Dear friends, welcome to the SignalPlus macro review. SignalPlus macro reviews update macro market information for you every day, and share our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to the SignalPlus macro review. SignalPlus macro reviews update macro market information for you every day, and share our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

The risky game of Russian roulette continued as Western Alliance Bancorp and PacWest became the latest banks to be forced into the game as US stocks fell for a fourth straight session and VIX rose to a one-month high.

While this view may be unpopular, we believe the banking crisis has evolved from deposit flight to panic-induced equity negatives, and now to aggressive shorting by speculators to increase the likelihood of bank runs and share price crashes, at current prices Movements have been largely decoupled from day-to-day fundamentals, but for speculative aggression, forced downside pays off handsomely.

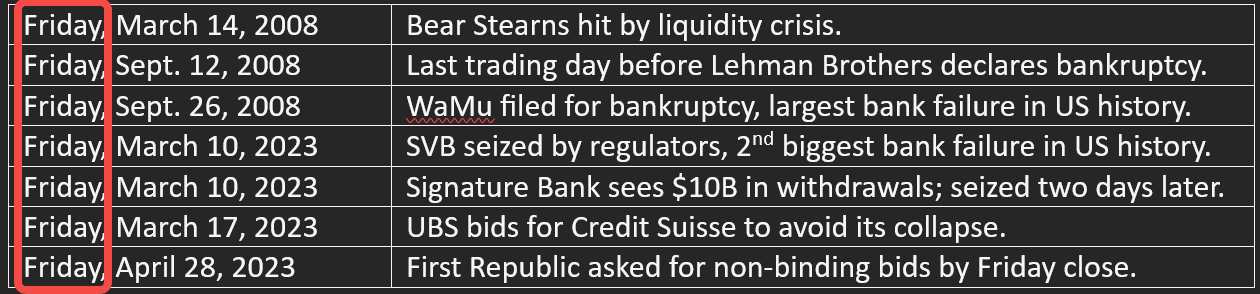

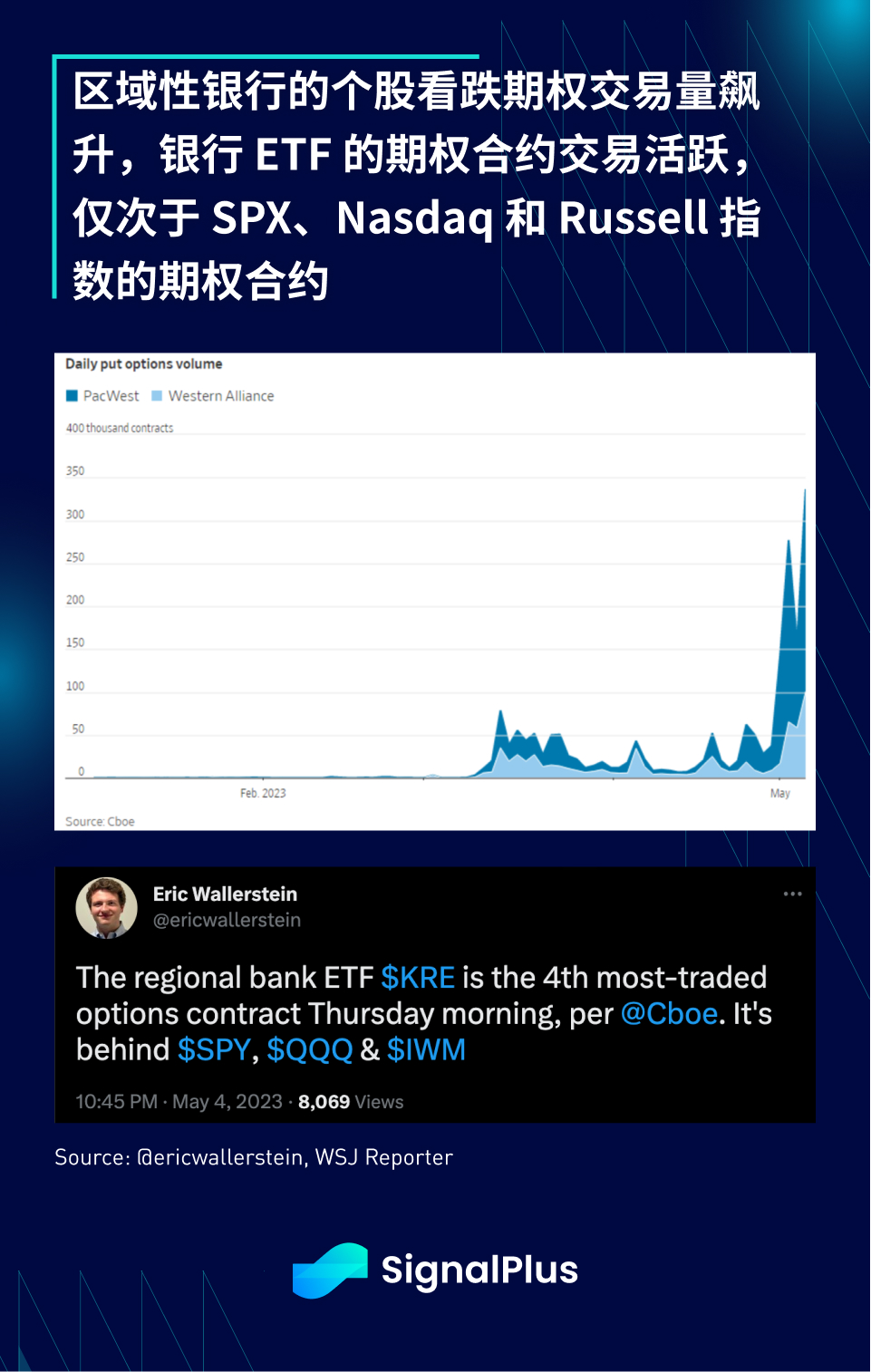

The trading volume of individual stock put options of regional banks in the United States soared, and the usually relatively small KRE bank ETF options even became the option contract with the fourth highest trading activity, second only to the major US index options.

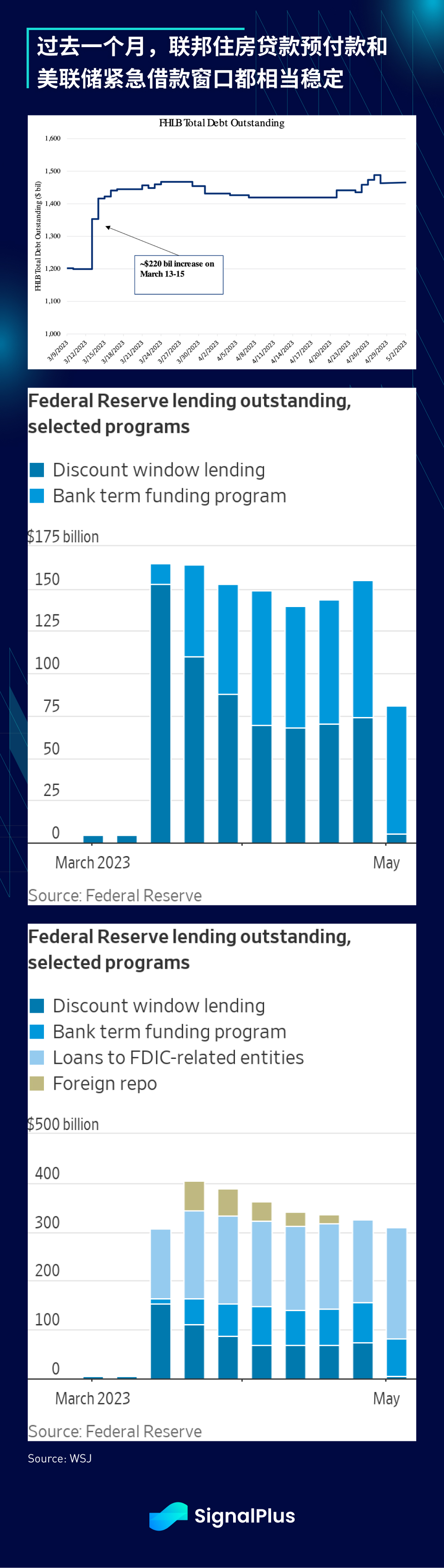

From a credit perspective, however, federal home loan advances have remained virtually unchanged over the past six weeks, and use of the Fed's emergency borrowing program has been fairly steady over the same period.

