first level title

1. Overview of the overall DeFi market

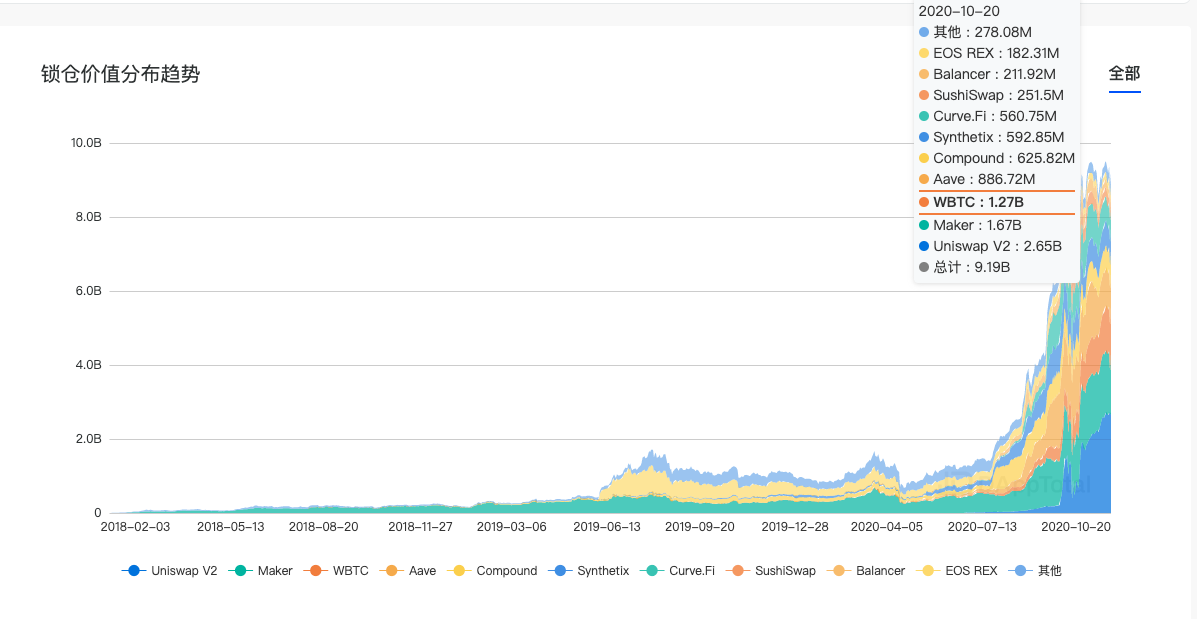

2018 is regarded as the first year of the development of the DeFi industry, but until 2019, the core indicator TVL has basically no major change trend. It was not until 2020 that the DeFi industry ushered in a huge explosion. The rise of the "mine" is indisputable.

secondary title

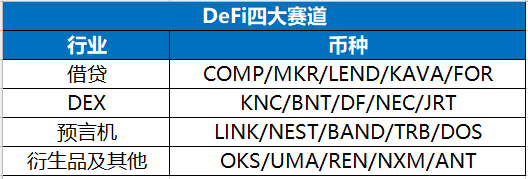

DeFi overall track

secondary title

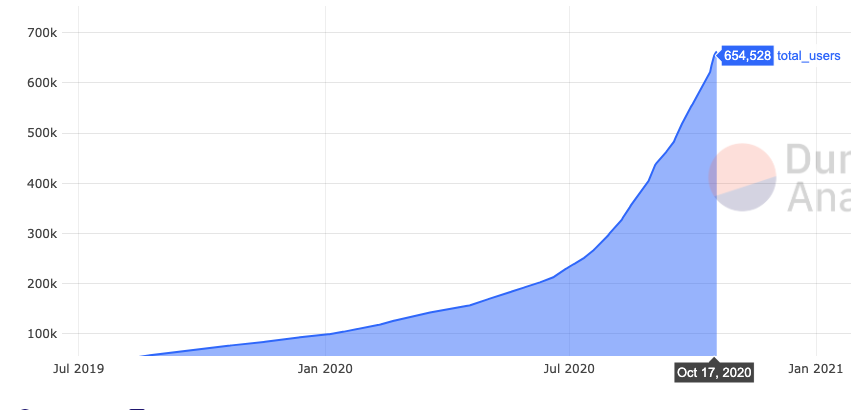

Number of participants in the DeFi market

secondary title

market performance

secondary title

Reason for innovation

The reason behind the rise of this wave of DeFi lies in the innovation of the automatic market maker AMM mechanism, which gave birth to liquidity mining, through which project tokens are allocated to bind the interests of early seed users. Thus detonating the entire DeFi industry.

