Original author: Pink Brains

Original translation: Luffy, Foresight News

Forget the Layer 2 battles; the new battlefield is the stablecoin blockchain. Institutions like Tether, Circle, and Stripe are launching dedicated blockchains to capture the global stablecoin payment landscape.

Here are the top players in this race:

Why build more chains when Ethereum, Solana, and Tron already run stablecoins? Because they are not designed for:

- Millions of daily transactions with millisecond latency

- Predictable and low-cost gas fees paid in the stablecoin itself

- Built-in fiat currency deposit and withdrawal channels

- Privacy protection that meets compliance requirements

- Custom control over infrastructure and economic models

The trend we are seeing now is a shift from general-purpose blockchains to vertical-specific chains that are end-to-end optimized for payments, settlement, and scalability.

The following is a detailed analysis of the seven major stablecoin native chains, including developers, operating mechanisms, and development directions.

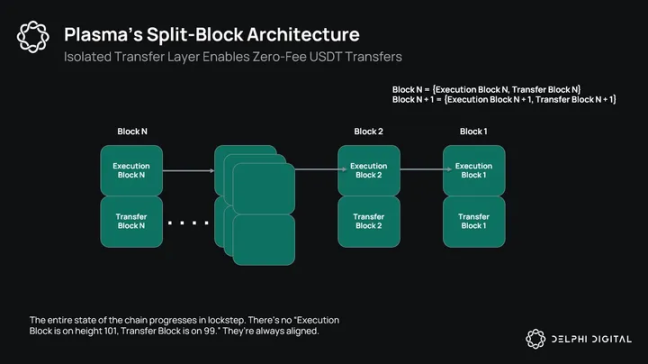

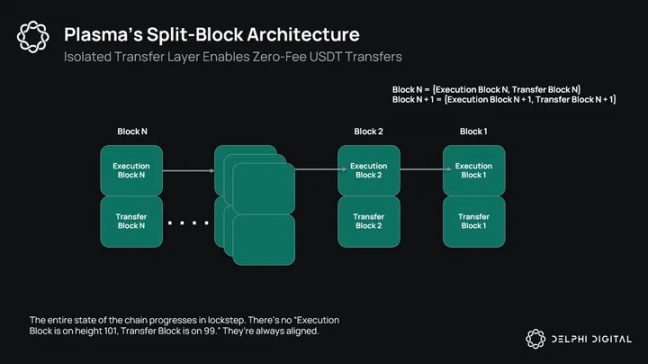

Plasma

Plasma is a Bitcoin-secured, Ethereum Virtual Machine (EVM)-compatible sidechain designed specifically for optimizing USDT transfers. Plasma features include:

- PlasmaBFT: A pipelined, parallelized variant of Fast HotStuff for faster finality and high throughput

- Zero USDT transfer fees, customizable gas tokens, and optional confidential payment functionality

- Fully EVM compatible

- Integrated stablecoin infrastructure: deposit and withdrawal channels, risk tools, and confidential payments

- Native trust-minimized Bitcoin bridge, enabling direct interaction between Bitcoin and the EVM

Plasma has already attracted a number of high-quality partners:

- Yellow Card: Sending USDT Across Africa via Plasma

- BiLira Kripto (TRYB): Providing compliant lira and USDT exchange services in Türkiye

- URANIUM DIGITAL: 24-hour on-chain uranium trading settlement

- Axis: Interest-earning xyUSD backed by hedge fund strategies

- Curve Finance: Supporting deep and efficient stablecoin exchange

Plasma, backed by Founders Fund, Framework Ventures, and Bitfinex, raised $24 million in its latest funding round. Plasma’s public token sale attracted $373 million in subscriptions and sold out in less than 30 minutes.

Currently, the Plasma testnet is online and the mainnet is about to be launched.

Stable

Stable is a new Layer 1 blockchain developed by Bitfinex and Tether, compatible with the EVM. Stable features include:

- Runs on StableBFT, a CometBFT PoS with low latency and high throughput, designed for stablecoin-heavy workloads

- Through optimistic parallel execution, the target throughput reaches 10,000 TPS

- gasUSDT is the native Gas token, but with the help of account abstraction technology, users can use USDT 0 to pay

- Peer-to-peer USDT 0 transfers with no gas fees

- USDT 0 holders can send gas-free transactions through LayerZero relayers

- The roadmap includes built-in fiat currency deposit and withdrawal channels, debit card integration and enterprise "fast lanes", aiming to combine the transfer speed of on-chain currency with Web 2-level user experience.

Stable eliminates nearly all friction in transferring USDT at scale.

