Original source: @Buidler DAO

Original post by @Jane @Niels

Article directory:

01/ve Introduction

01/01 How ve works

01/02 Curve - creator of the ve model

02/ Look at the innovation of ve and different protocols from the core mechanism level

02/01 Liquidity balance

02/02 Incentive Mechanism Setting

02/03 Governance Tradeoffs

02/04 Attempt at Rights-Right Separation/Layerization

03/ Summary

In the early defi projects, it was a very common method to reward early users through liquidity mining to promote cold start. However, although this method contributes a certain amount of initial liquidity, it cannot support the healthy development of an agreement for a long time. The more intuitive reaction of users is still speculative and digging and selling for peace of mind, so the agreement will inevitably enter a rapid decline, which is well depicted by the death spiral of defidigital.

In addition, when the tokens of an agreement only have governance functions, and the governance authority is quite limited in actual scenarios, users will also lack sufficient motivation to continue holding them.

If these two problems are summed up, how can tokens provide sufficient holding incentives, and the interests of users and the protocol can be aligned for a relatively long period of time, so that they have the motivation to contribute to the long-term development of the protocol.

The emergence of ve (vote escrow, voting escrow) is a pretty good answer to the above dilemma. After Curve first proposed ve, many other protocols have incorporated it into their own economic models, and have made their own iterations and innovations based on Curve ve.

first level title

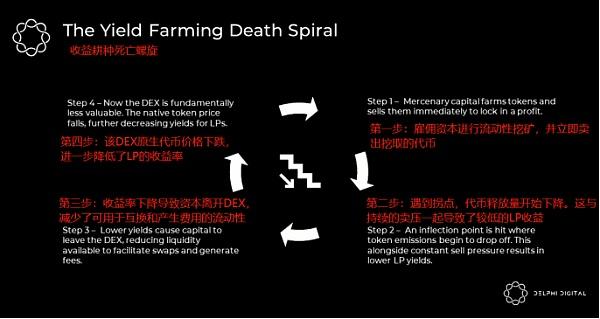

The core mechanism of ve is that users obtain veToken by locking tokens. veToken is a non-transferable and non-circulating governance token. The longer the lock-up time is selected (usually with an upper limit on the lock-up time), the more veTokens can be obtained. According to their veToken weight, users can obtain a corresponding proportion of voting rights. Part of the voting rights is reflected in the ownership of the liquidity pool that can determine the rewards of additional tokens, which will have a substantial impact on the user's personal benefits and enhance the user's motivation to hold currency.

How ve works

The core mechanism of ve is that users obtain veToken by locking tokens. veToken is a non-transferable and non-circulating governance token. The longer the lock-up time is selected (usually with an upper limit on the lock-up time), the more veTokens can be obtained. According to their veToken weight, users can obtain a corresponding proportion of voting rights. Part of the voting rights is reflected in the ownership of the liquidity pool that can determine the rewards of additional tokens, which will have a substantial impact on the user's personal benefits and enhance the user's motivation to hold currency.

For the protocol, locking can effectively reduce the circulation and reduce the selling pressure, thus making the currency price more stable. At the same time, after users are locked, their vital interests are more consistent with the agreement during the lock-up period, which also helps them make good governance choices. And those who are willing to lock in for a long time can get more benefits and governance rights, which is also very fair from a moral point of view.

Let's learn more about the actual use of ve through the Curve model.

Curve - the creator of the ve model

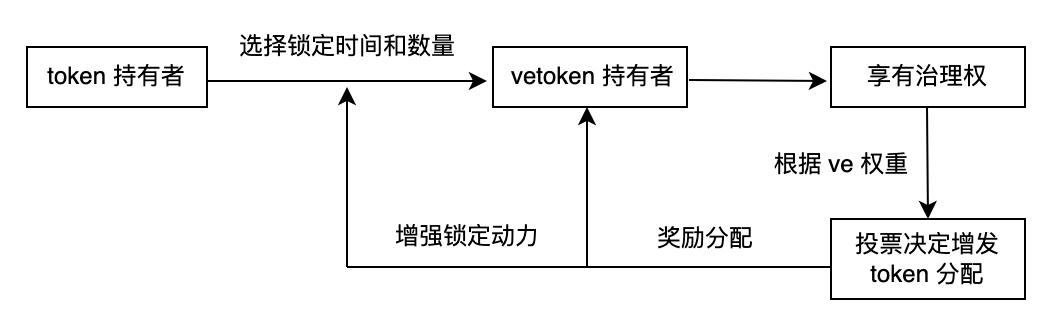

Users of the Curve platform will mainly receive two types of benefits: transaction fee rewards and CRV issuance rewards.

Trading fees are the source of revenue for the Curve platform. The platform charges this fee during the process of swap (0.04%, charged by the token of the output party), storage and withdrawal (0-0.02%). Among them, 50% of the transaction fee is given to veCRV holders (used to purchase 3 CRV, and then distributed to the holders, who can receive it once a week), and 50% is given to LP providers (ie Base APY).

CRV is Curve's native token, which is used to reward liquidity providers who pledge LP token (liquidity provider token, the token obtained by users who have contributed liquidity to the pool) into the Gauge. Gauge controller is the core component of Curve, controlled by Curve DAO. The Gauge controller records all parameters related to voting governance, such as "the current slope of each user in each Gauge, the power available to the user and the end time of the user's voting lock".

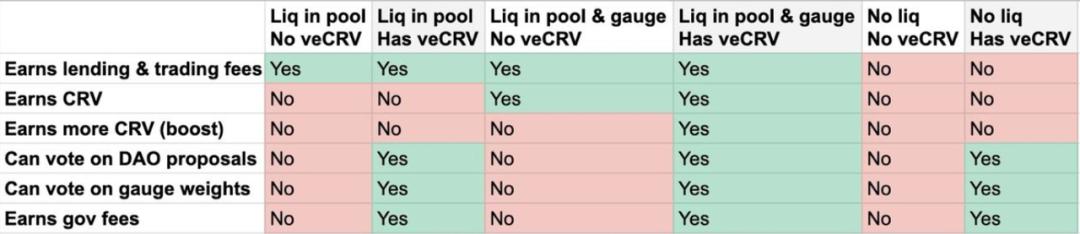

image description

https://github.com/curvefi/curve-dao-contracts/blob/master/doc/README.md

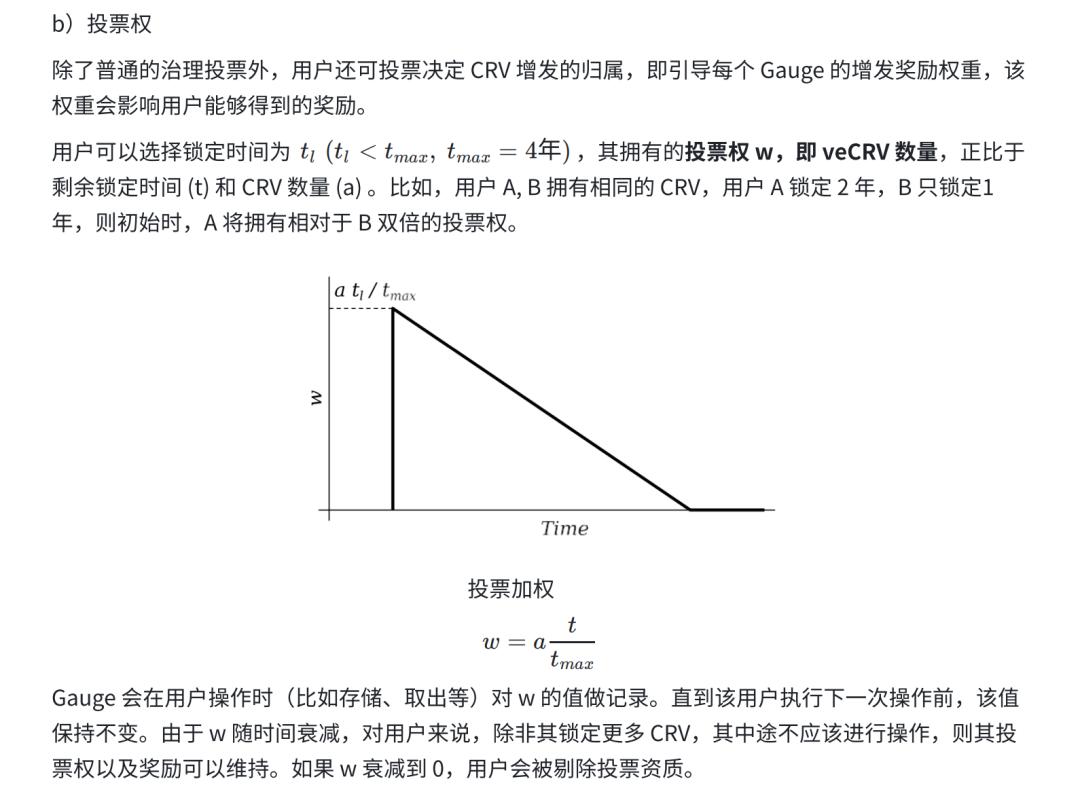

When the staking user further locks the CRV, he can obtain veCRV (veCRV is not transferable, and locking is the only way to obtain it). The length of lockout that users can choose ranges from 1 week to 4 years. The longer the lock-up time, the higher the conversion ratio of veCRV. 1 CRV can be locked for 4 years to get 1 veCRV, and locked for 1 year to get 0.25 veCRV. During the lock-up period, the number of veCRV of the user will decrease linearly as the remaining lock-up time decreases. If the user is locked multiple times, the expiration time must be selected uniformly.

