Hotairballoon has selected important information on the crypto market last week, investment and financing status, as well as on-chain data on current popular tracks such as LSD and RWA. It also counts projects with relatively large unlock volumes in the near future for your reference.

1. Important information about the encryption industry last week

A quick look at important industry information of the week.

(1) Policy/Supervision

1. Singapore introduces regulatory framework for crypto stablecoins

The Monetary Authority of Singapore (MAS) issued a document on its official website stating that it has finalized the regulatory framework for stablecoins. The regulatory framework takes into account feedback received following a public consultation in October 2022. MAS said that when well regulated to maintain value stability, stablecoins can serve as a trusted medium of exchange to support innovation, including the on-chain purchase and sale of digital assets. MAS’s stablecoin regulatory framework will apply to single currency stablecoins (SCS) pegged to the Singapore dollar or any G 10 currency.

2. Hong Kong Chief Executive Lee Ka-chiu: attaches great importance to the development of Web3 and is fully exploring the regulatory arrangements for stablecoins.

According to news on August 15, the Chief Executive of the Hong Kong Special Administrative Region, Lee Ka-chiu, attended the Innovation Technology and Art Development Summit Forum held by Bauhinia Magazine via video link.

Li Jiachao said that Web 3.0 is a new development direction of the Internet. It integrates technologies that have attracted widespread attention in recent years and has the potential to become a trend that promotes the future development of finance and commerce. The SAR government attaches great importance to the development of financial technology and Web 3.0 and has issued a policy declaration clearly stating that Hong Kong has an open and inclusive attitude towards innovators from around the world engaged in the virtual asset business.

3. Taiwan’s Ministry of Economic Affairs will add a new organizational category of “virtual currency business” to allow practitioners to form guilds.

Taiwan’s Ministry of Economic Affairs announced that it will add a new organizational category and business scope of “virtual currency business”. Practitioners who meet the virtual currency business qualifications can apply to form an association to help implement relevant legal compliance and self-discipline standards.

4. Invest Hong Kong: The Hong Kong government is considering building a public chain specifically to serve Hong Kong

According to news on August 15, Terry, senior manager of Invest Hong Kong, said in an interview with IQ Times: “The Hong Kong government is considering building a public chain specifically to serve Hong Kong. If the plan is realized, global participants will be able to use this public chain. chain.

5. Bloomberg: The U.S. Securities and Exchange Commission (SEC) plans to approve an Ethereum futures ETF

According to Bloomberg, the U.S. Securities and Exchange Commission (SEC) will give the green light to an Ethereum futures ETF and plans to approve the listing of the first Ethereum futures ETF.

It is reported that many companies including Volatility Shares, Bitwise, Roundhill and ProShares have applied to launch Ethereum futures ETFs.

6. Europe’s first spot Bitcoin ETF is about to be launched

Jacobi Asset Management has launched the Jacobi FT Wilshire Bitcoin ETF, which is the first spot Bitcoin ETF in Europe. It is reported that it will be launched on Euronext Amsterdam soon. The ETF trading code is BCOIN and is regulated by the Guernsey Financial Services Commission (GFSC). Supervision.

7. Coinbase gets approval to offer cryptocurrency futures trading to eligible U.S. customers

Coinbase Financial Markets has received regulatory approval from the National Futures Association (NFA), an organization designated by the U.S. Commodity Futures Trading Commission (CFTC), to operate a futures commission merchant (FCM) and offer federally regulated cryptocurrency futures trading to eligible U.S. customers. .

8. The judge in the Ripple case approved the SEC’s request for an interlocutory appeal

According to a court filing on Thursday, a New York district court judge granted the U.S. Securities and Exchange Commission’s (SEC) request for an interlocutory appeal in its legal dispute with Ripple Labs, The Block reported. Judge Analisa Torres said the SEC can file its motion by August 18 and Ripple must file its objections by September 1. The SEC said last week it planned to file an interlocutory appeal.

(2) Project information

1. OpenSea will move to an optional creator fee model

OpenSea has announced that it will be moving to optional creator fees starting Thursday, August 31, 2023, to better reflect the principles of choice and ownership that drive this decentralized ecosystem.

2. TrueUSD developer Archblock launches tokenized U.S. Treasury bill fund

Archblock, developer of stablecoin TrueUSD, announced the launch of a tokenized U.S. Treasury Bill Fund, the Adapt 3r Short-Term US Treasury Bill Fund, on its marketplace. The fund, managed by Adapt 3 r Digital, provides liquidity and access to short-term U.S. Treasury bond investments to non-U.S. USDC holders who do not have access to traditional U.S. bank or brokerage accounts.

3. Immutable zkEVM test network has been launched

Web3 game developer platform Immutable has launched the Immutable zkEVM test network. The testnet is built on Polygon Supernets, and existing smart contracts and Solidity code can be directly migrated to Immutable’s zkEVM testnet environment for free.

