Overall, 2020 has been an incredible year indeed.

At the beginning of 2020, DeFi became the driving force of the blockchain industry. While other blockchain projects lack developer support and interoperability, Ethereum is well-positioned for growth. However, this growth is not without warning signs.

In mid-March, the novel coronavirus pneumonia swept the world, and the prices of traditional markets and cryptocurrencies fell sharply, seriously affecting the exchange rate of MakerDAO's DAI stablecoin pegged to $1. MakerDAO almost collapsed, but fortunately, the strength of the community allowed it to continue.

The second key trend for 2020 is yield farming. Compound’s successful launch of the COMP token, along with its incentive model, has proven to be an excellent user acquisition channel.

Various DeFi dapps started releasing tokens and incentives at a rapid pace, while other developers built meta-protocols to maximize yield. Meanwhile, other categories like NFT collectibles and games have adopted the model.

Overall, most tokens issued in DeFi and NFT dapps are governance tokens. First, it allows the community to participate in the decision-making of the dapp. Second, the governance mechanism is another big step towards true decentralization.

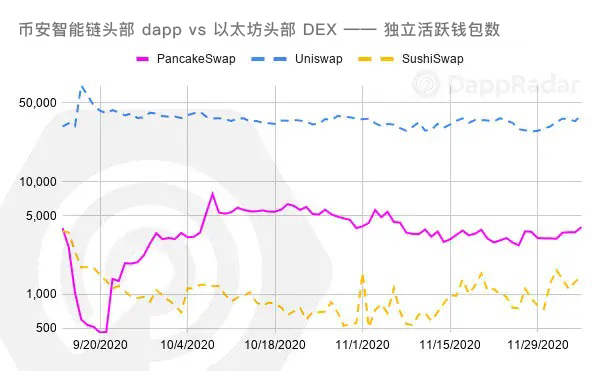

The hype surrounding yield farming has also exposed many problems. One of them is user retention. Uniswap’s lead was shaken by the launch of the so-called vampire dapp — SushiSwap, proving that user retention is one of the keys to success.

The increased activity in the Ethereum network brings up another problem - scalability. Expensive gas fees weighed on low-value dapp activity, especially gaming, which fell by more than 90% between May and August. This, in turn, creates opportunities for Ethereum-centric layer-2 network solutions as well as rival layer-1 blockchains.

Attacks and exploits targeting smart contracts are also proof that the industry is still experimental, resulting in insurance products that may become an essential part of the industry’s health.

Finally, protocols and developers are starting to realize that working in isolation may not be the best way to fight competition. There were some important mergers at the end of the year that look like they could be the main trend in 2021.

Note: The DeFi ecosystem refers to dapps such as decentralized finance and decentralized exchanges;

main points

Table of contents

main points

scalability issues

scalability issues

growing competition

Smart Contract Vulnerabilities

user retention

user retention

development at any cost

95% of transaction volume growth comes from Ethereum’s DeFi applications

Yield Farming Boosts DeFi Ecological Activity

The road to true decentralization

Rising Yields Incentivize Bitcoin Flows into Ethereum

Accurately Measuring DeFi Activity - aTVL

DeFi Teams Merge

foundation for growth

NFTs drive dapp growth in 2020

NFT sales show real potential

game

game

Earn coins game mode

The Virtual World of Ethereum

2020 Summary

secondary title

main points

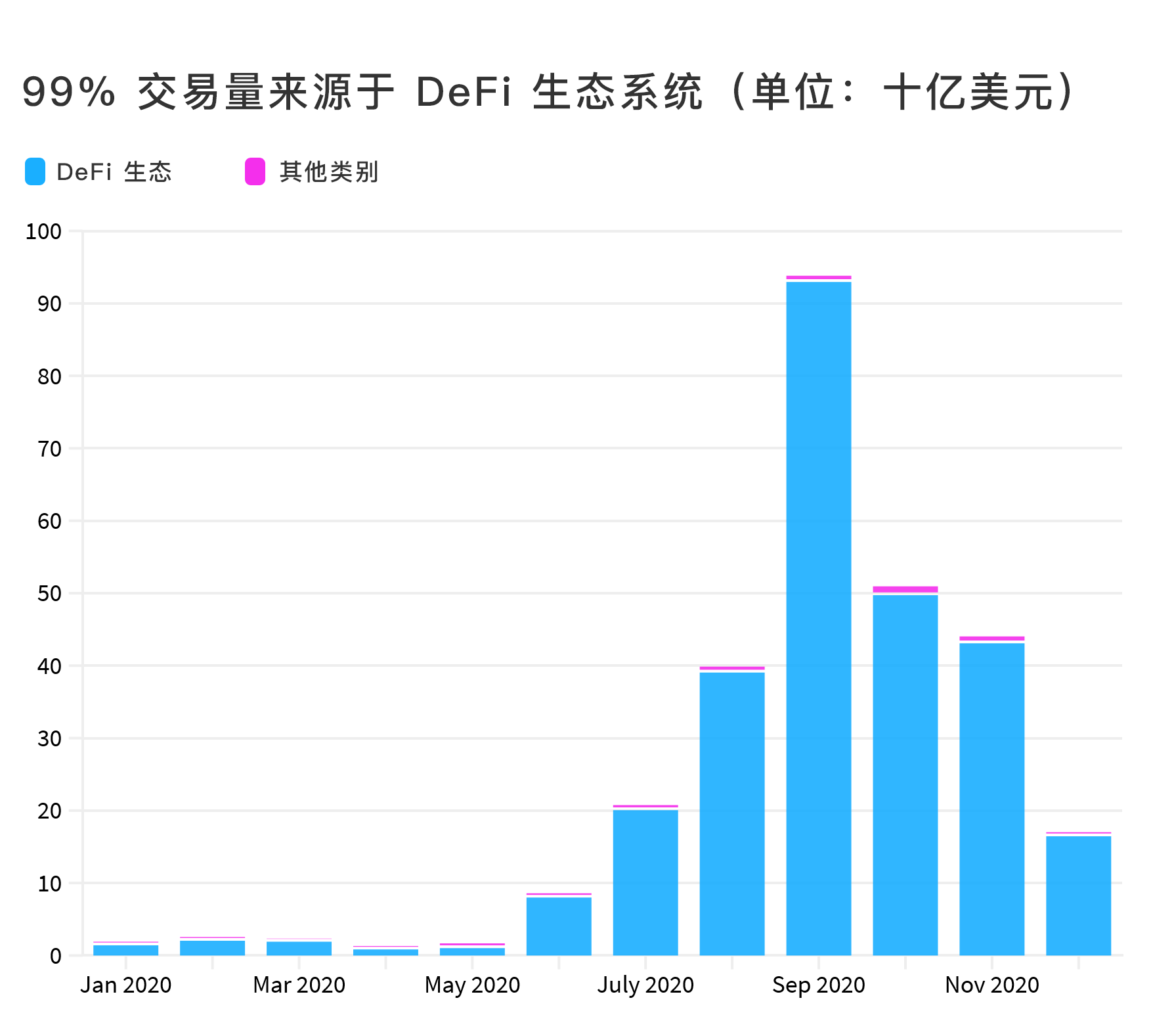

2020 has been a record year for the blockchain industry. Dapp transactions exceeded $270 billion, 95% of which came from the DeFi ecosystem on Ethereum.

For the top Ethereum dapps tracked by DappRadar, the total locked volume (TVL) and adjusted total locked volume (aTVL) reached an all-time high of $13 billion and $11 billion in 2020, respectively.

In 2020, a total of 238 new DeFi dapps were submitted to DappRadar. 106 of them (45%) run on the Ethereum chain.

In 2020, a total of 1,353 new dapps were submitted to DappRadar. 424 of them (32%) run on the Ethereum chain.

Scalability issues aren't the only challenges facing 2020. The growing usage of Dapps has resulted in multiple exploitable vulnerabilities and hacks that cost over $120 million.

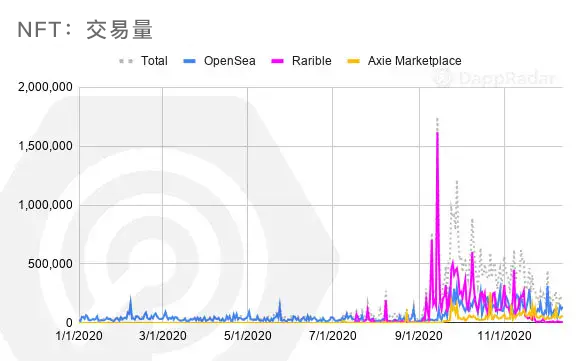

The number of active wallets on NFT marketplace Rarible jumped from around 200 to over 1,500 in September 2020 after implementing a yield farming incentive program.

The NFT market has shown great potential in 2020, with multiple transactions worth over $100,000.