Holders of veCRV have the governance rights of Curve. In order to encourage users to participate in governance (i.e. have an incentive to acquire more veCRV), some of the rights they enjoy are:

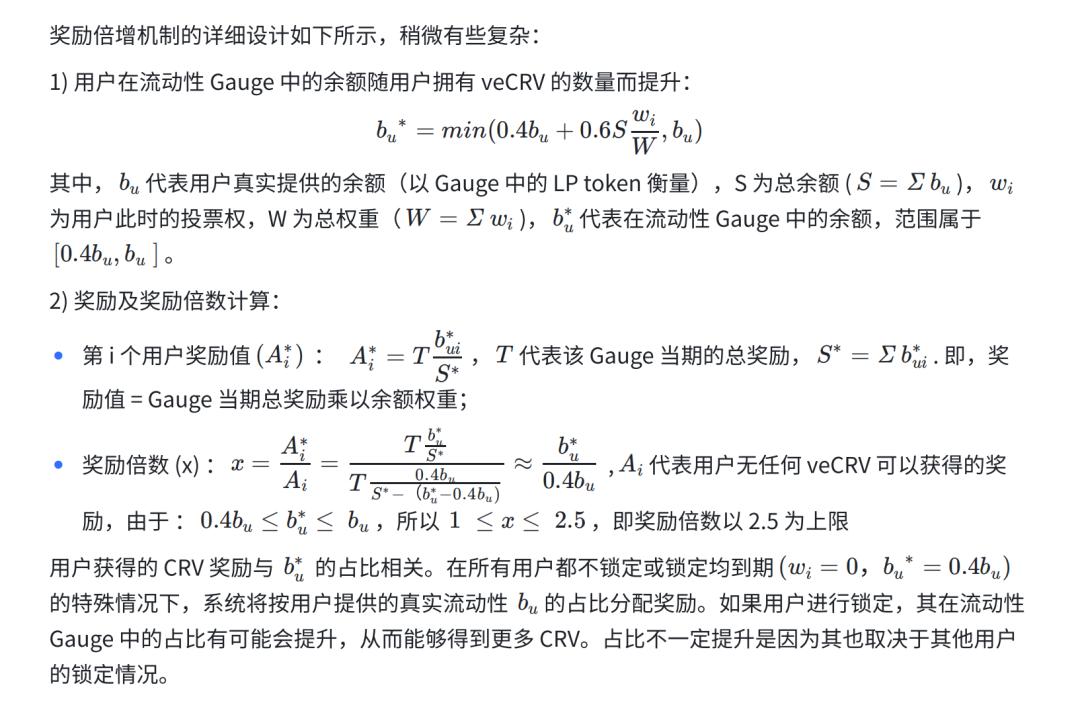

The intention behind setting a limit on the reward multiple of locked users is that although the ve mechanism is designed to encourage user locking and reward loyalty and stickiness, it is necessary to prevent the veCRV giant whale from grabbing more revenue without limit. Taking 100 U of stablecoins as an example, to achieve 2.5 times the income, 2840 veCRV is required, which is equivalent to 2840 CRV pledged for 4 years. According to CRV = 1 U, it is equivalent to holding 28 times the value of LP Token CRV.

It is difficult for ordinary users to obtain so many times of CRV in a short period of time, so the reward multiplication is often limited. The reason why it was finally set at 2.5 times is probably because the team felt that a relative incentive balance could be achieved at this limit. In addition, if a user provides liquidity to multiple pools, the reward multiplier may be different according to the lock-up of LP in different pools.

image description

https://resources.curve.fi/crv-token/understanding-crv

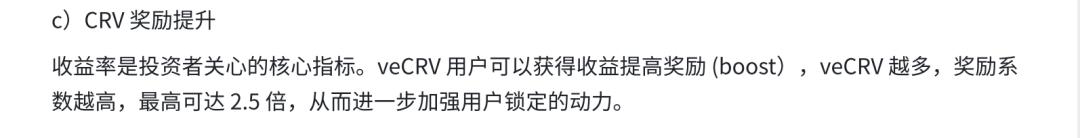

Interpretation:

1 )Liq in pool ——>earns lending & trading fees: Provide liquidity (deposit) and earn handling fees

2 )Has veCRV ——>vote on DAO proposals & vote on gauge weights & earn gov fees: hold veCRV: have governance authority, vote on gauge weights

3 )Liq in gauge ——>earn CRV: pledge LP token in the gauge to earn CRV

4 )Liq in gauge & has veCRV ——>boost: Pledge LP token in the gauge and still hold veCRV, you can get reward boost

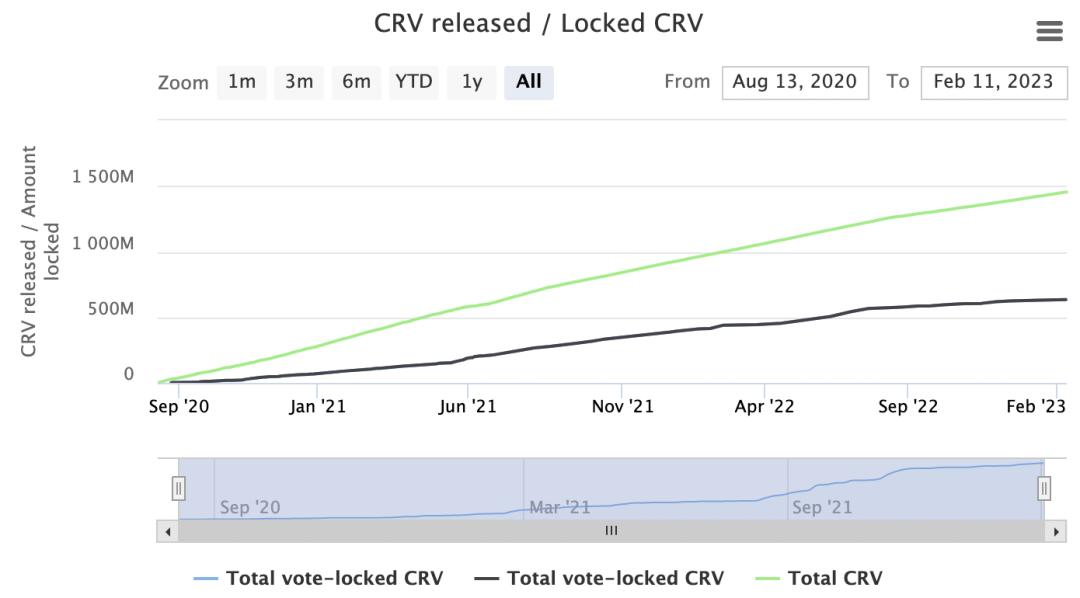

Judging from the current operating results, this mechanism is quite successful. 45% of CRV are vote-locked, with an average lock-up period of 3.56 years.

