This article comes fromTrustnodes, Odaily translator | Moni

This article comes from

, Odaily translator | Moni

Happy times are always short.

It took just a few days for the price of Ethereum to fall from $280 to the $250 range, a drop of more than 10%. Some analysts believe that the recent closure of a large number of collateralized debt positions (CDPs) by MakerDAO DAI may have caused Ethereum to be dragged down.

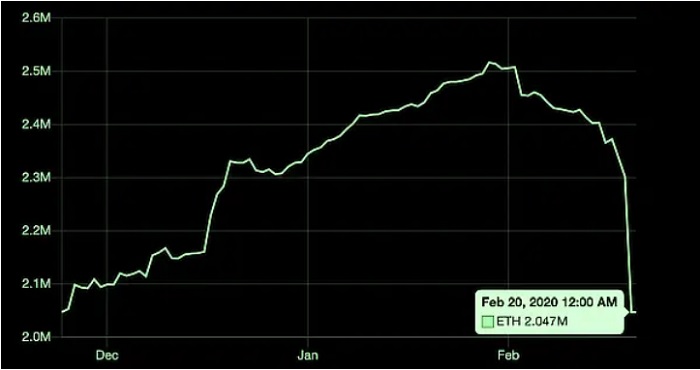

As can be seen from the figure above, the DAI collateralized debt position dropped rapidly on February 19, 2020, from 2.5 million ETH to 2 million ETH, a total loss of 500,000 ETH, which was about $130 million based on the current price. Not only that, the anchor price of the stablecoin DAI and the U.S. dollar also fluctuated slightly, from the standard $1 to $0.98, a drop of 2.57%, which may have had some indirect impact on the price of Ethereum.

It is reported that the reason why MakerDAO wants to close a large number of collateralized debt positions is likely to be because of the fear that the available MKR liquidity will rise to a level sufficient to attack the system with flash loans (Flashloan).

However, others believe that such fears are unfounded. As far as we know, unlike dYdX and Aave, the decentralized exchange Uniswap does not have flash loans and only provides 16,000 MKR, and at least 80,000 MKR is required to use flash loans to attack the system.

In fact, the "attack" on the bZx exchange on February 16 caused quite a stir in the DeFi industry, because the attackers used the latest flash loan function to successfully carry out arbitrage. Flash loan is a new concept in the field of decentralized finance. Since the current DeFi loans are over-collateralized, resulting in a low utilization rate of funds, and flash loan allows borrowers to borrow without collateral assets to improve the utilization rate of funds . However, while this emerging concept has many advantages, it also has structural flaws, such as the risk of assuming that funds are not returned, and this may also be a major concern for MakerDAO.

Many people may already know that as early as December 2019, Micah Zoltu, the author of the Augur white paper and an independent developer, pointed out that there is a vulnerability in MakerDAO. Attackers only need to use 40,000 MKR (approximately 20 million U.S. dollars) in just 15 seconds. Steal all collateral assets of Maker DAO, including DAI, SAI, and a large amount of assets (more than 340 million US dollars) from Compound, Uniswap, and other integrated Maker systems.

To steal all the ETH in MKR, all you have to do is write a new smart contract that says to send all the ETH of the mortgage deposit in DAI to 0xhaxor, and then you need to get more MKR than the currently active smart contract, So roughly 80,000 MKR (approx. $52 million) is required - a considerable amount, so it doesn't seem like Maker is terribly concerned. But the problem is that if there is a flash loan, the attacker can temporarily borrow collateral or credit funds that do not come from the liquidity pool without permission, which not only raises the risk of attack, but also may have an impact on the MKR governance system.

Of course, in order to prevent potential attacks, MakerDAO has set up some fail-safe mechanisms to delay the implementation of new rules, but as it stands, they have set the delay time to "0 seconds", which is obviously problematic. Therefore, MakerDAO is planning an emergency vote to increase the delay from 0 seconds to 24 hours, so that some illegal mortgages can be invalidated, and this time period can also be used as a fail-safe mechanism.

Another defensive measure may be to increase the number of staked MKR for the current active contract. Since the current MKR is still a highly centralized token, this plan may be relatively easy to implement.