secondary title

2020 Challenges

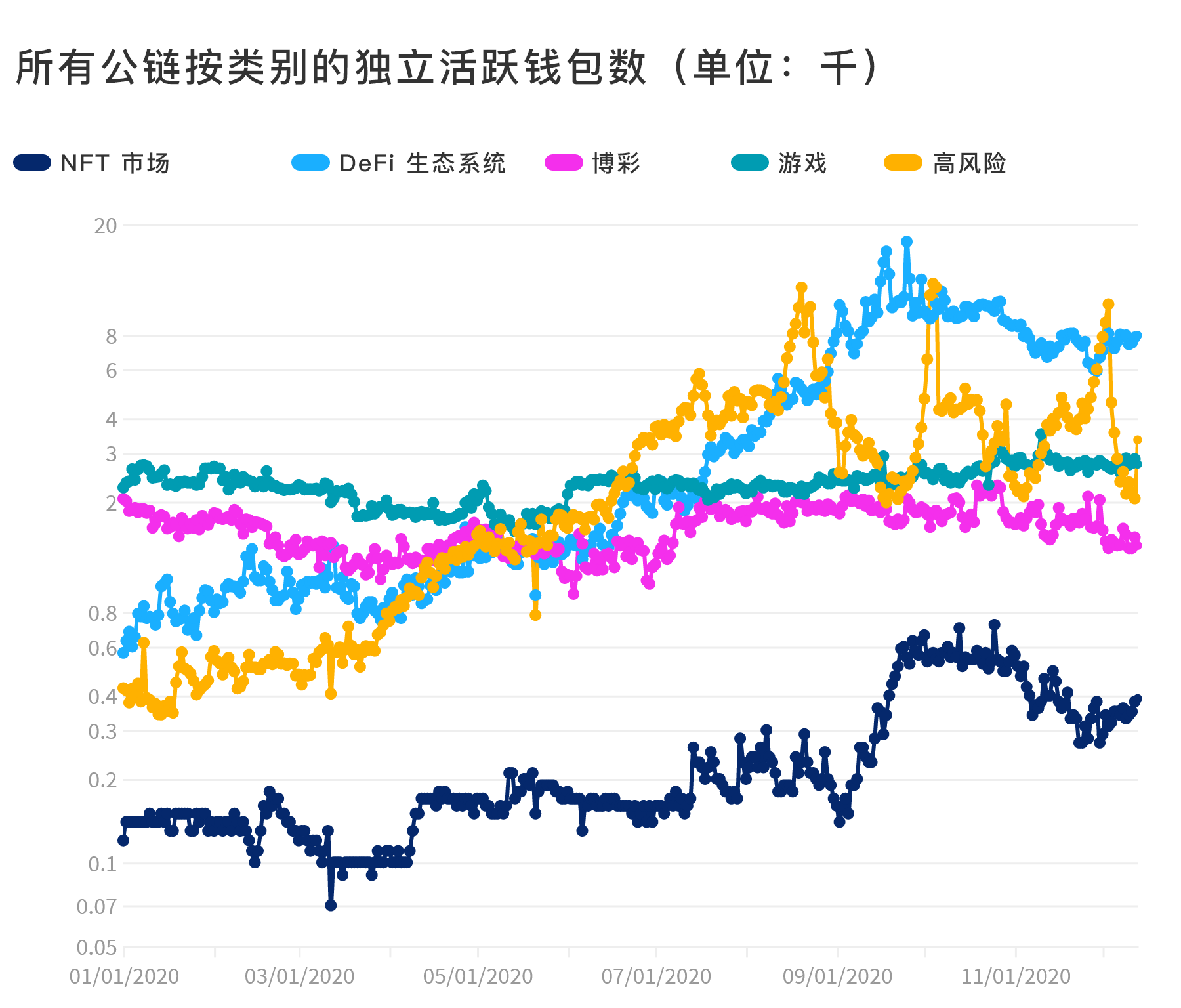

In 2019, more and more new dapps were launched on all blockchains. On top of that are DeFi, NFT, and gaming dapps, which fueled 2020 activity. As expected, most of the activity was focused on the Ethereum blockchain.

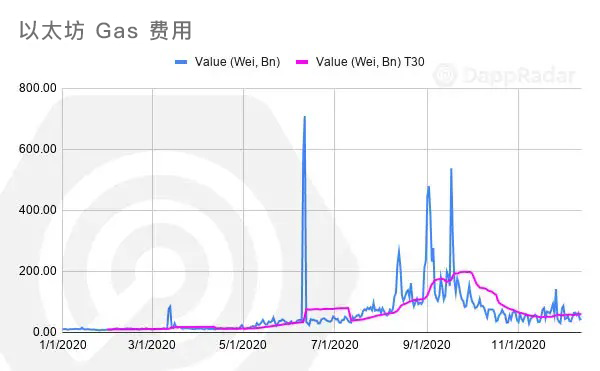

2020 is the year dapps try to grow at all costs. Of course, this has consequences, such as rising Ethereum gas fees.

The first wave of gas price increases was attributed to increased usage of the Tether USDT stablecoin on Ethereum, coupled with activity from several high-risk dapps, which flooded the network with spam transactions.

The second wave goes hand in hand with the newest trend of 2020 - Yield Farming. During peak transaction periods, the average transaction cost exceeds $50.

secondary title

source:Etherscan.io Gas Price

growing competition

source:

