01 background

01 background

text

Topics involved:

Comparing Cosmos ecological statistics when Terra crashed 6 months ago

Significance and Controversy of the Atom 2.0 Proposal

Looking at Cosmos Pain Points and Segmentation Track Opportunities from Atom 2.0

in conclusion

in conclusion

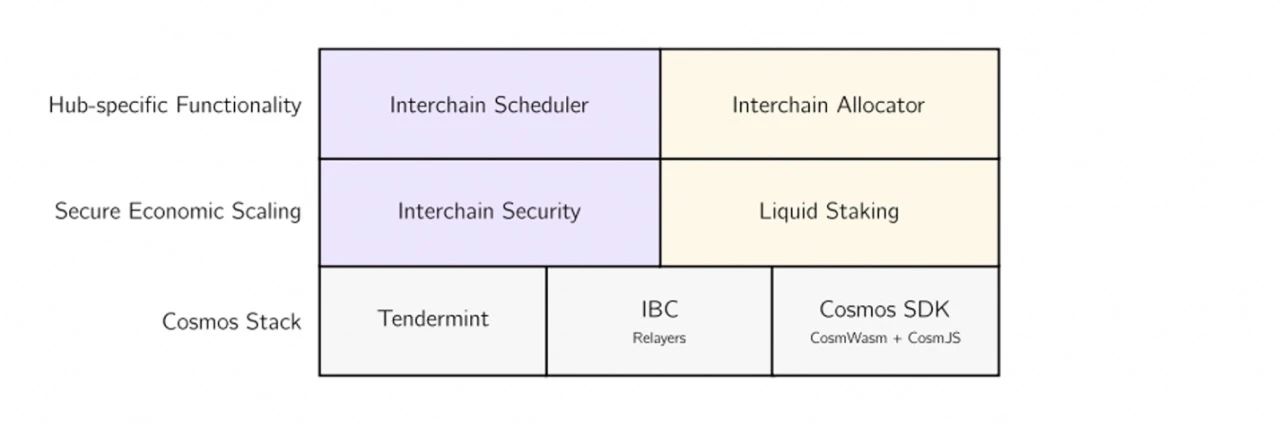

02 text

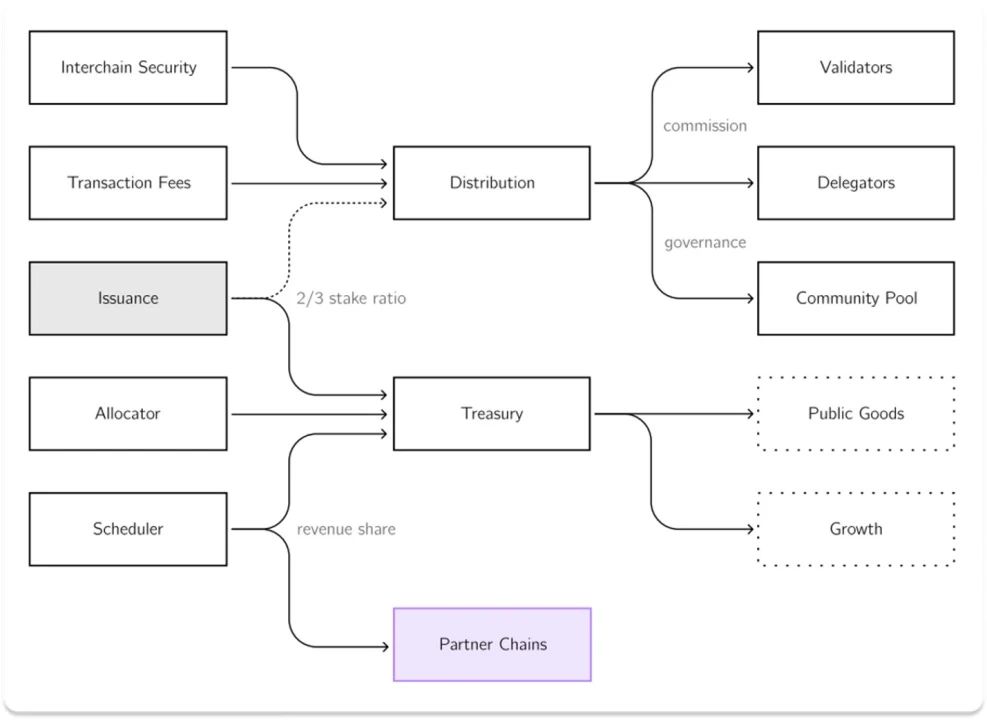

image description

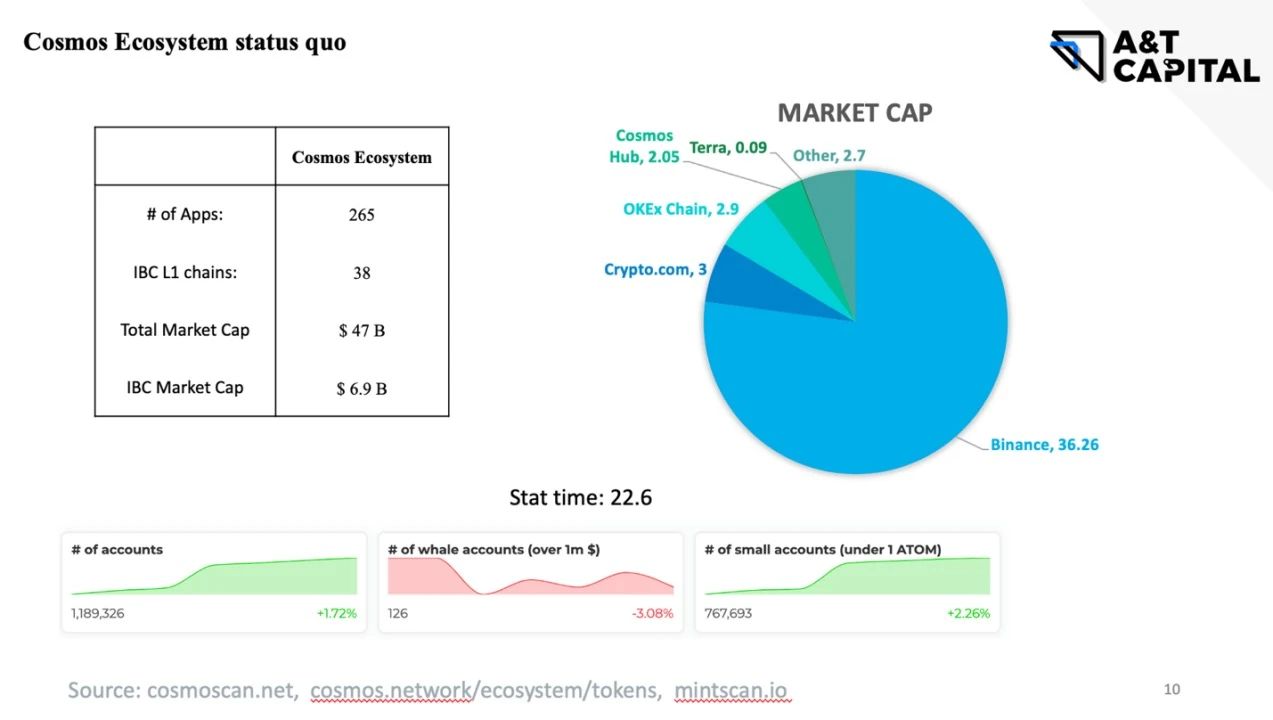

Cosmos Ecological Basic Data - June 2022 Statistics

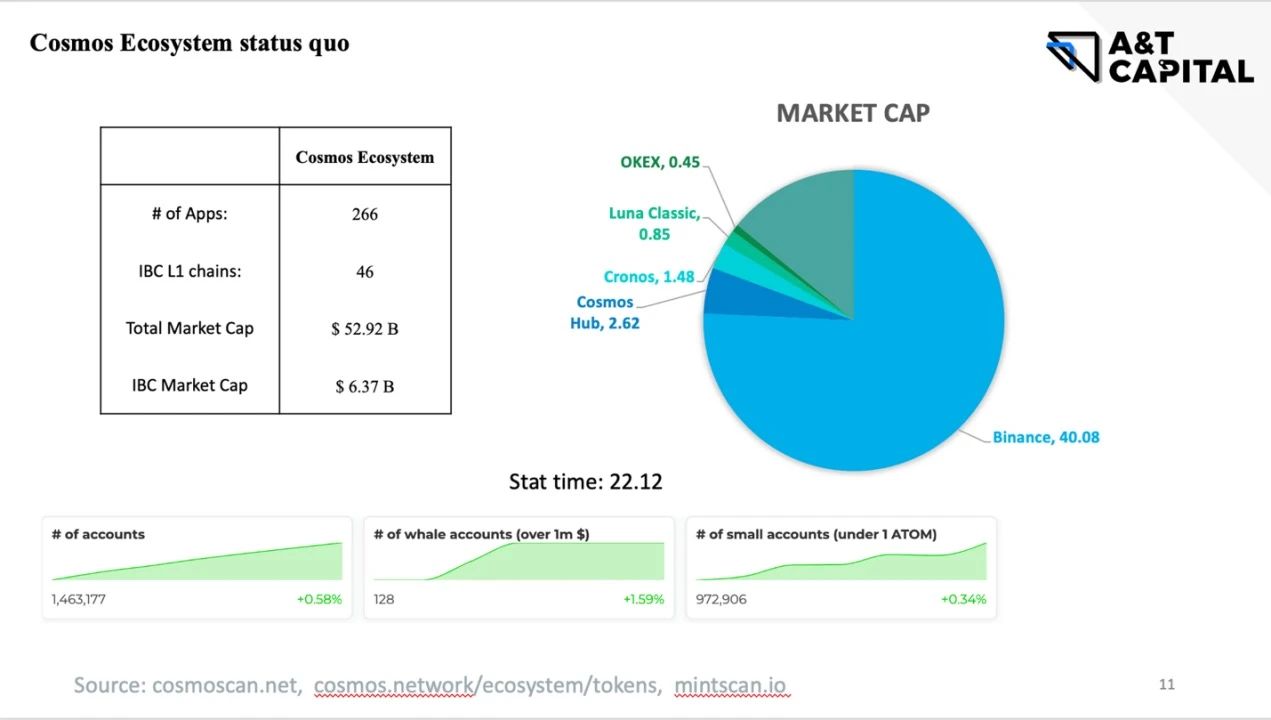

Cosmos Ecological Basic Data - December 2022 Statistics