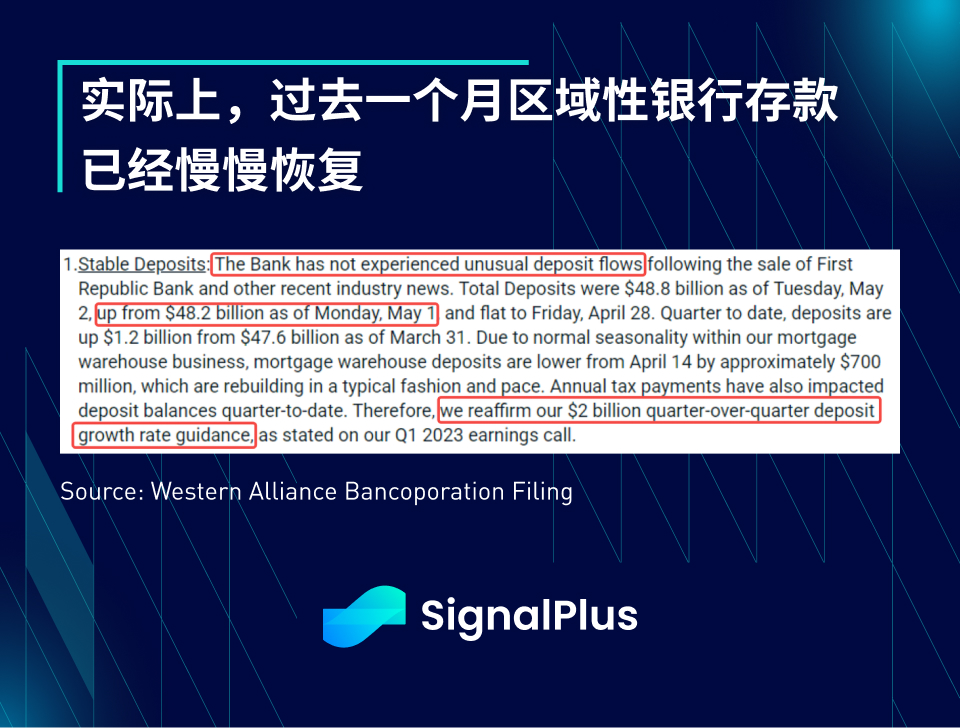

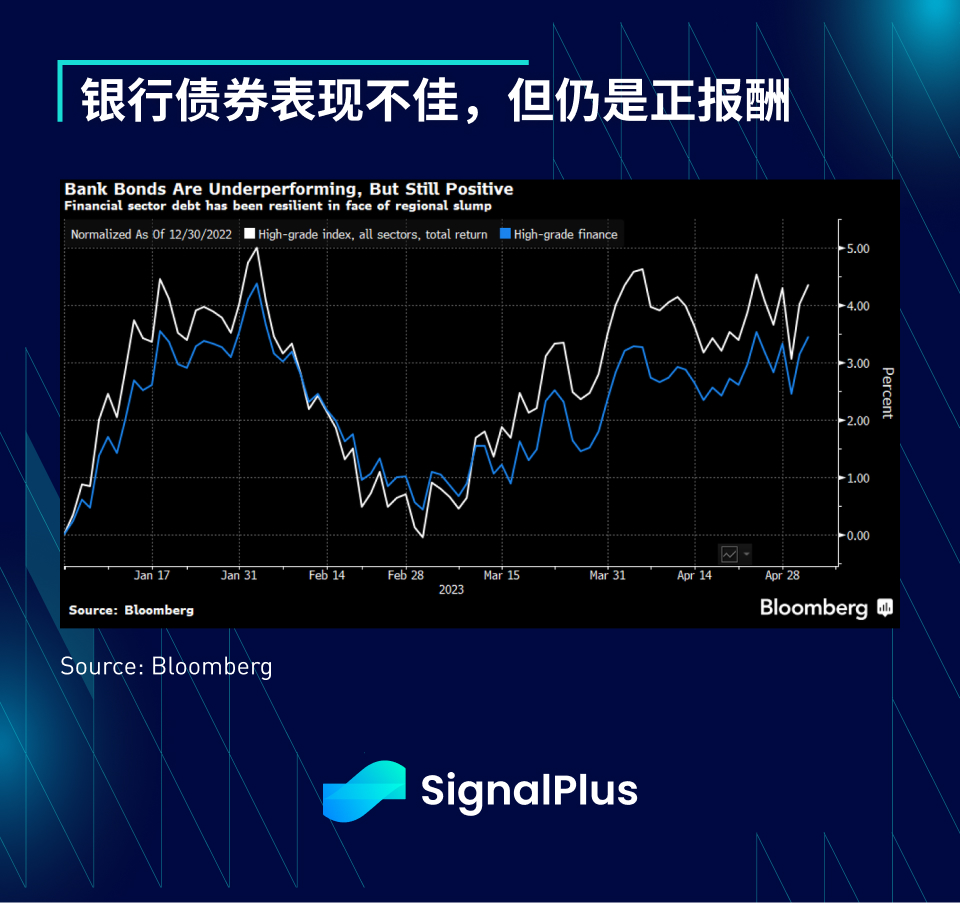

On the deposit side, regional banks like Western Alliance (or even First Republic) have actually seen a recovery in customer deposits, even as recently as the first week of May. Also, while bank stocks are going through a bloodbath, overall, bank bonds have been resilient throughout the move and, in fact, have rallied back to year-to-date highs.

