In June of this year, online brokerage giant Robinhood launched a new service for European users, offering trading opportunities in the "stock tokens" of top private unicorn companies like OpenAI and SpaceX. Robinhood even airdropped a small amount of OpenAI and SpaceX tokens to qualified new users as a means of attracting new users.

However, this move was immediately opposed by OpenAI. OpenAI officially clarified on X that "these OpenAI tokens do not represent OpenAI equity, and we have no partnership with Robinhood." Elon Musk did not directly comment on Robinhood's tokens in this post, but he retweeted OpenAI's statement, sarcastically saying, "Your own 'equity' is fake." This quip not only mocked OpenAI's capital operations after becoming a for-profit organization, but also indirectly pointed out the strong resistance of private companies to being deprived of their "pricing power" over such shares.

Despite skepticism, traditional brokerages' attempts reflect the market's strong interest in on-chain pre-IPO asset trading. The reason is simple: the huge dividends of the primary market have long been captured by a small number of institutions and high-net-worth individuals, leading to dramatic valuation increases for many star companies upon their IPOs (or acquisitions). For example, the design software company Figma, after failing to complete its acquisition with Adobe due to antitrust concerns, went public independently in 2025 at an IPO price of $33 per share. The stock price soared to $115.50 on its first day of trading, a 250% increase. This price translates to a market capitalization of nearly $68 billion, far exceeding the $20 billion valuation Adobe had previously negotiated with the company. Another example is the recently listed crypto exchange Bullish, which saw its stock price surge 290% upon opening.

These cases demonstrate that investing in such companies before they go public can yield returns several times, or even dozens of times, higher. However, traditionally, participating in such opportunities has been difficult and complex for average investors. The appeal of the on-chain Pre-IPO concept lies in allowing retail investors to share in the value-added dividends of future star companies through blockchain.

The size and barriers of the private equity market

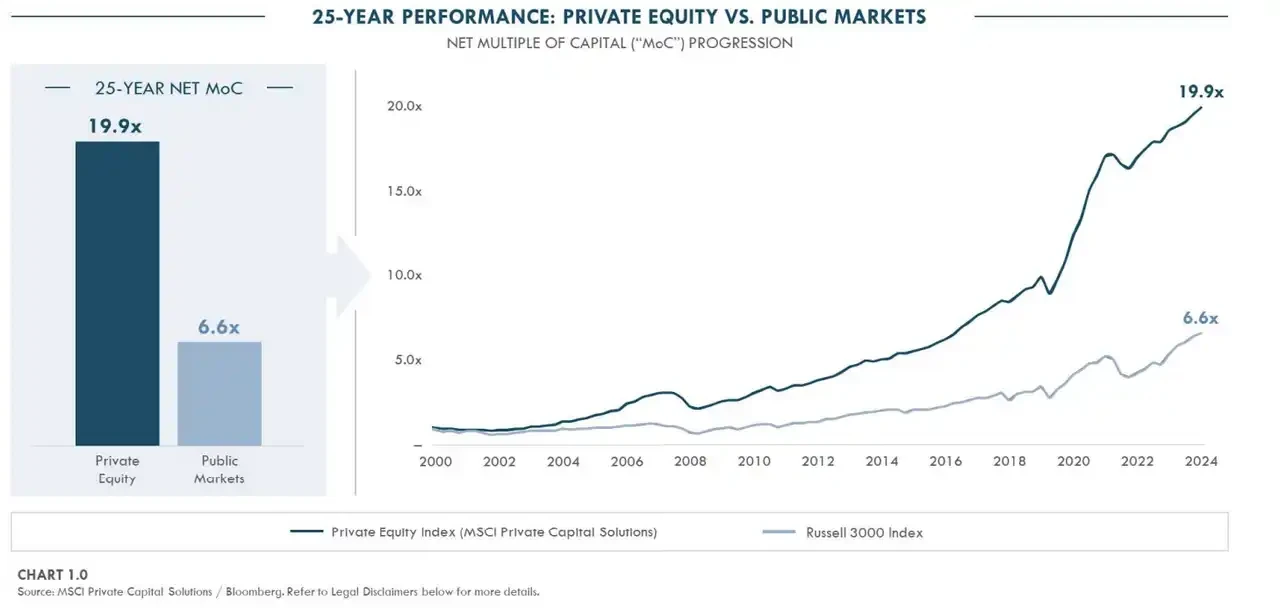

Over the past few decades, the global private equity market has been enormous and rapidly growing, yet highly closed. According to research by Yann Robard, a partner at Dawson Management, in his article " Why Private Equity Wins: Reflections on a Quarter Century of Outperformance ," over the past 25 years, the private market has created approximately three times the value of the public stock market during the same period. Many outstanding companies have delayed or even bypassed IPOs, raising billions of dollars through multiple rounds of private financing. For example, OpenAI secured $6.6 billion from investors including Microsoft and SoftBank in October 2024, and completed another $40 billion in March 2025, becoming the largest private equity financing round in history. With ample private capital, many companies can remain private for extended periods or list later. As a result, enormous growth dividends accrue before companies even go public, but only institutional investors can participate in these gains, completely excluding the general public.

Chart comparing value creation in private and public markets over the past 25 years, source: Dawsonpartners

Traditionally, a handful of secondary trading platforms targeting wealthy investors (such as Forge and EquityZen in the US) have provided limited pre-IPO share transfer channels. However, these platforms primarily employ a peer-to-peer matching model, with high entry barriers, typically targeting only accredited investors, with minimum investments of tens of thousands of dollars. This OTC model results in poor market liquidity, a lack of pricing discovery mechanisms, and low trading efficiency. Furthermore, the charters of many unicorn companies place significant restrictions on share transfers, requiring company approval for employees or early shareholders to sell their shares.

Under the current regulatory framework, the private equity secondary market is virtually closed to ordinary investors. However, this barrier is gradually opening up. For example, in June of this year, Nasdaq Private Market (NPM) launched Tape D, a real-time dataset of private equity companies. This data provides price transparency and valuation visibility for private and pre-IPO companies, allowing users to access the information they need through an API. This also provides a more level playing field for oracles.