According to Immutable, more than 20 gaming companies have partnered with Immutable to support the launch, including GameStop, TokenTrove marketplace, online game publisher Kongregate, game designer iLogos, and more.

4. The Sei airdrop is open to claim, and users need to update their Compass wallet to version 0.7.9

The Sei airdrop is open for claiming. To check qualifications and participate in cross-chain airdrops, users need to update their Compass wallet to the latest version 0.7.9. Versions 0.7.8 and below will not be able to claim tokens.

According to previous reports, Sei issued a document announcing that it will conduct cross-chain airdrops to active users in multiple ecosystems when the Pacific-1 mainnet is launched to reward pioneer users in the world on the chain.

5. Shiba Inu has launched L2 solution Shibarium mainnet

According to CoinDesk, Shiba Inu developers have launched Ethereum L2 scaling solution Shibarium mainnet. Applications built on the network will use BONE, TREAT, SHIB and LEASH tokens, and Shibarium will focus on the deployment and development of Metaverse and gaming applications.

6. Unibot launches unified trading terminal Unibot X

On August 16, Unibot announced the launch of a unified transaction terminal Unibot X, which can be used through the official link. In the future, we will work on separating Telegram and web applications, and implementing all features and extending functions in Unibot X. Subsequent development content includes: loyalty program, security upgrades, document transformation, multi-path routing support, etc.

7. Crypto exchange Txbit announced that it will close on September 14

According to news on August 14, the cryptocurrency exchange Txbit announced that it will close on September 14, 2023. All customers should withdraw funds before 20:00 on September 14, 2023 Beijing time. Any funds remaining after September 14, 2023 will be irretrievable.

8. Ethereum re-pledge protocol EigenLayer will increase the LST re-pledge limit on August 22

According to the official blog, the Ethereum re-pledging protocol EigenLayer will increase the re-pledging limit of LST (liquid pledge tokens, including stETH, rETH and cbETH) at 22:00 on August 22, Beijing time. Once the cap is lifted, users will be able to deposit any of the above tokens into EigenLayer. When either LST reaches the milestone of staking an additional 100,000 tokens, EigenLayer will again suspend accepting staking.

9. Messari: Since the launch of friend.tech, the number of independent buyers has exceeded the sum of the three NFT platforms including Blur in the same period.

According to Messari data, within less than a week after the release of the beta version on the Base chain, the number of independent buyers on the decentralized social platform friend. The total is 18,900. In addition, friend.tech has processed more than 300,000 transactions with a total transaction value of approximately $13.25 million. Since friend.tech provides users with 5% of the transaction amount, it means that in less than a week, the total income of its platform users has been about 650,000 US dollars.

10. PayPal will launch a cryptocurrency center for specific users to allow specific users to conduct cryptocurrency transactions.

PayPal has updated its terms and conditions following the launch of its stablecoin PayPal USD (PYUSD), launching Cryptocurrency Hub: a feature that allows users to hold and interact with Bitcoin. According to the company, the service will allow the sale and purchase of cryptocurrencies.

11. Ethereum developers release the key points of the Ethereum ACDE meeting

Ethereum core developer Tim Beiko wraps up the latest Ethereum Core Developers Executive Conference (ACDE), including Devnet 8 progress, ElP-4788, the Holesky testnet, EIP editorial updates, and the newly proposed EIP-7212 (secp 256 r 1 precompiled). Tim Beiko also said that the next ACDE is scheduled for 22:00 on August 31, Beijing time.

(3) Others

1. WSJ: SpaceX sold $373 million worth of Bitcoin acquired in 2021-2022

Earnings documents obtained by the Wall Street Journal show that SpaceX recorded $373 million worth of bitcoin on its balance sheet in 2021 and 2022, but has since sold the crypto asset, although it is unclear when.

2. Investment and financing situation last week

(1) DeFi

1. Launchpad TonUP announced a six-digit investment from TONcoin.Fund

Launchpad TonUP announced that it has received a six-figure investment from TONcoin.Fund and will devote itself to the development of projects and digital assets. TonUP is a newly launched Launchpad on The Open Network (TON), dedicated to cultivating new projects in the TON ecosystem, developed using Tact, the TON smart contract standard.

2. TRON DAO Ventures invests USD 2 million in Curve, and Curve will be launched simultaneously on TRON and BTTC

TRON DAO Ventures, the investment arm of TRON DAO, announced its recent purchase of $2 million worth of CRV tokens as an investment in Curve. As part of this strategic partnership, Curve will be launched simultaneously on the TRON and BTTC networks.

3. Ellipsis Labs completed a $3.3 million seed round of financing, led by Electric Capital

On August 18, Solana Eco DEX developer Ellipsis Labs announced the completion of a US$3.3 million seed round of financing, led by Electric Capital, Robot Ventures, Anagram and Solana co-founder Anatoly Yakovenko, Polygon Labs CEO Marc Boiron and Monad Labs CEO Keone Hon, etc. Angel investors participated.

