Author: David

Author: David

Press: Recently, encrypted lending platforms have suspended redemptions one after another, which has triggered panic among encrypted market participants and a sharp drop in the encrypted market. This article explains the inevitability of thunderstorms on such platforms, how to avoid such funds in the later stage, and the possible direction of DeFi in the future by sorting out the core model of the centralized encrypted lending platform and its actual operation method.

1. What is encrypted lending

Cryptocurrency lending is a novel financial tool that can quickly obtain liquidity, allowing cryptocurrencies to be mortgaged to obtain loans. Platforms that provide encrypted lending generally also provide deposit services. Depositors obtain interest income by depositing cryptocurrencies into deposit accounts. interest rates) to attract crypto deposits.

Encrypted lending platforms generally lend to institutions or individuals in the form of over-collateralization on the platform, and also require instant financing (leveraged transactions or short transactions, etc.) from institutions participating in encrypted transactions such as exchanges, market makers or hedge funds in the OTC market of participants carry out over-collateralized loans.

Encrypted lending does not require credit investigation of the borrower (but may involve different degrees of identity verification and source of funds review), but the borrower needs to mortgage the cryptocurrency to the lender, and the lender generally deposits it in an escrow account after receiving the collateral . This is different from P2P lending, which is generally a credit loan for a certain project, and generally does not involve collateral.

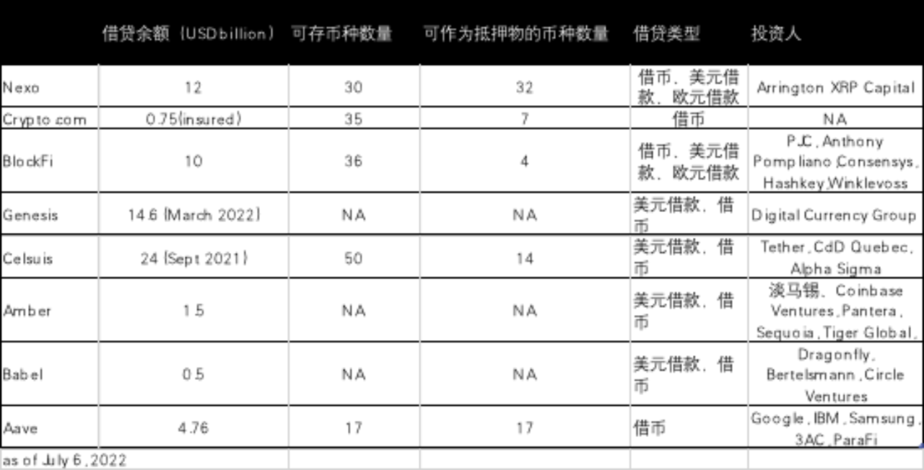

2. Overview of the centralized encrypted lending market

In 2020 alone, the assets under management of the three major CeFi lending platforms have increased by 734%. Celsius and BlockFi each hold more than $4 billion in assets, and Nexo's assets under management are about $2 billion. The three major CeFi platforms have a total of nearly $7 billion in assets locked on their platforms.

3. The role of encrypted lending

Facilitate market arbitrage behavior:

Cryptocurrencies are still an emerging asset class with low market liquidity leading to high volatility in cryptocurrency prices. Lack of liquidity often creates arbitrage opportunities, for example, if different cryptocurrency exchanges have different levels of liquidity, then there are different trading prices at the same time.

Crypto lending provides liquidity to institutional investors such as hedge funds, crypto exchanges or market makers, allowing them to take advantage of these arbitrage opportunities to earn the difference. The more market participants involved in arbitrage transactions, the smaller these arbitrage opportunities, and the more efficient and stable the entire crypto market becomes.

Provide liquidity to crypto institutions:

Due to the relatively lagging regulation, it is difficult for institutions involved in encryption activities, such as miners or encryption investment institutions, to obtain liquidity through the traditional financial system. Many of them cannot even open bank accounts. Generally, they can only obtain liquidity through encrypted lending.

