Original | Odaily

Author |

The growth space of a financial product/asset is often determined by market capacity. This market capacity includes both the size of funds and the number of investors. If considered from this dimension, the future of friend.tech is not optimistic.

Let’s take an illiquid NFT as an example. A “standard” PFP series has an “asset” amount of 10,000. In theory, such an NFT Collection could accommodate 10,000 investors. In order to improve poor liquidity, many NFTFi products such as fragmentation, lending, and leasing have emerged in the industry.

Talking back to friend.tech, how many investors does a user share target accommodate?

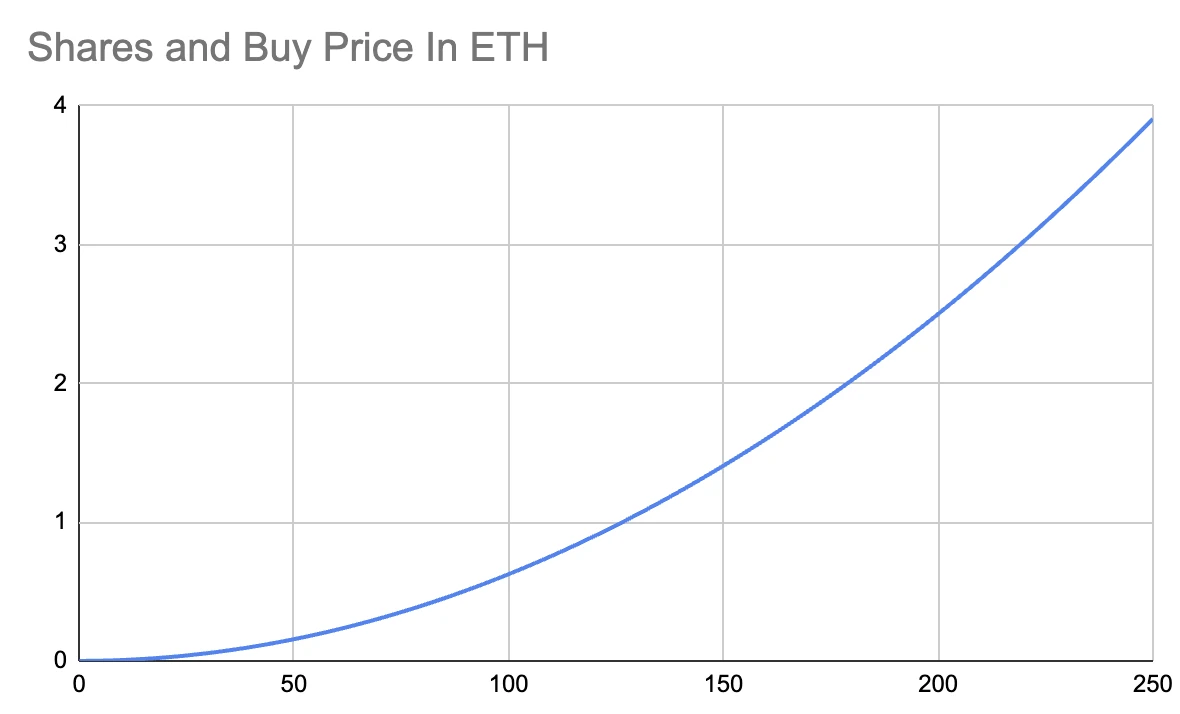

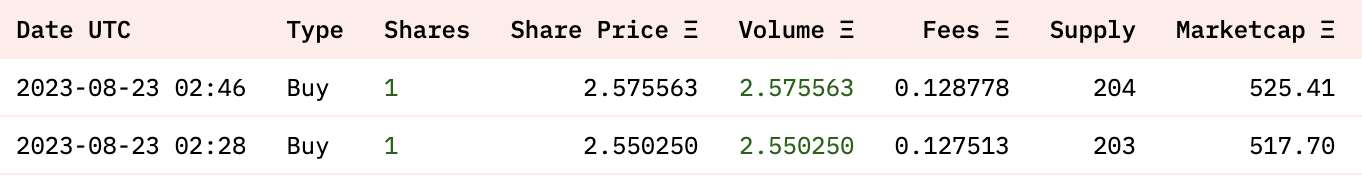

Lets take Racer, which ranks Top 1 in the share market value list, as an example. Racers current share market value is 773 ETH. Dune data shows that there are currently only 232 individual shares of Racer, and the number of holders is as low as 138 addresses; a total of 960 transactions have occurred, including 596 buys and 364 sells.

Have you noticed, even though it is hotly discussed in the circle, the transactions of the strongest target in friend.tech are still very low-frequency. This means that the market capitalization can soar to a high position (relative to the enthusiasm for market participation) with very few transactions.

Why is this happening?

