In 2021, Tiger Global invested US$38 million in FTX with the help of Bain’s due diligence; Temasek invested US$275 million in FTX after eight months of due diligence. After FTX went bankrupt on November 11, 2022, they will all The investment was written down to zero, and Temasek conducted an internal audit of its own due diligence. Under the iron law of "return is proportional to risk", traditional VCs such as Sequoia, Temasek, and Tiger obviously chose risk in their investment in FTX, but they are not ready to return to zero. From the perspective of initiative, these VCs basically focus on the due diligence link when reviewing and summarizing. For VCs, it seems that it is also the only link that can be controlled, so we bring everyone together to discuss this topic .

Guests:

Forest|Foresight Ventures

Todd|A&T Capital

Henry|NGC Ventures

Joanna|DFG&Jsquare

host:

Larry|Basics Capital

Dialogue interview:

Larry:In the Web3 industry, due to the high bonding of technical and financial attributes, the primary market, 1.5-level market and secondary market are almost open to all users, so everyone in the Web3 industry is an investor, but the entire market is important for investors. The professional requirements of the previous due diligence or research link are not high. In this way, the lower investment threshold also lowers the financing threshold.

Reflecting afterwards, as an institutional investor in the primary market, regarding the FTX incident itself, do you think there are any imperfections in VC due diligence, and if so, what are they?

Forest:I think there must be imperfect due diligence, but this issue is very complicated, and there is no uniform standard for due diligence, because the law of the market is that in a bull market, the more due diligence you have, the less you earn; In a bear market, the less due diligence you have, the more you will lose. So the core is whether you know everything you need to know when you make this decision. I personally feel that neither our Foresight nor our Web3 counterparts have basically done it right, because not all the information that needs to be known is known.

However, for investment in the primary market, the organization needs to conduct internal research, translation, analysis, benchmarking, and collation of opinions, and finally draw a self-convincing investment conclusion. There is such a point of view, if you are very involved in a matter, you cannot judge whether it is a bait, because you have invested too much subjective emotion in it, and it is easy to step on the bait at this time. Even their investors are still clinging to this FOMO sentiment towards FTX before FTX declared insolvency.

Todd:Because I did not participate in the investment of FTX, and I don’t know how far Temasek and Tiger have reached due diligence, so it is difficult for me to say whether they are in place during the due diligence process. Looking back at the results, I think they have some problems in judging risks, or in judging their own risk-taking ability. Now they think that there is a problem with their own due diligence. If their attitude is like this , I think it is that these investment institutions have not found a degree of investment risk control that suits them.

As for why you didn’t find it, it doesn’t matter whether you say it’s FOMO in the bull market, or you don’t have enough understanding of the industry. But what I want to express is that venture capital means that there must be risks. At the moment of making a decision and pulling the trigger, are you ready to pay for the decision you made.

For example, I know that FTX will have some problems like this, and there may be a 5% -10% probability that such problems will cause me losses. I can still accept it when making decisions. As a venture capitalist, this is acceptable to me scope. Then I think this kind of due diligence is appropriate. It is a dynamic matching and a dynamic balance.

Henry:I think traditional VCs like Temasek and Tiger have done much more comprehensive due diligence than crypto VCs. At that time, it took a lot of time and economic cost to read the reports, and they also did things similar to equity investment due diligence. . So I think they also see a lot of risks. But I think the due diligence link is more about facilitating rather than destroying the deal.

After seeing the risk through due diligence, I still chose to take the risk, but the scope of the risk was beyond my understanding. This is most likely the problem Temasek is facing.

Larry:Combining the views of Henry and Todd, when we decide to invest in a project, we should answer the question of why I don’t vote with due diligence, answer the question of why I want to vote, and finally decide on the combination of the two reasons. I have decided whether to make a move on this project.

Jenny:My understanding is that when traditional Web2 capital enters Web3, there are only a few targets they can choose. Apart from Binance, it seems that only FTX is the most suitable. It will not interfere with his willingness to vote.

Forest:I think DD is to show its advantages and disadvantages objectively and neutrally, and then show all these things, put them in the voting meeting and then make objective decisions. But most of the time, the agency is what Jenny said. I wanted to invest, but I just went through a process. The partners or bosses above have already agreed, and the bosses have already had dinner, and decided that we should do this together. , and then go through a process.

