As geopolitical conflicts fade from view, the most striking development of the past week was not the new tariff levels set by Trump’s “Version 2.0” amendment, but how the market completely ignored the escalation.

The new administration has already imposed 50% tariffs on Brazil, 35% on Canada, 25% on Japan and South Korea, and has promised to impose uniform tariffs of 15-20% on all trading partners. This is undoubtedly beyond market expectations. So, is the market expecting another "TACO-style" policy reversal soon? Or will the current strong momentum in the stock market force the president to take more aggressive action? We will find out soon...

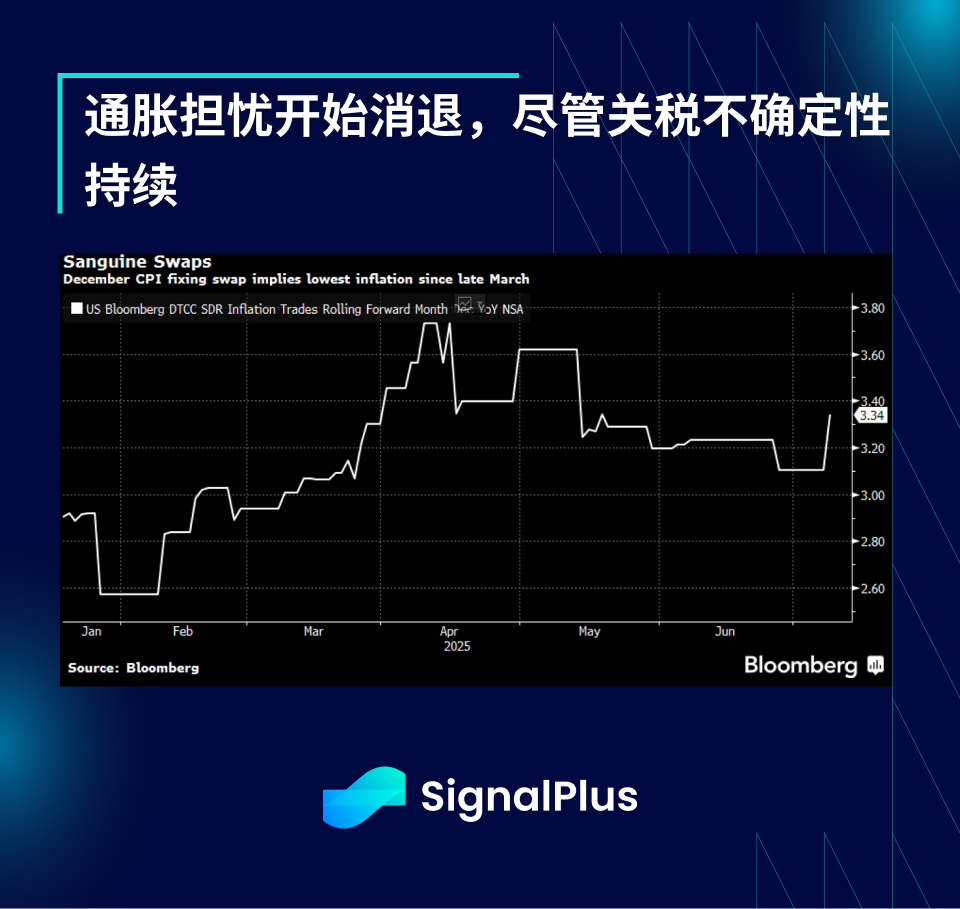

Economic data was muted in line with the recent Goldilocks narrative, and the June FOMC minutes did not offer much new insight. The FOMC “dot plot” remained unchanged, still expecting two rate cuts this year, despite disagreements among Fed members. Some notable quotes include:

“Several participants noted that tariffs would result in a one-time increase in prices”

“The majority of participants pointed to risks [of] longer-lasting impacts”

"Most participants agreed that a modest reduction in the target range for the federal funds rate would probably be appropriate this year."