secondary title

secondary title

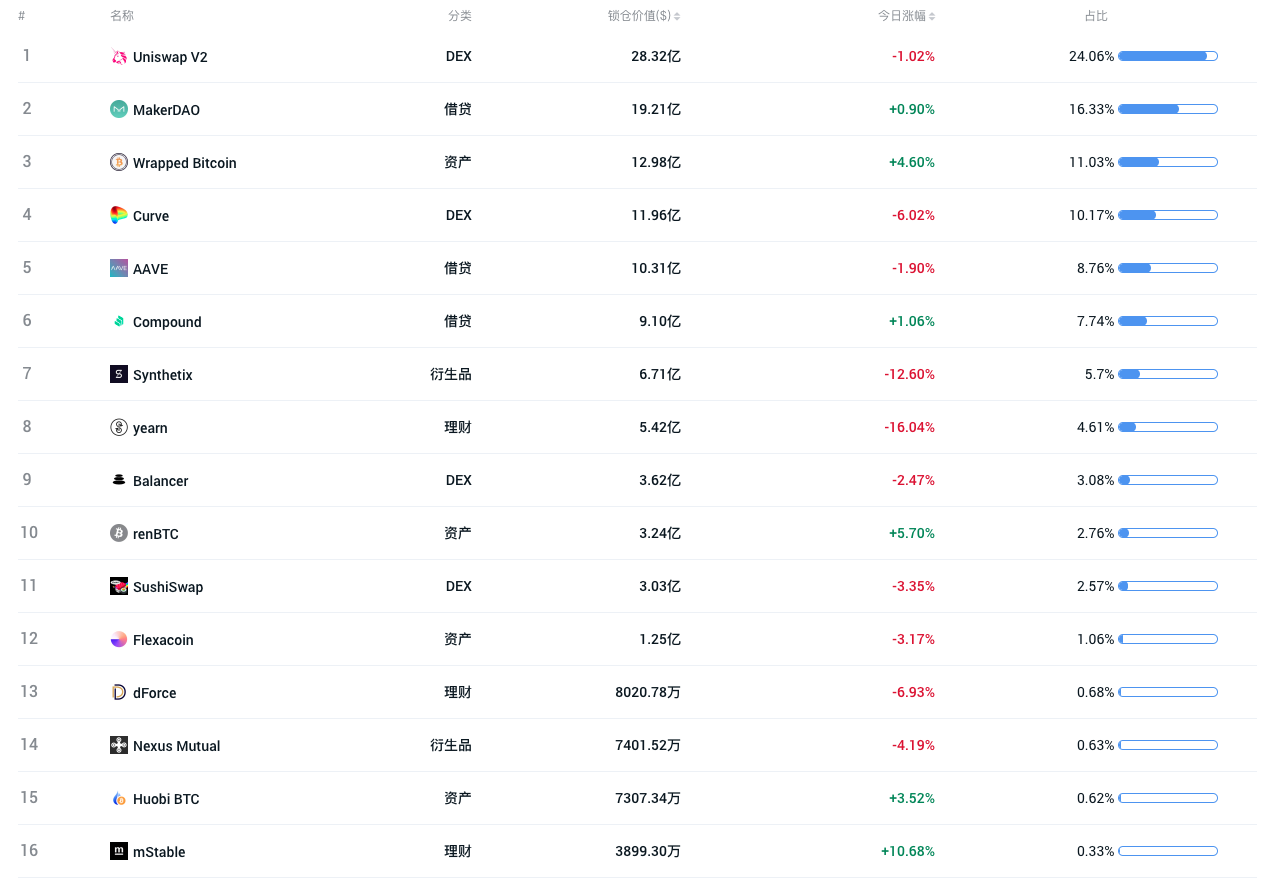

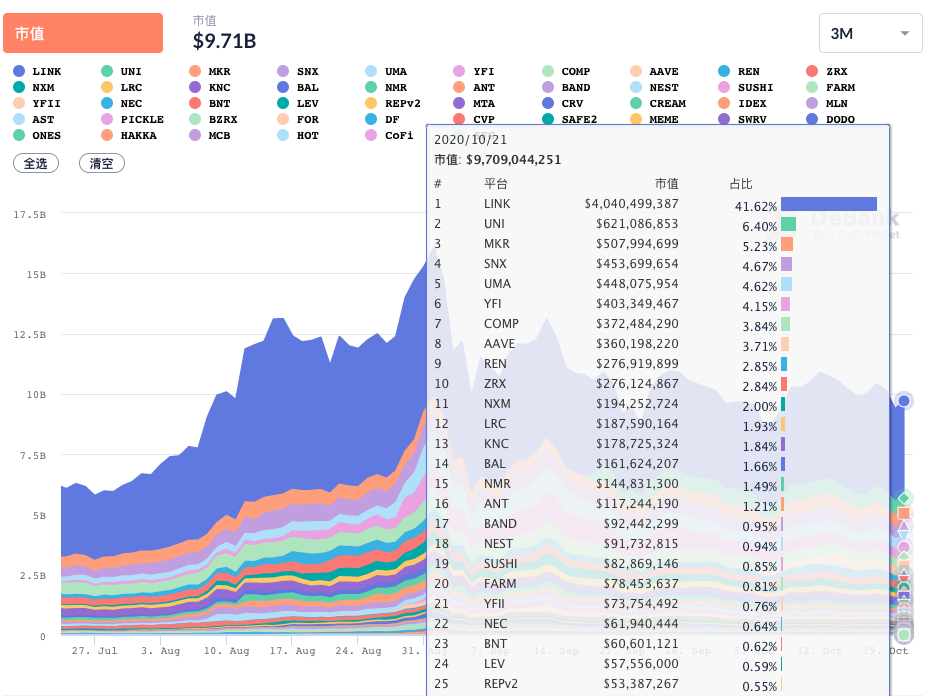

Top DeFi projects

secondary title

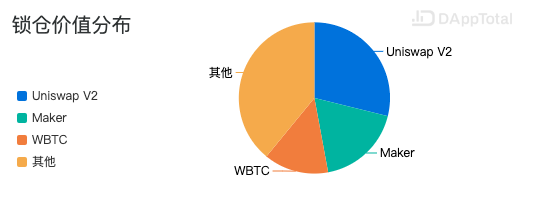

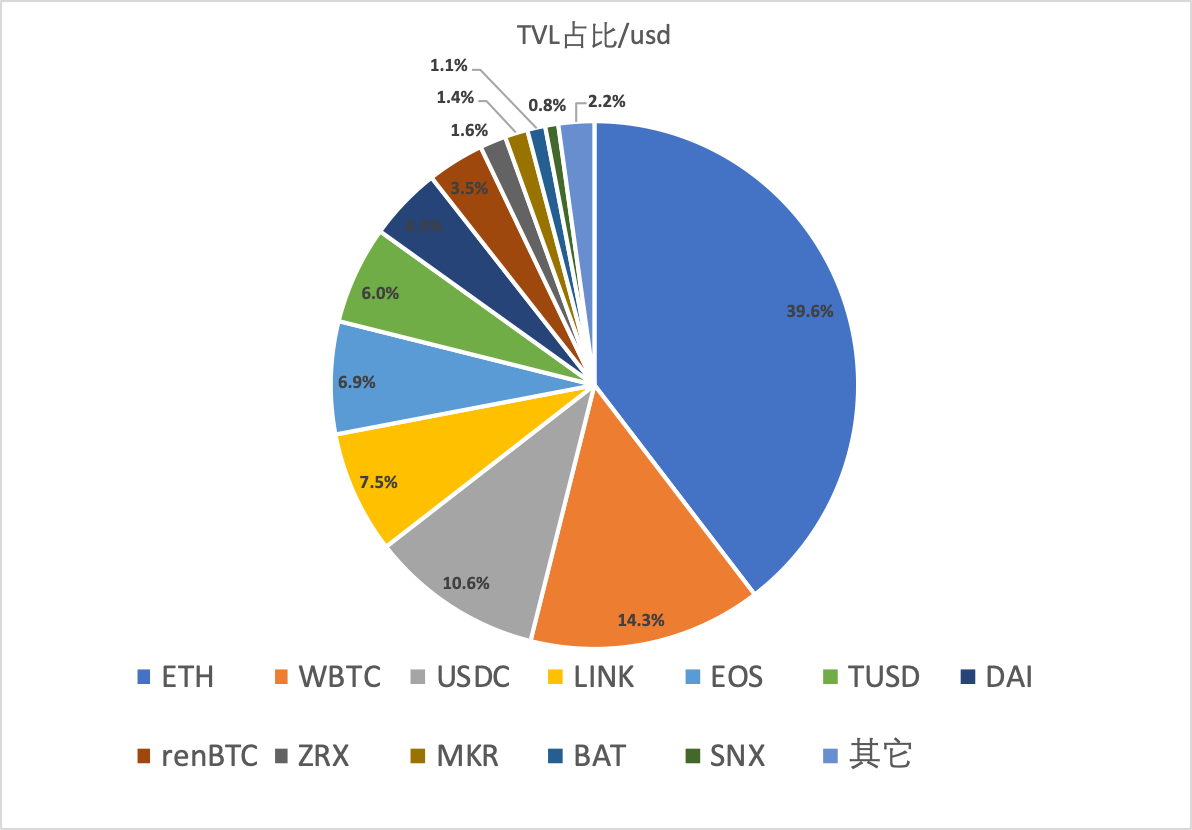

Distribution of locked assets

Currently locked assets mainly include: ETH, WBTC, USDC, LINK, EOS, TUSD, DAI, renBTC, ZRX, MKR, etc. ETH is currently the largest locked asset in the DeFi market, worth 3.6 billion US dollars, accounting for 39.6%; WBTC The lock-up value of the platform has also reached 1.3 billion US dollars, accounting for 14.3%; the rest of the assets also occupy a certain market share.

first level title

2. DEX market

A decentralized exchange (DEX) is a peer-to-peer free trading market. DEX before 2020 was basically an order thin market with poor liquidity and poor user experience. However, the automatic market maker algorithm launched around 2020 injected new soul into DEX, which had to attract the attention of centralized exchange giants .

