Hot air balloon (Hotairballoon) has selected important information about the encrypted market last week, investment and financing situations, as well as on-chain data of popular tracks such as LSD and RWA. In addition, it also provides statistics on recent projects with large unlocking amounts for reference.

I. Important Information in the Encrypted Industry Last Week

(A) Policies/Regulations

1. Indian Prime Minister Modi called for the establishment of a global cryptocurrency regulatory framework during the G20 summit.

On August 28th, according to Cointelegraph, Indian Prime Minister Modi called for global cooperation in formulating cryptocurrency regulations during the G20 summit. As the chair country of the G20, India has taken up the task of advocating the establishment of a comprehensive global cryptocurrency regulatory framework.

2. The Chairman of the U.S. House Financial Services Committee wrote a letter to Powell, condemning the Federal Reserve for undermining the clarity of stablecoin legislation.

On August 28, Chairman McHenry of the U.S. House Financial Services Committee sent a letter to Federal Reserve Chairman Powell, expressing that the recent supervisory and regulatory letters (SR 23-7 and SR 23-8) from the Federal Reserve have undermined the progress made by Congress in establishing a regulatory framework for stablecoins, and will undoubtedly hinder financial institutions from participating in the digital asset ecosystem.

3. U.S. SEC Commissioner Hester Peirce opposes SEC's enforcement actions against NFTs.

U.S. Securities and Exchange Commission (SEC) Commissioner Hester Peirce and Mark Uyeda oppose SEC's enforcement actions treating NFT sales as securities, citing disagreement with the application of the Howey Test. SEC lacks sufficient grounds to include this within its jurisdiction.

4. Hong Kong Legislative Council Member Wu Chi-wai: Hong Kong's future digital HKD can play the role of a stablecoin.

August 29th news, according to the Sing Tao Daily, Hong Kong Legislative Council member Wu Jiezhuang revealed that he had visited 6 provinces in mainland China and Singapore during the Legislative Council's summer recess. During his visit to Singapore, he found that the use of virtual currencies, such as USDT (Tether), for large luxury item transactions such as private jets, is already very common. He believes that Hong Kong should catch up quickly and improve the relevant regulatory system. He also believes that the future introduction of digital Hong Kong dollar can play the role of stablecoin and promote the development of virtual asset trading in Hong Kong.

5. Grayscale wins lawsuit against the US SEC.

August 29th news, US court documents show that Grayscale's request for review has been approved and the order from the US SEC has been revoked. Grayscale filed a lawsuit against the SEC last year after its proposal to convert its flagship fund, GBTC, into a physically-backed Bitcoin ETF was rejected by the SEC. This ruling means that Grayscale has won the lawsuit against the US SEC.

James Seyffart, an ETF analyst at Bloomberg, said that this does not automatically mean that GBTC will be converted into an ETF, but it does bring the approval of a Bitcoin physically-backed ETF closer.

10. Thailand plans to distribute digital assets of approximately $290 per person to all citizens aged 16 and above to promote the national economy.

On August 31, according to Blockworks, the Pheu Thai Party in Thailand will use "utility tokens" in its upcoming digital wallet program to stimulate the national economy. The program, which was promised during the campaign, will provide digital assets of 10,000 Thai baht ($290) to all Thai citizens aged 16 and above.

11. People's Court Daily: Virtual currencies are still legal property, and it is recommended not to seize or return all the funds involved in a uniform manner.

On September 1, the People's Court Daily published an article entitled "Recognition of the Property Nature of Virtual Currency and the Disposal of Involved Property," in which it analyzed the criminal law attributes of virtual currency and stated that virtual currency has economic attributes and can be attributed toFor property, the current laws and policies do not classify virtual currency as illegal items. Therefore, under the current legal framework, the virtual currency held by relevant entities in our country is still considered legal property and is protected by law.

(II) Project Information

1. PAULY: PEPE team sells coins through market manipulation and insider trading

On August 28th, CryptoPhunks, founder of the NFT market Not Larva Labs, Jeremy Cahen, tweeted that the PEPE team had stolen over $10 million from CEX wallets and dumped them on the open market. They have now transferred the remaining $9.6 million to a wallet controlled by an anonymous user. They placed a lot of short positions before stealing funds from CEX. The whole team participated in insider trading.

2. The dYdX community has voted on the proposal to "extend the current grant program for an additional 6 months."

On August 28th, the Snapshot page shows that the dYdX community has voted on the proposal to "extend the current grant program for an additional 6 months."