source:DappRadar

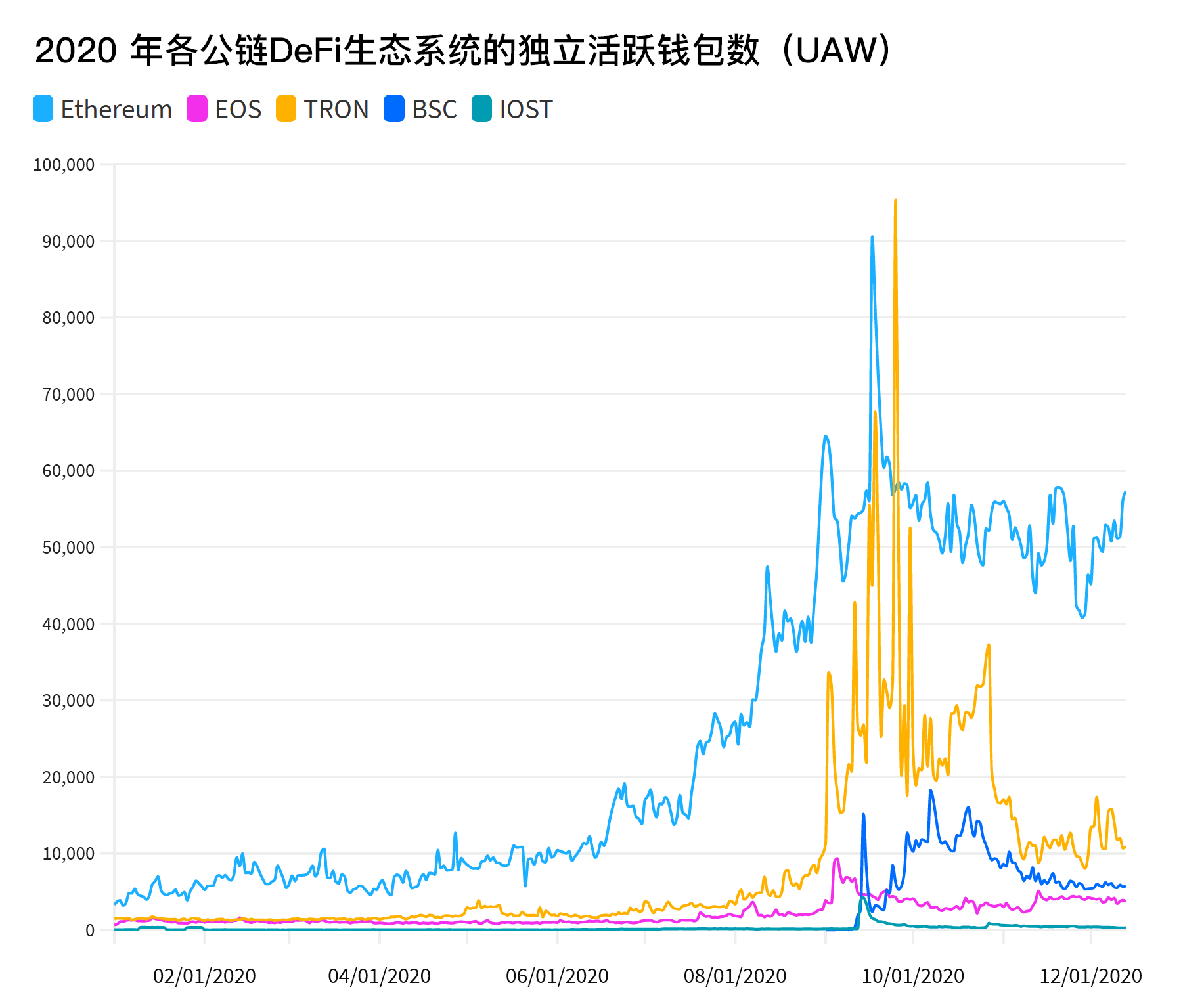

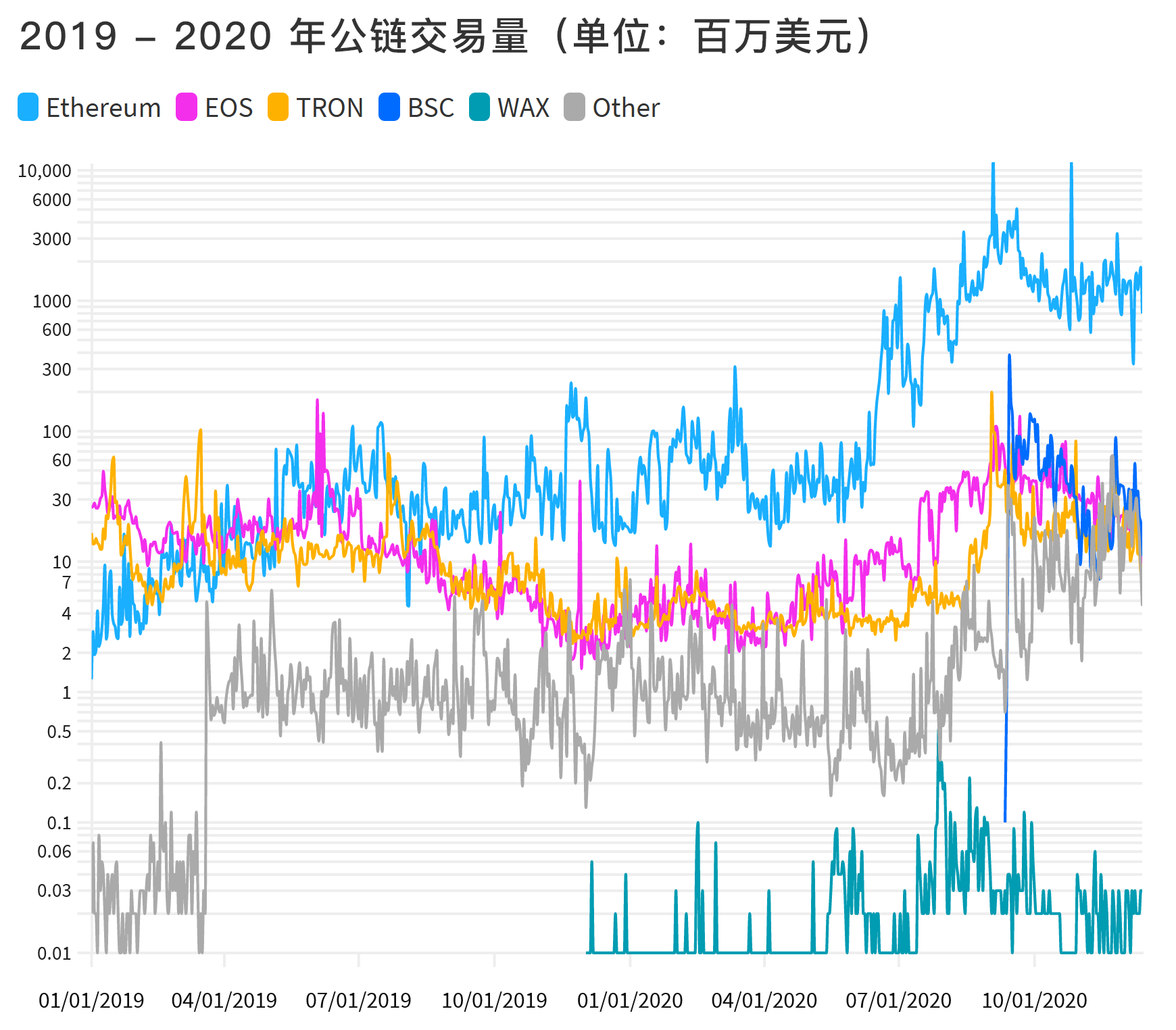

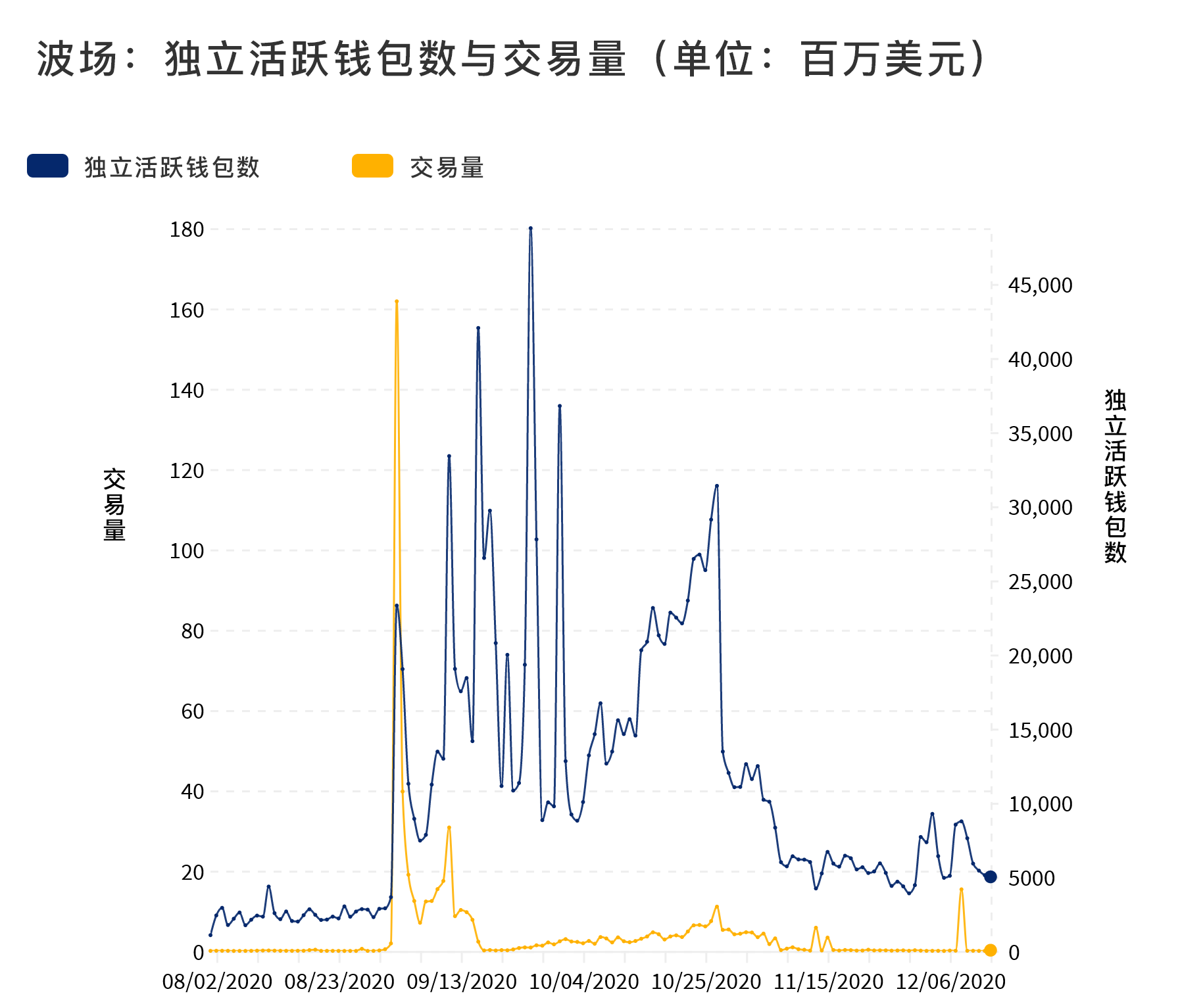

There is no doubt that EOS and TRON are playing catch-up in 2020 as the DeFi category explodes. Replicas of Ethereum dapps were built on TRON, and these dapps began to contribute a lot of activity. In the TRON DeFi ecosystem, more than 17,000 independent wallets are active every day.

EOS is a bit slower, and current activity is dominated by dapps in categories other than DeFi. Despite this, the EOS DeFi ecosystem still has about 4,000 unique wallets active every day.