The pre-IPO market isn't new to the crypto space. For the past few years, this model has struggled to achieve widespread adoption due to limitations in technical performance, regulatory compliance, and insufficient investor education. However, the landscape is maturing, with significant improvements in blockchain scalability and user experience, and increasingly robust infrastructure such as custody and KYC/AML. Furthermore, AI and crypto companies are rapidly approaching IPOs, creating new narratives and investment demand for early exposure to these high-growth targets. Compared to simply investing in highly volatile crypto assets, pre-IPO tokenized products offer both speculative potential and structured, predictable exit paths, attracting more funds seeking diversified investment opportunities.

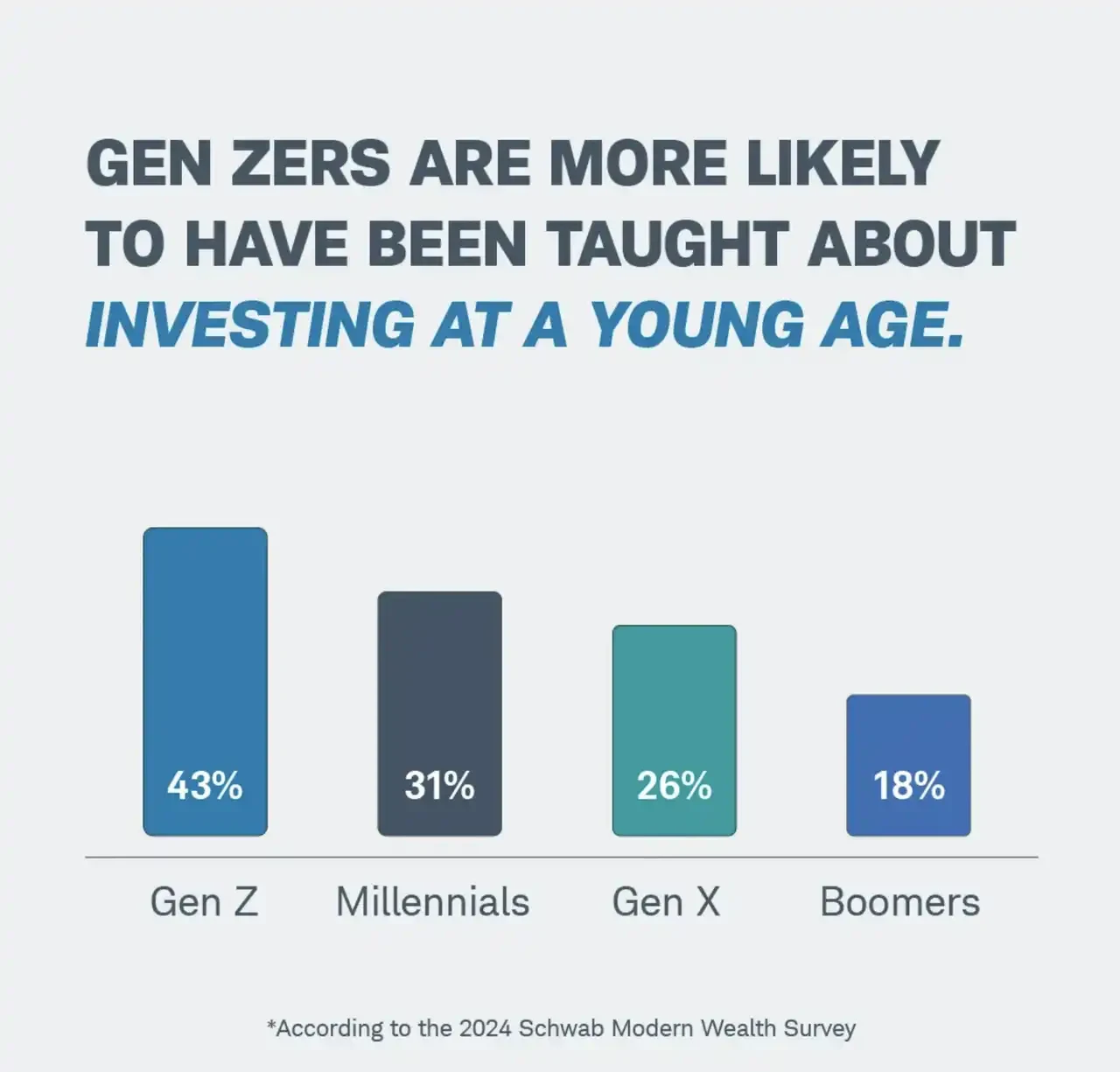

More importantly, Millennials and Generation Z are becoming the primary investors. They prefer direct investments, trade frequently, and actively seek out high-potential private equity opportunities, such as SpaceX, OpenAI, and Anthropic. However, under traditional frameworks, these deals are virtually inaccessible to them. If the pre-IPO market can leverage on-chain tokenization to divide unlisted shares into small, low-barrier-to-entry units and introduce transparent secondary liquidity mechanisms, it will have the potential to provide these young investors with cost-controlled, self-managed investment options that align with their values, thereby bringing an unprecedented pool of incremental global retail capital to private equity.

Gen Z and millennials are more inclined to invest their money rather than putting it into retirement. For more detailed data on these dimensions, see Jarsy's Medium research report.

Through tokenization, previously expensive and scarce unlisted equity can be broken down into small digital tokens and traded on-chain 24/7. Smart contracts can also automatically enforce rights like dividends and voting rights, enhancing transparency and efficiency. More importantly, if these tokens can be traded on a decentralized exchange (DEX) or a compliant platform, market makers and liquidity pools can provide continuous quotes, avoiding the illiquidity inherent in pure peer-to-peer transactions. In theory, tokenizing private equity could allow retail investors worldwide to participate in the growth of top private companies with minimal barriers to entry, improve price discovery, and make pricing more market-based and transparent.

