first level title

Introduction to NFT

If cryptocurrencies such as Bitcoin and Ethereum are more used as currencies and tokens for transaction purposes, then NFT is more like the concept corresponding to items in the real world.

first level title

The field of NFT artwork and collections dates back to 2017. During this time, projects like CryptoPunks paved the way for "rare" artwork on the Ethereum blockchain, and then there was the CryptoKitties game. Currently, NFTs account for more than 14% of total Ethereum network usage.

according toNonFungible.comAccording to statistics, as of now, there have been 4.98 million transactions in the NFT market, with a transaction volume of approximately US$134.9 million. In just one month, there were 88,700 transactions, which equates to a volume of $8.42 million.

first level title

NFT overall data

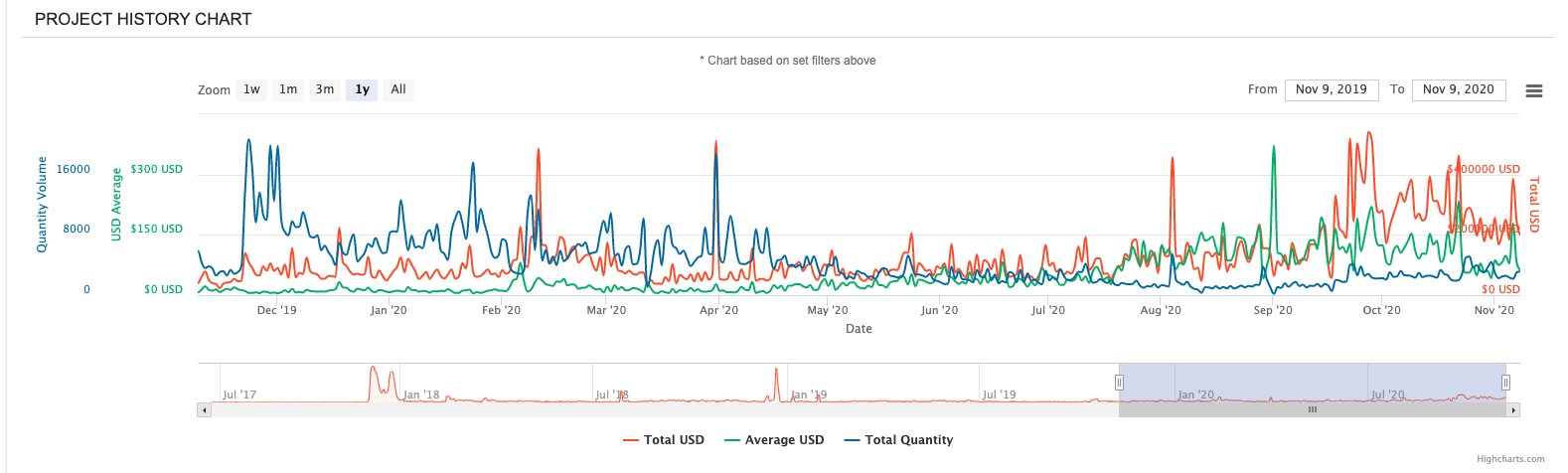

Changes in total market transaction volume and average transaction price

During the cooling period of DeFi, the NFT market led by MEME has risen rapidly. The total daily transaction volume has been rising since September 17, and reached the highest point of the year at 540,000 US dollars on the 27th. Recently, the daily transaction volume has remained at around 300,000 US dollars. The average transaction price is around $100;

In September 2020, the trading volume of the NFT market successfully exceeded 7 million US dollars, a surge of more than ten times within the month; in October, the trading volume exceeded 8 million US dollars, and the rising trend continued; as of October 17, 2020, the total transaction volume of the NFT market has exceeded $136 million, 5 million NFTs were sold, with an average price of about $27.3. The overall transaction data has shown a significant growth trend in recent months. Not only that, the NFT auction unit price also set a new record this month. On October 8, the 21st work (Block 21) of the blockchain artwork "Portraits of a Mind" series was successfully sold at Christie's in New York for over US$130,000. It was revealed that the transaction amount was more than six times higher than the initial estimate.