As cryptocurrencies are gradually recognized by regulators and their value is determined at the legal level, the application scenarios of encrypted lending will inevitably expand. Entering 2022, more and more CEFI or traditional financial institutions began to accept margin loans with BTC as collateral, such as Silvergate Bank's $250 million loan to MicroStrategy. But generally speaking, the window for crypto institutions to obtain USD liquidity is still narrow.

Improved efficiency and inclusiveness of financial resources:

Due to the technological attributes of encrypted lending itself and the digital attributes of the collateral, multiple transactions and businesses can be processed quickly in a short period of time. Compared with traditional financial institution lending, it has a huge efficiency advantage. At the same time, encrypted lending on the chain eliminates the need for credit evaluation of borrowers, recognizes currency but does not recognize people, and improves the inclusiveness of financial services.

4. The general terms of encrypted lending and the current actual situation of CEFI

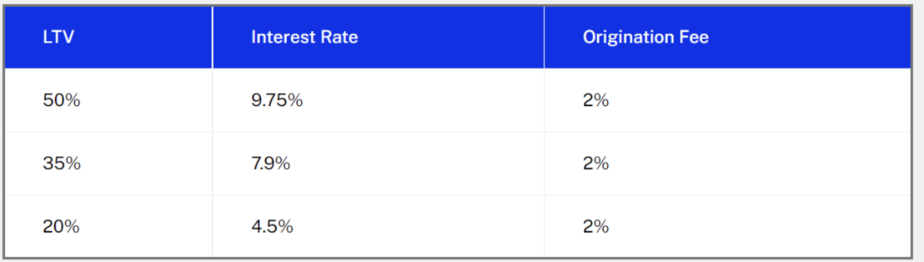

By sorting out the general terms and conditions of encrypted loans on NEXO, BlockFi and other platforms, the following characteristics can be found:

The value of the loan is determined based on the LTV (Loan-to-Value) given on the platform. The value of collateral is calculated by the platform based on market prices and related policies.

The platform has the ownership and all joint and several rights and interests of the collateral during the outstanding period of the relevant loan, and can dispose of the collateral in any way at its sole discretion. This point is more controversial, because in the general mortgage loan rights and obligations relationship, the lender only obtains the security interest rather than the ownership of the mortgage, and the security interest is generally subordinate to the creditor's right.

If the LTV increases beyond the maximum allowable value, the platform shall liquidate the necessary amount of collateral to bring the LTV back to the normal level after notifying the customer as far in advance as possible. Due to the volatility of the digital asset market, the client needs to understand that it may not be technically possible to provide advance notice before the relevant liquidation, and it is the client's sole responsibility to monitor the prevailing market conditions at any given time and maintain the mortgage rate at a normal level in full compliance with these general terms .

For the determination of LTV, the current (Monday, July 4, 2022) NEXO and BlockFi webpages are as follows:

Crypto loans are calculated according to compound interest.

According to the US SEC's investigation of BlockFi in February 2022, starting from the launch of BlockFi's certificate of deposit service BIA on March 4, 2019, BlockFi stated on its website and various promotional materials that its institutional loans are "usually" overcollateralized , and the LTV is less than 50%.In fact, the LTV used in most institutional loans is higher than this number, because institutional investors are usually unwilling to provide over-collateralization, and the lending market is highly competitive, and usually platforms only relax collateral requirements to obtain business.According to the SEC investigation data

In 2019, about 24% of institutional encrypted asset loans were over-collateralized; in 2020, only about 16% were over-collateralized; in the first half of 2021, about 17% were over-collateralized.

In fact, the mortgage rate is much higher than the requirement, which leads to the reduction of the core risk control measures, and the risk level of the entire loan asset is greatly increased: a slight fluctuation in the price of the collateral will cause the entire asset to face liquidity risk. This arrangement also allows individual investors to effectively take on more risk.