Still, after years of loss training and emotional abuse by the market, we fully understand how market confidence works, yet the current environment appears to have degenerated into an overly unfriendly witch hunt that often leads to policy The attention of policy makers, and then the introduction of enforcement measures such as new rules and regulations.

We cannot of course predict the final resolution, but it is looking more and more likely that eventually some form of full deposit guarantee will be introduced, whether funded by the government (taxpayers), G-SIB banks as ultimate winners, or Depositors charge extra premiums to cover deposits above $250,000; aggressive Fed rate cuts or massive QE are unlikely to be on the table, whatever the ultimate solution, as the issue has now shifted from a rate issue to a regulatory one (deposit protection).

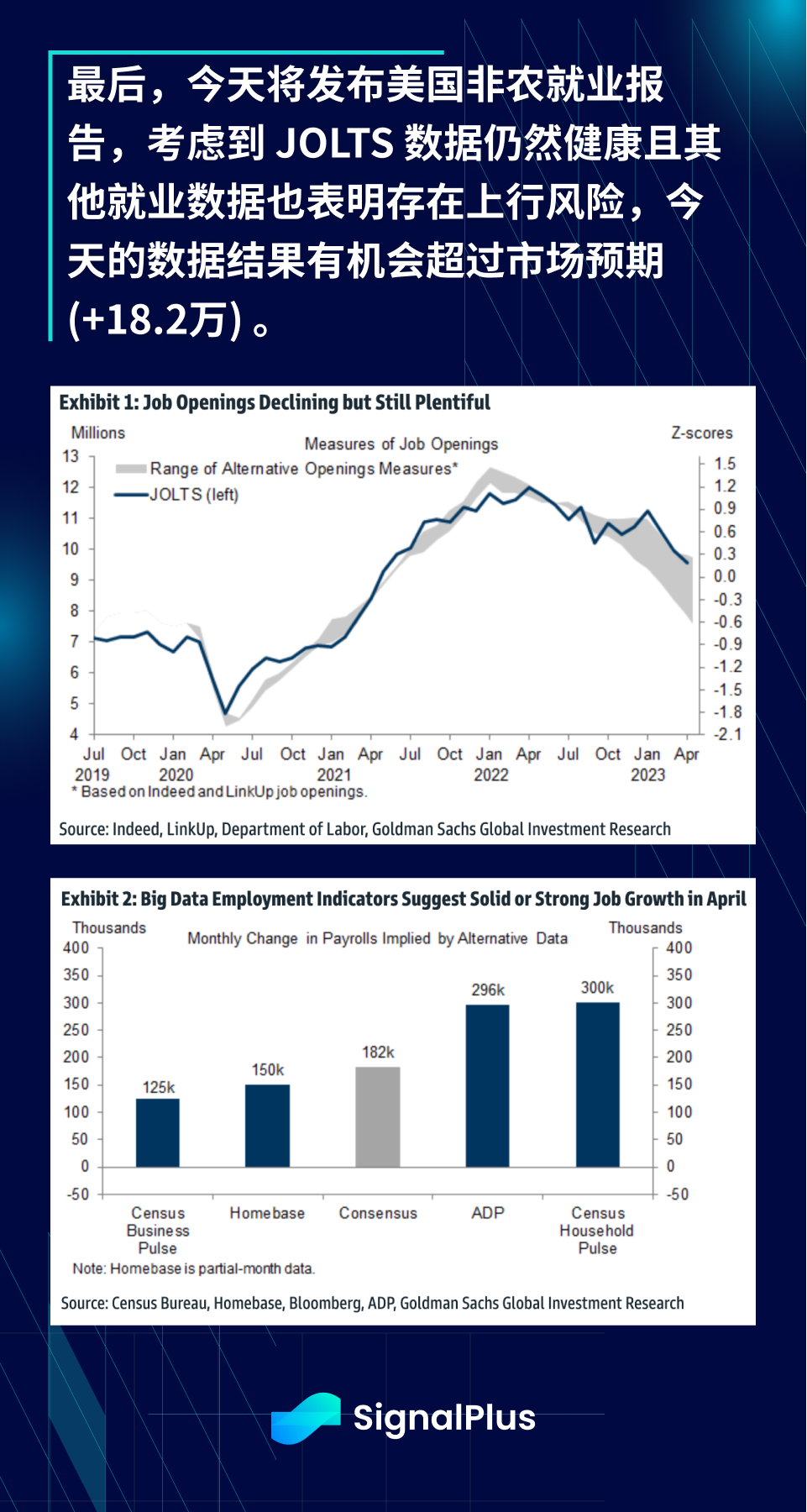

