Author: Adaverse Research Team

Advisors: 6th man Ventures and Coin98 Ventures

Emerging markets present unique opportunities for the development of cryptocurrencies and blockchain technology. In Africa, cryptocurrencies have emerged as an alternative to the traditional financial system, gaining popularity in the local market, especially for those without access to banking services. Blockchain technology can solve problems such as traceability in the supply chain, manage identity and ownership disputes, and thus has broad application prospects.

In Vietnam, as the economy continues to grow and technology develops, cryptocurrencies have quickly captured the hearts of Vietnamese young people. More and more Vietnamese regard cryptocurrencies as a safe and reliable financial choice; in India and Africa, due to local Financial markets are underbanked, local currencies are highly volatile, and cryptocurrency usage is on the rise.

first level title

secondary title

Africa

In Africa, usability is key to the success of products, including Web3 projects. Given Africa’s relatively low per capita GDP and underdeveloped financial, social and environmental infrastructure, proposals for the African market must be problem-solving or address clear market-scenario needs, including:

International Payments: Web3 enables faster and cheaper international payments compared to traditional financial systems, which is good for African financial markets because many African countries have underdeveloped banking infrastructure.

Digital identity: Web3 can help solve the problem of legal identity and create a secure and private verifiable digital identity.

Traceability in the supply chain: Blockchain technology can track products along the supply chain, helping to ensure the quality and authenticity of products and reducing corruption and fraud in Africa's agricultural and other sectors.

Decentralized marketplace: Web3 can facilitate the establishment of a decentralized marketplace where buyers and sellers can interact directly without intermediaries. This is particularly beneficial for farmers' markets in Africa, where farmers can sell their products directly to consumers without having to pay high commissions to middlemen.

These Web3 usage scenarios can effectively function to address specific and pressing issues facing various communities in Africa. The decentralization of Web3 makes the platform more flexible in dealing with regional issues, helping to promote financial inclusion and economic development in Africa.

Web3 in Africa is mainly in the form of integration, making the technology accessible to ordinary consumers. A successful example of this is Fonbnk, which allows users to exchange their airtime credits for crypto assets.

secondary title

Not just financial technology

The usage scenarios of Web3 are not only related to the financial market, blockchain technology also has great potential in other non-financial fields on the African continent. In addition to the above-mentioned poor technological infrastructure, another major problem in the African region is the lack of reliable and verifiable land ownership records, which has also led to many disputes and conflicts.

India

India

Although India is also an emerging market with rapid economic growth, its economic development is different from other developing economies. On the one hand, India has shown continuous interest in the field of cryptocurrency and tends to support new technologies such as Web3 and blockchain, but on the other hand, the Indian government has not formulated and implemented effective cryptocurrency regulations, which has caused market chaos and hindered industry development.

Since India's Supreme Court overturned the central bank's ban on digital currencies in 2020, the Indian government has debated the regulatory and legal status of cryptocurrencies but has yet to reach any clear conclusions.

For example, the central bank of India has been particularly vigilant about cryptocurrencies due to risks such as money laundering and financial instability, and has repeatedly highlighted cases of scams and fraud in the Indian cryptocurrency industry. These publicity further exacerbates concerns about blockchain security issues , banks and financial firms are finding it difficult to provide services to cryptocurrency exchanges in India.

secondary title

The Great Escape of Indian Crypto Projects

Many cryptocurrency companies based in India have considered relocating to other jurisdiction-friendly jurisdictions such as Singapore or the United Arab Emirates. Dubai is the best bet as the UAE is pro-cryptocurrency and has so far established several duty-free zones that issue cryptocurrency licenses.

Sandeep Nailwal, Polygon's chief executive, said on multiple occasions that he moved to Dubai two years ago because of the uncertainty of India's laws and regulations, and his company and team could be exposed to risks at any time. Although he hopes that he can live in India and promote the local Web3 ecological development, he expresses concern about the brain drain in the Indian blockchain field. He laments that Indian laws and regulations are driving investors, entrepreneurs and talent out.

So we can see that India and the UAE are very different in terms of Web3 technology and cryptocurrency; industry watchdog.

In addition, the UAE has launched special visas for technology entrepreneurs, allowing them to set up businesses in the country and obtain resources and funds. This policy has attracted many entrepreneurs from all over the world, and Dubai is expected to become an emerging technology center in the Middle East.

