secondary title

1.1 Project Introduction

1.1 Project IntroductionHarvest Finance is a revenue aggregator built on ETH, which is benchmarked against the YFI protocol.secondary title

1.2 Basic information

1.2 Basic information

In terms of income distribution, 30% of the mining income is allocated to FARM holders, which are used as long-term incentives and interest binding for Harvest users.

secondary title

2.1 Team

secondary title

2.2 Fundraising situation

secondary title

2.3 Project Highlights

secondary title

3. Project development

3.1 Project development history

4. Token Model

4.1 Token Distribution

4.1 Token Distribution

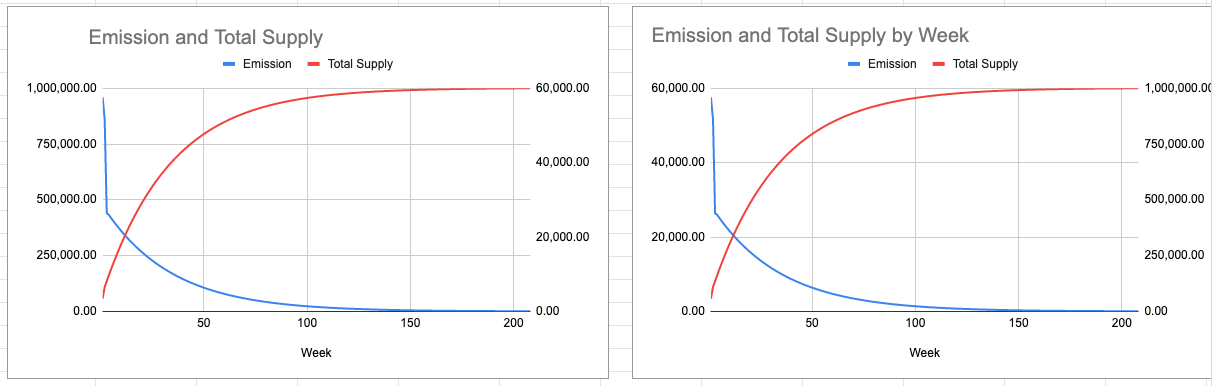

In the first month of the project’s launch, only 23.2% of the total supply of FARM will be released in the first four weeks, and the supply will be reduced by 4.45% every week until 208 weeks.

Although there is no pre-mining, the project will gradually release some tokens belonging to the team to motivate the further development of the project:

70% of FARM tokens will be allocated to liquidity providers on automated market makers (AMMs) such as Unsiwap;

10% of FARM tokens will be vested in the Ministry of Finance to pay for additional development and promotion;

secondary title

4.2 Token Value

4.2 Token Value

Harvest Finance FARM token functions:

1) FARM is the governance token of Harvest;

2) FARM holders can vote on the proposal of the Smart Pool;

secondary title

5. Track

5.1 Track Overview

5.1 Track Overview

The DeFi revenue aggregator is an important part of the DeFi track, and it can be said that it basically grasps the entrance of long-tail capital flow.

Its importance is self-evident, and the recent acquisition of Pickle, Cream, Cover, Akropolis, SushiSwap and other projects by YFI, as well as the release of Q3 financial reports, all reflect the expansion capabilities and strategic layout of the aggregator.

On the whole, the overall track significance of the DeFi revenue aggregator has three points:

1. Reduce user operation steps and improve time efficiency

2. Reduce user fees

3. Improve user income

The biggest difference between aggregators lies in the underlying strategy of the protocol. At present, the core competition point of this track lies in how to maintain a high yield of liquidity mining to attract and lock users to provide liquidity.

Liquidity mining is a network participation mechanism. The specific principle is: users provide funds to the DeFi protocol in exchange for the native token of the protocol.

Harvest Finance and the DeFi aggregators currently on the market are essentially similar to Yearn Finance. What the DeFi revenue aggregator has to do is to optimize the revenue by dynamically allocating the liquidity of various DeFi protocols. The liquidity provided in the DeFi ecosystem can be automatically allocated to different pools. Think of it as an automated yield farming protocol that explores markets for the highest return possibilities and matches capital to those opportunities.By using 30% of its business profits to reward FARM token holders, an additional layer of incentive mechanism is added to the original aggregation strategy, which is also one of the core elements of Harvest Finance's rate of return ahead of similar aggregation projects.

secondary title

5.2 Competition Analysis

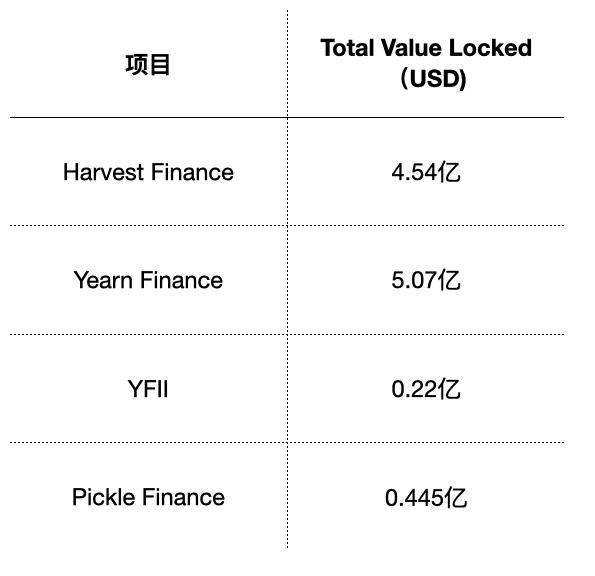

The comparison of competition mainly includes the following three aspects:

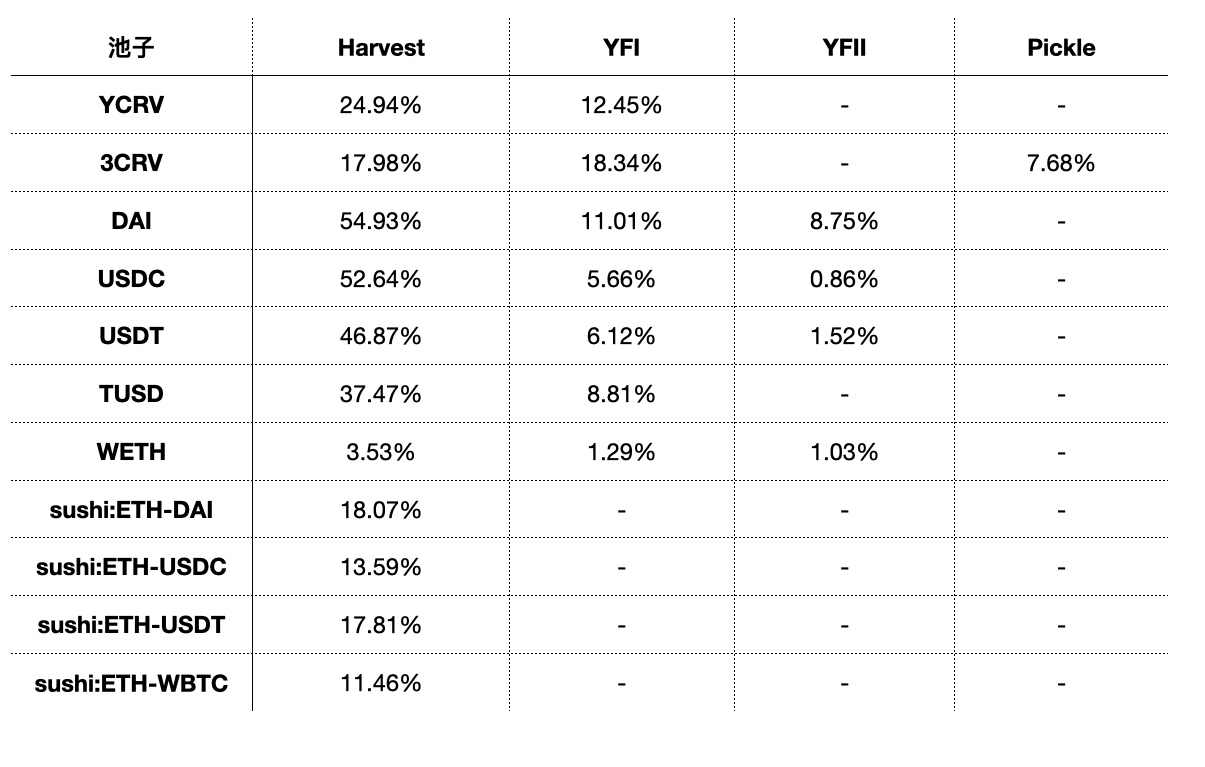

First: comparison of machine gun pool strategies;

Second: the comparison of yield;

Third: the comparison of asset scale;

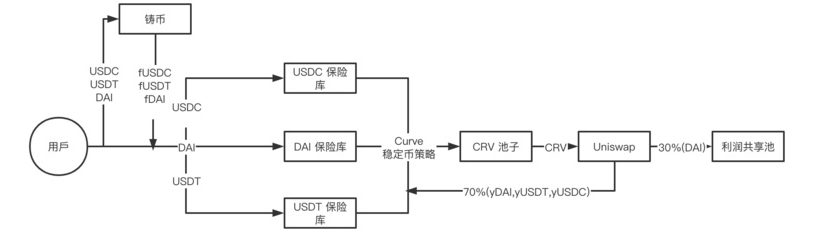

The ratio of smart pool fund allocation is actually quite obvious, basically including CRV strategy and Uniswap strategy. Mainly by providing liquidity mining users with their own platform's dividend token FARM to achieve a rate of return exceeding FYI.

Strategy Flowchart

Yield Comparison

image description

first level title

6. Summary

6. Summary

1. Harvest's aggregator track still has a lot of room for growth, and the entire Defi market is still in its early stages. In the later development of Defi, the aggregator track will benefit. Under the premise of ensuring the safety of restoration and restoring investor confidence, the Harvest project itself has a very broad market opportunity.

2. Harvest's token economic model has strong competitiveness, and tokens can effectively capture the value generated by the project. Compared with YFI, the leader of the track, in addition to the obvious gap in project reputation, it is necessary to make up for ecological layout, product capabilities, and product tonality.

3. Technical loopholes have become a mountain hindering the development of DeFi, which will greatly reduce the confidence and enthusiasm of users to participate. Therefore, ecological opportunities related to DEFI insurance have begun to appear in the market.