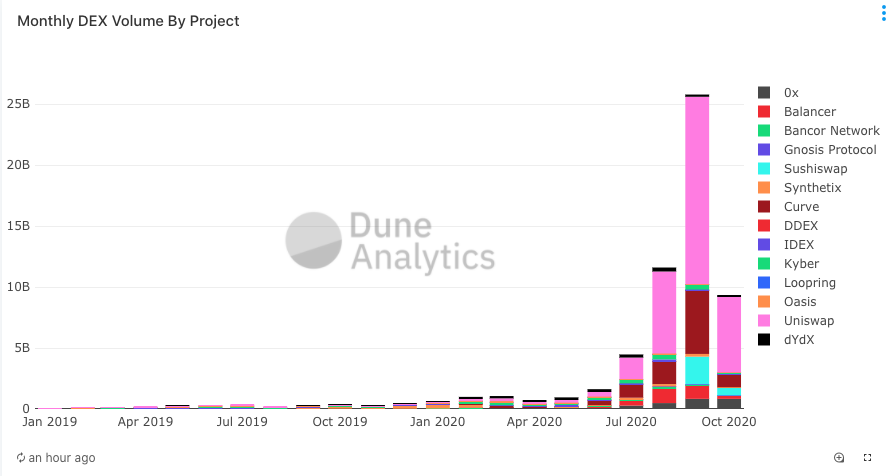

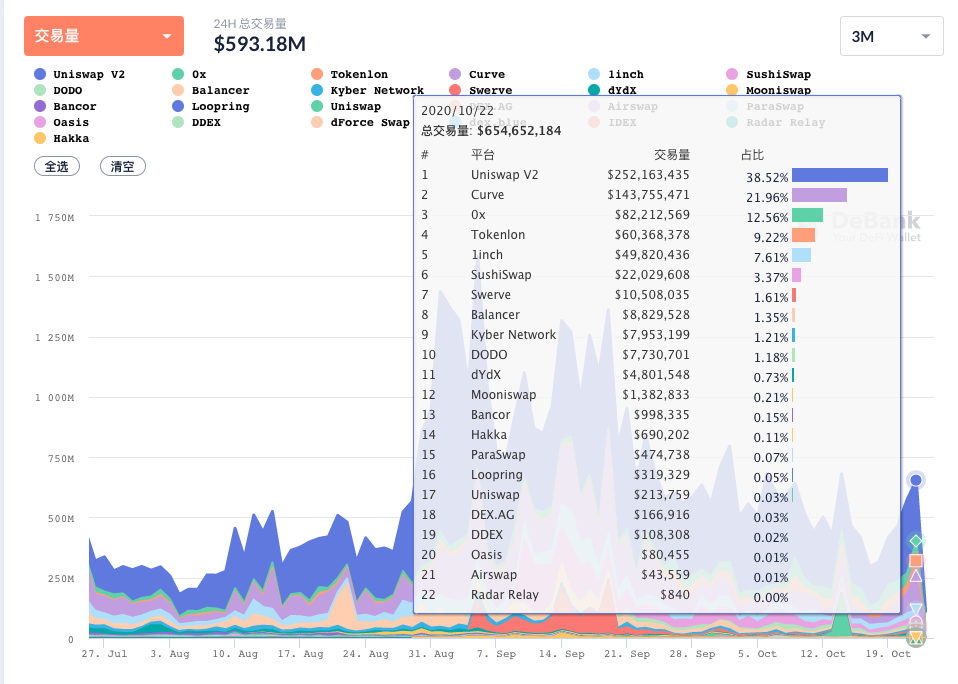

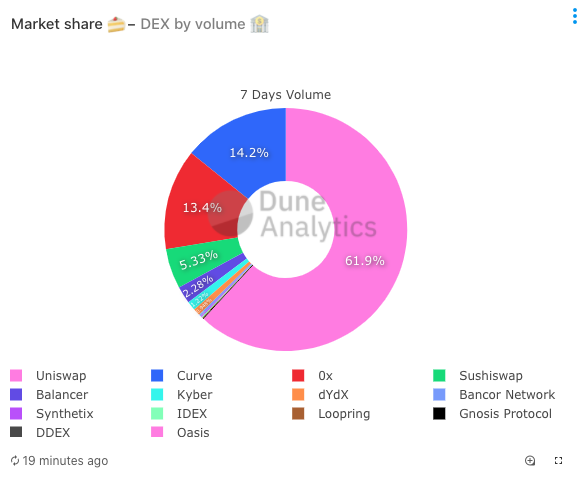

DEX industry trading volume

Since September, the monthly lock-up amount of DEX has doubled, of which Uniswap has the largest proportion.

On October 22, the total trading volume of DEX reached $650 million, of which Uniswap’s trading volume reached $250 million, accounting for