However, for India, the current form is not the final outcome, and many industry insiders hope that the Indian government will consider India's potential and try to establish clear and favorable regulations for the industry to positively and substantially change the Indian landscape.

In fact, blockchain technology, cryptocurrency, and Web3 can be applied in various industries, such as:

DeFi: The growing DeFi around the world is also in full swing in India, where users can use cryptocurrencies and blockchain to obtain decentralized and intermediary-free financial services such as loans, savings, and interest income.

Digital Identity: In India, Web3 can also improve the security and privacy of users' digital identities. Storing identities on the blockchain prevents unauthorized access to personal data by third parties.

Intellectual Property: Web3 can improve intellectual property protection for content creators by allowing content creators to store and manage their creations on the blockchain, giving them more control over the ownership and distribution of their creations.

India has a huge potential in the field of digital assets due to its large technical talent pool and highly skilled and qualified IT workforce; India has a high rate of technology adoption, with a large number of Internet users and growing smartphone penetration.

Moreover, India has been leading the way in developing products for international markets. India's software and IT services industry has been a major exporter and has achieved great success in the provision of information technology services globally, so India has the opportunity to lead in Web3 innovation and provide solutions to the global market.

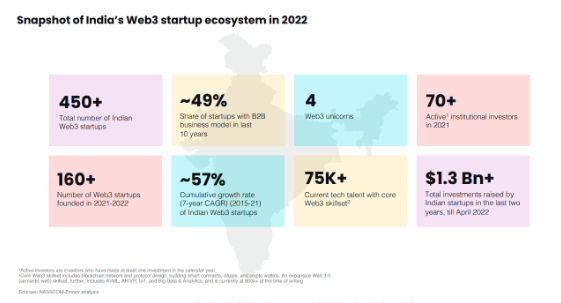

image description

image description

Data source: Nasscom

As can be seen from recent research by NASSCOM, India has the potential to become a thriving Web3 market due to its large talent pool and high adoption of digital technologies. Since the gap between talent supply and talent demand in India's technology sector is smaller than other countries, this means that there is a large number of technical talents who can work on Web3 projects.

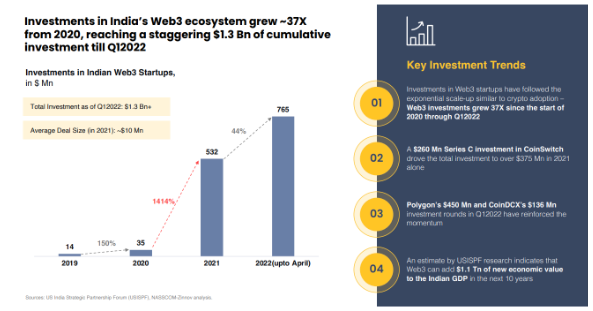

image description

Data source: Nasscom

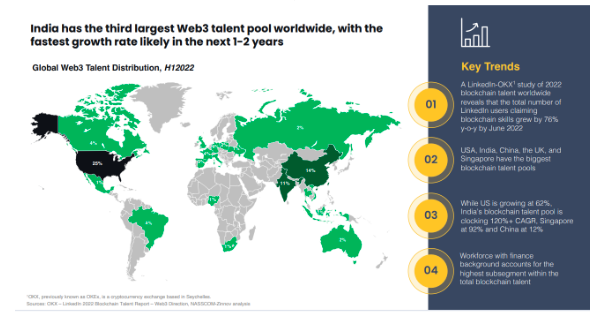

image description

Data source: Nasscom

While India ranks third in the global Web3 talent pool, research predicts that India will have the fastest talent pool growth rate in the coming years. In addition, India already has a huge talent pool in emerging technologies such as artificial intelligence and data analysis, and has the ability to lead the development of Web3 and blockchain in the future.

Also, let’s be aware that cryptocurrencies and blockchain technology can potentially improve India’s fiscal and taxation system, which has a fairly complex tax structure and one of the highest indirect tax rates in the world. High taxes will reduce the purchasing power of consumers and the competitiveness of enterprises, thereby harming economic and demographic development, and may also stimulate economic flight and the shadow economy.