5. General terms of encrypted deposits and the actual situation of CEFI

By sorting out the deposit terms of relevant platforms, we can find the following features:

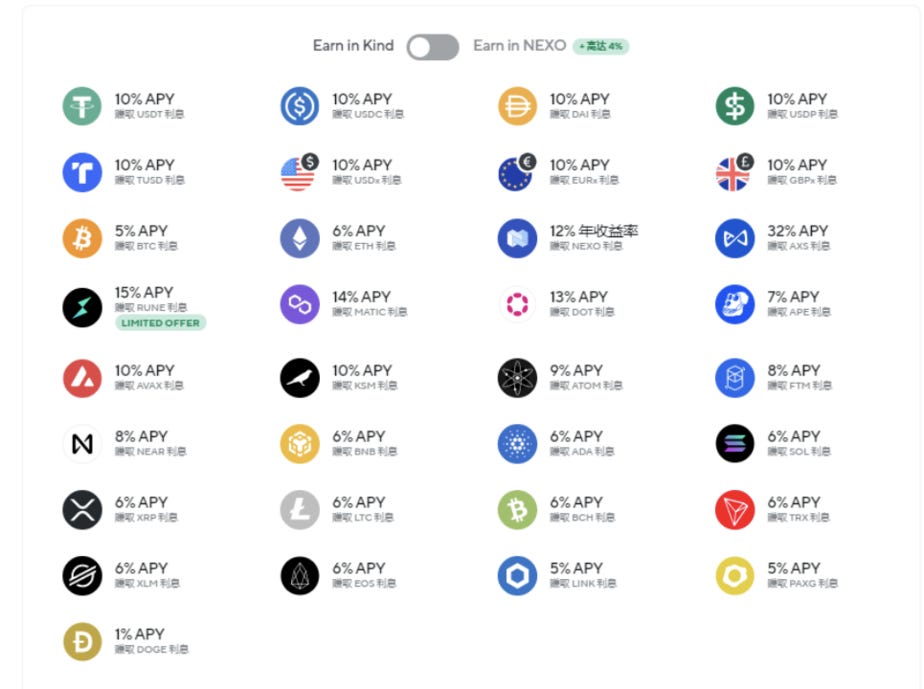

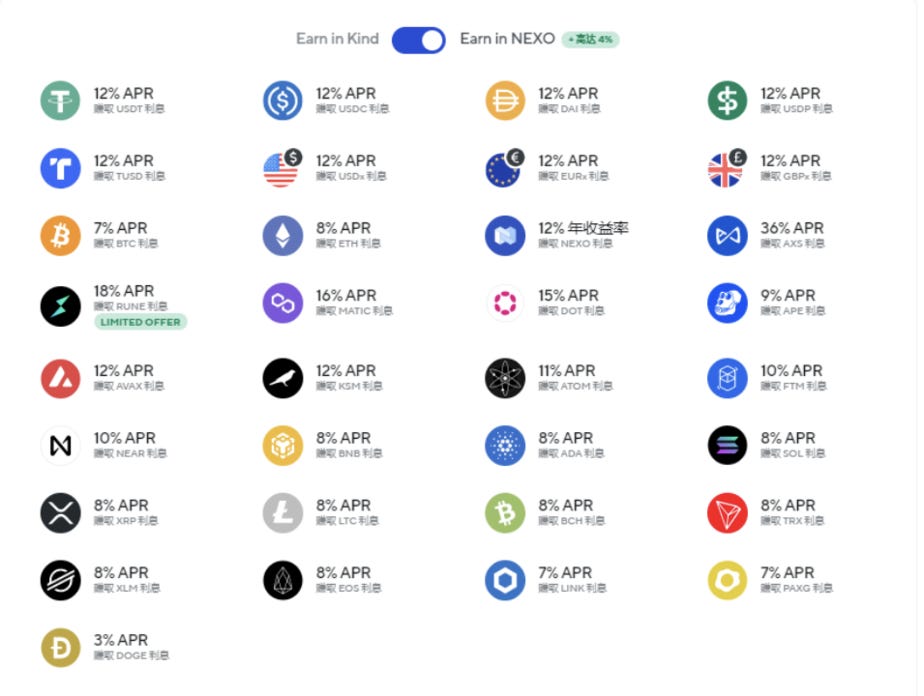

Users can choose regular or regular. CDs can serve as additional collateral when LTV is insufficient. Interest can be issued in the deposit currency (compound interest) or in platform tokens (simple interest), and can be switched arbitrarily (take NEXO as an example). If the user chooses to use platform tokens as interest income, the platform will provide additional interest income as an incentive. Users can deposit or redeem products at any time. Generally speaking, similar platforms will attract customers through high yields (as shown in the figure below). This picture was taken on July 4, 2022. Although there have been thunderstorms on many platforms, NEXO still puts this high-yield gimmick on its official website.

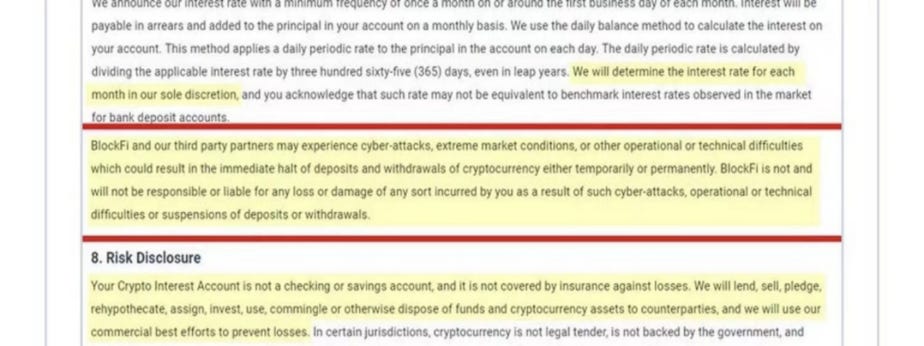

BlockFi also makes it clear in its deposit account terms of rights and responsibilities that it is not responsible for any loss of funds caused by cyber attacks or technical problems. For a business that deals in technology (at least that's what they claim to be), such a disclaimer is a bit odd.

