secondary title

The application for GRAIN started, but it plummeted when it went online.

On October 26, the DeFi aggregation protocol Harvest Finance suffered a flash loan attack. The official announcement later stated that the total loss of this attack was 33.8 million US dollars, accounting for about 3.2% of the total value locked in the agreement before the attack; the more than 2.47 million US dollars returned by the attacker will be distributed to the affected depositors in proportion according to the snapshot. Other remedies will be analyzed and voted on in governance.

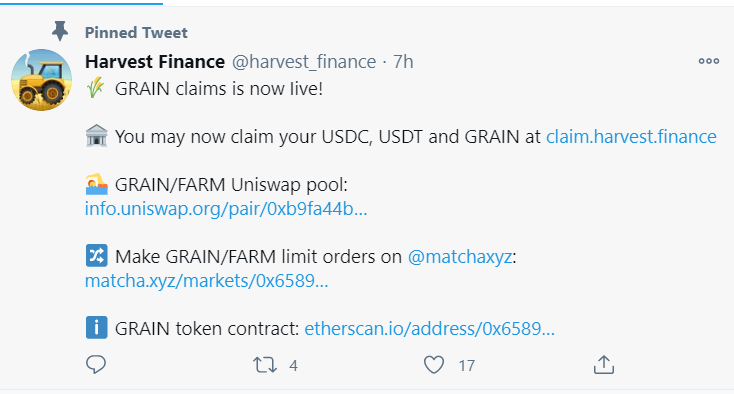

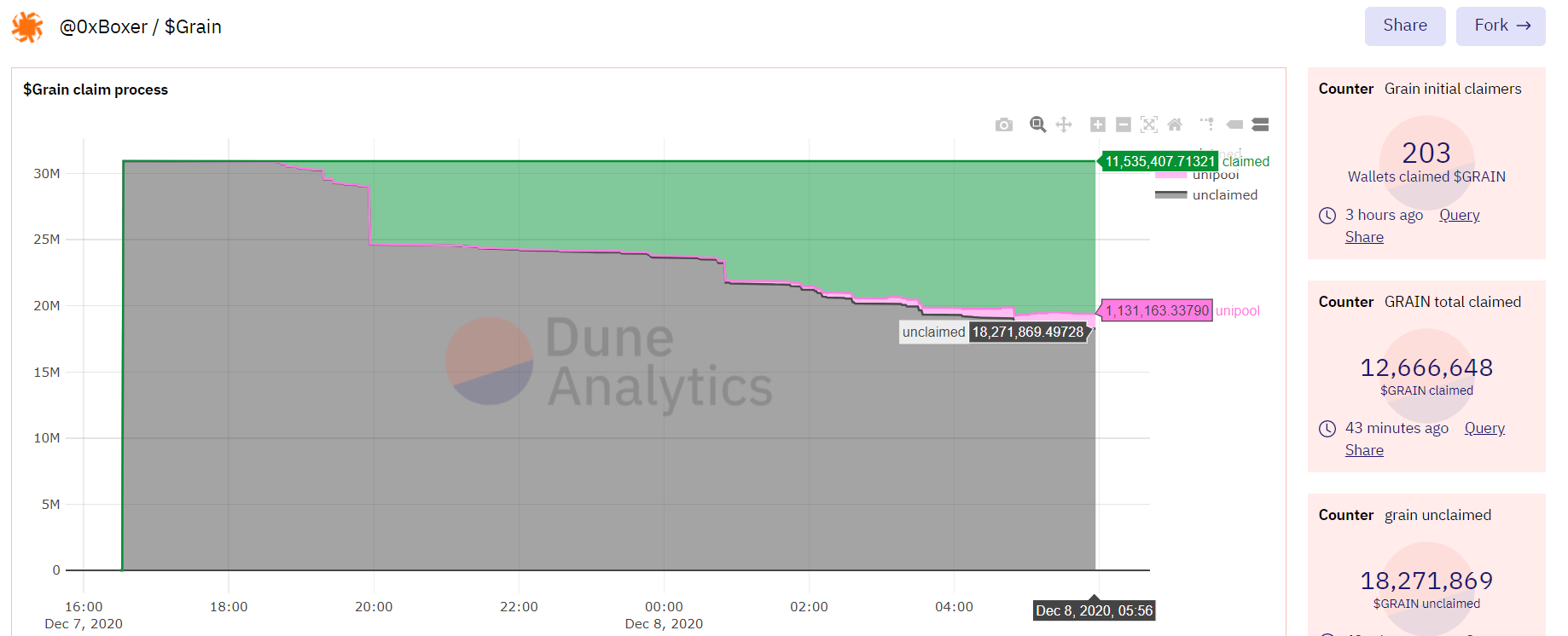

On December 6, Harvest Finance announced that 0.5% of the total supply of FARM will be used to repurchase GRAIN tokens. Users who suffer losses will receive GRAIN tokens on December 7, and GRAIN liquidity provider incentives will also be released on December 7. day starts. On December 7th, Harvest Finance officially announced the launch of GRAIN, USDC and USDT claim portals. Users who were previously affected by the attack will receive GRAIN tokens in proportion to their deposits, as well as distribute the funds returned by the hacker in proportion. According to official estimates, this mixed compensation method can reduce user losses to 13.5%.

At around 4 am Beijing time today, Harvest Finance announced that GRAIN was officially launched. At 10 am Beijing time, Harvest Finance announced the opening of GRAIN/FARM Uniswap LP pledge rewards.