The community has passed the "dYdX Grant Program v1.5 Extension" proposal with a 100% approval rate. According to the proposal, the dYdX Grant Program will extend for an additional 6 months using the remaining budget. The extension will begin on September 1, 2023, and end on March 1, 2024. The proposal introduces two new roles: sponsors and operators. Sponsors will be responsible for RFPs, procurement, recommendation of grants, and management of approved grants, while operators will handle payments and financial reporting.3. The "Aave V3 MVP Deployment to Gnosis Chain" proposal has passed the temperature check vote.

On August 28th, the Snapshot page shows that the Aave community has passed the temperature check vote for the "Aave V3 Minimum Viable Product (MVP) Deployment to Gnosis Chain" proposal with 100% support.

4. HashKey Exchange has opened BTC/USD and ETH/USD trading pairs to retail investors.

On August 28th, HashKey Exchange announced the availability of BTC/USD and ETH/USD trading pairs for retail investors.5. Cryptocurrency KOL: BlackRock is the second-largest shareholder of four listed Bitcoin mining companies. 8. On August 28, according to the 13F filing submitted to the SEC, BlackRock is the second-largest shareholder of four of the top-five listed Bitcoin mining companies worldwide, namely Riot Blockchain, Marathon Digital Holdings, Cipher Mining, Hut 8 Mining, and TeraWulf. 6. OPNX: The deadline for the conversion of FLEX to OX has passed, and the remaining 5.97 billion OX tokens will be stored in the custody contract after minting.1. August 29th news, encrypted claims and trading platform Open announced on the X platform that as of today, users can no longer swap FLEX for OX. During the token migration period, over 35 million FLEX tokens were swapped for OX by users, accounting for approximately 36% of the FLEX supply, and 3.89 billion OX tokens were issued. 2. Curve community has passed the proposal to "remove the Chainlink price safety restriction from crvUSD oracle". 3. August 29th news, according to the Curve governance platform, the proposal initiated by Curve founder Michael Egorov to remove the ±1.5% safety restriction on Chainlink price from the crvUSD oracle has been approved through on-chain voting. 4. Polygon Labs has launched the Chain Development Kit (CDK) for developing and connecting Ethereum L2 chains.data-selectable-paragraph="">August 29th News, according to The Block, Polygon Labs has released a software tool called Chain Development Kit (CDK), which allows developers to build layer 2 chains on Ethereum with zero-knowledge proof support. Layer 2 blockchains deployed using CDK will be able to connect to a shared ZK bridge, enabling interoperability. The code library of CDK will be open source.

9. The Ethereum Foundation officially launches the Ethereum Execution Layer Specifications (EELS)

August 30th News, according to official sources, the Ethereum Foundation announced the official release of the Ethereum Execution Layer Specifications (EELS) after over a year of development. EELS is a Python reference implementation of the core components of the Ethereum execution client, focusing on readability and clarity.

10. MakerDAO announces the "Endgame" final phase, aiming to increase DAI supply to over 100 billion US dollars within three years

September 2nd News, according to The Block, MakerDAO has published the final phase of "Endgame", which will involve a complete reimplementation on the native blockchain NewChain.;Construct the entire Maker protocol". Through this strategy, MakerDAO hopes to increase the supply of stablecoin DAI.

11. "Uniswap V2 deployed on all existing V3 specification instance chains" proposal passed the temperature check vote.

On August 31, the Snapshot page showed that the Uniswap community's proposal for "deploying V2 on all chains with existing V3 specification instances" passed the temperature check vote with a support rate of 98.36%.

12. "Aave Treasury to invest a portion of stablecoins into RWA" proposal passed the temperature check vote.

On August 31, the Aave community passed the temperature check vote for the "Aave Treasury proposal on RWA allocation," which proposes allocating a portion of stablecoins held by the Aave Treasury to low-risk real-world asset (RWA) investments through Centrifuge Prime.

September 1st, according to official sources, Coinbase announced that PayPal USD (PYUSD) has launched on the Coinbase website and Coinbase iOS and Android applications (with experimental labels). Coinbase users can log in to purchase, sell, convert, send, receive, or store these assets.

16, OpenSea's active users in August decreased by 12% to 126,000, the lowest level since July 2021

September 1st, according to The Block report, the number of active users on OpenSea also hit the lowest level since July 2021. In August, OpenSea's active users decreased by 12% to 126,000. In addition, the daily trading volume of the NFT market based on Solana fell below $1 million for the first time since September 2021.

17, Vitalik exchanged 500 MKR for 350 ETH, the first sale in two years.