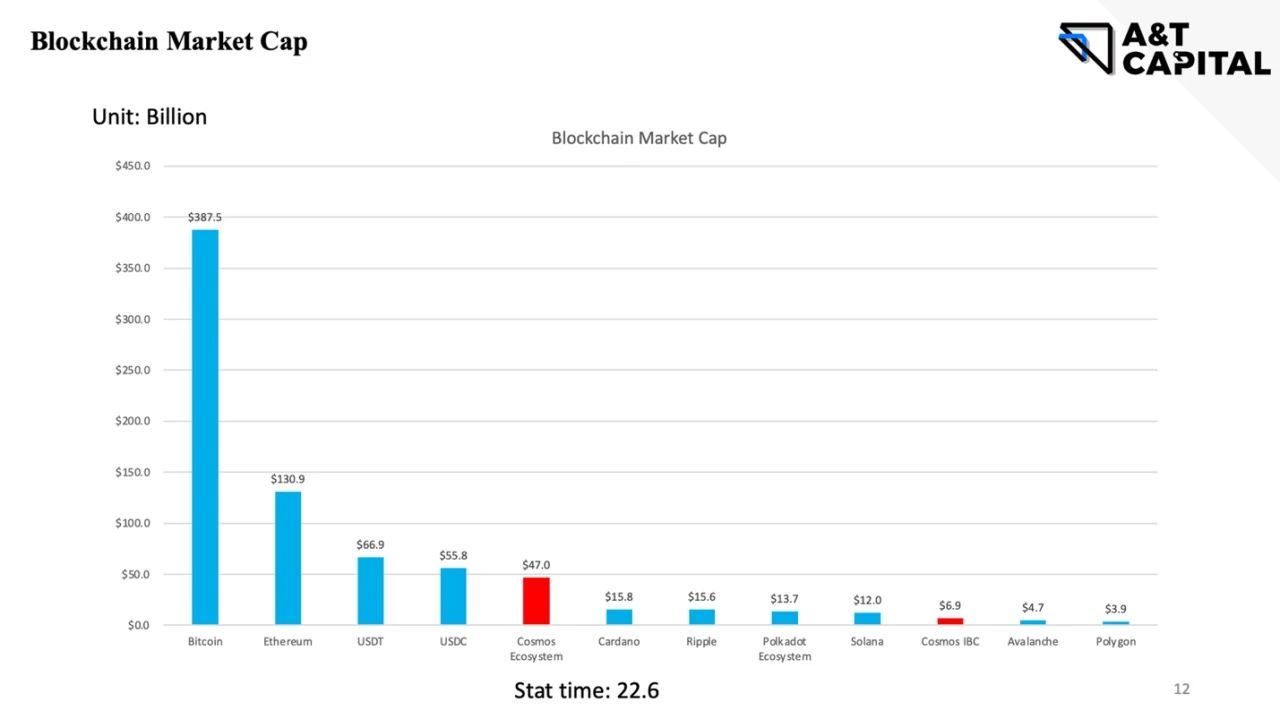

Crypto's overall market capitalization comparison - June 2022 statistics

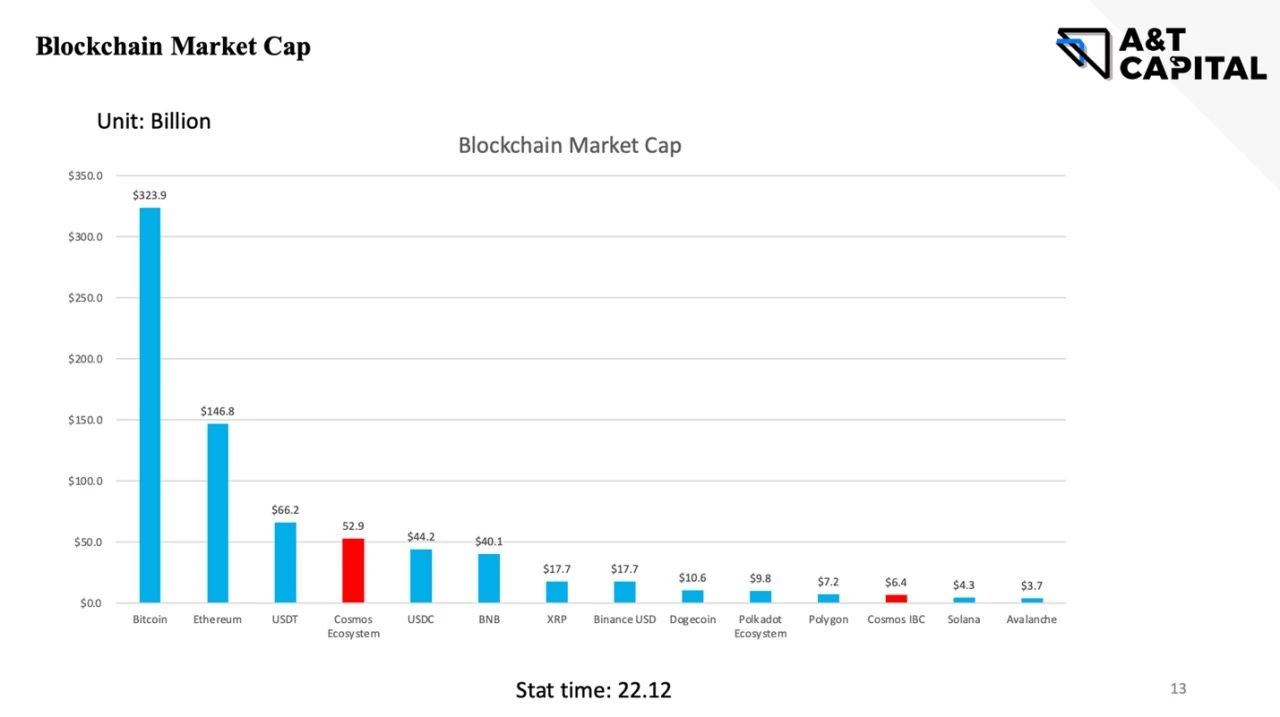

Crypto's overall market capitalization comparison - December 2022 statistics

With the frequent occurrence of Crypto vicious incidents in the second half of 2022, the overall Crypto market value will further decline, while the total market value of the Cosmos ecosystem has recovered compared to Terra's collapse. The overall ecology is significantly less affected by the Crypto bear market than other alternative L1. The structure of the IBC head public chain within Cosmos