Source: Buidler DAO

Author: @Fu Shaoqing @Economic Model Group

Editor: @Hei Yu Xiaodou

Preface

The Economic Model Group hopes to study the overall process related to Tokens. It mainly includes several parts:

Design of the economic model;

Issuance of Tokens;

Management of Token circulation.

This article mainly discusses the content related to token issuance. With the development of blockchain and Web3 projects, projects now include both FT and NFT. Currently, the academic community and application fields have conducted more research and development on the issuance of FT, while there is still a lack of rich cases and research on the role and issuance of NFT. Dr. Xiao Feng from Wanchain has released "Three Generations of Token Models for Web3 Applications," which involves knowledge related to NFT. In the last section of this article, we also briefly analyze the issuance of NFT. The group will continue to conduct in-depth research in this sub-field.

Token Issuance Basics

Types of Tokens

(1) Classification by the Swiss Financial Market Supervisory Authority

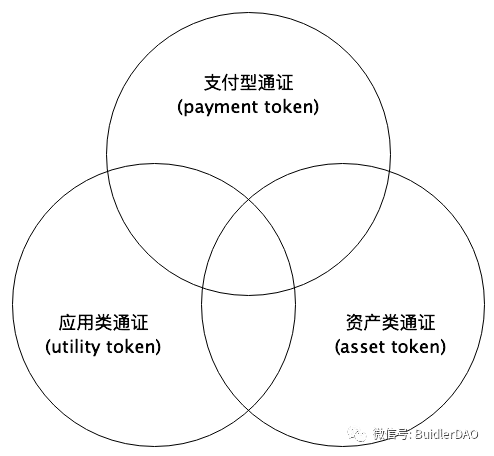

In 2018, the Swiss Financial Market Supervisory Authority classified tokens according to their potential economic functions, and this classification method has been widely recognized internationally. Referring to this relatively official and professional classification definition, specifically, tokens can be divided into the following three types.

Payment Tokens: This type of token is used as a means of payment, similar to currency, to obtain certain goods or services now or in the future.

Utility Token: This type of token exists in digital form and is primarily used for applications or services developed based on blockchain technology infrastructure. For example, the consumed gas fee.

Asset Token: This type of token is backed by certain assets, such as debt or equity that token holders can claim from issuers, a certain share of future company earnings or asset liquidity. Therefore, in terms of its economic function, this type of token is similar to stocks, bonds, or derivatives. If fiat currency is considered as an asset, stablecoins can be seen as tokens of this type.

This classification method may have intersections, with some tokens having attributes of two or three categories.

This classification is more in line with the observation of tokens from the perspectives of finance and currency. Tokens in projects generally have a process of evolution. Usually, they start with application attributes, and the prosperity of the application gives these tokens properties similar to general equivalents (currencies). As a result, they have more payment functions. Tokens that are widely used have good liquidity and value backing, making it easier to develop store of value properties and resemble assets.

(2) Focus on regulatory classification: utility and security (also known as application-based and equity-based)

Tokens are essentially carriers of value, using blockchain technology to tokenize value, rights, and physical assets. Their connotations can be equity, such as dividend rights, ownership, and debt rights; they can be assets, such as the mapping of physical assets on the chain, corresponding to asset tokens; they can be currencies, such as BTC, USDT, corresponding to payment tokens; they can be circulation tokens in applications or services, which are mainly issued for use within applications. Many dApps have issued their own tokens, corresponding to utility tokens; they can also be anything valuable, such as creativity, attention, etc.

However, in reality, some tokens are hybrids of multiple types, such as platform coins issued by exchanges, which are supported by partial profits of the exchanges and have strong financial attributes. At the same time, exchanges have also opened up numerous usage scenarios for them, giving them utility value.

The concept of token economy has emerged based on tokens and is considered to have unlimited potential. Its main characteristics are using the unique characteristics of tokens to create a better ecosystem, a better value model, a larger user base, and to achieve a large-scale distributed value creation form through tokens—this embodies the essence of open-source collaboration.

This regulatory-focused token classification model divides tokens into two major categories and four subcategories.

First major category: Utility Token.

Product or Service Token (Use of Product), representing the right to use a company's product or service.

Reward Token, tokens that users receive as a reward for their actions.

