secondary title

1.1 Project Introduction

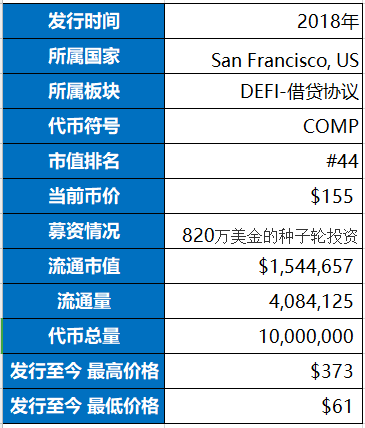

1.2 Basic information

1.2 Basic information

secondary title

2.1 Team

2.1 Team

Robert Leshner, CEO of Compound: A senior financial person, graduated from the Department of Economics of the University of Pennsylvania, a prestigious American university, has worked in well-known companies such as Discover and has experience in successful entrepreneurial exits, and holds a Certified Financial Analyst (CFA) license.

secondary title

2.2 Fundraising situation

secondary title

2.3 Project Highlights

2.3 Project Highlights

Compound is the first to use liquidity mining to distribute native tokens. It launched COMP with the idea of completely decentralizing the governance of its platform.

1. The interest rate is calculated by algorithm, so as to earn or pay floating interest rate. Attempts to solve liquidity problems through the money market system

3. Token Model

3. Token Model

secondary title

3.1 Token distribution

- 2,396,Compound has a total of 10 million tokens, and the distribution ratio is as follows

- 2,226,307 to the investors of the compound project

- 372,037 for the project team, 4 years vest

- 4,229,707 is reserved for the new team members who join later

- 775,949 is given to protocol users, and 2880 tokens are released through mining every day

secondary title

3.2 Token Value

4. Track

4. Track

secondary title

4.1 Track Overview

Investors, speculators, and hedgers generate transactions in thousands of encrypted asset markets, but participants have little ability to trade the time value of assets. Interest rates fill the gap between those who have assets to spare and those who don't. Trading the time value of assets benefits both parties and creates non-zero-sum wealth.

From a macro point of view, decentralized lending is one of the underlying protocol assets of DeFi, and the DeFi Lego model is also based on the three major protocols of stable currency, lending, and trading.

