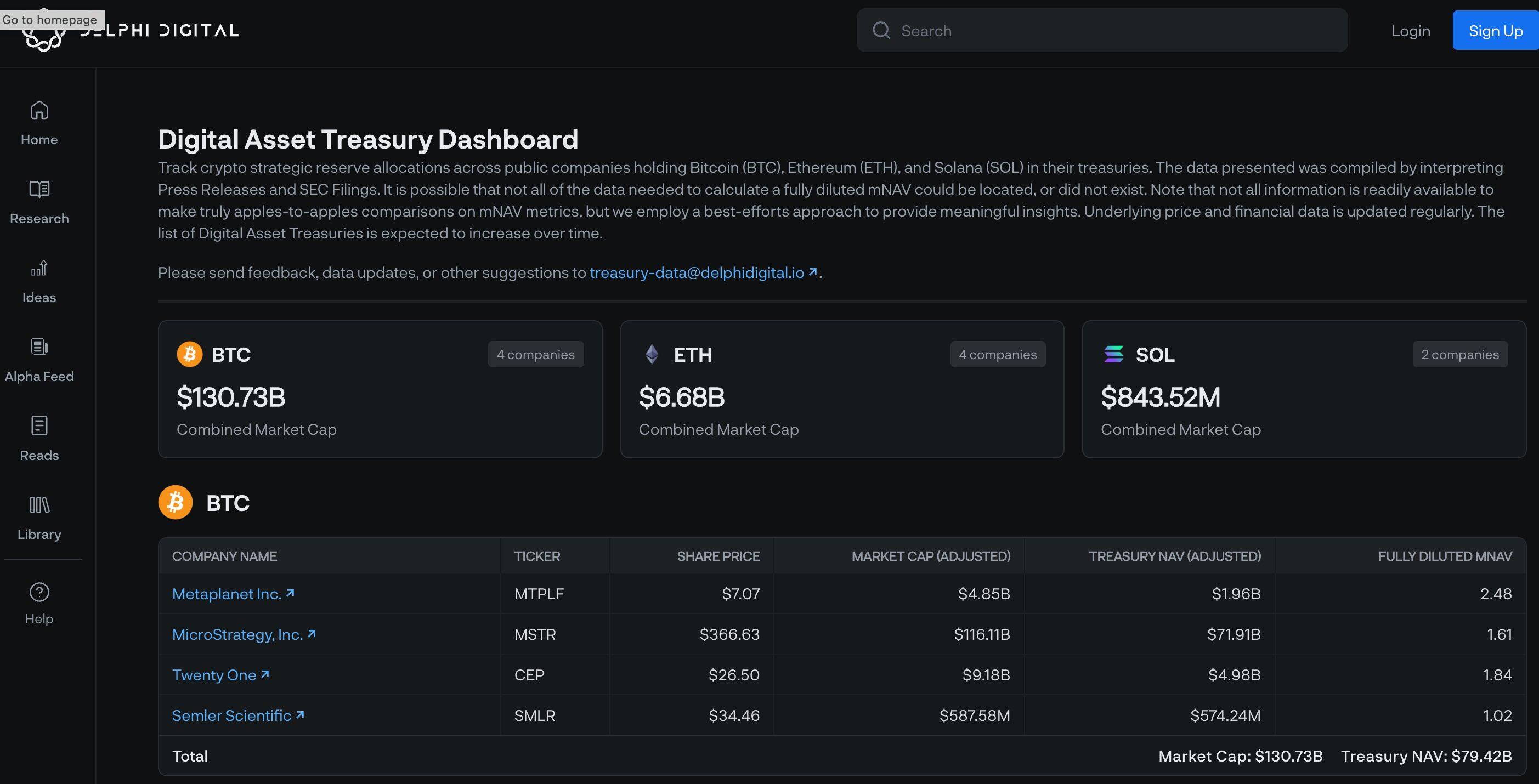

2. Delphi Digital

Delphi Digital's crypto reserve company data table includes BTC, ETH, and SOL, but the number of companies included is relatively small. Four companies are included for BTC reserves (Strategy, Metaplanet, Twenty One, and Semler Scientific), four companies are included for ETH reserves (Sharplink Gaming, BitMine Immersion Tech, BTCS Inc, and Bit Digital Inc), and two companies are included for SOL reserves (DeFi Development Corp and Upexi). Delphi Digital's data table includes company name, stock ticker, stock price, market capitalization, crypto asset value, and M (M is the value of market capitalization divided by crypto asset value mentioned above). (Data sourced from the SEC and press releases.)