Second Category: Security Tokens.

Equity Tokens, similar to company stocks, bonds, etc.

Asset Tokens, corresponding to assets in the real world, such as real estate, gold, etc.

This classification is more in line with the regulatory perspective. Utility Tokens can develop freely, while Security Tokens are subject to regulation. However, if Utility Tokens are involved in financial activities and possess securities attributes, they will also be regulated.

Note: our previous article Four Quadrant Token Economic Model (I): Dual FT Model has also elaborated on this in detail.

Purpose of Token Issuance

Based on existing cases, there are two main purposes for Token issuance:

Distributing Tokens to users (promoting user adoption of applications)

Capital fundraising

Two types of Tokens: FT and NFT:

FT is more in line with the characteristics of currency, and the above two objectives are most evident. The issuance of FT requires finding a group of people who recognize the value of FT, and the value of FT lies in its description of the project's future.

NFT can also achieve the above two objectives, but due to its characteristics and development history, there is not much analytical content available. (We will specifically discuss the issuance of NFT in a later section.)

Token issuance examination indicators

According to the purpose of Token issuance, we have initially summarized several indicators. Generally speaking, compliance issues should be prioritized, but due to the early development characteristics of the blockchain industry, regulations and compliance are still being explored, and some situations are not clear enough. Therefore, compliance issues are temporarily placed second.

Token issuance user coverage: High-value Web3 users are commonly used, and other filtering methods are needed according to the characteristics of the application, and according to planning and execution, to maximize the coverage of target users. The calculation method for the areas that Token should cover varies depending on each application.

Compliance issues: Adopting compliant issuance methods or conducting compliant verifications according to the nature of Token and the policies of the main countries

Fundraising indicators: Under the premise of compliance and coverage, whether the fundraising meets the planned targets is a major examination indicator. This indicator has two dimensions: total amount and granularity

Regarding the lock-up period of the issued Token, we believe that it is the task of the design phase and the later stage of liquidity management and should not be considered as an examination indicator in the issuance stage.

Token's initial issuance and Token issuance in project development

In Token issuance cases, there are several types of research standards:

Initial issuance total (two types: initial total is 0 and initial total is not 0)

Fixed total and variable total (this dimension only affects later liquidity analysis, which is not discussed in this article)

The following figure represents the economic model of a Token with an initial circulation of 0 and a fixed total amount. This type of economic model is designed with Bitcoin as the token and does not have early token issuance issues. For currency issuance based on the difficulty system in the later stage, which is beyond the scope of this article, it will be classified for learning and research in later liquidity management.

Fixed total token model (initial circulation is 0)

The following figure represents the case where the initial total is not 0 and it is necessary to use Token issuance methods to raise funds or reach users more accurately. Ethereum is used as the token, which is the Token issuance method we are studying, such as ICO, IEO, IDO, etc. The scope of application is indicated by the red circle in the figure. For Token quantities that exceed actual applications, economic means are used to freeze liquidity.

Fixed total token model (initial circulation is not 0)

For tokens issued through methods such as PoW and PoS during the project operation, we consider them as tasks in the later stage of liquidity management and do not discuss the issuance of these tokens.

Token Issuance Method IxO

There are two major classifications for token issuance: private placement and public offering. Here we are discussing public offering issuance, and private placement issuance does not involve these issues.

Let's start by summarizing several common methods of digital currency issuance in one sentence: the most primitive ICO is the method initiated directly on the public chain; Airdrop is the method of sending tokens directly to users' wallets for free; IE 0 is the method of issuing through centralized digital currency trading platforms; STO is the method of issuing in cooperation with financial regulatory institutions; ID 0 is the method of issuing on decentralized exchange platforms like DEX.

Private Placement

A private equity fund refers to an investment fund that raises funds from specific investors in a non-public manner and invests in specific targets. Private equity funds recruit through means other than mass communication, and the initiators pool funds from non-public diverse entities to establish investment funds for investment purposes.

In the token field, private placements are generally conducted by investment institutions or individuals in this field, and it is usually sufficient to negotiate offline, similar to traditional financing. This form of token financing later developed into SAFT. SAFT stands for Simple Agreement for Future Tokens, which is a token issued by blockchain developers for financing the development of blockchain networks. It is similar to futures and gives investors the right to obtain corresponding tokens after the development of the blockchain network is completed.