Larry:This is where the due diligence process is risky. In this case, its function is not correction, but more like an accomplice to help evildoers.

Todd:In fact, the formal process should be due diligence before the voting, and use the results of the due diligence to make the voting instead of using the results of the voting to do the due diligence. If you look at due diligence from a rational and professional perspective, due diligence is actually a prerequisite for voting, not just an auxiliary tool.

Forest:In addition, FTX’s business is suspicious. First of all, it does not have enough retail business. The main business comes from institutions. It is very poor; secondly, it builds up a high amount of debt, keeps financing and then goes for mergers and acquisitions, takes the subject of mergers and acquisitions and then goes for financing, and then goes for mergers and acquisitions, and expands its balance sheet infinitely by acquiring companies with a lot of assets. This is actually an operation that violates common sense in the market, very similar to China's Delong and Evergrande systems.

Joanna:It is still necessary to return to common sense. The mainstream exchanges at the same level have thousands of employees. If FTX’s business volume is really large enough, it is obviously not enough to have only a few hundred employees. There may be a lot of tricks in it.

Forest:The judgment standards of traditional Web2 equity institutions are not perfect, so we will not blindly follow these large institutions when making investments. Large institutions are also composed of people, and they will also encourage each other.

Larry:We have just transitioned to another topic to discuss. Do you think there is a difference between due diligence in Web3 project investment and traditional equity investment? If so, what aspects do you think are mainly reflected in it?

Henry:I think there is still a difference between investment due diligence in Web3 projects and traditional equity projects. Most Web3 projects have been established for a short time, and many things have not yet been seen. Generally speaking, when we invest in Web3 projects, the due diligence process is not complicated and the time is very short. The main thing is to observe the track logic, business logic, code audit and team background of the project itself. For those who are interested or have doubts, do some targeted due diligence, and it will be over soon. I understand that traditional equity due diligence requires multi-party coordination and due diligence, such as law firms, consulting companies, accounting firms, finance, bank records, teams, customers and partners, etc., and the timeline is average It will be much longer than the due diligence of the Web3 project, and the overall process, time, cost and focus are different.

Todd:Most of the projects you vote for in Web3 are in the first or second round, so we are all investing in very early projects. The traditional investment circle generally invests in relatively late-stage projects. Due diligence on an early-stage project and a relatively late-stage project with actual business data will definitely have different processes and results. I talked with friends who are more angel-oriented in traditional VC, and found that the difference is not that big, but the actual content of the due diligence may be different due to the difference in business, but the core things that everyone pays attention to are those, nothing more than big logic Agree or disagree, big logic agrees, is this team reliable, are they capable of making it, if so, or we believe he is capable of making it, basically the due diligence is over. We often encounter people who come to chat with you with a PPT, and what you can see for you to price is very limited. FTX events are relatively rare in this industry. If you are an early-stage VC, people are unlikely to come into contact with such events. So I think there may not be much difference between the early case and some due diligence of Web2.

Forest:I think there are still some differences:

First, the objective conditions are different; there seem to be not so many materials for you to know in the industry. In the Web2 industry, you have to communicate face to face, but in the Web3 industry there is no such condition, so the pricing must be quite different. ; In addition, in Web2, you can also do financial statement analysis, compliance analysis, etc., which is not available in Web3, so the objective conditions are different.

Second, the logic is different; traditional industries need to see how much income rate, annual output and other business information, but in this industry he does not need income rate, the Web3 industry has an advantage, that is, its value does not need to be measured by profit, nor It must be supported by income. This is a different logic from the traditional one, but I think this logic can still be established.

Larry:Everyone has mentioned the element of the team. From the perspective of the team, I have two questions: 1. What do you think of the team or founder who is working on two/multiple projects at the same time? 2. What do you think of anonymous team projects?

Todd:From the perspective of the A&T fund, we say No to these two situations. We do not invest in anonymous projects, and we cannot accept that you are working on two or more projects at the same time. In the bull market, I have some anonymous team projects in Angel. I think the anonymous is to make it easier for him to escape. If he says anything, he doesn’t need to take too much responsibility, and something will happen to him. This type of investing definitely exposes you to additional risk. As for the kind of two or three projects, I think the core of early investment is investing in people. When you invest in this person, you must hope that this person will focus 100% on the direction he promised you at the beginning. If This person is working on two or three projects, which means that his energy must be scattered. I really can't find any reason to accept this situation.

