This week, there are 4 projects worth paying attention to that will be unlocked, namely APT, IMX, FLOW, and APE.

Aptos

Project website: https://aptoslabs.com/

Official Twitter: https://twitter.com/aptoslabs

Unlock quantity for this round: 4.54 million

Unlock amount for this round: (approximately) 32.39 million USD

Aptos is one of the highly anticipated projects in the Move-based public chain arena, backed by Facebook's background and technology. This new Layer 1 chain has gained considerable attention from major capital players. The chain aims to provide users with a next-generation PoS public chain with good performance and higher TPS, in order to promote the popularization of blockchain at the application layer and welcome billions of users to the crypto world.

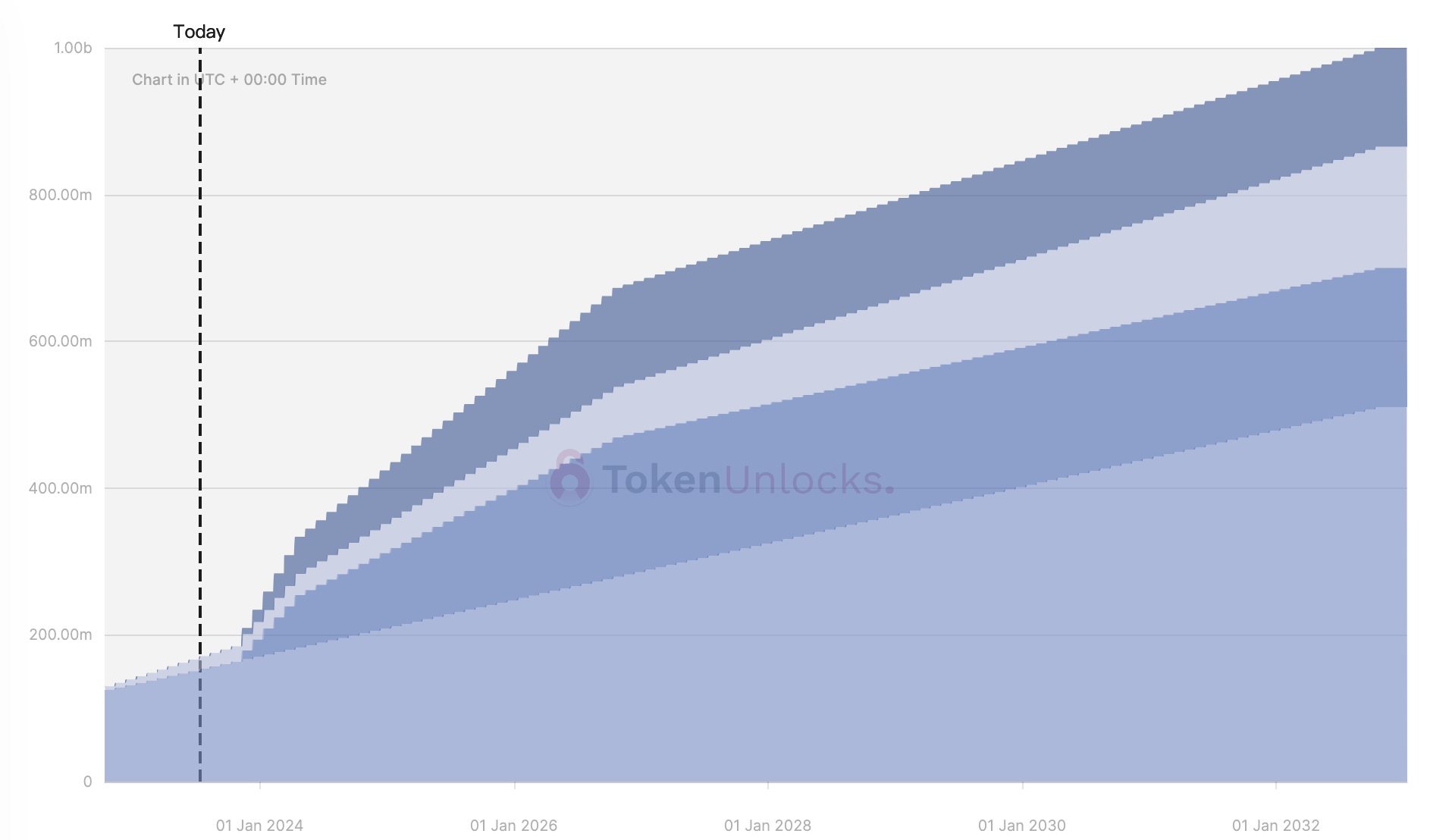

APT is the native token of Aptos. The tokenomics of APT show that 51% of the tokens are held in the community treasury, and the token has a significant amount of lock-up.

Currently, as high as 83% of the tokens are still locked, with only 17% in circulation.

In this round, approximately 4.5 million APT tokens will be unlocked, accounting for 2.16% of the total circulating supply.

ImmutableX

Official website of the project: https://www.immutable.com/

Official Twitter: https://twitter.com/Immutable

Amount unlocked this time: 18.08 million coins

Amount unlocked this time: (approximately) 12.76 million US dollars

Immutable X is touted as the first Layer 2 protocol for Ethereum ZK-rollup, used for trading and transferring NFTs, with instant transaction confirmation, zero gas fees, and significant scalability as it can handle 9000 transactions per second. Immutable X achieves all this without compromising user ownership. The protocol is built by the Starkware team using StarEx technology.