SAFT has been adopted by many well-known projects because of its strong compliance, such as Telegram and Filecoin. SAFT is particularly suitable for utility tokens, which are not securities after they go online, but fundraising for network construction is an investment agreement. The use of SAFT can make the compliance process clearer.

Based on the examination indicators of token issuance, we summarize the effects of private placement as follows:

Coverage issue of token issuance: Poor coverage, mainly investors rather than users

Compliance issue: Generally compliant

The fundraising indicators: generally achieve good results and the amounts are large. However, it is difficult to control the granularity of the funds, as they are all from large-scale users.

IC0 (Initial Coin Offering)

ICO (Initial Coin Offering) Initial public offering of digital currency

ICO stands for Initial Coin Offering. It is derived from the concept of Initial Public Offering (IPO) in the stock market and refers to the first issuance of tokens by a blockchain project, where general cryptocurrencies such as Bitcoin and Ethereum are used for fundraising. When a company issues cryptocurrency for the purpose of financing, it usually issues a certain quantity of cryptographic tokens and sells them to participants in the project. These tokens are commonly used for exchanging Bitcoin, Ethereum, and fiat currencies.

ICO is a fundraising method that originated from the digital currency and blockchain industry. The first ICO that can be traced back was the Mastercoin project (now renamed Omni), which announced its ICO crowdfunding using Bitcoin on Bitcointalk (the largest Bitcoin and cryptocurrency community forum) in July 2013. The project generated corresponding Mastercoin tokens and distributed them to the participants of the crowdfunding. Essentially, this ICO was an exchange where participants exchanged Bitcoin for tokens in the Mastercoin project. Initially, ICOs were just community activities for cryptocurrency enthusiasts, but with the continuous development of digital currencies and blockchain, more and more people began to accept and participate in ICOs. The majority of ICOs are conducted through Bitcoin or other digital currencies.

In the blockchain field, ICOs began to be widely used after the Ethereum system supported the issuance of ERC 20 tokens. The phenomenon of ICOs then experienced a surge. The largest fundraising project was EOS, which raised approximately 4 billion USD through a daily bidding issuance that lasted nearly a year.

Advantages of ICO:

It provides an online fundraising method based on digital currencies. It is simple, convenient, and facilitates the issuance of new tokens. ICO completes the two main tasks of fundraising and token issuance.

Issues with ICO:

Operational risks of the project: Most projects participating in ICOs are in their early stages, with poor risk resistance and prone to operational risks. Therefore, like angel investments, the majority of ICOs face risks in the early stages of projects, often leading to investment losses.

Financial risks: Investors participating in ICOs may face risks such as fundraising scams and investment losses. Currently, ICOs are in their early stages and lack regulation, creating opportunities for some start-up companies to fabricate false project information and engage in fraudulent fundraising through ICOs.

Risks of Regulatory Laws: Currently, most ICOs are funded using BTC and ETH and are still in a regulatory gray area, lacking relevant legal regulations. Since 2017, countries have increased their supervision and control over ICOs, but various forms of IXOs have emerged, serving similar purposes as ICOs.

Currently on CoinMarketCap, ICO is broadly referred to as the issuance of tokens, including IEO and IDO. As shown in the image below, the ICO Calendar at the top is a broad definition of ICO, while the ICOs in the Upcoming Project section are described in this section.

Based on the examination indicators for token issuance, we have summarized the effectiveness of ICOs:

Coverage of token issuance: No participation conditions or restrictions, allowing for the broadest coverage, but requires the design of participation rules to filter out genuine customers. Due to investment demands, ICOs often attract many non-application investment customers rather than angel users who actually use the application (combining with airdrops usually yields better results).

Compliance issues: Although KYC and other requirements have been added later on, ICOs are considered illegal in most regions.

Fundraising indicators: Generally achieve good results. In terms of fundraising, if ICOs do not perform well, it is difficult for other methods to yield good results. Fund granularity is difficult to control, but large-scale users can participate.

