Original author: Cheeezzyyyy

Original translation: TechFlow

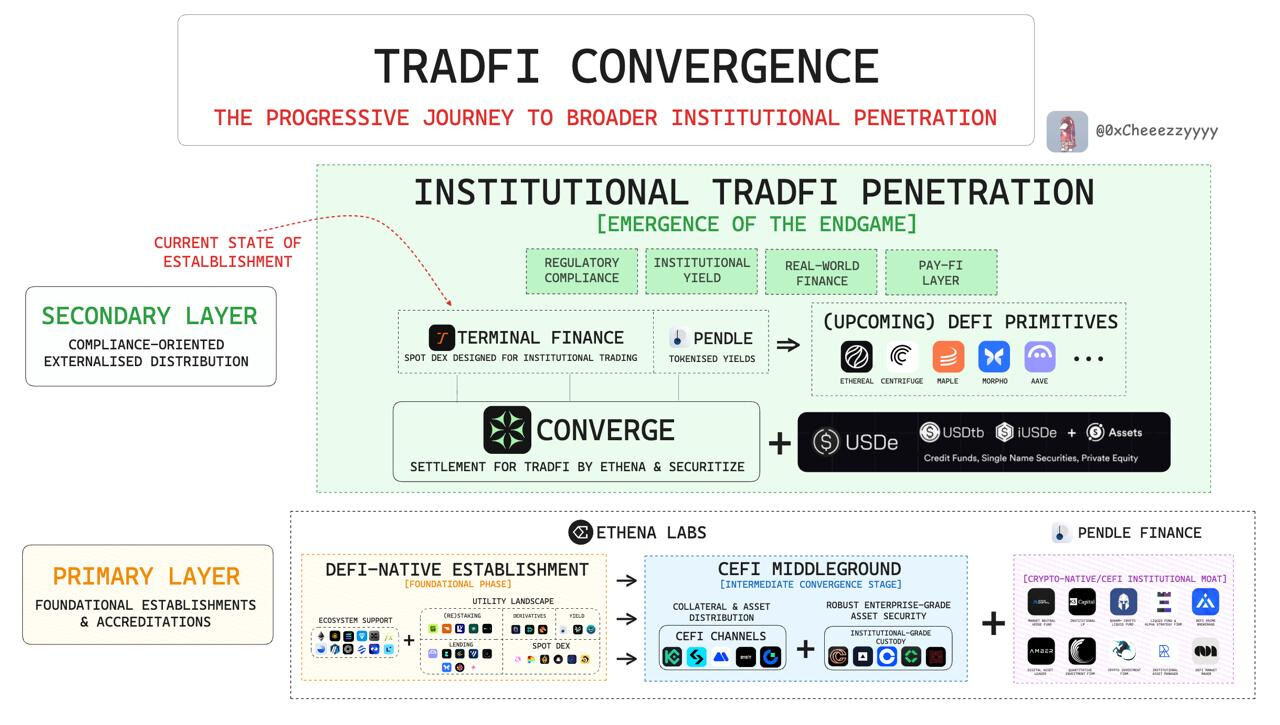

For institutions, the dawn of new DeFi-native financial assets is breaking.

Pendle's early integration with Terminal Finance is more than just another "revenue opportunity."

This marks the arrival of a new financial era:

The fusion of TradFi <> DeFi native financial assets at the most basic level.

This is a precursor to what Converge is bringing: strategic partnerships with Ethena and Securitize for TradFi, paving the way for the entry of institutional funds.

As TradFi begins to realize the powerful synergies unleashed by DeFi, the driving force behind it comes from new theories adopted by institutions, which are driving the arrival of this financial revolution.

Led by Terminal Finance and combining cutting-edge technologies from Ethena and Pendle, the Converge ecosystem brings together the best forces in the DeFi space that meet institutional needs.

Its credibility comes not only from the speculative appeal of the market, but also from a carefully designed financial structure:

- DeFi native infrastructure, deep integration and high composability

- Powerful CeFi external distribution capabilities

- Closed-loop institutional participation model

All of this together forms a solid underlying structure, laying the foundation for institutional funds to enter the DeFi field more widely.