secondary title

secondary title

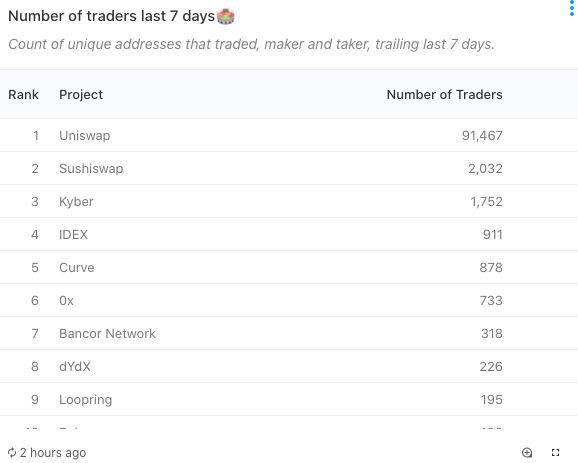

7-day active users

secondary title

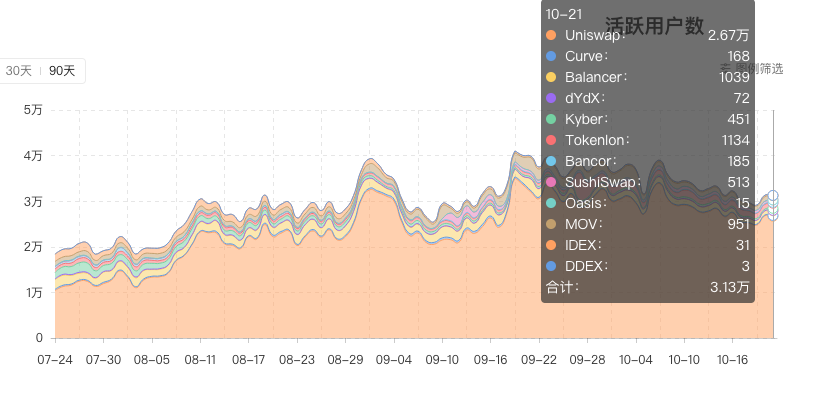

Change Trend of Average Daily Active Users

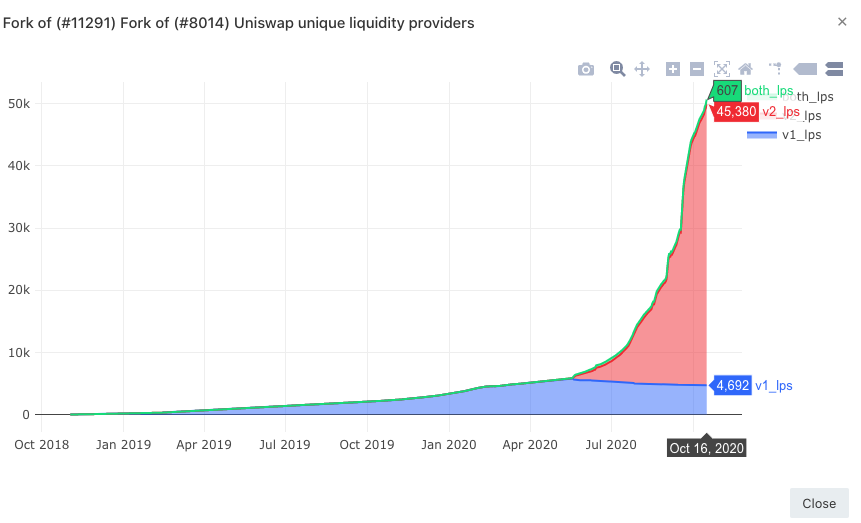

It can be basically seen from the chart that the trading users of Uniswap are far away from other DeFi products, and the user moat has obvious advantages.

secondary title

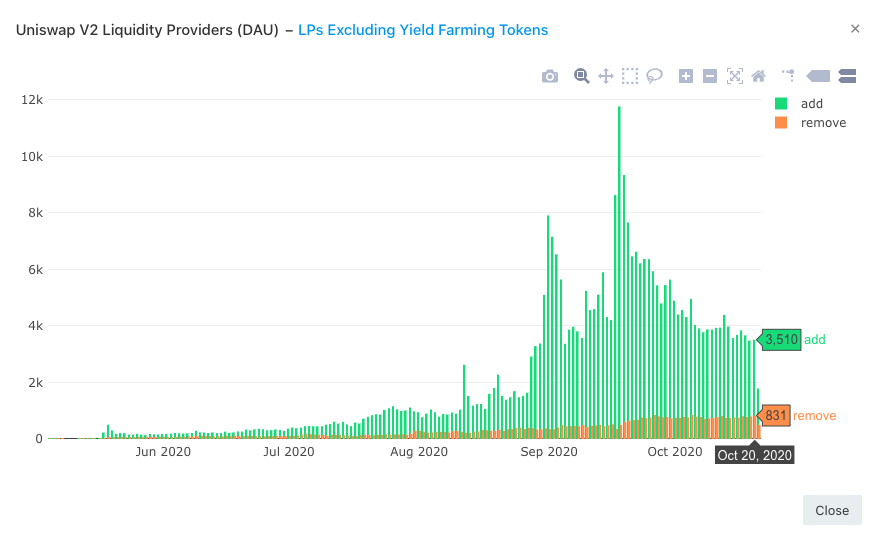

Uniswap liquidity provision

Data of daily active users

At present, the number of liquid trading pairs on Uniswap has exceeded 16,000, with more than 50,000 liquidity providers, more than 23,000 daily active users, and an average daily transaction volume of 200 million US dollars.