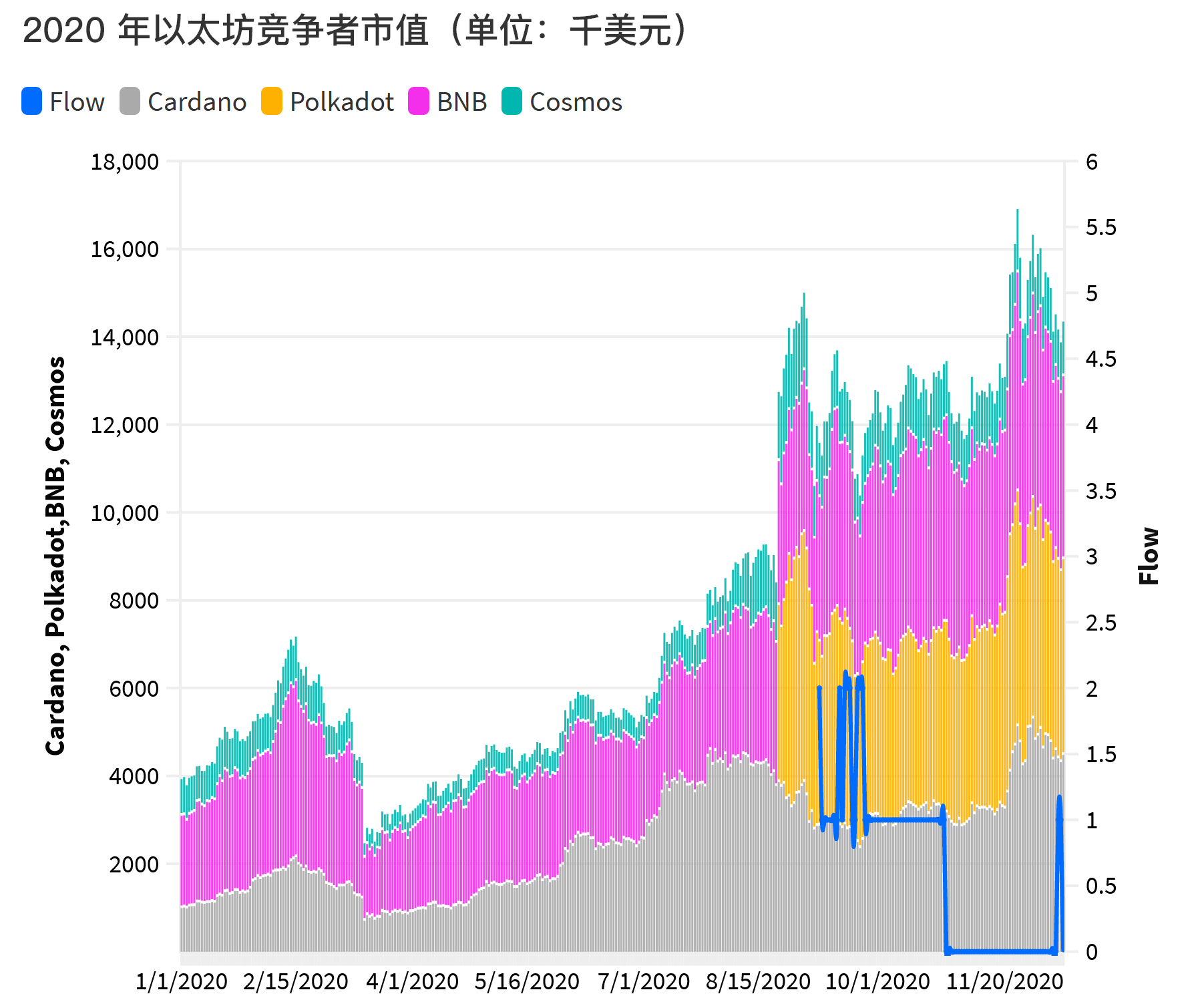

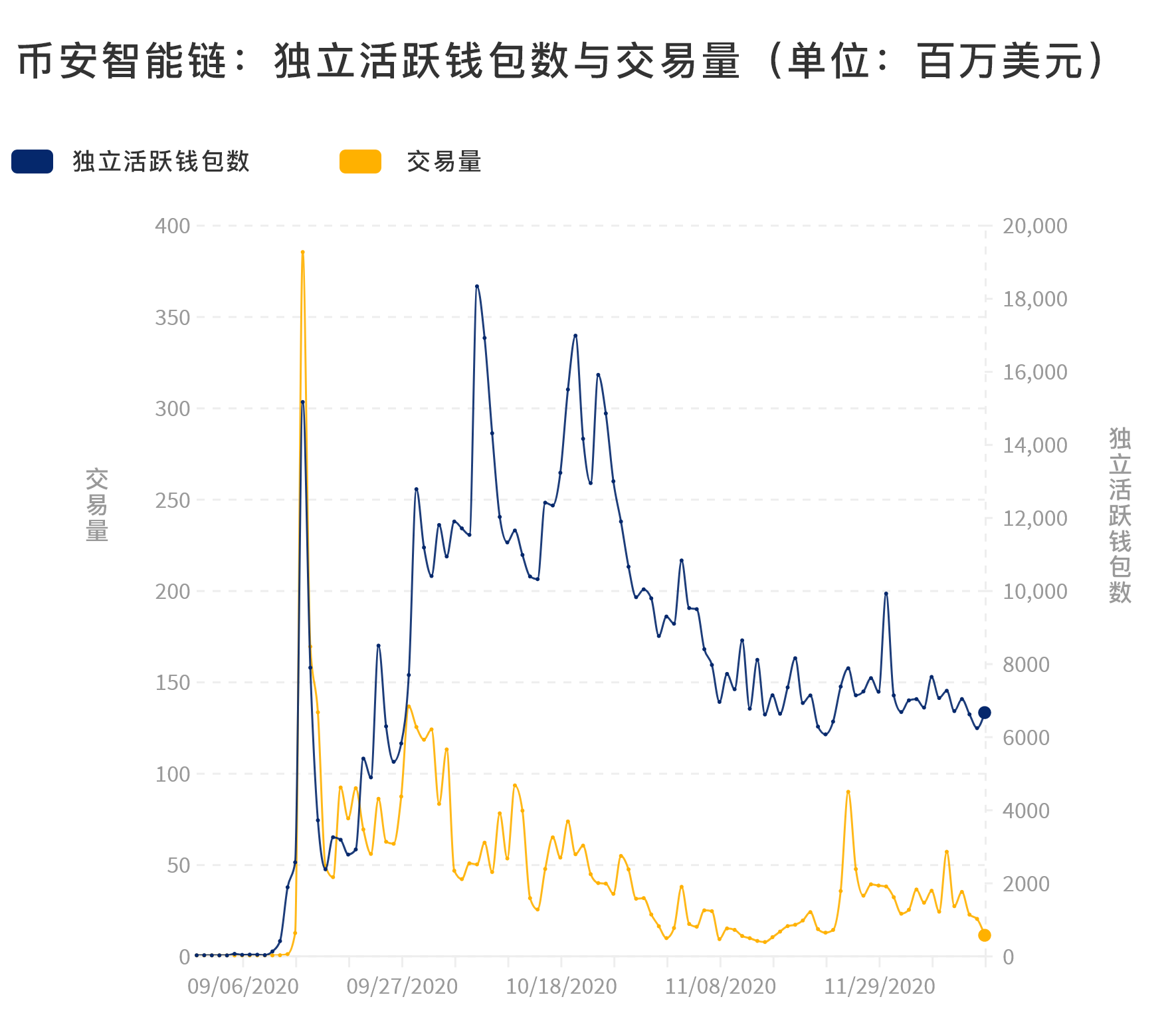

In 2020, more Ethereum competitors will come online. For example, Cardano, Polkadot, Binance Smart Chain, Cosmos, Near, and Flow. Although only a few projects are active on these blockchains so far.

In terms of products launched, Binance Smart Chain (BSC) is leading the way. Within just three months of launching the top BSC dapp, the number of unique active wallets per day is about 10,000.

source:

source:DappRadar

Other projects are still in the deployment stage, and Cardano recently announced that it will release its first DeFi project - Liqwid. Cardano has yet to deploy smart contracts, but is a serious contender as a top 10 project by market capitalization, according to CoinGecko.

Although no projects have been launched yet, Polkadot is also on the cusp of launching an ecosystem against Ethereum. The protocol has attracted media attention and new investors such as KR1 and RockX, which launched a $20 million investment program to support projects running on Polkadot.

Another Ethereum challenger is Cosmos, which is creating a decentralized network of independent blockchains on top of the Tendermint consensus layer. Although Cosmos is still in the early stages of deployment, projects such as Binance Chain, OKChain, and Akash are already using Cosmos.

secondary title

source:Coingecko

Smart Contract Vulnerabilities

Although various indicators of DeFi set records in 2020, it turns out that DeFi is still a very fragile ecosystem. Especially in unaudited smart contracts, there are a variety of attackable and exploitable vulnerabilities and program failures, even audited smart contracts have problems.

MakerDAO has undergone a serious test in 2020 as one of the most important dapps. In mid-March, the rapid decline in digital currency prices seriously affected the exchange rate of MakerDAO's DAI stablecoin pegged to $1, and then MakerDAO, which nearly collapsed, continued in the maintenance of the community.

YAM is a project that has attracted a lot of attention within only 24 hours of its launch. The project quickly collapsed within two days, with the price of the YAM token plummeting from a high of $200 to $1.04.

source:

source:Rarible

source:Rarible

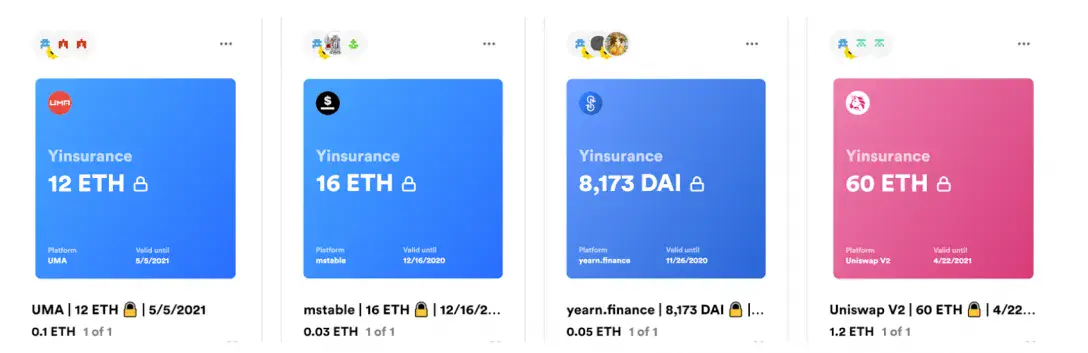

Centralized and decentralized insurance solutions are on the rise. For example, yInsure’s NFT insurance tokens have garnered a lot of attention as a novel commodity to trade. The industry appears ready to look further into insurance options in 2021.

Another interesting example is audit firm CertiK. CertiK has developed a membership service that enables participants to be compensated if attacked.

secondary title

High returns come with high risks

2020 has seen growing interest in DeFi applications and yield farming.

Multiple dapps have fairly high yields, but high returns come with risks.

There have been many cases throughout the year where users have lost huge amounts of money in purely running scams and fraudulent practices. Additionally, although dapps that contain certain risks are classified as high-risk dapps on DappRadar, we are starting to see that the division of risk levels is blurring.

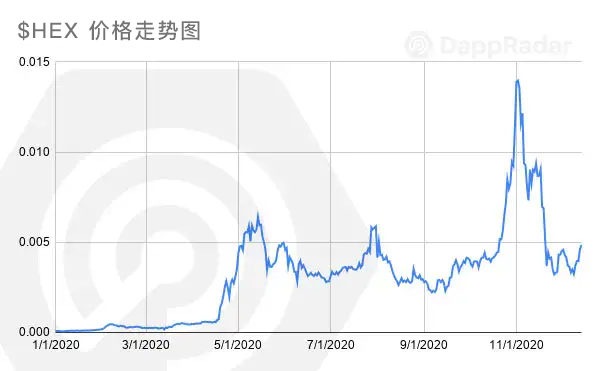

Launched in December 2019, the HEX project is led by longtime Bitcoin supremacist (also known as Bittheist) Richard Smart.

HEX is unique in that it is not a drumbeat game or a high-risk dapp like a typical pyramid scheme. Most high-risk dapps can only survive for less than three months, while it has been active for more than half a year.

user retention

source:Coingecko

user retention

The rapid growth in 2020 also highlights the importance of user retention from another perspective. As mentioned earlier, the number of unique active wallets interacting with a dapp smart contract is a key metric of success in the long run.

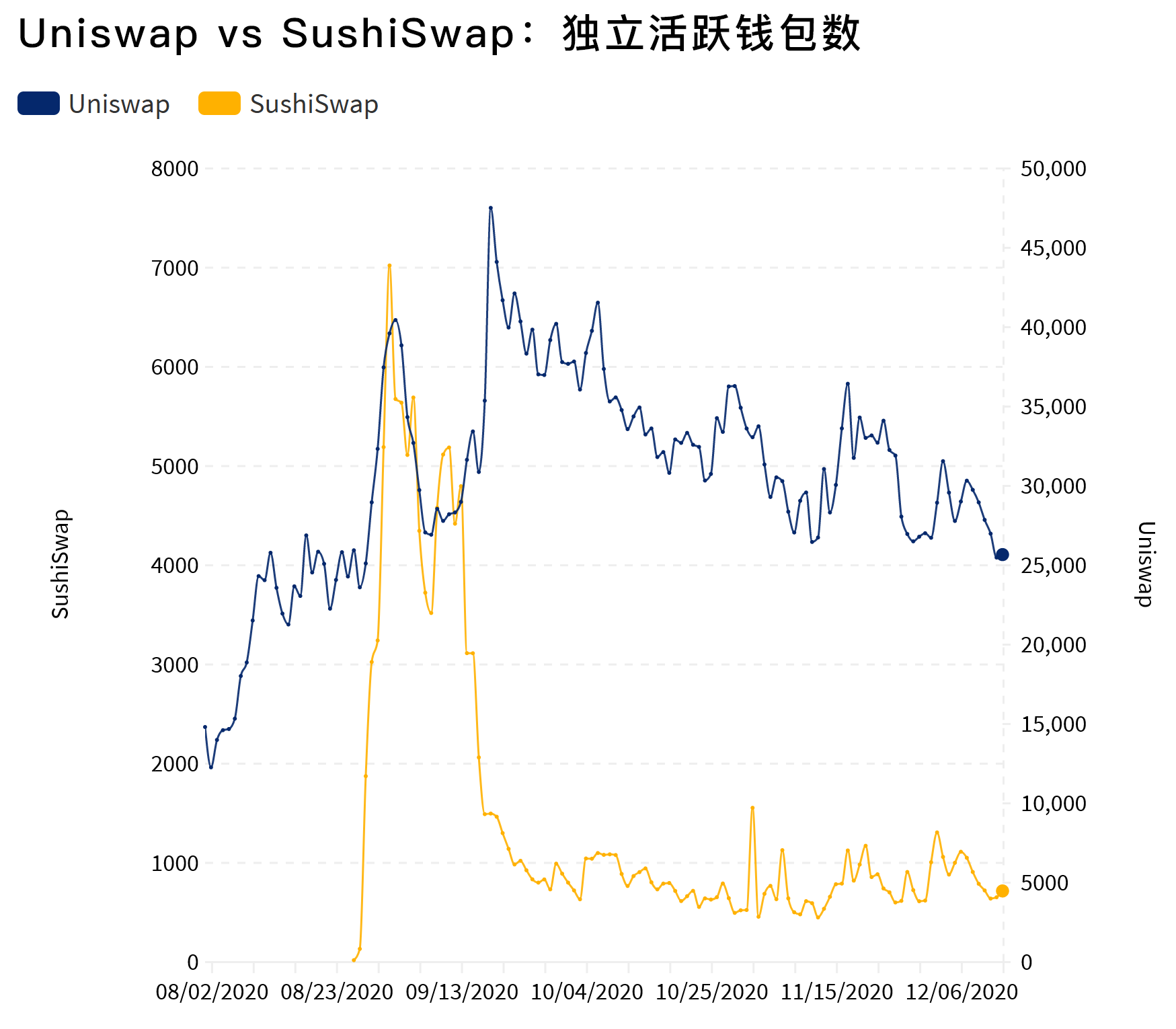

Uniswap is the clear leader in the decentralized exchange (DEX) category in 2020. However, another project has plotted a sneak attack, and that is SushiSwap, the release of a so-called vampire dapp that made headlines in mid-2020, essentially Sushiswap uses incentives to get users to move liquidity away from Uniswap.

source:

source:DappRadar

secondary title

development at any cost

Across all metrics across the 16 blockchains tracked by DappRadar, the blockchain industry has seen tremendous growth in 2020.