Blockchain technology and cryptocurrencies may be a solution to these problems. By providing transparent transaction tracking and full traceability, eliminating unnecessary intermediaries, blockchain technology can benefit small business owners and taxpayers by reducing entry costs and processing times, increasing efficiency, and by allowing all participants to access Same information, increasing trust and transparency in tax and fiscal systems. However, the implementation of these technologies will require governments to develop appropriate strategies and regulations.

secondary title

Vietnam

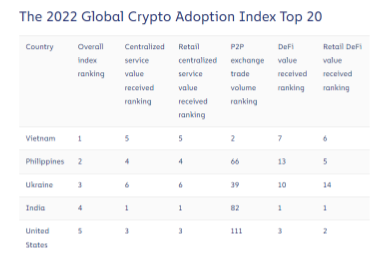

image description

image description

Data source: Chainalysis

In addition, Vietnam has no official regulations related to blockchain technology and cryptocurrencies. However, the chances of Vietnam’s prime minister approving improvements to the legal framework is a positive sign that the Vietnamese government recognizes the importance and potential of blockchain technology and is working to create a clear and secure regulatory framework.

This legal clarity can help facilitate further growth and development of cryptocurrencies and blockchain in Vietnam, while limiting the risks that these technologies may pose, such as money laundering and terrorist financing.

Overall, the Vietnamese government’s balanced approach to cryptocurrency and blockchain regulation can help promote a healthy and prosperous ecosystem and contribute to Vietnam’s economic and technological development in the future.

The fact is that Vietnam has maintained its top spot for two years in a row, establishing a solid foundation for the use of cryptocurrencies. Additionally, Vietnam’s high purchasing power has facilitated the ability of the populace to use centralized cryptocurrencies, DeFi, and P2P tools.

The popularity of cryptocurrency-based games in Vietnam is also conducive to the widespread adoption of cryptocurrencies. Some successful cryptocurrency companies have emerged in Vietnam, such as Coin 98 Finance, Axie Infinity, and Kyber Network. These companies will encourage more companies to enter the cryptocurrency market and further increase the popularity of blockchain technology. The Chainalysis report also noted that cryptocurrency adoption in Vietnam includes both centralized and decentralized tools, with a high percentage of both, and that cryptocurrency-based games, such as P2E and M2E games, are particularly popular.

Cryptocurrency projects in Vietnam are mostly focused on games and metadata, followed by DeFi, NFT and infrastructure. As more and more traditional companies turn to the blockchain and integrate blockchain technology into their businesses, Vietnamese cryptocurrency projects are also performing extraordinary in raising funds. These achievements are inspiring, and the future cryptocurrency market in Vietnam has a bright future .

first level title

Blockchain Technology for Emerging Markets

After discussing the opportunities and usage scenarios that blockchain technology brings to emerging markets, we can observe the potential of blockchain technology for future economic growth. For retail investors, institutional investors and governments, blockchain can be used as a financial tool that can bring huge added value to underdeveloped regions.

Although there is currently no unified blockchain technology suitable for all emerging markets (because each market has its own unique needs and difficulties), some common features of blockchain are destined to match with emerging markets, such as Cost-effectiveness, scalability, accessibility, ease of use, and interoperability.

In the face of various blockchain projects, Cardano is especially suitable for emerging markets. It is a blockchain technology specially designed to cater to emerging markets. It emphasizes enhancing the development of emerging economies through the interoperability, sustainability and financial inclusion of its smart contract platform.

Additionally, Cardano uses a proof-of-stake consensus mechanism, which consumes less energy than other consensus mechanisms used by other blockchain technologies such as Bitcoin, making it more affordable for users in developing countries. Cardano also focuses on education and training, suitable for emerging markets with blockchain technology training and skills development needs.

In terms of functionality, Cardano has a transaction layer using the cryptocurrency ADA, and a computing layer based on the Haskell programming language Plutus, which is mainly used to execute smart contracts (dApps). Overall, Cardano is an emerging technology that presents an innovative solution to the limitations of Bitcoin and Ethereum.

