The Financial Action Task Force (FATF) released its long-awaited guidance on virtual assets, setting standards that have the potential to reshape the cryptocurrency industry in the United States and around the world. The guidance addresses one of everyone’s most important concerns about the cryptocurrency industry: convincing regulators, lawmakers and the public that it does not facilitate money laundering.

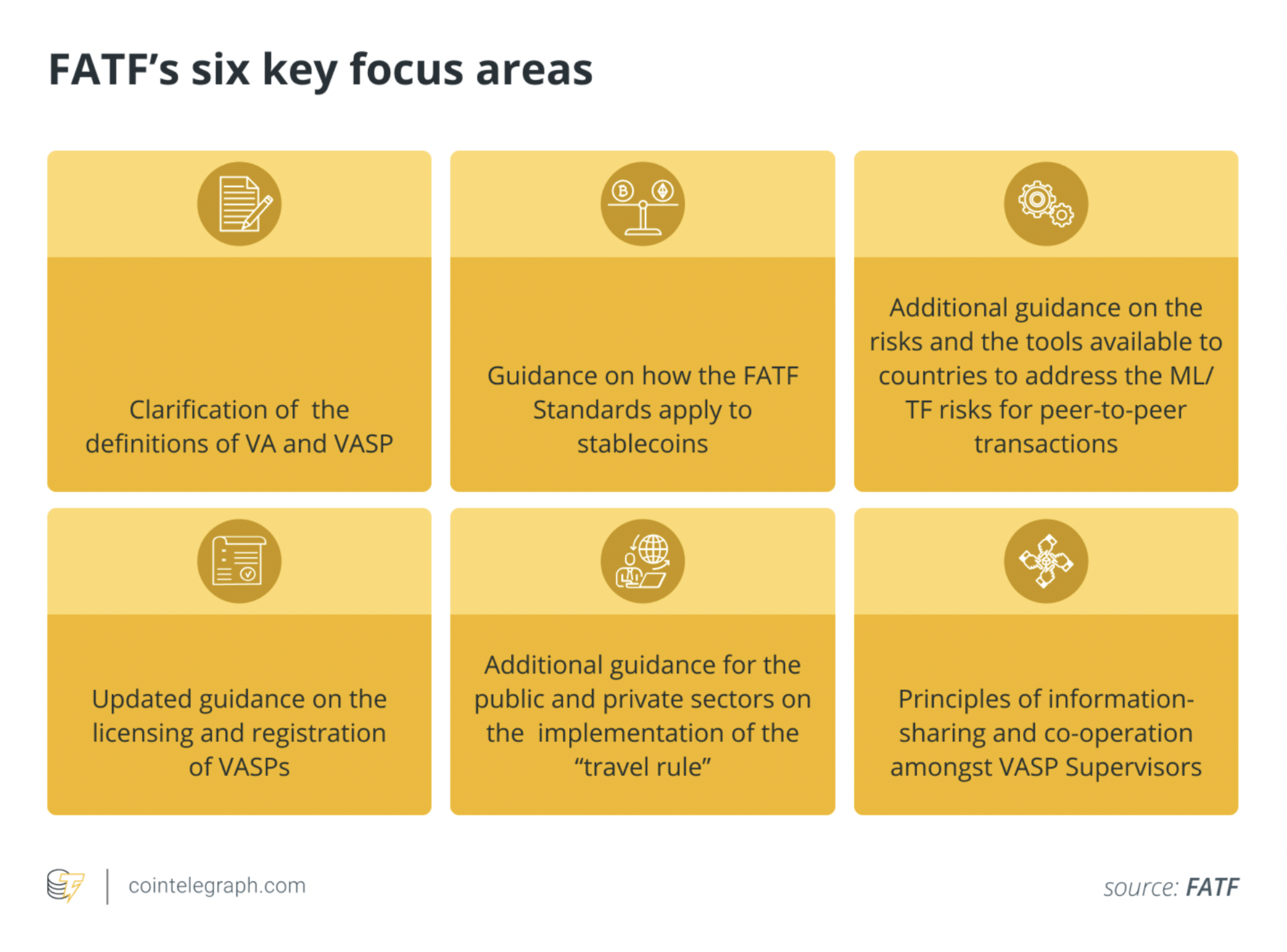

The guidance focuses in particular on the parts of the cryptocurrency industry with the greatest recent regulatory uncertainty, including DeFi, NFTs, and stablecoins.

