With the continuous development and maturity of digital currencies, Bitcoin ETF (Exchange-Traded Fund) is gradually attracting the attention of the financial world. Recently, industry giants Fidelity, BlackRock and other well-known financial institutions have submitted applications to regulatory agencies with the intention of launching spot Bitcoin ETFs, which has undoubtedly injected a strong impetus into the cryptocurrency market. At the same time, futures Bitcoin ETFs that have been approved and are now operating also provide investors with new ways to participate in the Bitcoin market. The rise of Bitcoin ETFs signals the cryptocurrency’s move toward broader capital markets, sparking significant interest from global investors.

When different spot Bitcoin ETF application news was released, the Bitcoin market also experienced different levels of fluctuations. This article summarizes the Bitcoin fluctuation trends on the day of different application submission dates and in the short term:

Ark Invest & 21 Shares

Cathie Wood’s Ark Invest and European asset management company 21 Shares were the first to submit, with the submission date being April 25 this year. However, this is already their third attempt, and the first two were rejected by the SEC. This filing is seen as a “gamble” in the lawsuit against Grayscale, because if the SEC loses the case with Grayscale, they will be forced to approve a spot Bitcoin ETF.

After the application news was released, according to Coinmarketcap data, Bitcoin saw a small increase that day, but experienced large fluctuations the next day. It was once close to US$30,000, but then fell back to around US$27,000, and finally stabilized at 29,200. Around 6.9% compared with before the news was released.

Bitcoin trends before and after the Ark Invest filing. Source: Coinmarketcap

It is reported that this may be the only application approved ahead of BlackRock.

