Original author: Nicky, Foresight News

As of August 6th, the MYX token experienced extreme price volatility. According to Bitget data, its price surged over the past three days, from $0.113 to $2.1, an increase of over 1,800%. However, within just 24 hours, the price plummeted 60% to $0.8237 and is currently trading at $1.05.

On August 7th, on-chain analyst @ai_9684 xtpa revealed a key development. Hack VC, an early investor in MYX, withdrew 1.27 million MYX (approximately $2.157 million) from the airdrop contract within seven hours. Of this total, 445,000 MYX were sold at an average price of $1.68 via addresses starting with 0x259, generating $747,000 in cash.

This move triggered market panic, rapidly drying up token liquidity. Amidst the market crash, Binance MYX contract trading volume surged to $7 billion in a single day, intensifying the battle between bulls and bears.

This steep price curve instantly attracted countless attention.

Back in November 2023, MYX.Finance secured $5 million in seed funding at a $50 million valuation. Sequoia China (formerly Sequoia China) led the round, followed by over a dozen other institutions, including Consensys and Hack VC.

With the support of capital, MYX.Finance launched with its innovative MPM (Matching Pool Mechanism) engine. It promises zero-slippage trading and addresses the pain points of on-chain derivatives with up to 125x on-chain leverage.

In June 2024, MYX.Finance became one of the first projects in the Linea Ecosystem Investment Alliance (LEIA). At the end of July this year, Linea officially announced the upcoming TGE and released its token economics.

On August 6, Etherex, a decentralized trading platform launched by Linea, Consensys and Nile, will launch its native token REX. The project partners include MYX.Finance.

A year later, key steps were taken. At the end of May 2025, the MYX node staking system, the "Keeper System," officially launched. Institutions such as Linea, a Layer 2 public chain, and Sequoia China participated in the node election. This system established a closed value loop: node revenue is directly used to repurchase MYX tokens, rewarding stakers.

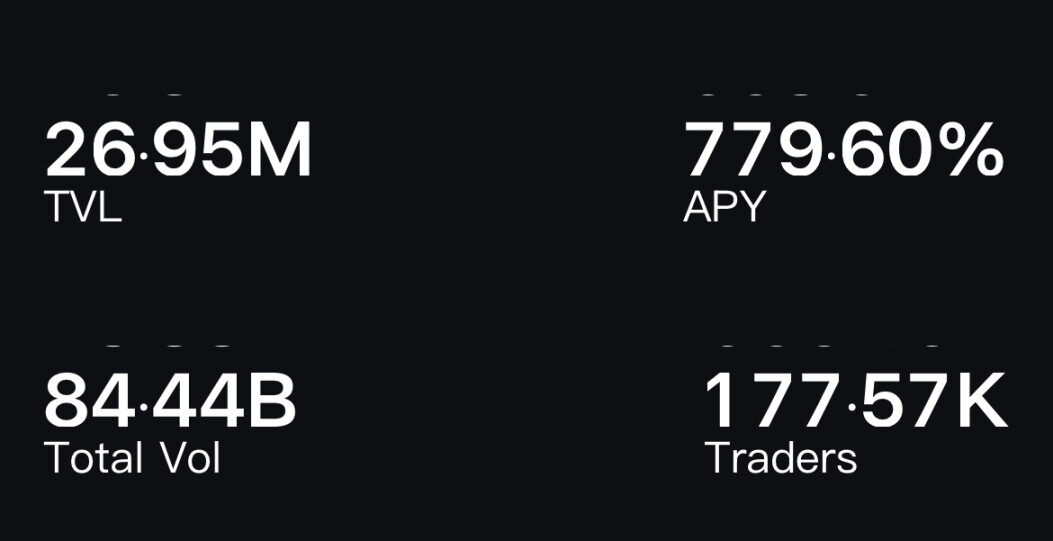

According to the official website, MYX.Finance's total locked value (TVL) has reached nearly $27 million, with a total trading volume exceeding $84 billion and over 170,000 users.

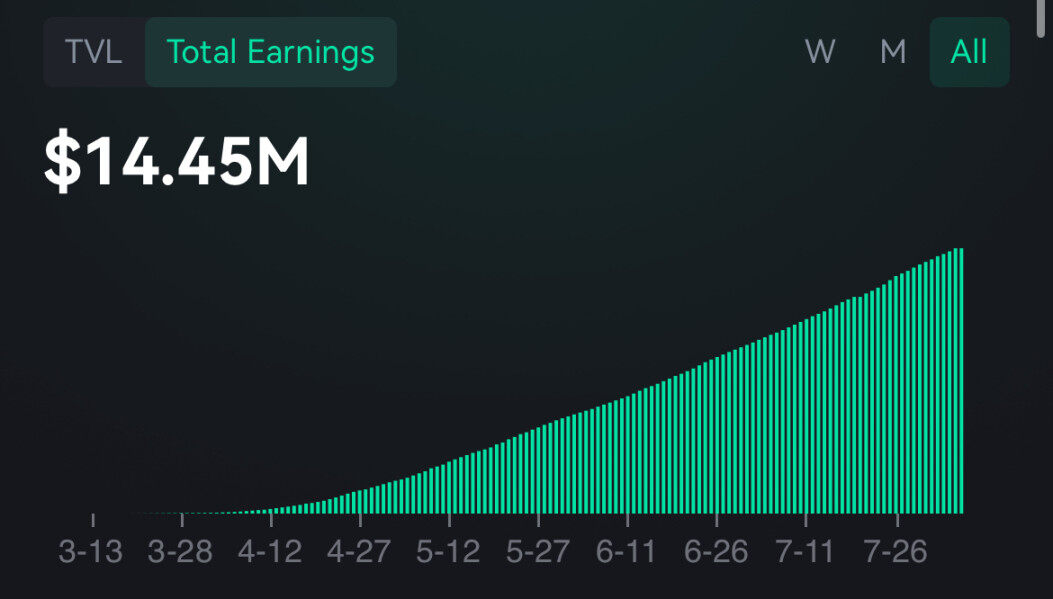

At the same time, the official website shows that the total income of MLP liquidity providers continues to rise, from US$35,000 on April 1, 2025 to US$14.45 million today. These figures serve as a footnote to the active ecosystem.

Harvesting controversy

Behind the prosperity, the community's memory has not faded. In 2023, BMYX, a BRC-20 inscription token associated with MYX.Finance, experienced turmoil and was accused by users of "harvesting."

Image source: @_FORAB

Even before the MYX token's TGE this year, there were still criticisms directed at its incubator, D11 Labs, alleging that several of its projects had "adverse consequences." The sentiment, "I thought everything was back to zero," captured the despair of investors at the time.

In response to the doubts, MYX.Finance CEO Mrak Zhang publicly promised compensation.

At the end of May 2025, it was announced that BMYX Holder compensation would be distributed according to the planned plan. The plan clearly stated: 30% USDT equivalent stablecoins + 70% MYX tokens (unlocked in phases). The team stated that 4% of the total token supply has been reserved for future dynamic adjustments to compensation to ensure fairness.