On September 2nd, according to The Data Nerd, 2 hours ago, Vitalik Buterin sold 500 MKR (worth about $581,000) on CoWSwap and exchanged it for 350 ETH. Vitalik then transferred all the received ETH to an address starting with 0x3f6.

(III) Other

1, Coinbase CEO shares his top 10 innovations in the cryptocurrency industry, including Flatcoin, on-chain reputation, and RWA, etc.

On August 31st, Coinbase CEO Brian Armstrong shared his current top 10 ideas in the cryptocurrency industry on the X platform, which are:

1. Flatcoin;

2. On-chain reputation;

3. On-chain advertising;

4. On-chain capital deployment;

5. Decentralized labor market;

6. Layer 2 privacy;

7. Fully on-chain P2P exchange;

8.Web3 Game Economy;

9.Tokenization of Real-World Assets;

10.Network Status Tools.

2. Bloomberg: Iceland Becomes a Haven for Bitcoin Miners;

On August 31st, Bloomberg reported that with the rising cost of energy and increased regulatory pressure on cryptocurrency operations in the United States and other countries, Iceland has become a haven for Bitcoin miners.

3. Security Companies: There were over 25 typical security incidents in August, resulting in a total loss of approximately $17.43 million in attack-related events.

August 31st news, according to Beosin EagleEye security risk monitoring, early warning, and blocking platform monitoring, a subsidiary of blockchain security audit company Beosin, the number of various security incidents and the amount of losses in August 2023 decreased significantly compared to July. In August, there were more than 25 typical security incidents with a total loss of approximately $17.43 million, a decrease of approximately 90% compared to July; the total amount of Rug Pull reached $28.85 million, an increase of approximately 18% compared to July. 4. Several Ethereum liquidity providers promise to limit the amount of collateral to no more than 22% of the total collateral. 9th September news, Ethereum community advisor superphiz.eth stated on the X platform that several Ethereum liquidity providers, including Rocket Pool, StakeWise, Stader Labs, Diva Stake, Puffer Finance, and Swell Network, have promised (or are currently promising) to limit their holdings to no more than 22% of the total collateral, in response to the increasing centralization problem in the Ethereum staking market. 5. OKX plans to enter the Indian market, recruiting local employees and exploring Web3 use cases.

September 1st news, according to CoinDesk, Haider Rafique, Chief Marketing Officer of OKX, said that the company is planning to enter the Indian market and recruit local employees to explore potential Web3 use cases. Rafique said that the company plans to expand its wallet services "exponentially" by leveraging India's highly regarded developer community.

Section 2: Last Week's Investment and Financing

(a) DeFi

1. Lightning network liquidity pooling project Stroom Network completes a $3.5 million seed round financing

August 31st news, according to Decrypt, Bitcoin lightning network liquidity pooling project Stroom Network completes a $3.5 million seed round financing. Led by Greenfield, Mission Street, the venture capital division of Ankr, provided strategic support, with participation from Lemniscap, No Limit Holdings, Cogitent Ventures, and several other venture capital firms and angel investors.

According to official news, Binance Labs announced investment in DeFi yield protocol Pendle Finance. The announcement states that this investment strengthens Binance Labs' commitment to supporting innovative projects aimed at shaping the next generation of DeFi primitives.

(II) Web3

1. Web3 marketing company Raleon completes $3.8 million seed funding

On August 24th, according to Cryptonews, Web3 marketing company Raleon announced the completion of a $3.8 million funding round. Blockchange, Play Ventures, Alliance DAO, and Portal Ventures participated in the investment, and the funds will be used to help project and brand development.

On August 22nd, Bing Ventures, the investment division of crypto exchange BingX, announced strategic investment in AI and Web3 startup Moonbox. The specific amount has not been disclosed.

3, Web3 infrastructure startup IronMill completes $2.6 million Pre-Seed financing round

On August 30th, AlexaBlockchain reported that Web3 infrastructure startup IronMill announced the completion of a $2.6 million Pre-Seed financing round. Gumi Cryptos Capital led the investment, with participation from Blockchain Builders Fund, Superscrypt, LongHash, Kestrel 0x1, and SevenX.

4. Web3 marketing company DeForm completes $4.6 million seed round financing

On August 31st, according to The Block, Web3 marketing company DeForm completed a $4.6 million seed round financing. It was led by Kindred Ventures, with participation from Elad Gil, Scalar Capital, A.Capital, Alchemy Ventures, Naval Ravikat, Sota Watanabe, Sep Kamvar, Scott Belsky, and Marc Bhargava.

