Produced | Odaily

Editor | Hao Fangzhou

Produced | Odaily

The focus of the blockchain industry this year is none other than IPFS.

Filecoin, which has been bounced many times and has been controversial, is about to launch the main network, which has once again attracted attention: mining machine manufacturers are scrambling to enter the market, and the exchange has launched FIL futures. Investors are looking forward to it and eager to try it.

But the market is full of scams and traps.

In order to help investors gain insight into the development direction of the industry and find real investment opportunities, today Odaily is holding the "Interstellar Rise - IPFS Technology and Distributed Storage Ecological Cloud Summit".

In the speech session, Xu Kun, Chief Strategy Officer of OKEx, shared the topic of "Opportunities and Risks of IPFS".

Xu Kun said that IPFS is not a blockchain technology, but a distributed storage and transmission protocol. The goal is to supplement or even replace the Hypertext Media Transfer Protocol (HTTP) used in the past 20 years. Free Internet Age. Filecoin is a blockchain project based on IPFS technology combined with token incentive layer design. IPFS and Filecoin are two sides of one body.

Regarding the recent hot FIL futures trading and mining tide, Xu Kun also gave a risk reminder:

The Filecoin project itself has more complex rules at the technical level, consensus level, and incentive level. Especially before the main network is officially launched, there are still uncertainties about the details of the pledge system and the algorithm at the execution level.

Mining machines and cloud computing power products are mixed, and there is information asymmetry in the market, which requires careful identification.

Mining machines and cloud computing power products are mixed, and there is information asymmetry in the market, which requires careful identification.

Participating in mining requires a large capital investment, and mining revenue is affected by diversified factors such as token prices and network computing power, and there is a certain degree of uncertainty. There must be rational expectations for the return on investment cycle.

Small exchanges may have the risk that the futures cannot be honored, and traders should especially choose the trading platform carefully.

first level title

The following is the full text of Xu Kun’s speech, organized by Odaily:

Good morning, everyone. I am Xu Kun. Thank you very much for the invitation of Odaily. On behalf of OKEx, I will make a simple sharing today.

Recently, IPFS is still relatively hot, so we also started a theme "Opportunities and Risks of IPFS" that is close to the market heat.

secondary title

1. Decentralized storage market trends

The trend of the decentralized storage market, in simple terms, has several points.

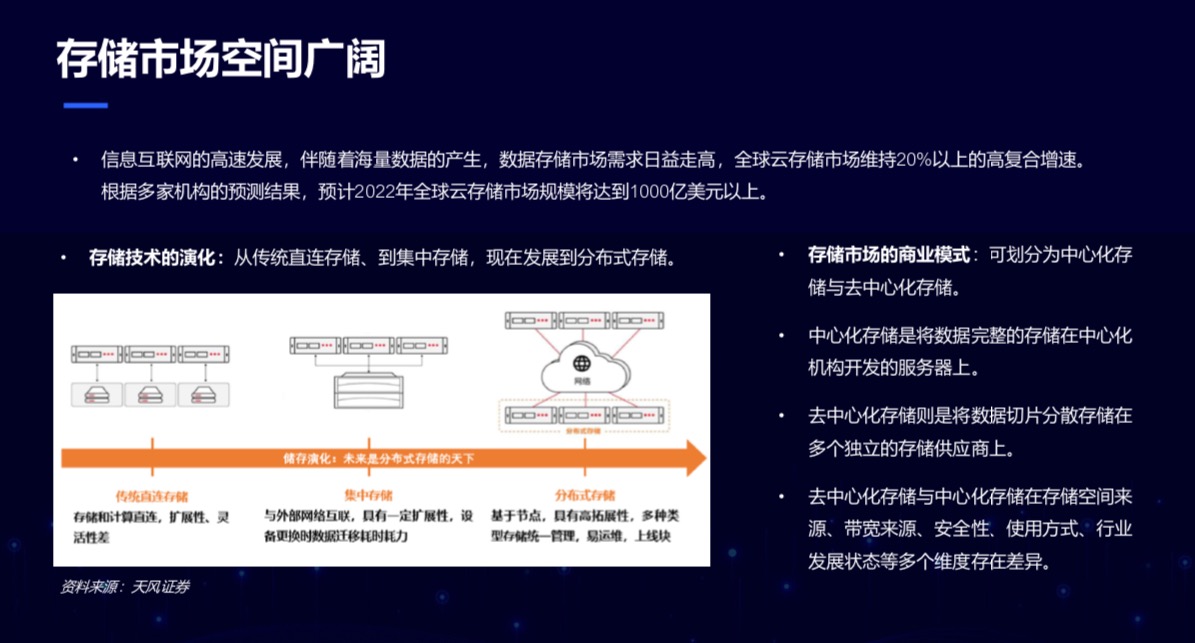

Storage technology has evolved along the path, from traditional direct-connected storage to centralized storage, and now to distributed storage. A large centralized company like Huawei will also have some distributed storage solutions.