Based on the characteristics of the deposit certificate itself, that is, an investment contract that can bring expected monetary returns sold to the public, the US SEC issued a regulatory letter to BlockFi on February 14, 2022, pointing out that its deposit certificate is essentially a security. BLOCKFI currently clarifies in the notes section of its website that BIA is not a bank or securities account and therefore will not be subject to regulatory protection.

From March 4, 2019 to the present, BlockFi has provided and sold BlockFi accounts BIA to investors, through which investors lend crypto assets to BlockFi in exchange for its promised interest income. According to the SEC, BlockFi advertised that BIA balances of up to 25 BTC or 500 ETH (equivalent to about $100,000 and $70,000 respectively at the time) would earn a 6.2% annualized return, with all balances Earn a tiered interest rate of 2.0% annualized return if you exceed this limit. However, SEC forensics found that as of November 1, 2021, BlockFi actually paid investors an interest rate between 0.1% and 9.5%, depending on the type of crypto asset and the size of the investment. The benefit to the depositor is that the depositor can redeem the deposit at any time.

6. Fund operation?

The current CEFI model can be simply compared to the fund pool/fund business. The fund pool is a non-compliant financial business with a long history that domestic investors are familiar with. It is an illegal act of absorbing funds by means of high interest rates on the fund raising side. The asset side takes advantage of the opacity of the asset pool itself to move assets within the pool and artificially match risks and returns, resulting in huge systemic financial risks.