https://dao.curve.fi/releaseschedule

advantage

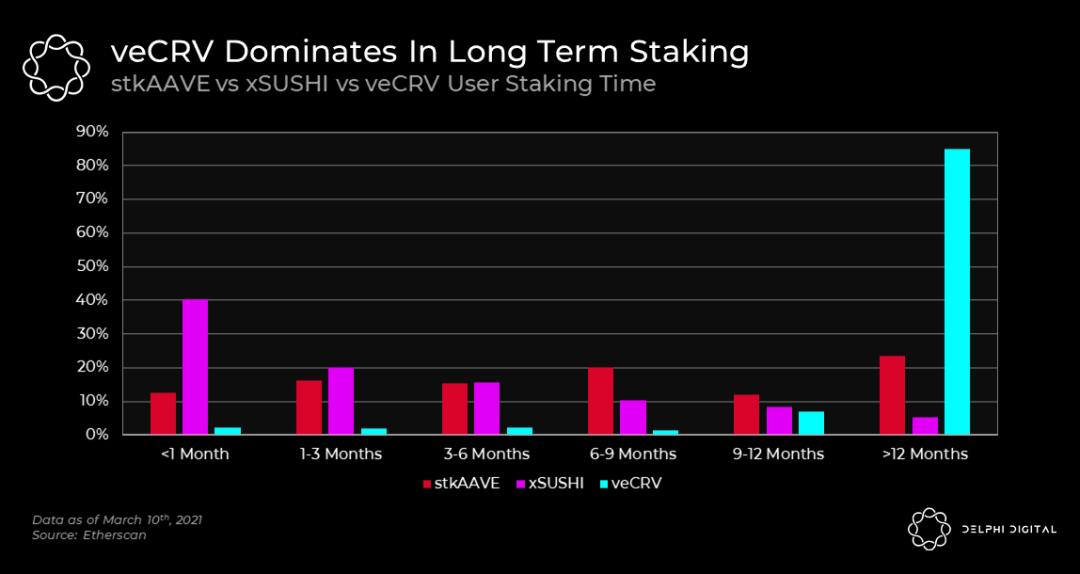

https://members.delphidigital.io/reports/an-alternative-implementation-of-vetoken-economics

advantage

It has been mentioned in the previous article, here is a summary of the advantages of ve:

1) After the lock-up, the liquidity is reduced, which reduces the selling pressure and helps to stabilize the currency price

2) Better governance possibilities: Governance rights are directly linked to the distribution of income, and users' motivation to hold coins is enhanced, which helps to increase governance participation. At the same time, long-term pledge users have greater governance weight, and they are also a group that is motivated to make better governance decisions. The time- and volume-based weightings reflected in the governance weights currently look quite reasonable.

3) The long-term interests of all parties are relatively coordinated: During the lock-up period, users cannot transfer their tokens. Due to their interests and rationality, they are more likely to ignore short-term and timely benefits and make decisions that are more consistent with the long-term interests of the agreement.

The locking mechanism also increases short-term manipulation costs for giant whales. And once they choose to lock in to increase their voice, there is a high probability that they will also tend to make rational votes that are in line with their own interests, and the possibility of malicious decisions is greatly reduced.

In addition, veCRV holders also enjoy fee sharing, that is, the interests of the liquidity provider, transaction party, token holder, and agreement are coordinated together. (The interests of the trading parties can now benefit from the strong liquidity of the pool and lower slippage)

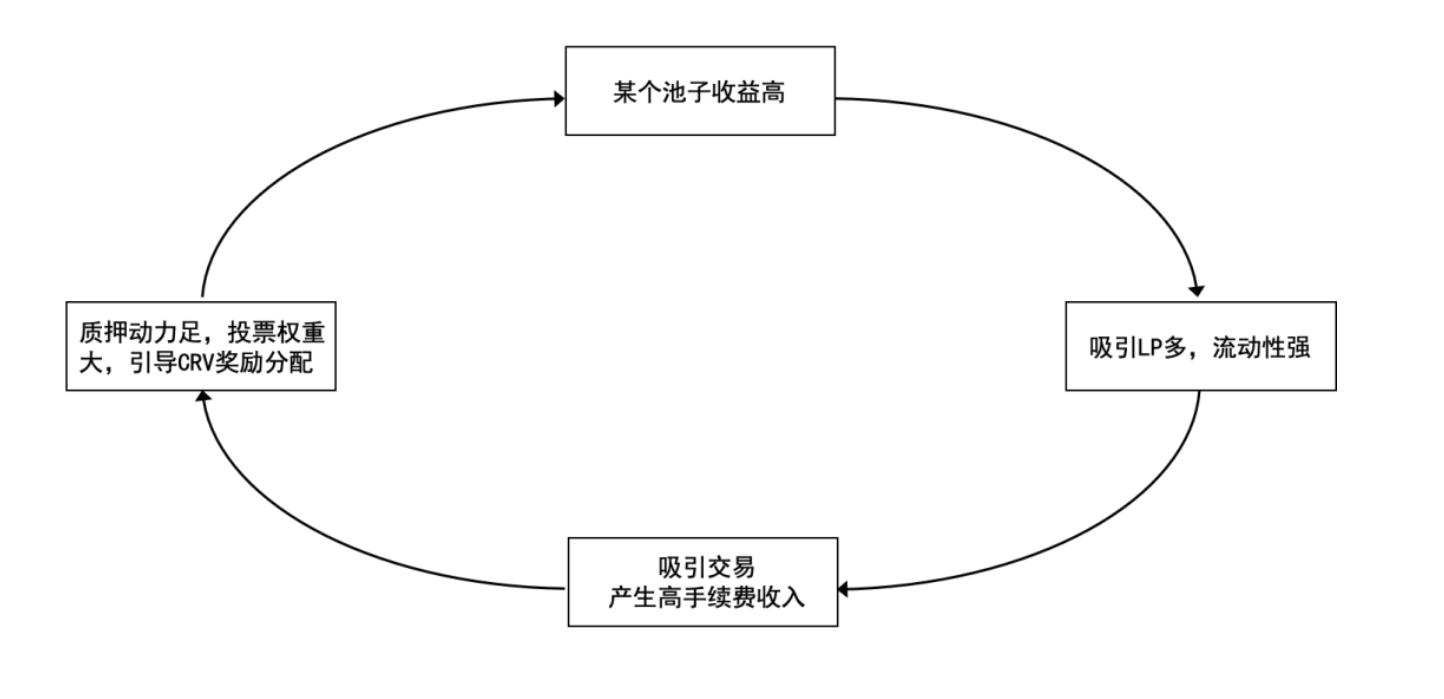

If the cold start period is passed smoothly, the Curve forms an excellent positive flywheel, and the VE plays an integral role in it.

It can be said that ve is a typical example of restricting human nature at the mechanism level and guiding positive behavior.

insufficient

No model is perfect, and ve also has its points of criticism.

1) The rigid "lock-in time" is not friendly enough for investors:

The lock-up period is not only a sweet spot, but also a point that many investors are discouraged. Some people joked that 4 years in the crypto industry is equivalent to 100 years in other industries. Quite a few investors don't want/have the ability to lock up for such a long time. If you want to continue to develop, how to increase the attractiveness to a wider range of investors and increase the flexibility of lock-in are all issues.

2) Centralization of governance:

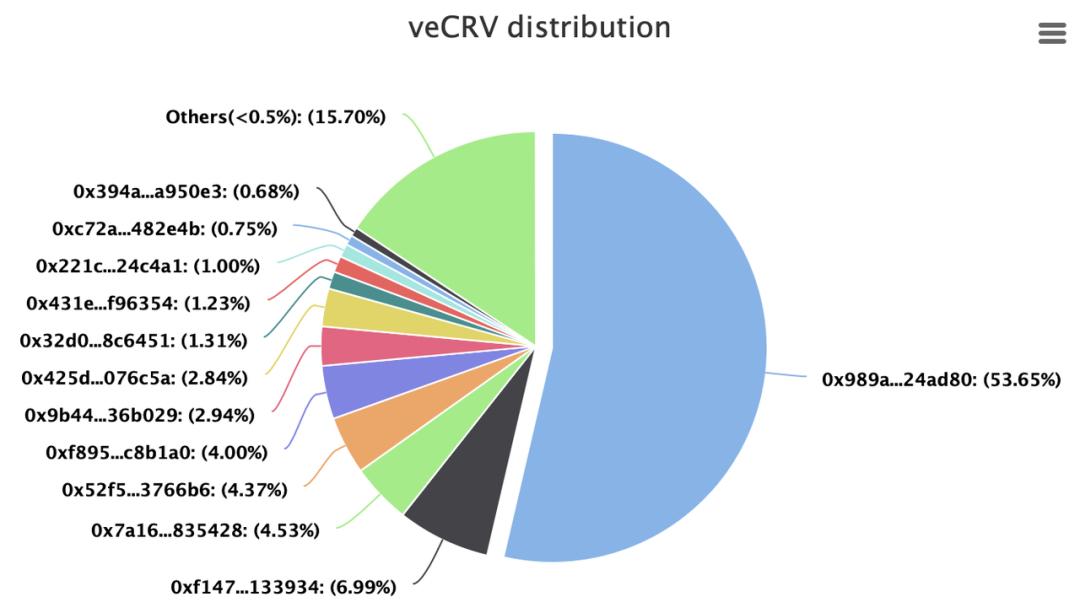

At present, more than half of the governance rights on Curve are in the hands of Convex (53.65%), and the governance rights are quite concentrated.

