first level title

1. Uniswap was born

On November 2, 2018, with restlessness, Uniswap founder Hayden Adams tweeted the news that Uniswap was officially launched. At that time, his Twitter had only 200 fans.

Before Uniswap, there were still multiple challengers in DEX, such as DDEX, 0x, and Loopring, but they were all order-thin product models. The extremely poor trading depth leads to a bad experience. Only Uniswap’s original AMM market maker has subverted the industry in one fell swoop. It turns out that DEX’s on-chain contracts can still play like this.

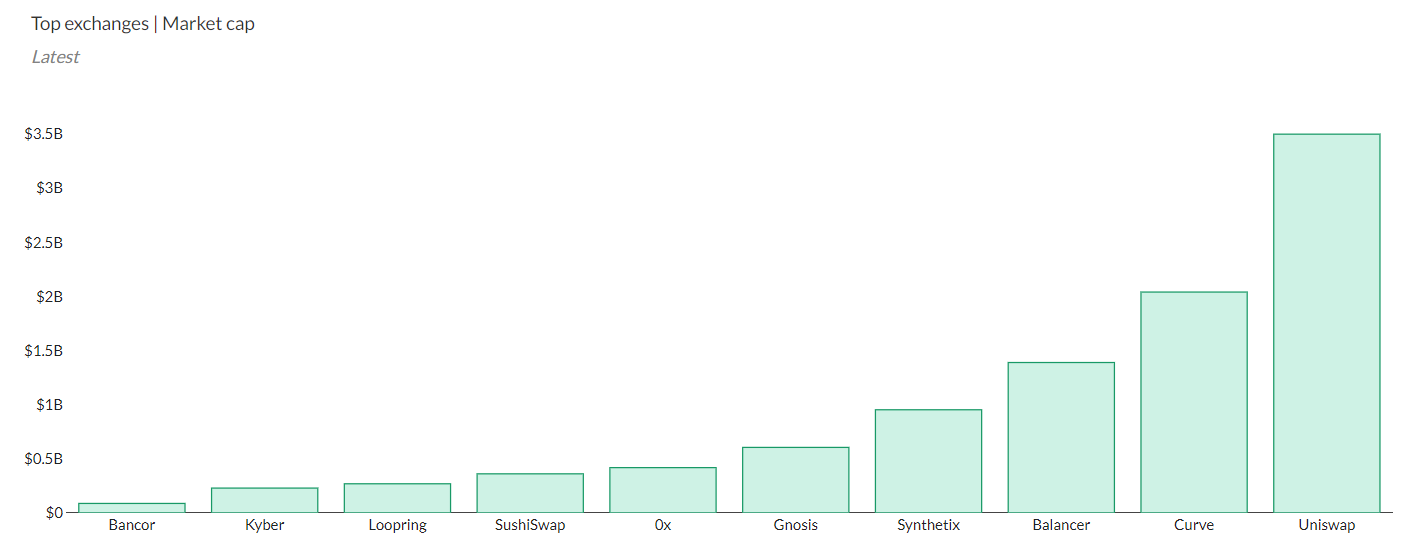

Uniswap Liquidity Growth

Uniswap market share

first level title

2. Token economic model and distribution plan

Distribution of UNI automatically decentralizes ownership to its users. Not investors or founding teams.