The number of unique active wallets has grown by 466%, from 58,000 at the end of 2019 to around 200,000 at the end of 2020. Transaction volume increased by 1178%, from $21 billion in 2019 to $270 billion in 2020.

source:

source:DappRadar

secondary title

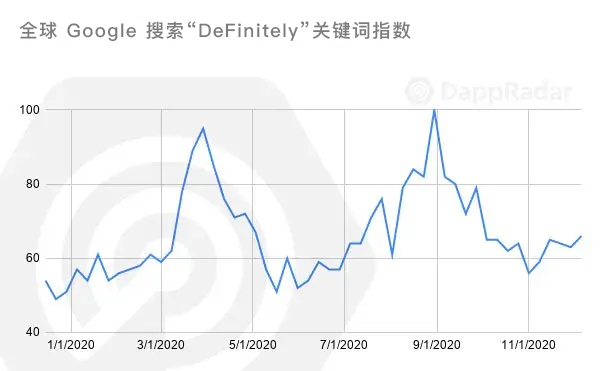

95% of transaction volume growth comes from Ethereum’s DeFi applications

source:

source:Google Trends

source:

source:DappRadar

source:

source:DappRadar

source:

source:DappRadar

secondary title

Yield Farming Boosts DeFi Ecological Activity

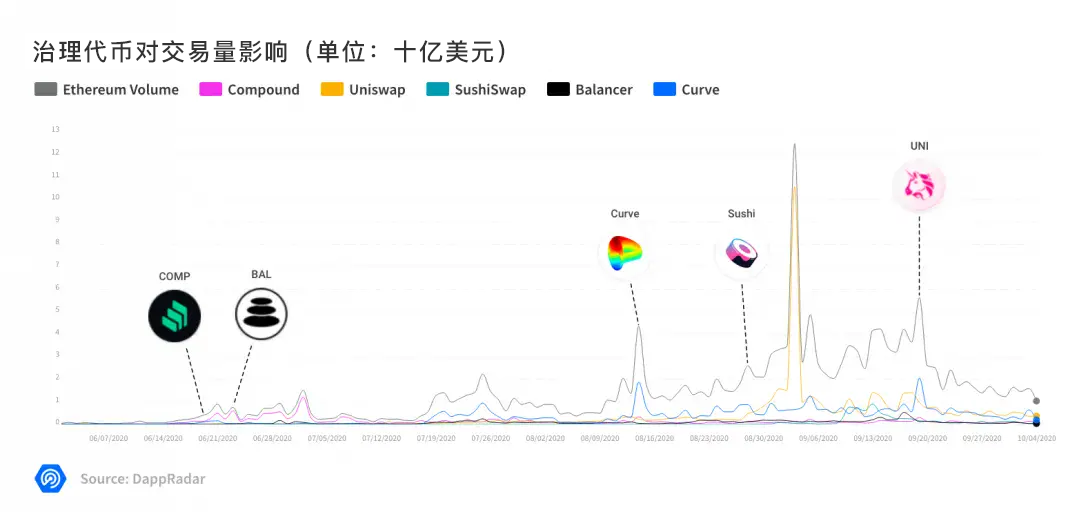

Yield farming was first introduced by Synthetix, and Compound and the COMP token made it popular. It can be said that Compound’s release of the COMP governance token triggered a chain reaction across the industry.

Balancer and Curve also followed the trend, and key indicators briefly rose. Not only that, the growth of key indicators reached the highest point when the SushiSwap project was launched. The following provides data points for the peak number of independent active wallets and project launches:

Ÿ COMP: In one week, UAW (Unique Active Wallets) increased from 300 to 2,700 (+800%).

Ÿ BAL: In one week, UAW increased from 200 to 650 (+225%).

Ÿ CRV: In one week, UAW increased from 1,000 to 4,100 (+310%).

Ÿ Sushi: In one week, UAW increased from 10 to 7,100 (+70,900%).

Ÿ UNI: In 24 hours, UAW increased from 30,000 to 71,000 (+137%).

At the end of August, the launch of SushiSwap shook up the DeFi ecosystem. The project started from the foundation of Uniswap with the aim of migrating its liquidity. In return, to incentivize users to migrate, the protocol distributes Sushi tokens. As of September 2020, the project's transaction volume exceeded $6 billion.

Uniswap counterattacked, airdropping 400 UNI to all wallets that have interacted with Uniswap in the past and current, in order to distribute 400 UNI tokens to each user. A few hours after the airdrop, these ghostwritings were worth about $1200.

source:

source:DappRadar

source:DappRadar

secondary title

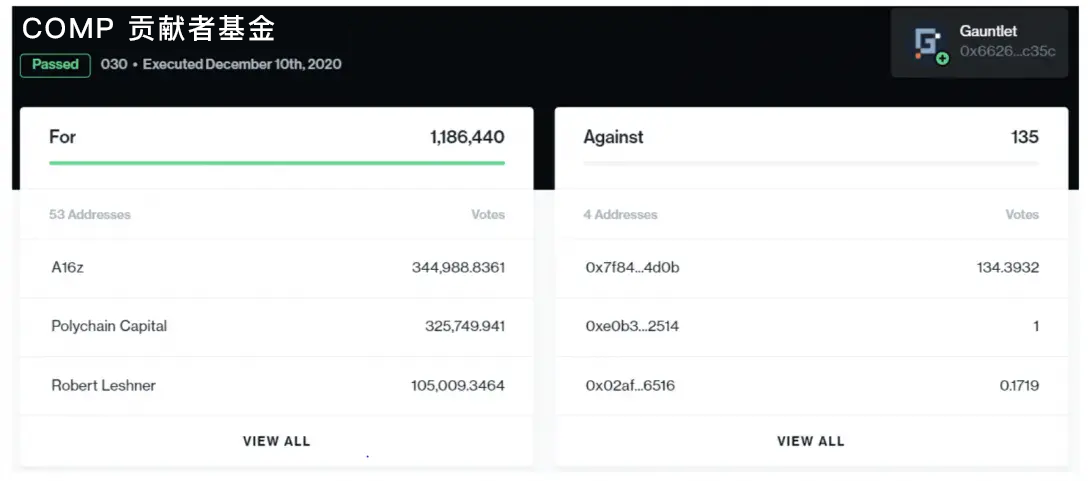

The road to true decentralization

All of the aforementioned dapps issued governance tokens in 2020, and holders could, in theory, vote to distribute the fees collected by the platform as income to themselves.

secondary title

source:Compound Proposal 030: COMP Contributor Grants

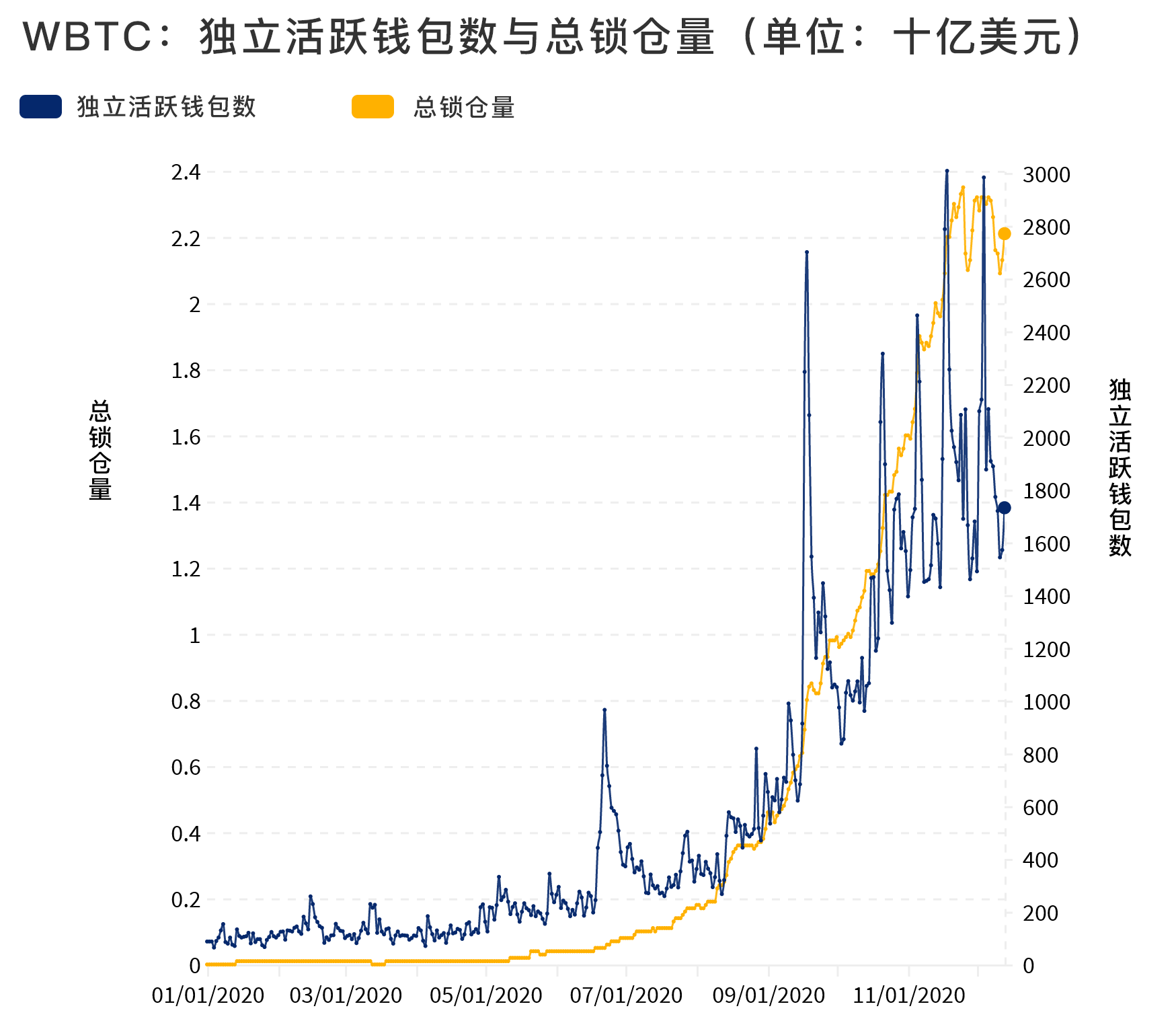

Rising Yields Incentivize Bitcoin Flows into Ethereum

Bitcoin remains the world's number one cryptocurrency by market capitalization and represents a massive amount of liquidity that hadn't previously entered the Ethereum DeFi space.