Of course, the grander the vision, the more limited the reality. Traditional regulatory complexities, resistance from private companies, and the complexity of technological integration all remain unresolved challenges on the path to tokenization. Even so, over the past year or so, with shifting policy trends, we have seen a surge in projects exploring on-chain pre-IPO transactions. Some focus on derivatives and leveraged trading, while others specialize in the tokenized transfer of real equity.

Pre-IPO on-chain transactions

This type of platform focuses on the trading experience and often doesn't directly hold actual shares in the underlying companies. Instead, it allows users to bet on the rise and fall of private company valuations through derivatives or other mechanisms. This approach offers the advantages of low barriers to entry and no complex equity delivery process; however, challenges lie in pricing and compliance risks.

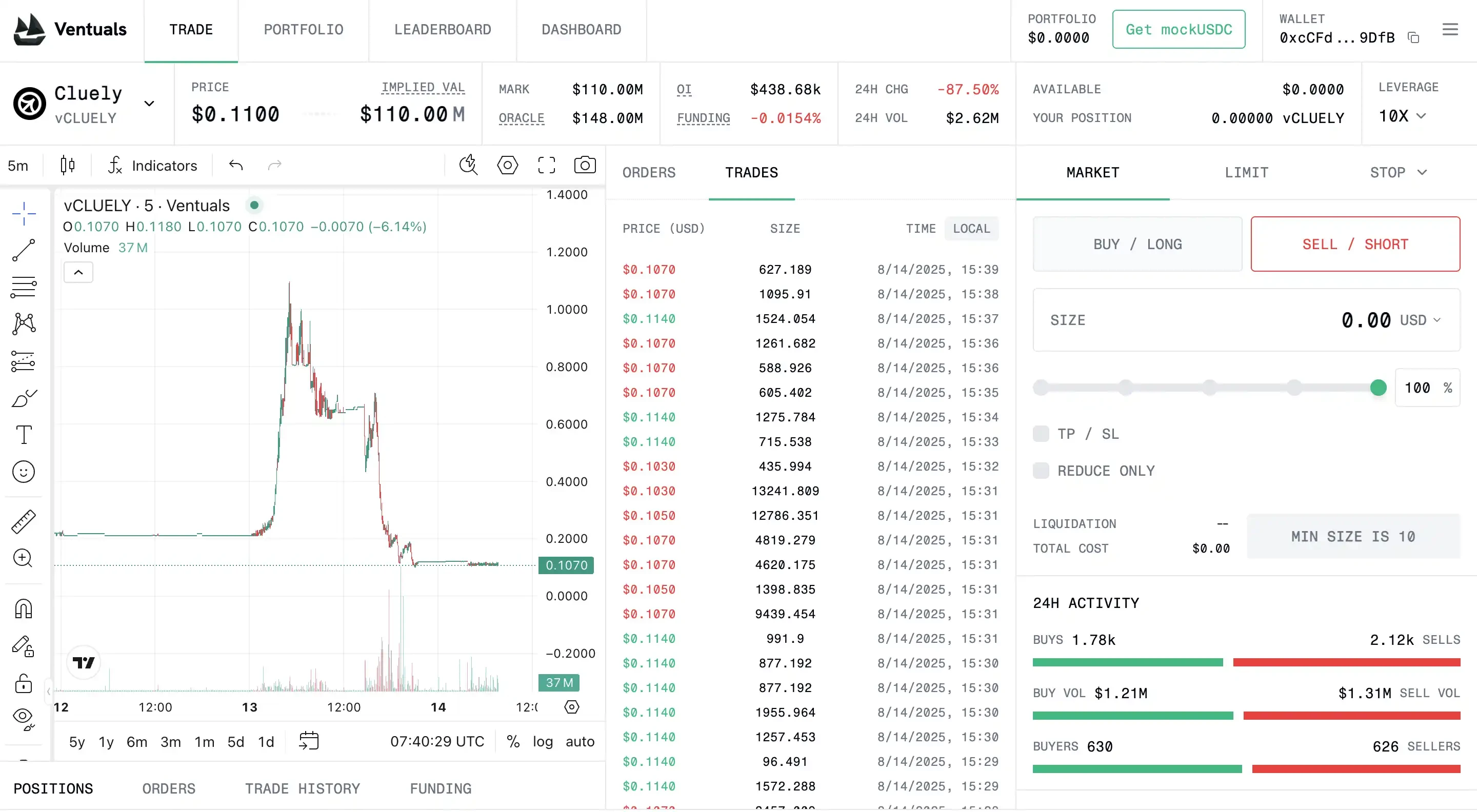

Ventuals : Ability to open 10x leveraged "Pre-IPO Perpetual Contract" on Hyperliuqid

Ventuals is a new project incubated by Paradigm and founded by Alvin Hsia, who is also the co-founder of the recently popular content platform Subs.fun. He also previously co-incubated the end-to-end data platform Shadow as Paradigm's Eir (Entrepreneur in Residence).

Ventuals aims to enable users to trade perpetual futures contracts on private companies on the Hyperliquid blockchain. This model is similar to common contract trading in the crypto market, but with the underlying asset being a valuation index of a popular startup. Ventuals' core advantage lies in providing a trading market without requiring users to own the underlying stock, making it more similar to prediction platforms like Polymarket. This also allows it to bypass many traditional securities regulatory requirements (such as identity verification and accredited investor qualifications).

The platform leverages Hyperliquid's HIP-3 standard to create custom perpetual contract markets and employs an "optimistic oracle" mechanism to obtain valuation data. Anyone can submit a company valuation and pledge a security deposit. If no one challenges the price, the price is valid. Disputes are resolved through on-chain voting. This mechanism brings consensus on private valuations, previously difficult to obtain, to the blockchain, providing a basis for pricing.

