Title image source: "Big Times"

From Wall Street investment banks to Bay Area technology companies to Asian financial giants and payment platforms, more and more companies are eyeing the same business - stablecoin issuance.

Due to economies of scale, the marginal issuance cost for stablecoin issuers is zero, making this a guaranteed arbitrage game. In the current global interest rate environment, the interest rate differential is incredibly attractive. Stablecoin issuers can simply deposit users' US dollars into short-term US Treasury bonds and earn billions of dollars annually from a steady 4-5% interest rate differential.

Tether and Circle have already proven this approach works. As stablecoin regulations gradually take effect in various regions, the path to compliance becomes clearer, prompting a growing number of companies to embrace the technology. Even FinTech giants like PayPal and Stripe are rapidly entering the market. Furthermore, stablecoins inherently possess the ability to integrate with payments, cross-border settlement, and even Web 3 scenarios, creating enormous potential for innovation.

Stablecoins have become a battleground for global financial companies.

But this is also the problem. Many people only see the arbitrage logic of stablecoins that "seemingly risk-free", but ignore the fact that this is a capital-intensive and high-threshold business.

If a company wants to issue a stablecoin legally and compliantly, how much will it cost?

This article will break down the true cost behind a stablecoin and tell you whether this seemingly easy arbitrage business is worth doing.

Several accounts behind the issuance of stablecoins

In many people’s impressions, issuing stablecoins is nothing more than issuing an on-chain asset, and from a technical perspective, the threshold does not seem high.

However, launching a truly compliant stablecoin for global users requires a far more complex organizational structure and system requirements than one might imagine. These requirements involve not only financial licenses and audits, but also heavy asset investments across multiple dimensions, including fund custody, reserve management, system security, and ongoing operations and maintenance.

In terms of cost and complexity, its overall construction requirements are no less than those of a medium-sized bank or a compliant trading platform.

The first hurdle faced by stablecoin issuers is the establishment of a compliance system.

They often need to simultaneously address regulatory requirements across multiple jurisdictions, obtaining key licenses including the US MSB, New York State BitLicense, EU MiCA, and Singapore VASP. These licenses require detailed financial disclosures, anti-money laundering mechanisms, and ongoing monitoring and compliance reporting obligations.

Compared with medium-sized banks with cross-border payment capabilities, the annual compliance and legal expenses of stablecoin issuers often reach tens of millions of dollars just to meet the most basic cross-border operation qualifications.

In addition to licenses, establishing a KYC/AML system is also a mandatory requirement. Project owners typically need to bring in sophisticated service providers, compliance consultants, and outsourcing teams to continuously implement a comprehensive set of mechanisms, including customer due diligence, on-chain audits, and address blacklist management.

With regulations becoming increasingly stringent, it is almost impossible to obtain access to major markets without establishing strong KYC and transaction review capabilities.

Market analysis indicates that HashKey's application for a Hong Kong VASP license will cost between HK$20 million and HK$50 million, and the company will need to hire at least two regulatory officers (ROs) and work with the three major accounting firms. The fees are several times higher than those in traditional industries.

In addition to compliance, reserve management is also a key cost in the issuance of stablecoins, covering two major parts: fund custody and liquidity arrangements.

On the surface, the asset-liability structure of stablecoins is not complicated. Users deposit US dollars, and the issuer purchases an equivalent amount of short-term US Treasury bonds.

However, once the reserve size exceeds $1 billion or even $10 billion, the underlying operating costs will rise rapidly. Annual fees for fund custody alone can reach tens of millions of dollars. Treasury bond trading, clearing processes, and liquidity management not only incur additional costs but also rely heavily on the collaborative execution of professional teams and financial institutions.

More importantly, in order to ensure the user experience of "instant redemption", the issuer must prepare sufficient liquidity positions off-chain to cope with large redemption requests under extreme market conditions.

This configuration logic is very close to the risk reserve mechanism of traditional money market funds or clearing banks, and is far more than just "smart contract locking".

To support this architecture, issuers must also establish a highly stable and auditable technical system covering key financial processes both on-chain and off-chain. This typically includes smart contract deployment, multi-chain minting, cross-chain bridge configuration, wallet whitelisting mechanisms, clearing systems, node operations and maintenance, security and risk control systems, and API integration.

These systems must not only support large-scale transaction processing and cash flow monitoring, but also be scalable to adapt to regulatory changes and business expansion.

Unlike the "lightweight deployment" of general DeFi projects, the underlying system of stablecoins actually plays the role of a "public settlement layer", and the technical and operation and maintenance costs are often at the level of millions of dollars.

Compliance, reserves, and systems are the three basic projects for the issuance of stablecoins, which together determine whether the project can develop sustainably in the long term.

In essence, stablecoin is not a technical tool product, but a financial infrastructure that combines trust, compliance structure and payment capabilities.

Only those companies that truly possess cross-border financial licenses, institutional-level clearing systems, on-chain and off-chain technical capabilities, and controllable distribution channels can operate stablecoins as platform-level capabilities.