"Several participants noted that they were willing to consider a rate cut at the next meeting."

A weaker labor market has replaced inflation as the primary concern. Members noted that higher tariffs and policy uncertainty would weigh on employment, and acknowledged that some indicators were showing "signs of softening."

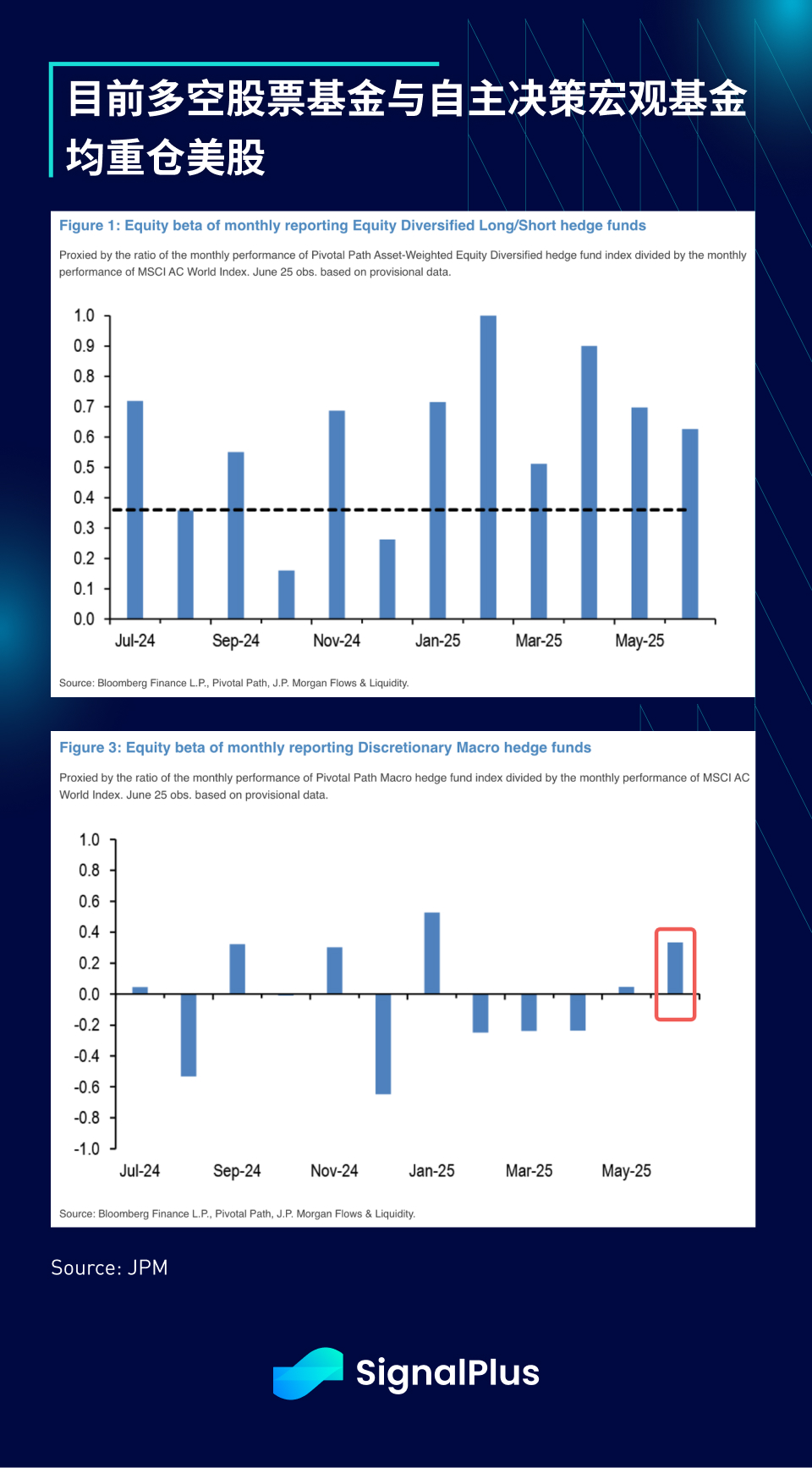

Stocks and Bitcoin both surged to new highs this week, with the former seeing positive inflows across all channels. Long-short hedge funds remained fully invested almost all year, including during the Liberation Day shock, while discretionary macro funds increased their long equity exposure for the first time this year, at the fastest pace since Trump's election.