Ventuals' pricing method is also interesting. Rather than directly using the company's most recent funding round share price, it uses the company's valuation divided by $1 billion as an anchor for the token price. For example, if OpenAI's latest valuation is $350 billion, then the initial price of one vOAI token is set at $350. This design lowers the barrier to entry and makes the price figures intuitive. However, the problem is that private company valuations are inherently opaque and infrequently updated, relying primarily on occasional financing or secondary trading information. While Ventuals has introduced techniques such as oracles and EMA (exponential moving average) to smooth prices, information asymmetry remains a major drawback: when underlying data is lagging or even distorted, derivatives trading based on it can amplify market volatility. Platforms like Polymarket that utilize oracles have encountered issues related to these flaws. At a larger scale, the rapid trading process could cause Ventuals even greater problems.

Thanks to the founding team that used investors' money to buy Ferrari, its market valuation plummeted. Source: Ventuals

As a trading platform, Ventuals' biggest selling point is offering long or short opportunities with up to 10x leverage, allowing users to "gain big profits with a small investment." However, the platform is currently still in the testing phase (running only on the testnet). Ventuals is pursuing a fully decentralized derivatives approach, leveraging high-performance on-chain matching (Hyperliquid's ability to process 100,000 orders per second) to create a global pre-IPO exchange without the need for trustworthy intermediaries. Of course, the regulatory compliance challenges remain substantial. Although these contracts do not hold actual shares, they are essentially bets on securities prices and may still be considered securities derivatives by regulators. Furthermore, who will provide liquidity and guarantee the accuracy of the oracles remains uncertain.

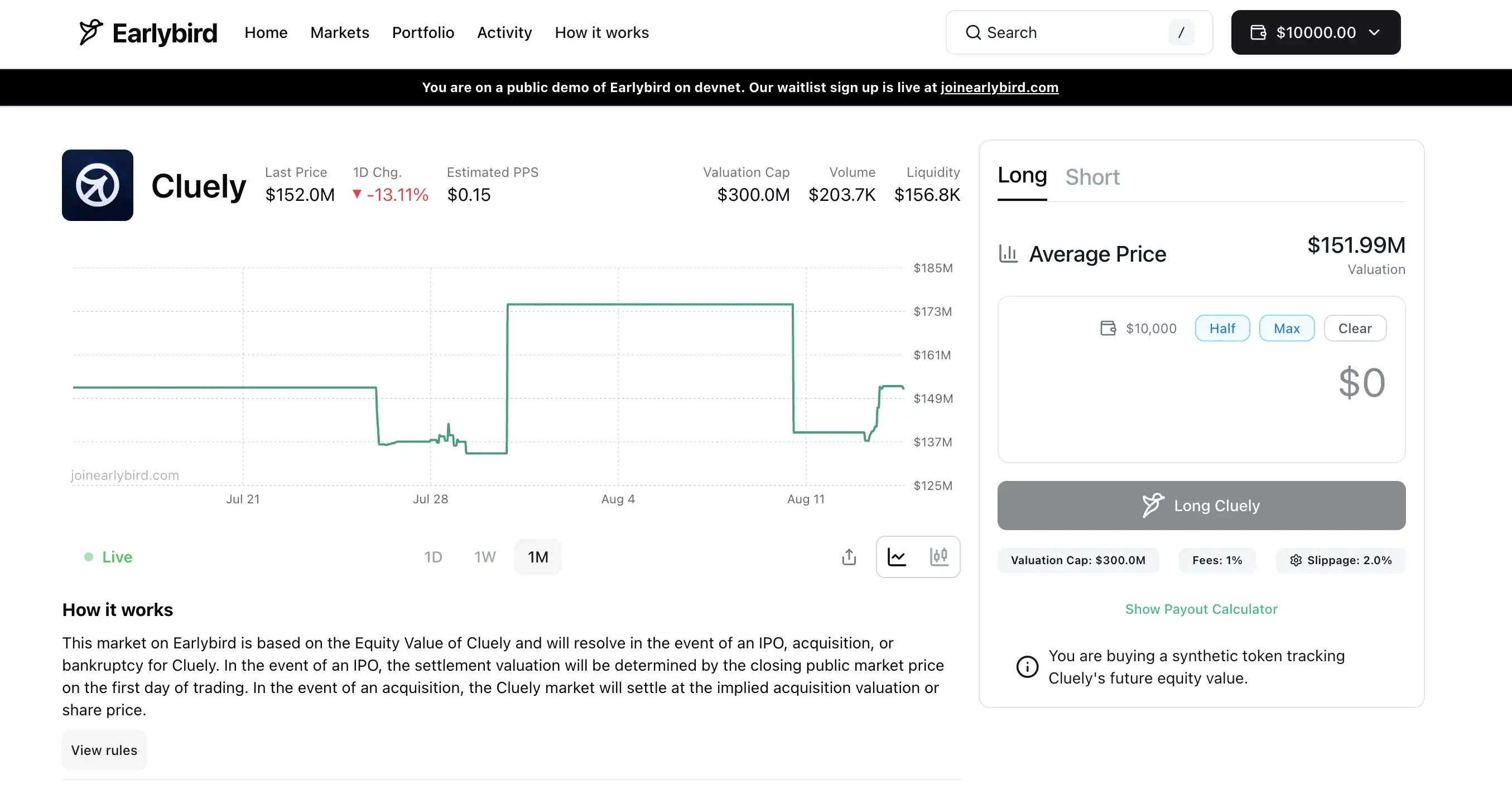

Earlybird : Pre-IPO Long/Short Market on Solana

Earlybird, founded by the team behind Hyperspace, the NFT marketplace on Solana (which ceased operations in 2024 and even Twitter renamed itself from Hyperspace to Earlybird), also focuses on allowing users to "go long or short" companies before their IPOs, positioning itself as a next-generation private equity trading platform for retail investors. The team, having previously received investment from top crypto venture capital firms (such as Dragonfly and Pantera) and accumulated experience in the Solana NFT space, is now shifting its focus to the pre-IPO market.

It seems that the prices given by the oracles of the two platforms are a bit different. I don’t know whether it will be fixed after the launch. In the future, with the help of polymarket, it may be possible to arbitrage on multiple platforms.