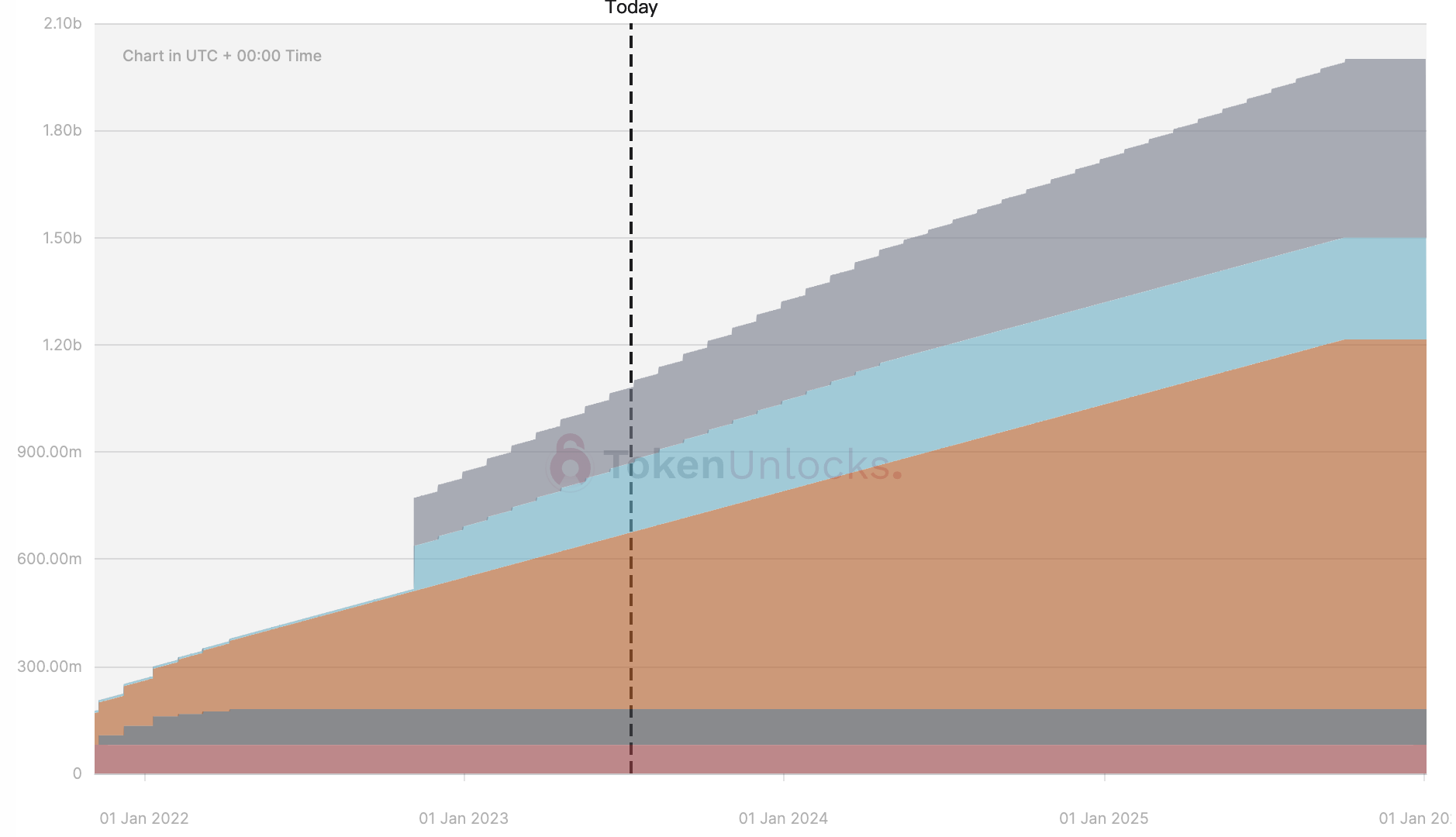

The unlocked amount for IMX is considerable, with the value of the unlocked amount reaching nearly 13 million US dollars, accounting for nearly 2% of the circulating market value. However, such unlocking situations are common.

From the perspective of the release model, the unlocking this time is not particularly special. Similar-scale or magnitude unlocking events occur every month. And there will not be larger-scale unlocking events that are different from regular unlocking events in the future. Investors have sufficient historical data for reference.

Flow

Official website of the project: https://apecoin.com/

Official Twitter: https://twitter.com/apecoin

Amount unlocked this time: 72.14 million coins

Amount unlocked this time: (approximately) 4.4 million US dollars

Flow is a high-performance chain designed for games and NFTs, with the aim of empowering the next generation of games, applications, and digital assets. The birth of Flow is to some extent to solve the problem of NFT circulation on the ETH chain, which can be scaled up on a large scale without using sharding to maintain fast and low-cost transactions.