(III) NFT/Blockchain Gaming

1. Early-stage company FirstMate raises $3.75 million in financing, led by Dragonfly Capital

On August 28th, according to The Block, FirstMate, a startup aiming to provide digital storefronts for NFT creators, raised $3.75 million in a funding round led by Dragonfly Capital. Coinbase Ventures and NextView also participated in the announced funding round.

2, Hungri Games completed a $1.9 million financing at a valuation of $23 million, led by Bogazici Ventures.

Web3 game developer Hungri Games announced that it has completed a seed round financing of $1.9 million at a valuation of $23 million, led by Bogazici Ventures. Other participants include Roko Finance, Preston Labs, Triple Dragon, Erol Ozmandiraci, Oyunfor, Caglan Tanriverdi, and Sebastien Borget, co-founder of The Sandbox.

(4) Infrastructure

1, Web3 talent and project network BuidlerDAO completed a financing of $2 million, led by Sequoia China Seed Fund and SevenX Ventures.

On August 28th, according to the official X account, Web3 talent and project network BuidlerDAO announced the completion of a $2 million angel round of financing, led by Sequoia China Seed Fund and SevenX Ventures, with participation from Bing Ventures, DRK Lab, M 77 Ventures, Gate Labs, Mirror World, Conflux, Nicholas Hu (PlanckerDAO), Xiao Zhang (founder of zCloak Network), Paka, Vitalbridge, Inverse Ventures, and Doc Labs. 2. Virtual event planning platform Allseated completed a $20 million equity financing round. On August 29th, according to TechCrunch, Allseated, a virtual venue display and event planning platform, completed a $20 million equity financing round. Allseated also stated that it is spinning off its metaverse division as a separate entity. With this round of financing, Allseated's total cash financing exceeds $43 million, including investments from Magma Ventures, Level Structured Capital, Vestech Partners, NYFF, and WGG,to further expand its spatial visualization and collaboration platform. (5) Other 1. Metaverse architecture project STELSI receives strategic investment from NGC Ventures.

On August 31, according to Globenewswire, the metaverse construction project STELSI announced that it has received strategic investment from NGC Ventures' metaverse fund, with the specific amount undisclosed. This investment will be used to expand project adoption, product release, and global expansion.

2. Roblox's educational technology platform Kinjo has completed a $6.5 million seed funding round.

On August 31, according to Businessinsider, Kinjo, an educational technology startup based on the Roblox metaverse platform, completed a $6.5 million seed funding round. The round was led by LiveOak Venture Partners, with participation from Silverton Partners, Breyer Capital, and Roble Capital. The startup plans to use the funds to offer its products on YouTube, Minecraft, and other popular online platforms.

3. Satoshi Network has completed a $2 million angel funding round.

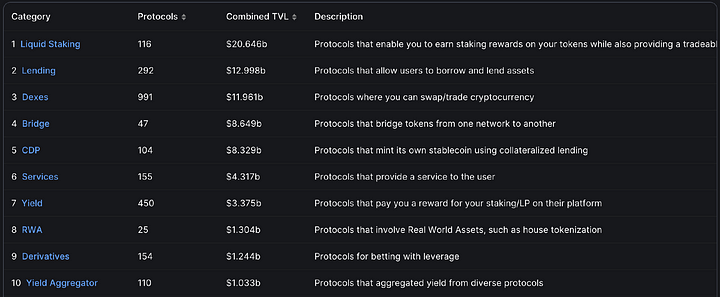

(I) RWA

According to the data statistics from defillama, the total TVL of the RWA track has reached $1.2 billion, slightly increased compared to last week. It ranks 8th in total locked value (TVL), previously ranked 9th. Defillama has recorded a total of 25 RWA protocols, an increase of 3 compared to last week.

In these Real World Asset (RWA) tokenization projects, including the tokenization of US Treasury bonds and real estate, are included.