Earlybird's founding team includes Hyperspace co-founders Kamil Mafoud and Santhosh Narayan. After Hyperspace shut down its NFT business in 2024, the team reportedly began focusing on Earlybird's development. In fact, they may be more comfortable with the concept of a "pre-IPO platform" than an "NFT platform." Both have experience as investment analysts at Morgan Stanley, and Wall Street connections are likely more important in this field than in the cryptocurrency sector.

The specific form of Earlybird's product has not yet been fully disclosed (the platform is still in closed beta, requiring applications), but users can try it out on the Dev testnet (with a $10,000 trial bonus, lol). Based on its promotional information, it seems likely to be similar to Ventures, leveraging on-chain derivatives or simulated assets to allow users to bet on the valuation of private companies. Solana's high-speed, low-fee on-chain environment is also suitable for building real-time trading markets. The team may adopt an order book or AMM market maker mechanism to provide more continuous liquidity than traditional OTC trading. It's worth noting that Solana already has similar pre-IPO asset trading practices, such as PreStocks, as well as earlier on-chain US stocks (such as the now-defunct mStock synthetic asset on Mango Markets).

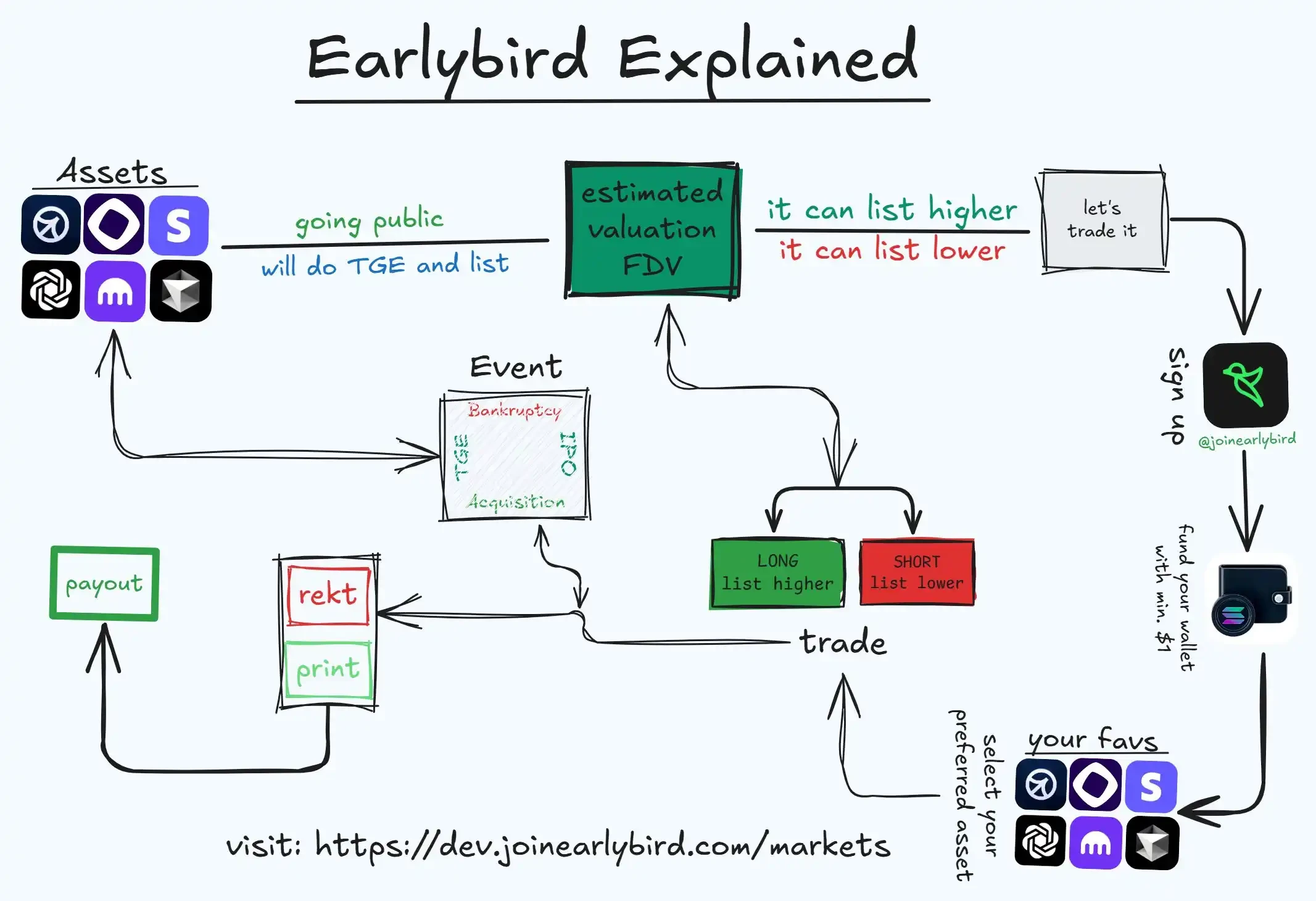

Earlybird’s trading logic, source: @0xprotonkid

From a market perspective, Earlybird may take a more open and decentralized approach, with relatively loose restrictions on user regions and qualification requirements. In short, Earlybird is an active explorer of the Pre-IPO track in the Solana camp. Like Ventures, it has chosen the idea of "not touching real equity and realizing the market through derivatives." Its success or failure depends largely on whether it can solve the two core issues of valuation pricing and compliance risk control.

PreStock (backed by Republic): The "good kid" among equity token trading platforms

Compared to the "asset-light" models of Ventures and Earlybird, PreStocks is closer to traditional stock trading, albeit on-chain. Founded by a Singaporean team and backed by the established private equity platform Republic Capital, PreStocks holds shares in real private companies through a special purpose vehicle (SPV) and issues tokens pegged 1:1 to the underlying assets.

Simply put, if PreStocks purchases a batch of OpenAI's initial shares through an SPV, it will mint "pOPENAI" tokens on Solana at a ratio of one token per share for users to trade. Each token is backed by actual shares, and investors holding these tokens enjoy nearly the same economic benefits as holding shares (such as stock price appreciation and future IPO cash flow), but without direct legal shareholder status or dividends.