Larry:Let me ask, because this industry changes quickly, and the life cycle of projects rotates very quickly. Is it possible that he has already done one project and then another project, and he can re-depict the narrative, because I have project experience, When working on the second project, there is one more reason to make it?

Todd:This situation is OK. If the case that this person has completed before has been very successful, and he can withdraw after he succeeds, I think this situation is OK. We at the A&T fund level should not be able to accept that even though your old case has been relatively successful, you still have not completely withdrawn from the old case.

Larry:Although you succeeded, you can only choose one, right?

Todd:Yes, because I hope your energy is focused, I think only focus can produce the best results, otherwise I think it is difficult to produce a particularly good effect.

Larry:The edges and corners are very clear. Okay, so let's get Henry's point next.

Henry:We basically don’t vote for anonymous teams. I think anonymous teams are considered anonymous. You can’t be anonymous to investors. Otherwise, we don’t know who we voted for, because Web3 is investing in people in the early days. If you don’t tell me who you are What background, you don't tell me what your situation is, what is the team's situation, and then directly bring a PPT over, and then say that our project can be successful, so why should we believe you? So if it is an anonymous team, if you want to be anonymous to the outside world, and then disclose your identity to investors, then we will consider it, but you have to be completely anonymous, and you don’t tell investors about your background. We definitely say that No. We don’t want to see this phenomenon as a team and founder of two or more projects, but as I said just now, if you have a very successful project, you can almost get away and start working on the next project. There are quite a lot of founders who do this, and there are also successful entrepreneurs in succession, so this matter still depends on individual cases.

Forest:I have the same opinion as these two. Of course, the anonymous team also has success, but the probability is too low; we are more sure about serial entrepreneurs, but we may have to distinguish whether his experience is good or bad. . Was every business he started before just a taste of it? If you're a serial entrepreneur who's scratching the surface, I think it's pretty bad. But if he knows what he is doing every time and goes all out, and has accumulated a lot of experience in the process, then even if he fails the first time, the probability of success the second time will be higher than that of a person who has never started a business It will also be much larger. In fact, the Web3 project will eventually involve some allocation of management, finance, rights and responsibilities. People who have never started a business have very little experience and knowledge in these areas. For a founder who manages multiple projects, if he does not put his best efforts into this business, it is unlikely that he can do his best part-time job, and the investors are not his parents, so no one is willing Pay for his entrepreneurial trial and error.

Larry:We have always said that 'Code is Law' in the Web3 industry, is Web3 investment really an investment? If a project with a team but no product is placed here, there is also a project with a formed product but unwilling to disclose its own team. So how would you choose?

Forest:People say that investing is investing in people, but I don't think so. In Web3, you must look at the trend. The wind is bigger than the people, and even the wind will lose. So many people in Web3 can make so much money, is it because they are better than the people in Web2? Of course not, just because we are in a trending industry. Therefore, choosing a track is more important than a team, and the team is the second most important. Then there is another question, investing is investing in people, why can your investment manager spot this person? How can he judge whether this person is good or not? How do you see that a track is relatively simple, but it is difficult to judge a person, because it is very difficult to judge whether his previous ability can support him to do a new business. Even if he had a relatively good resume before, it may just be because he studied hard, went to a big factory, and then worked step by step. With good luck, this does not mean that his ability will be stronger than others, nor does it mean that he will be able to work in a new environment. Make a new thing in the industry. So I don't agree with the saying "investment is investing in people".

Todd:I think this needs to be case by case, because if this product is in a state like UNI appeared in 2019, I might pull the trigger, because at that juncture, compared with all the projects on the market, UNI no the same. UNI can really move the DEX to the chain, and most of the Order Books before it can't solve this problem. If faced with such a case, if he can put the product in front of me, I will Thought I might go and pull the trigger. But other than that, in the face of most mediocre products on the market, I will say No, and I may say Yes to the very rare ones.

Henry:Whether a project can be successful is strongly related to the founder and the team, but these two are interactive things, and it is necessary to judge whether its resources and capabilities can match what he wants to do. The question of whether to vote or not, back to the root, is that you need to come up with your idea, your narrative, and see if this narrative matches you. The most important thing is whether the team is suitable for this project. things team. So it’s not just about the ability of this person. There are too many powerful people in big factories, but big factories do not necessarily succeed in doing Web3, and they need to be matched together to make a comprehensive judgment.

