The crisis of Curve is still fermenting.

Affected by safety accidents and potential liquidation risks, CRV continued to decline today, reaching a low of 0.482 dollars at one point. As of the time of writing, it has rebounded to 0.58 dollars, but the 24-hour decline is still 8.13%.

At the same time, the governance tokens of major Curve ecosystem projects have also suffered heavy losses. Among them, Convex (CVX), which is most deeply affected, fell to a low of 2.884 dollars, and now it is temporarily reported at 3.034 dollars, with a 24-hour decline of 11%.

Due to the potential threat of liquidation and bad debts, several lending projects such as Aave and Frax are also declining. AAVE is temporarily reported at 64.61 dollars, with a 24-hour decline of 8.87%; FXS is temporarily reported at 5.69 dollars, with a 24-hour decline of 5.03%.

The continuous spread of the impact has even led the entire DeFi sector to a pessimistic sentiment.

What is the main danger Curve is facing right now?

Although it has only been a day, the main source of crisis for Curve has now changed.

If yesterday the main risk Curve faced was the contract security threat caused by the Vyper vulnerability, today its main risk comes from the potential liquidation threat of CRV in major lending platforms' debt positions, with the health of Curve founder Michael Egorov's personal debt position being the key.

It needs to be clear that these two threats are fundamentally different. Even without the Vyper vulnerability, if the market continues to decline, Egorov's debt position liquidation risk would eventually be exposed, but this time Vyper has brought this "hidden thunderbolt" to light.

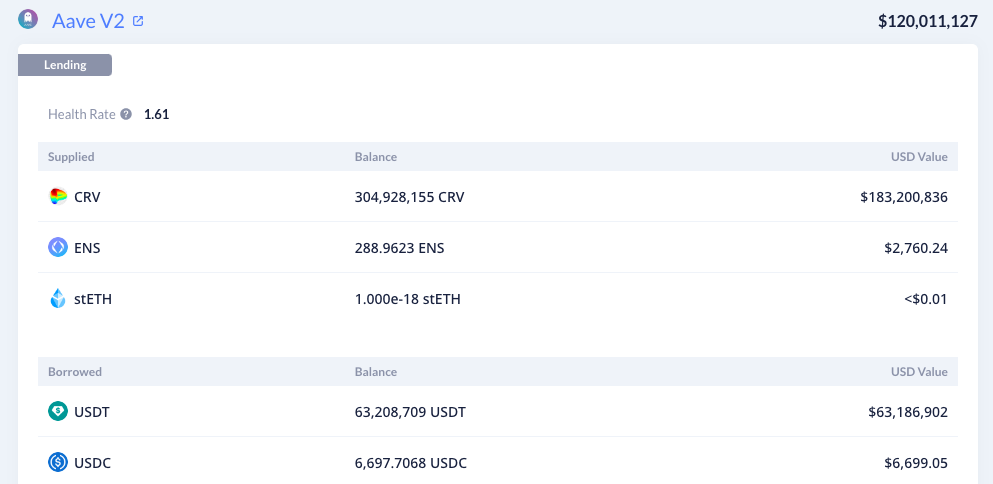

On-chain data shows that as of 15:00 this afternoon, Egorov has collateralized approximately 450 million CRV on Aave, Fraxlend, Abracadabr, and Inverse, and borrowed approximately $105 million. The overall liquidation price of this portion of debt positions is approximately $0.38 to $0.4.

As 450 million CRV accounts for half of the token's circulating supply, it can be confidently said that if these debt positions were to be liquidated, the massive selling pressure of CRV would directly enter the market in a short period of time, which would undoubtedly deal a heavy blow to the already precarious CRV price.

Will it go into liquidation?

Since the safety accident occurred yesterday, Egorov has been trying to avoid potential liquidation through various operations, such as adding CRV collateral, gradually repaying some of the debts, or using Curve to indirectly influence the debt position interest rate.

So, can these measures prevent potential liquidation?