Recent data: From the available data, the NFT trading market has shown large-scale growth in terms of transaction amount and number of transaction users.

In October, the number of traders in the NFT market rose sharply by 87%, among which the ARPU growth rate of the game and art sectors was the highest.

1. Compared with September, the total number of transactions in October increased by 87%. Largest contributors were OpenSea and Rarible; accounting for 76% of growth

2. In October, the trading volume of NFT reached 13 million US dollars.

3. The trading volume of OpenSea ranks first.

5. Axie Marketplace saw steady growth in both the number of traders and trading volume in October, ranking third.

first level title

Industry track

SANDBOX, AXIE, SUPERRARE, SORARE, DECENTRALAND, whether from the perspective of development history or the recent Volume, are all star projects in the NFT field.

first level title

NFT standards and application fields

Different blockchains have their own NFT standards:

On Ethereum, common NFT standards are ERC721 and ERC1155 protocols

On the WAX blockchain, the SimpleAssets and AtomicAssets protocols are common.

Still, the race between the agreements is far from a winner.

Decentralized domain names: ENS, Unstoppable DomainsGateway、KnownOrigin、WAX

DeFi+NFT:yInsure、NFTfi、NIFTEX、Aavegotchi、MEME、Dego、Whale、CryptoWine

NFT trading markets: Opensea, Rarible, MakersPlace, Mintbase, SuperRare, Dmarket, Nifty

Games: CryptoKitties, Gods Unchained, MyCryptoHeroes, Sorare, Axie Infinity

Virtual worlds: Decentraland, Sandbox, Cryptovoxels, Somnium Space

Collectibles: Urbit, CryptoPunks, Unisocks

NFT token layout of traditional digital currency exchanges: The current leading NFT token projects are ENJ and MANA, which are significantly ahead of other projects in terms of market value, trading volume, listing situation, project ecology, and community building; at the same time, DEFO, RARI, DEP, SAND, and FFF are all new projects in 2020, with great potential; overall, NFT token holders will basically get higher returns in 2020, with an average increase of about 300%; SAND among NFT tokens in 2020 The highest increase, an increase of more than 650%.

first level title

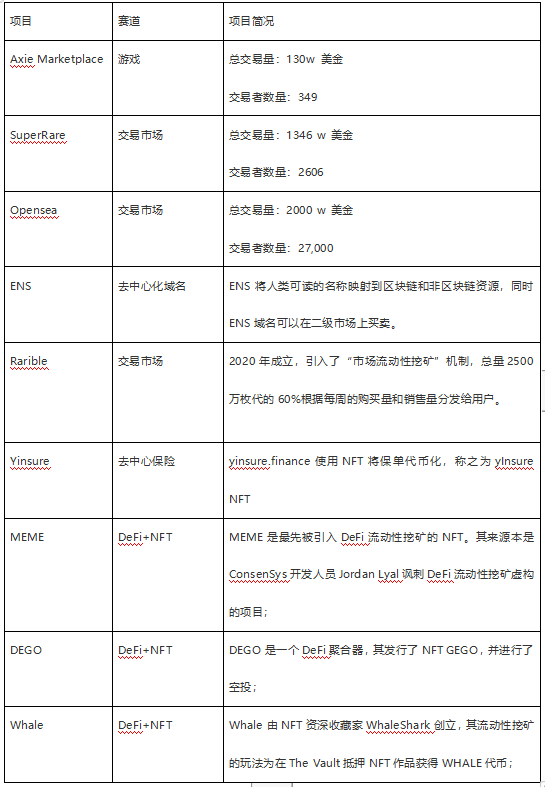

Axie Marketplace

NFT project example

The Axie Infinity game has its own internal trading market called Axie Marketplace, where players can buy, sell, auction and other operations on game assets.