According to the regulatory documents of domestic financial institutions, wealth management pools can be defined as "irregular fund pool business refers to multiple wealth management products of different types and different periods corresponding to multiple assets at the same time, and it is impossible to achieve separate accounting and standardized management of each wealth management product." .”

This kind of fund pool business generally continues to raise funds through the rolling sale of multiple wealth management products with different maturities, so as to maintain a balance between the source of funds and the use of funds. The funds are invested in various assets including bonds, bills, and trust plans. Fund pool wealth management products usually have the characteristics of "continuous sale, collective operation, mismatch of maturity, and separate pricing". At the same time, in order to ensure smooth fundraising, the fund pool usually has the characteristics of high interest rate storage.Continuous offering and high-interest storage:

Continuous offering refers to continuous offering of wealth management products for fund raising. Judging from the terms of deposit certificates of most CEFI platforms, users can deposit or redeem tokens at any time, and some can even change the interest calculation method at any time. At the same time, as mentioned earlier, most platforms use high yields to attract investors.Collection operation:Collective operation refers to the collection and management of raised funds, which are uniformly applied to a collective asset package composed of various underlying assets that meet the investment scope of this type of asset pool. The operating income of this asset package is used as a unified source to determine the income of each product.According to the SEC investigation, BlockFi opens a BIA account to investors in exchange for capital investment in the form of encrypted assets. BlockFi brings together the encrypted assets of BIA investors and uses these assets for lending and investment, and the investment income and interest income are shared between BlockFi and BIA investors.According to a survey by the Texas Securities Association

, Celsius is also "free to use cryptocurrencies deposited by investors in interest-bearing accounts, mix coins from various sources, invest in traditional financial assets and cryptocurrency assets, lend to institutional and corporate borrowers, and engage in any Celsius Other activities at their own discretion.” The biggest problem with collective operations is the opacity of operations, which provides a stage for high-risk operations and benefit transfer.Term Mismatch:

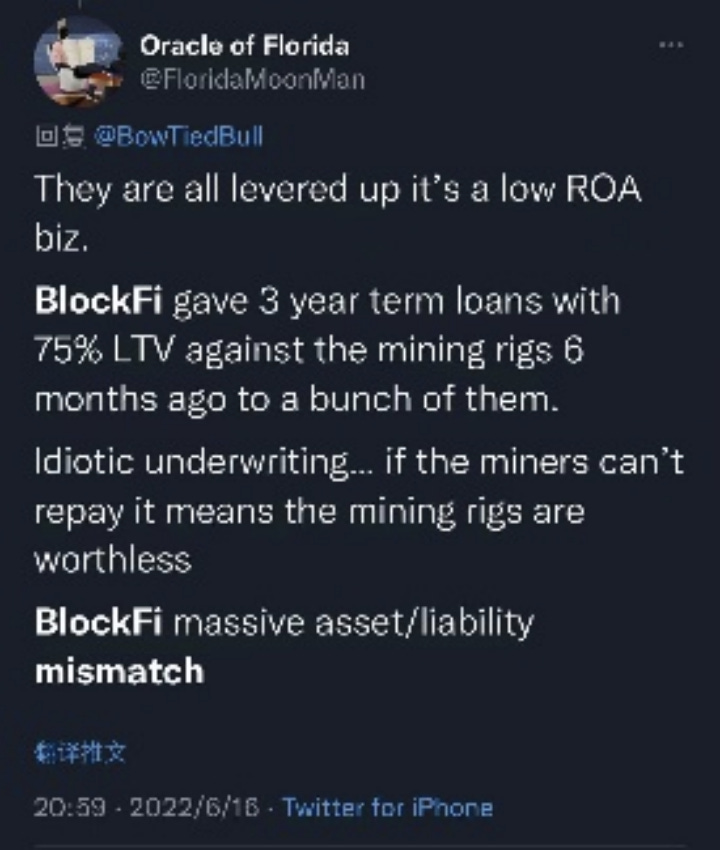

Term mismatch refers to the term of the asset pool fund source, which is not exactly the same as the term of the fund user (collective asset package). The term mismatch, especially the long-term asset side, superimposed short-term debt side, makes it easy for institutions to be trampled, which in turn causes market panic, and the platform can only announce a withdrawal/withdrawal freeze. The chart below shows the market rumor that BlockFi has made long-term (3-year) borrowing behavior with very high LTV.

