Original title: When brokerage firms set their sights on cryptocurrency trading

"I've been on the phone until 2 a.m. every day lately."

The person who said this was a veteran in the financial industry, with over a decade of experience in the traditional securities industry. He was sitting with his phone upside down on the coffee table as he spoke. His eyes were slightly red, but his tone remained nonchalant.

His Beijing office is located in a courtyard house in Xicheng District. The two gates are slightly peeling. The afternoon light slants into the courtyard, and a few specks of dust still float in the beams. He sits at an old wooden table, dealing with regulatory issues, business partnerships, and project scheduling.

Having worked in finance for over a decade, he experienced the last financial crisis and navigated global markets, managing funds, developing products, and leading teams across nearly every continent. It wasn't until recent years that he began turning to a direction that the entire traditional financial industry initially considered "unrealistic": virtual assets.

Traditional finance’s interest in Web 3 didn’t start in 2025. If we look back to the beginning, many people would mention Robinhood.

This platform, known for its "zero-commission stock trading" service, launched Bitcoin and Ethereum trading as early as 2018. Initially intended as a supplemental product line, it allowed users to purchase Bitcoins much like buying Tesla stock, without the need for a wallet or blockchain knowledge. While this feature received little fanfare at the time, it became a breakout feature a few years later.

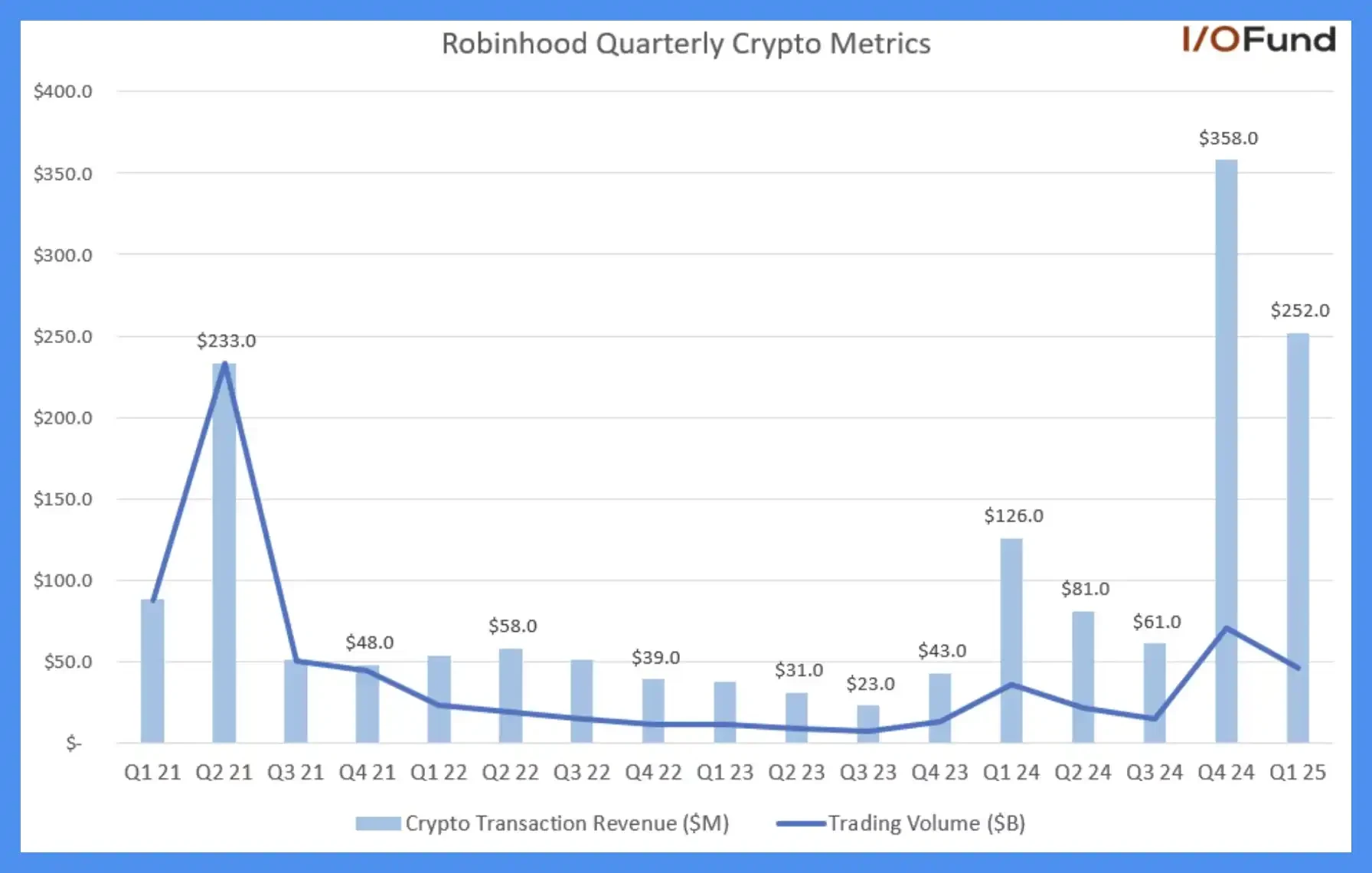

In the fourth quarter of last year, cryptocurrencies contributed over 35% of Robinhood's total net revenue, with a 455% surge in trading volume driving a 733% year-over-year increase in trading revenue to $358 million. This made crypto Robinhood's largest revenue contributor for the quarter. In the first quarter of 2025, cryptocurrencies contributed over 27% of total revenue, with trading revenue doubling year-over-year to $252 million.