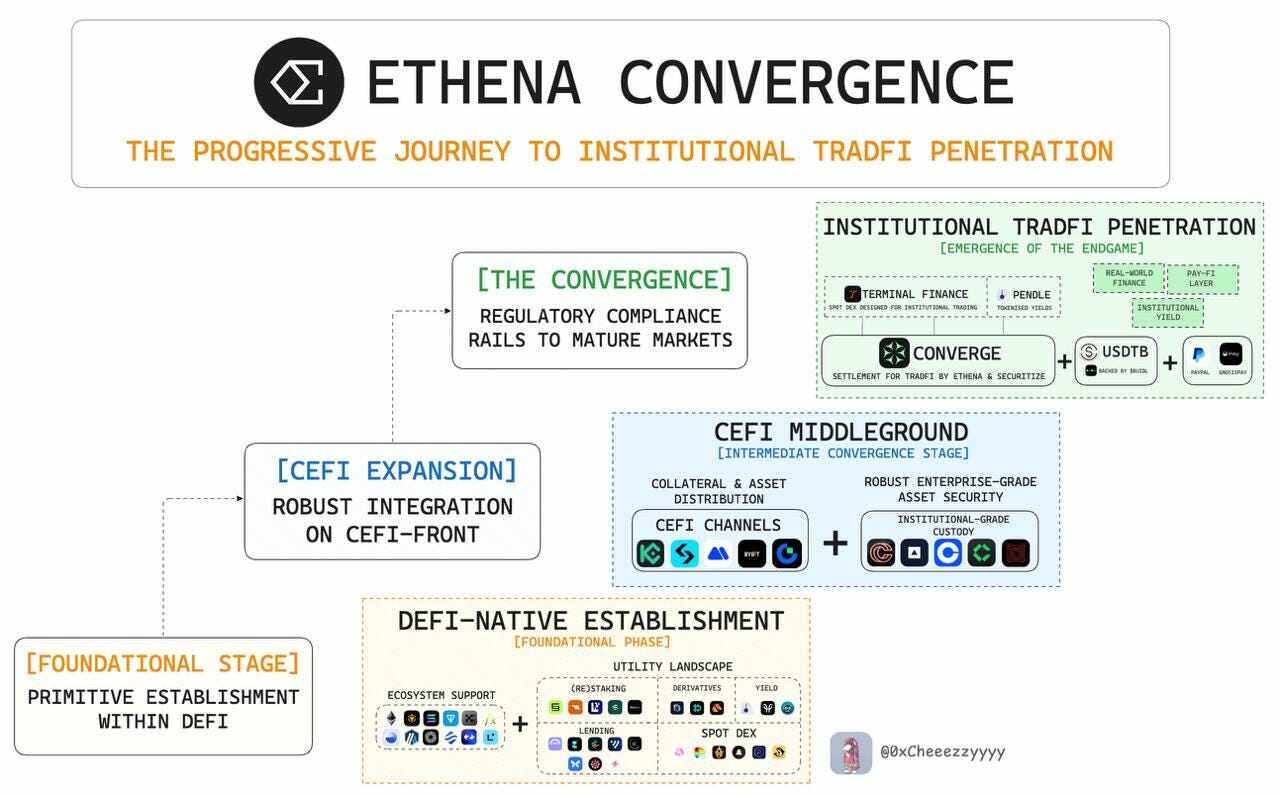

Next stage: Second level of formalization

This phase marks the final stage of the externalization of the Converge ecosystem, with the goal of creating a system that is fully aligned with traditional finance (TradFi). The core cornerstones include:

- Traditional financial strategic distribution channels

- Compliance regulatory framework

- Institutional-level liquidity coordination mechanism

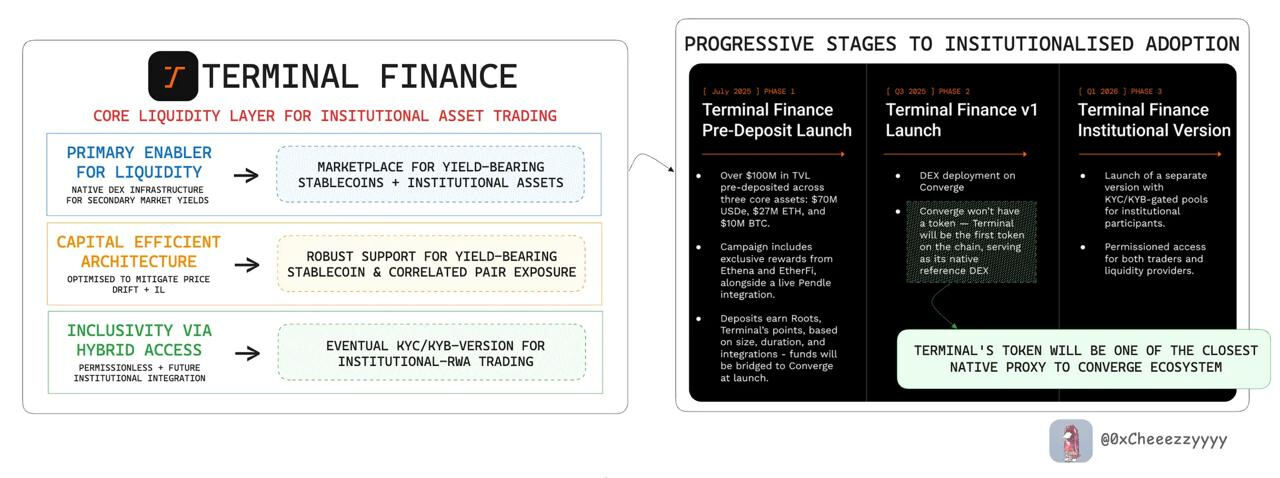

Through bottom-up design, Terminal Finance has become the core of Converge's liquidity hub for traditional finance, tailoring the entire financial architecture for institutional trading.

The entire ethos of the “Money Legos” that defined early DeFi was built on a single principle: composable liquidity .

However, composability is impossible without deep, reliable, and accessible liquidity, a critical gap that TerminalFi fills as the cornerstone of the Converge ecosystem.

It is not just an ordinary decentralized exchange (DEX), but an innovative platform designed specifically for institutional needs:

- Core enabler of the ecosystem : building a strong secondary market for institutional-grade assets and yield-generating stablecoins

- Capital efficiency first : Reduce price drift and impermanent loss (IL) through optimized design, improve liquidity and provide returns

- Inclusive accessibility : Supporting permissionless transactions while gradually introducing institutional-grade real-world asset (RWA) transactions that comply with KYC/KYB regulations

It’s clear that TerminalFi, as a native component of institutional-grade finance, offers a unique and compelling value proposition.

However, in the absence of a token roadmap for Converge, TerminalFi effectively serves as the closest native proxy for capturing Converge’s potential growth value.

