Original author: 1912212.eth, Foresight News

On August 1st, Coinbase, the largest US cryptocurrency exchange, released its second-quarter financial report, revealing its overall performance for Q2: net profit reached $1.43 billion, significantly exceeding the $36 million reported in the same period last year. Total trading volume reached $237 billion, a slight increase from $226 billion in the same period of 2014. Compared to the first quarter, trading revenue decreased by 39%, and spot trading volume decreased by over 30%. Notably, the previously disclosed user data breach ultimately resulted in a $307 million loss.

After the financial report was released, according to the data from the stock market, its stock price fell by more than 9% after the market closed to US$377.7, and then continued to decline in the following days, falling to a low of US$314.

Spot trading volume has dropped significantly year-on-year, with BTC holdings exceeding 11,000.

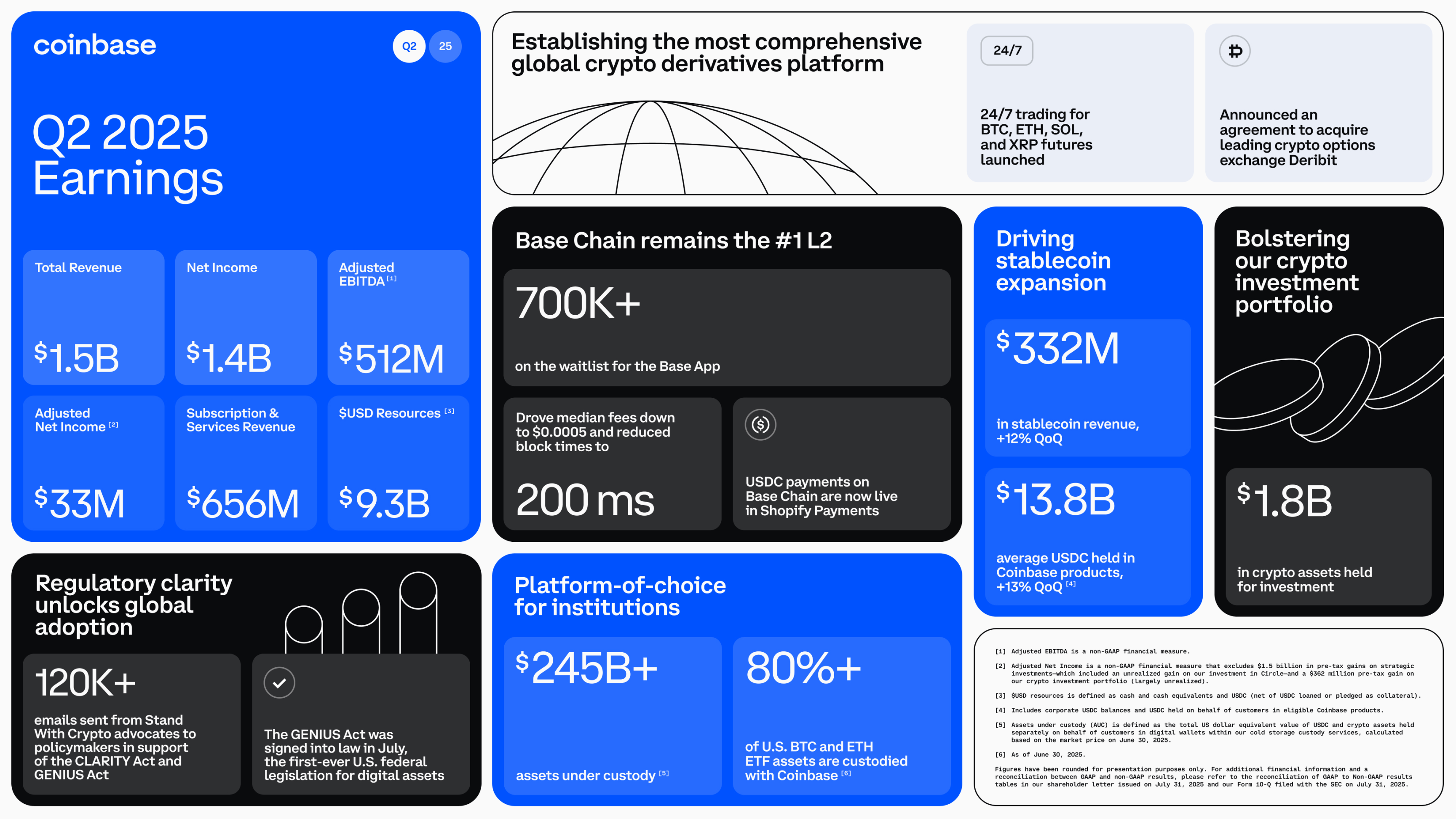

Coinbase's latest financial report shows total revenue of $1.5 billion in Q2, a year-on-year increase, but falling short of analysts' expectations of $1.59 billion. Net profit was $1.4 billion, primarily due to $1.5 billion in unrealized gains from strategic investments and $362 million in unrealized gains related to crypto assets. Excluding these impacts, adjusted net profit was $33 million.