Robinhood quarterly crypto asset trends, source: IO.FUND

This transformation wasn't driven by technology, but by the clicks of hundreds of thousands of users. Robinhood didn't promote a Web 3 narrative; instead, it simply followed its users' trading habits. As a result, cryptocurrency trading ceased to be a fringe business and became the core engine of the company's growth.

Since then, Robinhood has gradually transformed from a centralized brokerage to a digital asset trading platform.

With Robinhood's example, traditional finance will finally, by 2025, move beyond simply observing the crypto industry and enter the market en masse. They're not here to experience Web 3 or invest in projects; "traditional finance will take over the crypto industry within 10 years."

We are already in the midst of this reshuffle of traditional brokerages against crypto-native firms.

In March 2025, Charles Schwab, one of the world's largest retail brokerages with assets under management exceeding $10 trillion, announced that it would open spot Bitcoin trading services within a year.

In May 2025, Morgan Stanley, one of the most influential investment banks on Wall Street, announced plans to officially connect BTC and ETH to its trading platform E*Trade, providing retail users with a direct trading channel.

In May 2025, JPMorgan Chase, the largest bank in the United States by assets and a long-time critic of cryptocurrencies, announced that it would allow customers to buy Bitcoin.

In July 2025, Standard Chartered, a long-established British bank with deep roots in the Asian, Middle Eastern and African markets, announced that it would open Bitcoin and Ethereum spot trading services to institutional clients.