Stable raised $28 million in a seed round led by Bitfinex and Hack VC, with participation from Franklin Templeton, Castle Island, and USDT 0.

Currently, Stable is in the internal testnet stage and is expected to launch a public testnet later this year.

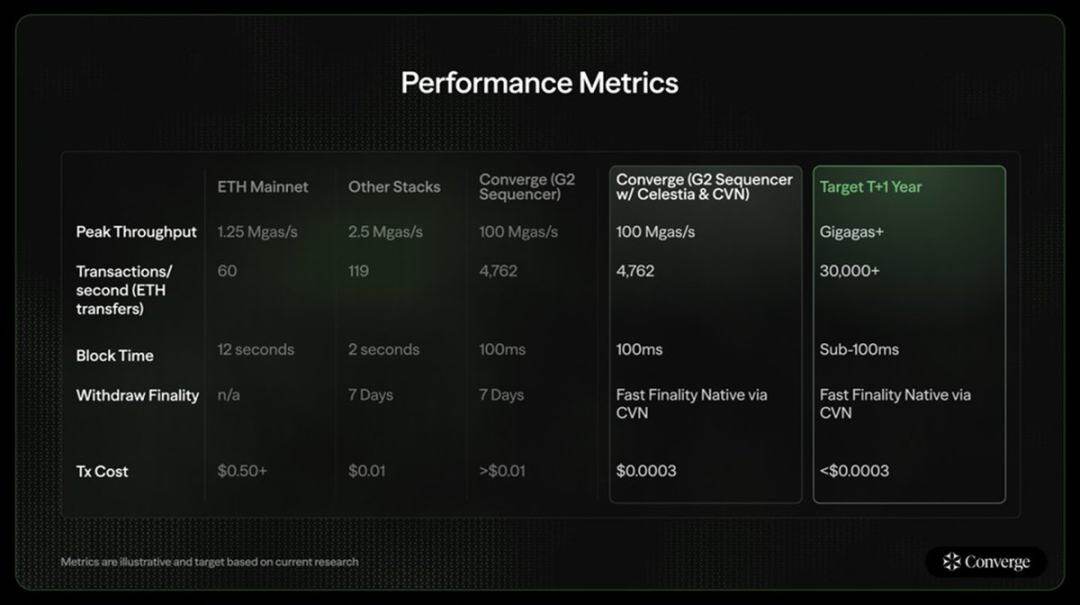

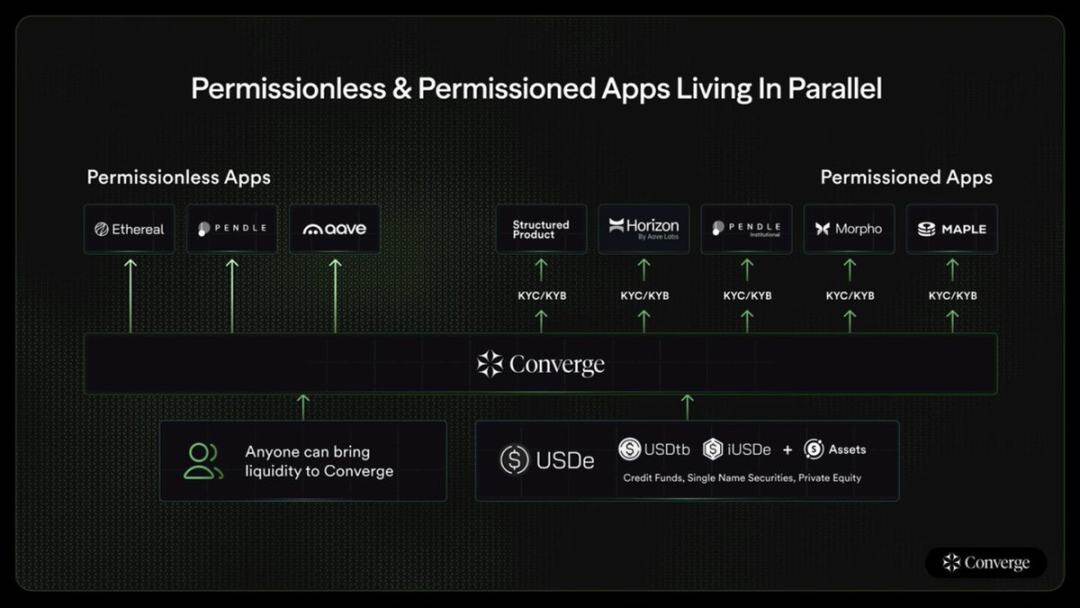

Converge

Converge is an Ethereum Layer 2 platform built on Arbitrum technology, jointly developed by Ethena Labs and Securitize. Converge features the following:

- Arbitrum as the execution layer and Celestia as the data availability layer

- Gas fees are paid in USDtb

- Built around a custom G2 sequencer (powered by Conduit), with a target block time of 100ms and plans to achieve Gigabit Gas throughput

- Nodes verify by staking ENA in the Converge validator network

- Leveraging Anchorage, Fireblocks, Zodia, and Copper to provide custodial security and operational convenience for institutional users

Converge has attracted many ecosystem participants:

- Hamilton Lane to Introduce Tokenized Private Credit and Equity Funds

- Permissioned applications for institutional capital: Morpho, Pendle, Maple, Horizon

- Native applications like Strata, Terminal Finance, Ethereal, Pendle, Aave are all built around sUSDe and real yield

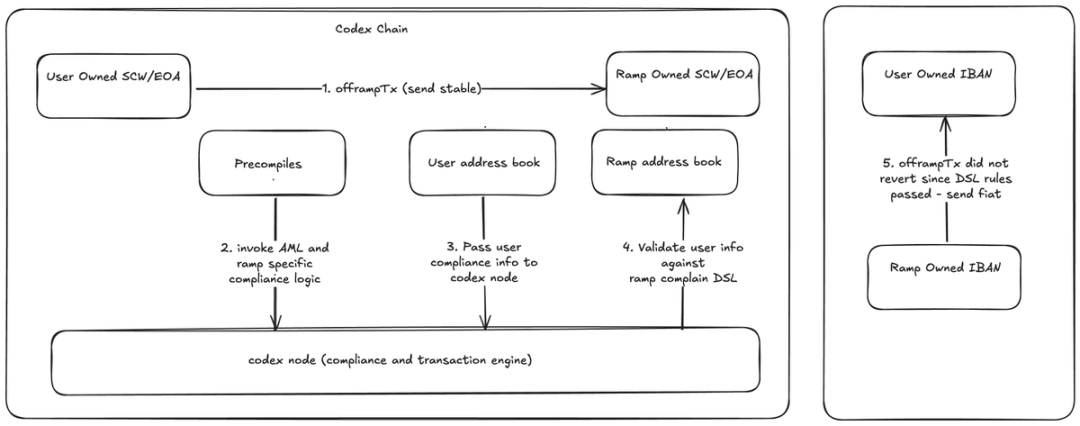

Codex

Codex is a secure, high-throughput Ethereum Layer 2 blockchain designed for stablecoin native payments, foreign exchange, and settlement. Codex features:

- Built on OP Stack and hosted by Conduit

- Fee design and gas abstraction tailored for stablecoin transactions

- Deterministic execution to meet institutional-grade reliability requirements

- Built-in foreign exchange and custody primitives, supporting multi-currency settlement

- Relying on Ethereum settlement to ensure security and finality

Codex is aimed at businesses that want to use stablecoins in real-world financial processes (payroll, treasury management, trade) while requiring compliance, predictability, and privacy.

Codex raised $15.8 million in a seed round led by Dragonfly, with participation from Circle Ventures, Coinbase, Cumberland, and Wintermute.

The Codex mainnet was launched in 2024.

Noble

Noble was originally designed as the Cosmos native asset issuance chain, specifically for bringing USDC and other stablecoins to IBC-connected application chains. Noble has processed over $8 billion in transaction volume and powers stablecoin flows for dYdX and other Cosmos application chains.

To address programmability limitations, Noble will launch an EVM-compatible Rollup (Noble AppLayer), secured by Celestia. This new Rollup supports:

- 100 millisecond block time

- Composable stablecoin income based on USDN (Noble's own stablecoin)

- Providing stablecoin liquidity to the EVM chain via Hyperlane/IBC Eureka

- Connecting to the EVM Gateway for Noble's Issuance Service

- Fully interoperable with Cosmos

It supports stablecoin native EVM-compatible applications and USDN while retaining Cosmos interoperability.

Noble raised $15 million in a Series A funding round last year led by Paradigm.

Noble AppLayer is expected to launch this summer.