(2) Web3

1. Web3s decentralized social data layer Port 3 Network announced the completion of a new round of multi-million dollar financing

Web3s decentralized social data layer Port 3 Network announced the completion of a new round of multi-million dollar financing. After the seed round Jump Crypto, Kucoin Ventures led the investment, EMURGO, Adaverse, Gate Labs and other institutions participated in its second round of financing , the cumulative financing amount reached 10 million US dollars. In addition, Port 3 Network has also obtained Grants from top ecosystems such as Binance Labs, Mask Network and Aptos Foundation.

2. Web3 security company Aegis completes multi-million dollar seed round financing, Generative Ventures and others participated in the investment

Aegis, a Web3 security company, announced that it has completed a multi-million dollar seed round of financing. This round of financing was participated by Generative Ventures, Northern Light Venture Capital and Evergreen.

Founded in 2022, Aegis was incubated from another global blockchain security company, Paidun. Aegis decided to build a low-threshold security platform to serve many Web3 C-end users.

3. Jada AI, a blockchain AI project, completed a financing of 25 million US dollars, and LDA Capital participated in the investment

Jada AI, an artificial intelligence project using blockchain technology, has completed $25 million in financing, with the participation of alternative investment group LDA Capital. The funds will be used to expand the projects development team and add new organizations.

(3) NFT/chain games

1. Music royalty marketplace MasterExchange completes $2.7 million in financing

Music royalty investment marketplace MasterExchange has raised $2.7 million, with participation from Vectr Fintech, Claes-Henrik Julander and Rob Small. MasterExchange has launched its first Initial Music Release (IMO) product Sofia and sold out.

Co-founded by artificial intelligence and blockchain expert Alexander Fred-Ojala, MasterExchange allows music creators to raise funds by selling some of their future revenue (i.e. music royalties) to support early production, and more are expected to launch this fall IMO .

2. Metaverse project ZepetoX completes $13 million in seed round financing led by Jump Crypto

According to Decrypt, the metaverse project ZepetoX completed a $13 million seed round of financing, led by Jump Crypto, with participation from Collab+Currency, Parataxis, MZ Web3 Fund, and Everest Ventures Group.

ZepetoX is a 3D metaverse platform, built by Zepeto, a metaverse platform of Korean Internet giant Naver, and Jump Crypto, allowing developers and users to build projects based on blockchain technology, and plans to launch its first NFT in the next few months land sale.

(4) Asset management

1. Encrypted payment company CityPay completed more than 2 million euros in seed round financing, Tether and others participated in the investment

Encrypted payment company CityPay has completed a seed round of more than 2 million euros, including a $500,000 cryptocurrency investment, with participation from Tether, Presto Ventures and other angel investors. The new financing will be used for market expansion and to promote the development of the B2C platform.

(5) Infrastructure

1. ZetaChain completed US$27 million in equity financing, with participation from Jane Street Capital and others

Full chain interoperability Layer 1 network ZetaChain announced the completion of $27 million in equity financing, Blockchain.com, Human Capital, VY Capital, Sky 9 Capital, Jane Street Capital, VistaLabs, CMT Digital, Foundation Capital, Lingfeng Capital, GSR, Kudasai, Krust Wait to vote.

(6) Others

1. Dinari, a securities investment platform, completed a $7.5 million seed round of financing, with participation from SPEILLLP and others

Dinari, a blockchain-based securities investment platform, announced the completion of a $7.5 million seed round of financing, with participation from SPEILLLP, 500 Global, former Coinbase CTO Balaji Srinivasan, Third Kind Venture Capital, Sancus Ventures, and Version One VC.

Founded in 2021, Dinari offers blockchain-powered equity trading through its dShare platform. Jake Timothy, co-founder and chief technology officer of Dinari, said that the dShare platform provides users with stock trading securities services such as Apple or Tesla based on the Arbitrum network, and does not support US users due to regulatory reasons.

2. Shuttle Labs, the development entity of the blockchain analysis platform Lore Explorer, completed a financing of 2.3 million US dollars, and SALT.org and others participated in the investment

Blockchain analysis platform Lore Explorer development entity Shuttle Labs completed a new round of financing of US$2.3 million, SALT.org, Arca, Balaji Srinivasan and Floodgate and a group of encryption industry angel investors participated in the investment. The new funds will be used to build Lores artificial intelligence Browser and EVM compatible network analysis tool.

Lore Explorer is an AI-first on-chain data analysis solution that has integrated a deep large language model (LLM) to make blockchain analysis conversational and easy for everyone (from traders and casual enthusiasts to engineers and analysts) use.