In fact, whether it is distributed storage or centralized storage, its market space and demand are very large. According to the forecast results of many institutions, it is estimated that the global cloud storage market will reach more than 100 billion US dollars in 2022.

Decentralized storage and centralized storage are opposed and divided in terms of business models.

Centralized storage is to store data completely on servers developed by centralized organizations, while decentralized storage is to store data slices scattered on multiple independent storage providers.

What is the model of decentralized storage? The decentralized storage model must use distributed storage technology, but the centralized storage model does not necessarily use distributed storage technology, so in terms of efficiency, distributed storage is the future.

Decentralized storage advocates strong privacy protection and low storage costs, including data redundancy backup storage, reducing intermediate costs to achieve storage effects. Therefore, decentralized storage from a commercial perspective is also a very definite trend.

secondary title

2. IPFS ecological development

In the second part, let’s talk about the current ecological development of IPFS.

IPFS is not blockchain technology, it is just a protocol. In essence, it is a content-addressable, versioned, point-to-point hypermedia distributed storage and transmission protocol.

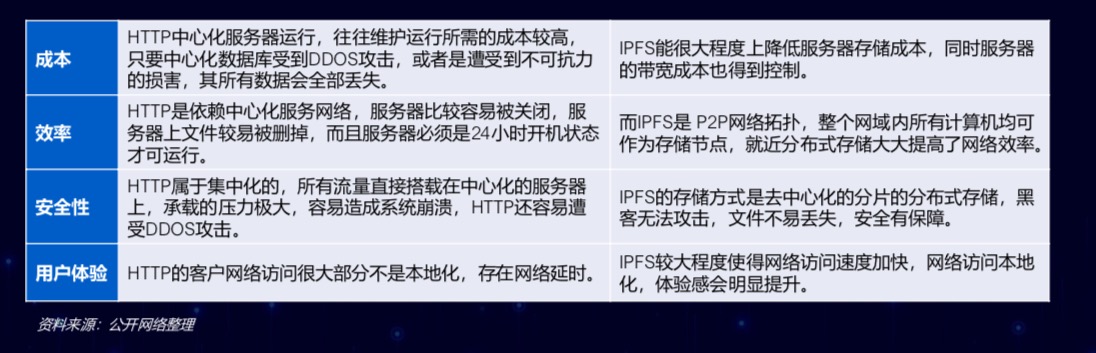

The goal of IPFS is to supplement or even replace the Hypertext Media Transfer Protocol (HTTP) used in the past 20 years, hoping to build a faster, safer, and freer Internet era. Therefore, the IPFS revelation is the opposite of HTTP. We can cite a few examples to compare the two.

In terms of cost, around the Spring Festival this year, a large number of centralized databases were attacked, which is also a common problem faced by centralized storage. But if you attack IPFS, because it is distributed storage, the attack cost is very high.

The same is true from the perspective of security. HTTP is extremely vulnerable to DDOS attacks, but IPFS is a decentralized, fragmented distributed storage, so it is difficult for hackers to attack, and files are not easy to lose, and it is more secure .

What are the application scenarios of IPFS?

