During the week of October 26-November 1, the events worthy of attention in the progress of star projects include: Harvest Finance was hacked, and the total amount stolen was about 34 million U.S. dollars; Polkadot officially joined the BSN open alliance chain; Uniswap No. 2 The governance proposal has not yet been passed; the public chain project Conflux has officially launched its mainnet.

Star Project Progress

The following are specific project progress and financing events:

Star Project Progress

Harvest Finance Hacked, Total Stolen About $34 Million

Harvest Finance was recently hacked due to a vulnerability, and the total amount stolen was about $34 million. The Harvest Finance team promised to fix the bug and asked the attackers to return the funds.

According to previous news, Harvest will take the following measures and compensation plans:

1. The funds returned by the attacker will be returned to the user in proportion to the snapshot. At present, the attacker has returned more than 2.47 million US dollars in the form of USDT and USDC;

2. In the future, a commit-reveal mechanism may be adopted for deposits to eliminate the behavior of performing deposits and withdrawals in a single transaction, thereby reducing flash loan attacks;

3. Consider using oracles to determine asset prices. (Decrypt)

Polkadot officially joined the BSN open alliance chain

Polkadot joins the BSN open consortium chain. After technical adaptation, the Polkadot blockchain will serve as one of the underlying frameworks of the BSN open consortium chain, providing Chinese companies and developers with compliant, low-cost, and easy-to-develop blockchain applications operating environment.

Gavin Wood: Parachain 1.0 code may be launched in two weeks

On October 26, at the Web3.0 training camp project Demo Day jointly sponsored by the Web3 Foundation and Wanxiang Blockchain, Polkadot founder Gavin Wood revealed that the team is stepping up the development of the parachain and hopes that the parachain 1.0 code Able to go live in two weeks. At the same time, he also expressed the hope that the Rococo testnet based on this code can be released soon.

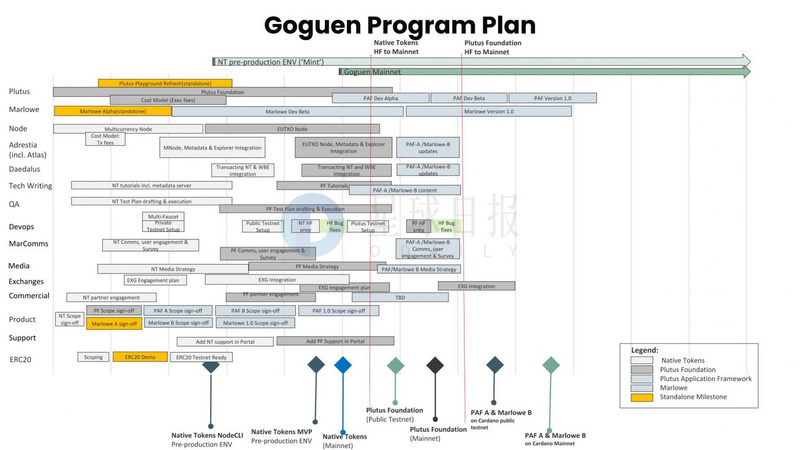

Cardano Releases Goguen Roadmap and Demonstrates ERC-20 Converter

Cardano has released the Goguen roadmap, and most components are scheduled to be delivered by the end of February 2021. With the launch of Goguen, Cardano is becoming a smart contract platform. Deployment of transaction metadata on Cardano will be early commercialized through the Atala product suite, including the Atala Prism, Atala Trace and Atala Scan solutions. Additionally, a live demo of an ERC-20 converter was conducted, which will allow projects and tokens on Ethereum to be ported to Cardano.

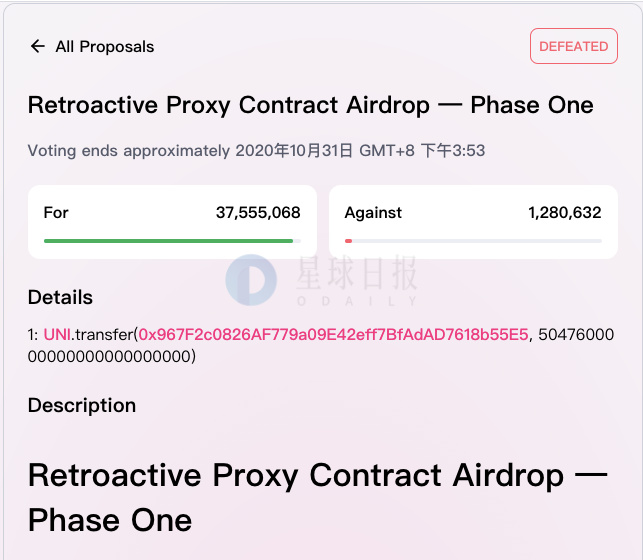

Uniswap Governance Proposal No. 2 Still Not Passed

The Uniswap Community Governance Proposal No. 2 initiated by Dharma was not passed. The final vote was 37,555,068 in favor and 1,280,632 against.