In terms of revenue contribution, Coinbase has three main sources of revenue: transaction revenue, subscription revenue, and others.

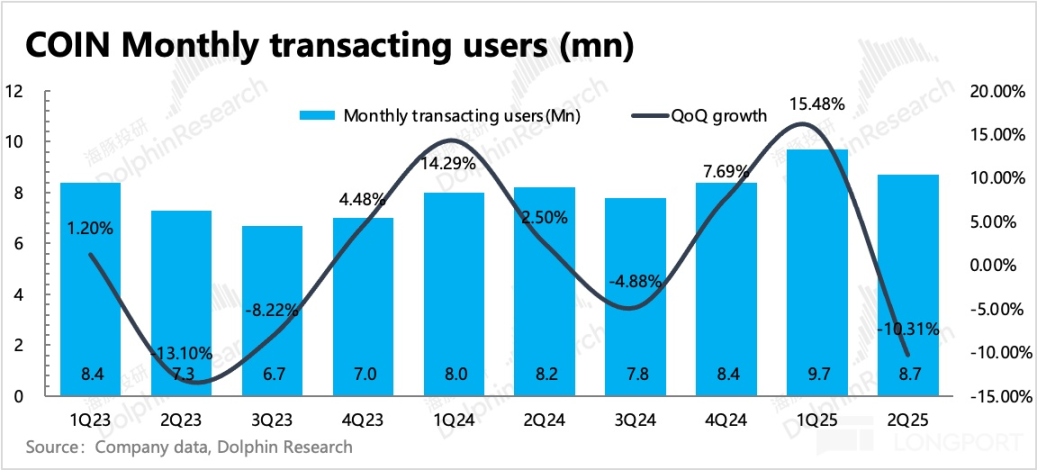

Trading revenue was $764 million, a 39% year-on-year decrease, far below market expectations. Overall trading volume decreased by 40% quarter-on-quarter, with retail trading down 45% and institutional trading down 38%. Retail trading revenue was $650 million (43 billion in trading volume), institutional trading revenue was $60.8 million (194 billion in trading volume), and other trading revenue was $54 million. The number of trading users decreased by 1 million quarter-on-quarter in the second quarter, falling to 8.7 million. This decline was primarily due to the panic among established users, with average trading volume dropping 38% per person, contributing to the dismal trading volume.

Subscription and Services revenue: $656 million, down 6% month-over-month. Stablecoin revenue (primarily USDC) was $333 million (up 12% month-over-month), with an average USDC balance on the Coinbase platform of 13.8 billion and 47.4 billion held outside the platform.

Staking rewards were $145 million (down 26% quarter-over-quarter), interest and financial fee income was $59.3 million (down 6% quarter-over-quarter), and other subscription and service revenue was $120 million (down 15% quarter-over-quarter).

At the end of the second quarter, Coinbase had $9.3 billion in USD resources, a decrease of $590 million, or 6%, from the previous quarter. This decrease was primarily due to an increase in fiat loan originations and purchases in our crypto asset portfolio. Cash and cash equivalents were $1.449 billion, including $1.784 billion in USDC (net), $5.980 billion in money market funds, and $110 million in cash held in third-party platforms.

The official tweet shows that Coinbase purchased 2,509 BTC in the second quarter, with a total BTC holding of 11,776, a total cost of US$740 million, and is now worth US$1.26 billion.

Crazy acquisitions and diversified businesses going hand in hand

As a US-listed exchange, its current product line includes the Coinbase main platform, Coinbase Pro (now Coinbase Advanced), Coinbase Wallet, Coinbase Card, Coinbase Earn, Coinbase Cloud, etc., covering multiple aspects such as retail investors and institutions, trading and custody, DeFi and payment.

Coinbase has also recently stepped up its acquisition efforts, expanding into various sectors. On July 29th, Bloomberg reported that Coinbase was in advanced negotiations with Indian crypto exchange CoinDCX to acquire the company. However, this was quickly denied by CoinDCX CEO Sumit Gupta, who stated that the company was not for sale.

On July 11th, Coinbase completed a talent acquisition, specifically acquiring Opyn CEO Andrew Leone and its head of research, Joe Clark. Leone and Clark will now join the Onchain Markets team, which operates within Coinbase’s institutional organization and focuses on development initiatives for verified pools and other on-chain market-focused products.

However, Coinbase's largest acquisition occurred in May of this year, when it officially confirmed its acquisition of Deribit, a cryptocurrency options platform, to unify spot, futures, and options trading. The acquisition price was approximately $2.9 billion, consisting of $700 million in cash and 11 million shares of Coinbase Class A common stock. This further strengthened its presence in the options and derivatives markets. Furthermore, Coinbase recently acquired Liquifi, a token management platform, to expand its asset management and token issuance capabilities.