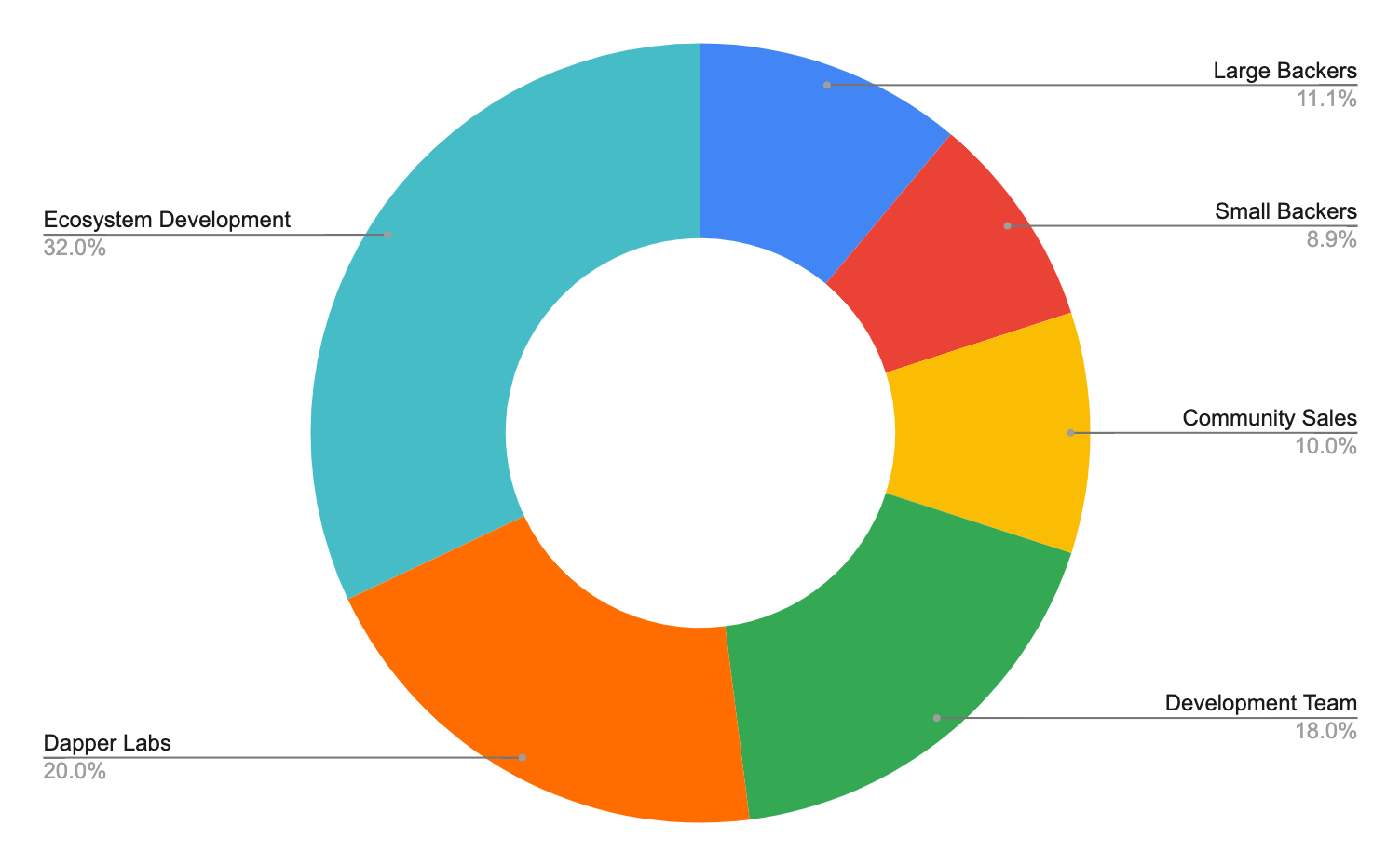

Flow Token Economics

The release model of Flow shows that FLOW is linear unlocked, and FLOW tokens are normalized and unlocked in small but frequent amounts. In this release, only about $4 million worth of Flow was unlocked. For FLOW, which already has a circulating market value of hundreds of millions, such a scale of unlocking is not enough to cause a significant impact on its large circulating supply.