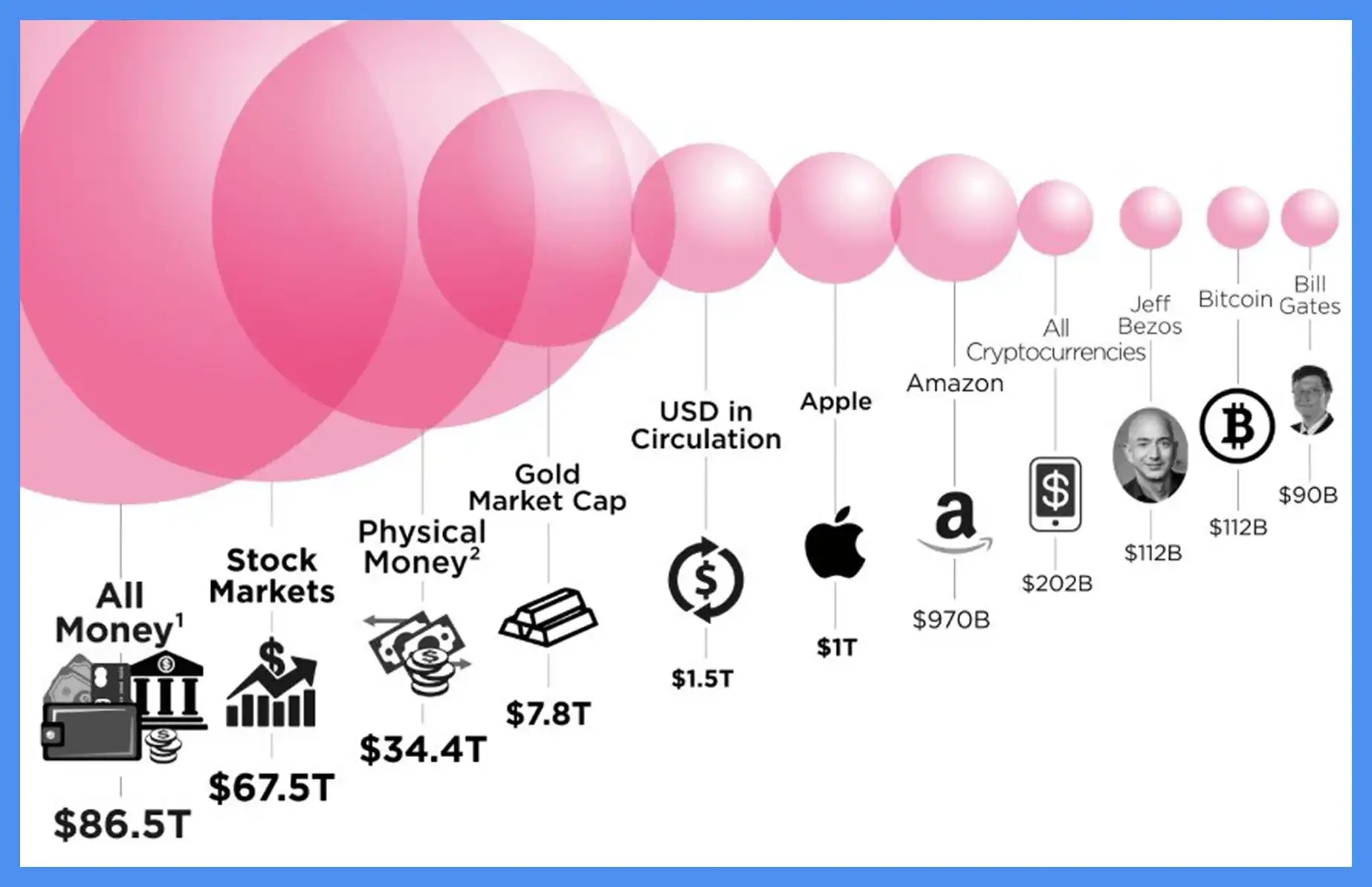

They are the behemoths that dominate the operation of the global financial system. These traditional financial institutions control the global capital inflow and outflow channels, clearing networks and fiat currency payment systems, and hold assets worth tens of trillions of dollars. In comparison, the current total market value of the crypto market is only 4 trillion.

Market capitalization rankings of mainstream assets, source: Steemit Community

They are gradually completing their layout in the crypto space based on the traditional financial compliance framework. When an institution has both compliance trust, user traffic, and clearing and settlement capabilities, it has all the elements to build a crypto trading network.

In the traditional financial system, whoever controls account opening authority controls capital flows, customer relationships, and even ultimate pricing power. For a long time, crypto trading platforms relied on listings to define their narratives and on deposits to control liquidity. However, the role of "asset gateway," which was taken away by CEXs for nearly a decade, is now being gradually reclaimed by traditional finance.

“It’s time for those crypto trading platforms to get anxious.”

His tone remained restrained, without a hint of gloating. The root of the anxiety might not just be the entry of a certain institution or the introduction of a certain policy, but rather a sense of industry awareness: crypto trading platforms may no longer be the sole dealers at the financial table.

How to stay at the table

An insider at a crypto trading platform told us that he's been replying to messages at 5 a.m. lately. He's been discussing partnerships during the day, monitoring progress at night, and checking user community feedback late at night, leaving him with little sleep.

“We can only survive in anxiety.”

The anxiety he talked about is the competition between platforms, and the survival state of having to fight for users, products, and traffic every day when you wake up.

The root cause of the fight for existing inventory is that there is little room for growth in the industry, and also because the external squeeze is too great.

Traditional finance is gradually eroding the core capabilities that crypto trading platforms rely on for survival—from fiat currency deposits to asset custody, from user account opening to spot matching. These platforms, armed with regulatory approvals and millions of users, are coming with considerable momentum, seemingly with no intention of coexisting with crypto-native platforms.

Almost every crypto exchange immediately launched cryptocurrency-to-stock products. Buy Apple with USDT, leverage Nvidia, and trade Tesla through on-chain contracts. These traditional asset-on-chain solutions launched on multiple platforms, becoming a common industry trend.

Bybit was one of the first to take the plunge. They completed the development and launch of a US stock token product in just two months, from internal project initiation to contact with the XStocks team and final launch—a remarkably fast pace.