The evolution of matchmaking: eliminating the role of counterparty

Here, we need to re-understand the mechanism design of friend.tech.

In traditional trading venues such as CEX, matching transactions through order books is the core pricing mechanism. Buyers and sellers continuously initiate bids, and when both parties reach an agreement, the transaction is completed. This transaction price is displayed instantly by the trading platform, and it is also the instantaneous price we observe that balances the expectations of both parties to the transaction. But in friend.tech, this process of constantly closing deals does not exist.

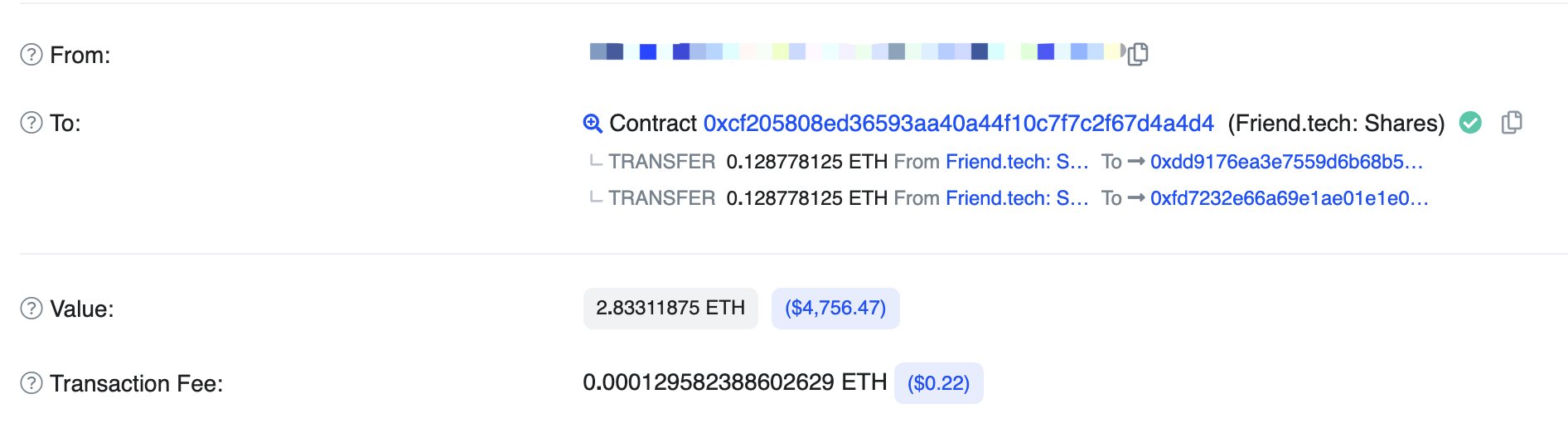

The picture above is a typical buy trade in friend.tech. We can see that the 2.83 ETH used to purchase the share, after deducting two 5% share, has all been entered into a contract address ending in a4d4. (By the way: It is also an important innovation of the project to directly exchange money for money without using NFT as an intermediary. In addition, the cancellation of mint also saves gas.)

In a sale transaction, we can see that the contract address ending in a4d4 directly transfers the proceeds from the sale to the seller after deducting two commissions.

The contract ending in a4d4 is named Friend tech Shares V1. This contract is used to store the ETH handed over by users when buying shares. Currently, there are 3434 shares in the contract.

Simply put, in friend.tech, there is never a direct transaction between buyers and sellers.

Yes, thats the magic of friend.tech. I even think that this is a great invention comparable to AMM.

Remember the shock that AMM brought to traders in the circle when it came out? It eliminates the disadvantage that the order book must be executed in real time, so that buyers and sellers do not need to exist together at the instant of the transaction.

Real-time transactions have great requirements for liquidity. For the nascent crypto market, it is difficult for a niche target to maintain sufficient and high-frequency transactions 7 x 24 hours.

AMM makes LP an ever-existing seller/buyer. As long as the LP remains, the buyer/seller can close the deal at any time.

And friend.tech is more radical than AMM, it even wiped out LP. There is no need for the role of LP to pretend as a counterparty, and it also allows transaction initiators to ignore liquidity and trade at any time.

Since friend.tech has never officially released a white paper, and has not named its mechanism. For the convenience of the following, I will use void trading as the nickname for its trading mechanism.