ApeCoin

Official website: https://apecoin.com/

Amount unlocked this time: 15.6 million coins

Amount unlocked this time: (approx) $30.11 million

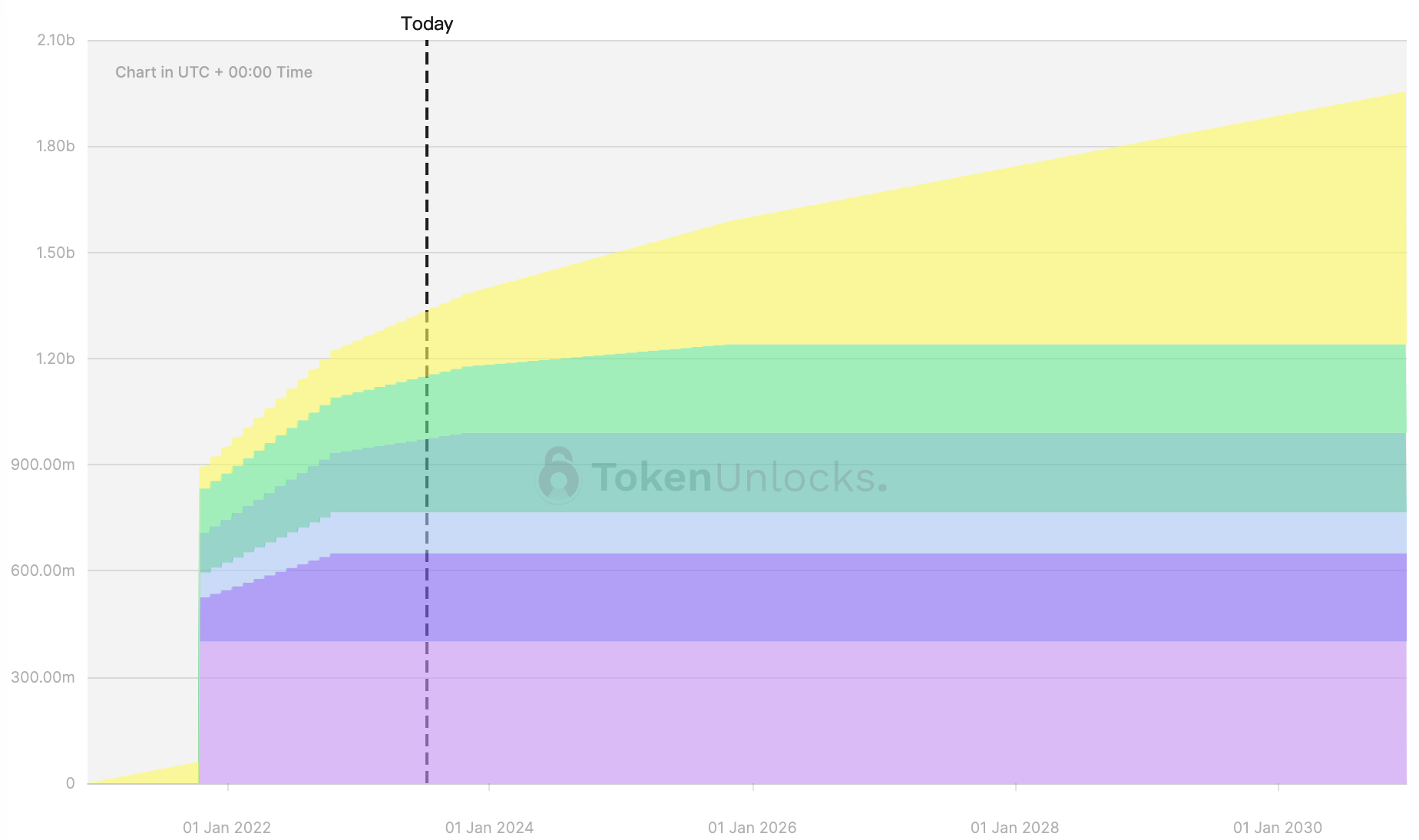

ApeCoin (APE) is the governance and utility token of the APE ecosystem, with a total supply of 1 billion coins. The project is controlled and established by the community, with ApeCoin DAO as its governing organization, allowing all APE holders to participate in governance decision-making voting. In addition to the DAO, Yuga has also established the APE Foundation as the legal regulator of the DAO. The foundation's board of directors consists of 5 members. At the initial distribution of the token, BAYC holders were airdropped a large amount of APE tokens.

APE, known for its publisher Yuga Labs, is the parent company of BAYC, and Yuga Labs has gained prominence in the NFT ecosystem. Yuga has expressed its intention to actively utilize APE as the primary token for all new products and services. In addition to BAYC, Yuga also owns two major IPs, CryptoPunks and Meebits.