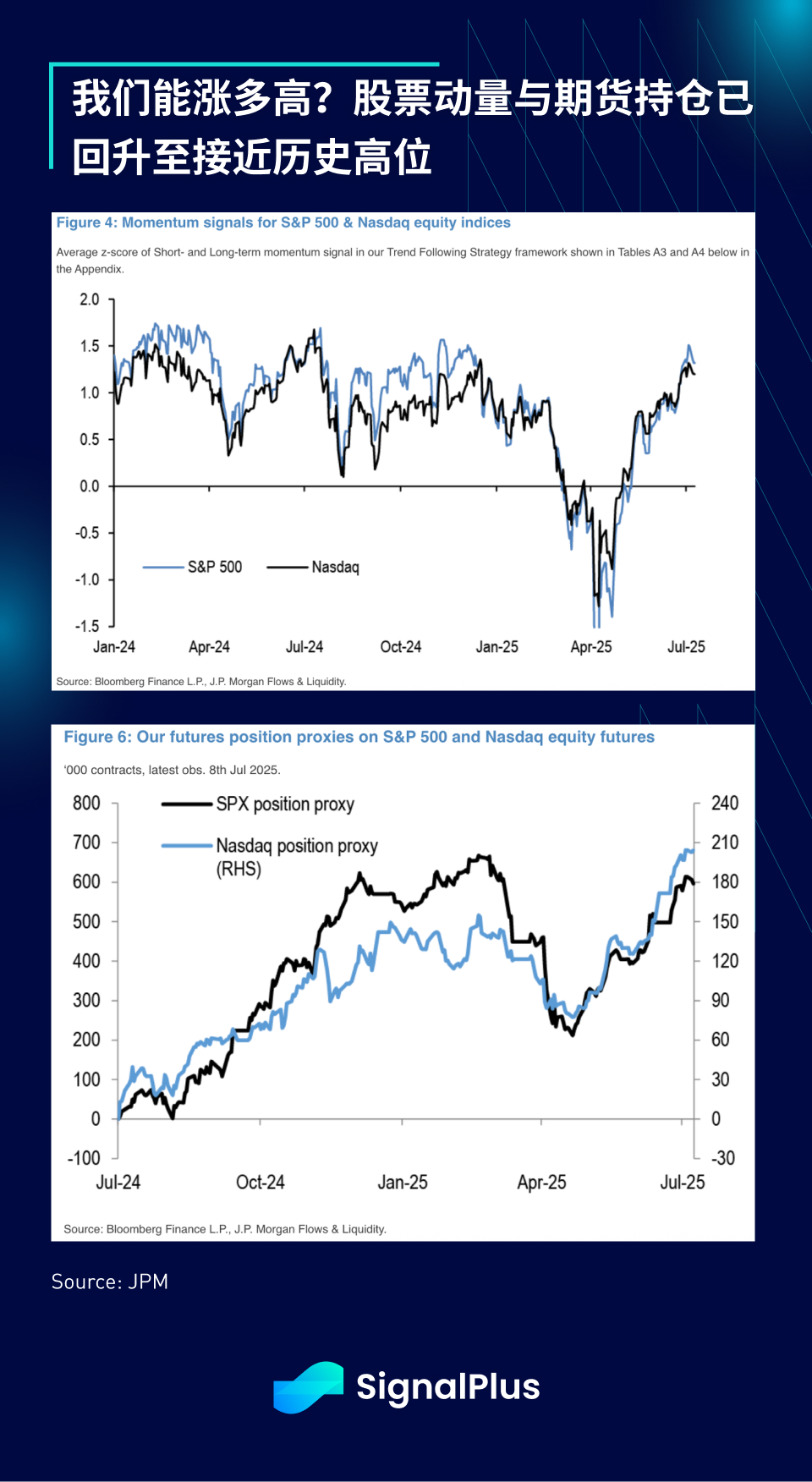

Momentum funds and CTA funds (commodity trading advisors) are also likely to hold long positions given the extremely positive signals sent by the recent market rally, as reflected in the long interest levels in US stock index futures that are close to all-time highs.

