In September 2020, an innovative term NFT (non-fungible token) began to slowly come into peoples sight and was captured by a few early players and institutions. Starting from February 2021, NFT has completely begun to grow explosively, with weekly trading volume exceeding US$2 million. In a few months, the total market value of most NFT projects has increased by as much as 2000%, and a large number of outsiders have squeezed out the market. Learn and get in.

More and more people come in and consensus spreads among the crowd. But for more people, how to invest and make profits from the rapidly growing NFT market is the first goal. The rules of the game for NFT are very different from the traditional way of doing things; although consensus is a beautiful thing, and the culture behind many projects is worthy of our attention and love, we cannot deny that most NFT projects during the bull market are more like drumming and spreading flowers. In the game, it is difficult for a small picture to have such a high value at the beginning.

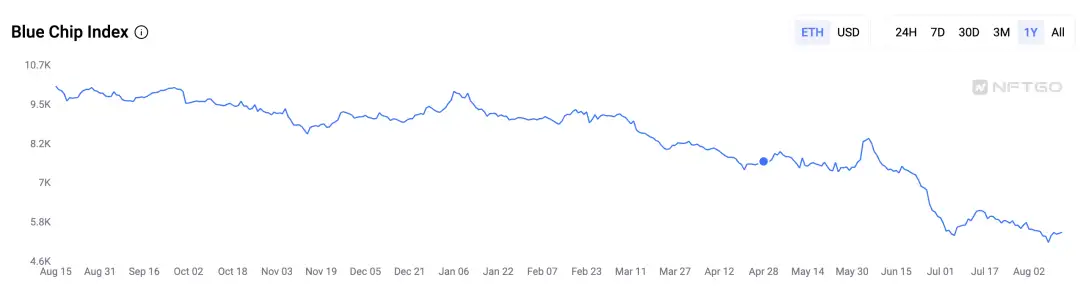

Therefore, in less than 150 days, most users had just figured out what non-fungible tokens were and what PFP was. They were shouting Everything can be NFT and were ready to make great achievements. The liquidity crisis It has quietly penetrated into every corner of the market, and the market has begun to plummet. In the short term, people still held out the hope of just a correction, but the situation did not improve after that. A large number of projects returned to zero, and the top blue-chip project BAYC also fell nearly 90% from its high point.

According to NFTGo data, there are only more than 40,000 users who have made profits in the past seven days, while as many as 450,000 users have made losses. It can be seen that the market has been in a cold winter.

Someone joked: The essence of NFT is to see a small picture you like, Ctrl C + Ctrl V, do you still want to buy it?

Each round of bull and bear market will replace a large number of users, and NFT is also experiencing its first bear market. Those who are still paying attention to the NFT track must be racking their brains to think-when will NFT pick up? How to catch the signs of recovery in advance?

First of all, we must understand that the NFT market is generally difficult to recover independently. The essence of the so-called sector rotation is the entry of funds. The market price of Token can depend on the general economic environment, etc., but for NFT, it has not become an investment target for many traditional investment groups and institutions, and it is difficult to be affected by the traditional financial environment.

Therefore, the recovery signal of NFT relies more on its own hard power. There are three signals for your reference:

The first point is to pay attention to the new moves of the giants and look for benefits

The Metaverse project became popular in the last cycle, and a large part of the reason behind it was that Facebook’s parent company changed its name to Meta. The giants have abundant funds, vast resources, and professional team judgment; each of these points is enough to push a certain segmented track to a climax. And people generally agree that giants are very forward-looking, and it is easier to make profits by following their footsteps.

But sometimes you have to be careful. Giants often manipulate the market by spreading good news. There is no signal when their funds are withdrawn early, and it is easy for people to realize it later. Secondly, the vision of giants is not 100% accurate; for example, Facebook parent company Meta stated in its first quarter financial report this year that its Metaverse business unit Reality Labs experienced an operating loss of US$3.99 billion in the quarter.

But there is no doubt that if a giant in the industry makes similar new moves again, the market will not be so deserted.

The second point is to pay attention to whether there are any epoch-making applications.

Just as the emergence of StepN ushered in the era of P2E, running, skipping and even Sleep to Earn were all kinds of projects. Even many domestic news media began to report on StepN to make everyone beware, which shows how popular it was at the time. Exaggeration (although StepN is not the first similar application, it is indeed the first to combine it with NFT and break the circle).

If there is another similar application, it will definitely bring a lot of popularity. Just like the recently launched blockchain game Matr 1 , not just 4399 anymore. However, even if applications that break the circle appear again, we will be pleasantly surprised but it also depends on how well the economic model is designed, otherwise the final outcome will be a death spiral and users will return to Work to Earn.