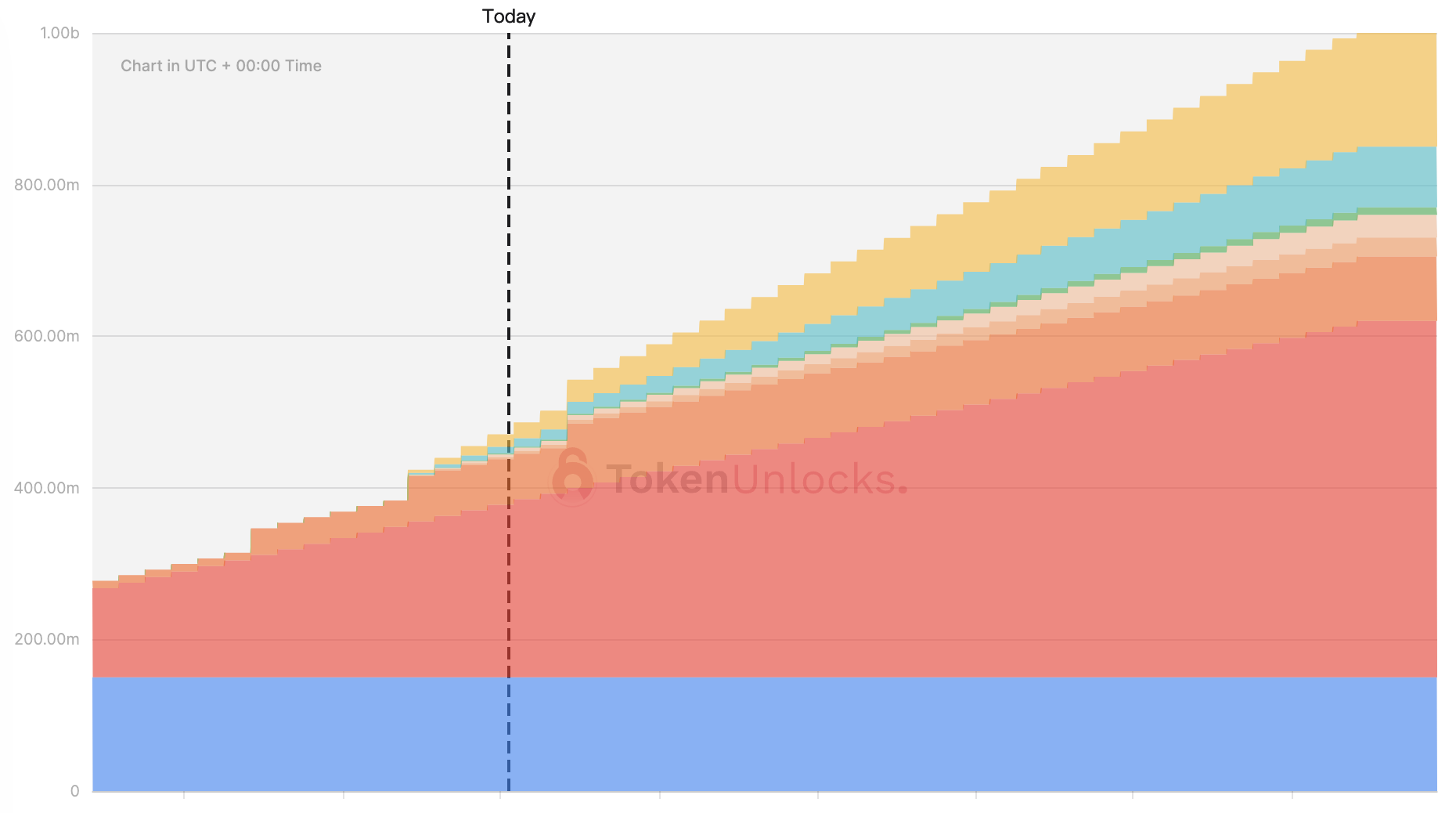

Since its initial release, APE has attracted a lot of attention due to its high topicality. Its large holdings by big players and reserved tokens have also sparked controversy. The tokenomics of APE show that 47% of its tokens are held in the treasury. Even today, nearly two years after the token launch, 56% of APE tokens are still locked.

The current unlocking accounts for 4.23% of the circulating supply, which is a considerable amount. However, similar-scale unlocks have occurred multiple times in the past, providing sufficient historical data for reference.

The current unlocking accounts for 4.23% of the circulating supply, which is a considerable amount. However, similar-scale unlocks have occurred multiple times in the past, providing sufficient historical data for reference.

Related Reading

Token unlocks often accompany short-term price fluctuations, and investors can pay attention to the market and capture trading opportunities while being aware of trading and holding risks. For more information on the correlation between tokens and prices, you can read the following previous articles from Odaily:

"An Analysis of Market Effects Brought by Token Unlocks: AXS, SAND, DYDX as Examples"

"How Token Unlocks Impact Prices? A Big Data Analysis of 5000 Projects"