first level title

1. Basic overview

AAVE is an encrypted asset mortgage lending protocol based on Ethereum. It ranks among the top three lending products, allowing people from all over the world to openly and transparently use secure lending functions and enjoy blockchain decentralized financial services.

"Aave" is a Finnish word that means "ghost". "Ghost" represents Aave's efforts to create a transparent, open infrastructure for decentralized finance. Headquartered in London, UK, Aave is composed of 17 innovative and creative industry leaders.

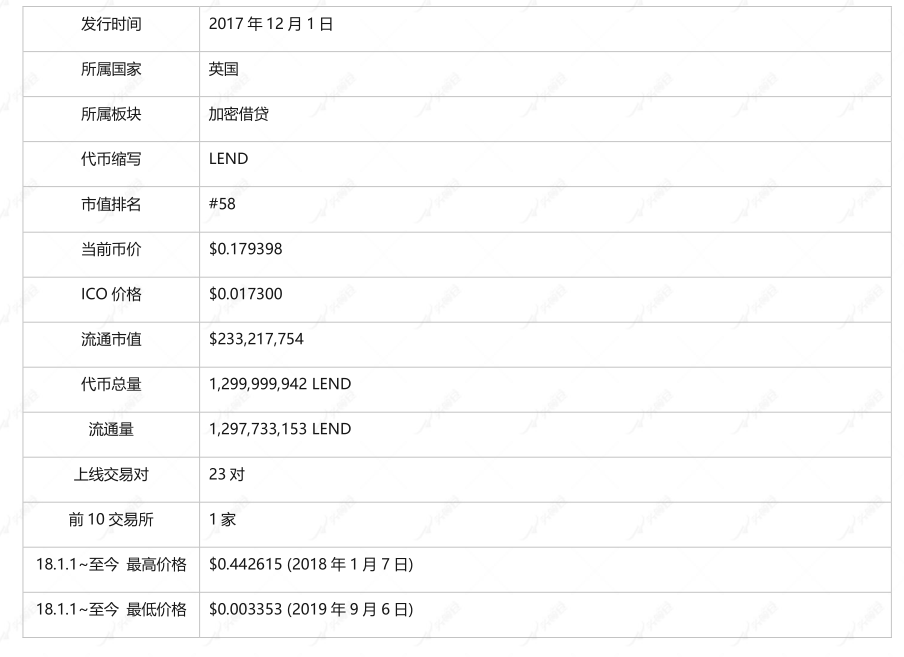

2. Basic Information of Tokens

3. Product business model

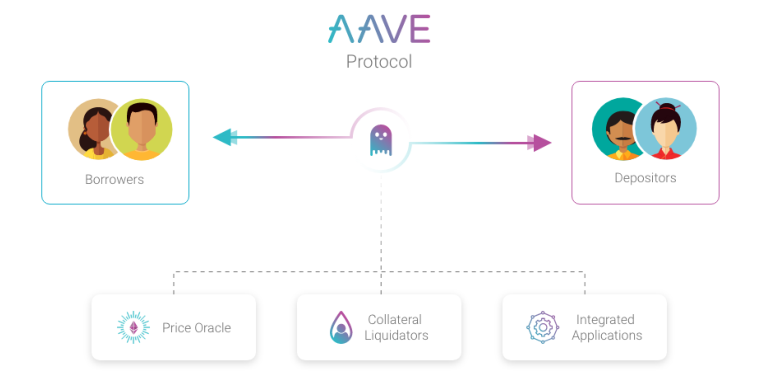

AAVE basic architecture

secondary title

Agreement participants: borrower, depositor, liquidator.

Depositors: When depositing assets into AAVE, they will receive aToken at a ratio of 1:1 as a deposit certificate.