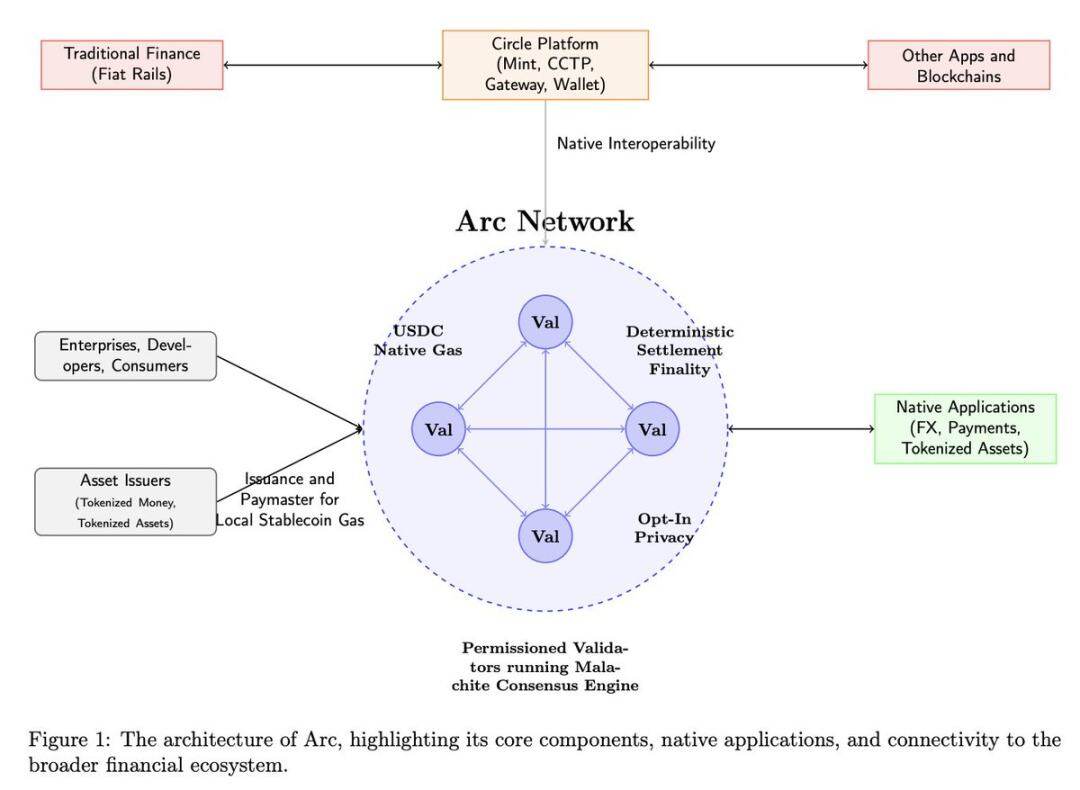

Arc

Arc is Circle's blockchain purpose-built for stablecoin finance. It combines fast settlement, native USDC integration, and global foreign exchange tools. Arc features include:

- About 3000 TPS, 20 verification nodes, final confirmation time < 350 milliseconds

- USDC as the native gas token supports interest-bearing USYC

- Built-in foreign exchange engine, realizing on-chain institutional exchange through inquiry mode

- Optional privacy protection

- Anti-MEV methods: encrypted memory pool, batch processing, multi-proposer mechanism

Arc aims to connect traditional finance and stablecoin native chains at an internet-grade scale.

Arc is also deeply integrated with Circle's infrastructure:

- Native support for CCTP and Gateway cross-chain protocols

- Chain Abstract Balance

- Tools for businesses: On-chain invoicing, refunds, AI financial agents

It is not built for maximum decentralization, but rather for embedding tokenized dollars into enterprise payments, foreign exchange, and money flows.

Arc will launch a private testnet in the coming weeks, with a public testnet expected to go live this fall.

While centered around USDC, the chain is open to any digital dollar or tokenized asset. Arc aims to provide trusted, high-speed settlement support for fintech applications, wallets, and financial institutions.

Tempo

Tempo is a stablecoin blockchain jointly developed by Stripe and Paradigm, focusing on the payments sector. While not much information has been released about Tempo, known details include:

- Compatible with Ethereum

- No native volatility token, only stablecoins for payment

- Designed to integrate with Stripe's merchant network

- Leverage Stripe’s acquisition of Bridge (stablecoin infrastructure) and Privy (wallet infrastructure that supports social account login)

- Paradigm co-founder Matt Huang will serve as Tempo's CEO

Tempo aims to embed stablecoin rails into Stripe's global infrastructure without compromising user experience or regulatory compliance.

Summarize

All of the above stablecoin protogenesis links have the following characteristics:

- Pay gas fees directly in stablecoins

- Sub-second final confirmation, throughput reaching thousands to tens of thousands of TPS

- Fee-free or subsidized transfers

- Direct connection with fiat bank channels

- Designed around real-world financial use cases, not just crypto-native activities

We may see multiple stablecoin chains coexist, each tied to a specific issuer and product suite, but all aiming to fulfill the same global need: a better way to move money.

The ultimate winner will seamlessly support all on-chain checkouts, payroll payments, and remittances.