The smooth integration of the two is an important step in bringing bitcoin holders into the ethereum network’s activity.

Rising yields are the main trigger for Bitcoin to flow into Ethereum. wBTC is the leading provider of tokenized Bitcoin on Ethereum, and many more to come.

secondary title

source:DappRadar

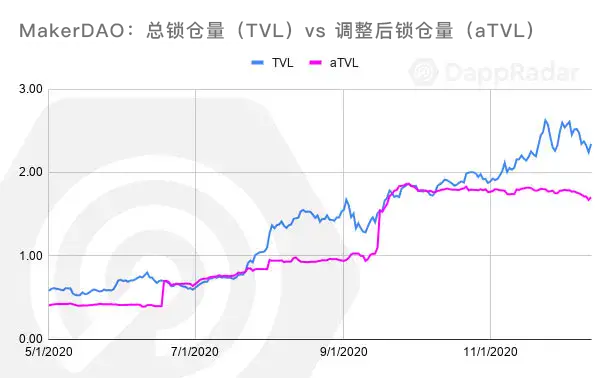

Accurately Measuring DeFi Activity - aTVL

source:

source:DappRadar

Total lockup is usually quoted in USD. Therefore, the price of the locked asset in the smart contract has a greater impact on the total locked amount than the amount of the locked asset.

In 2020, DappRadar proposed a new indicator: Adjusted Lockup Volume (aTVL), which effectively solves this problem. In the case of rising prices of Ethereum and other altcoins, adjusting the locked amount will reflect the real growth of the assets stored in the smart contract.

Additionally, the unique active wallets (UAW) metric can show whether activity is driven by multiple users or a single whale. Additionally, it can show whether there is wider community involvement.

secondary title

source:DappRadar

DeFi Teams Merge

source:

source:DappRadar

Each program specializes in a specific direction, but each program has encountered difficulties in facing competition. Many of these mergers are more like developer acquisition strategies, with Yearn picking development teams that might be struggling.

Mergers are very common in traditional markets, and this is the first merger done in a decentralized market. The merger may provide other dapps with an example and an incentive to follow the trend.

secondary title

foundation for growth

secondary title

source:DappRadar

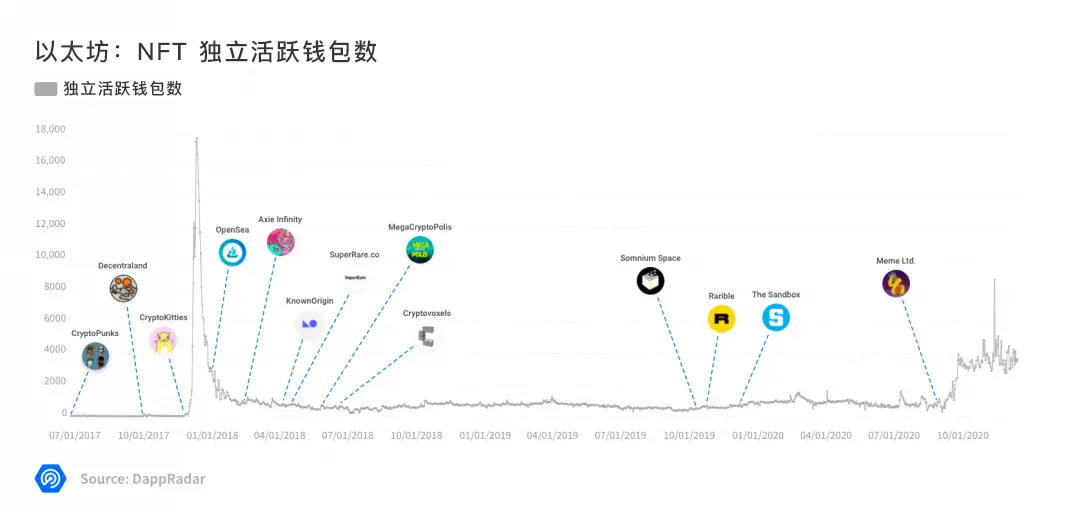

NFTs drive dapp growth in 2020

source:

source:DappRadar

source:DappRadar

Rarible was the first NFT trading platform to provide token farming, and it was quickly accepted by users, increasing the activity indicators of the platform.

source:

source:DappRadar

source:DappRadar

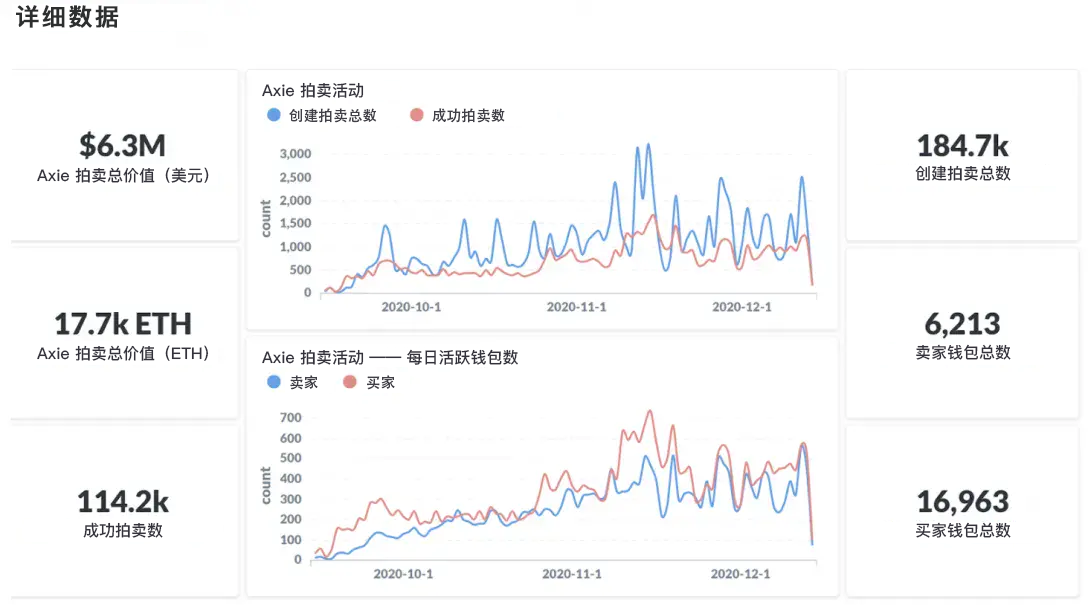

Another example of a governance token is the most popular dapp game Axie Infinity. Axie announced the launch of the ANX token, which inevitably affected the game and the activity of the Axie Marketplace trading platform, and the sales of NFT immediately soared, and the number of independent active wallets increased to about 800 by the end of the year.

On the other hand, OpenSea, one of the most famous NFT marketplaces, has yet to distribute tokens. Nonetheless, the platform has proven that it can attract and retain users fairly quickly even after a temporary dip in user loyalty, likely depending on user experience and the capabilities OpenSea already has.

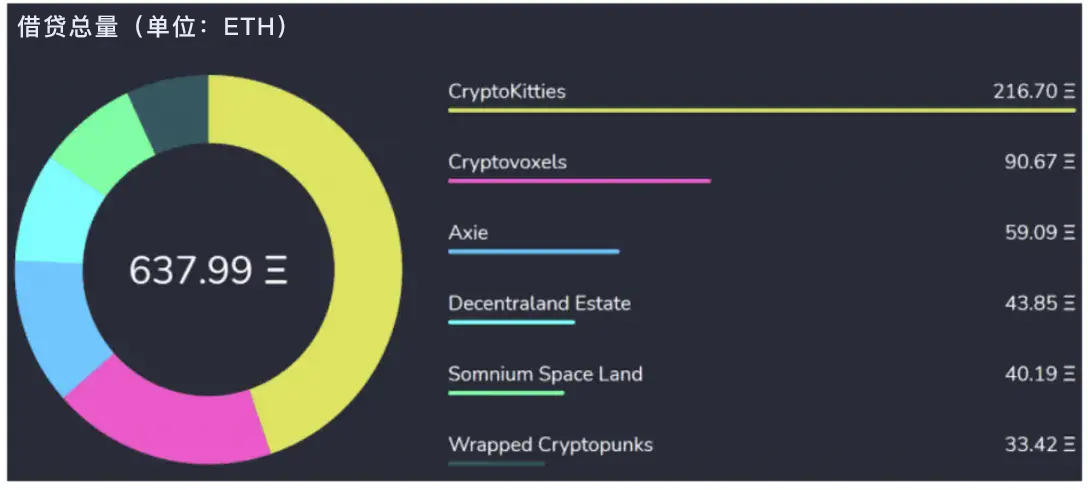

In 2020, the interconnection between DeFi and NFT became more and more obvious. More recently, a platform called NFTfi has enabled users to lock up NFTs as collateral to borrow cryptocurrencies.