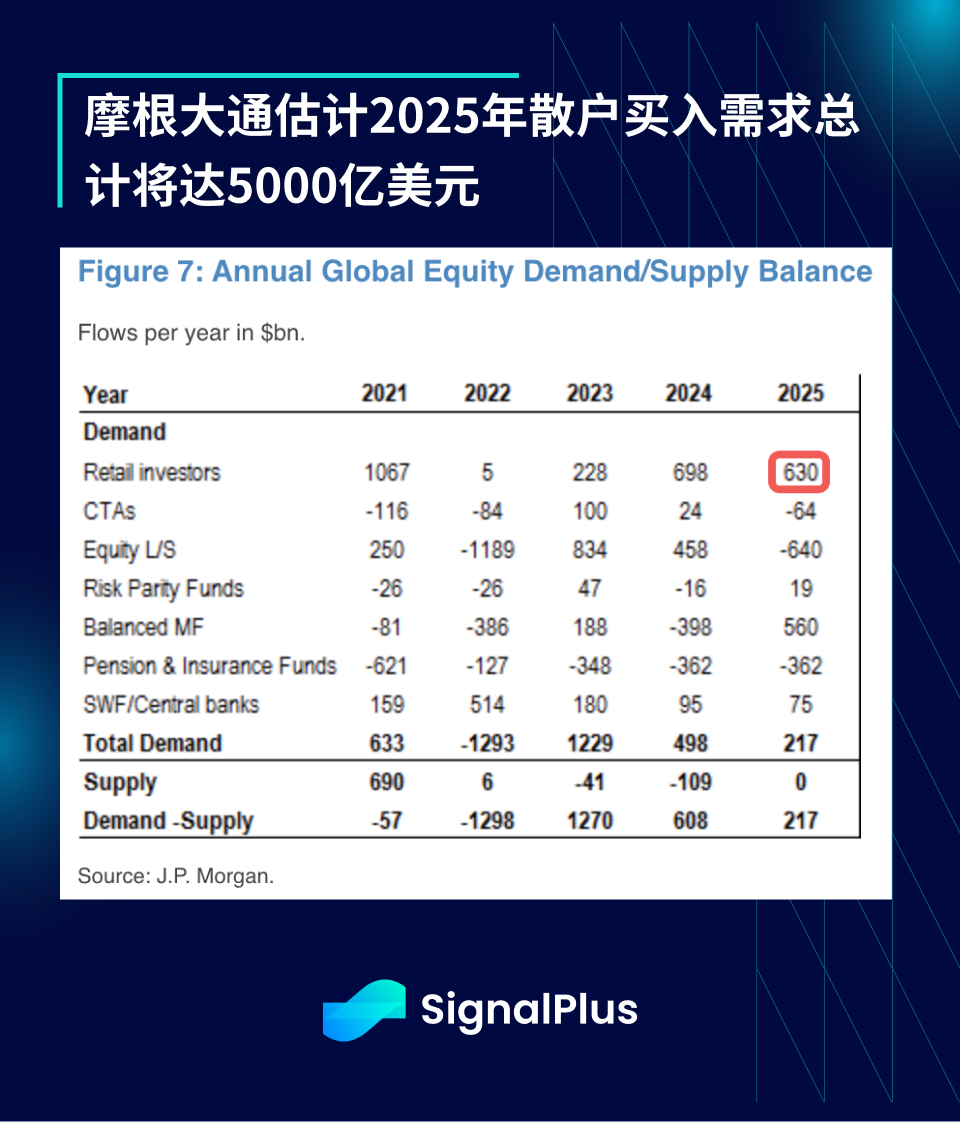

Not to be outdone, our fearless retail investors have also been piling into long equities this year. According to Vanda Research, retail investors have accumulated net purchases of stocks and ETFs to the tune of $155 billion so far this year, the fastest pace in more than a decade.