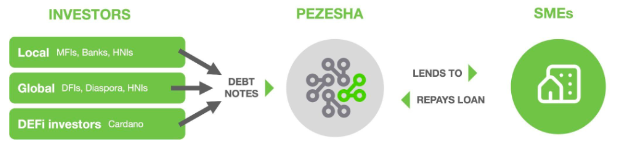

Another highlight of Cardano is its vision. Cardano and Hoskinson's vision is to use blockchain technology to create a fairer and more people-oriented economy, and microfinance is a key part of this vision. Partnering with Pezesha to create a P2P financial system in Africa is an example of Cardano's commitment to solving real problems and improving local livelihoods.

Partnering with Pezesha to create a P2P financial system in Africa is an example of how Cardano is working to solve real problems and improve economic access for all. The partnership allows people to borrow and borrow in a regulated manner, promoting local access to finance and economic growth.

Pezesha is a Kenyan fintech company focused on microfinance, which aims to provide small loans to small businesses and individuals in Africa. The joint investment between the two in Africa demonstrates Cardano's commitment to the economic development of Africa, showing its vision to use blockchain technology to solve practical problems, such as lack of access to financing. In short, Cardano has the potential to be a very suitable blockchain technology for emerging markets.

Blockchain technology can bring benefits to areas where it is difficult to obtain traditional financing, especially in Africa. On the one hand, small businesses are the mainstay of the local economy, and on the other hand, the lack of financing channels has caused huge obstacles to their development.

In addition to Cardano, there are some other blockchain technologies suitable for emerging markets in the market. Here we mainly look at the first three blockchain projects: EOS, Stellar and Aion.

EOS is a very attractive blockchain technology for emerging markets. It focuses on the scalability of transactions, has high transaction throughput and low transaction latency, and can greatly expand and accelerate payment applications and micro-transactions. Block.one has launched several initiatives to encourage the adoption of EOS in emerging markets. For example, in 2019, Block.one announced a partnership with online gaming platform Ultra to create an EOS-based gaming platform. Additionally, Block.one launched a $1 billion investment fund to support application development on the EOS platform.

However, like any emerging technology, EOS also faces its own set of challenges, including increasingly fierce competition in the industry, such as Ethereum, which has a large developer base and active community. Additionally, security and scalability are areas of focus for EOS and its community.

In contrast, Stellar's technology allows people anywhere in the world to trade tokens, which helps developing countries and regions with underdeveloped financial systems; another quite attractive advantage of Stellar is that the platform allows the issuance of tokens. Coins and create decentralized applications (dApps) that can be used for a variety of purposes, including financial inclusion and humanitarian aid.

Finally, there is Aion, which is considered very useful for emerging markets because it can provide solutions to interoperability problems that often arise in traditional financial systems in emerging economies. By enabling interoperability between blockchains, Aion can help drive financial inclusion in these markets and develop new financial services.

epilogue

epilogue

In recent years, blockchain technology and cryptocurrencies have gained increasing popularity in emerging Asian economies such as India and Vietnam. Many local markets are starting to use blockchain technology to address financial inclusion and improve efficiency in various industries, such as agriculture and trade.

Blockchain technology and cryptocurrencies can play a meaningful role in promoting financial inclusion in these emerging markets, providing people with financial alternatives that allow users to conduct more secure and efficient transactions without the need for traditional banking infrastructure.

In addition, technologies such as blockchain can help those who are supported by traditional financial funds to obtain funds, especially small businesses in Africa. They are the backbone of the local economy, but the lack of funds is a huge obstacle to their growth. In comparison, the Vietnamese market has 16 million cryptocurrency users across gaming, metaspace, DeFi, and NFT.

For India, India is well positioned to leverage Web3 due to its large talent pool, high digital technology adoption rate, and growing interest in cryptocurrencies and Web3 startups. However, despite these technological foundations, the Indian government needs to establish a clear regulatory regime, otherwise it will continue to suffer from brain drain and the market of 20 million cryptocurrency users will gradually dissolve.

Although there are still challenges in the adoption of blockchain technology and cryptocurrencies in these emerging markets, it is foreseeable that cryptocurrencies will continue to grow in the coming years. In addition, education about blockchain technology is also in full swing, and individuals and institutions will have a more open and inclusive attitude towards blockchain.

In short, blockchain technology and cryptocurrencies have great potential for development in emerging Asian markets, such as India and Vietnam, to help solve common problems and challenges in these regions, namely financial inclusion and efficiency in various industries. The development of blockchain technology and the popularization of related education will further promote the growth of these emerging markets.