Note: Convex is a Curve-based liquidity staking and mining platform. CRV holders can stake CRV on Convex and obtain cvxCRV. The Convex platform will automatically lock the obtained CRV tokens on Curve to obtain the agreement The mastered veCRV token can be understood as the cvxCRV token is a tokenized veCRV that can be circulated. That is, Convex bets on Curve through certain rule design and risk control, and realizes the maximum reward by taking advantage of the "scale advantage".

https://dao.curve.fi/locks/1667977964

https://dune.com/queries/56575/112408

On the one hand, this is related to the lock-up time mentioned in 1), it is difficult for non-big investors to have enough motivation and ability to continue to lock, and secondly, it is also related to Curve’s whitelist mechanism. This mechanism stipulates that unless a smart contract is approved by a vote (51% pass rate, 30% participation rate), it cannot participate in the DAO. Its proposed origin is to maintain the stability of the protocol. There are only 3 protocols that have obtained whitelist permission in history, Yearn, Staking DAO, and Convex.

At present, voting rights have been concentrated in a few agreements. Intuitively, they have no incentive to agree to allow more agreements to participate, which will lead to fierce competition. Curve war may be pushed to a new stage if there are new and innovative ways to play.

However, the whitelist is somewhat contrary to the fairness and openness that crypto has always advocated. If the early whitelist has played its role, it is debatable whether the open ecosystem without permission is more beneficial to Curve or even Convex in the long run. This Propsal (Remove Curve DAO Whitelist) was discussing whether the whitelist should be removed, which aroused widespread discussion. Users who insist on keeping the whitelist believe that the benefits of the whitelist still outweigh the disadvantages. If there are new protocols that are considered innovative enough, they should not worry about being blocked because of voting.

Looking at ve from the core mechanism level

and innovations in different protocols

The Defi world is changing with each passing day, and the economic model is constantly iterating. Curve is by no means the pinnacle of the ve mechanism. On the basis of Curve ve, different protocols have made different improvements. The following will classify these innovations from different levels of the core mechanism, analyze the problems they try to solve, and use this to see the points that we can weigh and optimize when designing the ve model.

liquidity balance

As mentioned above, the long lock-up period in Curve ve has added obstacles to many investors. The most intuitive may be to shorten the maximum lock-up period. For example, Balancer's maximum lock-up period is set to 1 year. In subsequent models, based on Curve's own veCRV, there are also protocols that directly provide liquidity solutions. In addition, compared with Curve's hard lock, many relatively soft lock methods have begun to appear, trying to achieve a certain degree of balance between long-term lock and liquidity.

ve token tokenization

Convex's answer to ve's low liquidity is to tokenize ve tokens. Users store CRV on the Convex platform to obtain cvxCRV (only one-way conversion is supported in Convex). After staking cvxCRV, in addition to getting 3 CRV transaction fee rewards (same as veCRV holders), they will also get additional CRV (Convex 10% of CRV mining revenue) and CVX rewards (Convex platform token). CVX locked users (ie vlCVX holders, vlCVX=The Vote Locked CVX) can obtain Convex governance rights and vote to determine the weight of each gauge.

As mentioned in 1.2.2 above, Convex controls more than half of the governance rights on Curve, and obtaining the governance rights of Convex (vlCVX holders) is equivalent to indirectly achieving stronger control over Curve. The difference is that the lock-up period on Convex is "only" 16 weeks + 7 days, which is much more flexible than Curve's 4 years.

In addition, as the meaning of the word Convex "convex" indicates (the slope of the convex function is increasing), Convex is equivalent to gathering the power of "retail investors" to obtain higher rewards. Higher annualized returns further add to Convex's appeal. These two also partly explain why Convex can quickly gain popularity after its launch (May 2021).

However, Convex will reduce the long-term consistency between veCRV holders and the agreement to some extent, which may be unavoidable after the liquidity is strengthened. Based on Convex, vlCVX bribery platforms such as Votium have been derived, and the governance level and complexity have further increased. (This article refers to Convex as Curve's functional L2, Votium as Convex L2, and makes a wonderful analysis of each Curve L2 protocol)

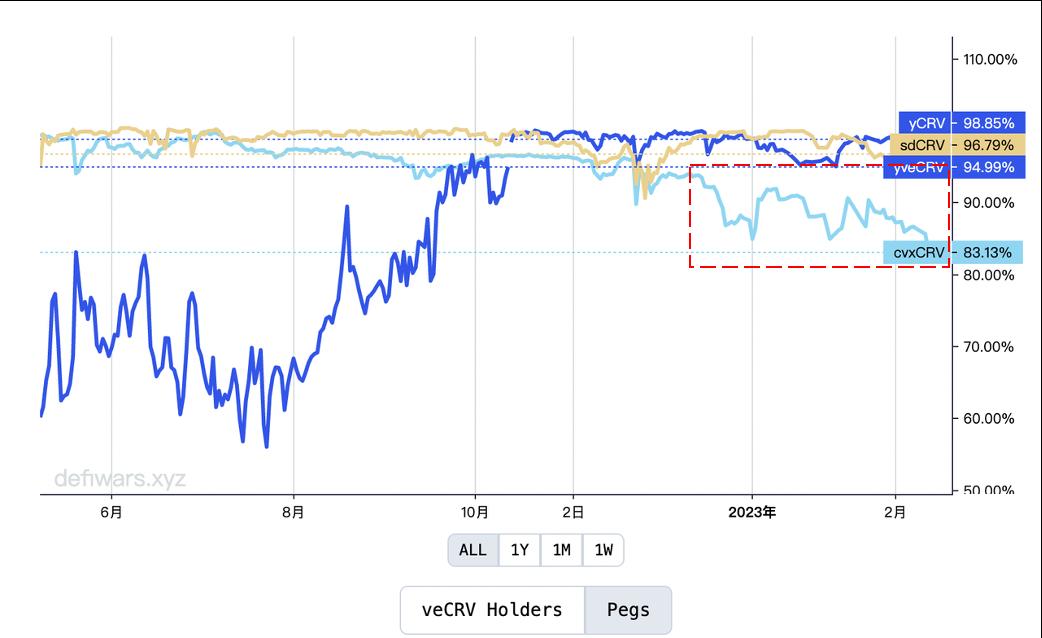

In addition, attention should be paid to the risk of decoupling between cvxCRV and CRV. Currently cvxCRV/CRV is around 0.83, which has deviated from 1 for a long time. To this end, Convex is also launching a new solution, the main direction is to give more rewards to cvxCRV holders.

https://www.defiwars.xyz/wars/curve

ve token NFT

From a locking perspective, veCRV is non-transferable ownership. In the VE(3, 3)* model proposed by AC (the founder of Yearn), an important mechanism innovation is to make ve tokens transferable. He designed the locked ve tokens as NFTs, allowing an account to form multiple veNFTs when locked multiple times, and the total amount of the account can be obtained by accumulating each NFT. After NFTization, ve tokens can not only be traded in the secondary market, but also can further develop the lending market in the future, thereby greatly improving liquidity. And because ve is linked to governance, that is, liquidity providers and governance users (veNFT holders) may be separated.

The question raised here is, how should veNFT be priced, and if the locked ve tokens can be traded directly (even at a discounted price), where does the motivation for users to lock ve come from? This is a point to be further improved.