Void Trading: The Great Innovation That Shifted the Price Timeline

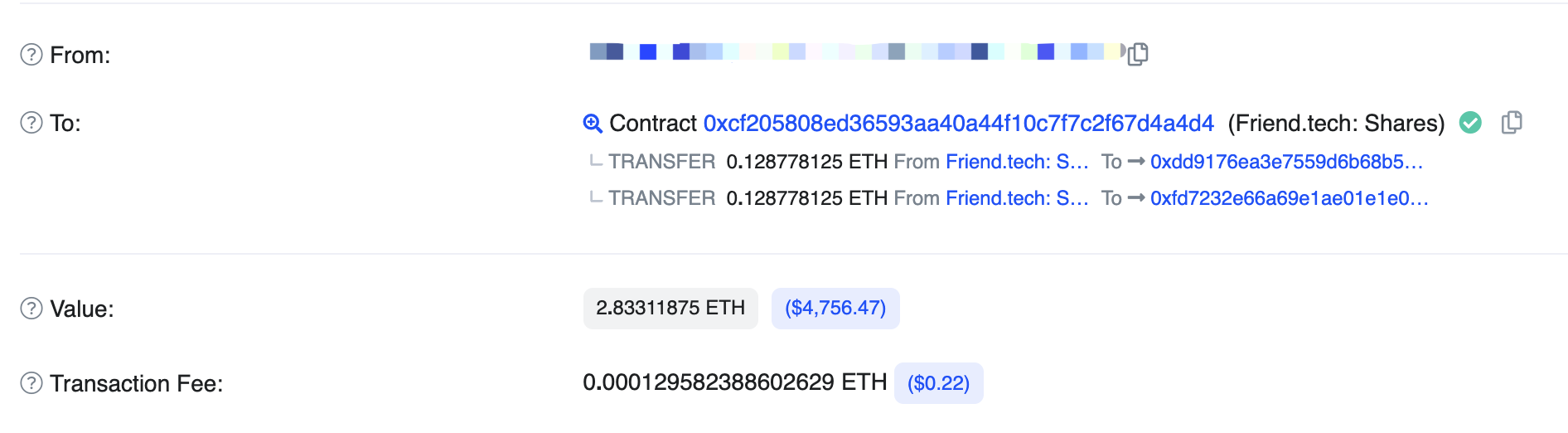

Odaily has been in Friend.tech is so popular, how are individual stocks priced?》The article introduces its price mechanism. In a nutshell, the price of friend.tech is determined by the supply of trading items - the more individual shares exist, the more expensive they are.

The horizontal axis is the number of shares, and the vertical axis is the transaction price.

Intuitively, this mechanism seems to be in line with common sense-the stronger the buying, the more buyers, and the more shares are created, so the price rises accordingly-scarcity leads to price rises.

But is that really the case?

Let’s look back at traditional matching transactions. In matching transactions, transactions are completed in real time. When you buy a target for $1,000, there must be someone who is willing to sell it for $1,000. And when the market expects it to rise, other traders will quote $1001 to buy due to supply exceeds demand. A closing price of $1,001 was reached.

No one has “priced” this trade at $1001. The market spontaneously filled the trade at $1001, and the trading platform displayed it, and that was it.

AMM is similar, LP only acts as an eternally existing counterparty.

In matching transactions and AMM, the price has already happened, it is past tense.

In empty trading, there are clear pricing rules, and the price is in the clear future tense——I must know what the next buy (or sell) price will be.

Under the mechanism trap, does transaction actually exist?

What problems will empty trading cause? Its hard to rate.

My personal subjective value judgment is that this mechanism greatly distorts the real market.

The purchase and sale of shares does not seem to be classified as a traditional transaction.

Because the price is a future tense rather than a past tense. Share trading is more like a game behavior with benefits - within a clear framework of rules, priced by rules, non-market spontaneous, and no opponents. The market script has been written in advance, and economic rules cannot freely set prices here.

In fact, this seems closer to a gambling behavior?

Void trading uses clear pricing rules to lock the rise and fall of prices in advance.This will bring about the following problems:

· Unable to achieve a sufficiently fair price - there is no counterparty in the market, no need to reach a consensus with others.

· There is no effective price - the price is a future tense rather than a past tense, and cannot represent the combined force that buyers and sellers have formed in the market.

The price is full of plans but jumps and changes - if 1 ETH cannot be traded, you cannot quote 1.01 ETH, and the price becomes stepped instead of linear.

Taking two adjacent buy transactions as an example, the second transaction has an increase of 0.99% compared with the previous one.

Changed to a more familiar expression - this meansDepth is seriously lacking.

Unlimited liquidity and high market value, is it a deliberate design by the project party?

In the NFT trading market, taking MAYC as an example, you can buy 65 NFTs within a 1% increase in the floor price (4.51 ETH). The same goes for the sell-off, with up to 90 bids available on Blur in the 1% down range.

In friend.tech, if you want to drive a 1% increase/decrease, you only need to initiate a buy transaction.

Such a poor depth means that it is more conducive to market making and trading.

Whether this empty trading mechanism is good or bad depends on where you start from.

On the positive side, this artificial pricing mechanism allows friend.tech to theoretically have unlimited liquidity. As long as you hold ETH or personal shares, users can eventually complete transactions under any market background.