Liquidator: It can help the borrower repay part of the assets when the market price fluctuates greatly and the collateral assets are insufficient, and at the same time obtain this part of the collateral at a certain discount.

secondary title

Product innovation points: interest rate model innovation, flash loan

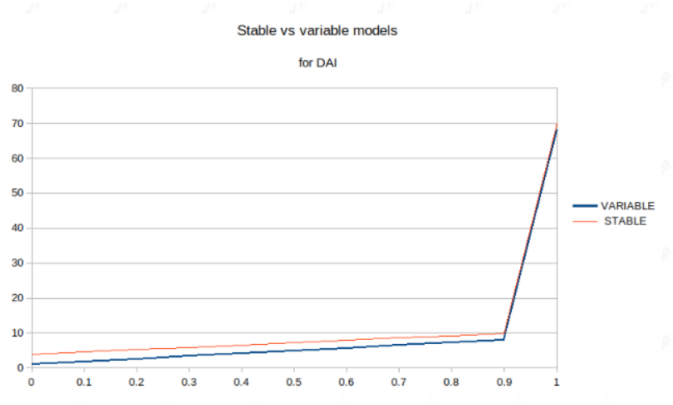

The interest rate model on AAVE is mainly divided into two types: deposit annual interest rate and loan annual interest rate.

The difference between Aave and other lending agreements is that its loan annual interest rate is divided into fixed interest rate and floating interest rate. The floating interest rate is generally lower than the fixed interest rate, which allows users to swap the fixed interest rate and floating interest rate, so as to always get the most The best interest rate, for example, a user initially chooses a floating rate, but in the event that rate rises sharply, the user can switch to a fixed rate. It should be noted that the fixed interest rate in Aave is not always fixed, and will be adjusted according to the supply and demand of the lending pool over a period of time.

secondary title

Token model

Token model

Aave’s token is simply called LEND

main effect:

1) Most of the service fees collected by the platform are used to repurchase and destroy LEND to increase the value of tokens;

3) AAVE currently adopts a deflationary model. The borrower charges 0.01% of the loan amount as a handling fee, 80% is used to burn LEND, and the remaining 20% will be used for referral rewards to recommenders who apply for loans, which is equivalent to direct promotion costs distributed to users. The lightning loan fee is 0.09%, and 24% is used to repurchase LEND, which is equivalent to dividends in disguise.

Four, the latest developments

secondary title

New Token Economic Model:

1. Total additional issuance: 13 million AAVEs are exchanged for 100 LEND to 1 AAVE, and 3 million AAVEs are the additional issuance, with an actual issuance rate of 23.08%. The additional issuance of 3 million is reserved for the development and protection of the AAVE ecology. LEND has been fully circulated and cannot be used for security and incentives, so there is no way to directly confront COMP and compete for the position of the leader in the DeFi lending market.

2. Part of the additional issuance of 3 million is used for the construction of security pools, incentives for lending ecology, protocol voting governance, and protocol upgrades.

3. AAVE's security pool model: AAVE will have a security pool that accepts AAVE and 80% AAVE/20% ETH for pledge. Once a risk occurs, the pledge pledged in the pool will bear the risk.

5. AAVE's voting protocol governance: Voting governance is more about preparing for the transition to DAO. After MKR, KNC and SNX, AAVE will also run wildly on the road of community governance, which can be well exempted from legal constraints.

secondary title

AAVE V2 version is coming:Yield & Collateral Exchange:

In DeFi, assets used as collateral are always tied up. But now with V2, collateral can be freely traded. Even if these assets are used as collateral, users can use the functions supported by Aave to trade collateral for other cryptocurrency assets. Collateral swaps can be used as a tool to avoid liquidation.Flash loan update:

Flash loans, a loan option without sufficient collateral, have affected the entire DeFi space, resulting in many innovative tools and "financial Lego". In the future, flash loans will also stimulate more creativity and allow Aave to have more possibilities.Collateral Repayment:

Prior to V2, if a user wanted to use part of the collateral to repay a loan, they would first withdraw the collateral, use it to purchase the borrowed asset, then repay the debt and unlock the deposited collateral. This requires at least 4 transactions on multiple protocols, not only costing time and money, but the user experience is also not smooth.

Flash liquidation: With Aave V2, liquidators can use flash loans to quickly borrow funds from the Aave protocol itself to execute liquidations.Users who have recently used Ethereum have noticed network congestion and high transaction gas fees. To help reduce these gas costs, Aave V2 introduces gas optimization schemes that in some cases reduce protocol transaction costs by up to 50%!

first level title

5. Competitive product analysis

Lending products can be analyzed from the perspectives of locked asset size, capital utilization efficiency, interest rate model, liquidation model, security performance, and asset claims.