PreStocks currently supports token trading for 22 private companies, including prominent unicorns like OpenAI and Canva. Users can buy and sell these tokens with a Solana wallet for as little as a few dollars, with no investment threshold. Tokens on PreStocks can be freely transferred on-chain, traded or borrowed on decentralized exchanges (DEXs), and even used to provide liquidity to earn trading fees or build new structured products. PreStocks integrates with the Jupiter aggregator and Meteora market maker, enabling 24/7 trading and instant settlement.

To ensure each token is backed by real shares, PreStocks has a regulated custodian holding the underlying shares and has committed to regularly disclosing audit reports. However, the team has yet to release detailed documentation supporting its holdings, stating only that all tokens are 100% fully collateralized. Given its involvement with private equity, PreStocks faces significant compliance pressures. Therefore, it has blocked users from major jurisdictions such as the United States (KYC is not required for on-chain trading, but is required for minting or redeeming PreStocks). The company was registered in Singapore due to its relatively relaxed regulations.

PreStocks founder Xavier Ekkel once stated his vision to make private equity investing as easy as trading public stocks. By providing retail investors with zero-barrier access to unicorns, PreStocks has indeed weakened the monopoly of the traditional secondary market. However, this model also has significant limitations. Firstly, liquidity: Due to the limited supply of shares per company (currently, the market capitalization of a single company's token on the PreStocks platform is typically only a few hundred thousand dollars), market depth is shallow, and large transactions can impact prices. Compared to established secondary institutions like Forge, which handle a median transaction size exceeding $5 million and possess an institutional-grade order management system, PreStocks' trading system requires the support of a broader user base.

Secondly, its scalability is limited by its 1:1 shareholding structure. For each new target, PreStocks must negotiate the purchase of actual stock offline. This requires case-by-case communication with sellers (employees, venture capital firms, funds, etc.), a lengthy process that is subject to the target company's wishes. Furthermore, PreStocks itself is not a licensed securities exchange and operates primarily in a gray area. If regulators change their stance, the platform could be forced to restrict or liquidate related assets.

Overall, PreStocks takes a more tangible approach than derivatives, using real money to "buy a path" for retail investors. Its advantage is greater investor protection (backed by real shares, ensuring real returns in future IPOs), but its disadvantages include high operating costs and significant compliance challenges. I believe Repuic prefers to develop PreStocks into an on-chain "high-liquidity trading platform" to distribute its mirror tokens. Because it operates under Reg CF rules, limiting investments to $5,000 and requiring a one-year lockup, and limiting liquidity and "lockup" restrictions on the acquired centralized trading platform INX, Repuic chose the "unconventional" approach of PreStocks.

Further reading: Figma is scheduled to be the largest IPO in the US this year. Can you buy its private equity on Republic?

A platform focused on tokenizing real equity

This type of platform directly offers end-users the opportunity to purchase equity in private companies, essentially a form of on-chain securities issuance or private crowdfunding. These platforms typically require investors to hold or lock up actual shares, using tokens as proof of future returns. This model is closer to traditional finance, but leverages blockchain for registration and transactions, and is therefore often managed by traditional financial firms or Fintech companies.

Jarsy : A group buying site for equity tokens

Among the many pre-IPO projects, Jarsy stands out for its steady progress. It launched quietly on the Arbitrum network in 2024. Jarsy, Inc., the San Francisco-based company behind it, was founded by Hanqin, Chunyang Shen, and Yiying Hu. The founding team includes former Uber China executives and Afterpay's engineering lead, with a deep understanding of the operations and regulation of internet products. It secured $5 million in funding from institutions including Breyer Capital, with other prominent industry figures including Mysten Labs CEO Evan Cheng, Anchorage CEO Nathan McCauley, and Huma Finance CEO Richard Liu. Jarsy's mission is to "democratize private investment through blockchain." Through strict 1:1 physical asset backing, it provides ordinary investors with access to equity in unicorn companies.

Jarsy's operating model involves first listing a target company's pre-IPO equity product on the platform, allowing users to pre-subscribe (payable in USDC or US dollars). Once a certain subscription threshold is reached, Jarsy negotiates with venture funds, early shareholders, or employees holding shares in the company to use the raised funds to acquire a certain amount of actual equity. If the acquisition is successful, tokens equal to the number of shares actually paid are minted and distributed to investors. If negotiations fail or insufficient funds are raised, the funds are returned. This process is similar to traditional private equity share transfers, but leverages the crowdfunding principle of "raise first, then buy," and uses on-chain tokens as proof of stake.