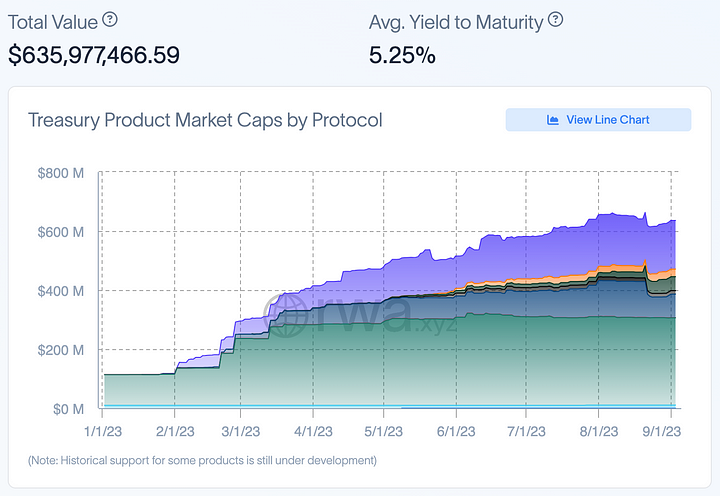

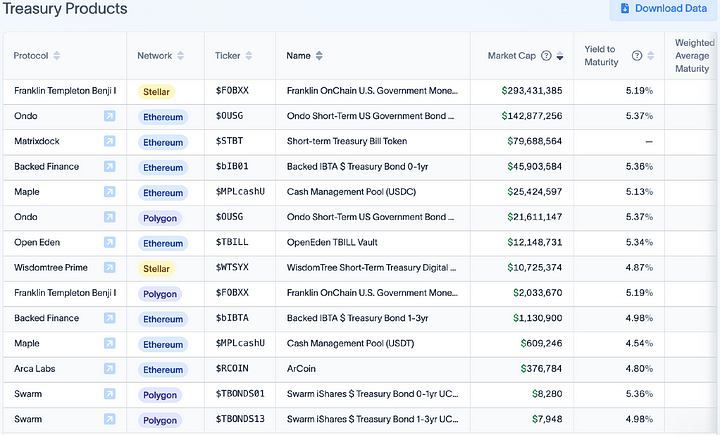

According to the data from rwa.xyz platform, the tokenization scale of US Treasury bonds has reached 635 million US dollars, slightly increased compared to last week, with an average yield rate of over 5%.

Among these tokenization projects of US Treasury bonds, Franklin Templeton's Benji Investments Market Cap on Steller is the highest, reaching 293 million US dollars, with a yield rate of 5.19%.

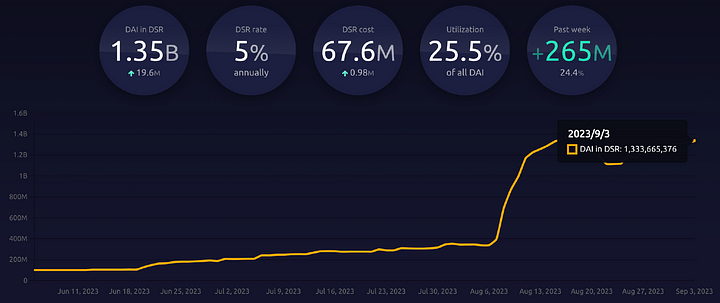

MakerDAO

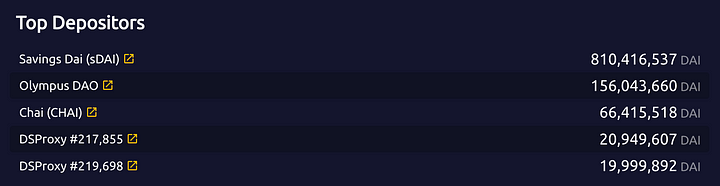

As of the time of writing, the Dai scale in DSR has increased by 265 million, reaching 1.35 billion, slightly higher than last week. The total Dai supply has increased to 5.296 billion, slightly higher than last week. Currently, DSR accounts for 24.6% of the total Dai supply, with a deposit interest rate of 5%.

Among them, the sDAI is 810 million, slightly higher than last week.

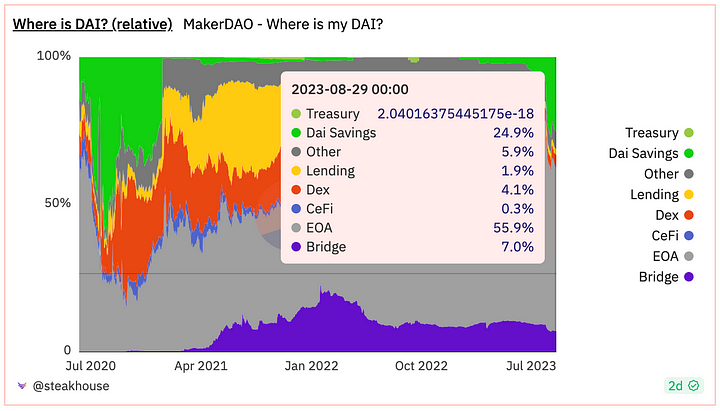

Let's take a look at the distribution of DAI.