3. Main track data last week

(1) RWA

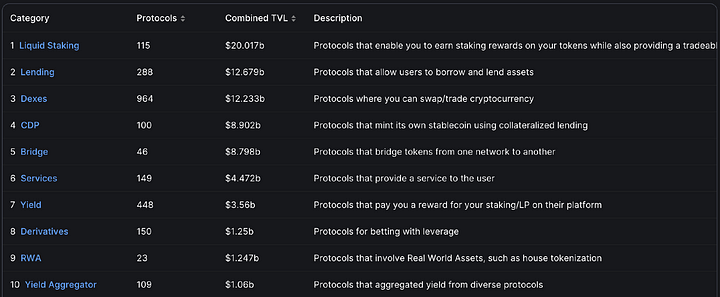

According to the statistics of defillama, the total TVL of the RWA track has reached 1.247 billion US dollars, and the total lock-up volume (TVL) ranks 9th. Defillama has included a total of 23 RWA agreements.

Among these RWA (real world assets) tokenization projects, the tokenization of U.S. Treasury bonds and real estate tokenization are included.

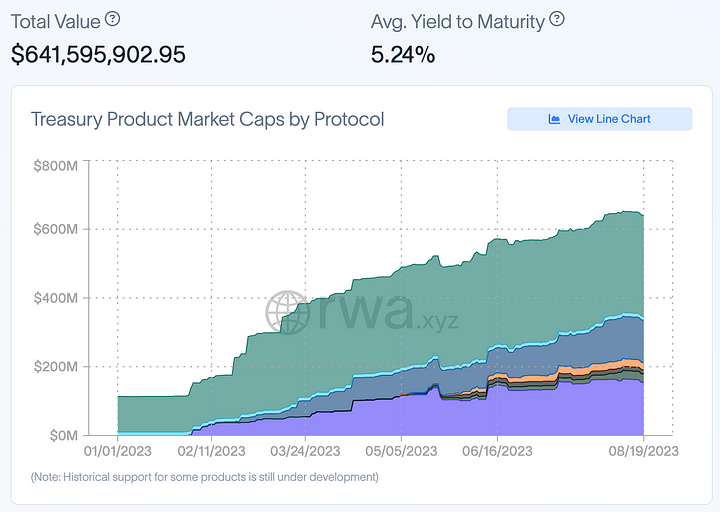

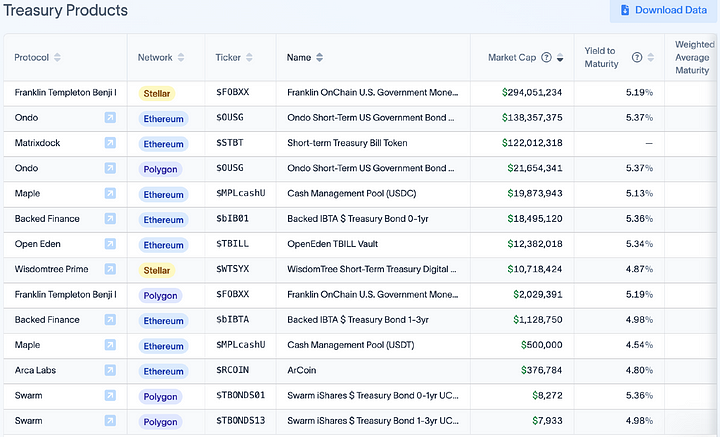

According to statistics from the rwa.xyz platform, the tokenization scale of U.S. Treasury bonds has reached US$640 million, with an average yield of more than 5%.

Among these U.S. debt tokenization projects, Franklin Templeton Benji Investments Market Cap on Steller has the highest market value, reaching 294 million US dollars, with a yield of 5.19%.