Bybit believes that the core advantages of centralized trading platforms remain. The user base, strong liquidity, and trading depth accumulated over the years remain resources that external brokerages cannot replicate overnight.

The launch of US stock tokens stems from a clear need, such as the need for trading during market hours or geographic and regulatory constraints that prevent users from accessing the traditional stock market. Crypto's 24/7 availability opens up new liquidity for traditional assets.

Of course, this doesn't mean it's a sure-win battle. Emily, head of spot trading at Bybit, admitted that the US stock token market is still in its early stages, with participation and enthusiasm far less than that of high-volume new coin launches.

However, she remains optimistic about this trend, as it represents the expansion of crypto into the world of TradFi. DeFi, synthetic assets, on-chain staking—new derivative scenarios for traditional assets on-chain—may represent the true value of this path.

However, these functions seem to be actively exploring new markets, but in the eyes of many people, they are more like a passive defense.

When trading platforms no longer hold the dominant position as the gateway to assets, they begin to attempt to appear connected to the world. Consequently, cryptocurrency stocks become the most common defensive move during this phase.

Crypto-stocks are actually not a new concept.

Back in 2020, FTX proposed the coin-to-stock model. Back then, they launched trading pairs like TSLA/BTC and AAPL/USDT, which were seen as an attempt to challenge traditional financial pricing logic.

That was the era when the cryptocurrency world was still on the offensive. FTX wanted to use crypto finance to rewrite the traditional financial trading model and use crypto finance to price the Nasdaq.

Perhaps he foresaw that brokerage firms would be the biggest future rivals for cryptocurrency trading platforms, and therefore acted preemptively. Looking back now, this model has been revived by the industry, but with a different meaning. After the collapse of FTX, crypto-to-equity became a bandage, not a battering ram.

The data also confirms this.

After the coin-stock model was launched, it did receive a wave of community attention in the early stages, but the activity quickly declined, and the attempts of various platforms failed to make much of a splash.

Meanwhile, Solana's memecoin market charted a completely different trajectory during the same period. A single tweet from Elon Musk could quickly elevate the market capitalization of related memecoins to hundreds of millions of dollars, with daily trading volumes exceeding the weekly trading volume of many cryptocurrency-to-stock pairs.

Top: XStocks trading volume, source: Dune; Bottom: meme coin Ani trading volume, source: gmgn

New features, no new users.

At this stage, it is no longer important what features CEX launches. What matters is why they launch these features and whether these features can bring back the role they are losing.

This round of cryptocurrency and stock craze is not because the industry has made progress, but because no one dares not to do something.

Kant said: “Freedom is not the ability to do what you want, but the ability to refrain from doing what you don’t want to do.”

Compliance is just an illusion

Over the past few months, nearly every crypto trading platform has been discussing compliance. Each has been diligently applying for licenses, adjusting their business structures, and hiring executives with traditional financial backgrounds, all in an attempt to prove they have emerged from their humble beginnings and become more like a financial institution acceptable to regulators.

This is an industry consensus and also a collective anxiety.

But in the eyes of traditional financial people, this understanding of compliance is still too thin.

“Many trading platforms go to small countries to obtain licenses to prove their compliance. However, licenses from small countries are not really licenses at all and such licenses are not acceptable,” he said, his tone not sharp but more like stating an industry common sense.

What he meant by "getting to the table" was not whether you had a business license, but whether you could access the real financial system - whether you could open an account at a mainstream bank, whether you could use the clearing and settlement network, whether you could be trusted by regulators and truly engage in business cooperation with them.

There is a reality hidden behind this: in the eyes of traditional finance, the crypto world has never been truly viewed equally.

The traditional financial system is built on a chain of responsibility and a closed loop of trust, emphasizing transparent customer structures, risk control, audit capabilities, and the explainability of capital flows. Crypto platforms, on the other hand, often thrive in institutional gaps, relying on ambiguity to maintain high profits and rapid growth in their early days, but rarely possess the ability to build these compliance foundations.

Everyone in the industry understands these issues. But no one paid much attention before because no one was vying for this space. Now that traditional financial institutions have entered the market and are operating according to their own rules, the crypto industry's "industry practices" have suddenly become a major flaw.

Some platforms are indeed making adjustments, introducing compliance audits, setting up offshore trust structures, and splitting their businesses in an effort to make themselves appear more formal.