has not changed significantly, but the market value has decreased significantly, and the market value of other new Cosmos L1s has grown rapidly. It can be expected that with the increase of Cosmos IBC chain changes in the future, the pattern of the Cosmos head public chain will change. The overall vitality of the Cosmos ecology is good, and it is worth deploying.

2. Significance and controversy of the ATOM 2.0 proposal

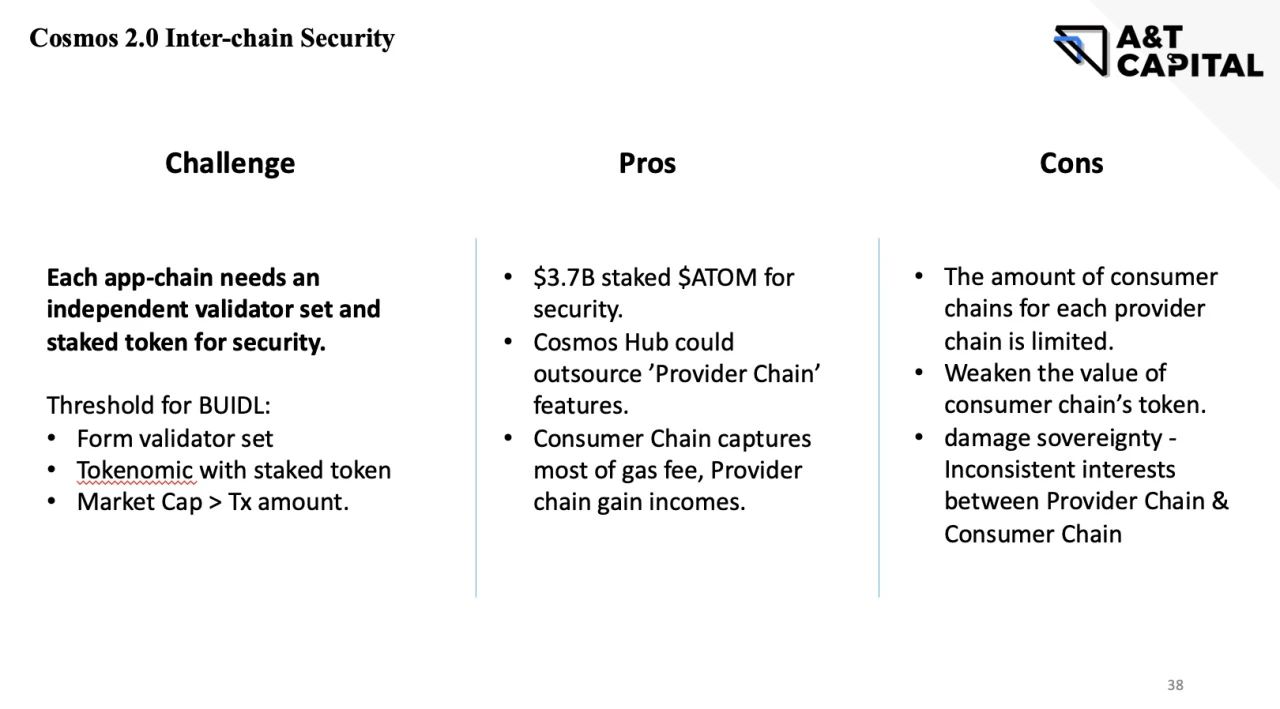

1 ) Interchain Security

It is necessary to have the ability to attract and screen reliable validators to form a validator set of its own chain