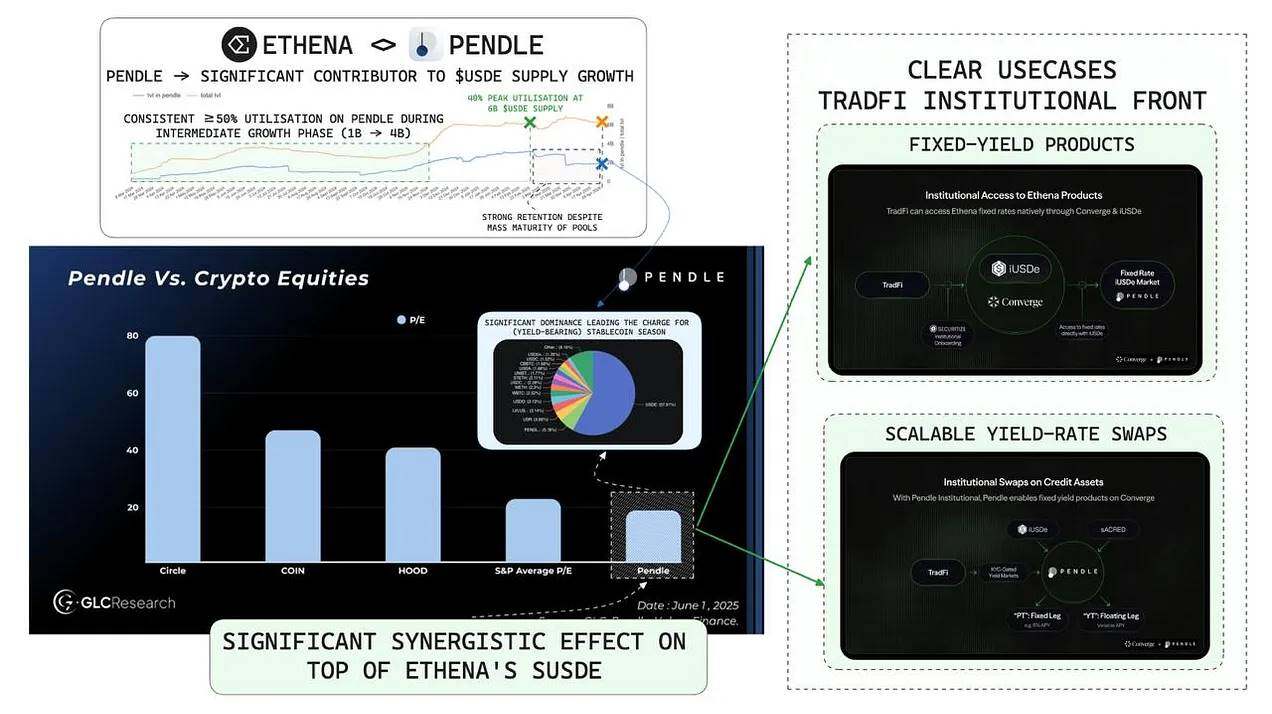

Choosing a strategic dual synergy: Pendle x Ethena

TerminalFi's YBS (yield-generating stablecoin) theory prompted it to strategically choose sUSDe as its core underlying asset, and the simultaneous launch with Pendle further consolidated this strategic direction.

This is no accident.

@ethena_labs achieved over $6 billion in supply in less than a year, and Pendle Finance played a significant role in this growth:

- As sUSDe supply climbed from $1 billion to $4 billion, over 50% of the sUSDe supply was tokenized via Pendle.

- Peak utilization reached 40% when supply reached $6 billion.

The high and sustained utilization on Pendle demonstrates the market fit for fixed- and floating-income tokenization within DeFi-native portfolios. More importantly, it further highlights the powerful synergy between Ethena and Pendle: the two fuel each other, creating a lasting, compounding network effect cycle that profoundly impacts the entire ecosystem.

But the synergy doesn’t stop there.

Ethena and Pendle are targeting much more than just DeFi users. Together, they are targeting the larger institutional market opportunity:

- Fixed income products : a $190 trillion market in traditional finance

- Interest rate swaps : A larger market segment, with a scale of $563 trillion

Through Converge's certified and regulated distribution channels , a critical bridge to institutional asset allocators has been established. This breakthrough provides institutions with broad access to crypto-native yield streams that are faster, composable, and designed with returns at their core.