Evaluation: Delphi Digital's data table is relatively simple, and can only find some older or well-known crypto reserve companies. It does not have data for some new reserve companies. In addition, the MANV data for Blockworks and Delphi Digital is also relatively simple, making it only an ordinary crypto reserve company data query alternative.

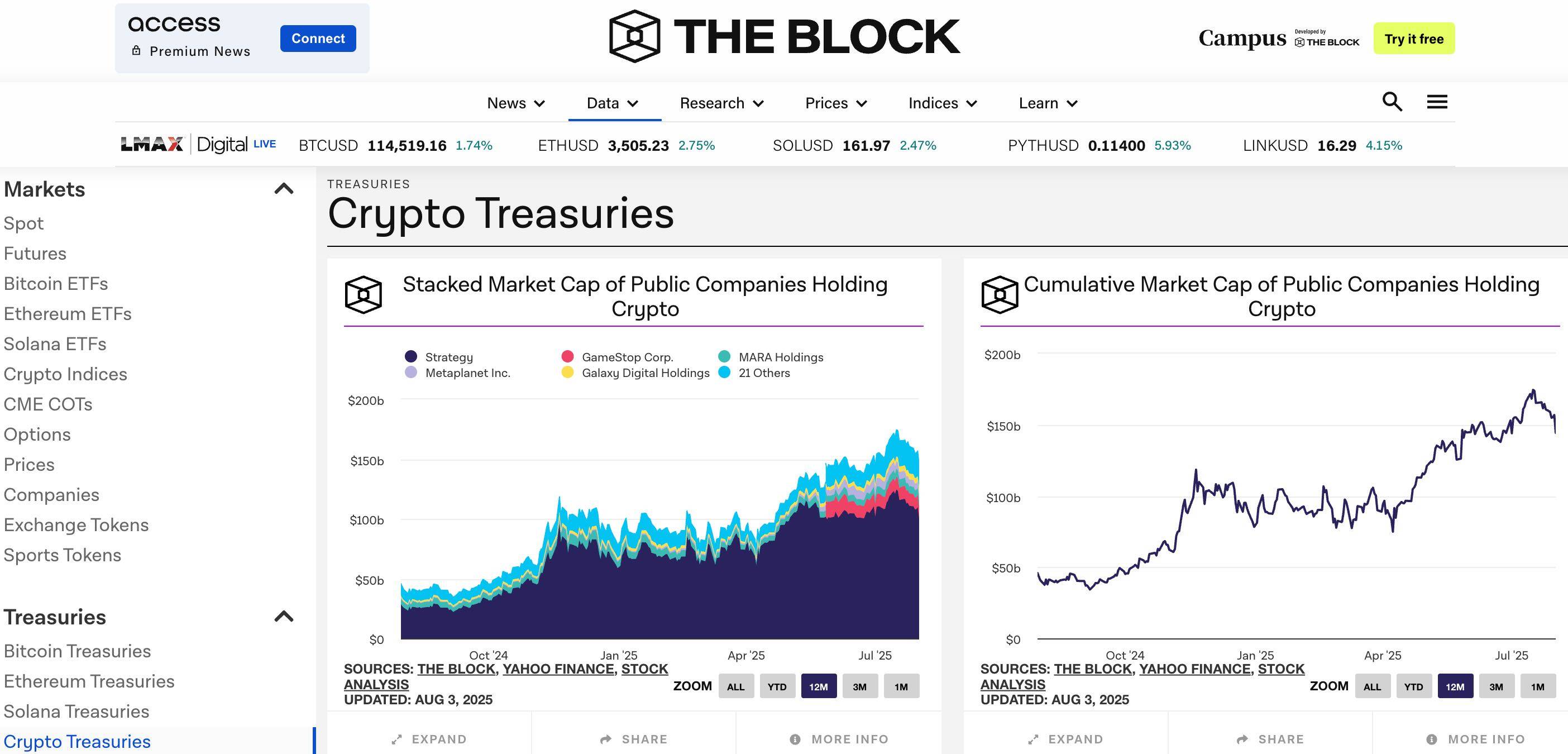

3. The Block

Introduction: The Block's Crypto Reserve Company data sheet is divided into four sections: BTC, ETH, and SOL, along with comprehensive crypto reserve company data, covering a total of 26 crypto reserve companies. This data covers major crypto reserve companies, including: crypto reserve company market capitalization, crypto reserve company token market capitalization, token holdings of individual major reserve companies, and total reserve company holdings of individual tokens.

Evaluation: Charts are inferior to Blockworks. Some of the crypto reserve data comes from the DUNE platform, so holdings are updated slowly and the data is not particularly accurate.

4. cryptotreasuries.info

Introduction: cryptotreasuries.info is divided into three categories of crypto reserves: BTC, ETH, and SOL. However, SOL does not include any company, while BTC reserves are included by more companies. In addition, the platform also provides price trends of related tokens.

The platform’s data columns include: company name and stock ticker, token holdings and total value, 30/90 day and 1 year BTC earnings per share and MNAV.

Evaluation: cryptotreasuries.info is the platform with the most BTC reserve companies among all query tools today, but ETH reserves are relatively small, and there is currently no SOL reserve company (not updated). The platform also draws a comparison chart of the reserve company's token holdings and stock price trends.