Airdrops

Airdrop is a way of distributing digital currencies. Initially, the only way to obtain digital currencies was through Bitcoin mining. However, later on, with the emergence of altcoins and forked coins, distribution could also be done through airdrops. Airdrop, as the name suggests, means giving away free digital currencies. The development team gives you digital currencies without requiring you to mine, purchase, or hold the original coins before a fork. Airdrops can be given without any conditions, but more often, there are certain conditions, such as holding certain digital currency accounts. The rules of the airdrop are decided by the issuer and can include giving you a certain amount of coins when you register or distributing them through snapshot methods, among others.

In the early stages of blockchain development, there were not many conditions for airdrops, but as the industry progresses to the Web3.0 stage, many projects prefer to airdrop after making significant progress. This allows them to airdrop to users who have contributed and to use airdrops as a way to guide users in completing related tasks. For example, the airdrop design of Arbitrum.

Advantages of Airdrops:

Allocate the new tokens to the desired user groups for the circulation and application promotion of the new currency. Airdrops generally do not have regulatory issues because they do not involve financing.

Targeted airdrops to the true users of the application and guide them to complete related tasks.

Disadvantages of airdrops:

The airdrop method lacks the financing function and only completes the currency issuance.

Based on the examination indicators for token issuance, we summarize the effects of the Airdrop method:

Coverage problem of token issuance: good coverage can be achieved by setting airdrop conditions.

Compliance issue: there are basically no compliance issues.

Fundraising indicators: cannot meet the requirements for fundraising. However, the intensity of distribution is controlled well.

IEO (Initial Exchange Offerings)

IEO (Initial Exchange Offerings) refers to the initial issuance of digital currencies by exchanges.

IEO is a way to raise funds for new projects through digital currency trading platforms.

IEO is usually supported by the trading platform, so project parties choosing this method must take their project seriously. In the majority of cases, the IEO proposal is rigorously reviewed by the participating trading platform. In a sense, the trading platform guarantees the IEO project approved based on its own business reputation.

Through IEO, potential investors can buy tokens before they are listed on the asset trading platform. Registered users who provide KYC (Know Your Customer) information can buy tokens on the public market before open trading on the platform that promotes token sales.

Advantages of IEO:

Compared to previous ICOs, IEO has more obvious advantages. The tokens are directly listed on the trading platform, which promotes token circulation. For ordinary investors, project tokens being listed on the exchange allow them to participate in trading more quickly. In addition, project parties benefit as well. By conducting IEO directly on the exchange, the target audience expands to the user base of the entire exchange, enlarging the audience of investors. For truly high-quality projects and early-stage entrepreneurs, IEO not only serves as a good financing channel, but also saves a lot of expenses and energy in listing on the trading platform, allowing them to focus on project development and community operations. For exchanges, the most immediate benefit of IEO is the increase in trading volume and daily activities. Project enthusiasts will join in large numbers as new users with their funds, and some of them may eventually become long-term users of the exchange. Such activities are more attractive than traditional operating methods such as referral commissions and trading competitions.

Disadvantages of IEO:

The issue of issuance costs. Exchanges generally require listing fees, and the amounts are not small. For some early-stage projects, this is a burden.

The IEO method has certain auditing requirements for projects, so the threshold is higher for many project parties.

According to the Token issuance examination indicators, we summarize the effects of IEO:

Token issuance coverage issue: It can only promote users with trading demands and cannot cover the angel customers of real products well. It is best used in conjunction with airdrops.

Compliance issue: Generally guaranteed by exchanges.

Fundraising indicators: Relatively good, able to raise abundant funds through trading. However, there is a tendency for market manipulation and early exit of early investors. Poor control of fund granularity.

Compared to the first appearance of IC0, IEO expands the group of trading users and is beneficial for fundraising.

STO (Security Token Offering)

STO, which stands for Security Token Offering, refers to the issuance of security tokens. Securities are valuable instruments representing property rights, and holders can use these instruments to prove ownership or rights of private property. The US SEC considers anything that meets the Howey Test as a security. The Howey Test states: "A contract, transaction, or scheme whereby a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party." In general, the SEC considers any investment with "expectation of profit" as a security.

STO represents various financial assets or ownerships in the real world, such as company equity, debt, intellectual property, trust shares, gold, jewelry, and other physical assets, being transformed into encrypted digital equity certificates on the blockchain. STO digitizes various real-world assets, ownerships, and services.