But regulators in many countries simply don't buy it. They might superficially cooperate with you on the process, but deep down, they have no intention of treating you as part of the formal financial system. No matter how close you get, it's just a "look," not a guarantee of staying.

However, not all exchanges are just putting on a front. Bybit is one of the few platforms that has truly broken through the regulatory shell. This year, they became one of the first centralized exchanges to receive a European MiCA license and established their European headquarters in Vienna, Austria.

Bybit doesn't deny the difficulties of this process, nor does it shy away from acknowledging regulatory scrutiny of the industry. But as Emily noted, regulators are no longer the same as they were five years ago, when they couldn't understand crypto. Now, regulators are truly understanding the industry's business logic and technical structure. From technology and models to marketing, their understanding is deepening, and the foundation for cooperation is becoming more solid.

Furthermore, Bitget's Chinese-language lead, Xie Jiayin, told us that Bitget has obtained virtual asset licenses in multiple countries and has established local compliance structures in accordance with regional regulatory requirements. He also revealed that the team is actively pursuing the MiCA license application, hoping to establish a more stable business channel in the European market and lay the foundation for future cross-border operations under a unified regulatory framework.

Even so, such cases remain rare. Most platforms lack the licenses, networks, and trust within the traditional financial system, and are losing the high-growth dividends previously enjoyed by this institutional vacuum. Those seeking compliance-based transformation find the barriers to entry too high; those seeking to return to crypto-native development find themselves facing a new wave of competitors.

As a result, everyone can only continue to lean towards regulators, continue to discuss compliance, apply for licenses, and go through the formalities. Often, behind these actions is not a strategic choice, but an anxious feeling of being pushed.

The middle moment of the game

At 5 a.m. in the social media chat room, Xie Jiayin was still answering user questions. Some asked about how to play the cryptocurrency stock market, some inquired about the platform's recent compliance progress, and some inquired about the status of the PUMP subscription and how they planned to handle it. He said that he and his colleagues often stayed up late, and that one all-nighter was nothing.

On a sweltering afternoon in Beijing, inside a courtyard, executives from a Hong Kong securities firm were drinking tea and discussing partnerships with several executives from listed companies. A carved wooden door separated the reception room from a courtyard paved with blue bricks, where insects chirped in the shade of trees.

Looking further afield, in Vienna, Austria, Bybit's new European headquarters just completed a ribbon-cutting ceremony and officially opened for business. This is their European outpost established after securing the MiCA license. They are among the first centralized trading platforms to have successfully crossed the river, but they are also aware that the vast majority of their peers are still feeling their way forward.

They are in different places, in different moods, and at different paces, but what they say has subtle echoes: they all mention that "changes are too fast", they all say "take it slow", and they are all thinking about how the industry should continue to move forward.

The premise for this move forward is no longer the same as it was a few years ago.

Cryptocurrency trading platforms may no longer be the most central players in this world, no longer the starting point for all traffic and narratives. They stand on the edge of a new order, slowly being squeezed out of the core by a layer of invisible rules.

More complex systems and larger capital have gradually replaced the original narratives and structures.

Crypto trading platforms are still around, new product features are being released as usual, and announcements are being released one after another. But their expressions are changing, their rhythm is changing, the contexts they want to fit into are changing, everything is changing.

Some changes are actively chosen, some are passively accepted, but more often than not, they are just attempts to retain a sense of existence without being eliminated by the times.

However, not everyone is pessimistic. Xie Jiayin and Emily both believe that the impact of crypto on traditional finance is greater than the latter's squeeze on CEXs. They are optimistic about the trend of traditional financial institutions entering the market, because every round of industry evolution requires new players and new participants. Centralized trading platforms have developed to this day and are continuously expanding their institutional clientele, beginning to provide services such as wealth management and asset allocation. The two sides' businesses are intersecting and merging, "The two financial worlds echoing each other from afar is a romantic moment."

But at the same time, everyone knows that this advantage itself does not eliminate anxiety.

Many questions will not have clear answers, such as whether regulators will truly allow these crypto trading platforms to operate, and whether traditional finance is truly willing to co-build rather than replace them.

For example, before the next round of industry trends arrives, do they still have another chance to define themselves?

No one dared to be too confident about these issues. Everyone was busy juggling their own portion of the work, attending meetings, refining products, applying for licenses, and waiting for feedback, all while maintaining the status quo and waiting for an opportunity to regain the initiative.

While waiting for the wave of industry reshuffle.