Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

Letsbonk.fun has recently completed a counterattack against the track's "big brother" Pump.fun at the data level.

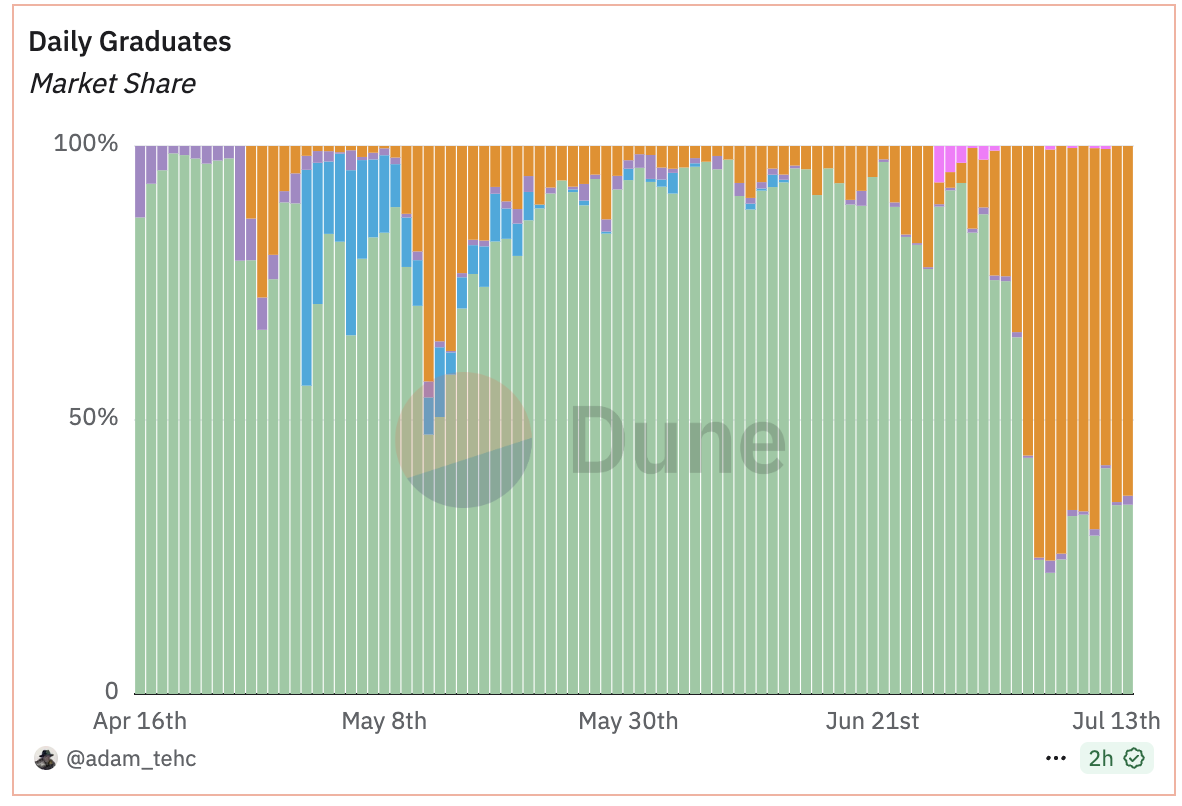

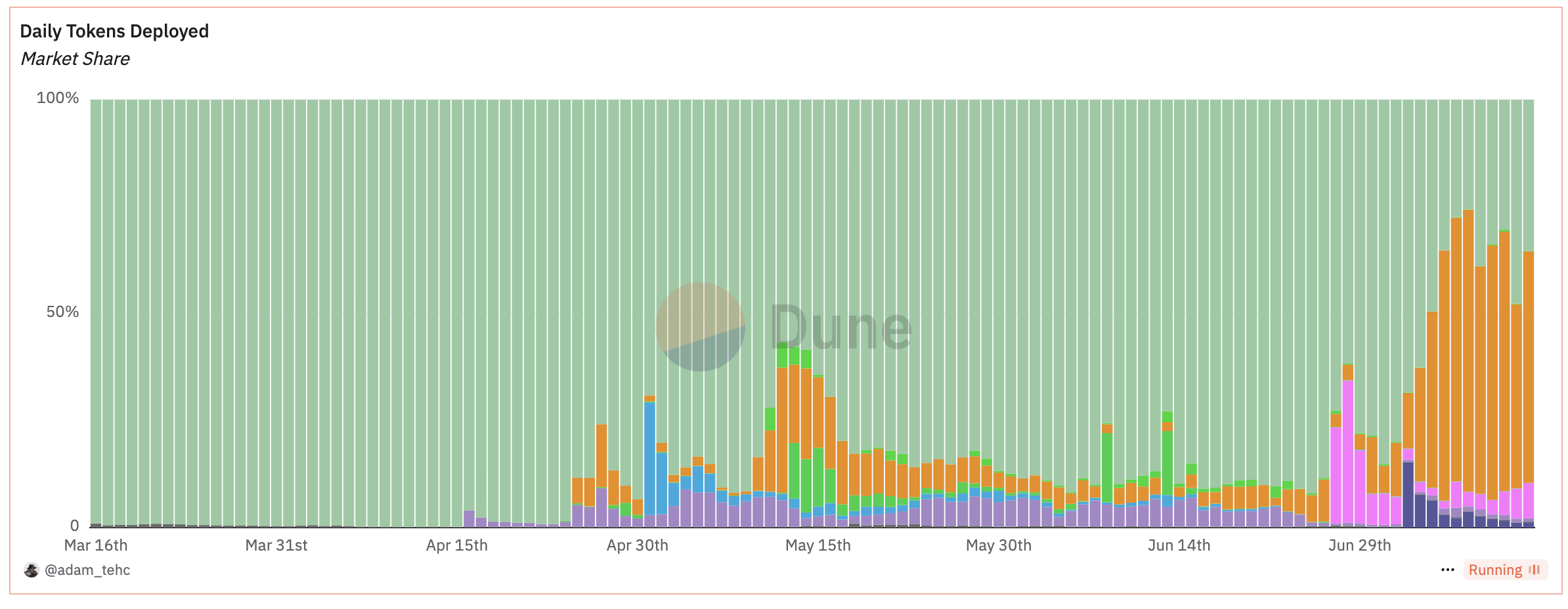

The data panel compiled by on-chain analyst Adam on Dune shows that Letsbonk.fun (the orange part in the figure below) has recently surpassed Pump.fun (the green part in the figure below) in two core data: daily token deployment and daily token graduation , becoming the most popular Meme token launch platform in the market.

With the strong rise of Letsbonk.fun, more and more people have begun to try to find potential wealth codes on this platform, but many people have overlooked another big winner after the surge in Letsbonk.fun data - Raydium.

Why is the rise of Letsbonk.fun good for Raydium? The story starts with the feud between Pump.fun and Raydium.

Pump.fun backs off, Raydium strikes back

We have previously published many articles to follow up on these stories. For details, please refer to " Data analysis shows how much Raydium relies on pump.fun? ", " Raydium fights back against pump.fun, who will have the last laugh in the meme comeback season? ", and " Pump.fun's hegemonic position is shaken for the first time, and Raydium's "wolf pack" strategy has worked ."

To give a brief overview, in the early design of Pump.fun, token issuance needs to go through two stages: "internal market" and "external market" - after the token is issued, it will first enter the "internal market" trading stage, which relies on the pump.fun protocol's own Bonding Curve for matching. When the trading volume reaches US$69,000, it will enter the "external market" trading stage. At that time, liquidity will be migrated to Raydium, a pool will be built on the DEX and trading will continue to be open.

However, Pump.fun announced the launch of its self-built AMM DEX product PumpSwap on March 21. From then on, when the Pump.fun token enters the "external market", the liquidity will no longer be migrated to Raydium, but will be directed to PumpSwap. This move directly cuts off the diversion path from Pump.fun to Raydium, thereby reducing the latter's trading volume and fee income.

In response, Raydium announced on April 16 that it had officially launched the token issuance platform LaunchLab, which allows users to quickly issue tokens through the platform and automatically migrate to Raydium AMM after the token liquidity reaches a certain scale (85 SOL). Obviously, this is Raydium's direct counterattack against the aggressive Pump.fun.

So what does this have to do with Letsbonk.fun?

Value Flow: Letsbonk.fun ➡️ LaunchLab ➡️ Raydium

Although LaunchLab is similar to Pump.fun in terms of token issuance, its biggest feature is not in the issuance process itself - LaunchLab's architecture supports third-party integration, which enables external teams and platforms to create and manage their own launch environments within the LaunchLab ecosystem . In other words, third parties can rely on LaunchLab's underlying technology and Raydium's liquidity pool to launch independent token launch front ends.

The protagonist of this article, Letsbonk.fun, is a third-party launch platform developed by the BONK team based on the LaunchLab framework.