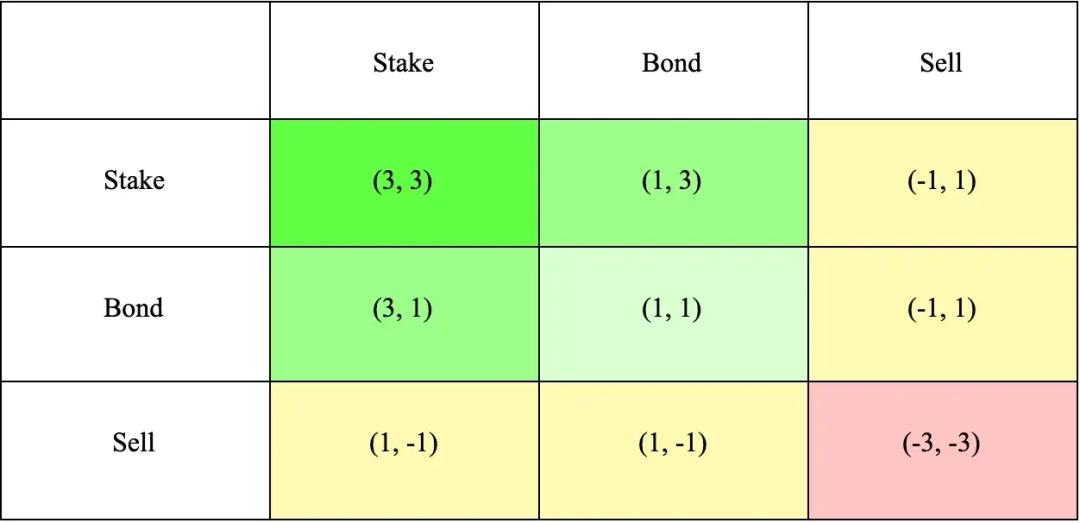

Note: VE( 3, 3) model combines Curve's ve model and OlympusDAO's (3, 3 ) game model. (3, 3 ) refers to the game results of investors under different behavior choices. The simplest Olympus model contains 2 investors, who can choose pledge, bond, and sell three behaviors. As can be seen from the table below, when both investors choose to pledge, the mutual benefit is the largest, reaching (3, 3 ), which is intended to encourage cooperation and pledge.

https://olympusdao.medium.com/the-game-theory-of-olympus-e 4 c 5 f 19 a 77 df

Soft Lockout*Exit Penalty

Compared with the mechanism that Curve cannot exit midway after being locked, many protocols have extended the mechanism that allows midway exit, but the exit penalty is superimposed. The penalty is usually related to the locked reward coefficient, which means that although users can quit halfway, they will also lose their locked rewards, increasing the opportunity cost of users quitting. In some scenarios (such as short-term price fluctuations), users may choose to stick to it.

Taking Platypus (a new type of stable currency AMM) as an example, pledge PTP (Platypus native token) to get vePTP and additional PTP issuance rewards. A pledged PTP can generate 0.014 vePTP/hour, and the upper limit of vePTP generation is 180 times (~18 months) of depositing PTP. The user can release the pledge at any time. The price is that once the user releases any amount of pledge, the vePTP accumulated over time will be cleared.

This is equivalent to giving the user the right to choose, whether to continue to persist for the achievements accumulated in the past, or choose to give up easily. It is conceivable that users' choices will be more subtle and diverse due to the superposition of their own judgments and loss aversion.

Compared to Platypus' radical zeroing rules, Yearn (a Defi revenue aggregator) is much gentler. In its upcoming ve model (based on YIP 65 passed at the end of 21), veYFI has a lockup period ranging from one week to 4 years. Holders who choose to quit are subject to a variable penalty related to their remaining lock time. If the remaining lock-up period is greater than 3 years, the penalty is 75% of locked YFI, otherwise, it is calculated according to the ratio of remaining lock-up period / longest lock-up period (4 years). This penalty fee will be rewarded to the remaining holders of veYFI.

There is also GMX (DEX) that cancels rewards proportionally, and its staking rewards Multiplier Points will be burned proportionally.

In addition to punishment rewards, there are also protocols that have chosen to extend the unstaking time. For example, Prism (derivatives protocol) stipulates a 21-day unstaking period.

To a certain extent, soft lock-up strikes a balance between liquidity and long-term holding incentives. Penalty fee redistribution to lock holders also further encourages long-term holding behavior. However, specific parameter settings (such as the longest lock time, exit penalty, etc.) should be set according to the priority you want to achieve in specific scenarios.

Incentive Mechanism Setting

In this section, we explore some details of the incentive distribution mechanism.

The sources of rewards for holding ve tokens can be roughly divided into:

1) token issuance rewards

2) Reward multiplier increased

3) Business income (such as handling fees) sharing

4) Punishment fees and other benefits are distributed proportionally (if any)

business share incentive

First look at the share of business income, that is, whether ve holders enjoy the share and the specific share ratio. In theory, if users are optimistic about the long-term development of the protocol, and the income of ve holders can be continuously bound to long-term income, it should increase the long-term motivation of users. Taking Curve as an example, veCRV holders enjoy 50% of the transaction fee share of all pools, distributed in the form of 3 CRV. This means that when the price of CRV drops, investors have the incentive to buy CRV and buy a larger share of revenue at a cheaper price.

On this basis, the ve(3, 3) model has been further refined, that is, users only enjoy the handling fees generated by the pools they vote for. This new limit makes users tend to vote for the most liquid pools that generate the most fees.

As for how to balance the income of veToken holders and liquidity providers, the specific sharing ratio depends on the consideration of the protocol designer. Curve adopts a 50-50 method. In the GMX protocol, the business of pledgers and liquidity providers Divide into a ratio of 3-7 open.

In addition, if it involves business sharing, the token will have a certain degree of stock nature. In US law, the Howey Test is used to determine whether it is a stock, and if it is classified as a stock, it will be subject to additional regulatory constraints. However, because it belongs to case law, the specific judgment should be looked at in detail according to the specific case. Different countries have different methods of determination.

Token issuance incentives

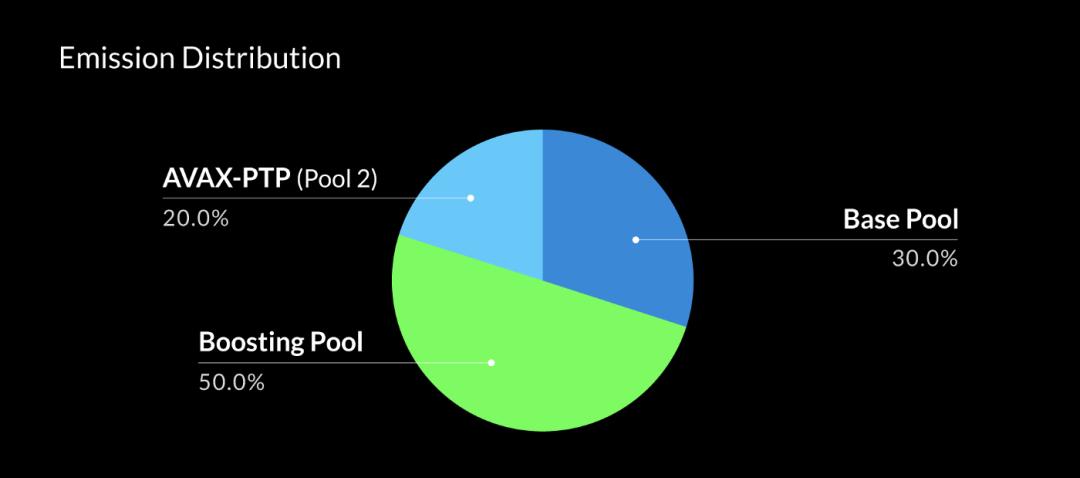

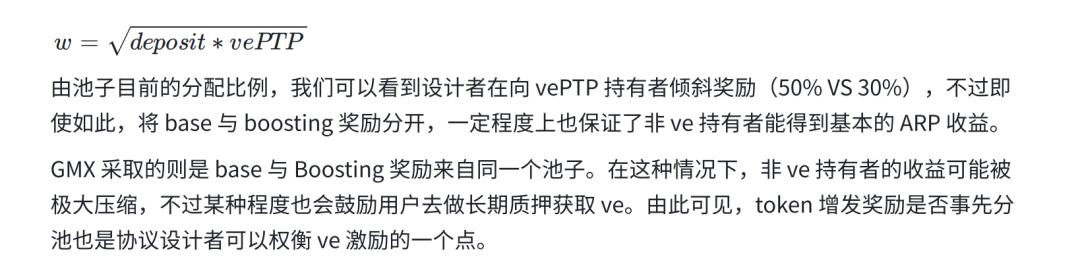

When issuing token rewards, Platypus (a new type of stablecoin AMM) carried out a three-pool design:

https://medium.com/platypus-finance/platypus-liquidity-mining-design-eli 5-part-i-52 fd 6 b 8 bed 1 d

The proportion of additional issuance income of the three pools is 20%, 30%, and 50% respectively (this weight can be adjusted later).