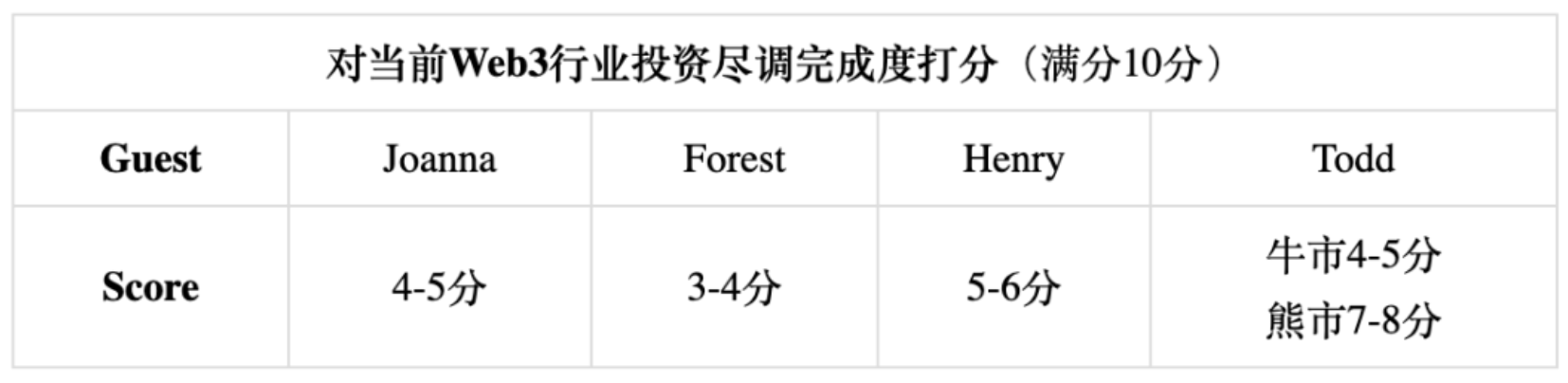

Larry:Next is a subjective question. What do you think is the completion of due diligence on the track of crypto VC? If you rate the industry level, how much can you score? Why?

Joanna:The due diligence of the current market, especially from the perspective of safety, I think the due diligence of the safety aspect of large projects is far from thorough enough and not careful enough. Of course, this is not just a problem of VC, but also that the supervision is not in place, and the audit has not yet reached the standard. We don’t know the use of their own funds by the early project parties. It is the money raised by these project parties. Where is the money raised? Where is it used? Is it safe? Is there hosting? These are black boxes. Therefore, if I score from the perspective of safety, it should be relatively low, about 4-5 points.

Forest:As far as the completion of this matter is concerned, I will score 3-4 points. In the bull market, everyone is very high-ranking, you can’t do FOMO, and you can’t do it without FOMO. At that time, there were too many monks and too little food, and due diligence must be imperfect. Everyone thought that I would get on the train. In fact, the AUM of most VCs in the currency circle is not high enough. It is difficult to build a comprehensive team, such as code audit, technical solutions, business models and Tokenomics. It is impossible for him to be able to do all the roles by himself. When you encounter a project that you don’t understand, ask a friend to help you take a look. The person who reads it may not be very professional. They come to tell you that there is no problem, and then make a decision. This is a very common situation, and I can only call 3-4 points.

Henry:I may be relatively optimistic, I will give a score of 5-6, which is the feeling of just going to the passing line. After all, in this Web3 industry, most of our deals are early-stage projects, and the depth of due diligence matches the risks that the investment can take, which is considered reasonable. Because of the risk appetite under the blessing of the bull market, it is basically on the verge of being qualified but risky. Now that the market has cooled down and the pace has slowed down, everyone has paid more attention to the depth of due diligence, so the industry has the ability to correct errors. Although it lags behind the risks of individual cases, it is still undergoing dynamic adjustments. , tending to the balance of the current industry development level.

Todd:I would say 4-5 points in a bull market, and 7-8 points in a bear market. As everyone mentioned just now, you have to grab allocation in a bull market, and you have time to chat for two rounds and three rounds in a bear market. The objective conditions are different, and the natural depth is also different.