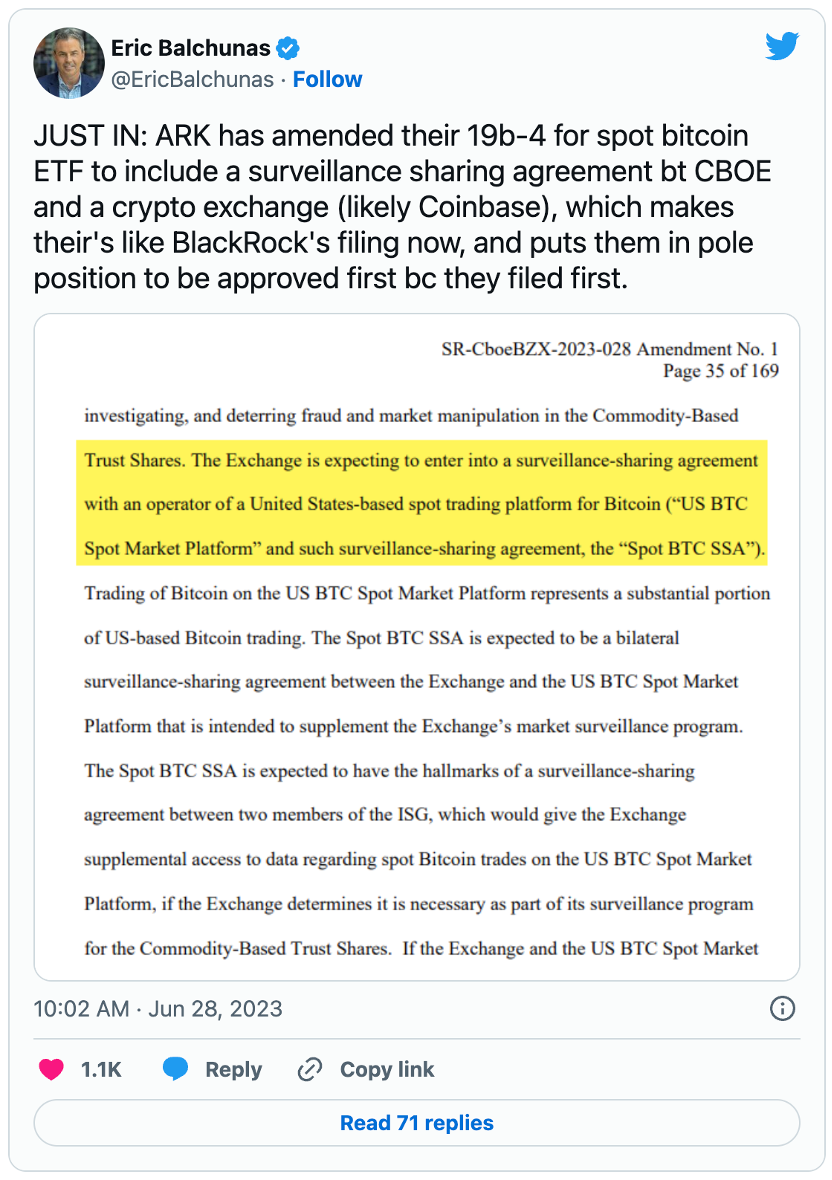

The April filing did not include the monitoring sharing agreement included in BlackRock and Fidelity Investments filings, which could be central to whether the SEC approves. As a result, on June 28, ARK Invest has amended its application documents for its spot Bitcoin exchange-traded fund to include a monitoring sharing agreement similar to BlackRock’s, which involves sharing information about market trading activity, settlement activity and customer identities. information to guard against the possibility of market manipulation.

Bloomberg ETF analyst Eric Balchunas noted that because ARKs filing preceded BlackRocks, ARKs filing may now be in first place awaiting approval.

BlackRock

Top asset manager BlackRock’s recent Bitcoin ETF filing is the start of this round of accelerated institutional entry into Bitcoin ETFs. On the afternoon of June 15, BlackRock’s iShares unit submitted an application document for the iShares Bitcoin Trust to the U.S. SEC. The iShares Bitcoin Trust will use Coinbase Custody as its custodian, according to a filing with the U.S. Securities and Exchange Commission (SEC).

Bitcoin prices were trading around $25,000 before BlackRock filed, but plummeted after the news. The single-day increase on the 15th was not large, only 2%; but it continued to rise, reaching $27,000 on the 19th.

Bitcoin trends before and after BlackRock filed. Source: Coinmarketcap

BlackRocks proposal technically creates a trust, but it is a trust that allows for redemptions, so it functions like an ETF. Therefore, the iShares product is completely different from GBTC which has no redemption mechanism. The key difference is that a spot Bitcoin ETF will be able to purchase Bitcoin at the end of the trading day to align the funds assets with the price at which it trades. Joe Consorti, market analyst at The Bitcoin Layer, said the trust doesn’t have the ability to do that.

Previously, the SEC has repeatedly rejected spot Bitcoin ETFs submitted by other institutions, and there are reports that it is concerned about market transparency and the possibility of market manipulation. BlackRocks application included a monitoring-sharing agreement that may have alleviated these concerns, and subsequent agency applications have included similar proposals.

At the same time, there are also some more conservative voices in the industry. For example, Mike McGlone, senior macro strategist at Bloomberg Intelligence, pointed out in the latest Crypto Outlook released on Twitter that even if BlackRocks application for a spot Bitcoin ETF is really approved , nor will it be launched within 2023. The report notes that since 2021, Bitcoin’s key price has been around $30,000, benefiting from the largest money supply surge in history, driving the rise of many risk assets. However, most central banks chose to continue tightening monetary policy in June. Although risk assets have rebounded on expectations of a mild U.S. recession and easing policy from the Federal Reserve, they are still in headwinds, so there is unlikely to be much of a liquidity increase.

Currently, the application is still under review. The approval process is not transparent and could take months or years, but industry insiders say BlackRocks reputation and influence in the financial industry may make it easier for regulators to approve it in days to weeks. this product.

