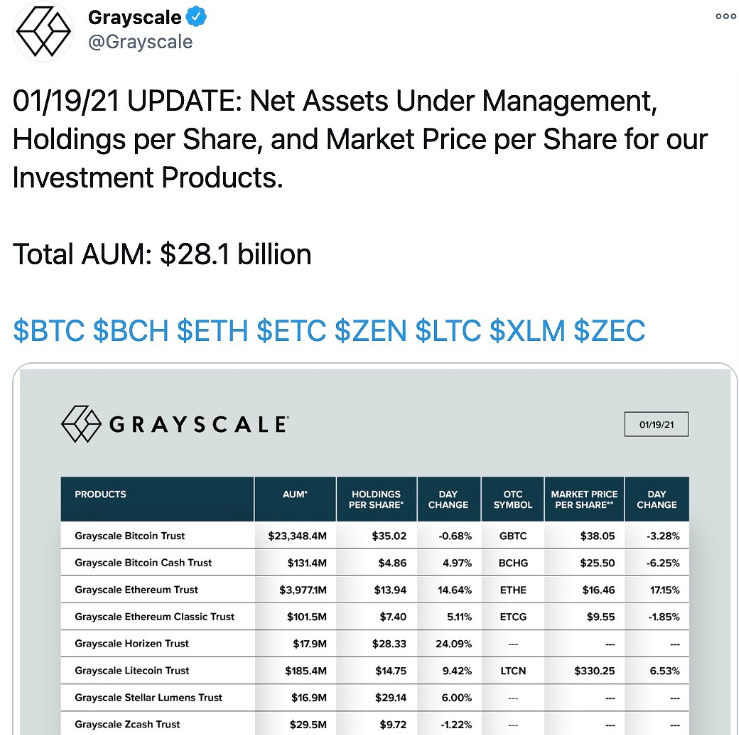

On January 19, Grayscale’s total assets under management rose to US$28.1 billion. The Bitcoin Trust (GBTC) traded at $38.05 per share, down 3.28% from the previous day; the Ethereum Trust (ETHE) traded at $16.46 per share, up 17.15% from the previous day.

Bitcoin is on a streak higher, staying within a range of about $34,000 to $40,000 for the past two weeks. In Deutsche Bank’s monthly survey, almost half of money managers surveyed rated Bitcoin a 10! Adding to the frenzy is the fact that Bitcoin is currently trading at over $36,000, triple what it was three months ago. This may be closely related to the current economic situation in the United States.

For various reasons, in order to protect itself from the impending inflation, MicroStrategy believes that Bitcoin is the most authentic market in store of value, and even started to resist gold, knowing that gold has been the industry's favorite for the past few decades.

In the financial crisis of 2008, the only asset that people could choose to hedge against inflation was gold, but now, Bitcoin, which was conceived in the economic crisis, has become a better choice, especially after this year's halving, its scarcity has returned. Once known to the world. Bitcoin, as an emerging asset class, has gained more and more consensus from Wall Street. American hedge fund manager Paul Tudor, the billionaire macro investor, revealed he considered investing in assets like gold, stocks, commodities and Treasuries before realizing the growing role of bitcoin Various bets.

In reality, as investors bought bitcoin in large quantities, its volatility began to decrease, and the problem of selling bitcoin to avoid falling prices was resolved to a certain extent. Bitcoin may be considered a more reliable asset than it is today, but even with this stability, Bitcoin would have to go through more stages to make this change.

But at this time, another voice appeared: Bitcoin is 1 to 10 times the size of the financial bubble. A majority of respondents to the survey said digital assets, as well as shares of electric car maker Tesla, are more likely to halve their value in the coming year than double.

In a monthly survey by Deutsche Bank, they believe that Bitcoin may be a bubble. Michael Hartnett, chief investment strategist at Bank of America Global Research, said earlier this month that BTC was the "mother of all bubbles" when it hit an all-time high above $40,000. A few days later, the market was volatile.

Meanwhile, respondents rated bitcoin as the most crowded trade for the first time, according to Bloomberg, meaning many are making similar bets on bitcoin. Bitcoin price rises. Crowded deals are often associated with bubbles.

But not everyone is sure the market is in bubble territory. Pantera Capital, a venture capital firm in the cryptocurrency space, published an investor letter last week tying BTC’s price rise to the May 2020 Bitcoin halving.

Bitcoin has risen by about 810% in 2020, which can be said to be the best in the world. It is undoubtedly the best performing asset in the world. At the same time, it is undeniable that traders have to bear the risks and fluctuations. Although Bitcoin has a currency word, the market's perception of it gradually tends to be digital gold, which has a good value storage capability.

In general, as a value investment, Bitcoin has its own risks, and investors need to do what they can and consider carefully.