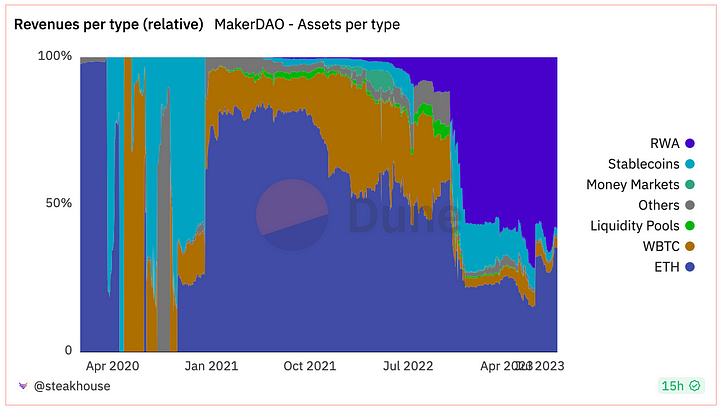

MakerDAO

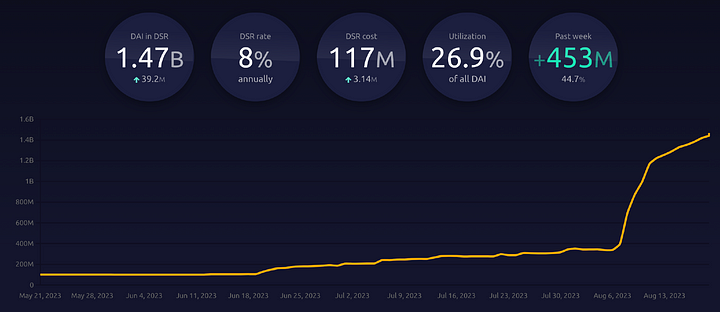

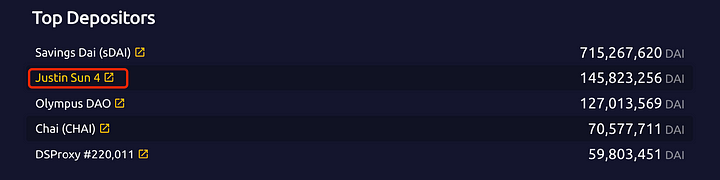

As of writing, the size of Dai in DSR has increased by 450 million compared to last week, reaching 1.47 billion, and the total amount of Dai has increased to 5.459 billion. Currently, DSR accounts for 26.9% of the total Dai, while in August 6 At that time, the proportion was only 9%, and the DSR deposit interest rate was 8%. The total amount of DAI has increased significantly after the DSR interest rate was raised.

Among them, sDAI is 715 million pieces, while justin Suns personal address DAI in DSR alone has reached 146 million pieces, accounting for 10% of DAI in DSR.

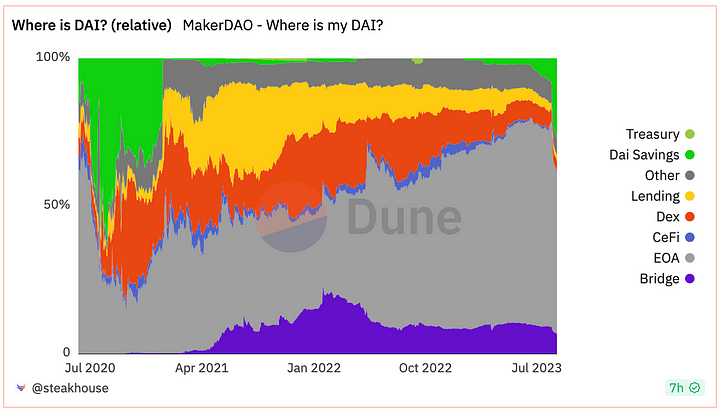

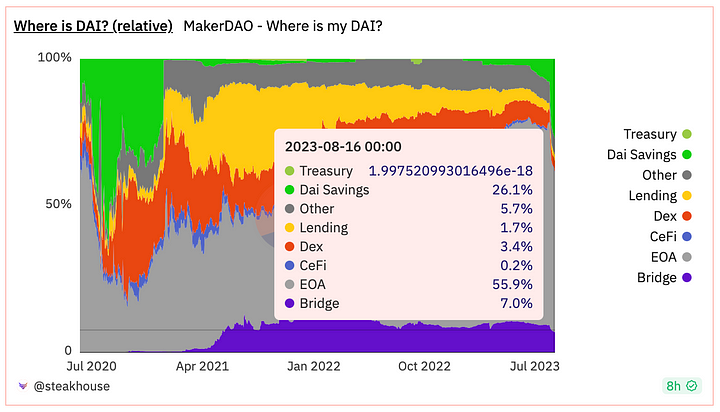

Lets take a look at the distribution of DAI.

The share of DAI in DEX and Lending has been declining since October 2022, while the holding rate of DAI in EOA accounts has been rising and has reached 56%. Since DSR adjusted the interest rate, the share of DAI Savings has been increasing Large, it has now reached more than 26%.

Currently, the ones with the highest proportion are: EOA, DAI Savings, and Bridge.

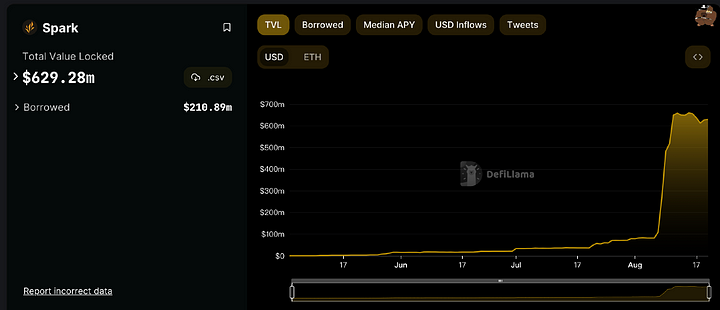

The TVL of Spark, Makers own lending protocol, reached 629 million, a very significant growth rate. Of course, it was also influenced by MakerDAO founder Runes proposal to establish a retroactive airdrop for Spark protocol users.

According to dune platform statistics, RWA accounts for more than 58% of MakerDAOs revenue.