STO is positioned between IPO and IC0, aiming to apply IPO management methods to regulate the issuance of digital currencies. On the one hand, STO recognizes its securities nature and accepts supervision from securities regulatory agencies in various countries. Although STO is based on underlying blockchain technology, it can achieve alignment with regulatory standards through technological updates. On the other hand, compared to the complex and time-consuming IPO process, similar to IC0, STO's underlying blockchain technology can also facilitate more efficient and convenient issuance of STO.

Origin of STO

IC0 continues to collapse, the myth of blockchain technology is shattered, and events such as no assets, no credit, cutting leeks, capital disks, and running away continue to occur. Fundamentally speaking, these events occur because IC0 lacks assets and value as a foundation, relying solely on propaganda, depicting the future, and meaningless consensus. The lack of direct supervision of important links such as IC0 and exchanges is also an important reason. STO, based on actual assets, actively embraces government regulation and tries to break the embarrassing situation of IC0.

The Securities and Exchange Commission (SEC) in the United States decided to include Token, a new species generated by blockchain, into securities regulation. This move once dealt a significant blow to the digital currency and blockchain industry, thinking that it would face a disaster.

However, the subsequent development is that more and more countries and regions have started to follow suit and have released their own regulatory policies. Although these regulatory policies even have certain differences in the definition of STO itself, it gradually makes the market realize that regulation is not a disaster, but it gives a legitimate identity and the ability to develop openly and honestly. So we see that from blockchain projects to traditional industries, from capital giants to securities professionals, and various asset holders, they are all actively paying attention to this industry and even rushing into this industry.

In a sense, STO and its underlying blockchain, Token, token economics, etc., in the current situation of unidentified identity and criticism, raising the sword of regulation is more like washing away its bad reputation and guiding its progress like a guiding light.

The STO regulation initiated by the United States has gradually triggered follow-ups from multiple countries and regions around the world, and the global regulatory system has shown a relatively clear trend in the chaos.

Advantages of STO:

1. Intrinsic value: ST has real assets or income as value support, such as company shares, profits, and real estate.

2. Automatic compliance and fast settlement: ST obtains approval and licenses from regulatory agencies, automates KYC/AML mechanisms, and achieves instantaneous settlement.

3. Smaller unit of ownership segmentation: Accelerate the segmentation of asset ownership and reduce the entry threshold for high-risk investment products, such as real estate and high-end artworks.

4. Democratization of venture capital: Expand the ways of raising funds.

5. Asset interoperability: Standardized protocols for assets will facilitate convenient interchange between different quality assets and different fiat currencies.

6. Increase liquidity and market depth: You can invest in illiquid assets through ST without worrying about redemption issues. Market depth will also increase through the following channels:

The rise in the price of digital assets has created billions of dollars in incremental wealth that will be invested in the market.

Programmatic market makers like Bancor have improved the liquidity of long-tail STs.

Asset interoperability protocols will promote the flow of cross-border assets.

7. Reduce regulatory risks and strengthen due diligence. It is applicable to regulatory exemption offers and writes the regulations of various countries on KYC and AML into smart contracts, with the hope of achieving automatic programmable compliance.

8. ST is expected to reduce the cost of asset circulation. In the process of reduction, transaction frictions such as automatic compliance and fund collection through smart contracts, data on-chain for contracts and accounting reports, increased asset divisibility, and T+0 settlement are implemented.

9. Regulated by the SEC under securities laws, ensuring legal compliance and enhanced security.

10. 24-hour trading.

STO issues:

1. Strict transfer and sale regulations. Referring to the description of Polymath ST-20 standard, ERC-20 tokens have no restrictions on the circulation and transfer of assets, and anyone can transfer a stack of ERC-20 tokens to anyone. But this is not possible for security tokens. The purpose of ST-20 is to ensure that the issuer can ensure that the tokens can only be circulated among individuals who have passed KYC, thereby narrowing the range of trading participants.

2. Cannot function as a payment method on platforms like a utility token.

3. There are significant regulatory barriers to cross-platform circulation of security tokens.

4. High asset liquidity may lead to significant price fluctuations. STO may allow a startup to become a publicly listed company with many ST holders. Due to the uncertainties and volatility faced by startups, these uncertain signals can cause drastic fluctuations in token prices.