Bank of America issues aside, risk sentiment dipped slightly after the FOMC and yesterday's hawkish ECB meeting (25bp rate hike) were muted, with European stocks down 0.3%, while the ECB unexpectedly halted its asset purchase program 2-year Bund yields surged 16 basis points, adding to Lagarde's comments that they are "not prepared to pause rate hikes" and that "there is still a lot of work to be done". In the United States, affected by rising labor costs, non-agricultural productivity contracted by 2.7%, far below expectations; the S&P 500 index fell only 0.7%, while U.S. bond yields and the dollar exchange rate were little changed, reflecting that investors generally remained Think regional banking problems are well under control so far.

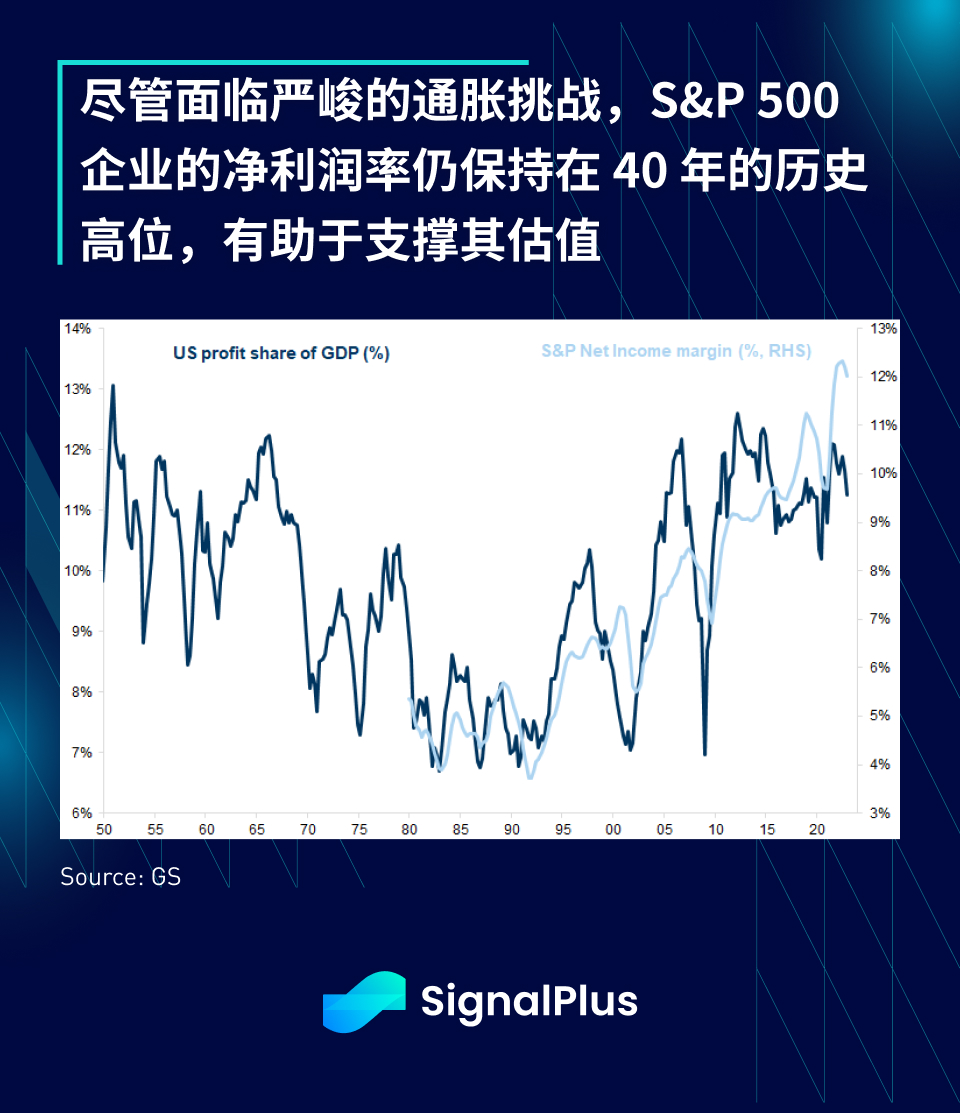

Over the past 12 months, despite a plethora of headlines, an aggressive Fed, and a record number of U.S. bank failures, global stock indexes have been largely flat, with the S&P 500 barely budging since May last year, which, given so many events Happened, the performance was pretty good.

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com/