When AMM replaced traditional market makers with LP, people exclaimed that market making could be so efficient. In friend.tech, even the 50/50 ratio in LP has been discarded, and all funds have become liquid.

But when you compare the data with traditional ERC-20, you will find the horror of void transactions.

Do you still remember the contract address with the mantissa a4d4 mentioned above? This address is used to store all liquidity, approximately 3434 ETH. Given that these funds are all ETH liquidity (no 50/50 design), they can be equivalent to TVL of 6868 ETH.

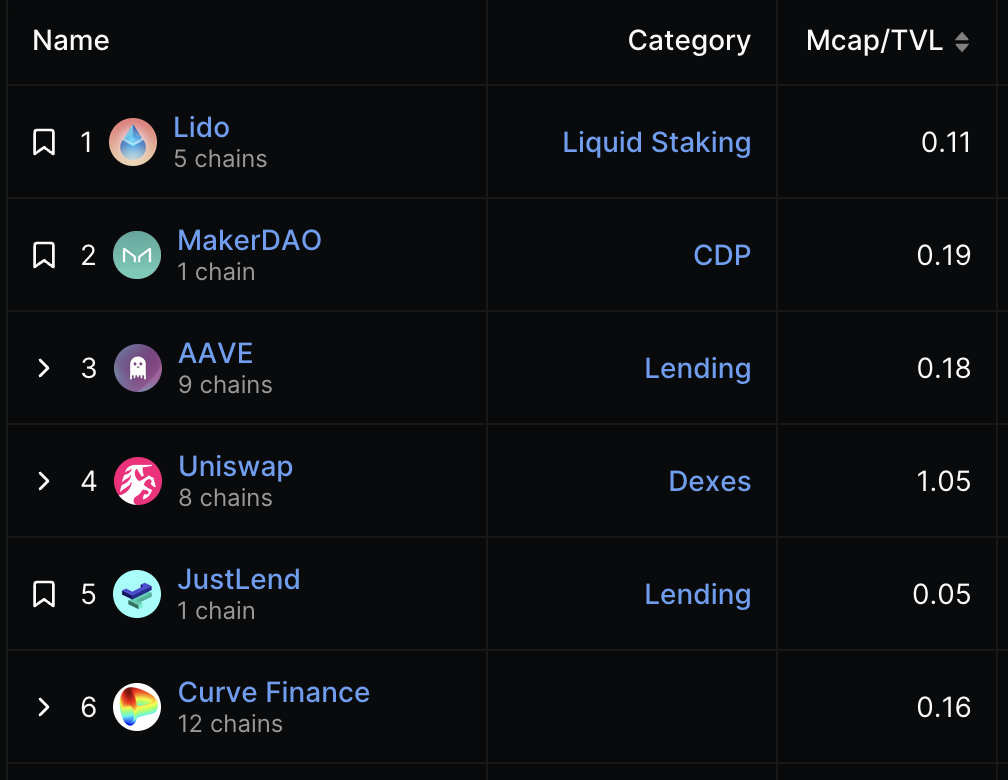

Generally speaking, if an on-chain protocol wants to support a larger market value, it needs to absorb a larger asset scale (i.e. TVL). A protocols ability to absorb assets is often seen as an important factor in protocol valuation.

The current total market value of friend.tech’s individual shares is 10,000 ETH. The ratio of MCap to TVL of friend.tech is as high as 1.45, which means the capital efficiency is extremely terrible.

DeFiLlama data shows that this figure is much higher than other on-chain protocols. To a certain extent, this means that its current market value is artificially high.

But the reason for the soaring market value is intriguing-is it the soaring market value caused by investors optimism about this project, or is it the market manipulation behavior caused by artificial mechanism design?

Insufficient vertical depth, horizontal obstacles

Viewed from each individual share.friend.tech has undermined Ponzis market space like never before.

The top trading target can only accommodate hundreds of people holding it at the same time. Once the number of people starts to grow rapidly, the artificially designed price curve will make the trading products sky-high and alienate most investors. And it is difficult to form a consensus on transaction targets that lack a broad mass base.

But on the other hand,It turns every trade into a little Ponzi.Although the market growth prospects of a single trading item are limited, friend.tech can provide you with countless similar trading targets.

A new trading mechanism was created that gave the most efficient liquidity but made prices extremely easy to manipulate. What impact will such innovation have on the industry?

Maybe in a few years, a great Ponzi project will be born: it has unlimited liquidity, scales out and prospers, and can attract everyone into an elaborate trap. And the origin of all this comes from the inspiration of a brand-new void transaction mechanism...

Will the innovative mechanism that friend.tech brings to the industry open up the market like AMM, or will it lead the industry into a darker abyss? The gears of fate have begun to turn.