Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

Hot money's pursuit of ETH has not diminished - following the short-term correction of the entire cryptocurrency market in the second half of last week, the market finally rebounded this week, and ETH once again became the leader of this small-scale rebound.

OKX market data shows that as of 8:40 Beijing time on August 5, ETH was temporarily reported at 3708 USDT, which has rebounded by more than 10% from the low of 3355 USDT on Sunday morning. Its performance during the same period was significantly better than other mainstream currencies such as BTC and SOL.

Rising logic: Institutional buying

We previously analyzed the underlying logic behind ETH's price rise in detail in the article " Five Key Logics for ETH's Price Increase Become Clearer, Possibly Leading to a Structural Reversal." In short, supported by five key factors—deregulation, increased institutional holdings, foundation reforms, increased on-chain activity, and a return of market confidence—ETH, after a long period of consolidation, may be poised for a structural reversal, with the potential for continued long-term growth.

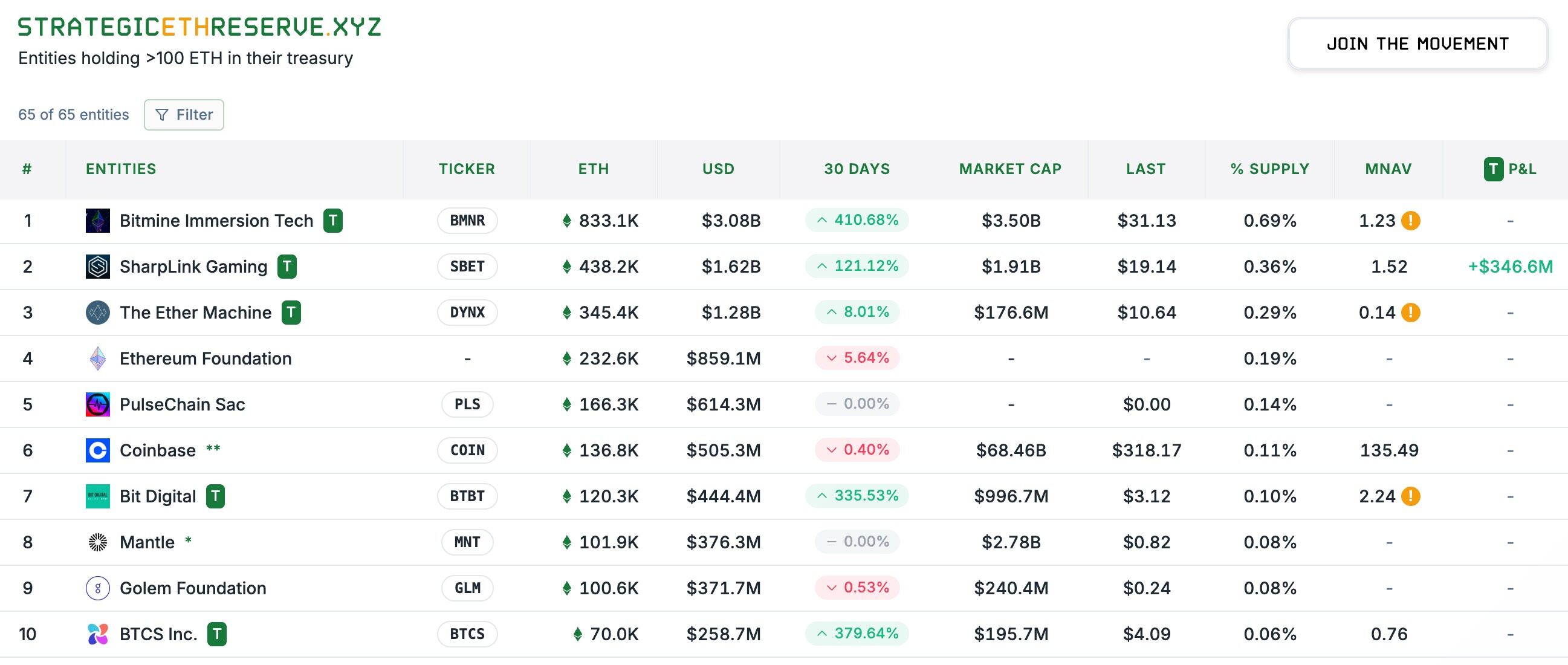

The most critical reason for this is naturally "the crazy pursuit of ETH by institutional funds." Strategic ETH Reserve data shows that as of August 5, Beijing time, three entities have surpassed the Ethereum Foundation in terms of holdings after crazy increases in holdings - BitMine holds 833,000 tokens, worth approximately US$3.08 billion; Sharplink holds 438,000 tokens, worth approximately US$1.62 billion; The Ether Machine holds 345,000 tokens, worth approximately US$1.28 billion.