Celsius’s investment in stETH and WBTC, Three Arrows Capital’s investment in Grayscale Trust’s shares, and the investment of such asset pools in the primary market are typical liquidity crises caused by maturity mismatches. Most of the funds raised on the CEFI platform are current properties and can be redeemed at any time, but their investment is a long-term investment.Separate pricing:

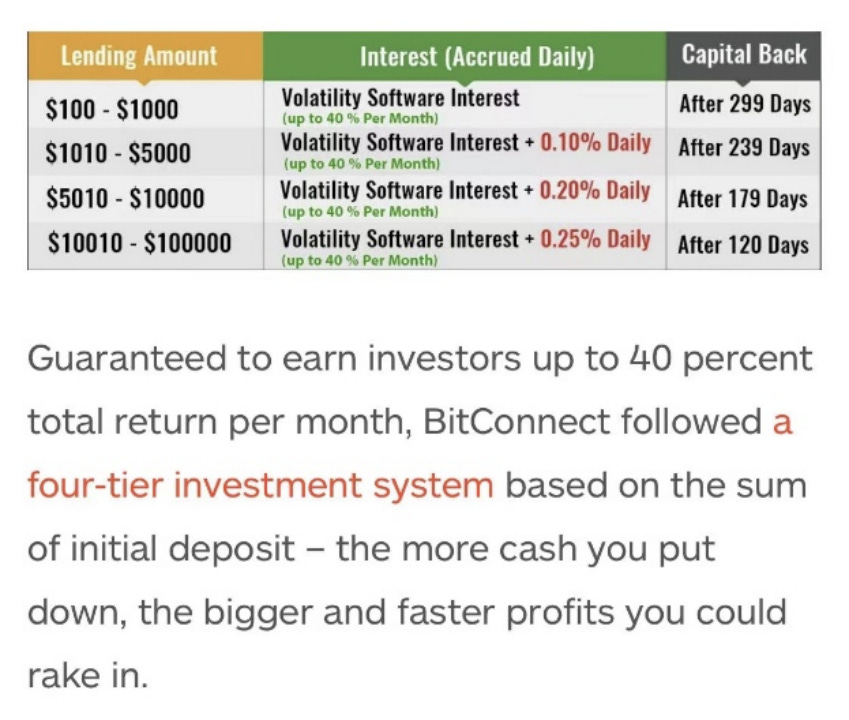

Separation pricing refers to the income level of various wealth management products sold by the same asset pool. Generally, it is not directly linked to the actual income of the collective asset package during the deposit period of the financial product, but is based on the expected yield to maturity of the collective asset package. Separate pricing. This pricing method will cause a mismatch between the actual risks and benefits of customers and BlockFi. The picture below is an example of Bitconnect. The more funds the user deposits, the higher the "guaranteed" interest rate and the shorter the payback period. The interest rate is not linked to the actual return on the underlying assets.

Separate pricing also leads to insufficient risk pricing, forming a so-called "death spiral" in a down market. Institutions have to invest in investments with higher returns due to the promise of high returns. Similar to the collapse of luna, the market sentiment towards these high-risk encryption projects has cooled sharply, and Celsius is already facing redemption pressure. As of May 17, the value of assets locked on the Celsius platform has shrunk sharply from more than $28 billion at the end of December to less than $12 billion. With the overall shrinking of DeFi yields, Celsius had to take risks and carry out some high-risk operations in order to meet the 17% yield promised to customers.