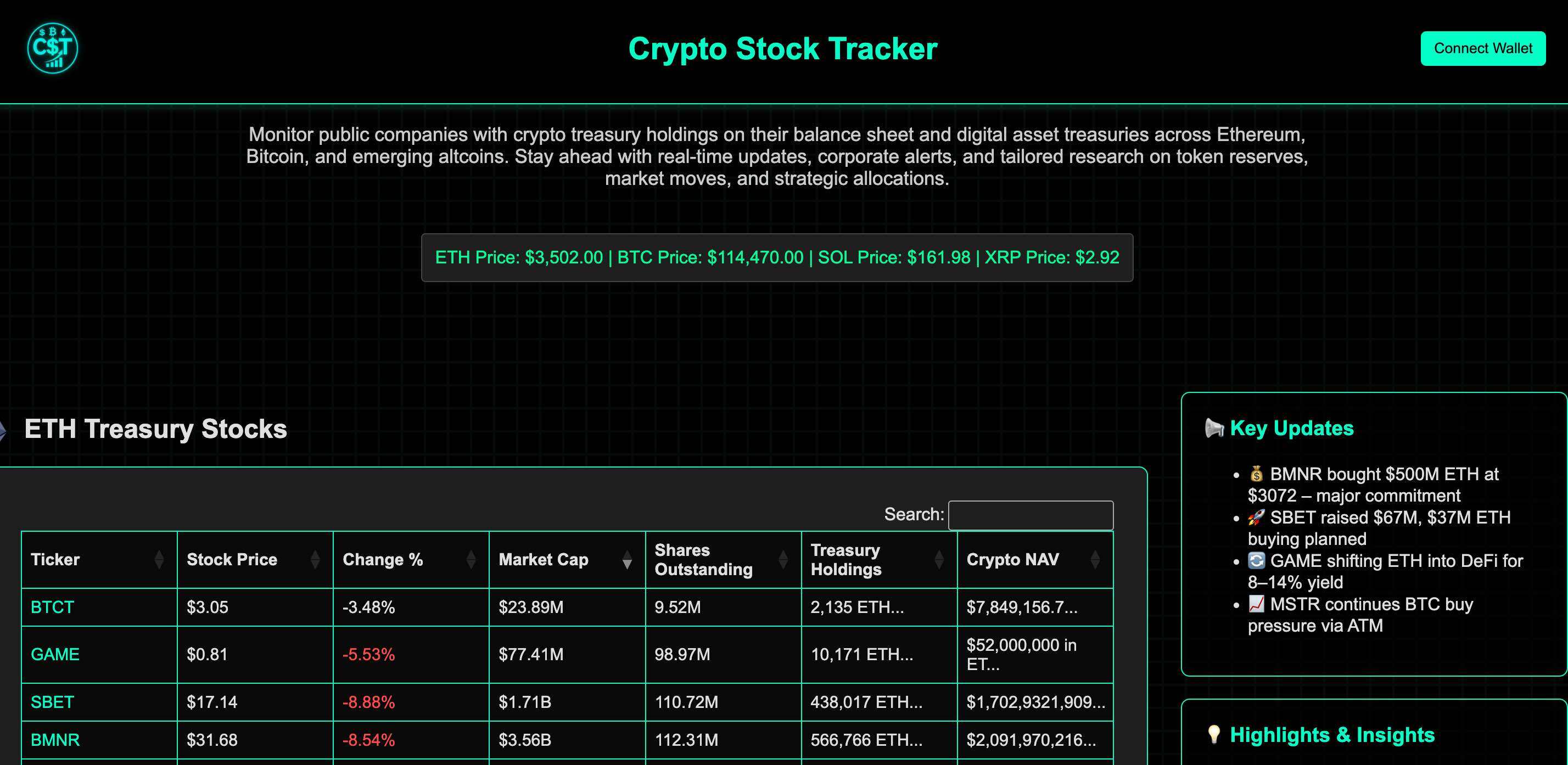

5. Crypto Stock Tracker

Introduction: The Crypto Stock Tracker data sheet includes stock tickers, stock price and intraday price fluctuations, market capitalization and outstanding shares, and the number and total value of crypto tokens held. Currently, it covers BTC, ETH, SOL, and XRP reserve companies, with a large number of reserve companies entered for each token. The right side of the interface displays recent increases and the latest news on crypto reserve companies that are about to increase their holdings, as well as information on recent platform updates.

Evaluation: Crypto Stock Tracker's X account was created in July. It is a new data platform established when crypto reserves were hot. It records a large number of crypto reserve companies and has a good section on crypto reserve-related opinions. Compared with other platforms, it has additional stock price and outstanding share data, that is, reserve company market value data, which is more friendly to players considering buying US stocks. If it is updated in a timely manner in the future, it can be included in the future crypto reserve data watch list.