AVAX-PTP second pool (20%), which is the liquidity pool of PTP;

The base pool (30%) rewards liquidity providers, and the reward weight is proportional to its storage ratio;

The boosting pool (50%) rewards ve holders, and the reward weight depends on the amount of storage and the number of vePTP.

anti-inflation

Since protocol tokens are typically minted continuously, locked tokens will also be subject to inflationary pressure if no action is taken. If the foreseeable inflationary pressure is too great and cannot be sold in the middle, it is obvious that users will not be willing to lock in. In response to this, ve( 3, 3) proposed its optimization scheme, which is specifically reflected in:

1) The weekly additional issuance will be dynamically adjusted based on the circulation

Assuming that the original weekly issuance is 2 M, if 0% of the current tokens are locked in ve, the weekly issuance is still 2 M, that is, 2 M*( 1-0%); if 50% of the tokens are locked in ve, then The weekly issuance amount is 1 M, which is 2 M*(1-50%); if 100% of the current tokens are locked, the weekly issuance amount will be 0, which is 2 M*(1-100%). That is to say, the more tokens locked, the less the amount of additional issuance, and the impact of additional issuance on locked users can be reduced by dynamically adjusting the amount of additional issuance.

2) ve lockers will be compensated proportionally

Assuming that the current total supply is 20 M, the locked amount of ve is 10 M, and the weekly additional issuance of this week is 1 M, which means a 5% increase in supply, that is, 1 M/20 M. In order to ensure that ve holders are not diluted, in the (3, 3) mode, their holdings will also increase by 5% accordingly, that is, 0.5 M= 10 M* 5%. The remaining 0.5 M of the weekly additional issuance will be released as a reward.

Combining 1) and 2), the designer hopes to enhance its locking power by protecting ve users from being diluted.

Inflation is equivalent to a tax, increasing the cost of holding for users. So if it involves token issuance, we also need to pay attention to the current circulation, maximum issuance and issuance speed when deciding to lock. The designer of the protocol can refer to ve(3, 3) to make more detailed regulations on additional issuance and compensation.

However, on another level, the token incentive balance between the first entrants and the late entrants should also be considered. If the issuance reward is too biased towards existing ve holders, it may not be attractive enough to potential new investors. The new Defi Thena.fi has made further improvements on the basis of ve(3, 3), which limits the increase in holdings to 30%, and only provides partial dilution protection to ve holders, thereby preventing tokens from being too concentrated in the early ve in the hands of the holder. The main consideration here is how token issuance can continue to provide impetus for the long-term development of the protocol.

Whether the Real Yield level is sustainable

Promoting cold start and holding through token rewards is already a common method for project parties. However, after experiencing the aggressiveness of releasing a large number of tokens to attract liquidity in the defi protocol in 2021, investors have also begun to calmly examine the sustainability of APY . The proposal of Real Yield is exactly the embodiment of this pursuit of stable income.

The calculation method of Real Yield: net income = protocol income - market value of additional tokens

The intention of this formula is that we should consider the additional tokens issued to users as real costs, and deduct them from the protocol revenue to calculate the net income, and use the net income to consider whether the protocol has the possibility of achieving positive returns.

Defiman has done a research on Real Yield. The results show that most of the leading protocols that implement token incentives cannot achieve positive real returns, not to mention that unknown or early protocols often adopt more radical codes. The currency incentive policy has doubts about its long-term sustainability.

In the ve model, in order to give users enough long-term motivation, but the protocol revenue rewards are limited, designers often choose to mainly focus on token rewards. Therefore, when setting incentives, it is worth thinking about how to reasonably set the incentive level, which can not only give users enough incentives, but also make the agreement sustainable, that is, the business income is enough to cover this part of the reward expenditure, while the business itself can remain competitive ( Fees and other income are reasonable but not too high). But the balance between short-term and long-term is indeed difficult to balance, and it also tests the designer's rhythm.

Governance Mechanism Tradeoffs

fluid governance

One of the core purposes of the ve model is to achieve good and stable governance. The key here is who to give the governance power to and how to distribute the governance weight of different people. Ideally, major governance rights should be allocated to investors whose long-term interests are aligned with the protocol. At the same time, from the perspective of time dynamics, it is best to achieve a certain flow of governance rights.

If investors holding a large amount of veCRV control the agreement by controlling voting rights, and thus further hinder the entry of new investors (see Curve's whitelist mechanism), it will be difficult to change the entire agreement. After the governance rights are fully solidified, the so-called governance rights do not exist to some extent (small voters cannot have a substantial impact on the results).

Here are a few points involved (without considering other specific constraints and requirements):

1) No whitelist restrictions, no permission to interact with the protocol (prevent monopoly, more open)

2) ve is designed to be non-transferable, thus avoiding direct bribery

3) The voting weight of ve decreases with time, and the governance rights can flow naturally

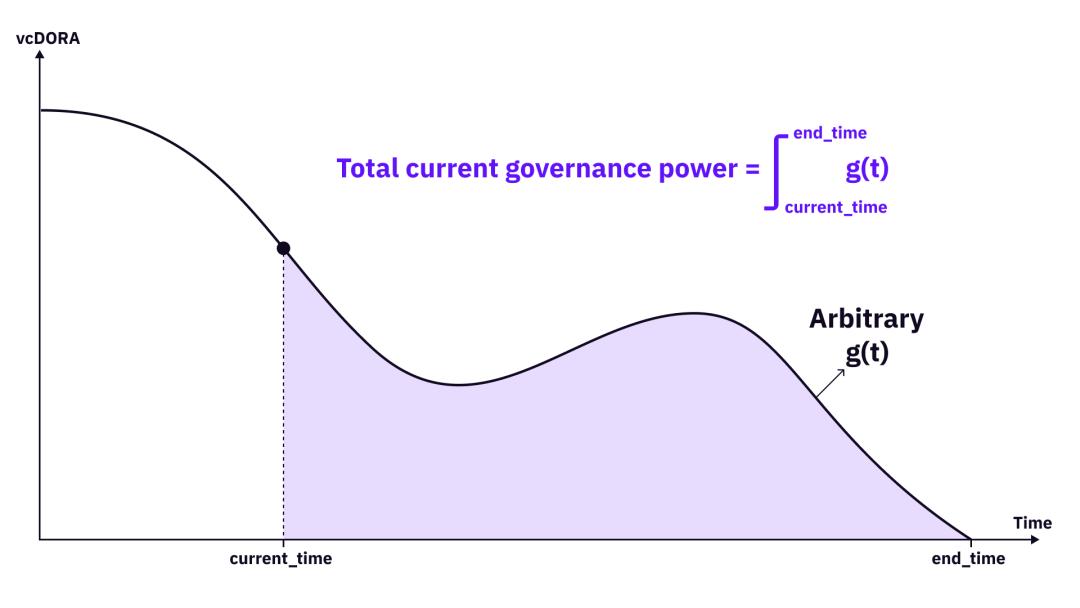

Take vcDORA (a veToken for open funding community governance) as an example, the governance ability of a certain amount of ve can be visually seen in the figure below (the shape of the curve in the figure below is an example, and there is no need to pay attention to why this is the case) shape), the area under the curve from the current time to the end time represents the sum of its governance capabilities. When the staking time expires, the user's governance rights become zero. And g(t) is a curve, which means that g(t) can be integrated as long as it can be integrated (that is, the area of the purple part in the figure below can be calculated), not necessarily a straight line of linear attenuation. This nonlinear governance power curve is also a direction to explore.

https://doraresear.ch/2022/09/16/vcdora/

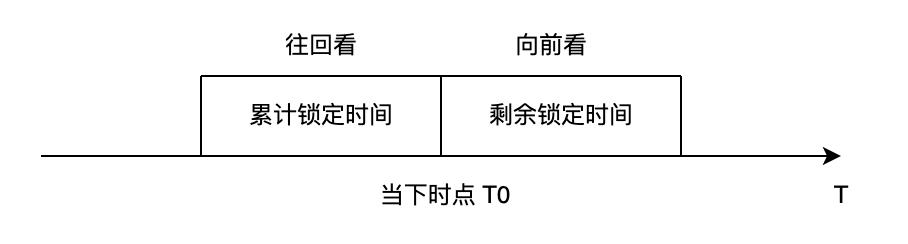

loyalty measure

If you think of weight as a way to quantify the loyalty of ve users to the protocol (weight determines voting/reward distribution, etc.), you can see that there are currently two measurement methods: one is Curve, which is based on its remaining lock time (Looking forward, the veToken will decrease linearly during the remaining lock-up period), and the other is to look at the user’s historical pledge time (looking back, the longer the pledge time, the more veToken will be accumulated, but there is an upper limit), The latter such as Platypus. These two measurement methods are to some extent the balance of new and old users.