DEX and Lending have been declining since October 2022, while the holding rate of DAI in EOA accounts has been rising and has reached 55.9%, slightly down from last week. The share of DAI in DAI Savings has been increasing since the adjustment of DSR interest rate, and currently stands at 24.9%, up two percentage points from last week.

Currently, the highest proportions are EOA, DAI Savings, and Bridge.

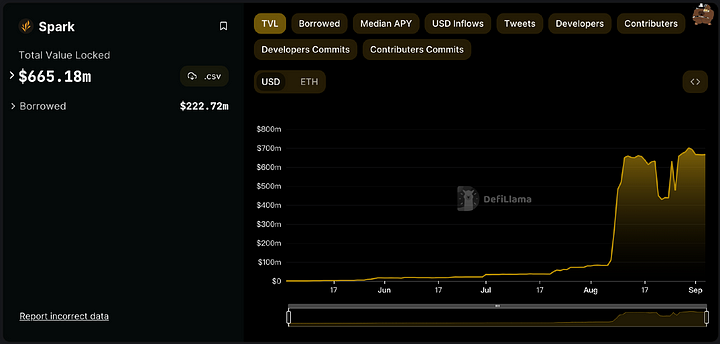

The TVL of Maker's proprietary lending protocol Spark has reached 660 million, slightly down from last week.

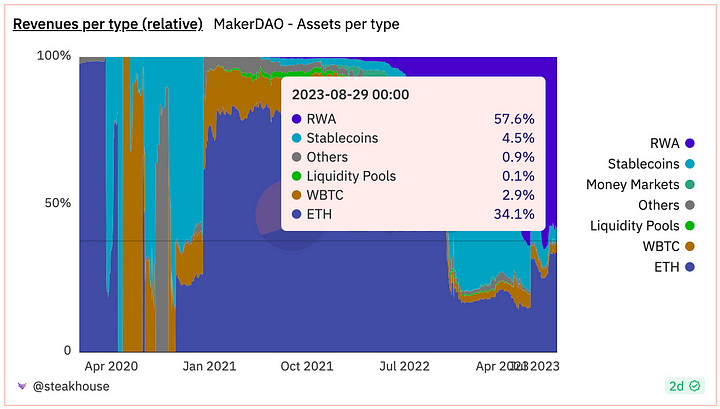

According to the data statistics on the dune platform, the proportion of RWA in MakerDAO's revenue has reached 57.6%, a very high proportion, which is related to the strong layout of MakerDAO in the RWA track, and has slightly decreased compared to last week.

(II) LSD

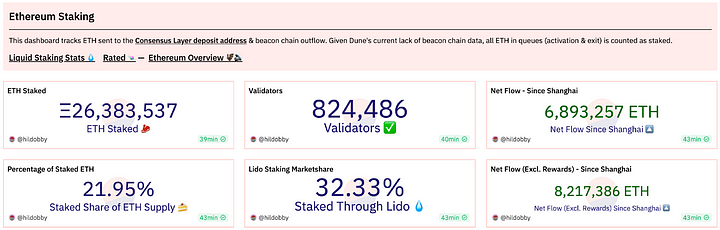

Currently, the staking volume of ETH in the beacon chain has reached 26.38 million ETH, which has slightly increased compared to last week, accounting for 21.95% of the total supply of ETH, and the number of nodes has exceeded 820,000.

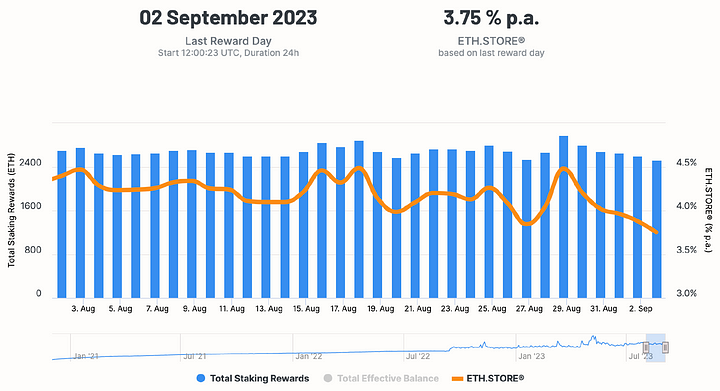

Currently, the staking yield of ETH is approximately 3.75%, and the yield is decreasing as the staking volume increases.

