Original author: Defi Mochi@defi_mochi

Original compilation: angelilu, Foresight News

This week, Arbitrum's token ARB airdrop will be officially unlocked. If nothing else, this will inject more than $2 billion in additional liquidity into the Arbitrum ecosystem.

andFlipsideandDefiLlamaI found some Arbitrum projects with great potential on the data websites such as .

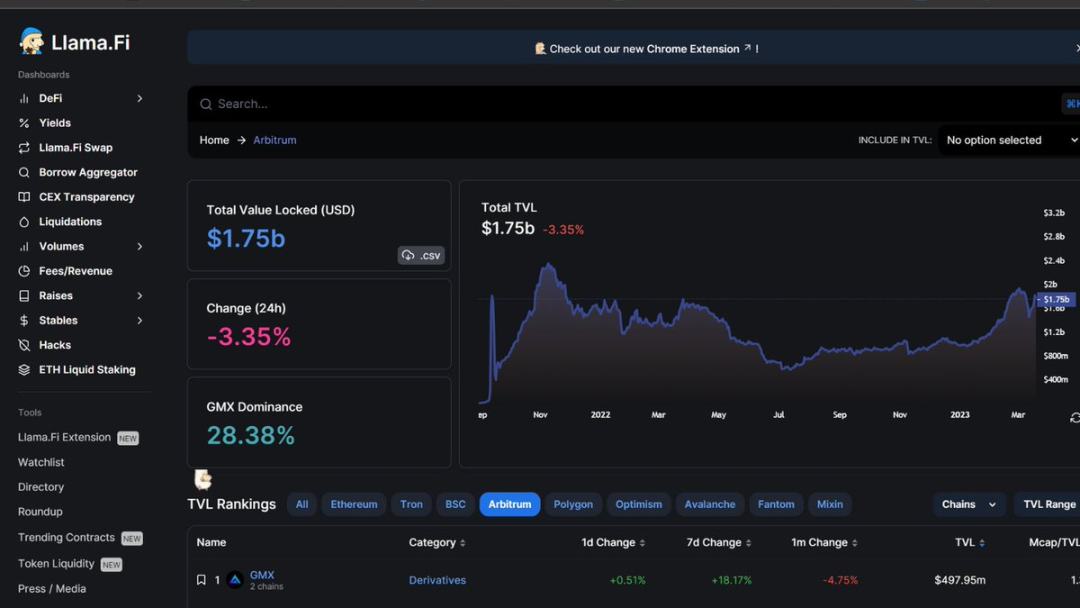

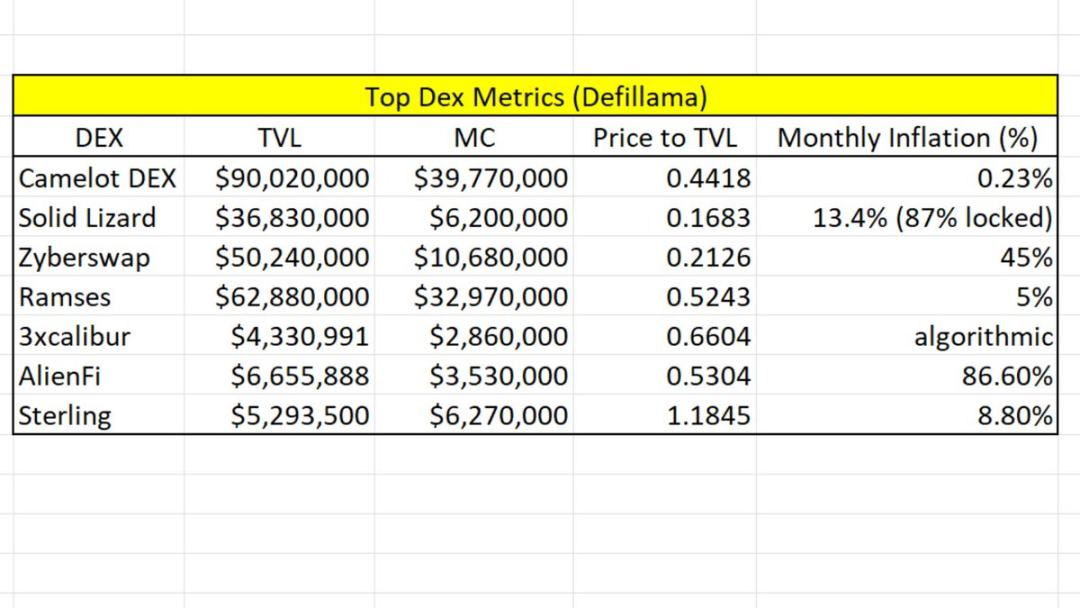

As of the time of publication, the total locked value (TVL) of the Arbitrum ecosystem is US$1.75 billion, and the value of tokens for ARB airdrops is expected to be between US$500 million and US$2 billion. Undoubtedly, all kinds of applications on Arbitrum will benefit from this liquidity injection. In order to find undervalued small-cap tokens, we can focus on two key indicators for different types of projects. For DEX, TVL is very important, and the application of derivatives category should focus on fee income (annualized).

use0x ngmi useLlama.Fiinstead ofDefilLama.com. Mochi would appreciate it if you could show your support to the alpaca team who work for us for free. (Foresight News Note: On March 19, 0x ngmi, the founder of DefiLlama, tweeted that the DefiLlama team did not want to be related to the person who controlled the Defillama Twitter account and domain name and decided to issue tokens, and decided to launch a new website with a forked versionLlama.Fi。)

Arbitrum Ecological Blue Chip DEX

From this table, we can see that the best blue-chip DEX on Arbitrum should beCamelot,andSolidLizardThe risk is higher.