(2) LSD

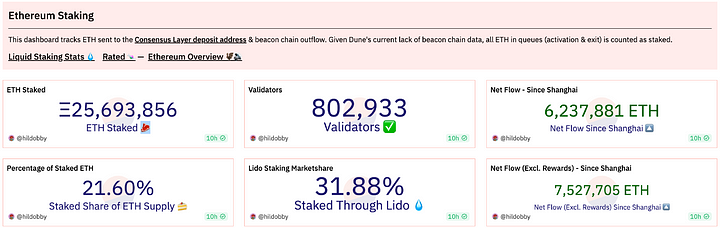

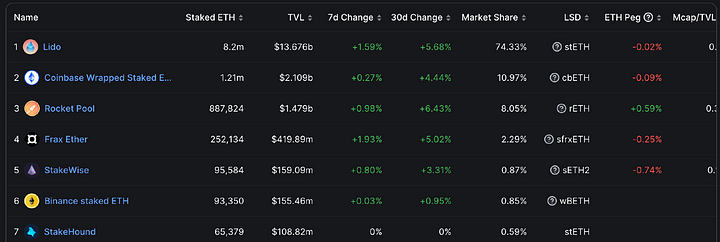

Currently, the amount of ETH pledged in the beacon chain has reached 25.69 million ETH, accounting for 21.6% of the total supply of ETH, and the number of nodes has exceeded 800,000.

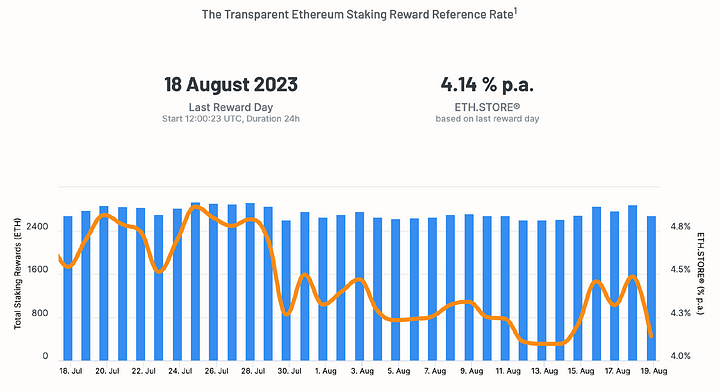

The current ETH staking yield is approximately 4.14%.

Among the three major protocols, judging from the amount of ETH pledged, Lido increased by 1.59% during the week, Rocket Pool increased by 0.98% during the week, and Frax increased by 1.93% during the week.

Judging from the price performance of the three major protocols, LDO fell by 10.37% in the week, RPL fell by 8.67% in the week, and FXS fell by 9.15% in the week.

The latest news on the three major agreements:

Lido Finance announced in a tweet that it will use Lido Grant to fund ZK technology developer Nil Foundation to build zkOracle, provide trust-minimized sanity checks for Lidos accounting reports, and ensure the liquidity of Lido Finance.

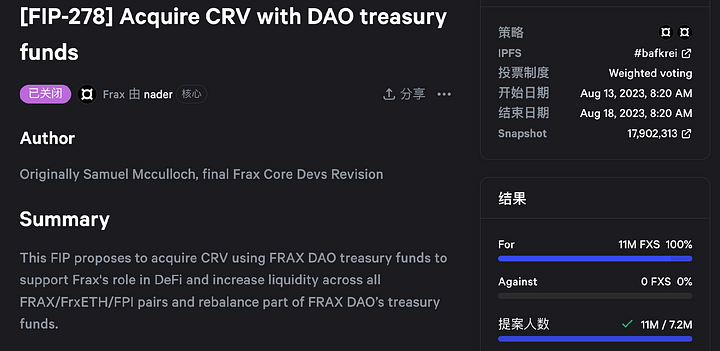

The Frax Finance community’s proposal to “use community treasury funds to purchase CRV” has been voted on.

The proposal states that Frax Finance will use 1 million FRAX in the FRAX DAO treasury to purchase CRV from Curve founders through OTC. Warehouse contract) or cvxCRV to promote the development of Frax within the Curve ecosystem.

Coinbase Ventures officially tweeted that it has recently made a strategic investment in the project by purchasing RPL tokens from the Rocket Pool team.