As of press time, GRAIN/FARM was 0.00217, and the real-time price was about $0.23. When it went online, GRAIN/FARM reached a maximum of 0.00535, a drop of 59.3%.

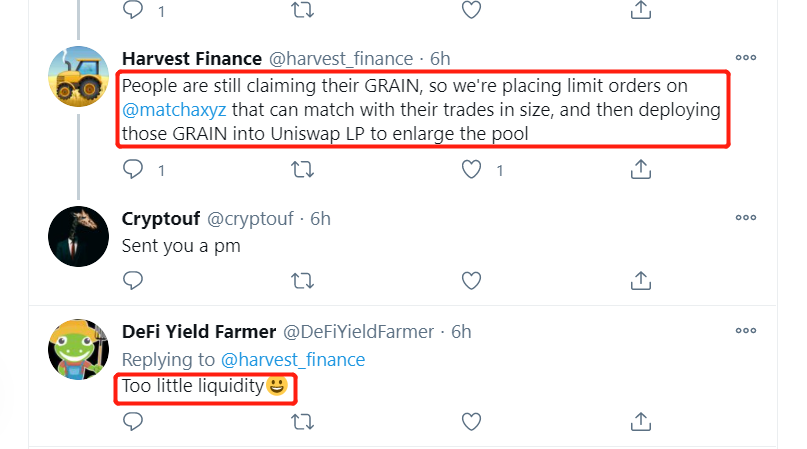

At present, the GRAIN/FARM liquidity pool is still very small. In response to netizens’ doubts, Harvest Finance officially responded that because the users who suffered losses are still claiming their GRAIN tokens, we provide them at matcha.xyz (DEX aggregation liquidity pool) After obtaining limited orders that can meet the trading needs, these GRAINs will be deployed to Uniswap LP to expand the liquidity pool.

secondary title

"Chicken thief" Harvest, questioning never stops

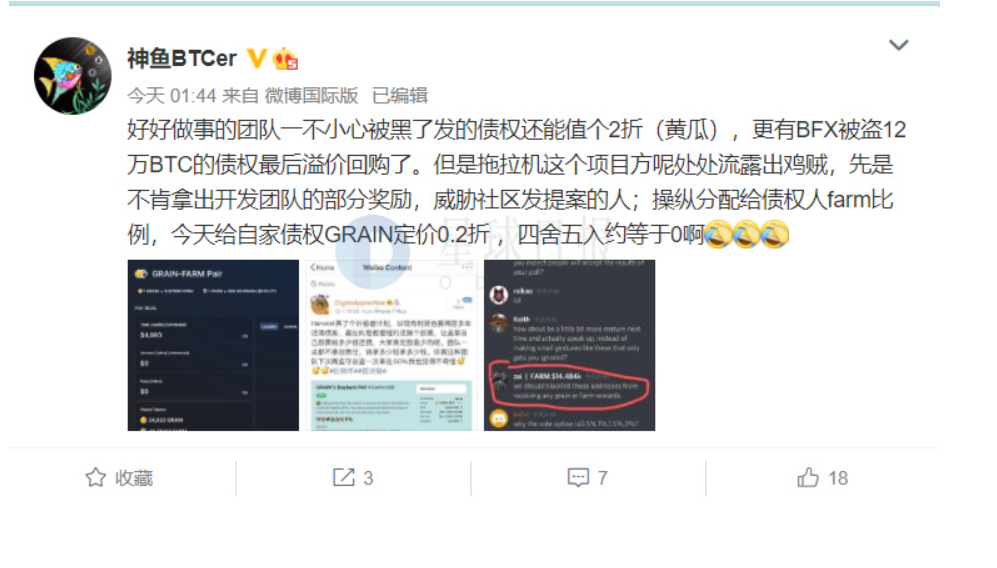

Shenyu, the founder of Yuchi, posted on Weibo in the early morning, saying, "The team that works hard is accidentally hacked, and the creditor's rights issued can be worth 20% off (cucumber), and BFX's stolen 120,000 BTC creditor's rights were finally repurchased at a premium. Yes. The tractor project is showing thieves everywhere. First, they refused to take out part of the rewards of the development team, threatening the community to send proposals; manipulating the farm ratio allocated to creditors, and today priced 0.2% of their own creditor’s rights GRAIN, rounded to about 0 .”

Harvest Finance has actually been in a crisis of public opinion. Because Harvest Finance's attitude towards arbitrage attackers is relatively "ambiguous", many voices believe that the official guards against theft, and staged a big drama of thieves shouting "stop the thief".Some investors asked on Twitter if they could use part of the team's coins to compensate the victims. Harvest replied that the amount of funds was too large and he could not afford it. In fact, everyone knows that whether to pay or not and whether they can afford to pay are two different things. This team doesn't want to pay at all.

secondary title

How far can Harvest go?

GRAIN plummeted as soon as it was launched. At present, most of the lost users have not applied for GRAIN. It is expected that GRAIN will have further room for decline. Since the beginning of this year, DeFi projects have attracted many loyal users through fair launch, decentralization of schemes, and incentives for specific user behaviors over a period of time. Although the value of DeFi itself has gradually been recognized, this field is still in its early stages of development, and many issues such as protocol security and model sustainability still need time to test. Hacking incidents like Harvest are common, and investors should pay attention to risks. In the future, I believe that as time goes by, the siphon effect of leading projects will gradually emerge, and some junk DeFi projects will gradually be abandoned. Odaily will continue to pay attention to how Harvest Finance will develop in the future.