In addition, Coinbase has reached cooperation with traditional financial institutions such as JPMorgan Chase, PNC Bank, and American Express to promote the implementation of services such as user deposits and reward points exchange for USDC.

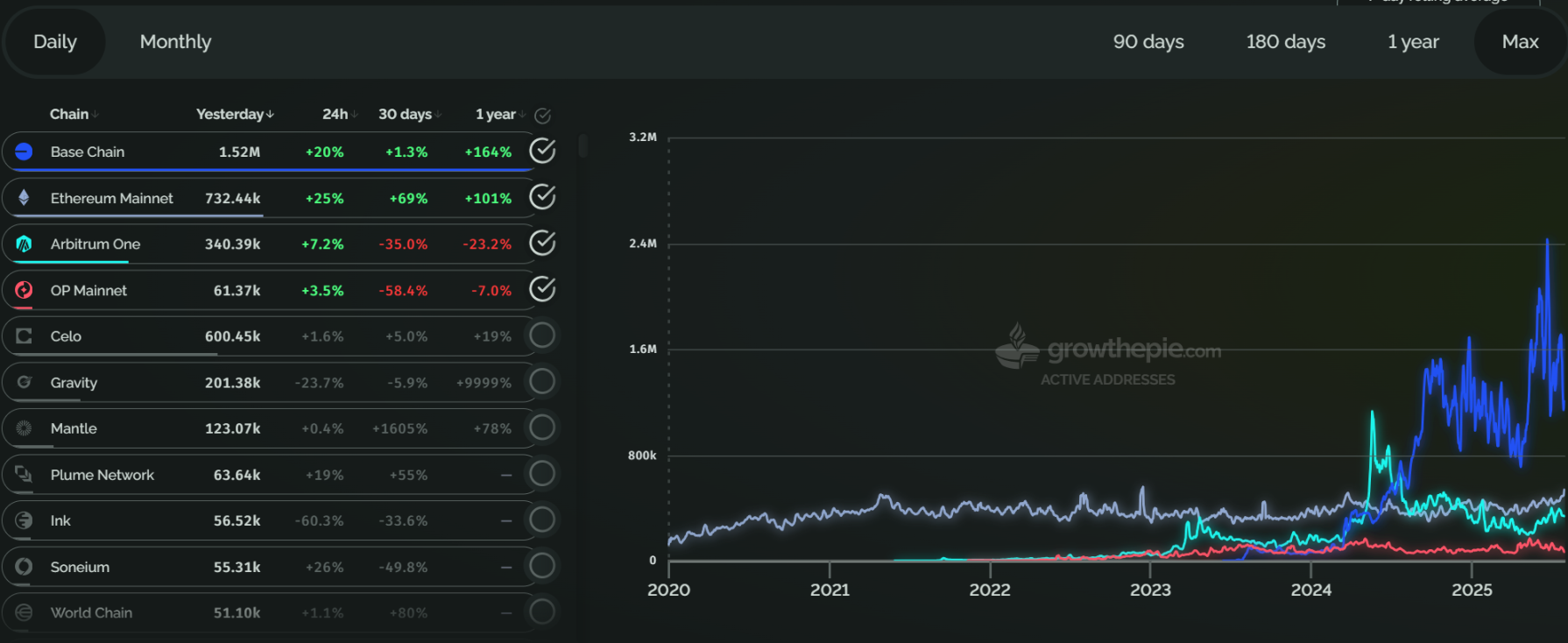

Coinbase's financial report shows that Base is one of the largest USDC distribution networks, with the vast majority of peer-to-peer transactions on Base conducted using USDC. The Base app is currently in public beta, integrating features such as wallet, trading, payment, social networking, games, and DApps. The latest data from growthepie shows that its active address count far exceeds that of OP and Arbitrum.

In terms of policy compliance, after the US SEC withdrew its lawsuit in February this year, Coinbase obtained the MiCA license in Luxembourg in June this year, authorizing it to provide core retail and institutional services in 30 European Economic Area member states, paving the way for entering the European market.

Future bets on prediction markets and tokenized stocks

Coinbase's ambitions will continue to span multiple areas.

Today, Coinbase Vice President of Product Max Branzburg told CNBC that Coinbase is expanding its services for US users, creating a "full-service exchange" that will include tokenized stocks, prediction markets, early-stage token sales, and more. A video released on Coinbase's official Twitter account echoed this sentiment.

However, in the prediction market space, Coinbase will face competition from Kalshi, the only federally licensed prediction market platform in the United States, and global leader Polymarket, which plans to re-enter the US market after its recent acquisition of licensed derivatives trading platform QCEX.

Coinbase’s tokenized stock product will also compete with similar offerings from Robinhood and other cryptocurrency trading platforms such as Gemini and Kraken, although these companies’ products are currently only available to investors outside the United States.