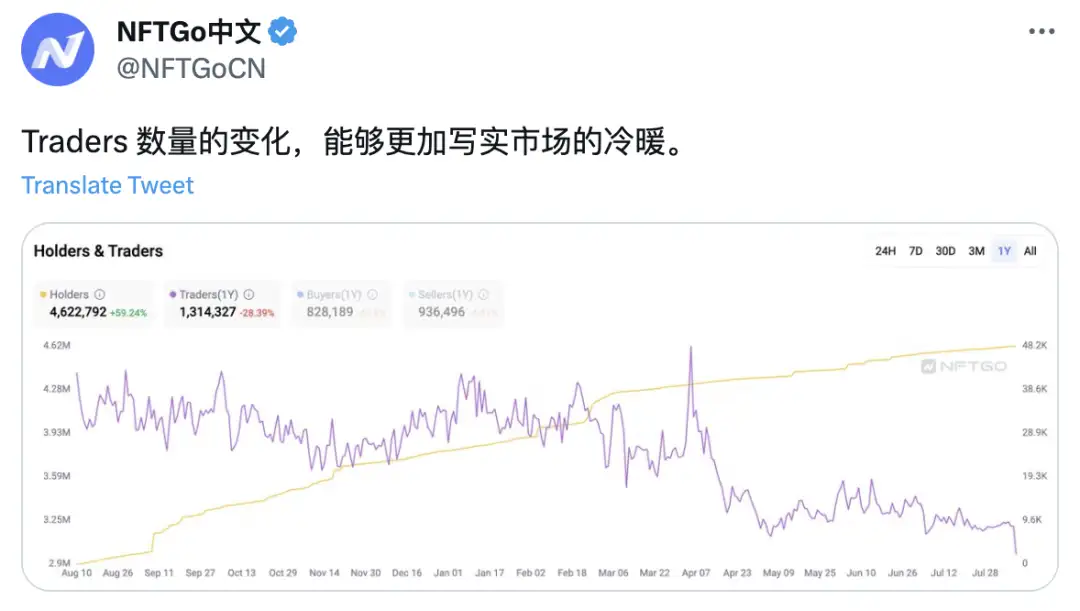

The third point, pay attention to the data

Although I said that the essence of sector rotation is the entry of funds, this happens to be the most important; wherever the funds flow, there are hot spots and there will be a rebound. Good projects may not necessarily fall, but bad projects will certainly not rise - of course, this must exclude some short-term gambling-style MEME projects.

We may not be able to know a lot of news immediately, but the data must be the most accurate and truly reflect market sentiment. In this regard, we can go to more data platforms (such as: NFTGo) and pay attention to some important data indicators, such as: market temperature indicators, the number of traders, profit and loss ratio, whale trading volume, etc.; once the data changes , you can spend more time searching for the reasons and make a judgment immediately.

Every bear market is difficult, but compared to the blockchain that was called a scam by many people five years ago, the current bear market is much gentler - because there are always people building, at least we believe that the bull market will come back, not Questioning whether the track will disappear.

So in the first cold winter of NFT, what can we do to make ourselves more prepared when the bull market arrives? The following points are for your reference:

First point, watch more and move less

The most painful thing about investing must be when the bull market arrives and the money is gone. Projects that are still hot in the bear market are basically MEME-type, relatively gambling-oriented, and have very low profit-loss ratios. However, because the market has been inactive for too long, it will become impatient, and it is easy to get into FOMO and lose ammunition. We can easily see wealth myths on the Internet (such as PEPE earning 100,000 times), but in reality few people are familiar with this. The probability of getting rich suddenly is very low. Giving up illusions and being down-to-earth is the way for most people to accumulate wealth (10 U God of War is not impossible).

Therefore, in a bear market, capital allocation must be done well. Everyone invests too much money and watches more but moves less.

The second point is to remember level one > level two in a bear market.

Even for projects like Ordi that have created a million-fold myth in the bear market, those who have made substantial profits are basically those who participate in the primary market to create new products. Most of the users who take over the secondary market are stuck - because when you know The project is probably already at a high level (previously NFT Labs reprinted the article xxx in the early days of BTC Inscription, and friends who pay attention and operate it should make a lot of profits). Even if you are optimistic about the long-term future of a certain project, it is best to wait until the FOMO mood of the project passes before slowly buying the bottom. Projects that take off in the short term will always come down. After all, most large players have to ship.

In the previous bull market, I recommended that everyone buy white orders instead of secondary purchases. This is especially true in the bear market. In addition, innovative projects with first-time quality will have more collection value and the price will be more arbitrary; such as: Punks of the ETH chain, Sub 10k of the BTC chain, etc.

The third point is to maintain focus on innovation

Whether NFT can really have some application scenarios is only a matter of time, because it actually depends more on the popularity and acceptance of encryption and blockchain in reality. But even in a bear market, NFTs are always innovating and improving. For example, the recently released ERC 6551 protocol (one of its authors, Benny, is also the inventor of ERC 721), allows an on-chain NFT to contain coins, SBT, and other NFT assets and package them, which can bring many new narratives And application scenarios, such as: sovereignty of PFP NFT, equity NFT, splitting of virtual item attributes, etc.

There may also be some epoch-making applications based on these protocols (such as interesting applications such as customizing unique NFTs for each person according to each persons personality), causing the market to pick up, so it is always right to stay tuned. The information gap in understanding new things is likely to be the source of your first pot of gold.

Conclusion

In every round of bull-bear transition, some people will enter and some will leave; this is essentially a difference in long-term investment judgment. Therefore, you only need to keep paying attention to the innovative products that you are optimistic about. With the patience of long-term learning and appropriate trial and error, you will soon have your own investment ideas.

It should also be noted that NFT is currently much more popular overseas than domestically. The recent explosion of the For the Culture slogan, the controversy caused by DeGods new move, and more interesting projects such as Milady, frEns, and Punks 2023 all happened overseas, and few people in China paid attention to them. Therefore, you must have an international perspective. Sometimes when you lose confidence, looking at the (NFT) world from another angle will suddenly make it clearer.

NFT Labs only provides relevant information and does not constitute any investment advice.

The NFT Labs community that has been urged many times by everyone is now open. Whether you are an NFT enthusiast, a blockchain game player, a trader, or a digital artist, everyone is welcome to exchange ideas together, NFT to damoon~ (How to join the group : Just poke me [ID:lovebit 98]! ^ ^)