It is no exaggeration to say that institutional forces represented by BitMine, Sharplink, and The Ether Machine have become the controllers of the current ETH price discourse, and their continuous increase in holdings has become the most powerful buying support for ETH prices.

Next stop, a battle for $4,000?

With the strong rebound of ETH, more and more people are looking forward to when ETH can regain the most important psychological level of $4,000.

The special significance of $4,000 is emphasized because it represents ETH's most glorious past. During the previous DeFi and NFT bull market, ETH reached a high of $4,878. At the end of last year, when BTC surged past $100,000 on the back of Trump's victory, ETH briefly reclaimed the $4,000 mark, only to quickly fall back.

Considering ETH's historical performance, the $4,000 mark has, in a certain sense, become an obsession in the hearts of many "e-guards". If it can be effectively broken through, it will surely greatly boost community confidence. On the contrary, if it still cannot achieve a breakthrough despite so many favorable factors, it will inevitably lead to a larger-scale collapse of faith.

Last week, ETH made several short-term attempts to test $4,000, but each attempt failed. The most unfortunate upsurge came on Tuesday, the eve of its tenth anniversary, when ETH briefly reached $3,941. People had expected a comeback on the anniversary, but unfortunately, it didn't happen.

With ETH showing renewed momentum in this week's rebound, the $4,000 mark is once again within reach. Can ETH reclaim its former glory this time? Based on the analysis of various experts, it seems that the general consensus is that ETH will continue to test $4,000, but there are different views on whether and when this will happen.

Well-known trader Eugene Ng Ah Sio wrote on his personal TG channel yesterday: "The market has been very dangerous these past few days, but we managed to survive. We were almost about to sell at the bottom, but after seeing BTC rebound from $112,000, we decided to hold on. Now we are watching to see if ETH can break through $3,800-4,000 again, looking for a short-term opportunity. However, if the market weakens again... "

Benjamin Cowen, founder of ITC Crypto, said on X: "I think ETH is most likely to take two paths at the moment. I hope to see ETH break through $4,000 in August. If this breakthrough is achieved, even if there is a pullback in September to test the $4,000 support level, it will lay the foundation for a higher price at the end of the cycle. Alternatively, if the breakthrough is not successful in August, we need to pay attention to the pressure performance of the bull market support band - ideally, ETH will form a higher low in this area in September. My basic judgment remains that ETH will set a new all-time high this year, but the path to achieve this goal is difficult to accurately predict."

Well-known international KOL Alyo stated, "In my opinion, ETH remains strong. During this market sell-off, ETH has demonstrated relative resilience against Bitcoin and remains firmly above all key moving averages. The pullback after this surge is a healthy one, and we should regroup and prepare to challenge the ultimate challenger—the $4,000 mark. Although we have failed in previous attempts, we will conquer this fortress next time. Now is not the time to waver, retreat, or indulge in bear market panic."

Meanwhile, some traders have set their sights on higher prices. Greeks.live noted in its latest English community newsletter that the community is expressing cautious optimism, with traders anticipating a market rebound rather than an immediate new high, while maintaining a mix of short call and put options. The altcoin market is showing significant divergence, with some traders remaining bullish on ETH, predicting a price target of over $5,000.

Tom Lee, the head of BitMine and a die-hard cryptocurrency bull, has a more radical view. He believes that $4,000 is only a matter of time, and that the fair price of ETH in the next 12 months may be around $10,000 to $20,000...

Can altcoins follow the rise?

Another big question surrounding ETH’s continued upward surge is - will altcoins follow suit?

Looking at a larger sample, during ETH's strong rebound from the bottom of $1,385, the altcoin market did show a significant follow-up rise, with some tokens such as ENA even rising more than ETH itself; but if we narrow the sample, during ETH's phased rebound this week, except for a few tokens with clear benefits such as FLUID, most altcoins failed to keep up with the pace of ETH's rebound.