Need Tokenomics capable of building staked tokens

Need to be able to quickly attract a large number of pledged tokens - the asset security of the application chain directly depends on the market value of the pledged tokens: if the transaction amount is greater than the market value of the pledged tokens, the validator set has the incentive to do evil (this also directly restricted the Defi chain in Cosmos in the past development of)

Advantage:

Advantage:

1. Over $3.7 B market cap of staked token ATOM provides security directly

Just as Ethereum can provide the security of pledged ETH for its smart contract applications, Consumer Chain can accept the protection of a complete validator set at the beginning of construction, without the need to attract and filter validator sets by itself, which greatly reduces the threshold for building Cosmos application chains

The market value of pledged tokens exceeds $3.7 B, the transaction limit on the Consumer Chain is greatly reduced, and the potential of Defi is no longer limited by this

Consumer Chain can be independent at any time, switching to independently operate the validator set to provide protection and restore Sovereignty

2. Provider Chain functions can be outsourced, maintaining Cosmos Hub "non-functional", and Cosmos ecological decentralization

As the official chain of Cosmos Hub, the original intention of construction is "non-functional" to maintain the decentralization of Cosmos ecology. Cosmos Hub can outsource the validator set function, such as QuickSilver

Not only Cosmos Hub, but other high market capitalization chains can also become Provider Chains to provide validator set and pledge token security

3. The Consumer Chain gets most of the gas fee on the chain, and a small part of the gas fee belongs to the Provider Chain

At present, most Cosmos project parties are still deployed on each Cosmos L1 in the form of smart contracts. No matter how large the transaction volume is, their gas fee still directly belongs to the lower layer L1. The lower threshold of the Interchain Security application chain makes these project parties have the motivation to directly build the application chain to become the Consumer Chain, sell some transaction gas fees to the Provider Chain, and capture most of the gas fees

dispute:

1. The validator set of Provider Chain may support a limited number of Consumer Chains

Validators are expected not only to simply run programs, but also to participate in governance, ensure and maintain an active position, participate in community discussions, and provide technical assistance in emergencies, etc. Supporting too many Consumer Chains will not be able to guarantee the governance quality of each Consumer Chain, limiting its healthy development

2. The value of the Token of the Consumer Chain project party weakens

Although the application chain that became the Consumer Chain was protected by shared security in the early stage, its own Token cannot be pledged, and its value capture ability is reduced. It may be difficult to realize the explosion of its own Token market value, so it is difficult to get rid of the Provider Chain to restore sovereignty (the market value of its own Token limits the transaction amount)

3. Inconsistent interests between Provider Chain and Consumer Chain damage sovereignty

The Provider Chain community votes on whether to support a specific Consumer Chain, and ultimately the decision of whether a Provider Chain’s validator set supports a Consumer Chain turns into an economic issue—whether it is profitable to support the chain. Create unequal support and governance for Consumer Chain

The validator of the Provider Chain participates in the governance of the Consumer Chain and community voting, so that it is controlled by the Provider Chain in case of conflict of interest and damages the sovereignty of the Consumer Chain

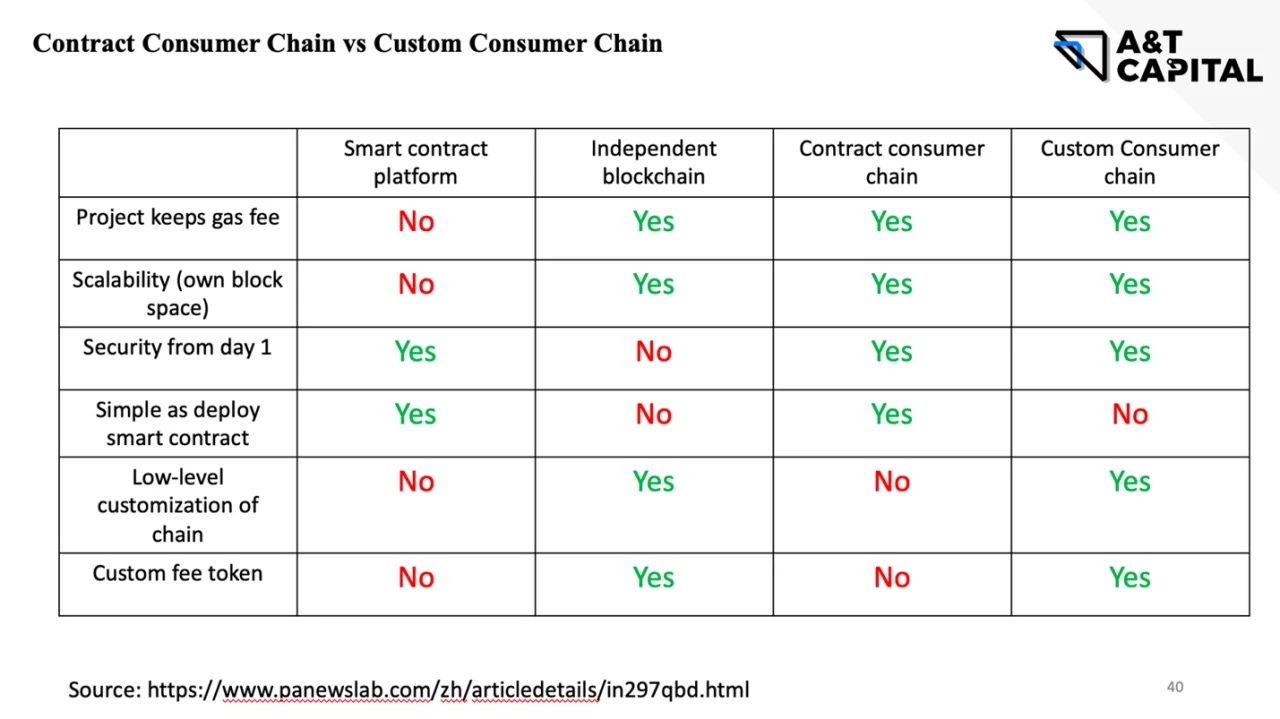

2 )Contract Consumer Chain vs Custom Consumer Chain

The application chain development team can choose to deploy Contract Consumer Chain or Custom Consumer Chain when configuring the Cosmos SDK.

The Contract Consumer Chain has greatly lowered the threshold for application chains. Developers can quickly deploy application chains that are secured by Provider Chains such as Cosmos Hub, and support execution environments such as EVM/CosmWasm/GnoVM. The application chain team only needs to focus on business logic development, and the threshold is close to the direct development of smart contracts. Compared with directly developing smart contracts, most of the gas fee belongs to the DAO.

The Custom Consumer Chain is similar to the current Cosmos application chain, the difference is that the shared security can be provided by the Provider Chain. It can guarantee the maximum degree of customization of the application chain, customize the configuration of the Cosmos SDK, and even change the Tendermint consensus engine for optimization.

