This article comes from TwitterThis article comes from

, the original author: francesco, compiled by Odaily translator Katie Koo.

The encrypted exchange Trader Joe is one of the top five DEXs by trading volume. It was originally the largest DEX on AVAX. After expanding to the Arbitrum ecology at the end of last year, it was "full-fired", attracting a lot of liquidity. At the same time, the native token JOE also keep rising. ARB’s airdrop has contributed significantly to their weekly transaction volume growth.Trader Joe's head of marketing, Blue, said that an upgraded version of the trading engine, the automatic market maker Liquidity Book V2.1, will be launched as soon as next week.

The new version of the engine will allow depositors to more efficiently add tokens to Trader Joe’s liquidity pools and improve the on-chain trading experience. Additionally, Trader Joe’s will launch a new rewards program that distributes tokens to those users who participate in Trader Joe’s centralized liquidity. Since March 26, Trader Joe’s total locked value was $131.78 million, with more than $520 million in trade volume, according to DefiLlama.

Trader Joe V2 uses an innovative AMM design called the Liquidity Book. This article provides an in-depth look at how the liquidity ledger works and its advantages over traditional AMM designs.

Not all exchanges are created equal. Most exchanges' trading algorithms are based on the popular Automated Market Maker (AMM) formula: x*y=k. This formula "determines a price range for two tokens based on the available quantity (liquidity) of each token. When the supply of token X increases, the supply of token Y must decrease, and vice versa, to maintain a constant product K value".

However, operating an AMM with this formula leads to the following problems:

impermanent loss;

Low composability.

secondary title

What's so special about Trader Joe's?<>Since the Trader Joe V2 update, Trader Joe has used a different design for its AMMs based on the Liquidity Book (LB). Liquidity Ledger is a novel protocol that provides a hybrid AMM

CLOB (Central Limit Order Book) style experience. Liquidity Ledger builds on the foundation and truly empowers Liquidity Providers (LPs) and traders equally by providing a very different experience than all existing centralized liquidity asset management tools.

(Odaily Note: At present, the agreement is mainly divided into two categories: AMM "Automatic Market Maker" and CLOB "Central Limit Order Book".

The flexible nature of liquidity funds gives LPs full control and customization of their strategies, similar to CLOBs. Choose your "Bin", execute your strategy, and simply rebalance any of your "Bin" for dynamic optimization.

secondary title

How does the liquidity ledger work?

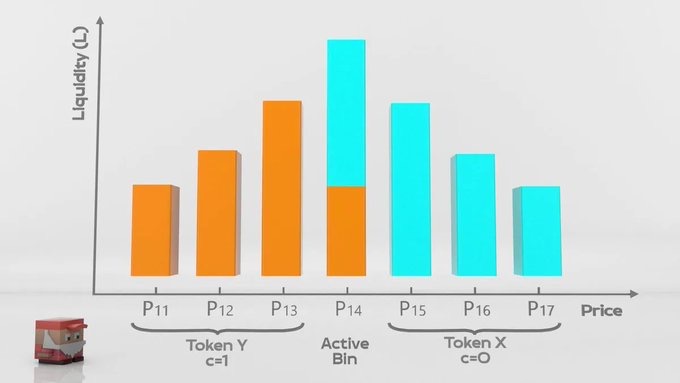

Another difference between traditional AMMs and liquidity ledgers is how liquidity is accumulated in liquidity pools. In the liquidity book, liquidity is aggregated vertically in different "Bins", rather than horizontally. Liquidity book fees will be paid out to a specific "Bin" compared to traditional AMMs, where anyone in the price range gets a portion of the fees.

secondary title

How does liquidity book design help with composability and flexibility?

The liquidity book design also provides LP with higher composability, and LP can obtain homogeneous token receipts for storing liquidity. Trader Joe predicts LPs will use receipts on other DeFi protocols. LPs also gain additional benefits from volatility-adjusted variable fees. This is a new internal mechanism for measuring instantaneous volatility, ensuring that it is completely accurate when applied to volatility-causing trades in liquidity pools.

