secondary title

1.1 Project Introduction

1.1 Project Introduction

1inch is one of the world's leading decentralized exchange aggregators. The platform aggregates liquidity from various exchanges and is able to split and trade a single transaction across multiple DEXs. Aggregator users using 1inch Exchange can optimize their transaction process and reduce transaction slippage.

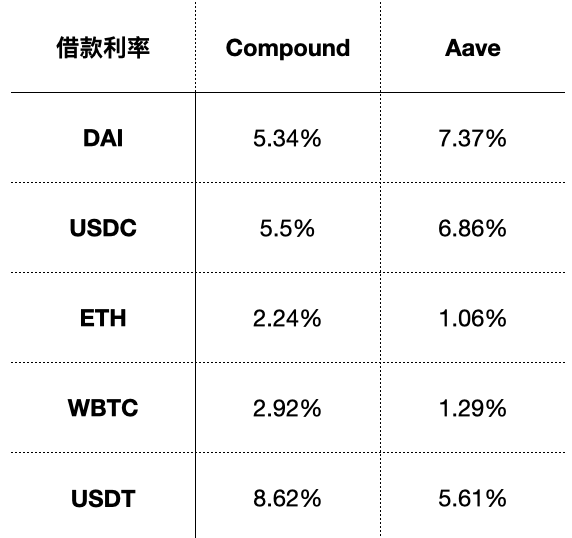

It is worth noting that, in addition to providing token trading functions, the 1inch platform can also carry out income farming, and obtain income by transferring users' idle encrypted assets to various lending platforms.

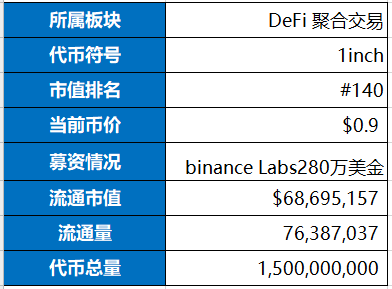

1.2 Basic information

secondary title

2.1 Team

2.1 Team

According to relevant information, 1inch's team is small, with 4 core personnel, and the team has relatively rich experience in the blockchain field.

secondary title

2.2 Fundraising situation

2.2 Fundraising situation

secondary title

2.3 Project Highlights

2.3 Project Highlights

1inch exchange provides users with a highly innovative DeFi trading experience, allowing users to process large transactions at the best exchange rates. In the past, users who wanted to find the best exchange rates for tokens had to manually search through many DEXs, which was difficult and time-consuming. In response to these problems in the market, 1inch V2 has made significant improvements in many aspects, including:

1. Bringing customizable and price-competitive transactions to users;

2. Aggregation fluidity;

4. While reducing user costs, important transaction functions are further simplified.

3. Project development

secondary title

3.1 Project development history

On August 12, 1inch launched Mooniswap, a decentralized exchange that integrates AMM and DEX functions.

On October 14, 1inch integrated the Swap function in the Metamask wallet.

On November 18, 1inch launched the second phase of liquidity mining. 4 new mining pool trading pairs were added to Mooniswap, and its tokens will reward liquidity providers.

On December 5th, 1inch released a new function, launching a private transaction available to everyone. This function can not only avoid transactions in advance, but also instantly connect to 10 Ethereum miners to broadcast user transactions directly to the miners, thereby shortening transaction mining. time.