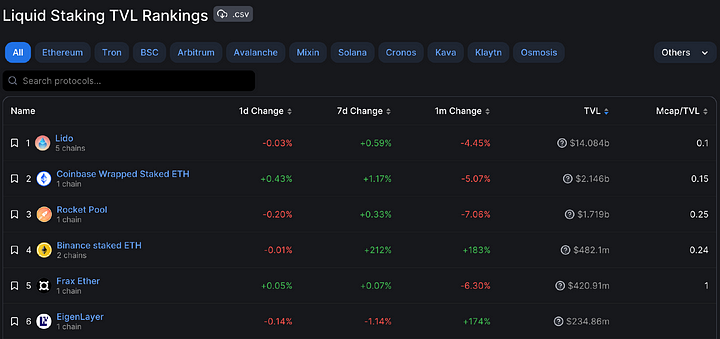

In the three major protocols, Lido has increased by 0.59% in one week^, Rocket Pool has increased by 0.33% in one week^, and Frax has increased by 0.07% in one week^.

In terms of the price performance of the three major protocols, LDO has fallen by 4.37% in one week^, RPL has fallen by 6.48% in one week^, and FXS has fallen by 0.07% compared to last week^.

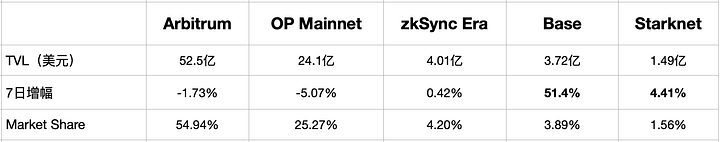

(III) Ethereum L2

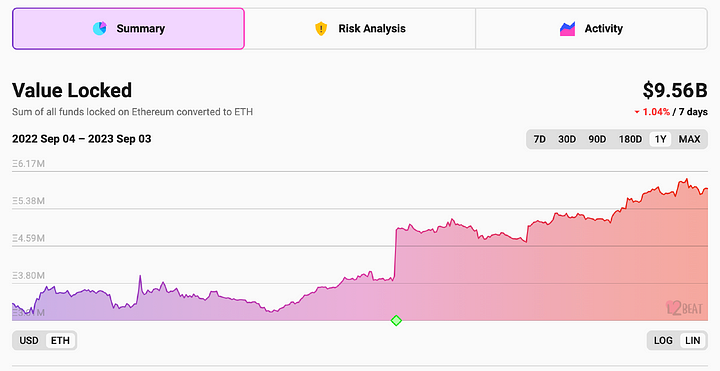

According to l2 beat platform's data statistics, Ethereum Layer 2 TVL has decreased by 1.04% in the past week^, and the current TVL is 9.56 billion USD. The reason for the TVL decline is partly due to the decrease in ETH price.

In Ethereum Layer 2, Arbitrum still has the highest TVL, accounting for 54.94%, and the fastest growing recently is Base, with a TVL increase of 51.4% in the past week, reaching $372 million, with a very fast growth rate.

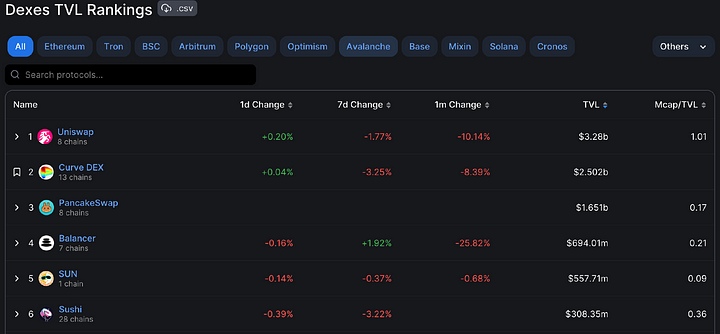

(Four) DEX

TVL

According to the data from defillama, the total locked value (TVL) in the DEX sector is $11.97 billion.

Uniswap is the highest-ranked in terms of locked volume, followed by Curve, PancakeSwap, Balancer, SUN, and Sushi. Except for Balancer, the TVL of other DEX has declined compared to last week.

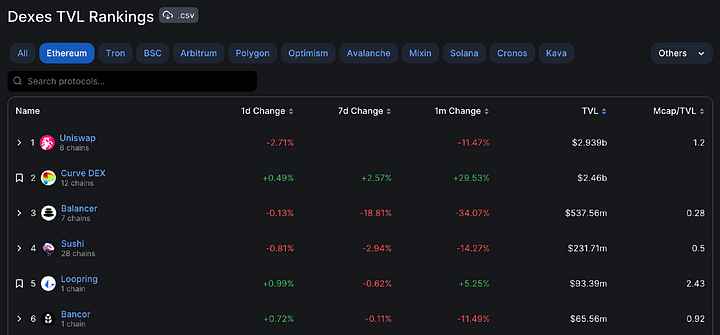

Among them, the highest TVL on the Ethereum mainnet is Uniswap, Curve, Balancer, Sushi, and Loopring.