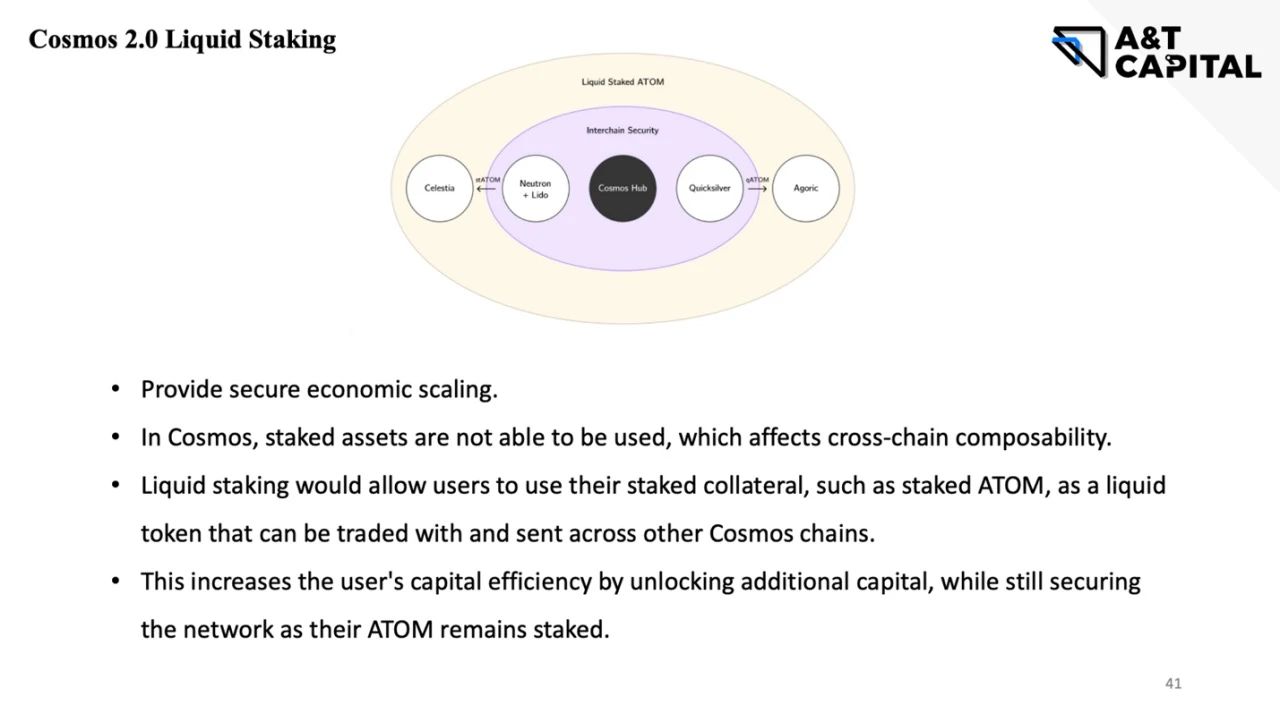

3 ) 21 Days Locking ——> Liquid Staking

At present, the pledge of Cosmos needs to be locked for 21 days, and the pledger must give up other potentially more valuable uses of funds, and the assets will be limited to the chain where the pledge is located, resulting in restrictions on cross-chain composability and capital efficiency. Especially considering that Cosmos needs to pledge a large proportion of Tokens to ensure security, which greatly limits the liquidity and usage of assets.

If Cosmos supports Liquid Staking, $ATOM holders can not only obtain staking income, but also use their deployed $ATOM for other purposes, and are no longer bound by the 21-day lock-up period. Users can freely deploy funds between different chains. Liquid Staking enables Token holders to not only provide security for the chain where the pledge is located, but also realize inter-chain asset exchange during Staking, promoting capital efficiency and inter-chain composability.

dispute:

1. According to Jae Kwon’s statement, Cosmos realizes liquid staking, which may increase leverage infinitely during the flow of cross-chain assets, and force other validators to participate in the increase of leverage. In the end, more than 1/3 of validators will be affected, resulting in the loss of network control. into a single external capital, destroying $ATOM. The original text of Jae Kwon is as follows: https://twitter.com/jaekwon/status/1590478003691479040

text

4 ) Inter-chain Schedular

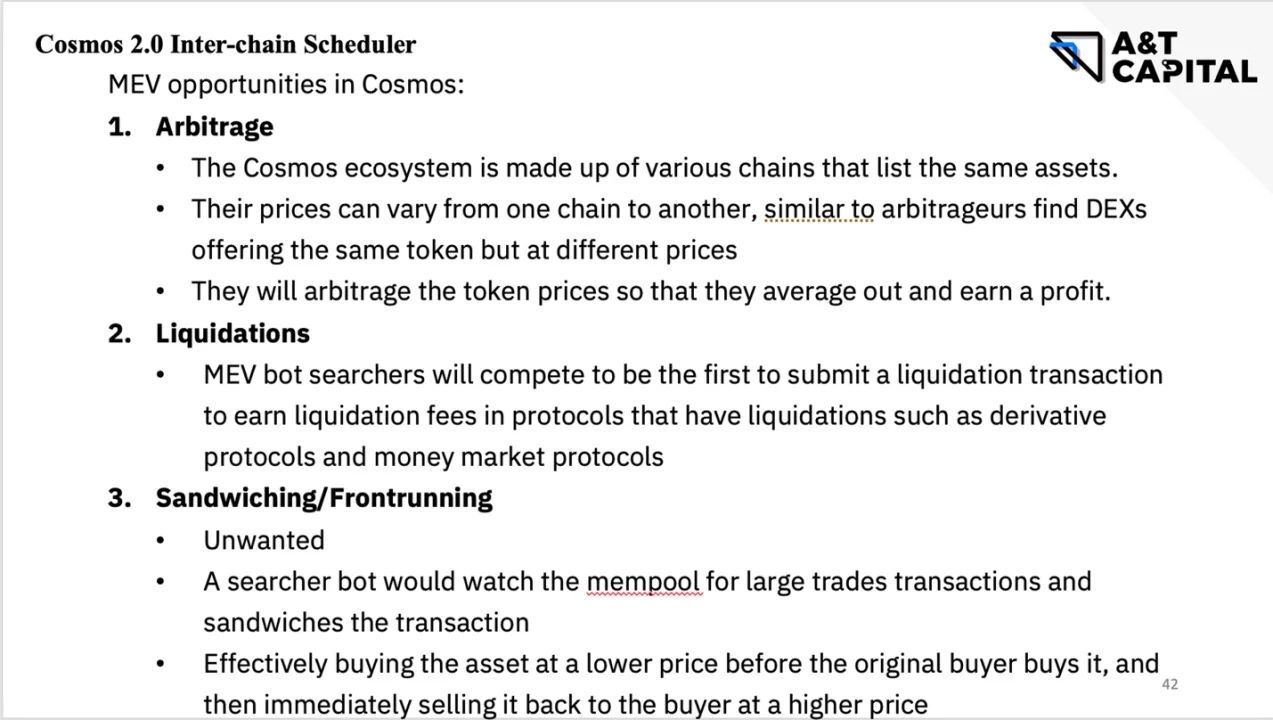

The MEV problem has been widely discussed in academia and industry in recent years, and it is expected that we will see a large number of solutions to this kind of problem. There are three categories of MEV opportunities at Cosmos:

1. Arbitrage - Arbitrage:Favorable MEV. Similar to the different prices of the same asset on different exchanges, the prices of the same asset on different chains in the Cosmos ecosystem are also different. MEV bots profit from token transaction spreads.