Objectively speaking, the rise of DEFI in June should basically be attributed to the popularity of liquidity mining. It has brought a lot of capital to the entire DEFI ecosystem and built the foundation of financial Lego. DEX has solved some problems in the DEFI ecosystem and gained some status, such as realizing independent currency listing, using AMM to solve market-making problems, and simplifying without KYC Transaction process.

However, there are still many problems in DEX, such as poor trading depth and rampant coin listing without audit. The trading depth and experience of the traditional order book cannot be solved by the current DEX.

first level title

3. Lending market

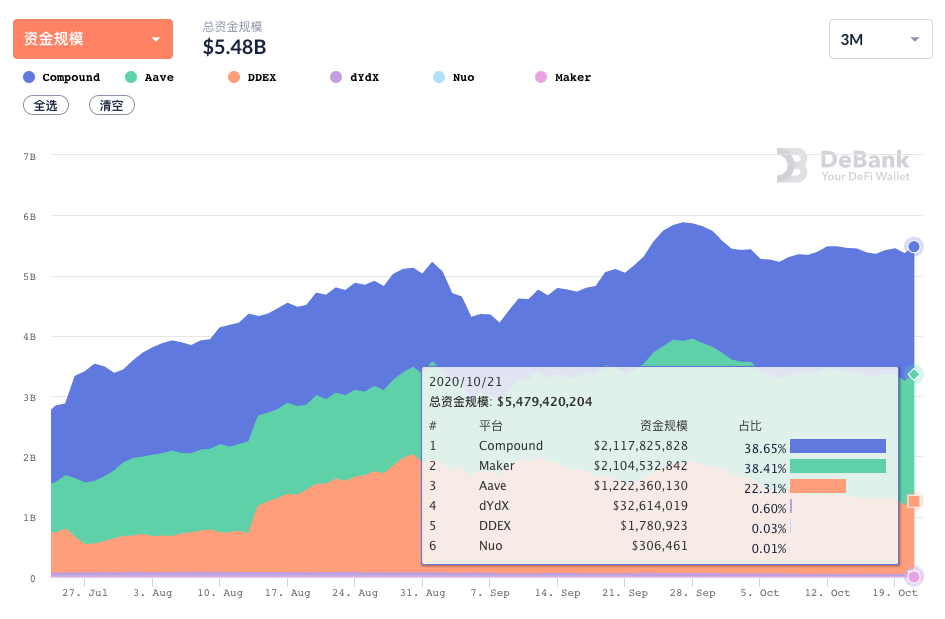

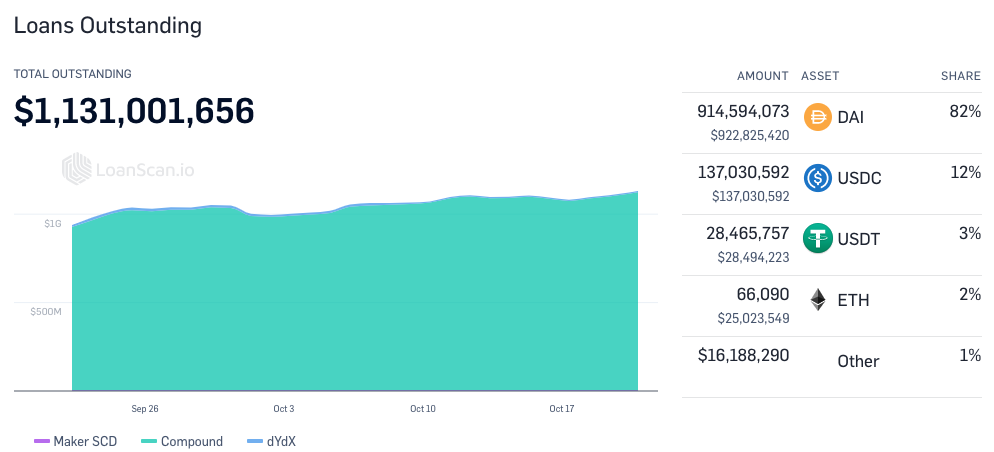

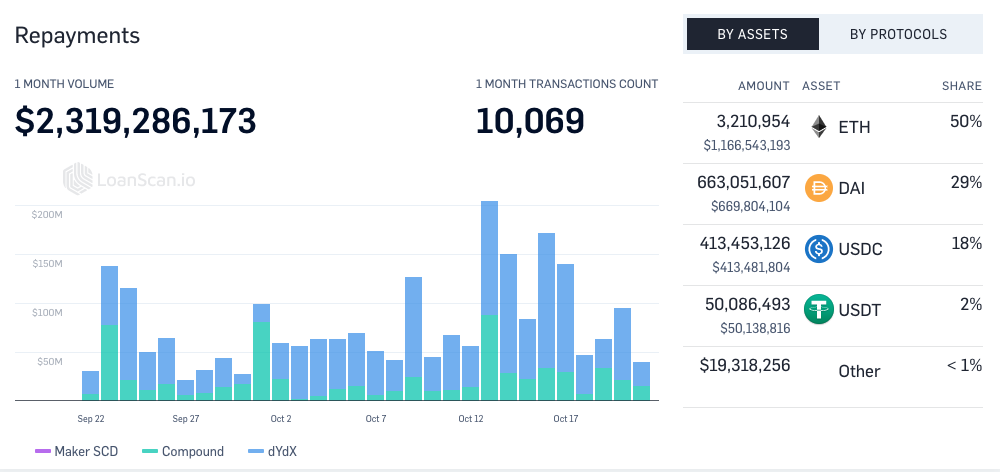

From 2017 to 2019, in principle, Maker is the big brother in the lending market, but since June this year, the market ranking has been quickly overturned, and both Comp and Aave have threatened Maker's top position. As of October 21, the total borrowing volume of the six platforms reached 2.3 billion, and the market size of the top three platforms has accounted for 99%. Without major innovations, it will be difficult to develop new products in the lending field.

Among the current three major lendings, Aave is a project worth refining. The flash loan pioneered by Aave quickly swept the market. Flash loan is a way to borrow funds quickly without collateral. After July and August this year, the transaction volume gradually increased. Of course, compared with the loan volume under other over-collateralized models, the flash loan Credit is still very nascent.