AAVE Total Borrowing

COMP Total Borrowing

Changes in the lock-up amount of COMP

Changes in AAVE's total lock-up volume

secondary title

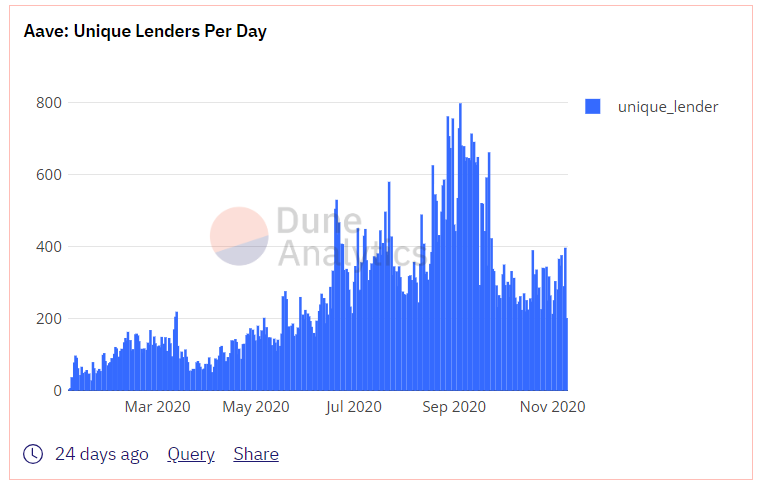

From the perspective of locked positions, AAVE is 1.74 billion US dollars, COMP is 1.59 billion US dollars, and the total loan data is AAVE 380 million US dollars, and COMP is 1.72 billion US dollars. And because COMP took the lead in launching liquidity mining, it has accumulated a certain amount of exploration experience, which also allows the rising star AAVE to quickly occupy part of the market as a newcomer.

secondary title

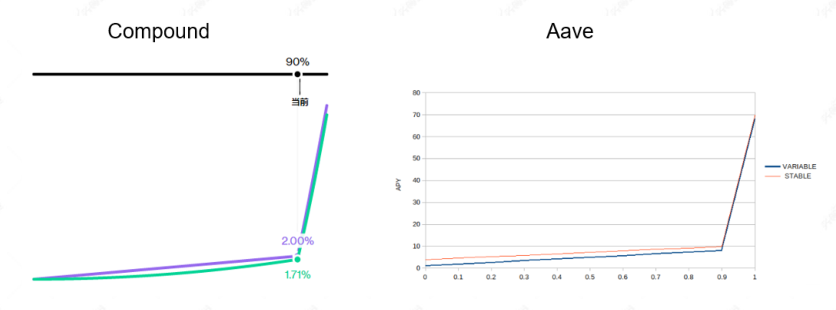

It can be seen from the figure that as the fund utilization rate reaches 90%, the loan interest rate will also rise sharply; Compound will charge part of the interest for each loan interest according to the reserve factor (reserve factor) as a reserve fund. The interest paid by borrowers in AAVE will flow directly into the lending pool and be allocated to depositor accounts in proportion. There is no concept of reserves in the current version of Aave.

secondary title

first level title

Summarize:

Summarize:

1. AAVE's rapid increase in market size is due to absolute integration, through the integration of My Ether Wallet, DeFi Saver, Idle Finance, Zerion, Trustwallet and more other applications. This helps drive adoption of the Aave protocol. High-quality integrations put the protocol in the hands of more users, which in turn attracts more deposits.

2. In the peer-to-peer unsecured credit model, it is also in a relatively leading position, and is currently preparing to provide peer-to-peer loans without formal mortgage requirements. The feature relies on agreements among peers that allow borrowers to freely use the lender's line of credit.

3. The Compound protocol was launched in 2018. It has gone through a long period of exploration, and the development of its asset scale has been relatively slow. It has remained at around 120 million for a long time. Aave is following the steps of its predecessors, reducing the chance of trial and error, and developing more For swift and aggressive.