5. STO innovation may simply pile up risks at the tail end.

6. Competing with traditional finance:

Competing with traditional financial products. From the perspective of investors, although there is a higher level of information transparency, being a security token (ST) does not necessarily guarantee safety compared to utility tokens. The quality of the underlying asset, development prospects, financial health, etc., still need to be considered.

Competing with traditional financial funding. Currently, the volume of funds and number of investors that high-quality assets can access in existing securities capital markets far exceed STO.

Competing with traditional financial institutions. Platforms for securities financing that only accept qualified investors have actually existed in the United States for many years, ranging from equity crowdfunding to real estate investment crowdfunding. For example, real estate investment platform Fundrise allows qualified investors to invest in partial profit rights of various projects without using tokens. Sharepost, for example, enables qualified investors to purchase pre-IPO equity in various startup companies, also based on existing technological infrastructure.

Competing with the traditional financial environment. The regulatory and legal maturity of traditional finance far surpasses STO.

7. Institutional investment decisions are relatively mature and rational. Without retail investors in the secondary market, liquidity should be discounted rather than at a premium. Valuation is generally difficult to be higher.

8. Security tokens rely on financial intermediaries for risk assessment and pricing, better matching the asset side and the fund side. ST needs to put the ownership and information of off-chain assets on the chain and circulate them in the form of tokens under the regulatory framework. Currently, the value of security tokens (ST) is not based on on-chain activities or decentralized networks, but on tokens that map equity or debt under regulatory premises. It has little to do with distributed networks and underlying blockchain technology.

STO is an attempt to manage the issuance of digital currencies using the traditional methods of IPO and securities regulation. This poses great difficulties and challenges because digital currencies have significant differences from traditional securities, and regulatory policies must be modified and adjusted.

Based on the token issuance examination indicators, we summarize the effects of STO:

Issue coverage: Only users who meet the regulatory requirements can participate, and it cannot cover the angel customers of the real product well. Even a large portion of customers who hold digital currencies cannot participate.

Compliance issues: Compliant

Fundraising indicators: Generally, due to restrictions, the fundraising situation is not good. Granularity is also difficult to control.

Others IXO

IFO Initial Fork Offerings

Initial Fork Offerings of digital currencies are usually based on mainstream currencies such as Bitcoin. IFO involves the splitting of the original Bitcoin blockchain into another chain according to different rules. For example, the first fork of Bitcoin gave birth to a new digital currency called BCH (Bitcoin Cash). "Fork" not only retains most of the code of Bitcoin, but also inherits the data before the fork.

Forks are often used in conjunction with airdrops. The newly generated coins are airdropped to old users, allowing them to benefit and accelerate the recognition and circulation of the new currency.

How many of the forked coins are successful? The success of blockchain projects lies in the continuous development of the project team. Teams that use the IFO method often have speculative intentions, making it difficult for the project to develop well.

IMO Initial Miner Offerings

IMO, Initial Miner Offerings, means issuing tokens by issuing miners.

The company or team creates a specific blockchain and uses a specific algorithm. Only the dedicated miners sold by the company or team can mine the tokens on this blockchain. Typically, these miners have application functionalities and obtain value from their continued use.

IMO This financing model, in simple terms, is to generate new digital currencies through the issuance of dedicated mining machines and mining. There have been some IMO cases, such as Thunder Play Cloud - Chainlink (formerly Play Guest Coin WKC), the traffic treasure box of the traffic ore under Quick Broadcast - Traffic Coin (LLT), and later the Storm Play Cool Cloud - BFC Points, etc.

Projects that require hardware support and rely on hardware operation business models can adopt this approach. It can accurately find early angel users and incentivize these users.

IBO (Initial Bancor Offering) Initial Conversion Issue

Before understanding IBO, let's understand Bancor. This word comes from the concept of a super-sovereign currency proposed by Keynes and Schumacher between 1940 and 1942. In Keynes' plan, Bancor can be used as an account unit for international trade, valued in gold. Member countries can exchange gold for "Bancor", but cannot exchange "Bancor" for gold. The currencies of various countries are priced in "Bancor".