(3) Ethereum L2

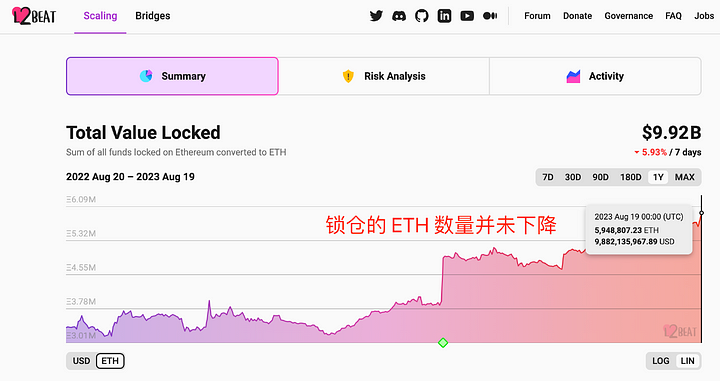

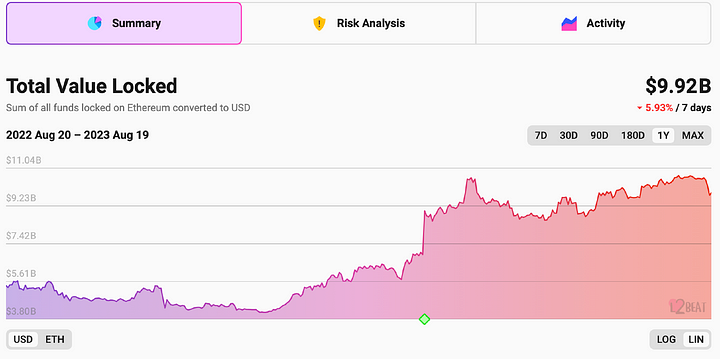

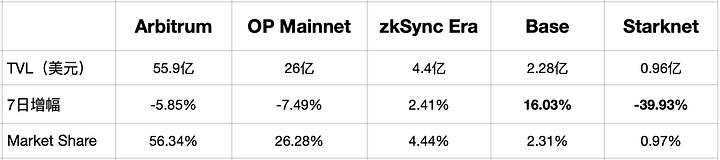

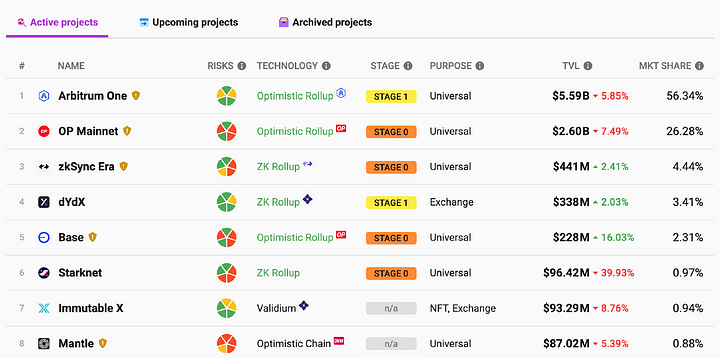

According to the statistics of the l2beat platform, the Ethereum Layer 2 TVL has dropped by 5.93% in the last week, and the current TVL is 9.92 billion US dollars. The reason for the TVL drop is mainly due to the drop in the price of ETH.

In Ethereum Layer 2, Arbitrum still has the highest TVL, accounting for 56.34%. The fastest growing recently is of course the Base launched by Coinbase. The TVL increased by 16.03% in the last week, reaching 228 million US dollars. It has surpassed Starknet and is currently ranked 5th, lower than dYdX.

The launch of the Base cross-chain bridge and the on-chain event Onchain Summer have also promoted the growth of Base TVL.

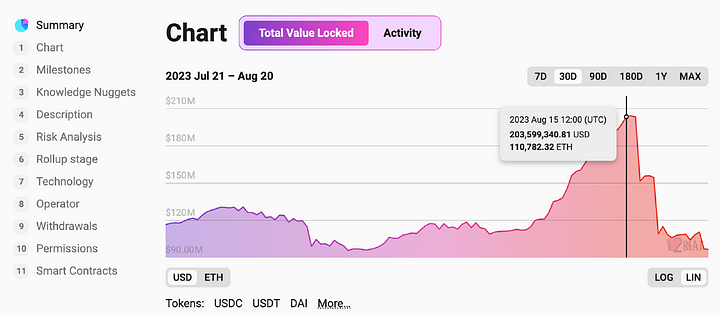

The TVL that has dropped the most is Starknet, which has dropped by 39.93% in the past week. TVL has dropped from US$200 million to less than US$100 million, which can be described as a cliff drop.

Regarding the BART (that is, a sudden rise and then a sudden fall) in StarkNet TVL, StarkWare team member odin free explained that this was caused by OKXs integration testing. They first made batch deposits with a small amount, and then withdrawn them twice $50 million.

In addition, BNB Chain tweeted that the opBNB mainnet has been opened to infrastructure providers, which is one step closer to the launch of the public opBNB mainnet.

(4) DEX

TVL

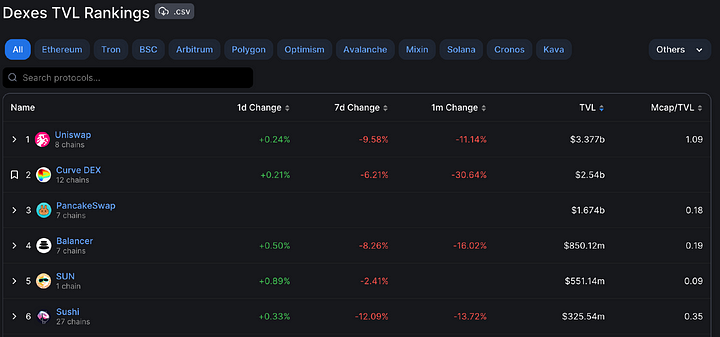

According to statistics from defillama, the total locked-up amount on the DEX track is 12.2 billion.