2. Liquidation - liquidation:Favorable MEV. MEV bots compete to be the first to submit trades for clearing, earning clearing fees on derivatives protocols and market-making protocols.

3. Sandwiching/Frontrunning - sandwich problem:Bad for MEV. MEV bots profit by monitoring the mempool, buying assets at a lower price before real buyers buy them, and selling them to real buyers at a higher price.

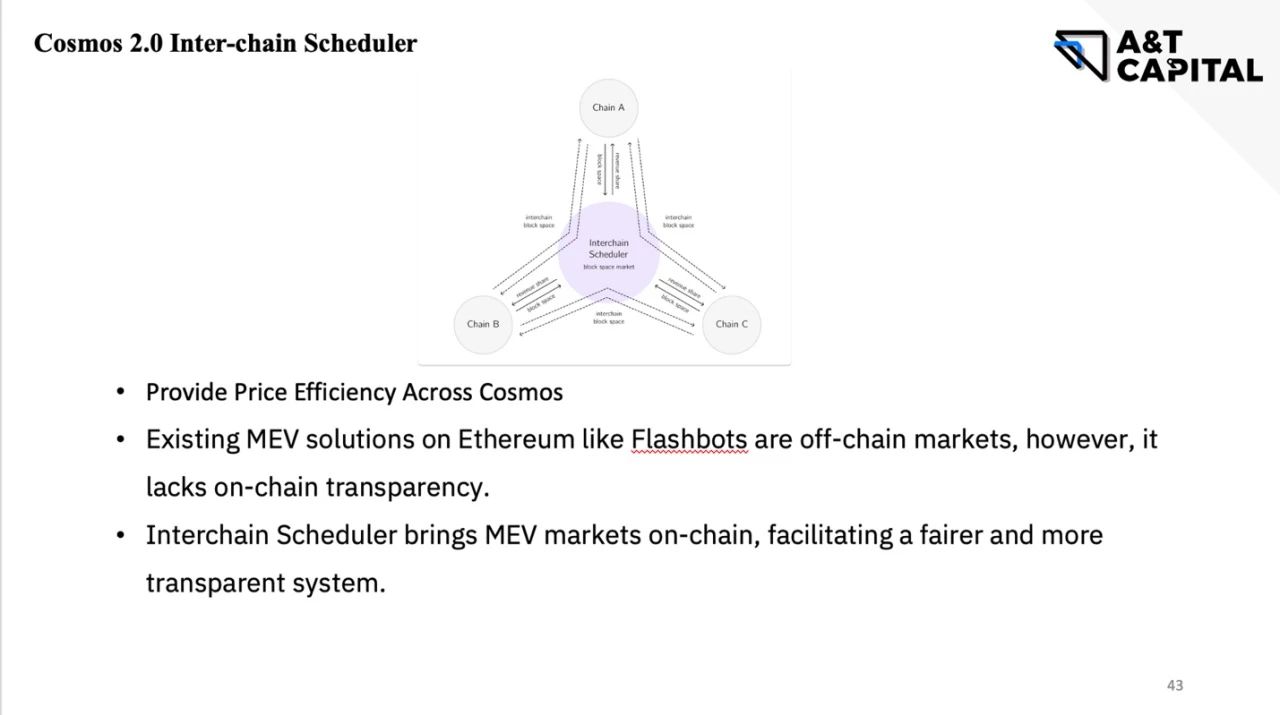

MEV cannot be avoided. Even Ethereum is facing MEV problems. Sandwiching MEV is an off-chain market that lacks transparency. A popular approach to unfavorable Sandwiching MEV is to create an open market for MEV opportunities. The validator is responsible for verifying transactions and producing new blocks. They can auction the space in the block, such as auctioning the opportunity for front-running transactions, creating an open market for selling block space to arbitrageurs. Arbitrage traders need to pay block producers a fee to ensure their trades are executed.

Inter-chain Scheduler is the concept of block space marketplace officially proposed by ATOM 2.0. The MEV market is put on the chain in the form of block space marketplace. By bidding for block space on different chains, arbitrageurs pay bidding fees to ensure that transactions are executed And lock in profits, and then make the MEV arbitrage transparent, and the bidding revenue supports the further development of Cosmos.