The guidance’s attitude towards DeFi and stablecoins largely follows the existing measures of US regulators, but its attitude towards NFTs is more friendly. It can be said that it calls for the presumption that NFTs are non-virtual assets, which is beneficial to the cryptocurrency industry. Said to be a positive sign. But at the same time, the guidance also states that if NFTs are used for activities with “investment purposes,” they need to be regulated.

secondary title

Expanding the definition of a virtual asset service provider

FATF is an intergovernmental organization whose mandate is to develop anti-money laundering and counter-terrorism financial policies. Although the FATF cannot make laws or policies, its guidance can have a significant impact on counter-terrorist financing and anti-money laundering laws in its member jurisdictions. The US Treasury generally follows and enforces regulations based on FATF guidance.

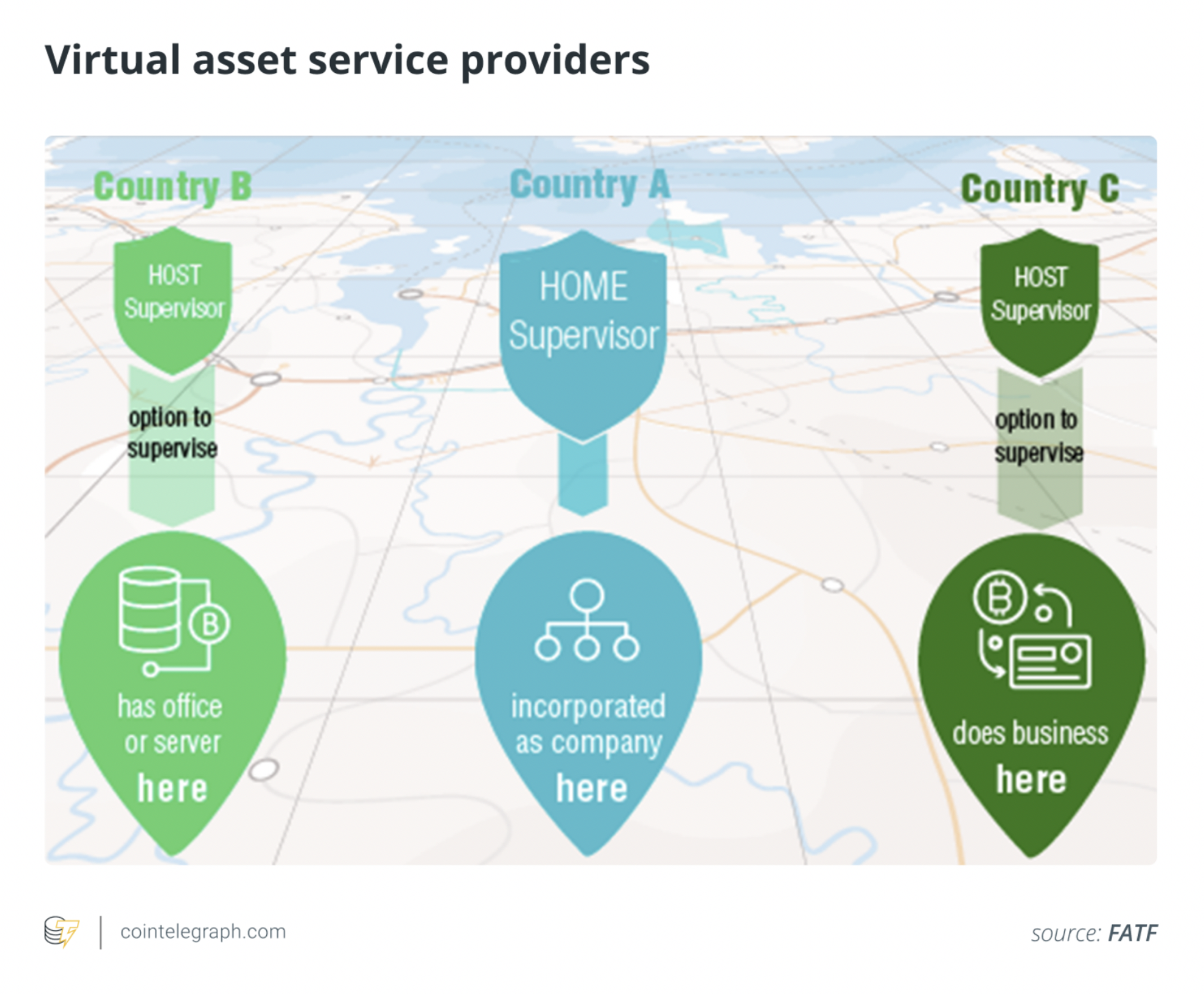

The FATF has taken a step toward broadening the definition of a virtual asset service provider (VASP)."Extensibility method". This new definition includes exchanges between virtual assets and legal tender; exchanges between multiple forms of virtual assets; transfers of digital assets; custody and management of virtual assets; Financial Services.

Once an entity is labeled as a VASP, it must comply with the applicable requirements of the jurisdiction in which it operates, typically including: implementing an anti-money laundering and counter-terrorism program, being licensed or registered with the local government, and being regulated by that government.

Additionally, the FATF provides a broader definition of virtual assets (VAs):

“A virtual asset is a digital representation of value that can be traded or transferred digitally and that can be used for payment or investment.” But does not include “digital representations of fiat currencies, securities, and other financial assets already covered elsewhere in the FATF Recommendations.” express".

secondary title

Impact on DeFi

FATF guidance on DeFi protocols is unclear.

The beginning statement is:"According to FATF standards, DeFi applications are not VASPs, because the standard does not apply to the underlying software or technology… "

But FATF then explained: creators, owners, operators, or others who maintain control or have sufficient influence over the DeFi protocol, if they provide or promote VASP services, they fall under the VASP defined by FATF. The guidance explains that DeFi project owners/operators who fall under the conditions of a VASP are distinguished based on their relationship to the activities they carry out. These owner/operators can exert sufficient control or influence over assets or project agreements. This influence may exist by maintaining an ongoing business relationship between them and users, even if this relationship is exercised through smart contracts or in some cases through voting agreements.