As a result, Celsius used customer tokens to participate in some high-risk projects and thunderstorms occurred one after another:

$120 million lost in the BadgerDAO hack last December;

In the Luna incident in May, the company withdrew $500 million in UST on Anchor (avoided losses);

The inclination of the stETH/ETH pool may cause liquidity risks to the company.

Especially when the encryption market fell as a whole and customers flocked to exchange BTC or ETH, they found that the company suspended the withdrawal and transfer functions, which aggravated the panic.

It can be seen that the current encrypted lending platform has the above four characteristics at the same time, and it is a typical capital market.

7. Is DEFI better than CEFI?

At present, it seems that in the absence of effective supervision, the operation of CEFI has inherited the fund mode in traditional finance and has become a hotbed of non-compliant financial operations, posing a major threat to the further development of the encryption ecology.

So will the situation improve when DeFi deals with these problems? The answer is yes. During the actual execution of DeFi's smart contracts, it solves the problems of opacity on the asset side and counterparty risk (if trustless), and effectively slows down the accumulation of financial risks.

However, as to whether it will eventually form a collective operation of funds and form effective risk pricing, no project has yet been seen to form a solution to this problem.

8. So, is the thunderstorm over now?

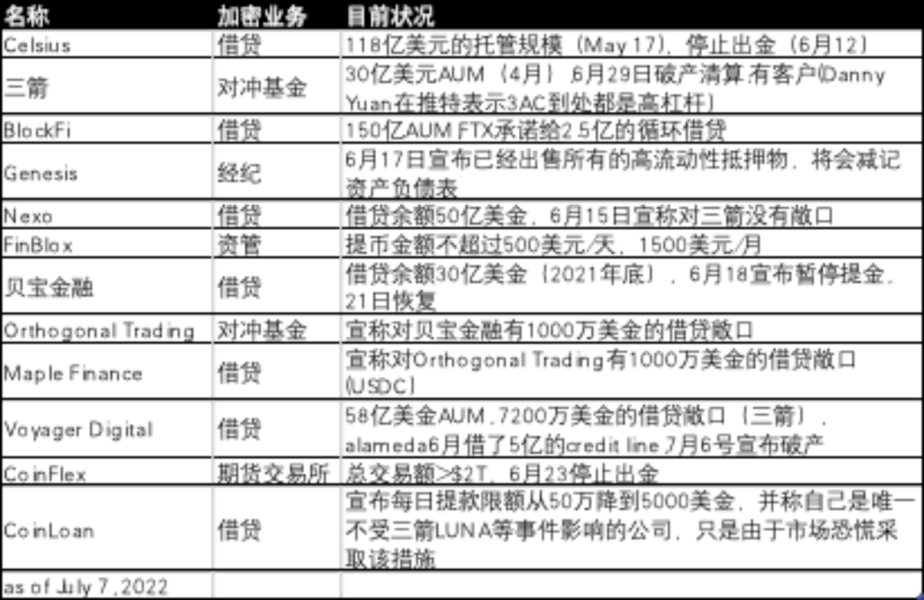

On June 29, Three Arrows Capital declared bankruptcy and liquidation. Sanjian Capital is currently one of the largest lenders and customers in the global crypto lending market. Almost all institutions in the picture have business dealings with Sanjian (except for NEXO and CoinLoan, which have declared that they have no exposure to Sanjian). Sanjian's bankruptcy liquidation will have a chain reaction on the market, and a large number of institutions will be forced to bear losses, write down their balance sheets, and even directly file for bankruptcy.

On July 6, Voyager Digital, with 3.5 million users and $5.8 billion in assets under management, declared bankruptcy. Further liquidation actions in the encryption market in the future should be a high probability event.

1.https://www.sec.gov/litigation/admin/2022/33-11029.pdf

2.https://www.ssb.texas.gov/sites/default/files/2021-09/20210917_FINAL_Celsius_NOH_js_signed.pdf