For this reason, before deciding whether to enter this market, companies must first determine whether they have the capabilities to build a complete stablecoin system. These include: Can they obtain sustained regulatory approval in multiple jurisdictions? Do they possess a proprietary or trusted custodial funding system? Can they directly control resources such as wallets and trading platforms to truly achieve a smooth circulation?

This is not an easy entrepreneurial opportunity, but a tough battle that requires extremely high capital, systems and long-term capabilities.

After issuing stablecoins, what next?

Completing the issuance of stablecoins is just the beginning.

Regulatory approvals, technical systems, and custody structures are just the prerequisites for entry. The real challenge is how to make it circulate.

The core competitiveness of stablecoins lies in whether or not they are used. Only when stablecoins are supported by trading platforms, integrated into wallets, accessed by payment gateways and merchants, and ultimately used by users, can they truly achieve circulation. However, this path still carries high distribution costs.

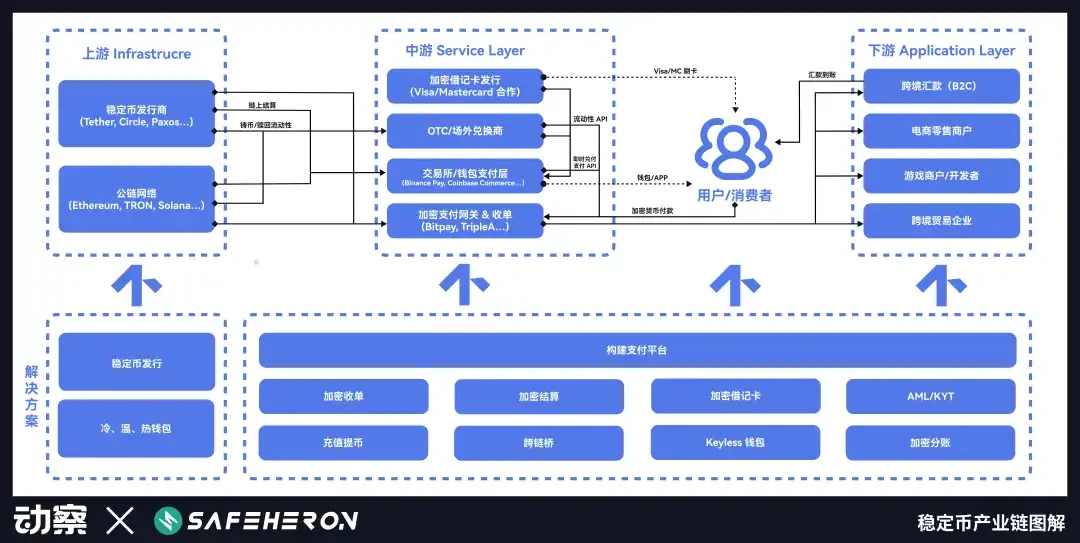

In the stablecoin industry chain diagram released by Insight Beating and digital asset self-custody service provider Safeheron, the issuance of stablecoins is only the starting point of the entire chain. If stablecoins are to be circulated, it is necessary to look to the middle and lower reaches.

Taking USDT, USDC, and PYUSD as examples, we can clearly see three completely different circulation strategies:

USDT relied on Grayscale's early use cases to build an unreplicable network effect, and with its first-mover advantage, it quickly became the market standard.

USDC mainly relies on channel cooperation under the compliance framework and gradually expands on platforms such as Coinbase;

Even though PYUSD is backed by PayPal, it still needs to rely on incentives to increase TVL, and it will always be difficult to enter real usage scenarios.

While their paths diverge, they all reveal the same truth: stablecoin competition lies not in issuance but in circulation. The key to success or failure lies in the ability to build a distribution network.

1. USDT’s unreplicable first-mover structure

The birth of USDT stems from the practical difficulties faced by crypto trading platforms at that time.

In 2014, Bitfinex, a cryptocurrency trading platform headquartered in Hong Kong, expanded rapidly to serve global users. Traders wanted to trade in US dollars, but the platform always lacked a stable channel for US dollar deposits.

The cross-border banking system is hostile to cryptocurrencies. It is difficult for funds to flow between China, Hong Kong and Taiwan. Accounts are often closed and traders may face a capital outage at any time.

Against this backdrop, Tether was born. Initially built on Bitcoin's Omni protocol, its logic was straightforward: users wired US dollars to Tether's bank account, and Tether then issued an equivalent amount of USDT on the blockchain.

This mechanism bypasses the traditional bank clearing system and allows the US dollar to circulate across borders 24 hours a day for the first time.

Bitfinex was Tether's first major distribution node. More importantly, both exchanges were operated by the same people. This deeply intertwined structure enabled USDT to quickly gain liquidity and adoption in its early stages. Tether, in turn, provided Bitfinex with an efficient, albeit ambiguous, USD channel for transacting with the currency. The two parties were colluding, possessing information symmetry and aligned interests.

From a technical perspective, Tether is not complicated, but it solves the pain points of crypto traders in terms of capital inflow and outflow, which is the key to its initial capture of users' minds.

