Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

Author | Qin Xiaofeng

Produced | OdailySociete GeneraleFor a long time, encrypted finance has been eager to embrace the mainstream society, link up with traditional finance, and introduce incremental funds.

But this vision is too ambitious, requires too many elements and conditions, and faces many difficulties, so that there are only a handful of projects that are really working in this direction. MakerDAO, known as the "Central Bank of Encryption", is one of them, and it is also one of the best. MakerDAO has tried many times to introduce real-world assets into the encrypted market, and has successively provided financing for real assets such as real estate and music copyrights.It is also favored.

Since its establishment four years ago, Centrifuge has integrated with multiple DeFi protocols such as MakerDAO and Aave, and will be launched in the Polkadot ecosystem to truly realize the barrier-free flow of DeFi and real assets.

Centrifuge, a company that provides technology and service support behind MakerDAO, is little known.

Since its establishment four years ago, Centrifuge has integrated with multiple DeFi protocols such as MakerDAO and Aave, and will be launched in the Polkadot ecosystem to truly realize the barrier-free flow of DeFi and real assets.

In the past two years, DeFi (decentralized finance) has ushered in a period of rapid development. Whether it is the number of projects or the amount of funds locked on the chain, the increase has reached hundreds of times.

The road is long and difficult, how far can Centrifuge go?

1. Real assets expand the boundaries of DeFi

In the past two years, DeFi (decentralized finance) has ushered in a period of rapid development. Whether it is the number of projects or the amount of funds locked on the chain, the increase has reached hundreds of times.

The prosperity of DeFi is not an accident, but a real solution to the pain points of traditional finance and cater to market demand. Taking the traditional lending market as an example, the entry threshold is very high, and the review of assets and the lending process are more complicated and cumbersome. In contrast, decentralized lending can be entered without permission, and transactions are conducted 7*24 hours, and lending is faster. Especially after the tokenization of real assets also increases their liquidity.It is with these advantages that DeFi has exploded in the past two years. Data on the chain shows that the current lock-up value of the entire DeFi ecosystem is about 250 billion US dollars. But judging from the data of the past few months, the growth has slowed down significantly. A fundamental reason is that currently DeFi is mainly competing for stock.

Taking lending as an example, although a number of leading projects such as Aave, Curue, and Compound have emerged, they have shined in ecosystems such as BSC, Polygon, and Solana. But these products are essentially homogeneous competition based on encrypted native assets. Although the data is bright, it has not had much impact on the traditional world. Moreover, the current $250 billion seems to be an astronomical figure, but there is a lot of water in it, and many projects have repeated mortgages, so the real demand for encrypted mortgages may have to be discounted.

Today, the development of DeFi has reached a bottleneck period. It is the right way to expand outward, get out of the encrypted native small world, and embrace real world assets.From the perspective of development prospects, the world scale of global real estate financing alone has reached trillions of dollars, not to mention other credit and financing needs."In our opinion, DeFi is a major trend in the future of financial reform, and its essence is to solve all trust issues. The future of DeFi should also be linked with the traditional financial industry, bringing trillions of dollars of real-world assets into encryption market, the prospect of this track is very bright.” said the Centrifuge team.The chaining of physical assets is also the direction that many projects have tried hard in the past few years, but they have failed one after another in the end. The main reasons are as follows: First, the timing is not ripe.

Such projects flourished around 2017. At that time, industry education had not yet been completed, and the recognition of encrypted assets in the mainstream world was low. In addition, the bear market in 2018 led to the early death of many projects.

Second, the plan is immature.

Previously, most projects issued ERC20 tokens for financing, but there were no real assets behind them for collateral, or the assets were overvalued, and they were basically cashing out with hyped project tokens without real financing needs.

“Now, with the completion of market education and NFT becoming a more widely accepted asset carrier, the real world is more closely connected, and real asset chaining is once again on the agenda. It is only because of the "failure" of the previous pseudo-demand project that the encryption market now has colored glasses for long-term projects that truly promote the on-chain of physical assets.But in the long run, the future of encrypted finance, especially DeFi, should be linked with traditional finance to introduce real assets into the encrypted market in order to achieve industry growth.

This is a cause that must be persisted for a long time. The "encrypted central bank" MakerDAO is always moving forward, and behind MakerDAO's ideal is Centrifuge's silent hard work to build a bridge to DeFi for real assets. For example, in April this year, MakerDAO announced the opening of a credit line of up to $5 million for real estate company New Silver, and this loan was realized with the help of Centrifuge's lending platform Tinlake.