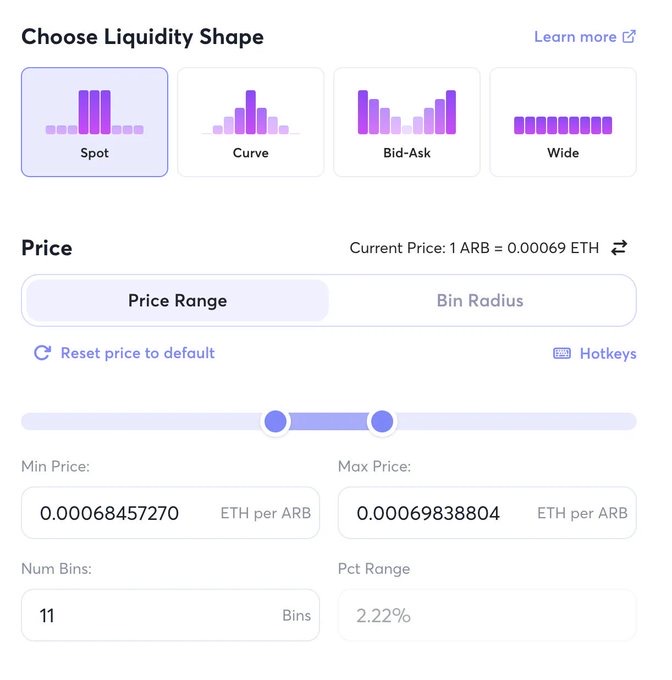

Liquidity Book Design also offers LPs unprecedented flexibility as it offers four different “Liquidity Profile Presets” to suit all different strategies.

Users will be able to choose their preferred price range and liquidity profile, as well as the number of "Bins" they want to deposit liquidity into. From these settings, the user can formulate up to 6 basic strategies, each with different advantages and disadvantages.

Such as Curve strategy and buying and selling strategy (Bid-Ask strategy).

Curve strategy:

Perform flawlessly and be capital efficient in a "calm" market;

Increased risk of impermanent loss;

Current prices need to be rebalanced for maximum efficiency.

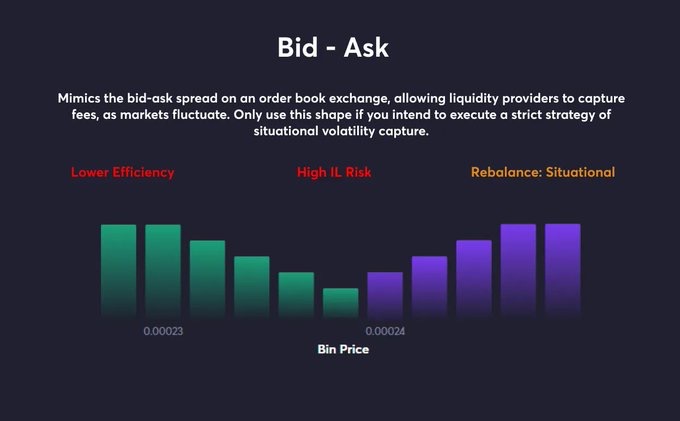

Buying and selling strategy:

Capturing market volatility, allowing DCA (cost averaging: an investment strategy designed to reduce the impact of volatility on asset purchases);

Rebalancing is required to maintain efficiency.

secondary title

How does liquidity book design help with impermanent losses?

Liquidity Book Design is a centralized liquidity AMM that combines elements of traditional order books and DeFi AMMs. It was introduced to help LPs eliminate impermanent loss (loss due to token price divergence. When the price returns, this loss is gone) and high slippage on the platform.

Trader Joe's fee structure has two components:

Basic rate: the lowest rate;

Trader Joe's is able to calculate the instant volatility of each liquidity pool thanks to an internal oracle called a "volatility accumulator". This enables a "surge pricing" feature that adds variable fees based on each pool's volatility. Variable fees are used to compensate LPs for impermanent losses that may be incurred by market fluctuations.

secondary title

How does liquidity book design reduce "slippage"?

secondary title

Summarize

Summarize

Trader Joe builds on the current AMM model, using an innovative liquidity book design. The main purpose is to obtain more efficient transactions, prevent impermanent losses, reduce slippage and maximize composability. The airdrop of star project Arbitrum proves that the "liquidity ledger" invented by Trader Joe is very effective. Attracted around $16 million in liquidity and generated massive transaction fees from over $100 million in volume in one week.