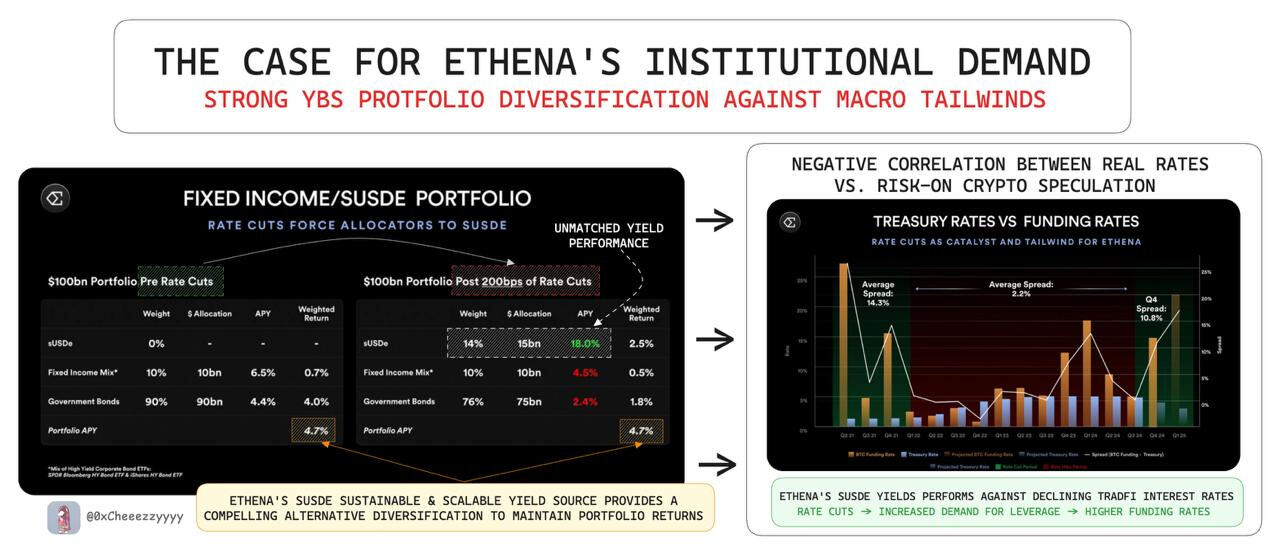

The successful establishment of this theory relies on innovative financial native assets and proper design for the upcoming macro tailwinds to work, and Ethena's sUSDe perfectly fits this requirement:

sUSDe's returns are negatively correlated with global real interest rates, which is very different from other debt instruments in traditional finance.

This means that sUSDe can not only survive changes in the interest rate environment, but can also benefit from it and thrive.

With current interest rates (approximately 4.50%) expected to decline, institutional portfolios are poised to face yield compression challenges – further solidifying sUSDe’s positioning as a logical alternative for capital preservation portfolio returns.

In 2020/21 and the fourth quarter of 2024, the BTC financing spread exceeded 15% compared to the actual interest rate.

what does that mean?

From a risk-adjusted return perspective, sUSDe and its derivative, iUSDe (a traditional finance wrapper), offer significant structural advantages. Combined with significantly lower capital costs than traditional finance (TradFi), this offers a potential 10x return on investment in the untapped traditional finance sector.

Double synergy growth effect: Pendle's key role

The next stage: integration

Clearly, Ethena and Pendle are strategically aligned and moving towards the same ultimate goal: traditional finance (TradFi) integration.

Since its establishment in the first quarter of 2024, Ethena has successfully consolidated its position in the middle ground between DeFi native field and CeFi with its strong infrastructure:

- USDe and sUSDe assets cover over 10 ecosystems + top DeFi integrations

- Enable multiple CeFi distribution channels via CEX for perps adoption + staking utility

- Payment layer integration, such as PayPal and Gnosis Pay

This solid foundation laid the foundation for the final stage of institutional traditional finance (TradFi) penetration, and the birth of Terminal Finance became Converge's core anchor, driving the development of a TradFi liquidity hub for institutional trading.