Centrifuge's mission is to connect asset sponsors and investors, making financing activities transparent and efficient, creating new opportunities for borrowers who have not been able to obtain DeFi liquidity so far, and getting rid of the middlemen, inefficiencies and high costs in the traditional financial industry. cost. We provide DeFi investors with a stable source of income and can obtain a safer and more stable rate of return.” the Centrifuge team told Odaily.:

Centrifuge Chain2. How to conduct encrypted financing for real assets?

TinlakeSince its establishment in 2017, Centrifuge has gone through four years. at present

The Centrifuge ecosystem mainly has the following parts, a POS blockchain built on Substrate, is also the location of real world assets (RWA) on the chain. Centrifuge Chain is already bridged to Ethereum, but using its own native token, the Centrifuge (CFG) token, which will be bridged to the Polkadot network in the future.

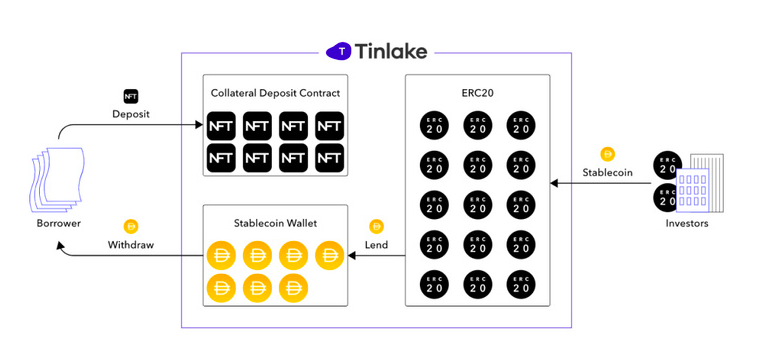

, a decentralized lending agreement based on Centrifuge Chain, acts as an open market for real-world asset pools, and is also the main product of Centrifuge, oriented to the C-end.P2P network protocol

, provides a secure method to create, exchange and verify asset data among collaborators, and tokenize assets into NFTs. Asset originators can optionally share asset details with service providers who can evaluate the data and provide information to minted NFTs. Cryptographic signatures can be used to verify the origin of data.

CFG Token

(1) Process explanation

First, music creators register on Paperchain and upload their music integration data on various platforms (currently mainly Merlin, Spotify, Apple and YouTube); Paperchain uses its own data model to price and predict its future streaming revenue every 24 hours ( tentatively referred to as "Accounts Receivable").

Next, we take the music streaming platform Paperchain as an example to explain the operation logic of Tinlake in detail.

First, music creators register on Paperchain and upload their music integration data on various platforms (currently mainly Merlin, Spotify, Apple and YouTube); Paperchain uses its own data model to price and predict its future streaming revenue every 24 hours ( tentatively referred to as "Accounts Receivable").

image description

(Tinlake operation process)

Then, Paperchain packages and sends the account receivable to the Tinlake platform to generate a non-homogeneous token (NFT) with legal effects; then convert the NFT into an interest-bearing ERC20 token, and Paperchain can set the income of the token rate and number of releases. Investors use the encrypted stablecoin DAI to purchase these interest-bearing ERC20 tokens for investment; these stablecoins are sent to Paperchain, which converts them into fiat currencies.

At this time, although the accounts receivable have not yet arrived, music creators can directly advance their copyright income from Paperchain. When the accounts receivable arrives, Paperchain gets the music creator's income, and then redeems and destroys the ERC20 tokens purchased by previous investors, thus forming a complete closed loop.

A brief summary of the Centrifuge financing process: asset promoters package and upload assets to generate a legally effective NFT; NFT is mortgaged, and the price is estimated through the model to generate interest-bearing ERC20 tokens; investors purchase these interest-bearing ERC20 tokens with DAI; The sponsor obtains financing, redeems it after maturity, and the investor obtains income.