As the initiator of this and the first community vote, Dharma stated that it will no longer initiate airdrop-related proposals. If the proposal is passed, Dharma will promise to allow Dharma users to entrust the platform or directly use their UNI to vote. Collaborate with other community members to participate in improving the Uniswap Improvement Proposal (UIP).

As the initiator of this and the first community vote, Dharma stated that it will no longer initiate airdrop-related proposals. If the proposal is passed, Dharma will promise to allow Dharma users to entrust the platform or directly use their UNI to vote. Collaborate with other community members to participate in improving the Uniswap Improvement Proposal (UIP).

The Blockchain Service Network (BSN) has completed the quarterly version iterations of the official website of BSN China and the official website of BSN International on October 31, improving existing functions, adding new functions and repairing some bugs.

JustLink, TRON's first official oracle project, has officially launched

According to official news, the JUST Foundation officially launched the decentralized oracle project JustLink on October 30. JustLink is the first decentralized oracle project running on the TRON network. Its role is to provide the smart contracts on the chain with real data generated in the real world in the safest way, including loan prices and stable currency exchange rates. , financial derivatives prices, forecast market data, etc.

SBI Holdings CEO Confirms Ripple May Move to Japan

Yoshitaka Kitao, CEO of Japanese financial giant SBI Holdings and member of Ripple's board of directors, confirmed at a quarterly financial briefing on the 28th that Ripple is considering "taking Japan as one of its headquarters."

MakerDAO Warns of Manipulating Governance Votes Using Flash Loans

MakerDAO issued a warning about DeFi protocol teams using flash loans to manipulate governance votes. Specifically, the team at B Protocol wanted to be whitelisted for access to MakerDAO’s price oracles. So they submitted their proposal for approval on October 23. Three days later, multiple transactions were created and processed. The first is to borrow ETH, which is then used as collateral to borrow $7 million worth of MKR. Newly borrowed MKR is used for voting and then returned to the market where it was lent. MakerDAO said the incident provided an example to the community that flash loans could impact system governance, emphasizing the need to actively monitor MKR market liquidity.

yearn.finance discloses flash loan security loopholes, funds are currently safe

yearn.finance (YFI) disclosed a new flash loan security vulnerability, which was reported by security researcher Wen-Ding Li through Yearn’s security vulnerability disclosure process on October 29, and the team mitigated the potential vulnerability after 1.5 hours. According to the disclosure, through this vulnerability, a flash loan attack could pose a security risk to TUSD Vault funds; it was not exploited. TUSD Vault is configured to stop deploying funds to spend its policies when the issue is investigated and fixed. Funds are currently safe and users do not need to take any action.

Conflux Tethys, the final stage of the mainnet of the public chain project Conflux, is now online, and the genesis block has been dug out. Currently, the Conflux Scan blockchain explorer is undergoing final testing and updating.

Aave Hands Over Management Keys to Community of AAVE Token Holders

Aave announced the transfer of administrative keys for its protocol to a governance contract controlled by AAVE token holders, shifting power from original developers to the Aave community, allowing decentralized governance voting to directly control protocol changes. (Decrypt)

ETC Labs builds Polkadot-based ETC Bridge

News On October 30, at the Web3 Conference hosted by the Web3 Foundation, ETC Labs announced that it is developing a Polkadot-based ETC Bridge. ETC Bridge will enable cross-chain circulation of ETC assets and Polkadot assets, and even communicate with other Polkadot ecological blockchains in the form of bridge chains as parallel chains in the future.

Aragon releases preview version of new DAO framework "Aragon Governance" for developers

DAO solution provider Aragon released a preview version of the new DAO framework "Aragon Governance" for developers, and it has been activated on the mainnet. Aragon said that "Aragon Governance" is a solution for off-chain polling and on-chain execution, that is, off-chain voting through Snapshot and on-chain voting using Aragon Court, etc., only needs 500 lines of code, which is smaller than aragonOS One order of magnitude. Aragon Governance works with TheGraph and will soon be integrated with Aragon Connect. Aragon reminded that this version is only a developer preview version and has not yet been reviewed, and a stable version will be released as soon as possible.