secondary title

source:NFTfi.com

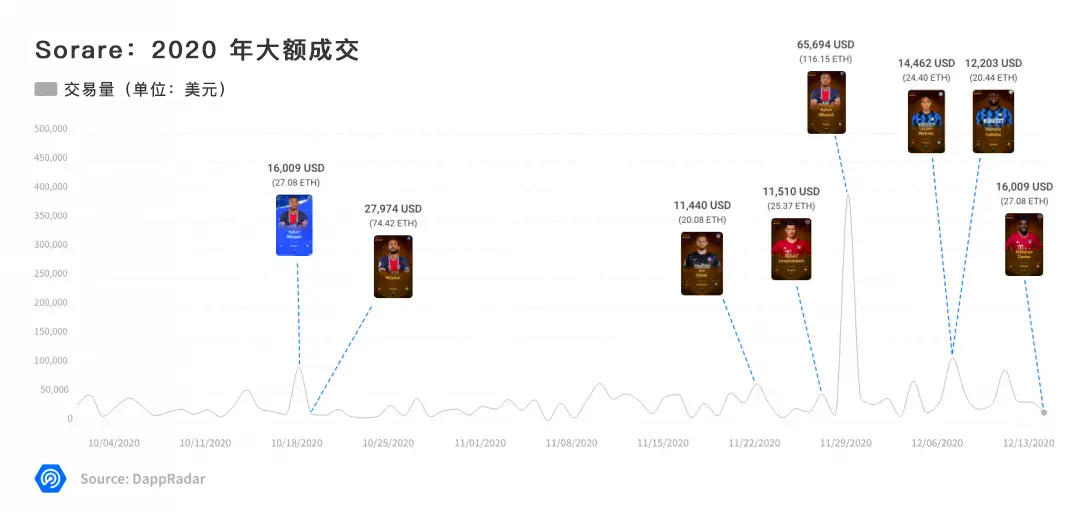

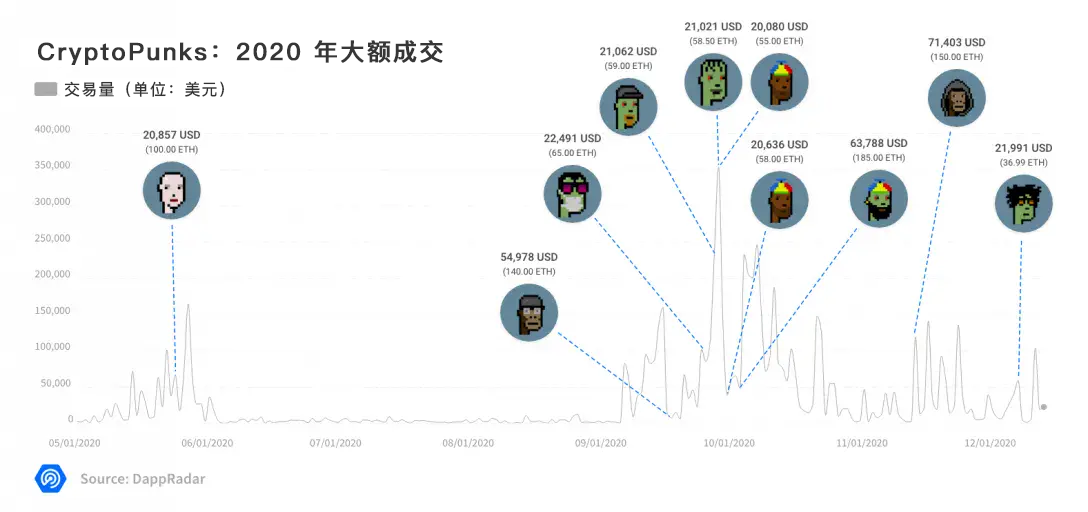

NFT sales show real potential

NFT transaction volume is still relatively small, at nearly $63 million in 2020, accounting for 0.02% of the total transaction value of all categories. More recently, NFT sales in dapps like Sorare and CryptoPunks have demonstrated the true potential of the category.

source:

source:DappRadar(ETH/USD exchange rate is taken from the value on the day of the transaction)

Arguably, CryptoPunks started this trend 3 years ago with the introduction of unique and limited NFT artwork. According to Larva Labs' Top 60 Sales Chart, CryptoPunks sold an astounding amount during their run, with prices ranging from 21 to 185 ETH per CryptoPunk.

source:

source:DappRadar(ETH/USD exchange rate is taken from the value on the day of the transaction)

Axie Infinity's NFT has completed several mega transactions in 2020. Looking at the top ten sales in 2020, two of them exceeded $130,000 and $97,000, respectively. Overall, Axie is the leader in large NFT transactions in 2020.

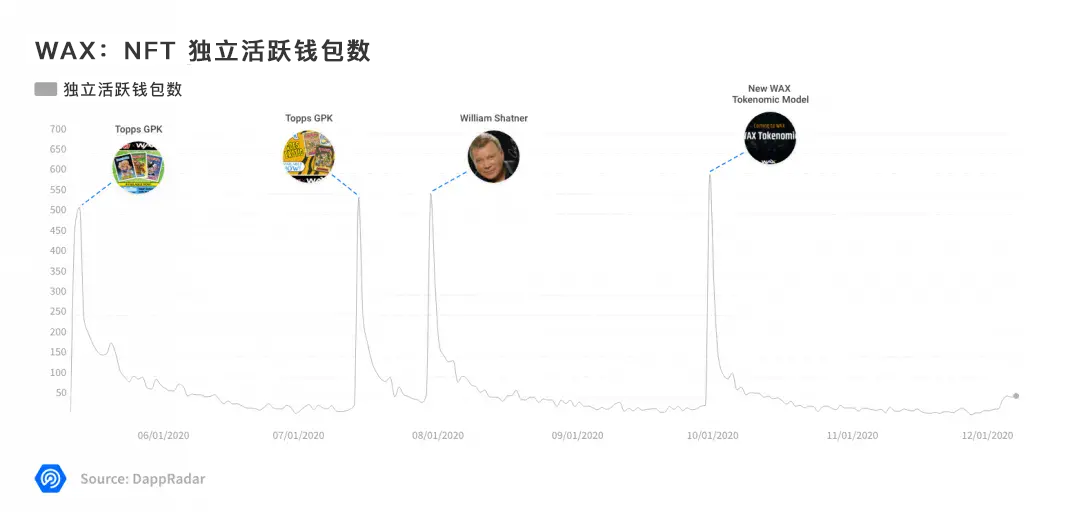

WAX Builds NFT Hub

source:

source:DappRadar(ETH/USD exchange rate is taken from the value on the day of the transaction)

source:DappRadar(ETH/USD exchange rate is taken from the value on the day of the transaction)

In 2020, WAX not only released some very successful NFT items, such as the iconic Garbage Pail Kids Topps cards, but also introduced a new token economic model to the blockchain industry.

In short, WAX hopes to infuse the economic value created on WAX into the Ethereum DeFi ecosystem. More precisely, use what WAX does best — create, sell, and trade NFTs, linking the resulting value to Ethereum.

game

game

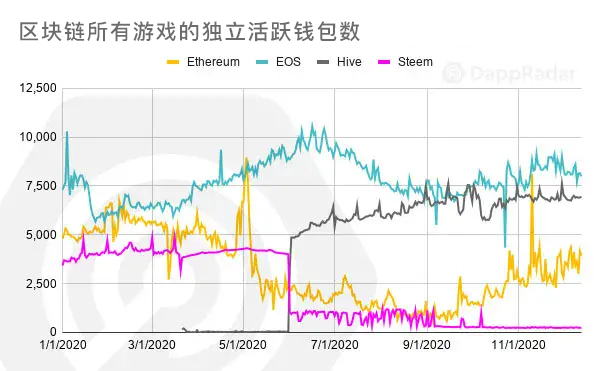

2020 has been a challenging year for dapp games, especially those running on the Ethereum chain.

In early 2020, gaming was the largest category in terms of unique active wallets. At its peak there were about 10,000 unique active wallets. The number of wallets in this category shrank to less than 1,000 in August 2020 and has been slowly recovering since then, as demand for DeFi applications drove up Ethereum gas prices.

source:

source:DappRadar

This downward trend presents an ideal opportunity for other blockchains to catch up. For example, the newly forked Hive protocol has maintained a strong position in the number of unique active wallets. The main driver of this activity is Splinterlands, currently the #1 blockchain game with over 6,000 unique wallets active every day.

EOS is currently leading in the Gaming category. Although user activity is only coming from a few individual dapps, namely Upland and Crypto Dynasty, these two games are constantly driving the growth of EOS. In 2020, they accounted for 42% and 16% of the total daily active wallets in the EOS gaming category, respectively.

EOS land trading game Upland has grown in 2020, recently launching Tilia Pay, which allows players to cash out proceeds from virtual land transactions into fiat currency. Soon, the game hopes to allow users to sell NFTs through its virtual businesses such as art galleries, nurseries, and car dealerships

In our opinion, Upland is a great positive example of a coin-earning blockchain game. Good user experience and most of the blockchain features hidden in the background make this game very popular.

Crypto Dynasty is another coin-earning game that has gained popularity over the past two years while maintaining activity on the EOS blockchain. Currently, the number of unique active wallets for Crypto Dynasty is at least three times lower than it was at its peak, still around 1,500 daily active wallets.

source:

source:DappRadar

EOS and Hive are not the only blockchains having an impact on the gaming industry, layer 1 and layer 2 networking solutions are also finding their way.

source:

source:DappRadar

As mentioned earlier, Flow is another contender who has set their site in the gaming category. Flow is a layer solution that is fast, decentralized, and easy to develop. With brands like NBA Top Shot, Animoca, and Ubisoft on board, we expect more competition on the blockchain in 2021.

Expensive gas fees nearly killed gaming on Ethereum in 2020, and despite a recent pick-up, the main reason behind the growth is the rise of coin-earning game models.

The play-to-earn model is the latest development trend in the dapp game industry. This business model includes the concept of an open economy and provides economic benefits to any participant who adds value to the project.

Axie Infinity is one of the first blockchain games to introduce a coin earning model. For example, players can use Axie to play games, improve its functionality and sell it on Axie Marketplace (Axie Marketplace) or other similar platforms. In 2020, there have been many reports of players earning sustainable income from games.

source:

source:Axie Infinity extended analytics by DappRadar

secondary title

The Virtual World of Ethereum

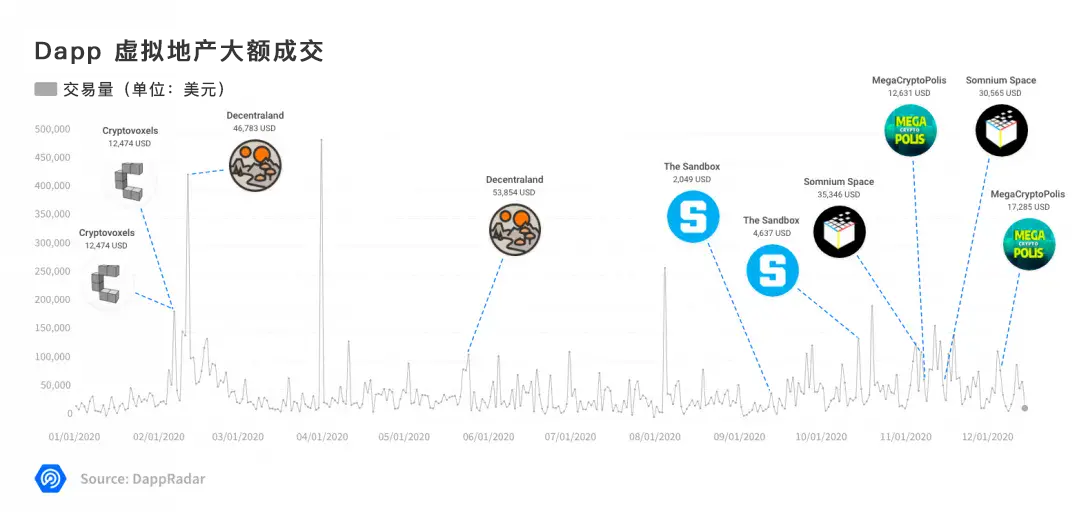

Currently, most virtual world dapps are centralized on the Ethereum network. Projects like Decentraland, MegaCryptoPolis, The Sandbox, and Cryptovoxels have made it possible to create entire universes on the blockchain. These universes contain real estate, objects, wearables, artwork, group activities, and more, enabling users to interact and own items in a virtual environment. Furthermore, these dapps create opportunities to participate in and profit from the virtual economy.