(2) Analysis of Tinlake asset pool

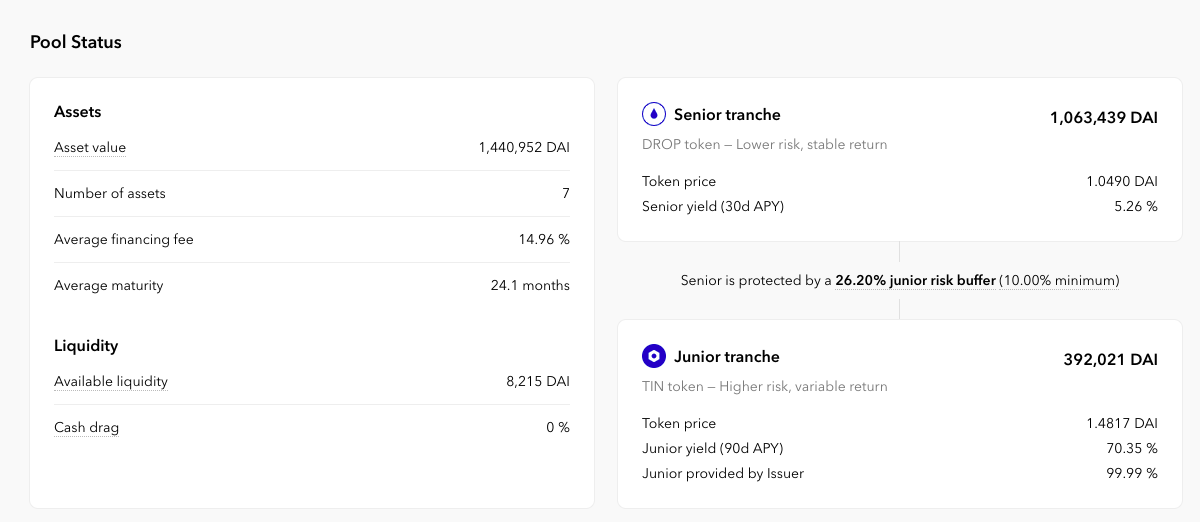

The aforementioned interest-bearing ERC20 token, also known as the Tinlake asset pool, currently has two main types: Tin and Drop.

Drop tokens are similar to senior bonds in traditional financial investment portfolios, with small returns, generally fixed, and low risk; Tin tokens are similar to junior bonds, with high returns, but they first bear the risk of default, and only Drop tokens are fully When being redeemed, Tin tokens can only get a return on investment, and the risk is greater, and the principal may be lost.

image description

(Fortunafi Series 1 Funding Pool)

Furthermore, if the asset promoter does not want to issue two tokens to set up a portfolio, he can issue only one token, but it must be Tin; if TIN and Drop are issued at the same time, the ratio of TIN issuance for different types of assets is also different , but the vast majority require a TIN issuance ratio of at least 10%—meaning losses as a Drop token holder will only occur if the loss exceeds 10% of the portfolio value.

Second, asset sponsors can create separate Tinlake pools (asset pools) for each asset type, such as one Tinlake pool for invoices and one Tinlake pool for mortgage loans; all Tinlake pools are independent of each other, and the interest rates are configured separately. Therefore, each set of Tin and Drop is unique and cannot be used universally. For investors, the risks and benefits are limited to the Tinlake pool they belong to and cannot be shared across Tinlake pools.

Finally, as Centrifuge envisions, stablecoins are not limited to DAI, currently accepting DAI and cUSD (Celo USD) in their pools, and in the future could accept any stablecoin such as Acala, DAI or Celo. The team is also working on building money markets on Compound and Aave. In addition, the setting of interest-bearing ERC20 tokens can be a centralized entity, a set of smart contracts that automatically price assets, or a DAO that manages Tinlake deployments.

secondary title

3. Is the Centrifuge model worth promoting?

From a theoretical point of view, the Centrifuge mode is completely feasible, but how does it work in practice, and is it worth promoting? May wish to speak through data.

From the perspective of real implementation, Centrifuge's Tinlake has indeed enhanced the liquidity of real assets.

Taking Paperchain as an example, the traditional music copyright payment cycle is generally 90 days. Through Tinlake, Paperchain successfully completed a pilot transaction on September 11, 2019, and prepaid customers $60,035 in Spotify revenue at an annualized rate of 7%. The initiation time of the entire pilot transaction prepayment is less than 30 minutes, and the initial cost is less than 3 US dollars (Ethereum Gas fee cost), which greatly accelerates the payment cycle, and creators can focus more on music creation and create better works. Taking the cargo company ConsolFreight as an example, the payment cycle of its freight invoices is generally 30 to 45 days, which is also shortened to within one day; the shortened payment cycle is conducive to improving capital utilization and helping ConsolFreight expand its scale.Currently, Centrifuge has a lock-up amount of 48.6 million DAI, a total of 11 asset pools are in the financing period, and a total of more than 70 companies/asset sponsors have created pools for mortgage loans. In addition, Centrifuge has established long-term partnerships with financial companies such as: New Silver (technical non-bank lender), ConsolFreight (trade finance and factoring provider), Harbor (supply chain finance).