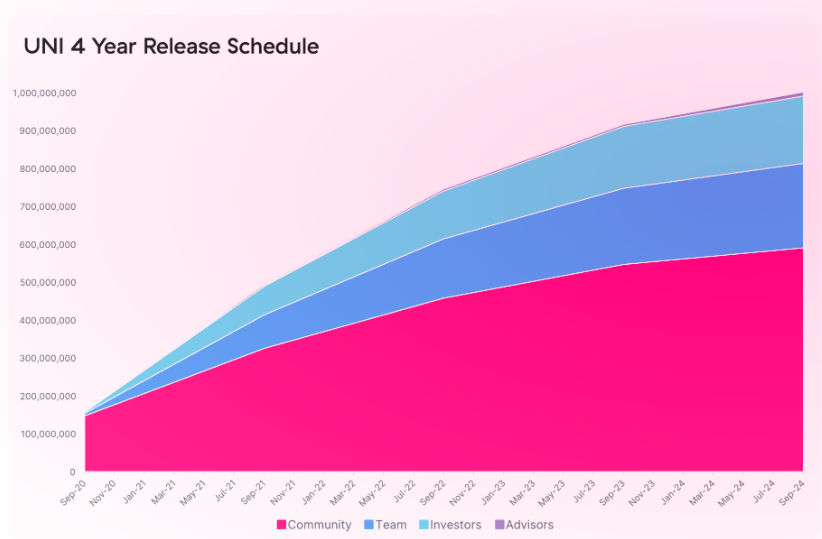

1 billion UNI has been issued on Genesis and will be earned within four years. The initial allocation for the first four years is as follows:

60% to Uniswap community members -- -- 600,000,000 UNI(UNI)

21.5% to team members and future employees, released linearly over 4 years - 215,101,000 UNI

17.8% to investors, 4-year linear release--178,000,000 UNI

0.07% to advisors, released linearly over 4 years - 6,899,000 UNI

At the time of launch, 15% of the tokens were received by accounts that had traded on the Uniswap platform before September 1. When many community members claimed their UNI tokens, Ethereum’s Gas fee soared sharply, making Ethereum congested and once again Almost unusable.

After the 4-year linear release, there will be a permanent inflation rate of 2%, which is to ensure the community's continued participation and contribution to uniswap.

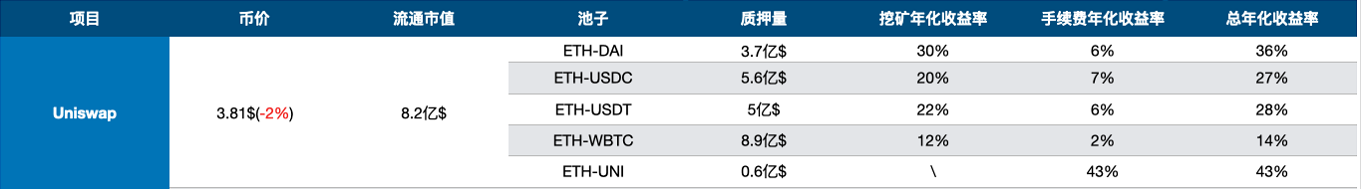

At present, UNI is basically just a governance token, and the handling fee is not distributed to the UNI token, which means that the UNI token does not capture the value of the platform’s handling fee.