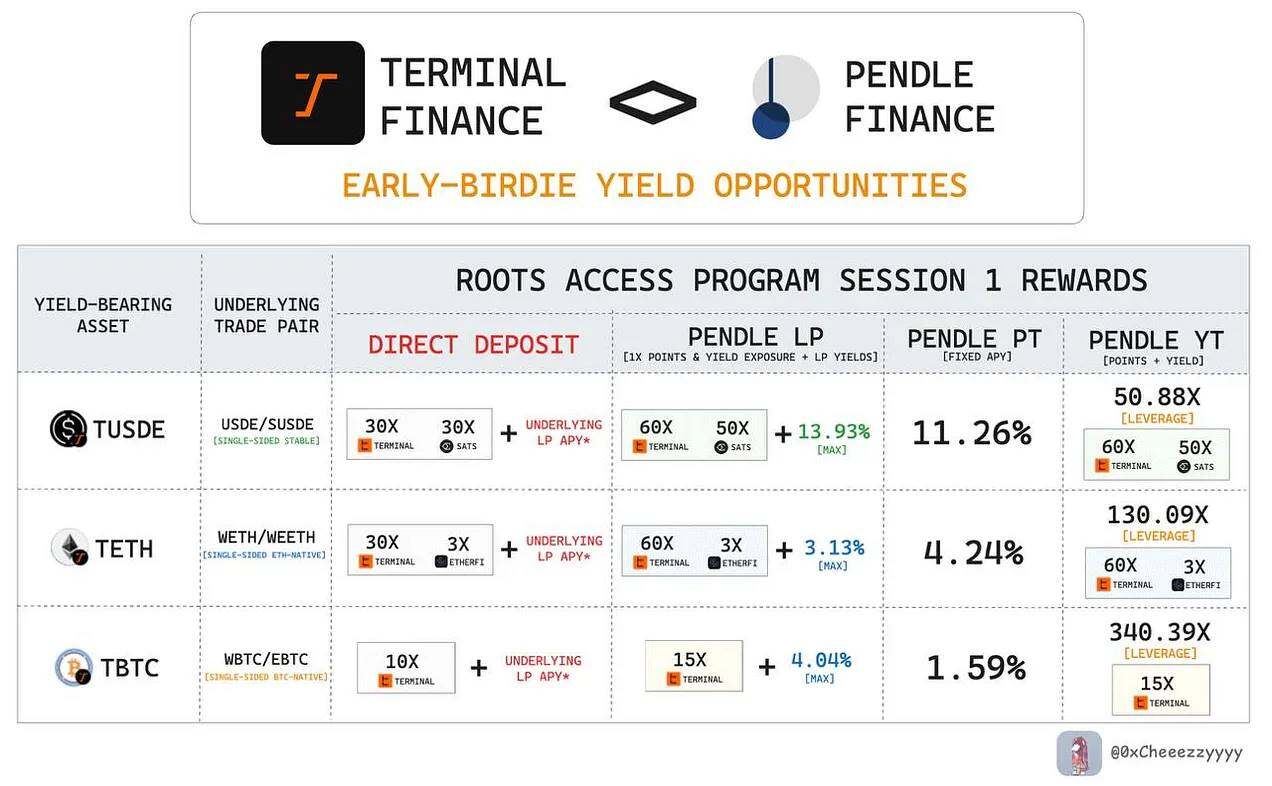

There is no doubt that Pendle's participation has unleashed the financial potential of YBS native assets. At the same time, Pendle has also launched a LP token pre-deposit function for the initial pool:

- tUSDe: sUSDe/USDe pool

- tETH: wETH/weETH (provided by EtherFi) pool

- tBTC: wBTC/eBTC (provided by EtherFi) pool

*These pools are specifically designed for unilateral beta exposure + while minimizing impermanent loss (IL) risk to attract committed LPs willing to participate in liquidity provision for the long term.

About Early Access: Roots Access Program Phase 1

The early stage of the bootstrapping process is accompanied by Pendle’s exclusive multiplier rewards, which are time-sensitive:

- Terminal Points : 15x to 60x multiplier rewards (compared to 10x to 30x for direct deposits)

- tUSDe Rewards : 50x Sats Multiplier

- tETH Rewards : 3x EtherFi Multiplier

- LP Annualized Percentage Yield (APY) : Up to 13.93%, including income and point rewards, assuming that one-sided exposure and impermanent loss are negligible.

- Fixed annualized yield : tUSDe offers 11.26%

- Highly capital-efficient YT exposure : total returns and pips can range from 51% to 340%

Clearly, no other avenue offers such strategic opportunities in the early-stage emerging institutional native asset space.

Final Thoughts:

Looking at the bigger picture, the establishment of Converge marks the birth of the financial operating system for the next generation of economically native assets.

If you haven’t seen this trend yet:

- Ethena offers a yield-based dollar

- Pendle builds a structured income layer

- Terminal leads institutional market access

Together, these three form the core framework of a unique on-chain interest rate system that is composable, scalable, and able to meet the demand for higher returns from trillions of dollars in global fixed income markets.

This truly opens the box for institutional-grade DeFi.

And this transformation has already begun.