On August 13th, ETH surged past $4,700, reaching a four-year high. Meanwhile, Solana struggled, hovering around $200. In 2024, Pump.fun sparked a meme frenzy across the Solana chain. Earlier this year, Trump launched $TRUMP on the platform, sending Solana's price soaring to around $300, sparking widespread calls for Solana to replace ETH.

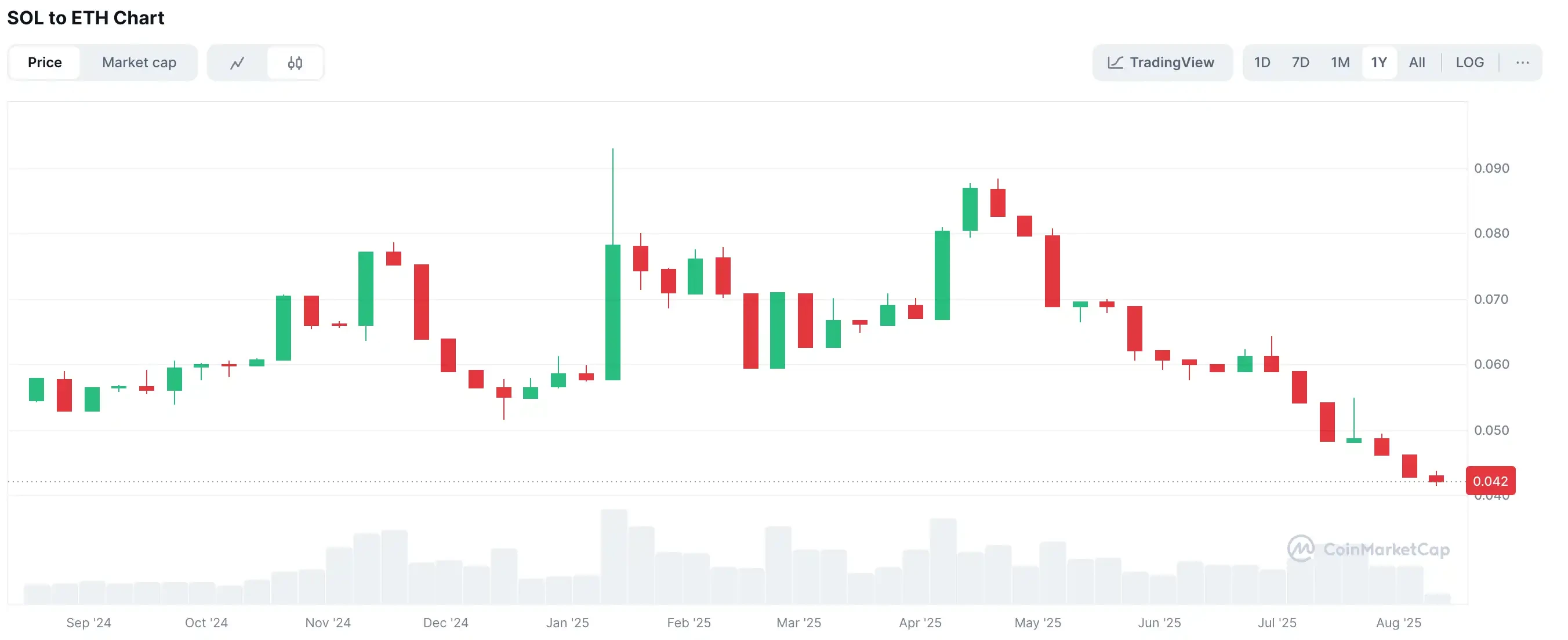

However, the market's actual performance gave it a sobering response. While both ETH and SOL were promoting treasury strategies in an attempt to build up funding for their ecosystems, their performance diverged significantly. The SOL/ETH exchange rate plummeted from 0.09 at the beginning of the year to 0.042, maintaining a weak trend throughout the year. The underlying reason may lie not only in price fluctuations but also in a complex combination of diverging narratives, ecosystem structure, and investor expectations.

Treasury Strategy: The Dual Gap Between Leaders and Fund Size

On June 30th, Tom Lee, a Wall Street contrarian, was appointed chairman of BitMine. That day, ETH was still hovering around $2,500. Just a month and a half later, ETH soared to $4,700, a whopping 88% increase. Lee, a frequent guest on top financial programs like CNBC and Bloomberg, bucked market pessimism with his precise "bottom-picking" pronouncements during the 2022 US stock market crash. Today, this influential market influencer has become the face of the ETH treasury. Meanwhile, ARK Invest, owned by Wood Sister, invested $182 million in BMNR shares, further fueling confidence in the ETH camp.