However, due to the dominance of the United States after World War II, the British plan represented by Keynes was not adopted at the Bretton Woods Conference. Returning to the Bancor protocol, the Bancor protocol is proposed and applied by the Bancor Network project, aiming to set the exchange price of digital assets using formulas. The Bancor protocol makes it possible for automatic price discovery and autonomous liquidity mechanisms on smart contract blockchains. These smart tokens have one or more connectors that connect to networks holding other tokens, allowing users to directly purchase or liquidate smart tokens connected to a continuous calculation to maintain a balanced trading volume. price, through the smart token contract.

In a standard IB 0 issuance, the project party needs to first mortgage another Token of a certain value as a "reserve" according to the set ratio, and then it is completely realized through smart contracts for the issuance and circulation of Tokens. The project's funds are locked in the smart contract and are supervised by everyone at any time. Therefore, the IB 0 model has derived the following advantages.

An example of IBO is FIBOS in the EOS sidechain project. Because of this new concept of IBO, FIBOS raised 850,000 EOS within a week after its mainnet went live in late August of that year.

The theory of IBO is the underlying theory of applications like DEX. In DEX and IDO, the exchange of different digital currencies is smoother.

IDO Related Knowledge

From Coinmarketcap and other industry-related sources, IDO is currently the main issuance method. In this section, we will delve into the details of IDO. From the graph in section 2.1, we can see that most projects in 2023 have adopted the IDO method.

Basic Concepts

IDO, short for Initial DEX Offering, refers to the token's initial issuance based on a decentralized exchange (DEX). IDO promotes token sales through decentralized exchanges (DEX). Cryptocurrency projects provide tokens to DEX, and users invest funds through the platform, with DEX handling the final distribution and transfer. These processes are automated through smart contracts on the blockchain.

In 2019, IDO began to receive attention due to its low to zero fees and decentralized nature, becoming the preferred platform for projects to seek funding outside of private and early seed rounds. Since the first IDO in 2018, there have been 2365 IDOs, raising over $1.6 billion in funds (source: CryptoRank, December 2022). For more detailed information about IDO, you can refer to the cited references. The following link provides comprehensive statistical information:

https://blog.bybit.com/en-US/post/a-deep-dive-into-the-ID0-landscape-blt6b833275fde1a848/

Although IDO is issued on DEX, it can be roughly divided into the following channels depending on the specific method:

Issued through traditional DEX platforms like Uniswap, Balancer's LBP, SushiSwap, DODO crowdfunding pool, etc.

Issued through token issuance platforms like PolkaStarter, DuckStarter, Bounce, Mesa, etc.

Issued through DAO platforms like DAO Maker.

Other new channel methods: ITO created by MASK, announced and distributed through social platforms such as Twitter. (Twitter serves as an entrance, with a traditional DEX as the underlying platform).

Due to the different ways IDO is subdivided, there are also some differences in the process. If it is on a traditional DEX platform, there is generally no need for review. If it is through an issuance platform, the platform will handle the necessary reviews. Some projects have already generated tokens (usually in ERC-20 format) and do not need to rely on the token issuance capabilities provided by the platform.

In general, if a project wants to raise funds through token issuance, many processes are similar. The common ones are as follows:

Build a business plan

Prepare promotional materials (such as official website, project whitepaper, etc.)

Select a token issuance method (which can be ICO, IEO, IDO, etc.)

Prepare according to the selected issuance method. (such as issuing ERC-20 tokens, relevant audit materials)

Complete token issuance

Receive funds raised

For the IDO issuance method, the general process is as follows: choose a method from several forms of IDO issuance, and the common practice is to use a token issuance platform for issuance, which we will also illustrate with this method. The choice of issuance platform may vary depending on the different platforms.

Usually, platforms will conduct reviews:

After the review is completed, the project party can carry out IDO on the DEX. The project party supplies tokens at a fixed price, and users lock funds to obtain tokens. Investors will receive tokens in a Token Generation Event (TGE) shortly after.

There is usually an investor whitelist. Investors may need to complete marketing tasks to join, or only need to provide a wallet address.

Part of the raised funds will be used to create liquidity for the project's token. The remaining funds will be kept by the team. Investors can trade tokens after TGE. The provided liquidity is usually locked for a period of time.

In the TGE stage, tokens are transferred to users, and the liquidity pool for tokens is open for trading.