If the second way of looking back dominates, the advantages of investors who have pledged for a longer period of time are basically difficult to overcome. But whether users with longer pledges are more likely to continue to insist on stable pledges is a matter of opinion. However, since the second method is often combined with a midway exit penalty mechanism (see 2.1.3), investors will face a certain opportunity cost, which may motivate them to continue to stabilize their pledge.

The forward-looking (mainly based on the remaining lock time) method led by Curve may lead to a more fluid weight distribution. Any new user who chooses to lock for a long time will get enough ve, and the old user will no longer have ve if the remaining lock time expires and no longer chooses to continue locking. Therefore, if users want to continue to have a good reward multiplier, they need to update their lock-up time to keep their remaining lock-up time at a relatively long level. This also partly explains why Curve's average lock-up period can reach 3.5 years.

bribery pros and cons

Vote-buying is a controversial topic. We tend to think that bribery is a neutral word, depending on the main demands of users in specific scenarios. After all, in real life, it has another similar word lobbying (lobby).

In some scenarios, users mainly care about the rate of return, and a convenient bribery mechanism can improve user experience. It is even possible to consider directly combining the bribery reward mechanism into the protocol, thereby increasing the attractiveness of ve’s revenue and increasing the motivation to participate in the election. Because for small ve holders, if there is no convenient way to participate in the bribery agreement, it may be difficult to commercialize their governance rights, or face high communication costs. For giant whales, if they conduct privately directly through OTC, they may also face the risk of breach of contract. The built-in bribery mechanism solves these trust problems.

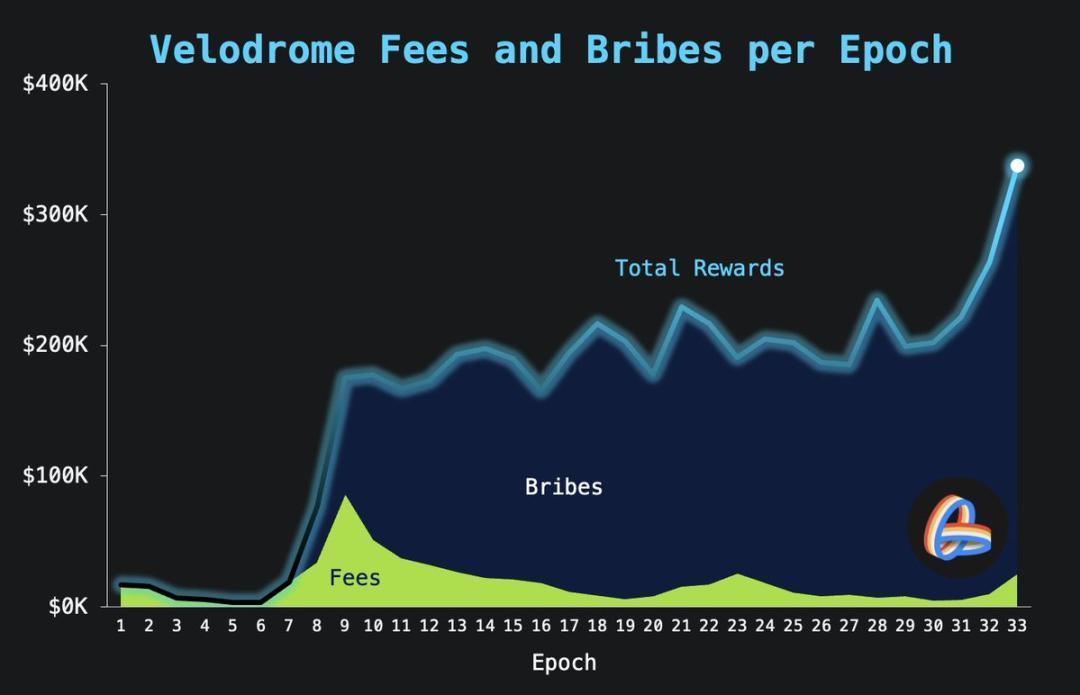

Even in Velodrome Finance (currently the DEX with the largest amount of locked positions on Optimism), bribery income contributes the main ve rewards (as shown in the figure below). In addition, after the bribery mechanism is embedded, it will inevitably have an impact on second-tier derivative protocols such as Convex.

https://twitter.com/VelodromeFi/status/1616489024268402711

In some scenarios, if you are very concerned about the authenticity of voting and hope that users can participate in voting as much as possible and reduce bribery as much as possible, you can use ZK-based MACI voting (hide everyone's vote, but show the final voting results) and so on. In this case, firstly, the privacy of voters can be well protected, and secondly, the bribery party cannot know the real voting situation, thus lacking the incentive to bribery.

It can be seen that protocol design is only a tool, and these methods can be used in combination according to specific scenarios.

Attempts at Right-Entitlement Separation/Layerization

On the basis of ve, many protocols are also exploring new token rights distribution methods, that is, to further split veToken, different tokens have different rights, so as to do more refined rights management.

The Convex mentioned above essentially splits the income rights and governance rights of veCRV, and gives more flexibility: staking cvxCRV can get 3 CRV rewards, and locking CVX to get vlCVX can affect the veCRV controlled by Convex, thereby affecting Curve The pool's governance decisions are voted on.

Separation of governance rights and reward promotion rights

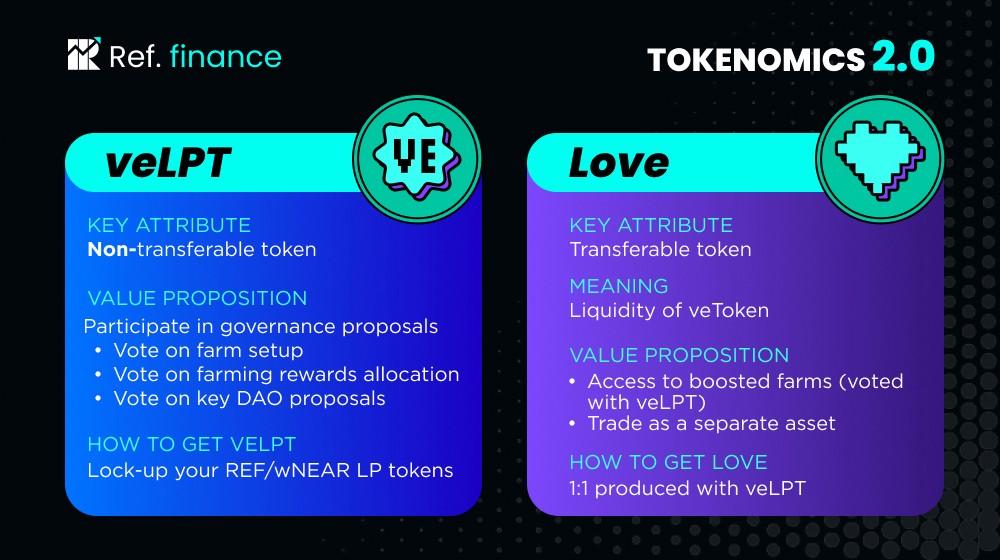

Ref Finance (the DEX of the Near ecology) proposed a new set of solutions in its 2.0 version token design. Compared with obtaining a single veToken, liquidity providers can obtain veLPT and Love(Ref) tokens (1 : 1 ).

Among them, veLPT cannot be transferred, and corresponds to the voting governance rights of users in ve tokens, and users who hold them can vote to determine the allocation of incentives. Love(Ref) corresponds to the liquidity provided by users in ve tokens (locked liquidity shares), and holders can enjoy increased income (determined by veLPT voting). Moreover, Love(Ref) is transferable, that is, if the user only wants to enjoy the right to vote, he can transfer the right to increase the income to others. However, when unlocking veLPT, the account still needs to have 1: 1 veLPT and Love(Ref).

https://ref-finance.medium.com/ref-tokenomics-2-0-vetokenomics-on-testnet-c 2b 6 ea 0 e 4 f 96

It can be seen that after the token rights are subdivided, different investors can choose the part they want most in the agreement according to their needs, and focus on investing. Flexibility for all parties is enhanced.

right-right stratification

The Astroport (Terra ecological dex) mechanism strikes a balance between Curve ve's no-lock-in, no-governance rights, and long-term lock-in high returns. It innovatively adopts a three-token mechanism, ASTRO, xASTRO (obtainable by staking ASTRO), and vxASTRO (obtainable by locking xASTRO, which decays linearly with time). xASTRO is transferable and can enjoy certain governance rights and transaction share (50%). In addition to the 50% transaction share, vxASTRO can enjoy more governance rights and income enhancement (up to 2.5 times).