In addition, although both ETH and SOL have treasury strategy companies in their own camps, the scale is very different. In terms of the size of holdings, BTC and ETH treasury strategy companies occupy the top ten. BitMine Immersion (BMNR), the leader of "ETH Micro Strategy", recently planned to increase its financing scale by US$20 billion to increase its holdings of ETH. It currently has a NAV (net asset value) of US$5.3 billion, second only to MSTR. This level of capital means that it has more "bullets" when the market fluctuates, and has a stronger ability to shape the market. The current NAV of the leader of "SOL Micro Strategy" is only US$365 million, ranking 11th, more than 10 times that of BMNR. Lacking a public spokesperson with global influence like Tom Lee, and without the same level of capital firepower, SOL naturally seems powerless in this round of market.

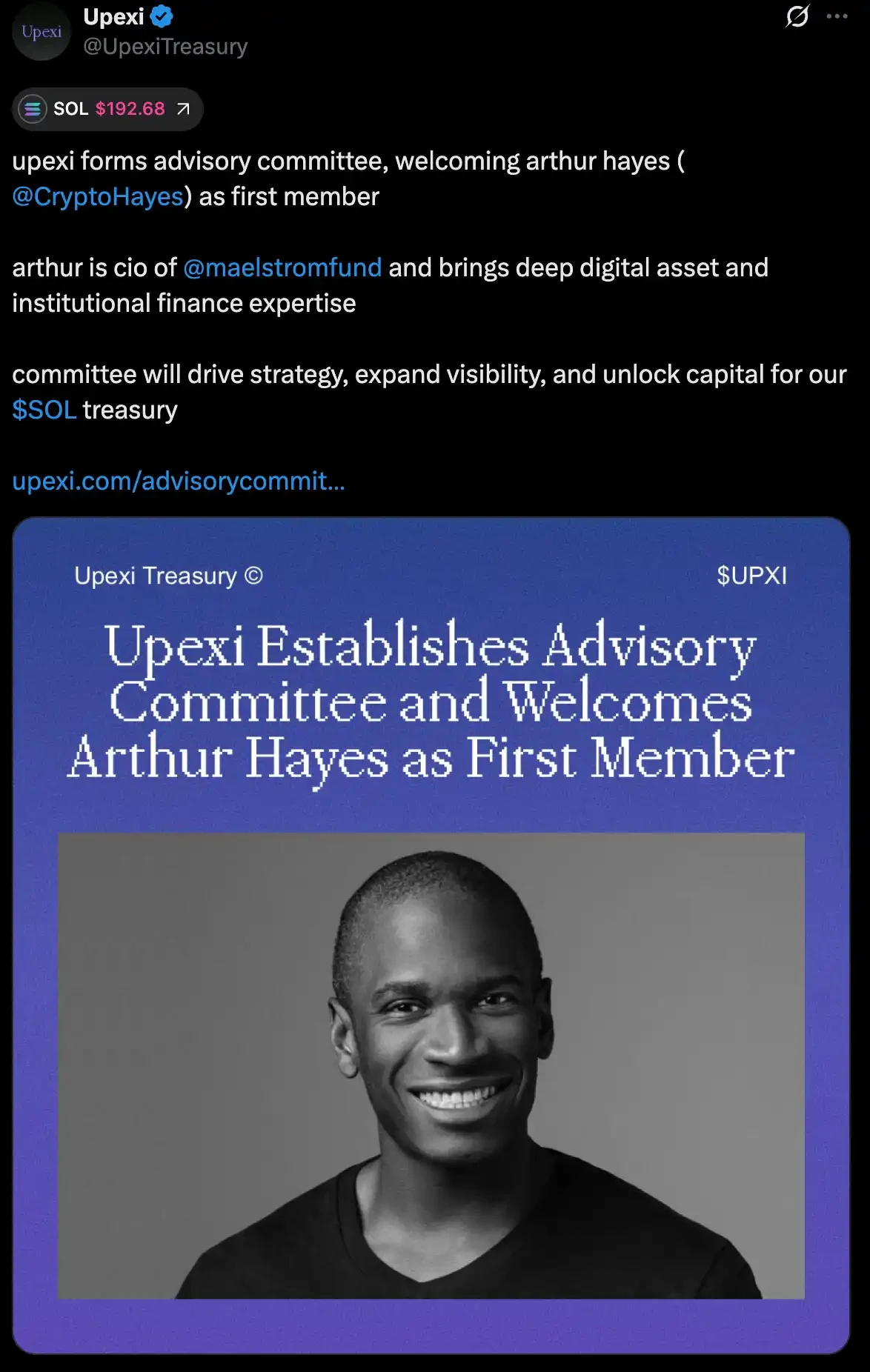

However, recent moves by Solona are gradually addressing this shortcoming. On August 12th, Upexi, the "SOL Microstrategy," established a new advisory board and appointed Arthur Hayes as its first member. Hayes, co-founder of BitMEX and a pioneer of perpetual contracts, previously worked as a trader at Deutsche Bank and Citigroup, and currently leads the digital asset investment fund Maelstrom. With a background in traditional finance and a deep understanding of crypto market structure, he can provide practical guidance on institutional financing and digital asset strategies.