Axie Infinity is expected to release its governance token, Axie Infinity Shards (AXS), in early November, before we dive into the current growth. The token may also impact metrics on the Axie Marketplace in the near future.

Compared to September, October saw a 54% increase in transaction volume and a 41% increase in the number of traders. Axie Infinity proves that gaming NFTs are also gaining traction.

secondary title

The total number of users is 2,606, the average daily user is about 150, the total transaction volume is 13.46 million US dollars, and the average daily transaction volume is about 110,000 US dollars;

Opensea

secondary title

The total number of users is 27,000, and the average daily user is about 400; the total transaction volume exceeds 20 million US dollars, and the average daily transaction volume is about 800,000 US dollars; it is currently the largest NFT trading platform

ENS

secondary title

ENS is the most famous decentralized domain name service platform. ENS maps human-readable names to blockchain and non-blockchain resources such as Ethereum addresses, IPFS hashes, or website URLs. ENS domain names can be bought and sold on the secondary market. Unstoppable Domains allows users to replace cryptocurrency addresses with human-readable addresses that are censorship-resistant.

Rarible

Rarible is another popular NFT trading platform, which was only established in 2020, but its innovation is that it released the governance token RARI on July 15, allowing the most active creators and collectors on Rarible to vote for any platform upgrade , and participate in management and auditing. In addition, in order to attract users, Rarible has also introduced a "market liquidity mining" mechanism, and 60% of the total 25 million tokens are distributed to users based on weekly purchases and sales.

Yinsure

yinsure.finance is YFI's decentralized insurance project. yinsure.finance uses NFT to tokenize insurance policies, calling it yInsure NFT. In addition to being held by yourself, NFT policies can also be traded in the NFT market or participate in mining.

MEME

MEME is the first NFT introduced into DeFi liquidity mining. Its source was ConsenSys developer Jordan Lyal's satirical DeFi liquidity mining fictitious project. A few hours later, the MEME token was created instead and airdropped for free. The gameplay is to pledge MEME to get pineapple points, and the points can be exchanged for limited edition NFT collection cards, all drawn by famous encryption artists. The price of NFT varies according to the rarity level. For example, the NFT card of YFI founder Andre Cronje is priced at 48ETH.

DEGO

DEGO is a DeFi aggregator. It issued NFT GEGO and conducted an airdrop. Users can receive V1-V6 quality GEGO after completing the tasks as required. DEGO also launched NFT mining. Users can obtain NFT collection GEGO by pledging DEGO, and can participate in mining, dividends and governance.

Whale

Whale was founded by WhaleShark, a veteran NFT collector. Its liquidity mining method is to mortgage NFT works in The Vault to obtain WHALE tokens, so WHALE has the value of NFT works as support. WHALE holders have privileges such as buying or renting NFT works in The Vault.

first level title

NFT Industry Outlook

Bitrise Capital (Bitrise Capital) is a venture capital institution focusing on the blockchain field. Its main investment direction is digital currency and mining. Bitrise Capital (Bitrise Capital) has invested in more than 60 projects.

Bitrise Capital (Bitrise Capital) is a venture capital institution focusing on the blockchain field. Its main investment direction is digital currency and mining. Bitrise Capital (Bitrise Capital) has invested in more than 60 projects.

In August 2020, Bitrise Capital (Bitrise Capital) announced that it will establish a special fund of 10 million US dollars, focusing on investing in Defi and other innovative track projects, including but not limited to Defi, IPFS/Fil, Polkadot Ecology and other popular fields, to promote blockchain The healthy development of chain ecology.

In August 2020, Bitrise Capital (Bitrise Capital) announced that it will establish a special fund of 10 million US dollars, focusing on investing in Defi and other innovative track projects, including but not limited to Defi, IPFS/Fil, Polkadot Ecology and other popular fields, to promote blockchain The healthy development of chain ecology.