As if that weren’t enough, JPMorgan estimates that retail stock buying demand will total $500 billion throughout 2025. According to their calculations, this will drive the market up another “5-10%.” This would make them the largest source of demand of all major investor groups — who is the “smart money” anyway?

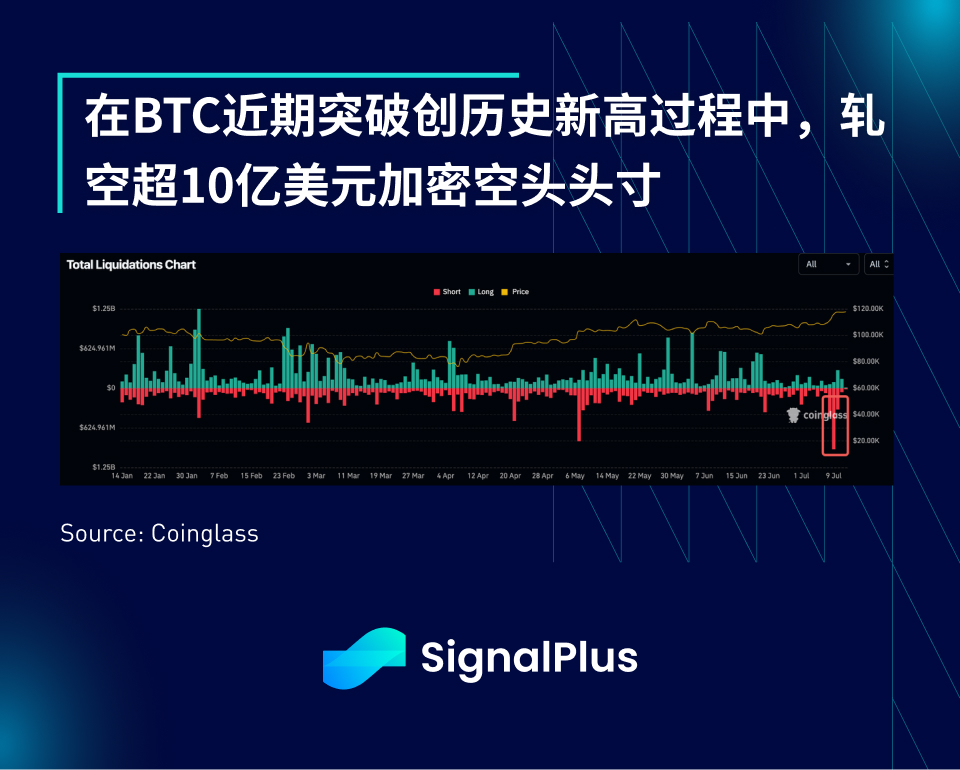

Cryptocurrency prices benefited from the overall market enthusiasm, with BTC trading as high as the $118,000 range, squeezing out more than $1 billion in crypto short positions, creating the most violent short squeeze in recent memory.