Fidelity Investment

Two weeks after BlackRock filed for a Bitcoin spot ETF, Fidelity Investments also filed oneApplication for Spot Bitcoin ETF. Prior to this, Fidelity had submitted the same application once, but it had been rejected by the SEC. This is its resubmission, which may come as BlackRocks filing is seen as a sign that the SECs position may soon change.

After Fidelity Investments filed for the ETF, the Bitcoin market began to soar, rising from fluctuations around $30,100 to around $30,800, an increase of approximately 2.3%.After the SEC released news on June 30 that the application had “insufficient documentation”, there is a slight correction.

Thursday’s filing was made by Cboe BZX Exchange to unveil the “Wise Origin Bitcoin Trust,” the name of a Bitcoin ETF previously proposed by Fidelity but rejected by the SEC in 2022. The exchange has filed similar applications for other companies over the past two weeks.

Similar to BlackRock’s filing, today’s Fidelity Investments filing includes a “monitoring sharing agreement” with an unnamed U.S. spot Bitcoin trading platform, which is intended to help alleviate SEC concerns about market manipulation.

Fidelity Investments currently manages $11 trillion in assets and has tens of millions of retail brokerage customers. The company is no stranger to cryptocurrencies, having operated an institutional custody and trading services business in the market since 2018.

Valkyrie、WisdomTree、Invesco、Bitwise

Compared with the giants BlackRock and Fidelity Investments, the asset management scale of these companies is relatively small: Valkyrie and Bitwise both have asset management scales of about US$1 billion, and WisdomTree is87 billion[ 1 ], Invesco is approx.1.48 trillion[ 2 ]. The applications for Bitcoin spot ETFs from these asset management companies all appeared after BlackRock’s application. It is said that BlackRock’s application may make the Bitcoin spot ETF possible.

Among them, Bitwise was the earliest to submit the application. It submitted its application on June 16, the day after BlackRock announced its application. Bitcoin rose by about 3% that day. It cannot be ruled out that there is also some follow-up influence from BlackRock. However, after Invesco, WisdomTree and Valkyrie announced their submissions on the 20th and 21st respectively, Bitcoin began to soar, rising from around 26,700 to more than 30,000 US dollars, an increase of 12.4%. When BlackRock applied separately before, there were a lot of conspiracy theories that the SEC had sued native exchanges and asset management companies in the currency circle some time ago, thereby making room for established American institutions to enter the currency circle. However, the follow-up by these institutions strengthened investors confidence in other U.S. asset management institutions entry into Bitcoin, leading to a sharp surge in Bitcoin.

Bitcoin trends around June 20th. Source: Coinmarketcap

While the popularity of Bitcoin spot ETFs is rising, the futures Bitcoin market has also welcomed Volatility Shares’ first U.S. leveraged Bitcoin futures ETF. The U.S. SEC has been approving Bitcoin futures ETFs since 2021. The first futures ETF was released by ProShares, and the fund size has reached US$1 billion. The release of the leveraged ETF released by Volatility Shares, which went online on Tuesday, did not meet market expectations. In the two trading days after the first day, the single-day trading volumeOnly less than US$300,000, and the current asset management scale is US$5.7 million. The lawsuit between Grayscale and the SEC is still ongoing, and it is unclear whether the trust can be successfully converted into an ETF.

Whether it is a spot Bitcoin ETF that is being applied for or a futures Bitcoin ETF that is already in operation, the emergence of these products further proves that Bitcoin’s status in the traditional financial system is gradually recognized. As more financial institutions become involved in the cryptocurrency market, the development of Bitcoin ETFs is bound to provide investors with more choices, increase market liquidity, and further promote the value and recognition of Bitcoin. However, investors still need to remain rational, understand the risks of the cryptocurrency market, and carefully evaluate their own investment capabilities and risk tolerance. The rise of Bitcoin ETFs marks a new chapter for digital assets, and we look forward to seeing more innovative products and investment opportunities emerge, bringing more diverse choices to global investors.