BM: EOS can be integrated into a parallel chain

Investment and financing overview

Investment and financing overview

Encrypted venture capital firm Galaxy Digital announced that it has received $50 million in private equity (PIPE) financing, led by Slate Path Capital LP, with participation from CI Investments, NZ Funds and Corriente Advisors. According to practice, this round of PIPE financing is expected to close in November 2020. The company intends to use the new funds for general corporate and working capital purposes across its line of business, with a particular focus on expanding its client financing business and launching new asset management-related products. (Newswire)

Digital Currency Startup Bitt Receives $8 Million Investment from Medici Ventures

Medici Ventures, a wholly-owned subsidiary of Overstock, announced the acquisition of an equity stake in Barbados digital currency startup Bitt for $8 million. This latest investment gives Medici a controlling stake in the company.

Medici Ventures first bought a $4 million stake in Bitt in early 2016 and another $3 million stake in 2018. Strategically, Medici Ventures appears to be planning to expand its ability to influence digital currency adoption with this investment. (Forbes)

Figment Networks Raises $2.5M in Series A Funding Led by Bonfire Ventures

Crypto infrastructure provider Figment Networks has announced a $2.5 million Series A round of funding. The round was led by Bonfire Ventures, with participation from FJ Labs, XDL Capital Group, Leminiscap, BKCM, and angel investor Stephan Patnernot.

Nansen Closes $1.2M Seed Funding Round Led by Mechanism Capital and Skyfall Ventures

Launched in April this year, Nansen is a subscription-based product currently focused on ethereum data. Svanevik said the company hopes to add support for the bitcoin blockchain and other ethereum Layer-2 networks within the next year. (The Block)

Launched in April this year, Nansen is a subscription-based product currently focused on ethereum data. Svanevik said the company hopes to add support for the bitcoin blockchain and other ethereum Layer-2 networks within the next year. (The Block)

Litentry, the first decentralized cross-chain identity protocol in the Polkadot ecosystem, completed a million-dollar seed round of equity financing. Participating investment institutions include FBG Capital, Candaq Group, Signum Capital, NGC Ventures, BlockVC, D1 Ventures, Altonomy, Hypersphere Ventures , PAKA Fund, Digital Renaissance Foundation, RockX and LD Capital, etc.

Notional Protocol Allowing Fixed-Rate Lending Raises $1.3M, Launches Beta on Ethereum

The Notional protocol launches beta today on Ethereum to bring fixed-rate lending to DeFi. The protocol allows users to borrow and lend cryptocurrencies at a fixed rate. The startup also announced Monday that it has raised $1.3 million from eight investors including Coinbase Ventures, 1confirmation and Polychain. (CoinDesk)

Stablecoin aggregator DefiDollar raises $1.2 million led by Divergence Ventures

Stablecoin aggregator DefiDollar announced the completion of a $1.2 million seed round of financing for the establishment of a strong stablecoin index, designed to act as a stablecoin aggregator and help users spread risk. The financing was led by Divergence Ventures, Standard Crypto, and Accomplice, with participation from CMS Holdings, DeFi Alliance, LedgerPrime, and Bollinger Investment Group.

Binance Smart Chain Announces Second Batch of Seed Funds

According to Binance’s official announcement, the Binance Smart Chain Ecological Acceleration Program has released the second batch of seed fund-winning projects: JustLiquidity, Gitcoin, Bounce, DefiStation, and Parsiq.

So far, Binance Smart Chain Seed Fund has supported 11 decentralized blockchain projects, and has received strong support from decentralized blockchain projects, developers, and community contributors. There are already more than 40 active DApps, blockchain infrastructure, and Binance Smart Chain auxiliary tools on Binance Smart Chain.

Personal Token Platform Roll Completes $1 Million Financing

Roll, a personal token platform based on social attributes, announced the completion of $1 million in financing. Investors include Fabric Ventures, IOSG, William Mougayar and other companies. The total amount of financing for the platform so far has reached $2.7 million. Launched in summer 2019, Roll allows people to create their own tokens and define token usage. According to the Roll team, the system has an average daily transaction volume of about $500,000 and has attracted 250 token creators so far. (CoinDesk)

DeFi Synthetic Asset Protocol Linear Finance Receives Strategic Investment from 3Commas

The DeFi synthetic asset protocol Linear Finance (LINA) announced that it has reached a strategic investment partnership with the encrypted asset management platform 3Commas, and will cooperate and integrate in the future. 3Commas' strategic investment in Linear Finance will be used for future integration of platforms and tools, simplification of operational processes, and enhancement of Linear Finance's functionality and product offerings. 3Commas can form a unique transaction solution for specific situations and apply it to the Linear platform. Its trading function solutions allow traders to maximize profits from sudden volatility in the cryptocurrency market.