4. Token Model

4.1 Token Distribution

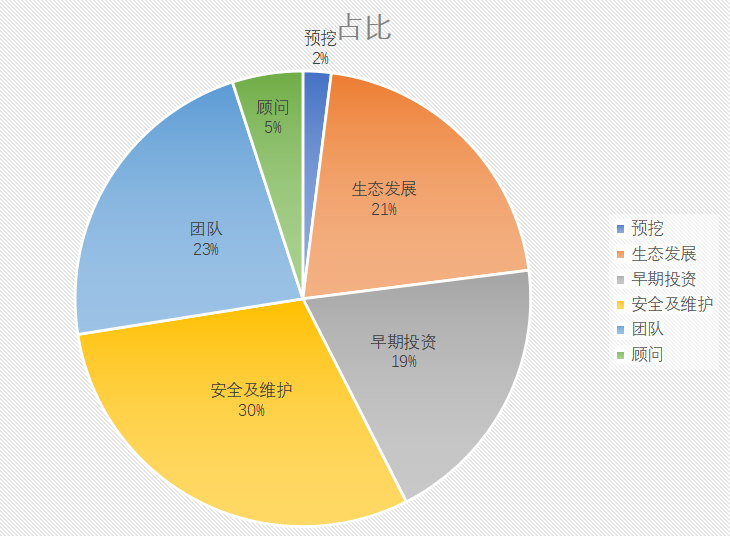

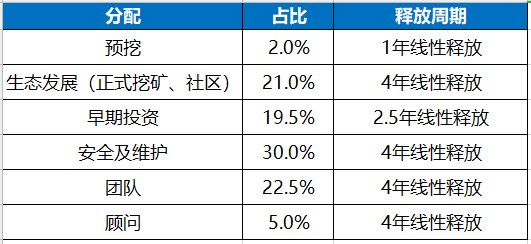

Token Distribution 1

image description

Token Distribution 2

According to the economic model released by the 1inch official team, the total amount of 1inch tokens is 1.5 billion. In the initial stage of launch, 16% of the tokens will be in circulation. From the perspective of the token unlocking model, 30% of the total supply of tokens will be used to ensure network security and maintain its functions (unlocked in 4 years), and 22.5% of the tokens will be distributed to the 1inch core team and future employees (unlocked in 4 years) ), 21% for ecological construction (unlocked in 4 years, some of which are used for liquidity mining plan), 19.5% of tokens are allocated to investors and shareholders (unlocked in 2.5 years), 5% are allocated to consultants (4 2% will be allocated to early liquidity providers of Mooniswap, its automated market maker product (unlocked in 1 year).

1inch's tokens will be used for the following purposes:

1. Ensure that the interaction with the protocol maintains a permissionless interaction mode;

2. Raise funds for the development of the ecosystem;

4. Ensure the security of the network.

secondary title

4.2 Token Value

Users who own 1INCH tokens, as well as liquidity providers in the 1inch liquidity protocol, can vote directly on the main protocol parameters: price influence fees, transaction fees, governance rewards, referral rewards, and decay periods.

All voting will be done with 1INCH tokens, which have no economic value. The community will decide on protocol fees and reward distribution.There are two types of governance

: Pool Governance and Factory Governance.

Pool governance will include the configuration of parameters specific to each pool, such as transaction fees, price influence fees, and decay periods.

Factory governance is responsible for parameters shared by all pools, such as default transaction fees, default price influence fees, default decay periods, referral rewards, and governance rewards.

1inch's governance model is aggregation protocol governance and liquidity protocol governance. 1inch governance parameters mainly include: transaction fees, slippage fees, decay period, governance rewards, recommendation rewards, voting procedures, etc.

5. Track

secondary title

5.1 Track Overview

When we trade on an aggregated trading platform, the platform will automatically calculate the path with the best price and lowest slippage for you to complete the transaction. And when the aggregator finds that the trading pair selected by the user has insufficient liquidity in most DEXs, it is also possible to complete the transaction through a bridging transaction.

For the DeFi industry, 1inch has helped solve another industry-wide problem: impermanent loss, that is, the problem of unpaid loss. As we all know, it is difficult to avoid the unpaid loss of participating in AMM liquidity mining, and the high slippage creates opportunities for arbitrage traders to make up the difference by conducting reverse transactions.

secondary title

At present, in addition to 1inch, the platform with the largest transaction volume, the DeFi transaction aggregator also has high-quality projects such as Matcha, InstaDapp, and ParaSwap.

Matcha

The main user-friendly platform, Matcha, was created by the 0x team and currently has access to 16 DEX protocols including 0x, Curve, Uniswap, Shell, Kyber, Moniswap, Bancor, Balancer, and mStable. According to the introduction, Matcha has done research and optimization in terms of saving fees, and helps users pay part of the transaction fees through meta-transactions. Matcha's user interface is very clear, easy to use, and low-cost to get started. For token transactions other than ETH, the price limit transaction function is also provided.

InstaDap

InstaDapp aims at high-end players, brings composability to a higher level, and provides a developer-friendly interface. This can be seen as the way he builds his own moat and widens the gap. The user's assets on the platform are still in a non-custodial manner and will not be misappropriated by the platform. Compared with directly operating ordinary Ethereum accounts, InstaDapp needs to spend a higher gas fee.

ParaSwap

secondary title

ParaSwap has built its own liquidity pool, ParaSwapPool, and is also connected to multiple trading protocols, such as Kyber, Bancor, Uniswap2, Oasis, Curve, 0x, etc.

According to paraswap's introduction, ParaSwapPool is a private liquidity pool provided by partners, and users need to apply for cooperation before they can join and become LPs. By using GST2 (GasToken), ParaSwap also tries to help users save transaction gas fees. Currently, the platform is free to use.

first level title

6. Summary

6. Summary

1. In the traditional financial market, only investment banks and large financial institutions can provide transaction aggregation/prime brokerage services to help hedge funds or other banks promote active trading operations. 1inch is positioned as an investment bank in the DeFi field.

2. 1inch currently has a clear first-mover advantage in the subdivided track field of aggregation transactions. Looking forward to the products and services that 1inch will provide in the future.