4.2 Competition Analysis

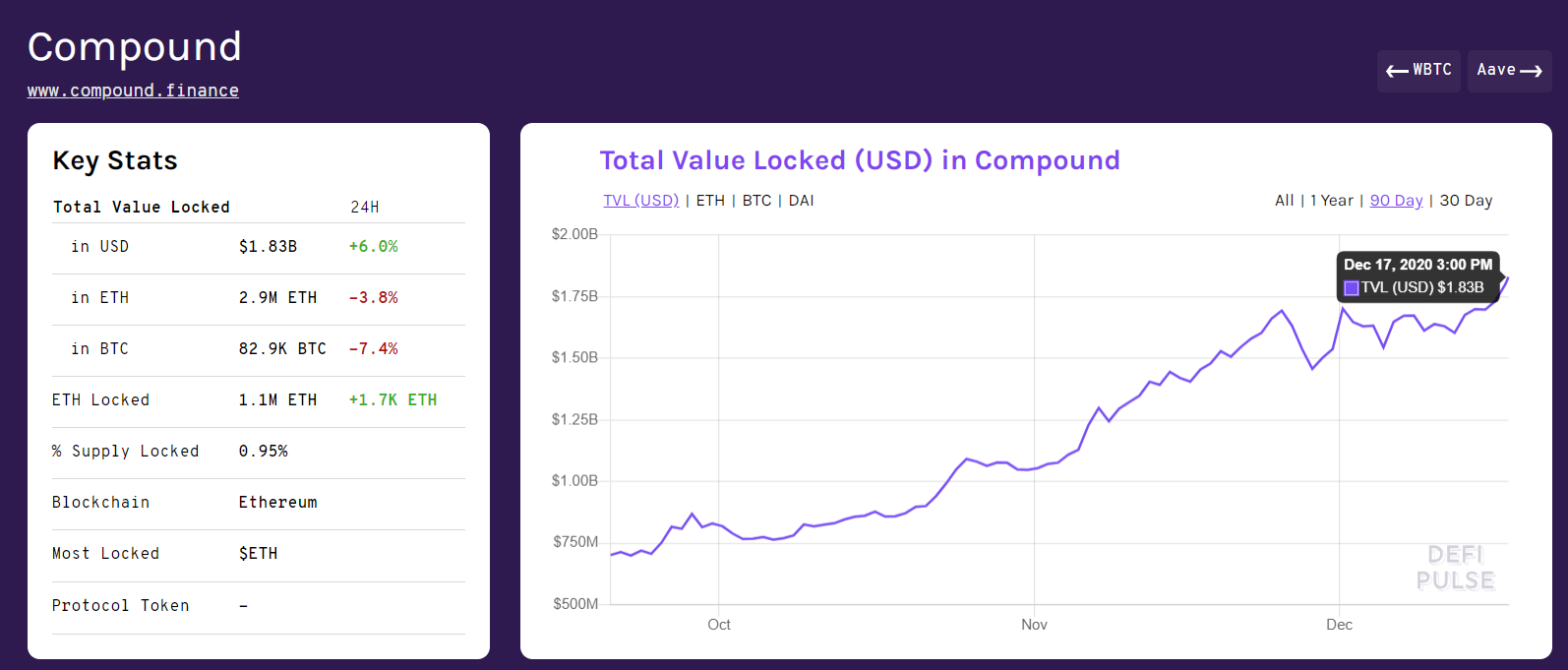

Compound lock-up trend

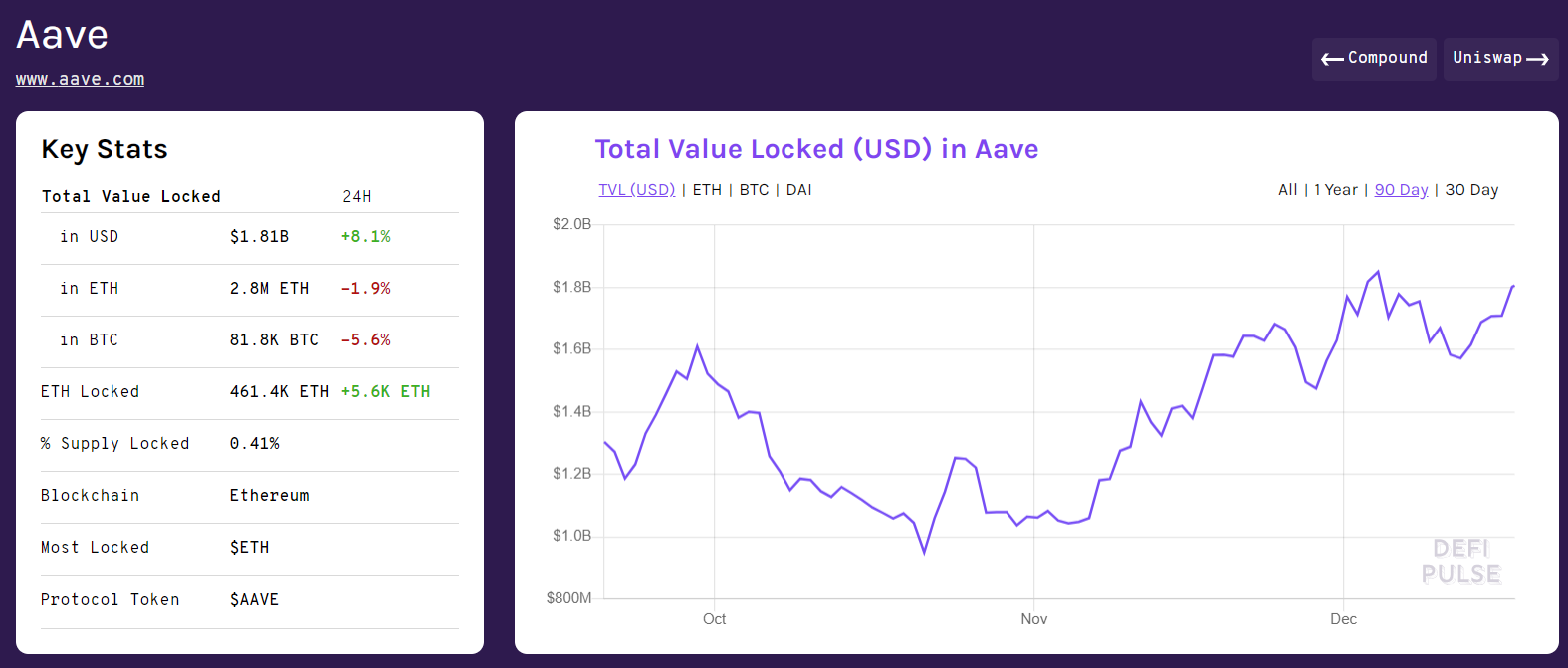

image description

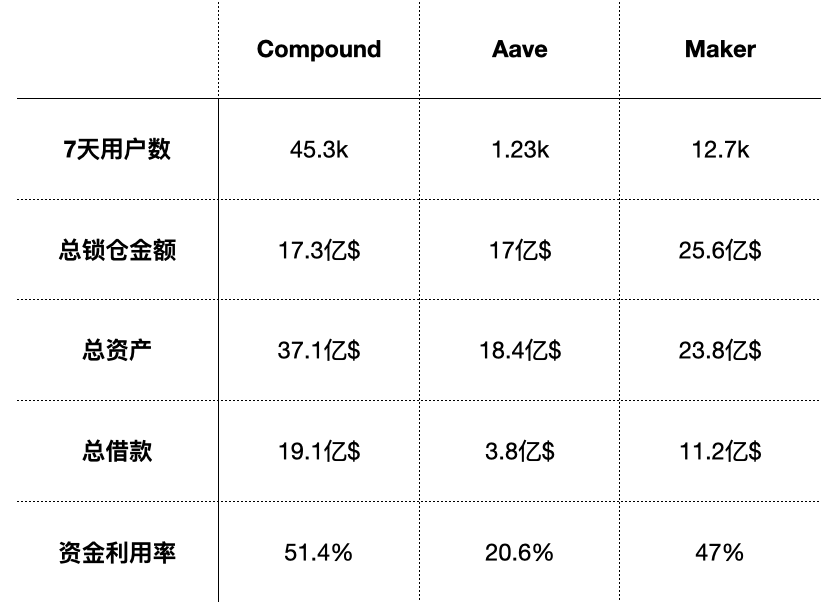

The recent lock-up volumes of both remain at around 1.8 billion US dollars, of which Compound locks 110WETH and Aave locks 46WETH.

Comparison of core indicators

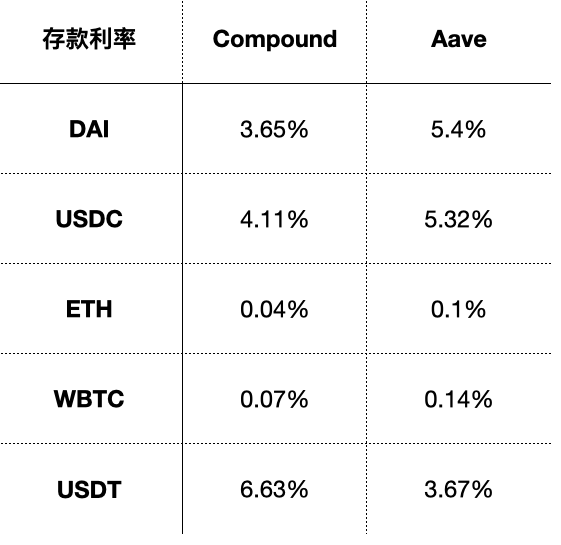

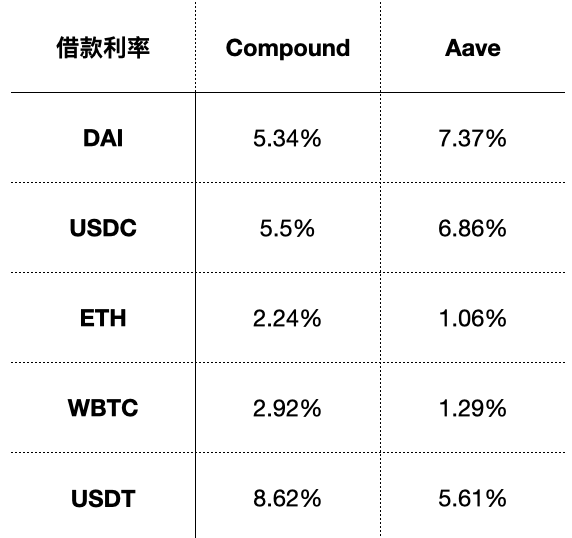

Deposit Interest Rate Comparison

first level title

V. Summary

V. Summary

1. Lending accounts for nearly half of the business volume in the traditional financial field. For DeFi, decentralized lending is also one of the important areas in its development process in the future, and there is huge room for future development.

2. Lending products in the DeFi field continue to come out, but the leading effect of this track has already appeared.