Advantages of IDO:

Features decentralized trading (open and transparent, good liquidity)

After the primary market issuance is completed, it is convenient to start secondary market listing

Provides opportunities for investors to participate in early-stage projects

Personally, I think the reason why IDO is currently popular is that there is no need to worry about regulation.

Disadvantages of IDO:

Generally, there is no KYC or AML. There have been many false projects in the early stages, similar to false transactions in the early stages.

IDO on issuance platforms often requires owning the platform's token to participate, increasing the cost for participants.

DEX scalability is poor. There have been projects that raised over $1 billion in ICO and IEO, but such cases have not occurred in DEX. IDO amounts are generally small.

IDO is facing a balance between regulation and innovation, as well as a balance between decentralization and risk control in its development and changes.

According to the Token issuance examination index, we summarize the effects of IDO:

Coverage issue of Token issuance: It can only cover users with trading demand in decentralized exchanges, and cannot cover angel customers of real products well. It is best to use it in conjunction with airdrops.

Compliance issue: Generally guaranteed by DEX exchanges, or this method gives up compliance.

Fundraising indicators: relatively good, able to raise abundant funds through trading. Good control over funds, can set the amount for individual participants.

Compared with the first appearance of IEO, IDO trading users in the early stage are not large, but the effects will gradually be better than centralized exchanges with the development of decentralized exchanges.

IDO issuance channels and platforms

In the previous section, we have explained several common channels for IDO, as follows:

Issuance through traditional DEX platforms, such as Uniswap, Balancer's LBP, SushiSwap, DODO crowdfunding building pool, etc.;

Issuance through Token issuance platforms, such as PolkaStarter, DuckStarter, Bounce, Mesa, etc.;

Issuance through DAO platforms, such as Dao Maker;

Other new channel methods: ITO method created by MASK, announced and issued through social platforms such as Twitter. (Twitter is the entrance, the underlying is still traditional DEX)

Looking at the ranking of IDOs on the Cryptorank.io website. https://cryptorank.io/ID0-platforms-roi

The screenshot below is from May 30, 2023. Take a look at the total number of IDOs and the return on investment for each platform.

According to historical data from Cryptorank, the tokens of these IDO platforms have seen increases of several hundred to thousands of percentage points from issuance to their all-time highs. Among them, GameFi platform's token has seen a growth of up to 4946.3%, making it one of the highest-performing representative cases among IDO tokens. This shows that excellent IDO platforms often have tokens with higher growth potential, making them one of the most favored objects of blockchain investors.

A few typical IDO platforms

https://daomaker.com/launchpad

https://governance.polkastarter.com/

https://bscpad.com/

https://dashboard.trustswap.org/

https://starterlabs.xyz/#/home

https://enjinstarter.com/index.html

https://occam.fi/

https://bullperks.com/

https://pancakeswap.finance/

A comparison of several main issuance methods

NFT issuance involved in the economic model

Two purposes of token issuance:

1. Distributing tokens to users (promoting user engagement)

2. Fundraising

NFTs can also achieve these two objectives. NFTs can be sent to users by directly sending them to their wallet address or by distributing them through NFT marketplaces. The value of NFTs lies more in the recognition of their value, and many NFTs are presented in the form of collections, reflecting the cultural factors of memes. Usually, it only takes finding one person among the crowd who recognizes the value.

Selling NFTs can serve the function of fundraising, especially for equity-based NFTs, as users are more likely to buy NFTs based on their expectations of future profits.

In this specific field, other members of the economics team will conduct further research and publish related articles to output research results.

References

Fu Shaoqing, Hu Shuguang, "Blockchain Economic Model," Beijing Institute of Technology Press, April 2022.

Camila Russo, "Everything's Connected: Ethereum and the Future of Digital Finance," Zhongyi Publishing, October 2022.

Xiao Feng, "Web3 New Economy and Tokenization" (Third Generation Token Model), HashGroup, April 2023.

cointelegraph. Initial DEX offering (IDO): A beginner's guide on launching a cryptocurrency on a decentralized exchange[EB/OL]. 202 x. https://cointelegraph.com/learn/initial-dex-offering-ido 。

Ian Lee. A Deep Dive Into The IDO Landscape[EB/OL]. 2023.1.16 https://blog.bybit.com/en-US/post/a-deep-dive-into-the-ido-landscape-blt6b833275fde1a848/