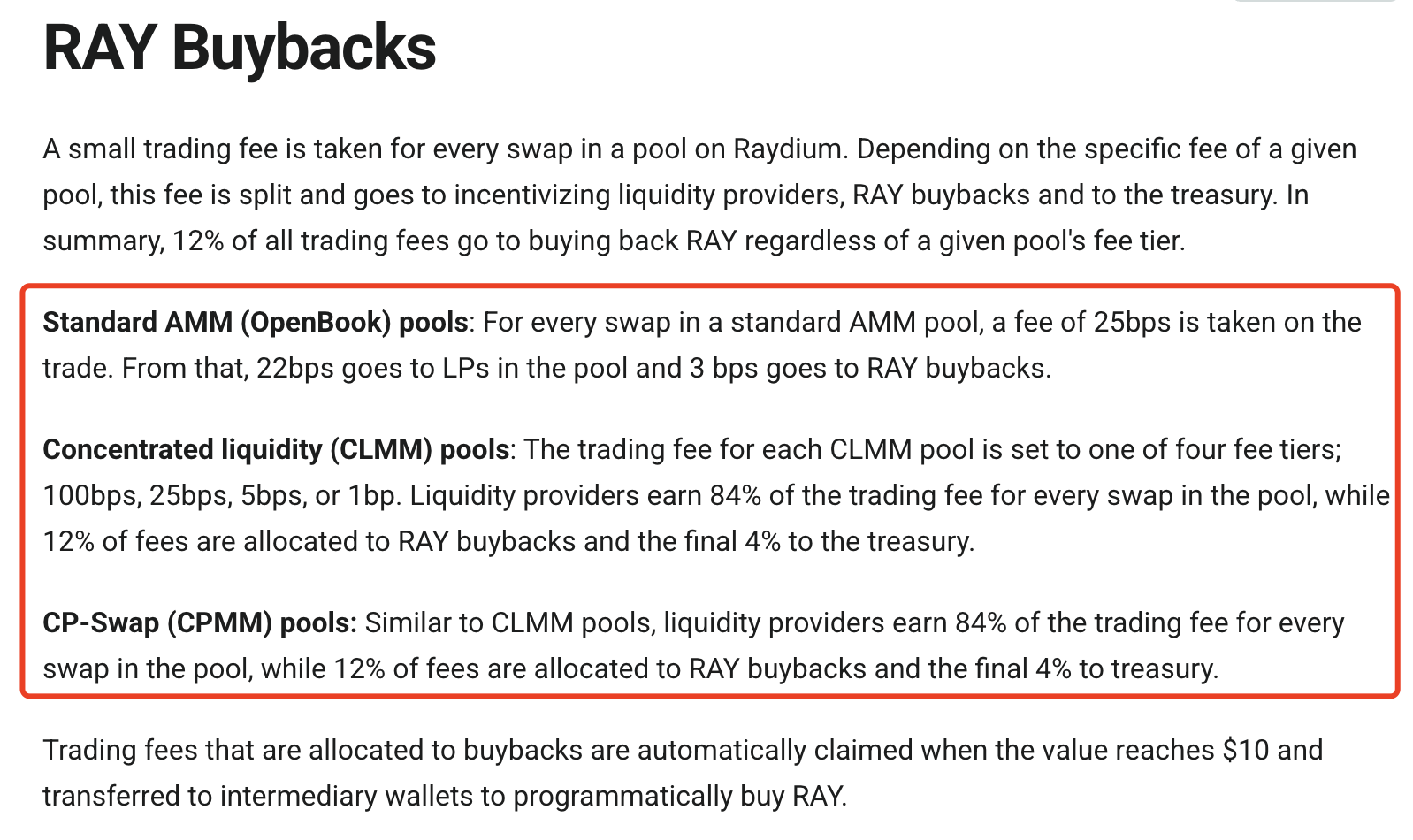

As a third-party platform developed based on LaunchLab, Letsbonk.fun has adopted LaunchLab's fee mechanism. For all Meme tokens issued based on Letsbonk.fun, LaunchLab will charge a 1% joint curve issuance fee, of which 25% will be directly used for the repurchase of RAY; in addition, after the tokens are released from the "internal market", Raydium will also charge fees based on the fee rules of the liquidity pool, and part of the fees will be invested in the repurchase of RAY.

Odaily: Raydium’s fee repurchase ratio for different types of liquidity pools.