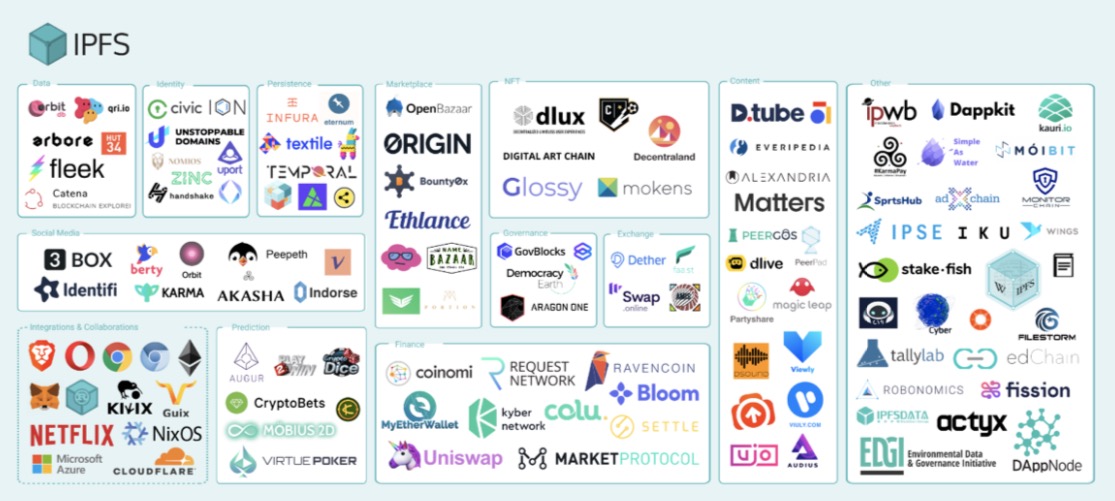

IPFS can be combined with blockchain. At present, the biggest problem of most public chains is that they cannot store a large amount of hypermedia data on their own chains. If DApp wants to develop into a super app, it is greatly restricted. The IPFS protocol can provide a storage solution.

IPFS can also provide distributed caching solutions for traditional applications. IPFS-GEO is a project that provides distributed caching for traditional LBS applications. It can convert geographic location coordinate data into one-dimensional strings through the GeoHash algorithm, and store associated data with retrieval value into the IPFS network. IPFS The network identifier is unique and distributed on each adjacent node.

image description

(IPFS ecological map)

secondary title

3. Opportunities and risks of Filecoin

Finally, let's systematically talk about Filecoin, which has become very popular recently.

Many people often confuse IPFS and Filecoin. What is the relationship between the two?

In a narrow sense, IPFS refers to the basic protocol for distributed storage and transmission: 1. IPFS is not a blockchain technology; 2. IPFS has no tokens and cannot be mined.

Filecoin is a blockchain project based on the IPFS protocol: 1. Filecoin has its own consensus mechanism, miners and tokens; 2. Filecoin is currently in the second stage of the testnet, and the mainnet launch window is currently August 31- September 21st.

In a broad sense, IPFS is actually a family consisting of five projects: IPFS, Filecoin, libp2p, IPLD, and Multiformats, all of which were developed by Protocol Labs. We often come into contact with IPFS and Filecoin, and the latter three involve technical aspects.

Next, let's focus on Filecoin.

Filecoin is a decentralized storage network that turns cloud storage into an algorithmic marketplace. Miners earn native tokens (called “Filecoin” or"FIL"), users store and read data by paying FIL, storage miners obtain FIL by providing storage services, and retrieval miners obtain FIL by providing data.

Just like Bitcoin, Filecoin is also mining, and 70% of it is used for mining by miners, so it is an ecology that integrates mining, trading, and applications, and it is also a composite of multi-party participation and multi-party games ecology. It involves the participation of multiple parties, which will definitely involve a game of interests, so I will remind you of its risks later.

At present, miners are the core of Filecoin, and a large number of decentralized miners can provide stable and reliable services for the network. The value support of the Fliecoin network comes from the user's demand for storage and retrieval services. The more users, the stronger the demand and stimulate the growth of ecological scale.

However, the Filecoin mining mechanism is different from Bitcoin's PoW mining. As you can see, the manufacturers of PoW mining machines have actually spawned relatively large chip, mining machine, and mining machine manufacturers. This ecology is very large.

Filecoin miners not only provide computing power, but also provide storage. Miners are rewarded based on the size of their storage space. The more "effective storage capacity", that is, the greater the "computing power", the greater the probability of generating blocks and obtaining rewards. In addition, the official also revealed that a certain token FIL needs to be mortgaged to mine.

Therefore, to a certain extent, Bitcoin is a PoW consensus mechanism, and the core indicator is effective computing power; Filecoin is not completely PoW, and the indicator is effective storage. The stronger the storage power, the stronger your reward will be.

Filecoin mining machines do not rely on customized Asic chips, but on hard drives, CPUs, software, bandwidth and many other factors.

You have also seen that some time ago, various companies were selling Filecoin’s cloud computing power, but the information on the assembly of the mining machine, the source of the mining machine, and the manufacturer is actually asymmetrical, because it is entirely based on the hard disk of a mining machine, an assembly , so its early camera obscura was relatively large.

Regarding the influencing factors of Filecoin mining, let's also split it up. The first requirement is the computer room; the second requirement is the optimization of the algorithm and the speed of storage. If there is research on Filecoin, everyone will pay more attention to the speed of storage. The size of the storage speed can also increase the storage and mining of effective computing power. Incentives; the third requirement is software support, order management, and the status of some equipment delivered by the machine; the last requirement is technical operation and maintenance. At present, there is actually no mining pool in the Filecoin field, and everyone directly connects with mining machine manufacturers. How to ensure that the equipment is always online and quickly handle faults is a key problem.