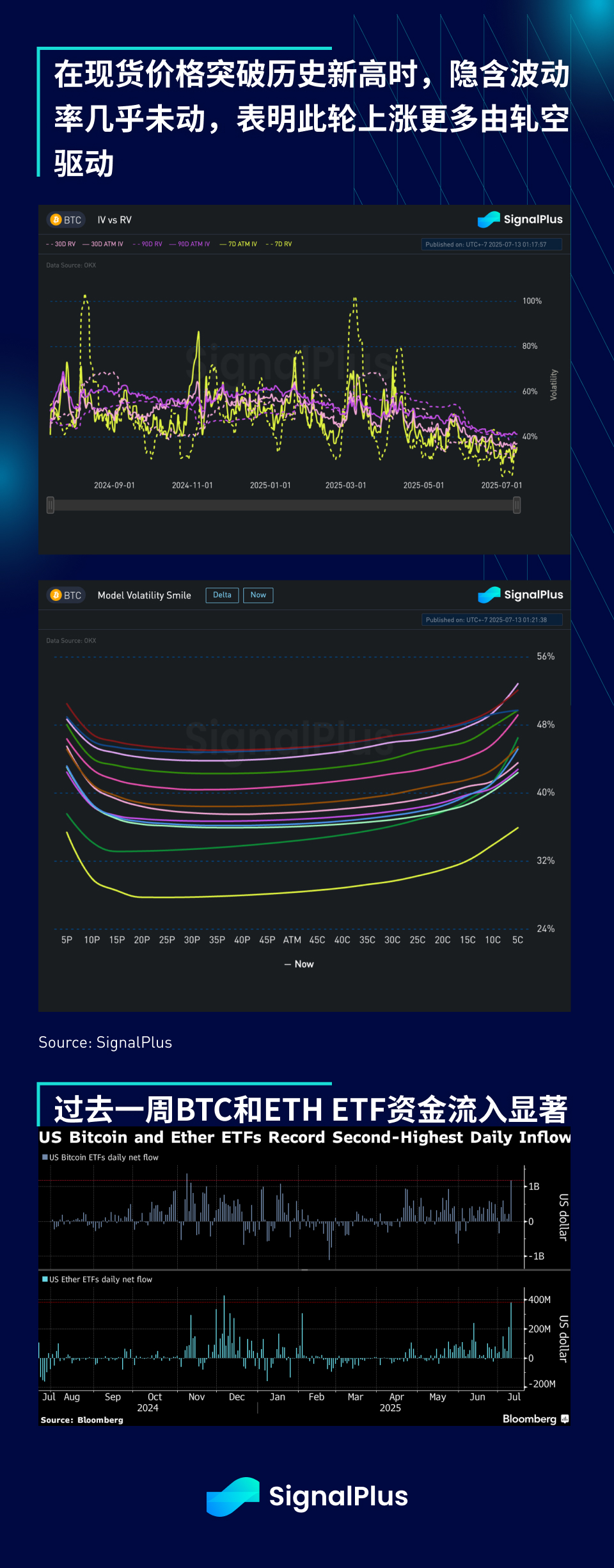

Interestingly, volatility has not jumped significantly yet, still hovering near cycle lows. This suggests that there is no significant FOMO buying in the market, except for the understandable tilt in vol skews as shorts rush to seek protection. The sector (crypto) still feels under-positioned, with positions struggling to rebuild after the April shock, while buying of traditional financial (TradFi) ETFs remains relentless and price-insensitive, and the mainstream narrative continues to strengthen.

Some observers point to the recent shift in attitude by Chinese regulators as a catalyst for the market rally, but we believe this is more of a symbolic gesture and substantive change is still some time away. Fundamental capital control restrictions remain an unresolved issue, and the recent passage of Hong Kong’s stablecoin bill suggests that pilot projects may be prioritized in Hong Kong.

Looking ahead, while it may sound cliché, market sentiment is likely to remain high throughout the summer. The only real risk catalyst is a complete breakdown in tariff talks, but the ball is now in the president's court to see how aggressive he wants to be.

In the meantime, enjoy the market and try not to fight it, because quiet and boring markets are often the most dangerous to short! Good luck with your trading.

You can use the SignalPlus trading indicator function for free at t.signalplus.com/crypto-news/all, which integrates market information through AI and makes market sentiment clear at a glance.

If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between the English and the number: SignalPlus 666), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com