The data shows that as of October 21, the current total loan amount is $2.3 billion, of which 50% comes from Compound.

secondary title

Distribution of deposit assets:

secondary title

secondary title

4. Conclusion

4. Conclusion

1. The visible future development trend of Defi mainly lies in the introduction of privacy computing, breaking the current status of only excess mortgage loans, thereby enhancing the growth space of the entire lenging field. Privacy computing is the underlying infrastructure for developing credit loans. Our current DEFI loan field lacks relevant certification of personal identity information and account information. A large part of the reason is that it is easy to leak one's identity privacy. After the exploration in the field of privacy computing is gradually improved, it is believed that DEFI will have further explosive growth.

2. At present, most of DeFi is on Ethereum. BTC has gradually entered the ETH ecosystem through WBTC, increasing the scale of the entire ecosystem. Currently, there are 1.43 billion US dollars of WBTC on the chain. In the future, more and more mainstream assets will also enter the DEFI ecosystem in the form of WBTC for a series of decentralized financial activities.

3. Compared with the traditional financial market, the market capitalization of the encrypted digital currency market is still small. Capital never sleeps. Where there is capital gain, there will be flow. Large funds outside the circle are still cautiously investigating cryptocurrency and DEFI Ecology, with the continuous improvement of the infrastructure in the circle and the improvement of cognition, the entry of assets outside the circle is the key development direction in the future.