The advantage of this model is that it accommodates the demands of both short-term holders and long-term holders. By allowing non-locked user xASTRO holders to also enjoy certain governance rights, the governance process is more democratic and the friction of participation in governance is reduced. At the same time, by giving vxASTRO holders excess rewards asymmetrically, it also fully encourages long-term holding behavior. In this way, investors with small amounts but strong beliefs can amplify their influence through long-term holdings, and subtle wrestling can form between them and investors with large amounts but short-term holdings.

summary

summary

The ve model coordinates the interests of all parties through lock-in and revenue sharing, so that participants have the motivation to contribute to the long-term healthy development of the protocol. From the perspective of the economic model, ve is a great improvement compared to the previous model, and it has also achieved great success.

Based on ve, innovations of different protocols emerge in an endless stream, contributing iterative solutions from different dimensions. In this process, we can see that each protocol makes repeated adjustments at key levels of the mechanism according to its own needs and priorities. As a system designer, knowing the potential adjustment space and designing based on your own situation, the subtlety is reflected in these trade-offs. The permissionless and composable nature further encourages the continuous emergence of innovations.

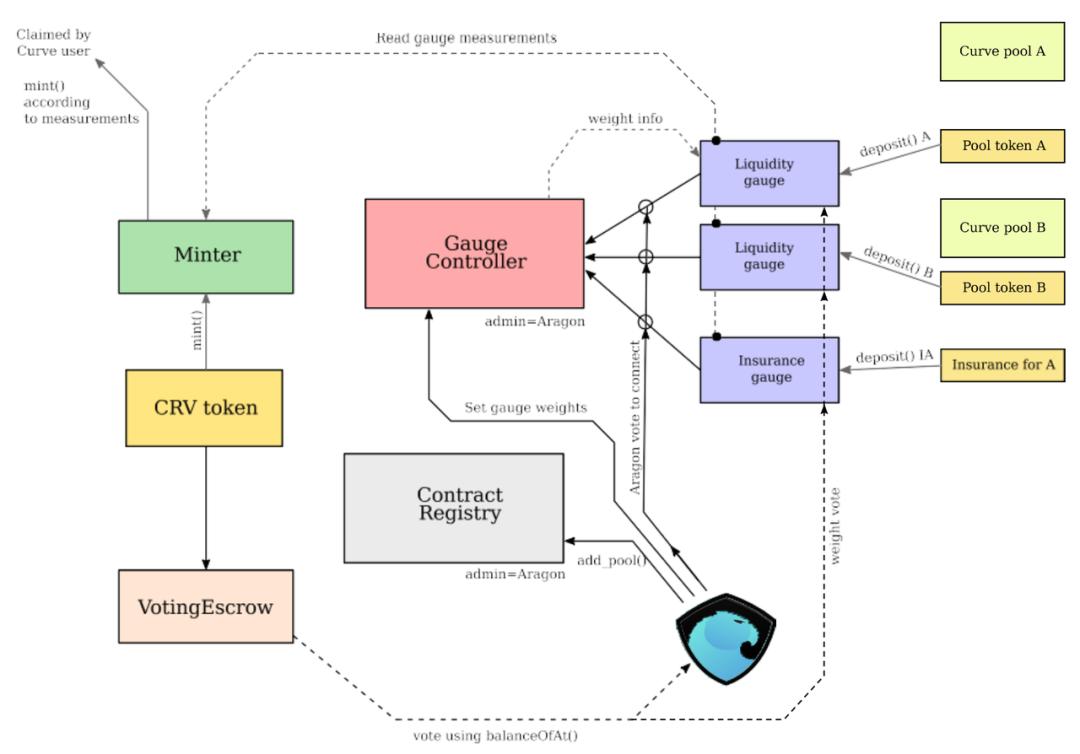

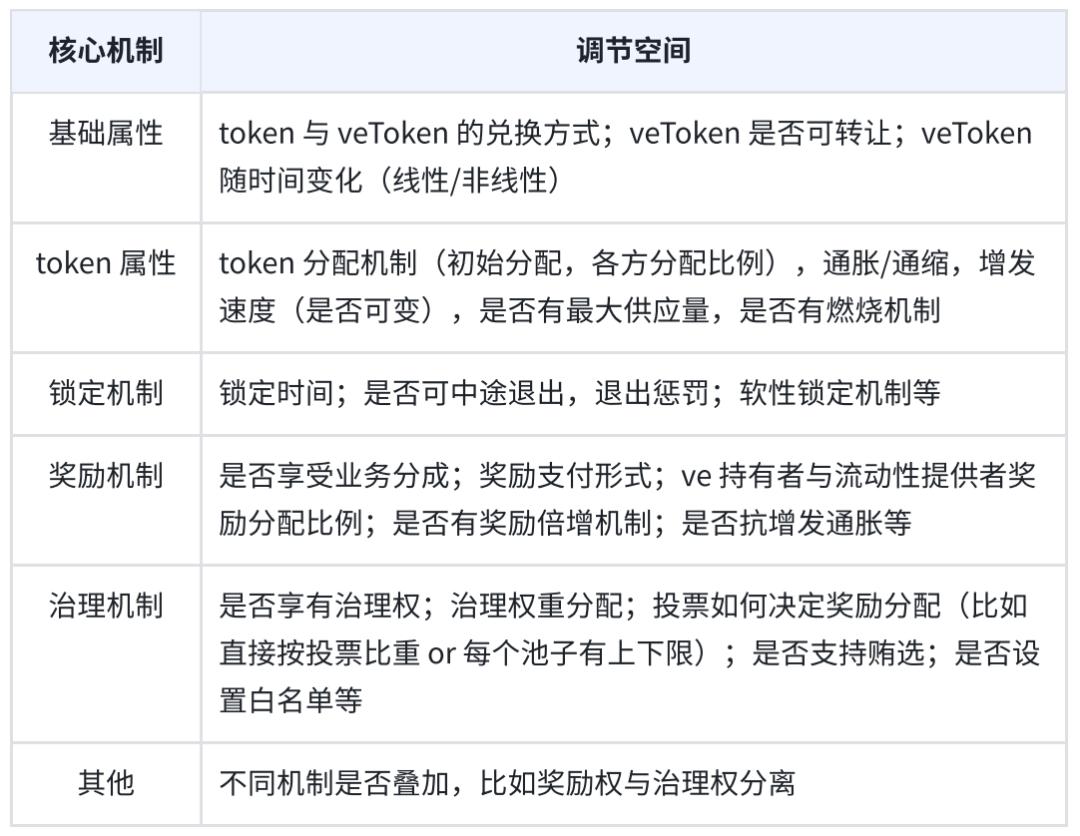

ve model core set dimension

Furthermore, in protocol design, built-in mechanisms are the best way to interact with participants. We cannot acquiesce in assuming that the participants are rational beings, able to adhere to the (3, 3 ) principle, or willing to align their interests with the agreement. In practice, we have to allow participants to make as reasonable a decision as possible through things such as locking up rewards, exit penalties, and opportunity costs. And through the stratification/separation of rights, participants can choose the investment plan that suits them best. A good mechanism can guide the orderly development of the protocol, provide long-term motivation and reasonable incentives, which is also the core mainline of ve's continuous iteration.

Through ve, we may also extend the path to better governance mechanisms. In the above table, we can get the final voting synergy result by assigning different weights to different factors. One of the yardsticks for considering a successful governance mechanism design should be whether it can promote more value creation and bring about better benefit distribution.

However, in the process of continuously refining the protocol, we must also pay attention to restraint. AC once reflected on the design of Solidly in his article, and mentioned "Simplicity works decentralized, complexity doesn't". Yes, sometimes complex doesn't mean effective. Also, the complexity should also be adapted to the scene. Whether ve must be required, whether ve tokens can be traded, whether non-ve holders can also enjoy certain governance rights, these are no standard answers.

Of course, despite many innovations, the effectiveness of the ve model will ultimately depend on the market and time to test it. We can design the fineness of the ve model as needed, and constantly adjust the design according to the feedback. Looking forward to more exciting ve model designs.