Judging from the results, the Centrifuge model is worth learning, but we think there are still several issues worth exploring.

One is how to ensure the asset sponsor's ownership of the asset.Centrifuge will require sponsors to provide documents proving the ownership of financial assets, and information on these assets will be shared with third parties in Centrifuge's secure network, including asset valuation companies, audit companies, underlying asset end borrowers and service providers, and sponsors can Asset details are selectively shared with these third parties, who can evaluate the data and provide feedback to minted NFTs. In this way, anyone can become an asset originator.

"In the traditional financial system, small businesses cannot efficiently obtain low-cost funds. Centrifuge hopes that these SME borrowers can become asset sponsors and use the Centrifuge platform to obtain DeFi liquidity." The Centrifuge team explained.

The second is the valuation of non-standard assets.In some cases, real assets may not be standard assets such as cars and houses, but non-standard assets such as copyright taxes.

For this, Centrifuge employs a fair value valuation based on the use of financial models. This valuation method evaluates the future cash flows expected to be received by the mortgaged asset and discounts the cash flows to reflect the present value of the cash flows - the so-called discounted cash flow ("DCF") method. "Of course, we will also make risk adjustments to the expected cash flow to reflect the risk of the asset pool and the possibility of investment recovery. We have been continuously optimizing our products and pricing systems. Regarding this, we are also very Willing to hear from the community."The third is the issue of asset liquidity.

Even if some asset promoters pass the review, the encryption market may not have a high degree of recognition of some real assets, resulting in insufficient liquidity of real assets and the failure to complete financing smoothly. In this regard, Centrifuge has cooperated with MakerDAO and Aave to create instant liquidity for the Tinlake mining pool. This method expands the source of stable coins and ensures faster realization of collateral; in the future, Tinlake will also be launched on the Polkadot ecosystem. Therefore, realizing DeFi crosses Polkadot and Ethereum to form an infinite market. "This partnership between Centrifuge and Aave is the first of its kind in DeFi financing and will be a game-changer for millions of corporate financing, providing instant, unbanked liquidity for real-world assets."

For breach of contract, the liquidation of real assets may not be as simple as on-chain assets, especially non-standard real assets such as copyrights may not have good liquidity, and it is difficult to find a counterparty for liquidation.

In this regard, Centrifuge adopts a two-step strategy: on the one hand, borrowers are required to provide sufficient collateral when lending, and reduce risks for investors through the mechanism of over-collateralization; on the other hand, if a default occurs, investors will People still have the right of recourse.

"In the case that the borrower is not bankrupt, the borrower is obliged to liquidate the assets and repay the investor. If the liquidation value of the assets is not enough to repay the investor's investment amount, then the borrower is obliged to make up for the shortfall by itself part,” added the Centrifuge team.

secondary title

Fourth, the road resistance and long

In today's traditional financial system, only leading companies are eligible to enter the working capital market, and most people and small businesses can only meet their capital needs through banks. The lack of an open and transparent market prevents this group from obtaining competitive interest rates.

DeFi is a major trend of future changes in the financial field, especially institutions like Centrifuge, which focus on building a bridge between real assets and the DeFi market, creating new opportunities for borrowers who have not been able to obtain DeFi liquidity so far.

Although Centrifuge has achieved some results, it has not stopped. After all, there are still some obstacles in the introduction of real assets into the encryption ecosystem, and it is a long-term undertaking. Centrifuge has been quietly working in this segment since its establishment, and will continue to do so for a long time.

“In bridging the regulated world of TradFi to the world of trustless DeFi, we encountered challenges that only a few in DeFi have encountered so far. We have done a lot to comply with AML regulations as we go live and U.S. securities standards. This is an emerging industry, and the Centrifuge team is willing to explore this new field with the industry.” Looking back on the hardships of starting a business, the Centrifuge team was quite emotional.

This road is not easy to walk, but Centrifuge has no hesitation, bridging real assets to DeFi has always been its mission. Founder Martin Quensel is a serial entrepreneur in the fields of financial technology, encryption technology and financial supply chain automation. He was the co-founder of Taulia; co-founder Lucas Vogelsang was the CTO of the Swiss e-commerce start-up company DeinDeal. Working in the intersection field, met Martin at Taulia, and then co-founded Centrifuge; software engineer Alina Sinelnikova graduated from MIT with many years of development experience; other core members have good capabilities in traditional financial industry and technology development.