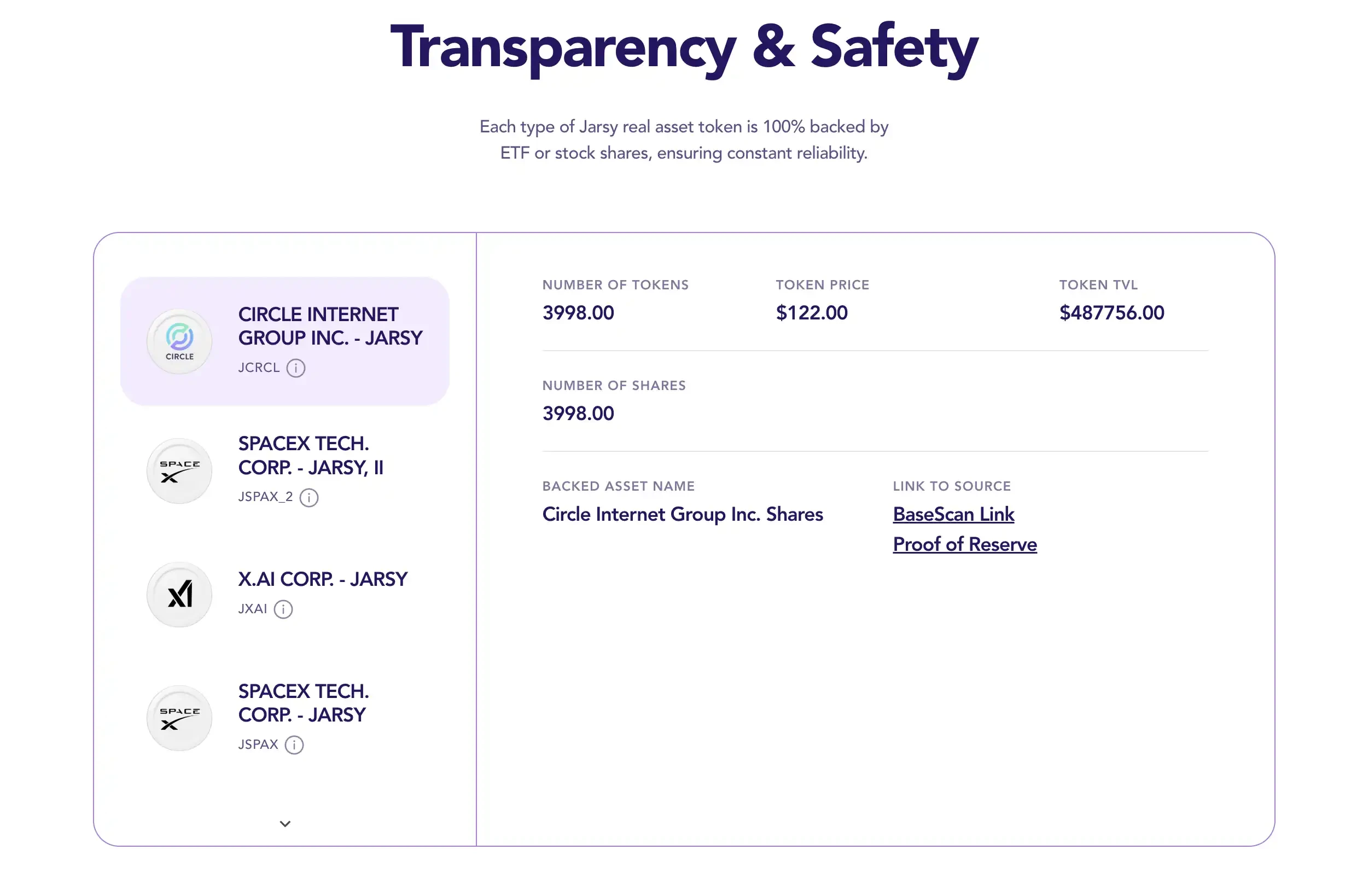

Jarsy similarly holds all stock holdings in a dedicated SPV (Special Purpose Vehicle) and provides a real-time on-chain proof-of-reserve page for easy access. Each Jarsy token (e.g., JSPACEX represents SpaceX shares) purchased by investors is backed by one actual share. While token holders are not legal shareholders of the company, they enjoy nearly identical economic rights to stock ownership, including future cash out in an IPO, consideration in an acquisition, and even potential dividends. This distinguishes Jarsy from the other aforementioned projects, making it more like a private equity "group buying website."

Yet, Jarsy has significantly lowered the barrier to entry, with investments starting at just $10 per transaction. Even more remarkable, with the exception of US investors, global users can participate without the need for accredited investor verification. Jarsy also optimizes the Web 2 user experience, supporting email registration and fiat payment, creating a custodial wallet for users, and making the complexities of blockchain virtually invisible when purchasing tokens. Jarsy prioritizes compliance and ease of use, aiming to build a bridge product between a "Web 2 interface and a Web 3 backend." Since its launch, Jarsy has already launched tokenized equity in high-profile companies such as Anthropic, Stripe, and Perplexity AI, with many products selling out immediately.

Of course, the Jarsy model still faces two major challenges. The first is liquidity. Since the supply of each Jarsy token depends on the number of shares actually acquired, and private equity itself lacks public market pricing, when large holders of a large number of tokens sell off, prices can easily plummet or there will be no takers. Currently, Jarsy's largest holdings are X.ai (approximately $350,000), Circle ($490,000), and SpaceX ($670,000), none of which are large in size. In such a shallow market, a sell order of tens of thousands of dollars can crash the price, and trading depth is clearly insufficient.

Secondly, there's the expansion bottleneck common to any project with "real holdings." Jarsy requires significantly more effort to add each new asset than derivatives platforms, and it also requires a high level of connections and resources. Furthermore, despite claiming to prioritize compliance, Jarsy offers unregistered security tokens, raising uncertainties within the US regulatory landscape. However, Jarsy has proactively partnered with top law firms WSGR (Wilson Sonsini, Goodrich & Rosati) to develop a compliance strategy, signaling its intention to seek regulatory exemptions or approvals. This may make it more appealing to institutions in the current regulatory environment.

As CEO Han Qin puts it, "We founded Jarsy to bring private equity investment opportunities, long monopolized by institutions, to everyday people." Despite challenges like liquidity and compliance, Jarsy has taken an important first step and is now one of the more compliant "equity tokenization platforms." As its user base grows and its asset base expands, and if regulatory approval is gradually achieved, it's possible that its tokens will eventually be circulated in compliant secondary markets, making pre-IPO equity a truly mainstream asset class.