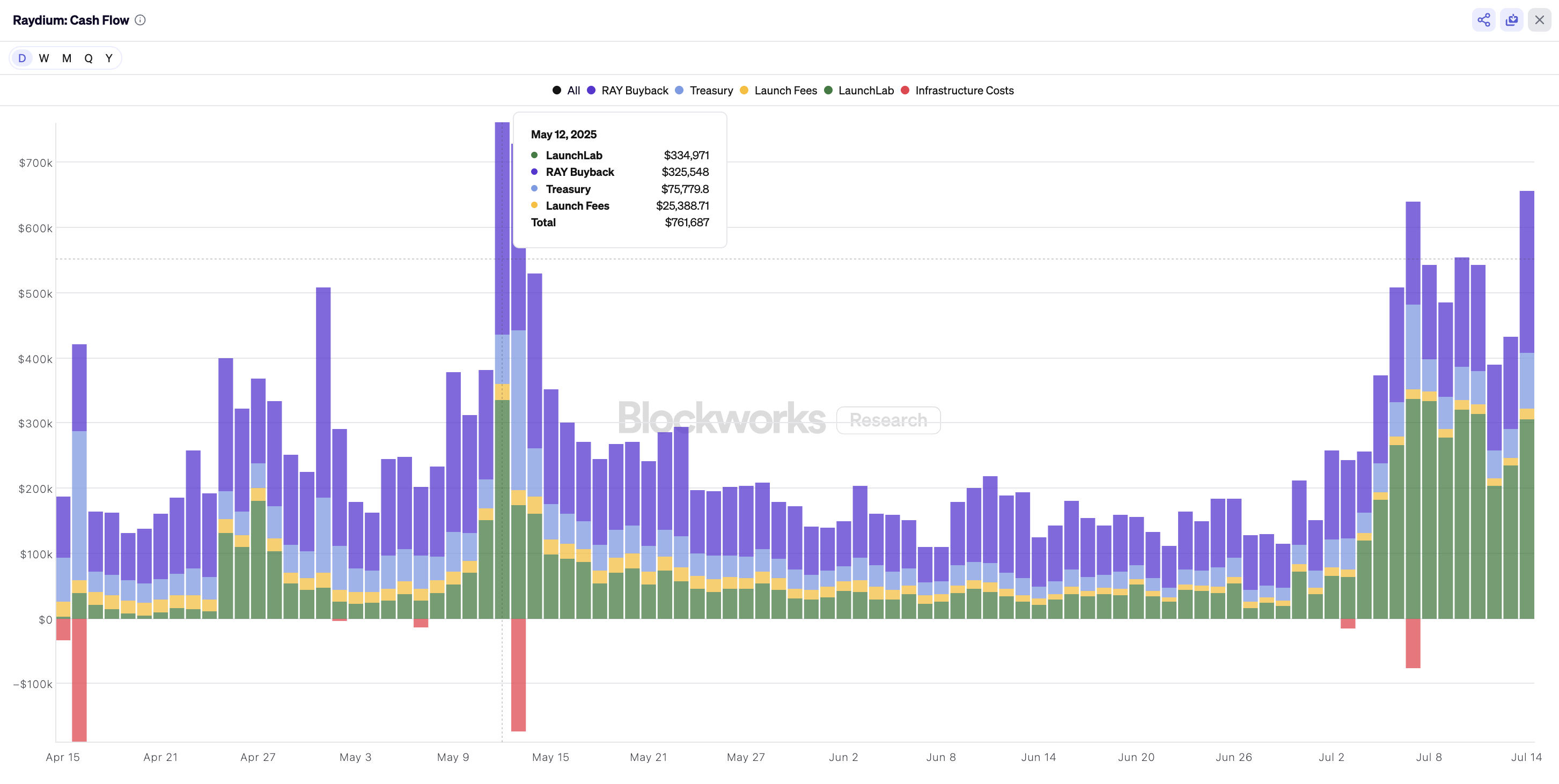

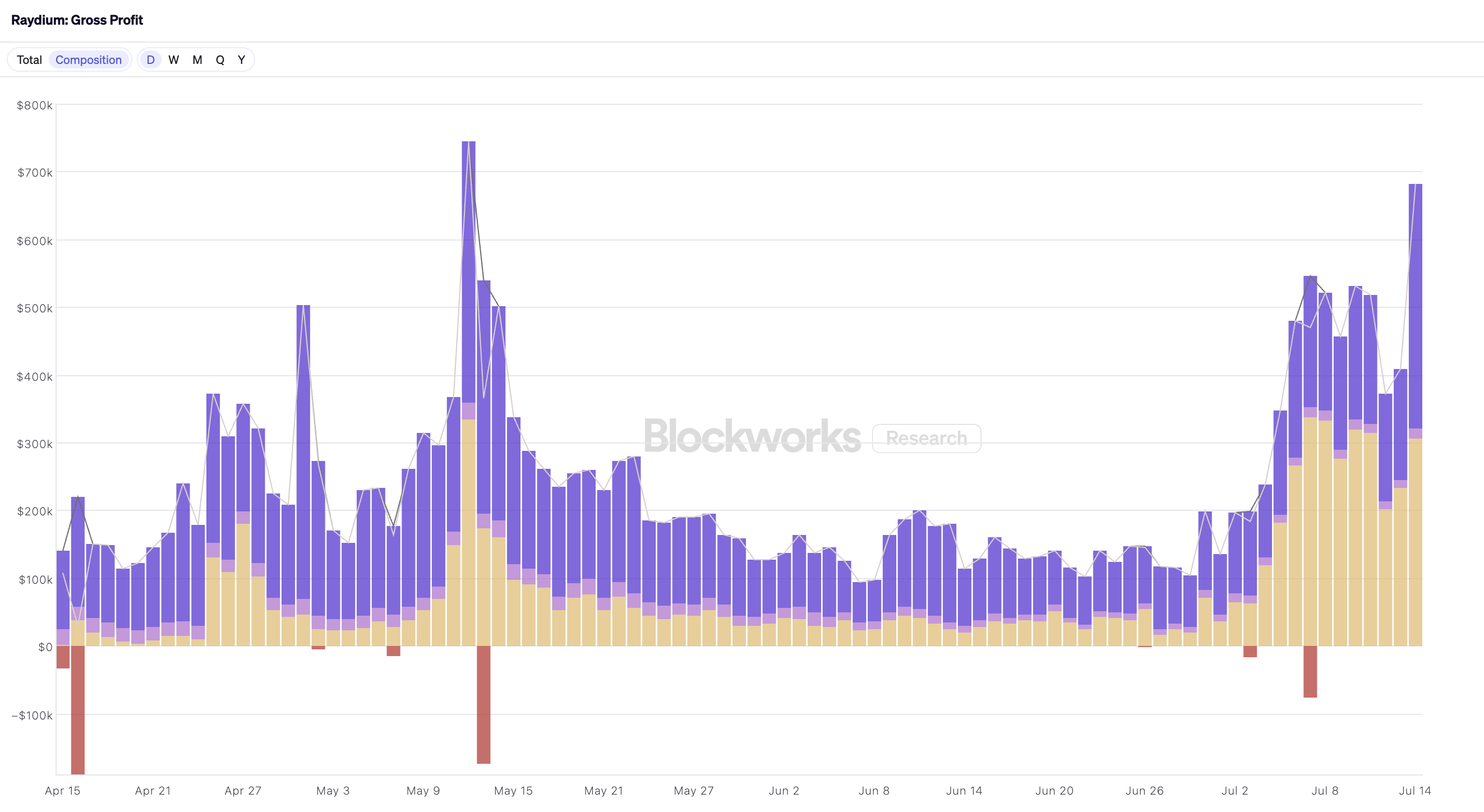

Blockworks data shows that since LaunchLab went online on April 16, Raydium's protocol revenue and RAY repurchase volume have shown significant growth, and its growth trajectory highly overlaps with the data fluctuations of the LaunchLab platform - on May 13 , the LaunchLab platform surpassed Pump.fun for the first time in the number of token graduations, and on the same day Raydium set a recent repurchase peak of US$325,000; in addition, with the recent outbreak of Letsbonk.fun, Raydium's protocol revenue and RAY repurchase volume have once again shown a significant increase.

What is more noteworthy is that previously Raydium's protocol revenue mainly came from the exchange fees of the liquidity pool (the purple part in the figure below), but recently LaunchLab's issuance fee income (the yellow part in the figure below) has gradually surpassed and become Raydium's new main source of income, and 25% of these fees will be directly used for the repurchase of RAY.

Based on yesterday's repurchase data of $249,000, Raydium will be able to invest approximately $90.88 million in the repurchase of RAY each year. The current liquid market value of RAY is approximately $749 million, which means that 12% of RAY's market value will be repurchased each year , which will form a huge and continuous buying force.

In addition to Meme, there is also the tokenization of US stocks

In addition to the continued growth in LaunchLab fee income, the recent hot U.S. stock tokenization is also expected to increase Raydium's protocol revenue.

Previously, Kraken's stock tokenization platform xStocks has been officially launched, and a series of tokenized certificates of popular US stocks have been issued on Solana, and most of these US stock tokens have deployed liquidity pools on Raydium. Although the current trading volume is still limited and the contribution of fees is not obvious, considering the market trend of US stock tokenization, this sector also has strong revenue growth expectations.

Looking ahead, if Letsbonk.fun can continue to maintain its current market share (even without considering the growth of LaunchLab and other third-party platforms), Raydium will be able to maintain its current level of agreement revenue and repurchase strength. Coupled with the potential growth expectations of US stock trading, this data is expected to achieve further breakthroughs.