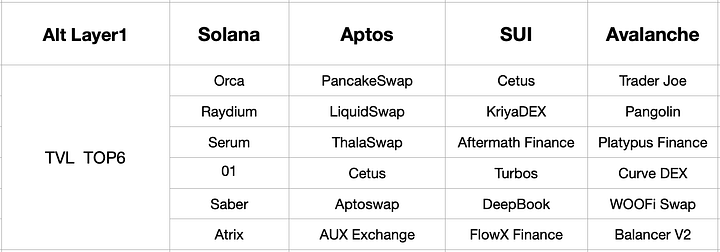

The top 6 DEX on Arbitrum, OP Mainnet, zkSync Era, Starknet, and Base Chain in terms of TVL are as follows.

The above are the top 6 DEX on other Layer 1 chains by TVL.

Trading Volume

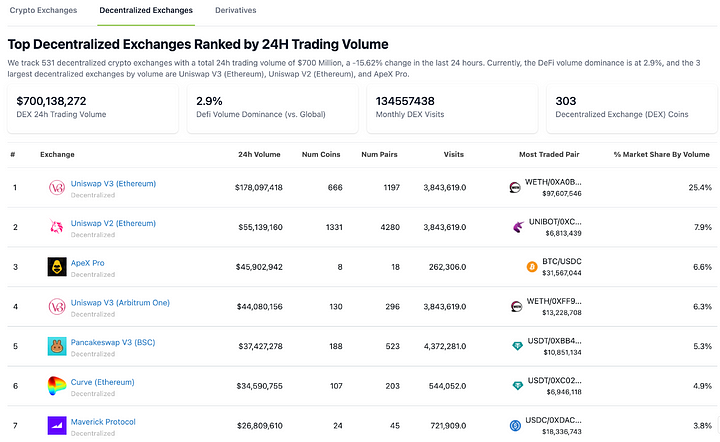

The decentralized exchange (DEX) has a trading volume of nearly $700 million in the past 24 hours, which is a decrease from last week. The total trading volume of global cryptocurrency exchanges in the past 24 hours is $24.5 billion, with DEX accounting for only 2.9%.

In DEX, popular exchanges with high trading volume include Uniswap, ApeX, Pancakeswap, Curve, and Maverick, among others.

(5) Derivative DEX

TVL

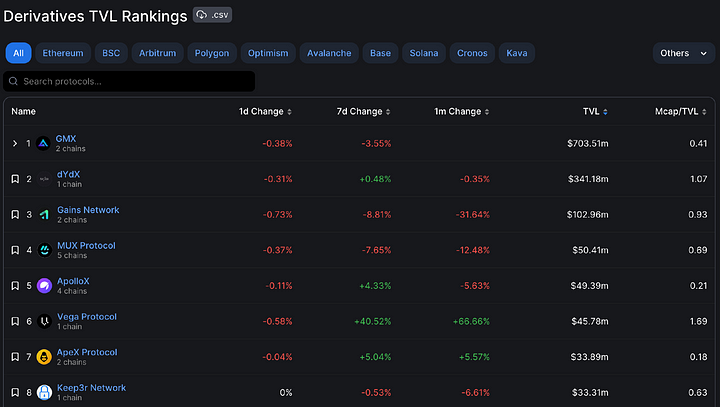

According to the data from defillama, except for dYdX, the TVL of most recent derivative DEX has been decreasing, partly due to the drop in token prices and partly due to the overall decrease in trading volume in the derivative sector.

In the derivative sector, GMX has the highest TVL, followed by dYdX, Gains Network, NUX Protocol, and ApolloX, and so on.

Trading Volume

According to the data from the Coingecko platform, the decentralized derivatives exchange with the highest trading volume is dYdX, with a trading volume of 250 million US dollars in the last 24 hours. Next is GMX, with a trading volume of 13.65 million US dollars in the last 24 hours.

4. Recent Token Unlocking

Recently, there are 6 projects with token unlocks worth paying attention to. Among them, the token unlock of the ImmutableX project, IMX, is relatively large. The amount of unlocked tokens this time reached $9.83 million, accounting for 1.61% of the IMX token's flow.

Follow @HorairballoonCN on Twitter to explore more industry information: https://twitter.com/HotairballoonCN