We can also take a look at the token mechanism of Filecoin and break it down. The token FIL is not only the value carrier within the ecology, but also undertakes the function of value exchange with the outside world.

The total amount of FIL is 2 billion, and the foundation holds 5%, which will be released linearly in 6 years. The team holds 15%, which is also a 6-year linear release. In 2017, 10% of tokens were raised for financing, raising $257 million. Among them, $52 million was raised in private placement, and the private placement price was $0.75. Participating institutions included Sequoia, Andreessen Horowitz, Union Square Ventures and other VC companies and angel investors; ICO projects. The remaining 70% is owned by miners. Following the law of radioactive decay in nature, according to the exponential decline model, the rewards of each block decrease.

Although the Filecoin mainnet has not been launched for a long time, more than 10 exchanges have launched Filecoin futures. FIL6, FIL12, what do these numbers represent? Represents the time of delivery, and represents how long it will take for FIL to be released for delivery after the mainnet goes live. FIL6 is the futures of 6 months after the mainnet launch, FIL12 corresponds to 1 year, and FIL36 is 3 years.

In 2018, the price of FIL futures once touched $30. From the initial private placement price of 0.75 US dollars to 30 US dollars, it has increased by almost 40 times. Finally, with the entire market falling, it has been consolidating for more than a year, and it is currently around 10-15 US dollars.

Let's analyze Filecoin's valuation expectations. No matter what kind of linear unlocking your linear unlocking is, the linear unlocking of investors, or the unlocking of miners mining, it is an action to increase the circulation of the secondary market. So we have to briefly analyze the current market situation.

We assume that based on the current market price, the circulating market value of the tokens released one year after its mainnet launch will reach 4.29 billion US dollars, so judging from the current market data, it is expected to surpass BCH and rank among the top five. Calculated according to private placement and public placement, in fact, before the mainnet goes live, the secondary market has already risen a lot. Based on the highest cost of US$5 for public equity investors, the rate of return is already 2 times, while the rate of return for private equity investors is as high as 19 times. So investors should judge cautiously.

Therefore, everyone has different opinions on FIL after it goes online. There are various voices, some are bullish and some are bearish.

Let's rationally assess the potential risks of Filecoin. I think there are four risks that are worth explaining to everyone.

First, the uncertainty that may be encountered in the development of the Filecoin project remains to be seen whether it can be supported by the continuous growth of real storage demand as a value. The Filecoin project itself has more complex rules at the technical level, consensus level, and incentive level. Especially before the main network is officially launched, there are still uncertainties about the details of the pledge system and the algorithm at the execution level.

Second, mining machines and cloud computing power products are mixed, and there is information asymmetry in the market, which needs to be carefully identified. For investors, whether you buy cloud computing power or mining machines, you are not sure about the quality of the goods you get and whether the cost of the goods you get is relatively fair, so you must be cautious on this point To identify and then to participate.

Third, many waist exchanges currently have FIL futures online. If the future price of Filecoin is relatively high, can these FIL6 and FIL12 be safely cashed by then? I think the risk of cashing is still relatively large. Therefore, for traders, we still need to choose the trading platform carefully, and we must choose the top platform, because the anti-risk ability of the top platform is still relatively large.

secondary title

4. Actions of OKEx

Finally, I would like to talk about OKEx’s support for Filecoin, why it supports it, and what we are looking at next.

First of all, one of our OKEx values is to embrace change. What is change? It is innovation.

OKEx is an Internet platform, so "users first" is something we value very much. Based on the needs of many users recently, we will launch Filecoin's perpetual contracts today. Judging from the current situation in the global market, it is also the first head exchange to launch the Filecoin perpetual contract. I also posted this news on Weibo.

In addition, OKEx is a comprehensive exchange that integrates currency, contracts, mining pools, Yubibao and other diversified product lines. We will pay attention to high-quality projects and global hot projects. But on the basis of careful assessment of risks, to meet the needs of users.

As for whether to launch other products in the future, we will make a comprehensive consideration based on project progress, market environment and other factors. Our original intention is always to be responsible to users, not only to meet the diverse needs of users, but also to help users correctly understand potential risks.

That's all for today's sharing, and I am very grateful to Odaily fans and Odaily users. You can also follow my Weibo and WeChat public account.