Uniswap ranks highest in lock-up volume, followed by Curve, PancakeSwap, Balancer, SUN and Sushi. Due to the decline in market prices, TVL has declined in the past week.

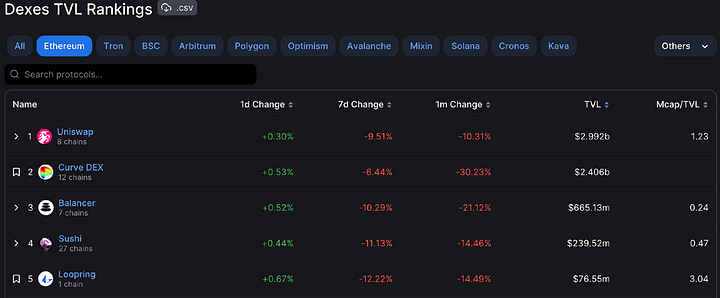

Among them, the DEXs with the highest TVL on the Ethereum mainnet are Uniswap, Curve, Balancer, Sushi and Loopring.

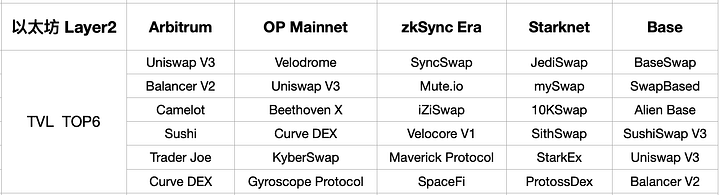

The above are the top 6 TVL DEXs on Arbitrum, OP Mainnet, zkSync Era, Starknet and Base chain.

The above are the top 6 TVL-ranked DEXs on other Layer 1 chains.

Trading volume

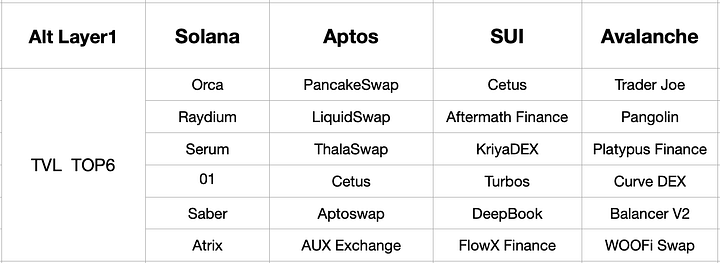

The trading volume of decentralized exchanges (DEX) in the last 24 hours was nearly 1.3 billion US dollars, while the total trading volume of global cryptocurrency exchanges in the last 24 hours was 32.5 billion US dollars, of which DEX trading volume accounted for only 4%.

Among DEXs, the exchanges with higher trading volume include Uniswap, Curve, THORWallet DEX and PancakeSwap.

(5) Derivatives DEX

TVL

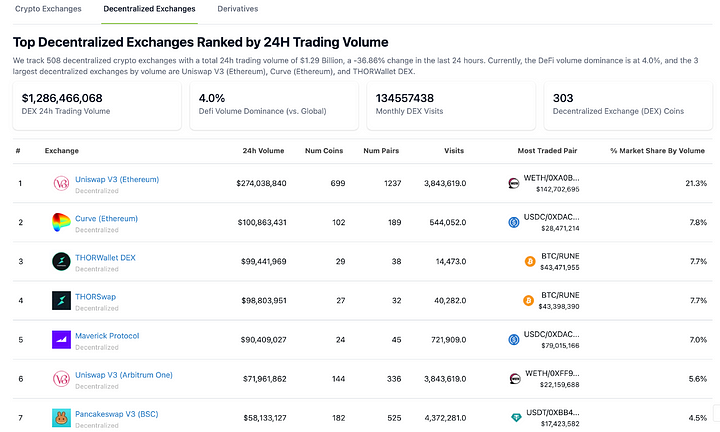

Judging from the data of defillama, the TVL of derivatives DEX has basically declined recently. On the one hand, it is due to the decline in token prices, and on the other hand, it is due to the decline in the overall trading volume of the derivatives track.

In the derivatives track, GMX has the highest TVL, followed by dYdX, Gains Network, NUX Protocol and ApolloX.

Trading volume

According to the statistics of the coingecko platform, the decentralized derivatives trading platform with the highest trading volume is dYdX, whose trading volume in the last 24 hours reached 320 million US dollars, followed by GMX, whose trading volume in the last 24 hours reached 270 million US dollars.

4. Recent token unlocking

Recently, many projects have welcomed token unlocking, including some old and well-known projects, such as LDO, AVAX, 1INCH, etc.

Among them, AVAX is the project with the largest unlocked amount recently, and will unlock more than $100 million in tokens.

The unlocked amount of YGG accounts for 7.04% of the circulating supply, which is enough to have some potential impact on the market and deserves the attention of investors.

Follow hot air balloon @HorairballoonCN on Twitter to explore more industry news:https://twitter.com/HotairballoonCN