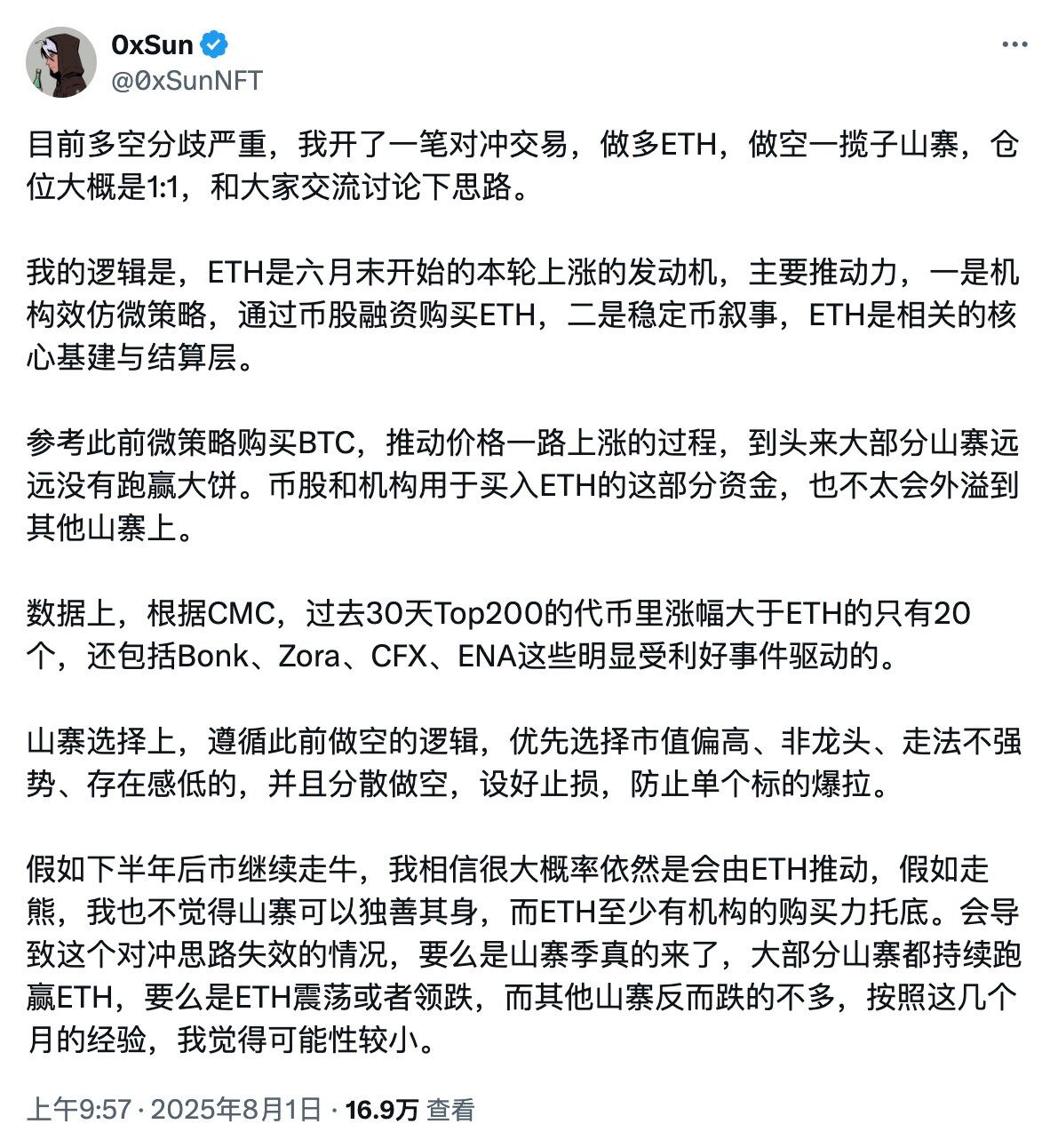

Earlier last week, well-known trader 0xSun wrote that he had gone long on ETH and diversified his short positions in weak altcoins for hedging. The logic was that he did not believe that the funds flowing into ETH would spill over to altcoins.

We tend to agree with this strategy. In previous articles analyzing the "altcoin season," we have repeatedly mentioned the view of Evgeny Gaevoy, founder and CEO of Wintermute: " There may not be another full-scale bull market, and investors will pay more attention to protocols that have real practical uses and sustainable economic models ."

This view has actually been repeatedly verified in the market trends of the past two years. The era of mindless all-in gambling of "one coin rises, ten thousand coins follow" is over. As the cryptocurrency market gradually matures, the demand for investment and research around individual protocols will continue to increase. Investors should not lump all altcoins together, but should screen out their own Alpha and Beta through more comprehensive and in-depth analysis.