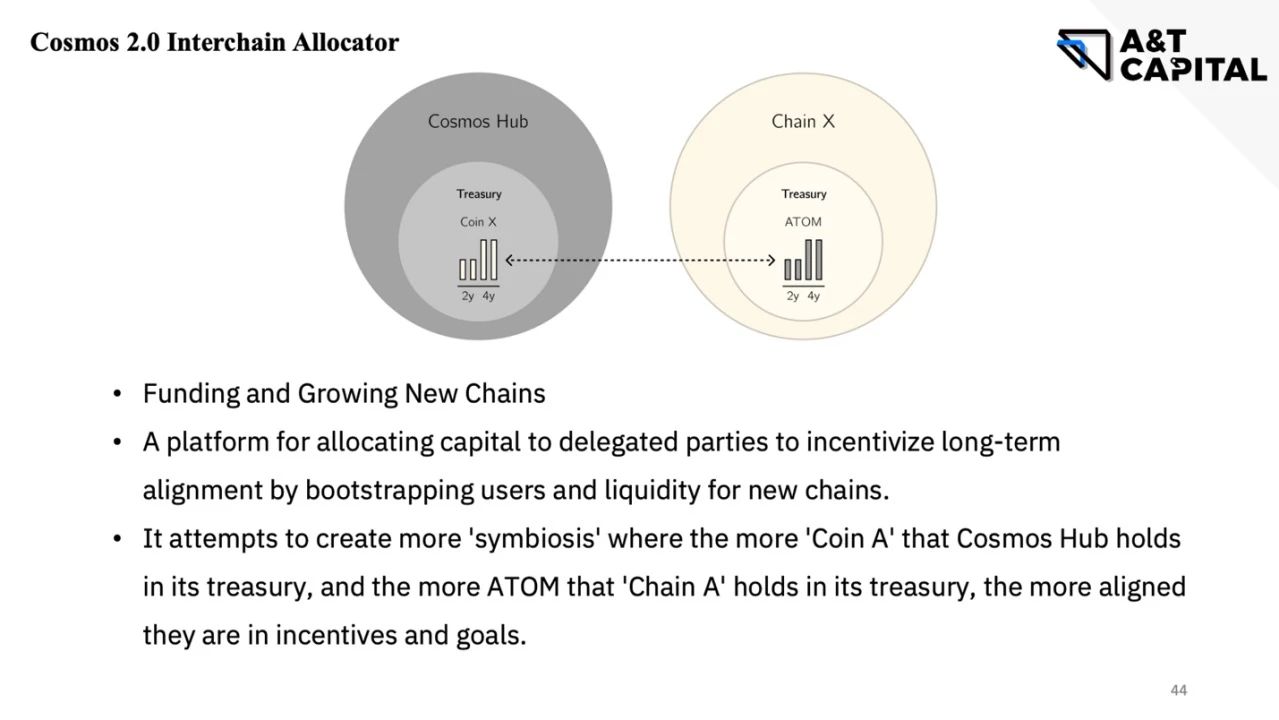

5 ) Inter-chain Allocator

Inter-chain Allocator assumes Cosmos' ecological incubator, sponsors the incubation of the new Cosmos chain, and introduces Cosmos Hub users and liquidity into the new chain. The Cosmos Hub exchanges new chain tokens with a certain percentage of $ATOM, and the new chain uses the circulating $ATOM tokens to achieve early construction. However, this also means that Cosmos Hub is further capitalized, and it is necessary to control capital exposure to avoid risks and fully disclose the state treasury funds to ensure transparency.

6 )Tokenomics

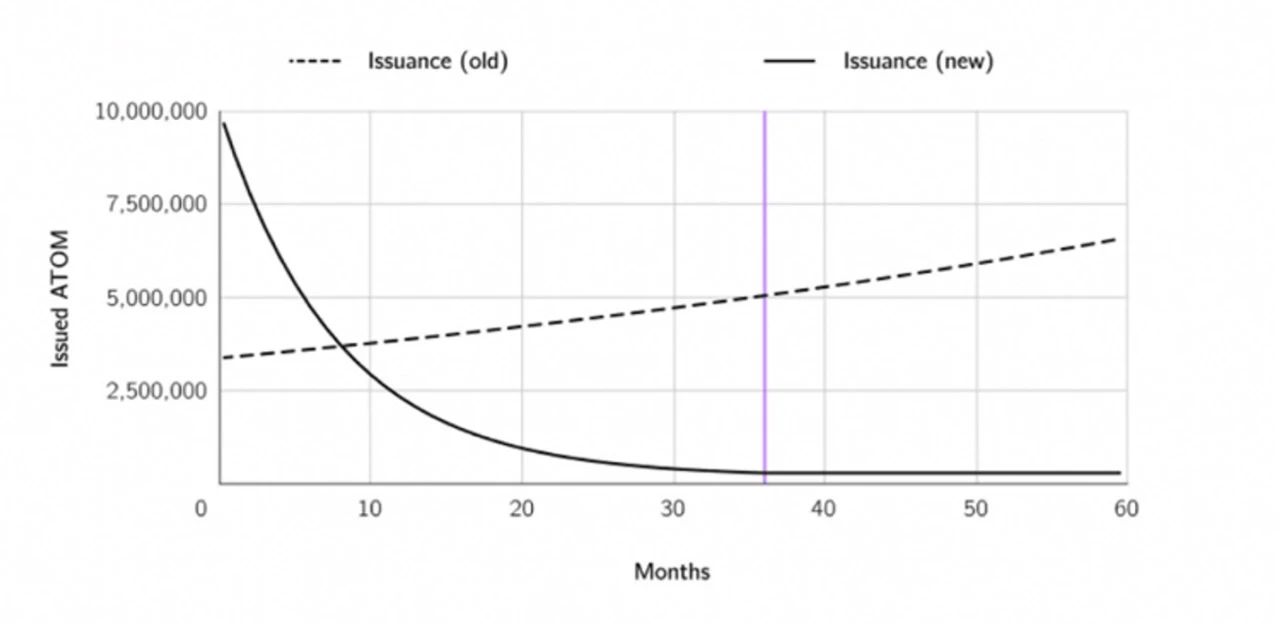

The current Tokenomics balances security and liquidity by adjusting the inflation issuance through the pledge rate. If the $ATOM staking ratio falls below the lower threshold, token issuance is increased and additional staking is incentivized for increased security but lower liquidity. If the pledge rate exceeds the upper threshold, the issuance is reduced, suppressing pledges, and improving liquidity (at the expense of security). There is always a balance between security and liquidity. The theoretical annualized inflation rate of $ATOM is between 7% and 20%, but the actual rate is basically above 10%, which has been criticized.

Under the new Tokenomics of ATOM 2.0, 10 million $ATOMs were issued every month in the first 9 months, and more than 55 million $ATOMs were minted in the first year, and then decreased, and entered a stable or even deflation after 36 months. The high inflation during its initial issuance period caused great controversy in the community, worrying that $ATOM holdings would be diluted. Even after the Cosmos Hub modified the 2.0 white paper, it was changed to issue 4 million $ATOMs in 10 batches per batch, which was still subject to Cosmos original creation. Jae Kwon strongly disagrees, arguing that most of the $ATOM will eventually go to the Central Committee of the Treasury.

The new Tokenomics has greatly increased the source of income for the Cosmos Hub. In theory, it has greatly increased the value capture of $ATOM as the official Cosmos chain Token, but it has also been criticized because a large amount of income will flow into the treasury. As the token of $Photon, $Photon can only be used as a gas fee medium by bundling $ATOM for pledge casting, or replacing $ATOM to achieve various functions such as Inter-chain Security, thereby maintaining the "uselessness" of the Cosmos Hub, However, the $ATOM/$Photon dual-token model it advocates has been strongly resisted by the community, who believes that the dual-token model is not conducive to the development of the public chain.

There are constant rumors in the market, and we don't know what deeper disputes lie behind the trade-offs of seemingly different plans. But no matter which one, the significance of the proposal itself lies in the face-up and innovation of existing problems, and it is a signal of the positive self-evolution of the Cosmos ecology. What a crypto fund can do is to explore the pain points and opportunities behind the signal, help buidlers who are willing to change, and help build a better ecology.

3. Looking at Cosmos pain points and subdivision track opportunities from Atom 2.0

1. Cosmos Liquid Staking Solution

Addressing Pain Points: The current 21-day lockup of the Cosmos chain results in limited cross-chain composability and capital efficiency

Representative projects: QuickSilver, etc.