Opening Bell : A Pioneer in Traditional Stock Chain Reform

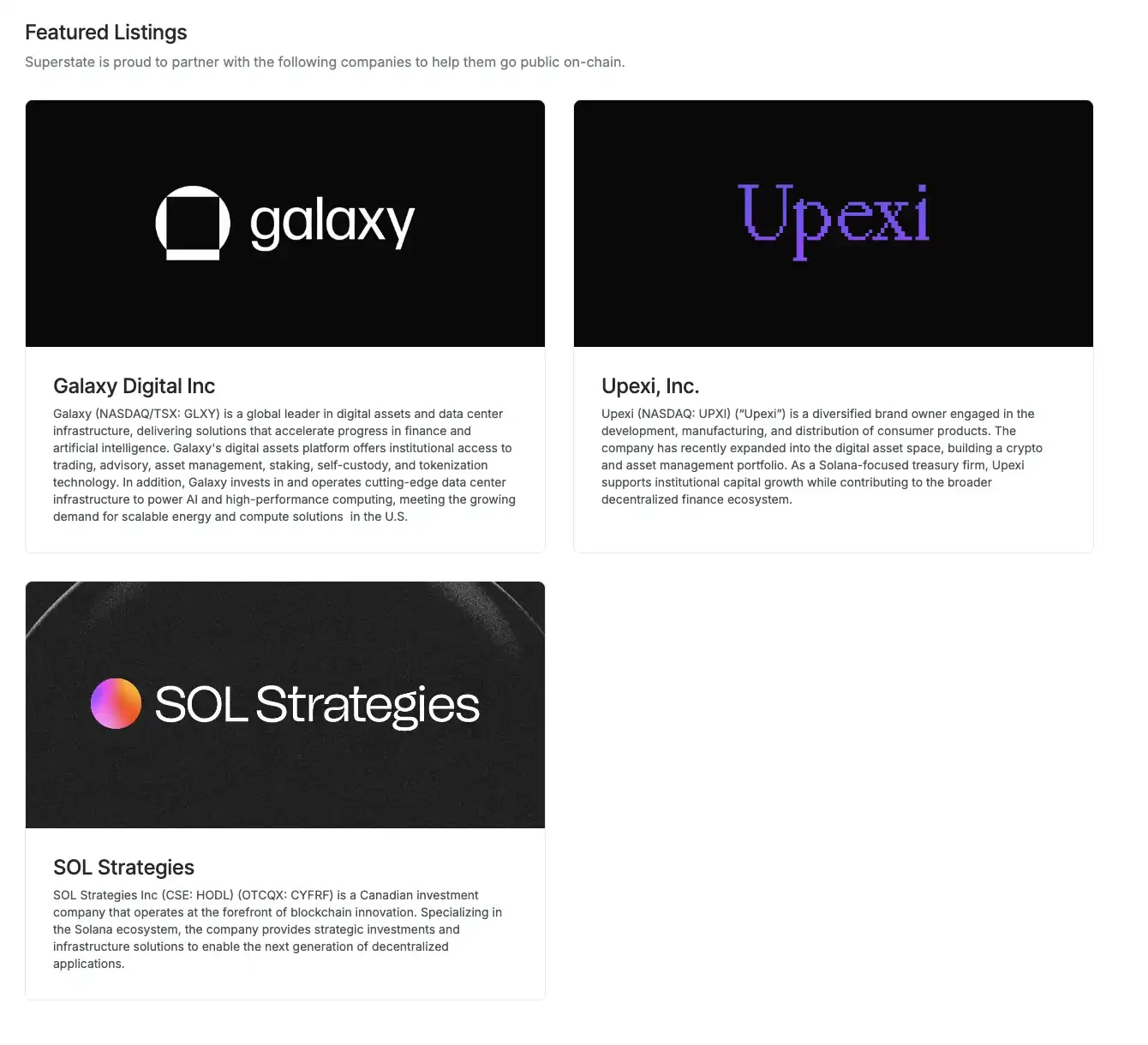

The Opening Bell platform, launched by Superstate, offers an alternative path, allowing companies to directly bring their own stock onto the blockchain. Unlike the aforementioned projects, where a third party purchased shares and issued tokens, here the company itself becomes the issuing entity. In May 2025, Superstate (a compliant fintech company founded by Compound founder Robert Leshner and others) announced the launch of Opening Bell, allowing SEC-registered stocks or eligible private companies to trade on the Solana blockchain 24/7. Simply put, publicly or privately held companies can issue on-chain equity tokens on the Opening Bell platform, ensuring that these tokens represent actual legal equity (not mirror token synthetics).

Initial adopters of this model include Nasdaq-listed Upexi (ticker symbol UPXI) and Canada's SOL Strategies. Galaxy Digital, which recently garnered significant attention for its Ethereum-based token-shares, is also involved (although SOL Strategies is the only company that has not yet listed on Nasdaq). This requires a rigorous legal framework. For example, Superstate has registered a digital transfer agent in the United States to ensure that the on-chain shareholder register is synchronized with the traditional register.

The emergence of Opening Bell marks a further convergence of traditional finance and blockchain. Through this platform, company shares can be traded in real time, 24 hours a day, providing unprecedented flexibility and transparency, making shares "always on," like cryptocurrencies. Private companies can also use Opening Bell to gain early access to liquidity. Companies planning to go public or those not in a rush to IPO can access global investors and raise funds or realize shareholder liquidity by issuing on-chain shares. Superstate has clarified that Opening Bell's target customers include both publicly traded companies and "late-stage private companies" seeking liquidity.

Of course, the advancement of this model still requires regulatory approval. While companies like SOL Strategies have already submitted blockchain-based plans to the SEC, these plans are marked "pending regulatory approval." However, at least on a trend basis, regulators are showing a more open approach to discussing asset tokenization. The US SEC held a special roundtable discussion on securities tokenization in 2025, with even traditional giants like the CEOs of Blackstone and Robinhood publicly expressing their support. Superstate already has successful experience with stablecoins (USTB) and on-chain Treasury bond funds, and its expansion into the stock market is timely.

Regarding pre-IPOs, Opening Bell offers a potential path to a disguised IPO. Instead of going through the lengthy traditional IPO process, companies can leverage blockchain to publicly trade their shares during the private placement phase. For example, a unicorn company could first issue a portion of its equity tokens for trading on Opening Bell, then proceed with a formal IPO or direct integration when conditions are ripe. This is somewhat similar to the traditional OTC market, but with the added benefit of on-chain technology, transparency and efficiency are significantly enhanced.

From a certain perspective, if this model is recognized, future IPOs may no longer require Wall Street underwriters, but instead be completed on-chain. From this perspective, Superstate is like the "Binance Alpha" of Nasdaq.