UNI four-year release plan

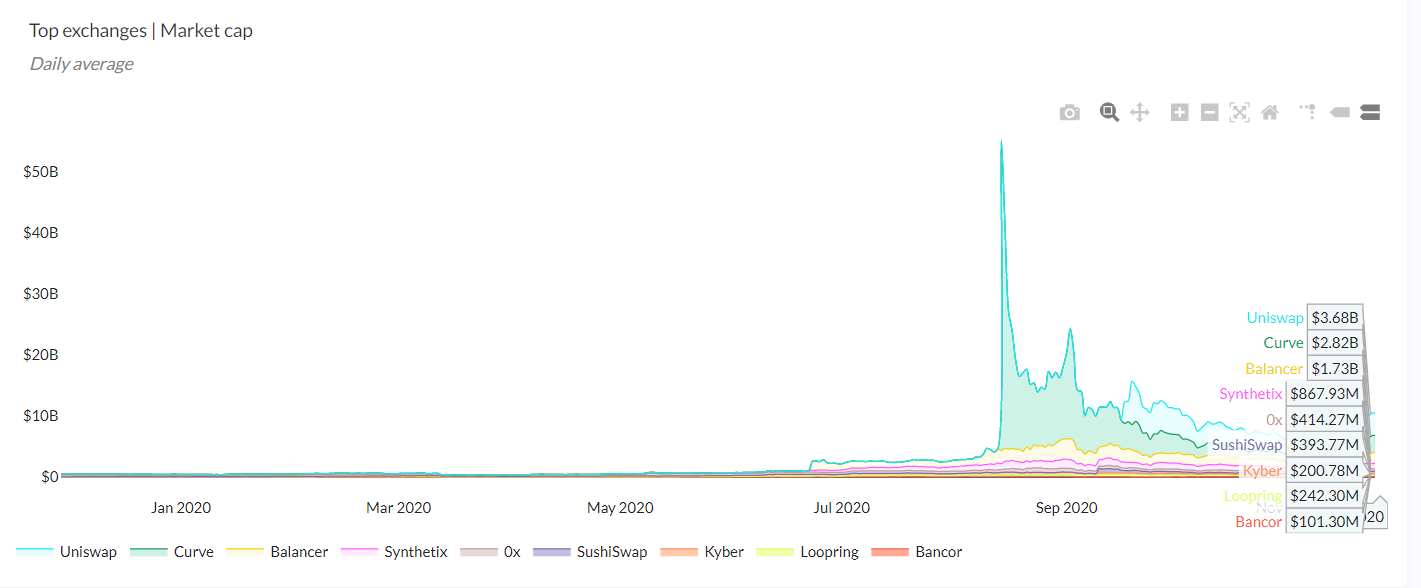

Uniswap market share changes

3. The value and risks of UNI

advantage:

advantage:

1. UNI belongs to the underlying assets of the cryptocurrency world.

2. High efficiency and low cost. The Uniswap team has less than 20 people, and the human efficiency is ahead of the industry, and there is a lot of room for thinking.

3. Holders of the platform currency have no say in the development of the token economy, while UNI holders can participate in governance.

Hidden dangers:

1. There is no threshold for Uniswap token issuance, and only ERC-20 tokens can be traded. Whether the token quality and ecological ceiling will limit the development of Uniswap exchange.

2. The mainstream pricing power is still in the hands of centralized exchanges. Uniswap adopts AMM (Automatic Market Maker System). AMM can only generate transaction prices and cannot discover market prices.

3. Occasionally high transaction fees and congested transaction experience. Transactions on Uniswap need to pay gas fees. This part of the fee is outflowed and captured by Ethereum miners. Platform currency transactions basically do not require additional gas, a closed transaction system.

4. Governance issues are questionable. How to mobilize the governance enthusiasm of small and medium-sized currency holders and enhance the consensus of the platform.

5. UNI is an inflation currency. After 4 years, the annual inflation rate of UNI will be maintained at about 2%, while the platform currency will continue to deflate due to repurchase and destruction.

6. Insufficient incentives for UNI holders. At present, it is only a governance token and does not include dividends.

Moreover, in terms of the core mechanism of the platform, AMM is not a perfect solution in the strict sense after all, such as low capital utilization, additional risk exposure, and impermanent losses that are criticized.

first level title

4. Summary:

This research institution will pay attention to the subsequent development of uniswap from the following perspectives, including but not limited to.

secondary title

At present, an optimized version of the market-making mechanism has appeared. In the long run, the impact of the optimized mechanism system on AMM is still unknown. Uniswap can continue to operate as it is for the time being without feeling any obvious threat.

secondary title

DeFi is not only limited to liquidity mining. Businesses such as lending, insurance, funds, and stable coins can all be migrated on the chain. In the absence of obvious barriers, unicorns that have mastered traffic and funds still have to develop or acquire product lines It is worth paying attention to how uniswap builds its group matrix in the future.

secondary title

Whether tokens are considered for dividends should balance the interests of token holders and liquidity providers.

secondary title

Bitrise Capital (Bitrise Capital) is a venture capital institution focusing on the blockchain field. Its main investment direction is digital currency and mining. Bitrise Capital (Bitrise Capital) has invested in more than 60 projects.

Bitrise Capital (Bitrise Capital) is a venture capital institution focusing on the blockchain field. Its main investment direction is digital currency and mining. Bitrise Capital (Bitrise Capital) has invested in more than 60 projects.

In August 2020, Bitrise Capital (Bitrise Capital) announced that it will establish a special fund of 10 million US dollars, focusing on investing in Defi and other innovative track projects, including but not limited to Defi, IPFS/Fil, Polkadot Ecology and other popular fields, to promote blockchain The healthy development of chain ecology.

In August 2020, Bitrise Capital (Bitrise Capital) announced that it will establish a special fund of 10 million US dollars, focusing on investing in Defi and other innovative track projects, including but not limited to Defi, IPFS/Fil, Polkadot Ecology and other popular fields, to promote blockchain The healthy development of chain ecology.