For example, MegaCryptoPolis allows users to build buildings (such as offices) and rent them out to other users, and the wallet gets game assets that can be easily exchanged for the game token $MEGA. While other worlds are more like virtual art galleries, locations for events like concerts, exhibitions or festivals.

source:

source:Nonfungible.com (Token/USD conversion rate on the day of the transaction)

Although most user activity in virtual worlds is still event-driven, these dapps generate impressive transaction volumes.

Overall, most activity is clearly very concentrated on the Ethereum blockchain, while scalability issues make it difficult for certain categories and individual dapps to survive.

secondary title

2020 Summary

Overall, 2020 has been an incredible year. Despite the challenges of a global infectious disease pandemic, blockchain applications have emerged. The pandemic appears to be drawing increased attention to decentralized solutions such as universal basic income and globally distributed database management systems.

Ethereum dominated the landscape and maintained a strong leadership, but new competitors also arrived in 2020 to vie for the crown. The arrival of Ethereum 2.0 has become critical to maintaining leadership.

There is no doubt that 2020 is the year that financial services and products go to decentralization, and although various dapp categories have skyrocketed this year, the headlines have always belonged to DeFi. Looking ahead to 2021, we expect DeFi to play a bigger role than in 2020.

It can be expected that the DeFi ecosystem will form the basis of the crypto-economy not only for NFTs and games, but also for social, logistics and other dapp categories. NFT Marketplace applications continue to hit year-round records, suggesting that developers are beginning to band together to solve problems and take on competitors as new synergies are discovered. Mergers and acquisitions became a trend in late 2020 and are expected to continue not just in dapps but across the blockchain industry as a whole.

The data shows that Binance Smart Chain will become an important competitor of Ethereum in the future. The dapp launched on this blockchain has attracted widespread attention with its continuous development momentum in just a few months.

Flow is also a very promising contender in the gaming and NFT categories. Looking ahead to 2021, we believe user acquisition and retention will be the next challenge and a key metric for these two fledgling blockchains.

secondary title

some important points

To add a little energy to the blockchain and dapp space in 2020, we asked some of our partners and media for their thoughts on 2020 and the year ahead.

Note: The following are only personal opinions and do not represent the official opinions of DappRadar.

Aleksander Leonard Larsen - Founder and COO of Axie Infinity

2020 has been Axie Infinity's best year yet, with our user base growing by over 700% since the beginning of the year. Without a doubt, Small Love Potions has been the biggest success for us, and it's amazing how many players' lives have been changed by it.

2021 will be even better for Axie with a major update to the combat system, the official launch of the land game, and scaling with our Ronin sidechain. The secret weapon, of course, is Axie Infinity Shards, which allow our products to grow rapidly.

Tim Copeland - Decrypt News Editor

This year has been characterized by widespread institutional adoption of Bitcoin, with Grayscale’s Bitcoin Trust and companies like MicroStrategy buying Bitcoin outright. I think it will be very interesting to see how Bitcoin develops now that there are so many rich people owning so much Bitcoin.

In terms of Ethereum, it has made technical improvements and started to take a big step towards Ethereum 2.0, and DeFi broke out this year. It will be interesting how much innovation can be done on this blockchain platform. But it is also worth mentioning that a lot of money has been invested in experimental smart contracts, and a large number of hacks have caused many investors to suffer huge losses. The industry is growing at breakneck speed and nothing seems to be stopping it.

Next year may see more regulatory battles. Now that so many institutional investors and companies are exposed to bitcoin, regulators may see more reasons to get involved. They've been quite active this year, with the SEC cracking down on ICOs and proposed bills such as the Stability Act. But this is cryptocurrency, so it's very unpredictable.

Sebastien Borget – Founder and COO of The Sandbox

2020 has proven that gamers are hungry for connected gaming experiences, with interest in virtual worlds higher than ever, with Minecraft reaching 124 million active users in August alone. Some in-game events, such as Travis Scott's Fortnite concert was popular with 12 million players, and Roblox's stock market capitalization is estimated at $8 billion, showing the potential of the game.

While these successes were built on their community, they didn't do the players any favors, as the game's economy existed within sieges, with purchased items locked inside. In 2021, that will change.

In early 2021, we will launch our play-to-earn season system and at the same time we will release the first playable beta version. Items earned by players in the game's 166,464 LAND (owned by players and investors like Atari) can be transferred to other LANDS, traded or sold for "SAND" (the game's cryptocurrency). Since NFTs are traceable and limited, items gain value based on scarcity.

In virtual worlds, we can design new models that drive community engagement and deliver more value in meaningful ways, areas of interoperability we haven't yet explored, and this has huge potential to unlock the true value of millions of NFTs.

Just gaming, there is still a lot of room for growth, such as experiments around governance, staking, and DeFi. Breakthrough sales of NFT-based encrypted art and games last month hint at further growth in 2021.

Han Kao - Founder and CEO of Crypto Briefing

If I could sum up 2020 in one word, it would be Bittersweet. Unfortunately, the global pandemic has highlighted the digital economy. As people and activities move online, and governments look to fund economic recovery, the arguments being made in the crypto community are starting to resonate with more readers.

Across the globe, people have had to deal with some very difficult times. However, we have seen that macro events and prominent traditional investors confirm the Bitcoin narrative, and DeFi is no longer a vain dream.

2020 has allowed many dapp developers to finally build and experiment at production scale. With more tools and more options, we should see more development and innovation, hopefully with more focus on the end user experience.

Matthew Lam - Analyst at OKEx Insights

Represents Matthew's personal views only, and does not represent the opinions of OKEx Insights.

I sum up 2020 as "progress". In particular, I have seen many developments in DeFi, NFT and CBDC. Liquidity mining has become the #1 buzzword in the crypto community!

I believe that 2020 will be a year of "progress" and 2021 will be a year of "harvest"!

In terms of DeFi, I think AMMs and price oracles are worth watching! Meanwhile, seeing as China launches DCEP next year, it’s no surprise that Wall Street giants are racing each other to launch their crypto trading platforms and institutional-grade crypto custody solutions!

I think the launch of ETH 2.0 is a long-term price driver, and I am inclined to be bullish on the price of ETH next year!

Raindy Lu - Marketing Operations Manager, Ontology

A big win for us this year was the launch of the "Inclusive Pool" on the Wing platform, the first credit-based cross-chain pool built on the Ontology blockchain.

Heading into 2021, our focus is on furthering the ecosystem by helping more dapps focus on self-managed ID and data protection services. Another goal is to further optimize product development and bring wider users to ONTO wallet, SAGA and Wing platforms.

We believe DeFi will continue its upward trend in 2021 as more players enter the space. This will lead to further innovations such as different combinations of staking or the further development of NFTs.

Antonio Madeira - Lead Advertising Manager at CryptoCompare and Contributor to CoinTelegraph

2020 is the year DeFi gets attention as it’s a newcomer to the chain, while Bitcoin is solidly positioned to shine among big institutional investments.

I believe DeFi will start to show signs of maturing, and other parts of the space will start to shine, especially NFTs. I think Bitcoin will continue to gain traction among institutional investors. I believe that the interest and value of many altcoins will continue to decline because most altcoins have no real use.

Justin Sun —— CEO and Founder of TRON

2020 has been an amazing year! I am very satisfied with the progress TRON has made in 2020. Launched many new products, including JustStable, JustSwap, JustLend, JustLink, SUN community, which laid the foundation for TRON's decentralized financial ecosystem.

We will focus on growing and scaling our DeFi infrastructure. Through the DeFi products built on our platform, TRON's DeFi projects will be based on JST, integrating decentralized lending, trading and other financial services. Then JST will evolve into a source of empowerment and become an important symbol of the entire TRON DeFi ecosystem. Our position in DeFi illustrates TRON's evolution from small-scale success to industry leader and innovator.

DeFi will continue to grow in 2021 as it makes financial services accessible to many unbanked people and businesses. We will continue to develop the stablecoin ecosystem on TRON and invite more regulated stablecoins.

Interest in blockchain technology continues to grow, and today, more large institutions than ever before are investing heavily in blockchain solutions.

Dirk Lueth —— Upland CEO

In a word: start. (Of course, I am referring to the beginning of NFT becoming mainstream).

2020 is not yet the year of NFTs. It wasn’t until the end of the year that we started to see the idea mature, the products become more complex, and we saw early signs of non-crypto fans starting to pay attention. Even though some NFTs have sold for thousands of dollars, this does not represent mass market adoption.

It can be said that once the daily active users reach more than 100,000, the blockchain will start to become mainstream. In 2021, the first companies will break this barrier. The big question, however, remains whether these new entrants have blockchain DNA from the ground up, or come from established companies adding blockchain functionality to existing games.

I think the transactions in the blockchain market such as digital art, collectibles and other assets will start to move to the multiverse, because the latter can create better content, user and transaction experience.

Finally: Tokenized assets from the real world will enrich the world of NFTs, will anyone own a Picasso? The lines between the digital and physical worlds will blur.

Dr. Jesse “aggroed” Reich – Founder and CEO, Splinterlands

Splinterlands did a great job. In September, we reached 10,000 monthly active users for the first time, we saw new user growth of about 10% per month, and our social media presence continued to grow. All of these contributed to the success of our land sales, with the first lot sold out in 21 seconds and the second lot in 30 minutes.

We will add a second round of combat where players can see the board, game items and spells. To accomplish this, we had to sell items and spells, not just pack them together, but transfer the rights to mint them to the player. Landowners will harvest resources, construct buildings, slay monsters, and use all of this to craft items and spells, which can be rented or sold on the marketplace.

I think 2021 is an incredible bull market for Bitcoin and cryptocurrencies. I see every type of business in cryptocurrency doing well and enjoying the largest transfer of wealth in the history of the world.

data analysis:

——————————

author:

Modesta Jurgelevičienė

Ian Kane

data analysis:

Modesta Jurgelevičienė

Yashoda Savanth Raghunatha Rao

Jurgis Jaška

graphic design:

Justas Samalius

Lukas Grekavicius

Special thanks:

Kornelija Gudzevičiūtė - Social Media Expert, DappRadar

Jon Jordan - Head of Communications, DappRadar

Ilya Abugov - Advisor, DappRadar

This article was translated by WJW, a community volunteer of the WePiggy lending agreement.