secondary title

Impact on Stablecoins

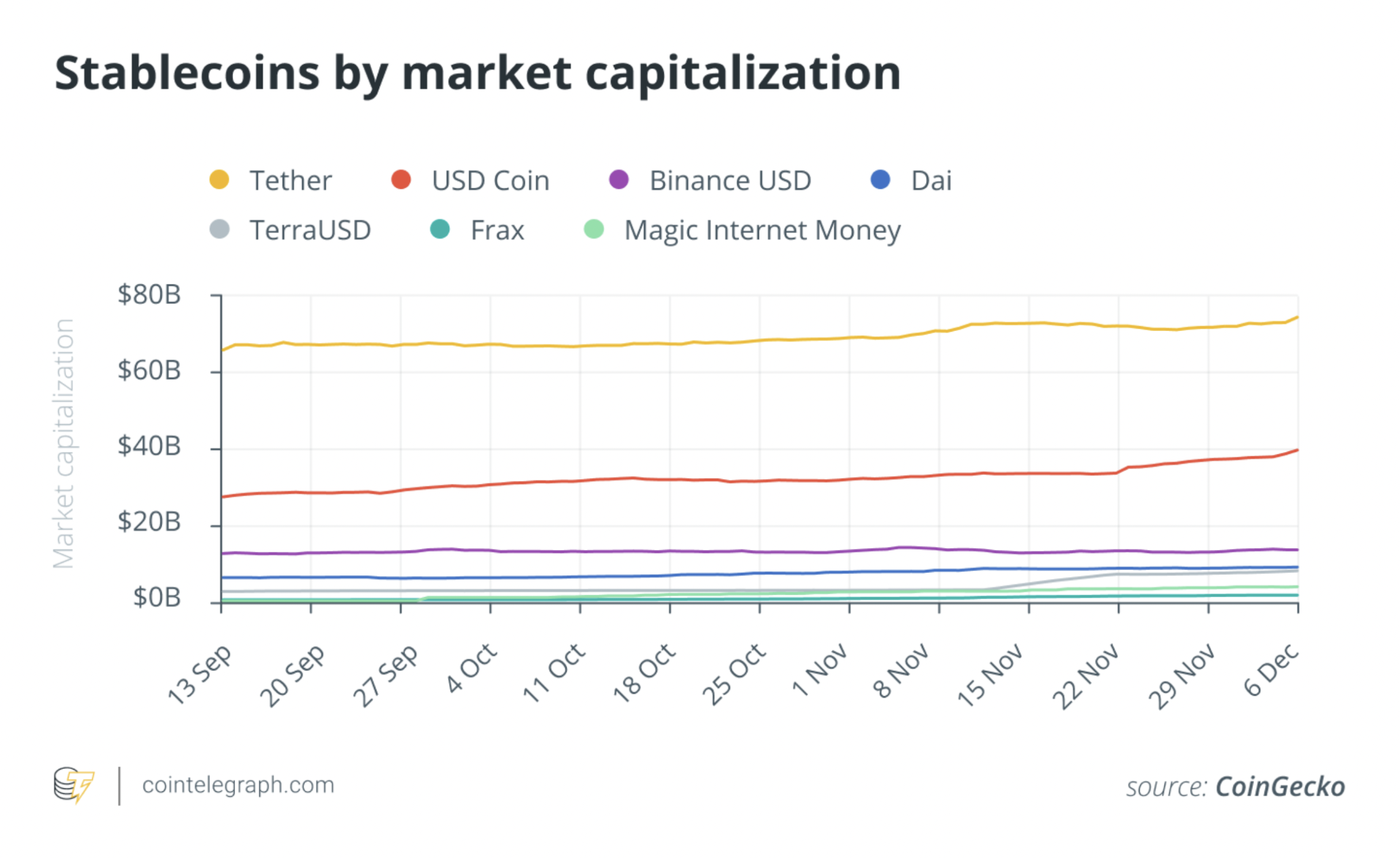

The new guidance reiterates the group’s previous stance that stablecoins would be considered VASPs, subject to FATF standards.

The guidance addresses the risks of mass adoption of stablecoins and examines specific design features of stablecoins that may present risks to anti-money laundering. The guidance states that stablecoin central governance bodies with the role of VASPs will generally be covered by FATF standards. Similar to its general approach to DeFi, the agency believes that decentralized governance is not sufficient to evade regulatory scrutiny. For example, even if the governance body of the stablecoin is decentralized, the FATF encourages members of its jurisdiction to identify the entities obligated to mitigate its series of related risks, regardless of the design and name of the body.

secondary title

Impact on NFTs

In addition to DeFi and stablecoins, NFTs have also exploded in popularity and are currently a major pillar of the contemporary cryptocurrency ecosystem. In contrast to the broad regulatory guidance approach adopted for other aspects of the cryptocurrency industry, the FATF advises that NFTs are generally not considered virtual assets under the FATF definition. This can be said to be a presumption that NFTs are not virtual assets, and their issuers are not VASPs.

However, similar to its approach to DeFi, the FATF emphasized that regulators should consider the nature of NFTs and their functions in practice, rather than what marketing terms they use. FATF believes that NFTs used for payment or investment purposes can be defined as virtual assets.

secondary title

What FATF Guidance Means for the Crypto Industry