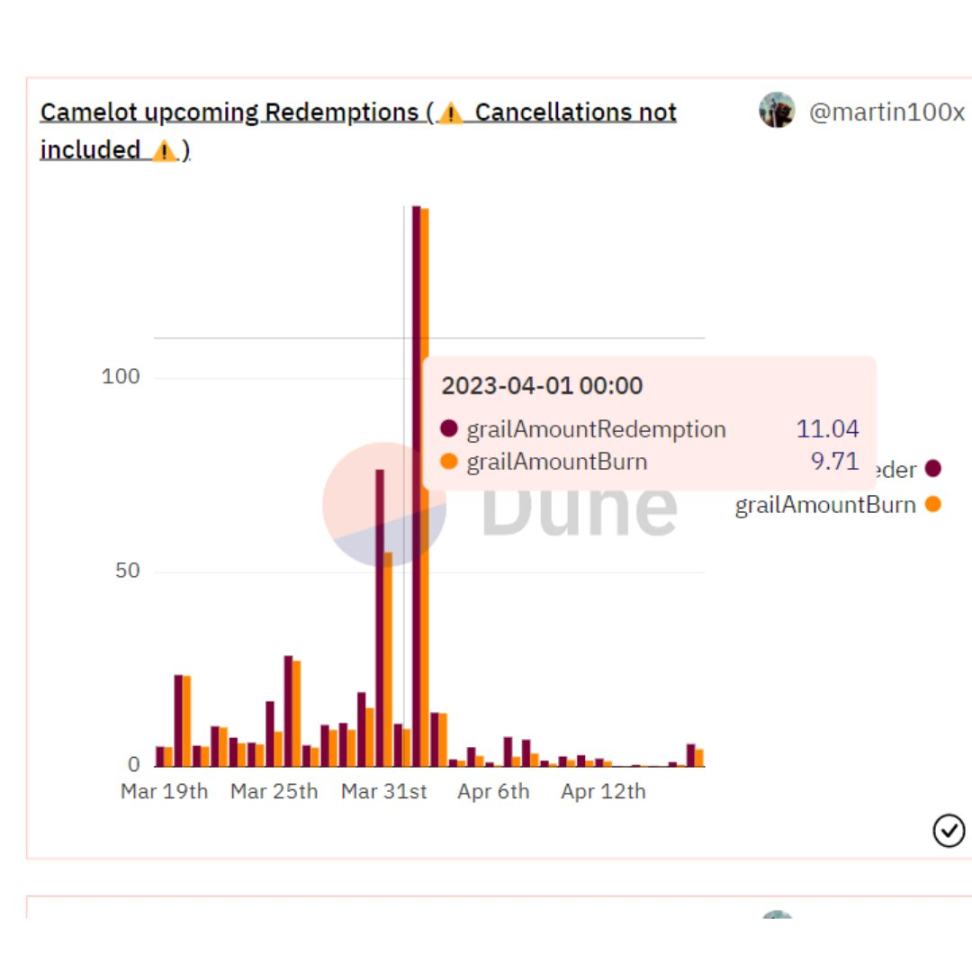