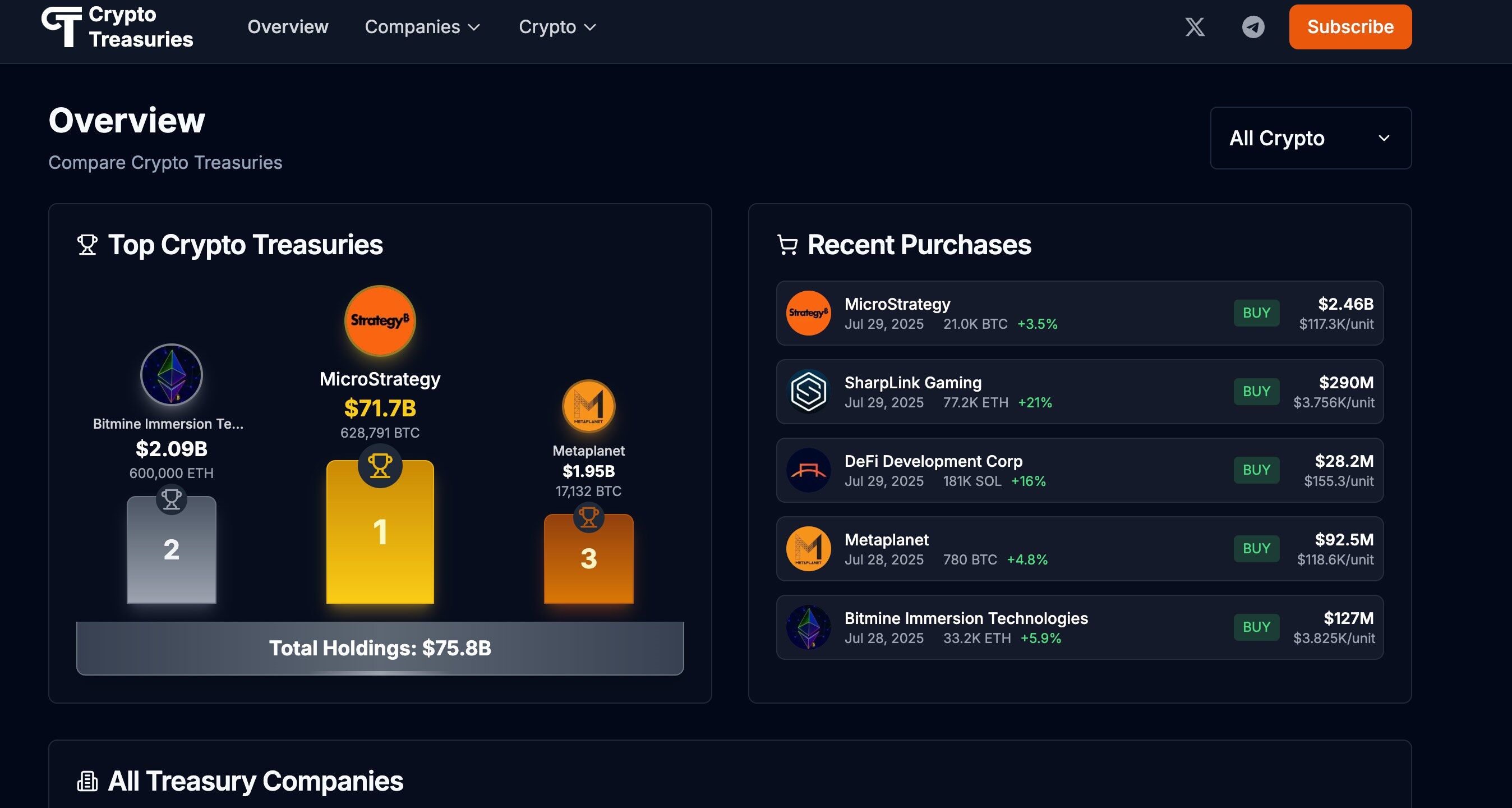

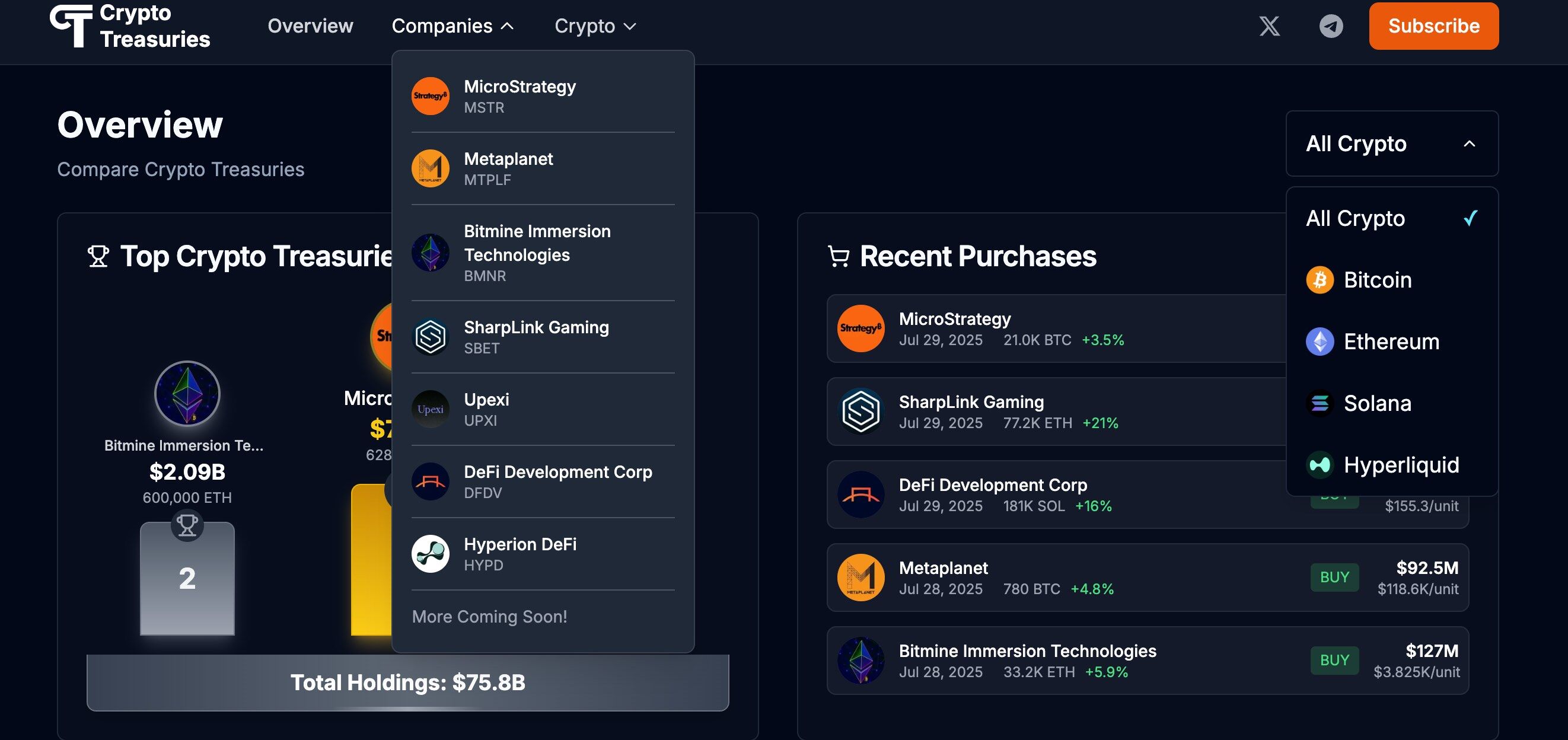

6. cryptotreasuries.com

Introduction: cryptotreasuries.com is a new crypto strategic reserve company data and analysis platform launched in July. Currently, the number of crypto reserve companies recorded is relatively small, including two BTC reserve companies Strategy and Metaplanet, two ETH reserve companies Bitmine and Sharplink, two SOL reserve companies Upexi and DeFiDevelopment Corp, and one HYPE reserve company Hypreion DeFi.

Its comprehensive data columns include: company name, stock ticker, number and total value of crypto reserve tokens held, stock price, market capitalization and MNAV.

Evaluation: Cryptotreasuries.com has a simple and intuitive interface, with relatively few companies to enter. However, its strength lies in listing companies that have recently increased