First of all, it is important to note that Egorov's personal debt positions are scattered across multiple lending platforms, including Aave, Fraxlend, Abracadabr, Inverse, etc. The size and risk conditions of each debt position are different (in simple terms, these liquidations are not binary events of 0 or 1, but there are multiple possibilities in between). Among them, the debt position on Aave is the largest in size, but the most dangerous one is the debt position on FRAXlend.

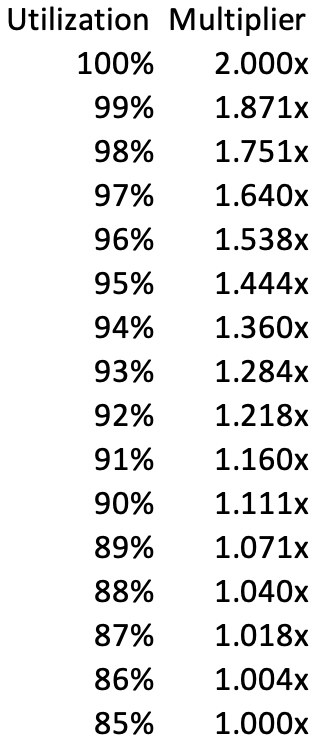

The reason for this is that FRAXlend adopts a rather special interest rate adjustment mechanism. When the overall funds of a market reach 85%, the interest rate will increase by a certain multiplier every 12 hours (it will double when it reaches 100%), and the maximum interest rate can go up to 10000% .

Odaily Note: The interest rate multiplier for Fraxlend liquidity exceeding 85%.

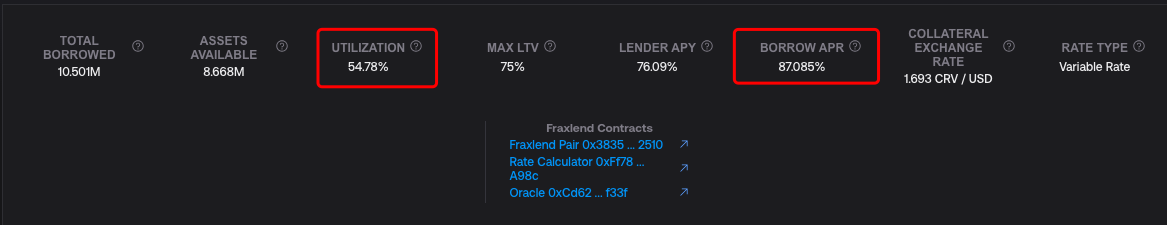

Due to a prolonged period of time from yesterday to now, the overall utilization rate of the CRV/FRAX market within Fraxlend has exceeded 85% and even approached 100%. This has caused the lending interest rates in this market to continue to rise (according to user statistics, the interest rate has reached 132% at one point) and there is a possibility of further increase.

This also means that if the overall utilization rate of the CRV/FRAX market in the future does not decrease, Egorov will face increasingly high lending interest rates, resulting in the continuous expansion of its debt scale, and subsequently raising its liquidation threshold, exacerbating the liquidation risk of the entire vault.

Fortunately, Egorov has realized the special situation of this vault within Fraxlend. In order to reduce the utilization rate of this market, Egorov has implemented various measures. With Egorov gradually repaying $7.13 million to Fraxlend this afternoon, the size of this vault has been reduced to about $10 million, the overall utilization rate of the CRV/FRAX market has also dropped to 54.78%, and the lending interest rate has dropped to 87.085%, temporarily containing the danger.

It is worth mentioning that during this period, Curve has also launched a liquidity pool called crvUSD/fFRAX for the Fraxlend CRV/FRAX market. If users want to participate in this pool and obtain CRV incentives, they need to make a deposit in the CRV/FRAX market within Fraxlend, thereby reducing the overall utilization rate of this market. Some users have criticized this measure as a centralization move by Egorov, taking advantage of Curve to alleviate its own crisis.