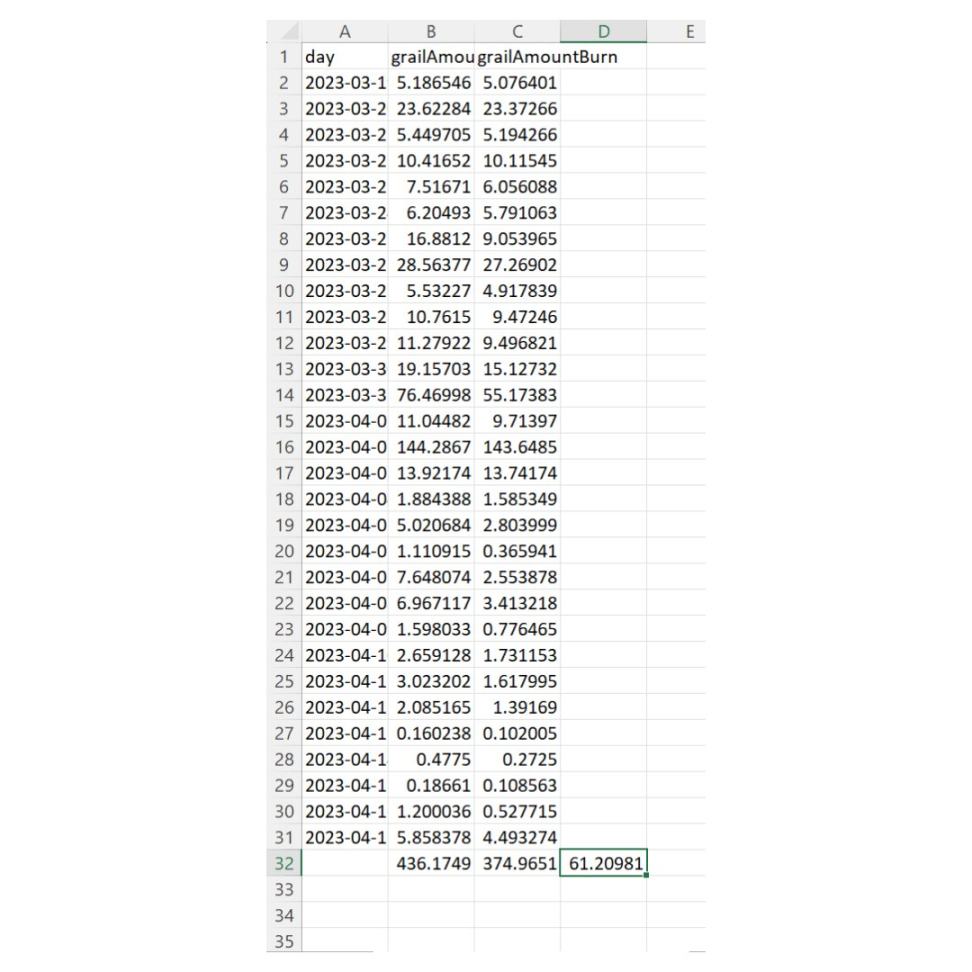

I thinkCamelotsource:

source:@martin 10 0x

https://dune.com/martin 10 0x/camelot-grail-tokenomics

Arbitrum Ecological Blue Chip Derivatives Agreement

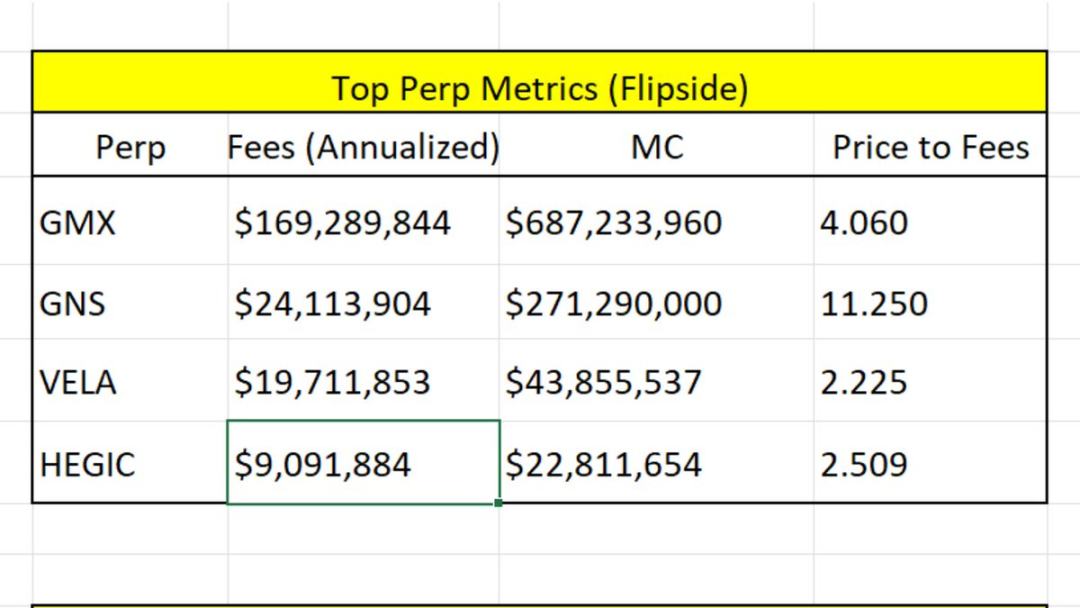

GMX is still the best blue-chip derivatives agreement in the Arbitrum ecosystem, and the ratio of its circulating market value to annualized fee income is as high as 4. Considering that GMX is about to support synthetic asset transactions, this will obviously provide new positive support for the currency price.

The fees in the table below are the annualized fee income for the past 30 days:

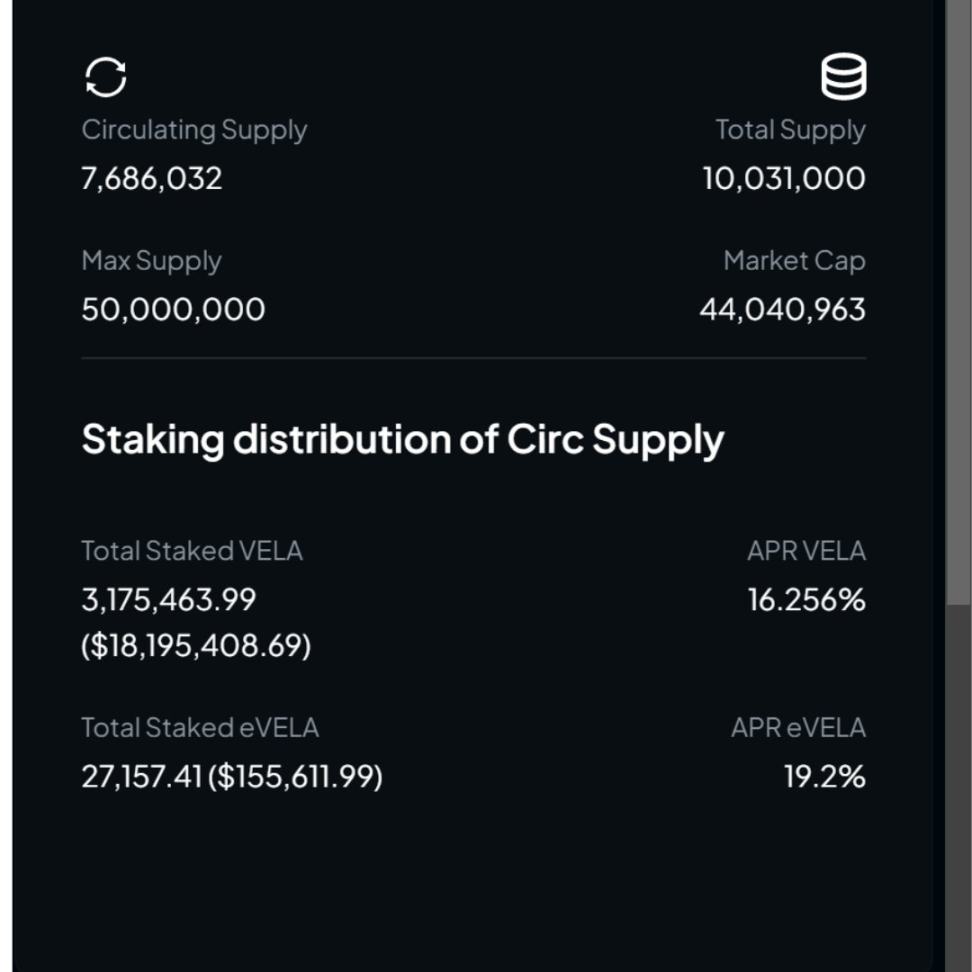

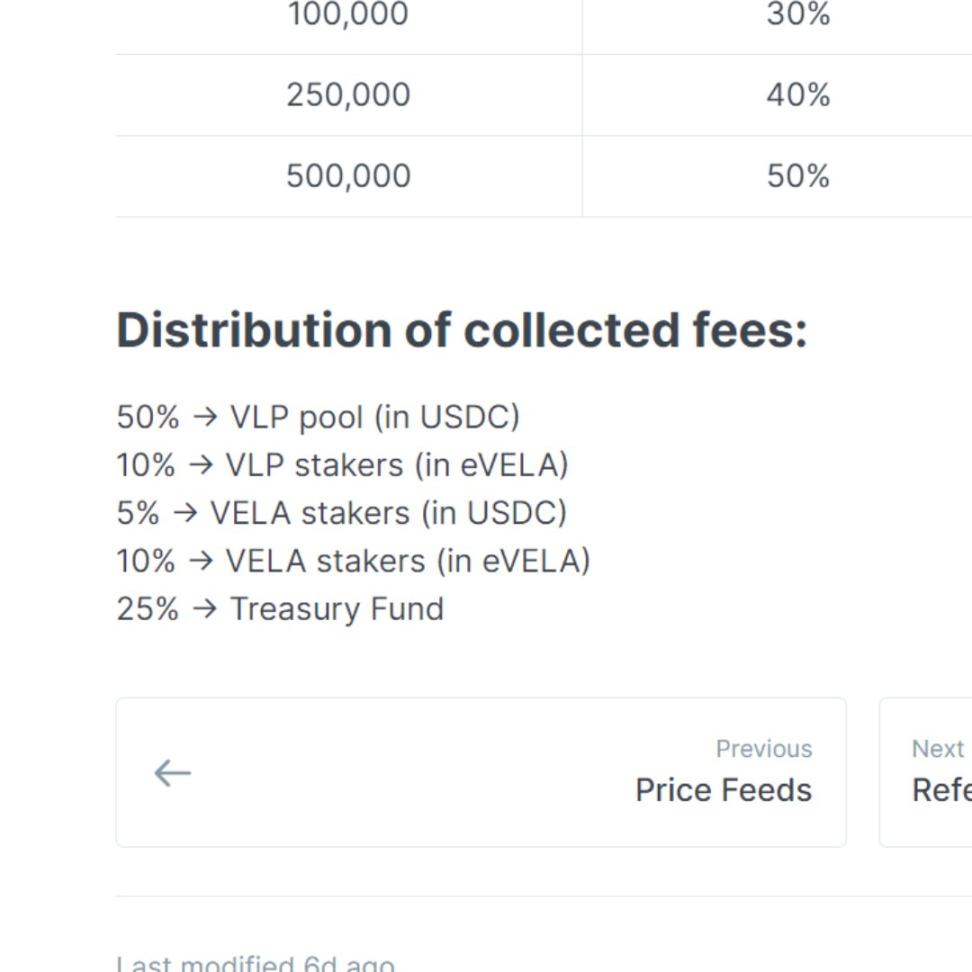

I think the authenticity of VELA's data on the Dune dashboard is questionable, so I decided to calculate VELA's fee income based on its APR. Under the APR of 16.25%, staking VELA can earn 2,956,753 fees per year. Assuming 15% is owned by VELA, according to the current currency price estimate, the fee income is about 19 million US dollars.

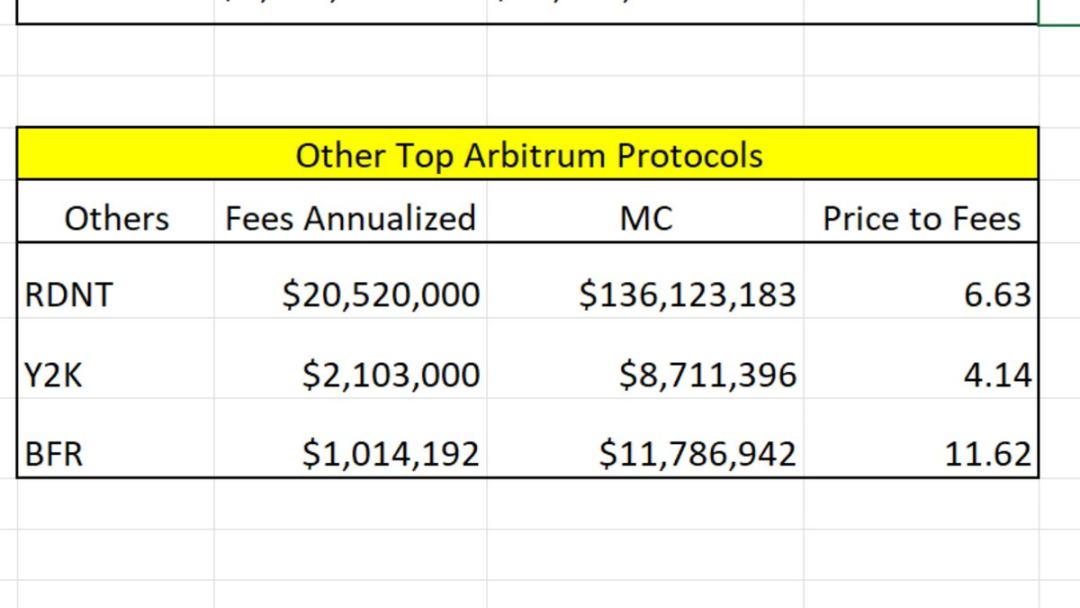

other agreements

Radiant’s token RDNT andY 2 K FinanceIt is worth looking forward to. The data of these two projects are shown in the table below. In addition, the strong performance of Y 2 K during black swan events (such as Depegs) proves that it can be used as a target for risk hedging in an effective investment portfolio.

I'm also very optimisticPlutusDAOsource:

source:https://dune.com/defimochi/plutus-metrics

The recent positive events of the several projects I mentioned above are worthy of attention:

PlutusDAO, V2 token economic model, plsRDNT, plsARB (circulation market value/TVL is 0.49)

Radiant Capital, the V2 version was launched on March 19

Vesta Finance, the upcoming Vesta lev+ (circulating market value/TVL is 0.35)

GMXOriginal link