Upexi's strategic goal is clear: to leverage Solona's scalability and efficiency to further expand its SOL portfolio. According to public documents, the company currently holds over 1.8 million SOL (with a market capitalization of approximately $365 million), and has staked a portion of its holdings to earn a 7%-9% return, ensuring long-term holding while generating a stable cash flow. Notably, the company will acquire locked-up SOL at a discount, thereby generating returns for shareholders. Upexi plans to recruit more members to its advisory committee in the future, providing expertise in cryptocurrency and finance.

Meanwhile, other listed companies are also increasing their SOL holdings. For example, DFDV further expanded its SOL holdings, now totaling over 1 million. BTCM disclosed its purchase of approximately 27,190 SOL and plans to convert some of these assets to Solana. This institutional demand is expected to reduce the amount of circulating chips in the secondary market, thereby supporting the supply and demand dynamics.

ETH ETF leads the market, while SOL ETF is waiting for a breakthrough

The assets under management of ETH spot ETFs have surpassed $22 billion, demonstrating not only institutional recognition of ETH but also its unparalleled advantages in liquidity and market depth. Driven by the continued influx of institutional funds, BlackRock submitted its ETH ETF staking application last month. If approved, it will provide holders with stable staking returns and attract more long-term capital.

In contrast, despite REX-Osprey's launch of the Solana ETF (SSK) in July, featuring a staking mechanism, market interest has been muted, with zero net inflows on most trading days and only approximately $150 million in cumulative inflows since its listing. Furthermore, it is not a standard SEC-registered spot ETF, but rather indirectly holds Solana through other vehicles. This structure, combining a staking mechanism with an offshore ETF configuration, complicates understanding and operation, leading some institutions to remain on the sidelines. The issuer, REX, also lacks the brand and channel influence of Wall Street giants like BlackRock and Fidelity, and lacks the endorsement of a major institution.

The market's focus is currently shifting to the SOL spot ETF applications from VanEck, Grayscale, and others, which are expected to be approved in October. Once regulatory approval is granted, coupled with the funding boost from treasury strategies, and if institutional investors begin to diversify from BTC and ETH to other high-quality assets, the SOL ETF could provide a new growth point for the Solona ecosystem.

A fork in the road for applied narrative

From the perspective of application narrative, ETH and Solana are currently on two completely different tracks.

Ethereum is steadily building a compliant, sustainable on-chain financial infrastructure. The surge in stablecoins has been described by Tom Lee as the crypto industry's "ChatGPT moment." Currently, the global stablecoin market capitalization exceeds $250 billion, with over half of issuance and approximately 30% of gas fees occurring on the Ethereum network. This not only further solidifies ETH's core position in the payment and clearing system but also provides a steady stream of cash flow for businesses like staking, DeFi yield farming, and on-chain infrastructure.

Furthermore, Robinhood's issuance of equity tokens on Ethereum's Layer 2 and Coinbase's vigorous development of the Base Chain ecosystem have brought ETH to even more application scenarios. Currently, Ethereum is practically the only blockchain that simultaneously meets regulatory compliance, ecosystem maturity, and scalability requirements. Once ETH establishes a key position in stablecoin payments and RWA liquidations, its strategic position will be prioritized by financial institutions, much like a "structured subscription right."

Solana, on the other hand, has focused its narrative on the "old-fashioned" high-volatility sectors of meme coins and the Launchpad wars. Despite multiple attempts to enter the RWA space this year, including supporting a series of tokens like $IBRL and the Believe ecosystem under the slogan "Internet Capital Market," these efforts have all failed. However, things have recently taken a turn for the better. On August 8th, CMB International, a subsidiary of China Merchants Bank, partnered with Singapore's DigiFT and OnChain, Solana's public blockchain service provider, to tokenize a US dollar money market fund mutually recognized in Hong Kong and Singapore. The tokens were issued on the blockchain as CMBMINT, setting a benchmark for cross-border RWA compliance cooperation. That same day, the price of Solana surpassed $200, prompting the market to see it as a potential starting point for a new narrative, hoping that this new application scenario would open up broader institutional funding channels for Solana.

Summarize

While Solana currently lags behind ETH in key metrics like market popularity and exchange rate performance, its underlying competitiveness and potential remain undiminished. As a US-based blockchain, it naturally possesses greater regulatory compliance and capital market recognition. Currently, ETH is garnering institutional favor thanks to its treasury strategy, the ETF boom, RWAs, and stablecoin applications. This also leaves Solana with an opportunity for a catch-up rally and a shift in narrative.

From a structural perspective, the anticipated approval of a spot ETF will open up new institutional capital inflows for Solana. Once products from major players like VanEck and Grayscale are approved, market liquidity and trading depth are likely to surge. Furthermore, the cross-border implementation of RWA demonstrates that Solana's capabilities on a high-performance public chain extend beyond memes and launchpads. Future penetration in areas like DeFi, payments, and asset tokenization remains substantial. The current pullback is more of a buildup of strength than a curtain call.