The FATF guidance closely tracks the U.S. regulator’s aggressive stance on DeFi, stablecoins and other major parts of the cryptocurrency ecosystem. As a result, both centralized and decentralized projects find themselves under increasing pressure knowing that it has been clarified that they need to comply with the same anti-money laundering requirements as traditional financial institutions.

While future DeFi projects delve deeper into their businesses, they also need to try new governance structures, such as DAOs that are close to "true decentralization". This approach is also somewhat risky, as FATF broadly defines VASPs as key signers or private key holders for smart contracts. This is especially important for DAOs, since signers may all be classified as VASPs.

Given the FATF's sweeping interpretation of who "controls or influences" a project, cryptocurrency entrepreneurs everywhere face an uphill battle.

The views, ideas and opinions expressed here are those of the author alone and the article is intended to provide general information and should not be construed as legal advice.

About zCloak Network

zCloak Network is a private computing service platform based on the Polkadot ecosystem, which uses the zk-STARK virtual machine to generate and verify zero-knowledge proofs for general computing. Based on the original autonomous data and self-certifying computing technology, users can analyze and calculate data without sending data externally. Through the Polkadot cross-chain messaging mechanism, data privacy protection support can be provided for other parallel chains and other public chains in the Polkadot ecosystem. The project will adopt the "zero-knowledge proof-as-a-service" business model to create a one-stop multi-chain privacy computing infrastructure.