In summary, it seems that Egorov has found some respite for this vault within Fraxlend, which has also led to a certain rebound in the price of CRV, indirectly alleviating the liquidation risk of its vaults on other platforms such as Aave, Fraxlend, and Abracadabr.

If a comprehensive liquidation occurs, what will happen?

First, let's confirm two points.

One is that besides the pools affected by the Vyper vulnerability yesterday, other smart contracts of Curve are still operating normally. As a leading project that emerged strong in the DeFi race, Curve's own contract quality should not be questioned too much - it is difficult to predict bugs in the underlying programming language.

Second, while the operation of the Curve protocol is related to the price of CRV in terms of functionality (mainly affecting incentives), it does not need to rely on the latter. In other words, CRV can drop significantly, but Curve will still exist. As for the price trend of CRV, personally, I lean towards the possibility of a comprehensive liquidation being unlikely. This is because, from the on-chain records of Egorov repaying Fraxlend this afternoon, it seems that he is selling CRV off-market at a price of $0.4 (Frog Nation's former CFO 0 x Sifu revealed that the buyer will have a 6-month lock-up period). This price is essentially equivalent to the potential liquidation price of Egorov's several debt positions.

This means that some large funds in the market still have a relatively reasonable estimate of the value of CRV, and are willing to hold it for the long term at a certain discount price, even in the face of short-term liquidation risks.

Therefore, even if the liquidation really occurs, CRV may indeed experience a short-term plunge due to the sudden massive selling pressure. However, if a lower price than the market estimate appears, potential buying pressure may help CRV gradually recover. After all, the Curve protocol is still operating solidly, and the reputation accumulated over the past two years will not completely dissipate.

Ultimately, compared to the industry benchmark Curve two days ago, today's Curve has only encountered one security incident (and Vyper has to take the blame). Although the actual losses are not small, they can be compensated considering Curve's financial reserves.

What lessons can be learned afterwards?

With the passage of time, events will eventually come to a conclusion.

The story I personally imagine is that regardless of whether this liquidation will occur, Curve will continue to exist, and CRV will gradually return to normal after experiencing various fluctuations, ultimately bringing the situation back to calm.

At this moment, I want to reflect on the three parties involved in this crisis (Curve, Egorov, and the lending protocol).

Firstly, regarding Curve, it seems difficult to have too many expectations because it's hard to find vulnerabilities in the underlying code even with extensive audits. Curve's focus should perhaps be on discussing a fair compensation plan with other affected protocols (Alchemix, JPEG'd, Metronome).

Next, regarding Egorov, as an individual user, there doesn't seem to be any problem with using the rules of the lending protocol to maximize personal capital utilization efficiency. However, as a core figure in Curve, Egorov's actions of leveraging borrowing to transfer financial risks to the lending protocol and the entire community have raised suspicion among some community users (some suspect that Egorov never intended to liquidate).

As for the lending protocol, the topic of the scale limit of debt positions in regards to meme coins is a long-discussed topic in the DeFi industry. One of the concrete manifestations of a bear market turning point is the reduction of meme coin liquidity, which has turned the once lucrative meme coin pool into a source of risk. After this incident, it is certain that major lending protocols will pay more attention to this issue.

In terms of specific projects, Fraxlend demonstrated better resilience in this liquidation crisis through the use of dynamic interest rate design. It "forced" Egorov to prioritize addressing the platform's debt position issue, thus reducing risk exposure in advance without adjusting the rules, indirectly achieving a "head start".

Regarding this incident,

After that, some voices exclaimed that DeFi was over, but I don't think so. After so many years, DeFi has witnessed many ups and downs. The impact of various negative events during the bear market is always magnified. But looking back in the future, this may just be a relatively special hacker attack, coupled with an unhealthy lending and borrowing mechanism.Related Reading

Vyper Language Vulnerabilities Found, Curve and other Projects Attacked

How is Fraxlend's interest rate calculated that surged 10,000% in three and a half days?