their holdings, along with the percentage of increase. As a new platform, it may add more data on crypto treasuries in the future, making it a promising platform.

Conclusion

Currently, the pace of transitioning from listed companies to crypto reserve companies is relatively rapid. For example, several new listed companies announce their purchases of, or upcoming plans to purchase, BTC as strategic reserves almost every week. Besides direct purchases, other methods include raising funds or issuing additional shares to increase crypto reserves (funding can take time after the announcement). Calculating the market capitalization and crypto reserves of some entities about to merge is difficult, making it difficult to provide detailed data. This leads to some discrepancies in the actual total number of companies with crypto reserves. Furthermore, some of the aforementioned platforms also include reserve data for crypto mining companies.

But overall it's not bad. Among the reserve company query websites/tools mentioned above, Blockworks is relatively advanced, both in terms of charts and data graphs. In addition, several new platforms also have their own advantages in interface and data classification. Crypto Stock Tracker is the only platform mentioned above that has recorded XRP reserves, cryptotreasuries.com is the only platform among all the above platforms that has recorded HYPE, and cryptotreasuries.info is the platform with the most BTC reserve companies recorded among all query tools today.

It is worth noting that none of the above platforms have updated Sharplink’s ETH holdings data (Sharplink Gaming increased its holdings by 15,822 ETH yesterday, and its ETH reserves rose to 480,204, with a total value of US$1.62 billion).