Project Introduction: Cosmos L1, liquid pledge protocol, Quicksilver team has customized a liquid pledge protocol to create a better pledge experience for the connected Cosmos L1, aiming to improve capital efficiency and decentralization.

Website: https://quicksilver.zone/

2. Trustless Liquid Staking Solution

Targeting Pain Points: Centralized Systemic Risks of Liquid Staking

Representative projects: Puffer.Finance, etc.

Project Brief: Puffer's Secure-Signer prevents Slashable offenses, protects staked ETH, and provides security for Decentralized Stake Pools when combined with Distributed Validator technology.

Website: https://www.puffer.fi/

3. Solutions to promote Cosmos asset liquidity and capital efficiency

Aiming at pain points: Cosmos pledged Token capital efficiency and lack of liquidity

Representative project: Crescent

Project Introduction: Provide multi-chain asset DEX, derivatives, and bring capital efficiency and liquidity stimulation

Website: https://crescent.network/

4. Solutions to potential leverage problems in the process of cross-chain asset flow

For pain points: Cosmos realizes Liquid Staking, which may increase leverage infinitely in the process of cross-chain asset flow

Representative project: not found yet (welcome to discuss)

5. Provide shared security solutions for the early construction of the Cosmos public chain

For the pain point: each application chain needs an independent validator set and an independent pledge token to provide security, which is difficult to guarantee in the early stage of the new chain, which becomes the threshold for building the Cosmos sovereign chain.

Representative projects: Babylon etc.

Project Introduction: To provide security by utilizing PoW's Bitcoin chain to verify the order of transaction blocks for Cosmos' PoS chain.

Website: https://babylonchain.io/

6.Sandwiching MEV solution

Addressing Pain Points: Unfavorable Sandwiching MEV Arbitrage Problems

Representative projects: Skip Protocol, Sei Network, etc.

Project Introduction: Increase favorable MEV impact (Arbitrage & Liquidations), weaken unfavorable MEV impact (Sandwiching & Frontrunning) / Defi Hub with pre-emptive transaction protection and built-in order matching engine by greatly optimizing block time

Website: https://skip.money/, https://www.seinetwork.io/

7. The block space marketplace that carries the role of Inter-chain Scheduler

Addressing Pain Points: Creating an Open Market for MEV Arbitrage Opportunities

Representative project: Mekatek

Project Introduction: The first Maximum Aggregate Value (MAV) marketplace in Interchain

Website: https://meka.tech/

8. A first-mover advantage chain to realize the vision of ATOM 2.0

Aiming at pain points: becoming the earliest experimental sub-ecology of the ATOM 2.0 vision

Representative projects: Neutron, etc.

Project Introduction: Sub-ecology based on interchain Account, Interchain Security, CosmWasm

Website: https://neutron.org/

9. Solutions to facilitate governance interaction among Cosmos multi-chain DAOs

For pain points: Cosmos inter-chain governance and disputes

Representative projects: Gnoland, Territori, etc.

Project introduction: Sub-Cosmos created by the original team of Jae Kwon, introducing GnoVM, Proof of contributions, Tendermint 2, IBC 2, DAO governance liquidity, Network of Dao, Contract marketplace and other concepts

Website: https://gno.land/

10. Solutions to introduce large-scale stablecoins to the Cosmos ecosystem

For the pain point: Cosmos ecological stable currency is immature, which limits the development of Defi

Representative projects: Canto, Osmosis (it is rumored that Circle will issue $USDC in Osmosis), etc.

Project Introduction: Bringing New Stablecoin $NOTE to Cosmos

Website: https://canto.io/

11. Solutions to promote further modularization and generalization of Cosmos

For the pain point: Cosmos application chain development is difficult and costly, and the degree of modularity can still be optimized

Representative projects: Celestia, dYmension, Agoric, etc.

Project Introduction: Further improve the scalability of the application chain by providing a general Data Availability (DA) layer

Website: https://celestia.space/

12. Expand the Cosmos ecosystem by optimizing the Tendermint consensus engine

Solve pain points: Cosmos and other blockchain ecology open up/further modularization of Cosmos consensus engine

Representative projects: Evmos, Celestia (Optimint), etc.

Project Introduction: Ethermint Core Development Team, EVM Chain and Cosmos Gateway

Website: https://evmos.org/

13. For blockchain scalability, a new multi-chain ecological narrative

Solve the pain point: not limited to the existing architecture, a new narrative for blockchain scalability

Representative projects: Linera, Artela (Titan that A&T is incubating), etc.

Project introduction: WASM multi-chain ecology L1 of public validator set through scalability technology innovation

Website: https://linera.io/

4. Cosmos ecological primary market investment logic and financing suggestions

1. Subdivided track:

The above-mentioned tracks with structural opportunities due to ecological pain points (the following are in no particular order):

Cosmos Liquid Staking Solutions

Trustless Liquid Staking Solutions

Solutions to facilitate liquidity and capital efficiency of Cosmos assets

A solution to the leverage problem in the process of cross-chain asset flow

Provide shared security solutions for the early construction of the Cosmos public chain

Sandwiching MEV Solutions

The block space marketplace that carries the role of Inter-chain Scheduler

A first-mover advantage chain to realize the ATOM 2.0 vision

A Solution to Facilitate Interaction among Cosmos Multi-Chain DAOs

Expand the Cosmos ecosystem by optimizing the Tendermint consensus engine

A new multi-chain ecological narrative for blockchain scalability

2. Team background suggestion:

Due to the rejection of the ATOM 2.0 proposal, Cosmos currently has a high threshold for the application chain team. By analyzing the background of the current Cosmos head public chain team, the following background application chain teams will have the advantage to become the future Cosmos head public chain:

Have experience in successful crypto projects in Cosmos or other ecosystems

The team has a Tendermint background or Tendermint official team endorsement

Deep understanding and innovation of blockchain scalability supported by papers/community proposals (only for infra projects)

3. Financing advice:

For Asian teams, going overseas is the biggest challenge. Consider:

Put the technical narrative on the pen, publish it in overseas communities and create community popularity

Strive to participate in overseas conferences as Speakers, public chain official channels for overseas exposure

Recruit overseas community operators with experience in the Cosmos community at the right time

V. Conclusion

V. Conclusion

Although the ATOM 2.0 proposal ended in phased failure, the significance of the proposal itself lies in the face-up and innovation of existing problems, and it is a signal of the positive self-evolution of the Cosmos ecology. Analyzing the significance and controversy of the proposal, and exploring the pain points and opportunities behind the signal will help us better understand and build the application chain ecology.

The overall Cosmos ecology is significantly less affected by the Crypto bear market than other alternative L1. The overall vitality of the Cosmos ecology is relatively good. With the increase in the metabolism of the Cosmos IBC chain in the future, it is expected that the pattern of the Cosmos head public chain will change, and it is worth deploying.

Original link