As capital market volatility intensified in 2015, USDT's appeal rapidly grew. Numerous users in non-USD regions began seeking alternatives to the dollar that circumvented capital controls. Tether offered them a "digital dollar" solution that required no account opening, no KYC required, and could be used with an internet connection.

For many users, USDT is not just a tool, but also a means of hedging.

The 2017 IC 0 craze marked a pivotal moment for Tether in achieving its PMF. Following the launch of the Ethereum mainnet, ERC-20 projects exploded, prompting trading platforms to shift towards crypto asset trading pairs. USDT quickly became a "USD stand-in" for the altcoin market. Using USDT, traders could freely move between platforms like Binance and Poloniex to complete transactions without having to repeatedly transfer funds in and out.

Interestingly, Tether has never actively spent money on promotion.

Unlike other stablecoins that adopt subsidy strategies to expand their market share in the early stages, Tether has never actively subsidized trading platforms or users for using its services.

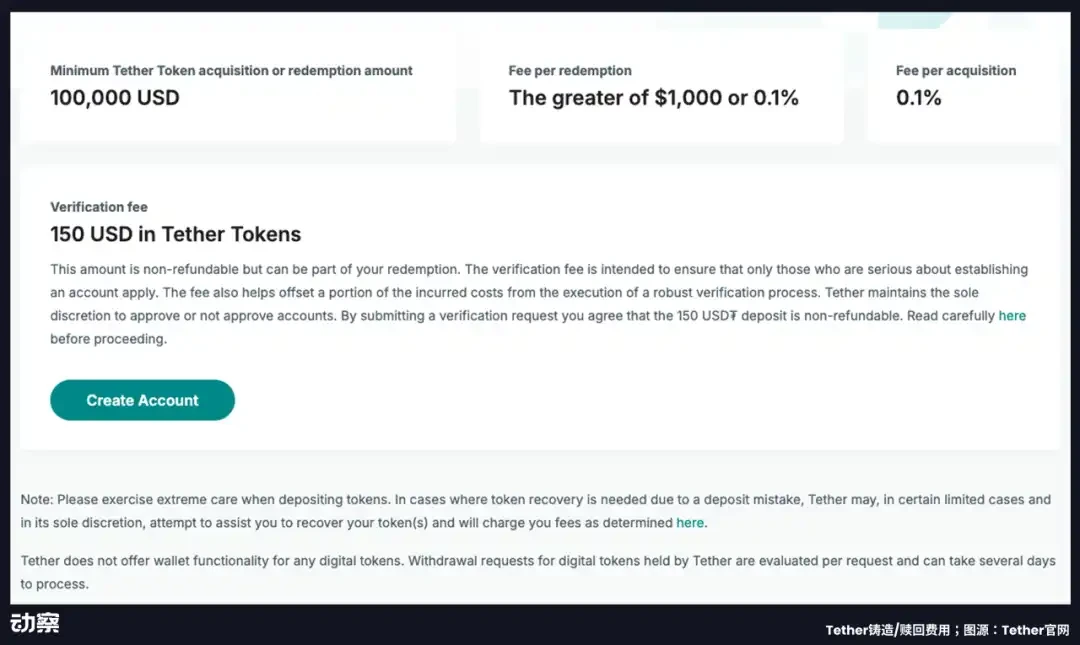

In contrast, Tether charges a 0.1% handling fee for each minting and redemption, and the minimum redemption threshold is as high as US$100,000, and an additional verification fee of 150 USDT is required.

For institutions seeking direct access to its system, this fee mechanism constitutes almost a "reverse marketing" strategy. It's not about promoting a product, but rather setting standards. The cryptocurrency trading network has long been built around USDT, and anyone seeking access must align with it.

Since 2019, USDT has become almost synonymous with "on-chain dollars." Despite repeated regulatory scrutiny, media scrutiny, and controversy surrounding its reserves, USDT's market share and circulation have continued to climb.

By 2023, USDT had become the most widely used stablecoin in non-US markets, particularly in the Global South. In particular, in high-inflation regions like Argentina, Nigeria, Turkey, and Ukraine, USDT was used for salary settlements, international remittances, and even as a replacement for local currencies.

Tether's true moat has never been its code or its asset transparency, but rather the trust and distribution network it established in the Chinese-speaking crypto trading community in its early years. This network, originating in Hong Kong and using Greater China as a springboard, has gradually expanded to the entire non-Western world.

This "first-mover advantage" also means that Tether no longer needs to prove its identity to users. Instead, the market must adapt to its already established circulation system.

2. Why Circle relies on Coinbase

Unlike Tether's natural growth path in the grayscale scene, USDC was designed from the outset as a standardized and institutionalized financial product.

In 2018, Circle and Coinbase jointly launched USDC, aiming to create an on-chain dollar system for institutions and mainstream users within a compliant and controllable framework. To ensure neutral governance and technical collaboration, the two parties each held a 50/50 stake in a joint venture called Center, which is responsible for the governance, issuance, and operation of USDC.

However, this joint venture governance model cannot solve the key problem - how can USDC be truly circulated?

…