Larry:To make a simple summary:

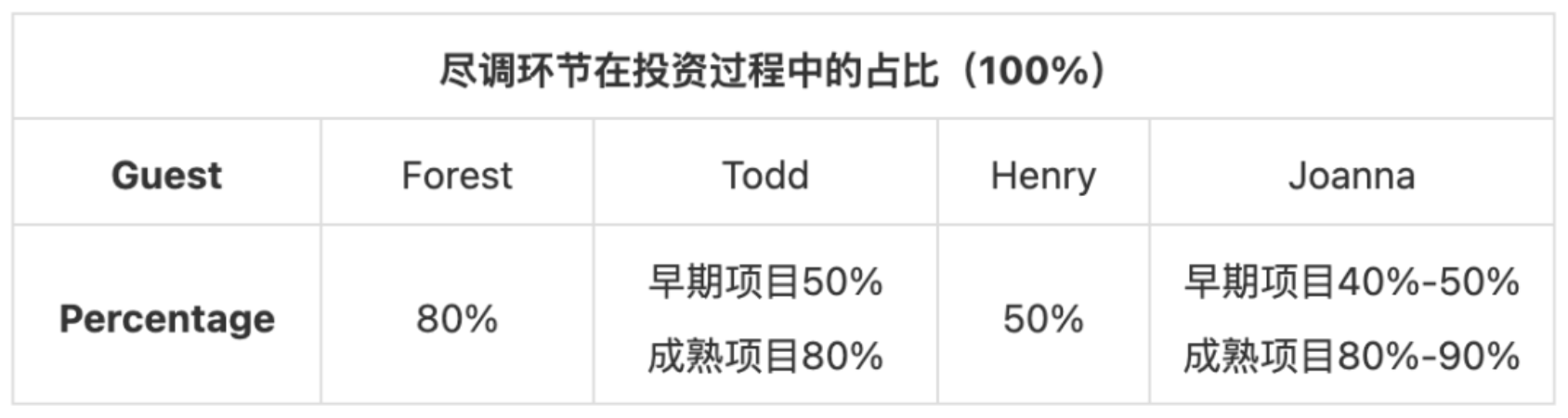

Next, I would like to ask you how to do due diligence in the investment process? Will the FTX incident make you pay more attention to due diligence? What do you think is the proportion of due diligence in your entire investment process?

Henry:I mentioned some of our operating procedures earlier, first look at the narrative logic and basic situation, then look at the overall situation of the meeting, and then we will focus on the overall narrative of the project itself and what we think are the key points, especially the team and the narrative Key content, as well as possible risk points and other information to do some targeted due diligence. The FTX incident will definitely make us pay more attention to due diligence, and I believe this is also the trend of the entire industry. The proportion of due diligence in our entire investment process, I think, should be around 50%.

Forest:In our own investment decision-making chain, due diligence definitely accounts for the vast majority. My requirement is 80%. I don’t think voting is the core part. The core part must be due diligence. Due diligence must be sufficient. objective. We are very clear internally that if you have a problem, you can write it out. It does not mean that if the thing is not good, you will not vote. Of course, you will still vote objectively. But if there is a problem with it, but the due diligence fails to find it, then we will be held accountable. This is a problem of work ability. If we rate our own due diligence, I can score 6. It is our requirement to be higher than the industry level, and I hope we can achieve 9 points. The part of due diligence will eventually come back to whether you understand him or not. No matter how long it takes, if you don’t understand FTX’s business, you still don’t know why FTX failed. If you understand the exchange business, you will know at a glance where its core problems lie and where its core values occur. Therefore, it is very important to understand the business. This is also a relatively high standard for due diligence. We have also recruited some people from investment banks, but the financial analysis, technical analysis, framework analysis, etc. of investment banks are the most basic due diligence procedures. not enough.

Todd:I think the process of due diligence should be similar for everyone. In a sense, I will include the background of people in the due diligence. We think it is very important, no matter what kind of case we look at. Do. Learn about the moral level of this person based on people who know him, his partners, and where he has been before. The part about people does not change for a single case. For each case, you must dig out the moral level of the person. And as for whether the FTX matter will make us pay more attention to the process of due diligence, I think the answer is definitely yes. I think that no matter whether it is a bull market or a bear market, as a responsible fund, if objective conditions permit, we will Must have done everything that could be done. As for the proportion of the entire due diligence process on our side, I think it should be divided into stages. For especially early projects, due diligence may be 50%; but for those that you have produced a POC, the proportion will be higher at this stage, and may reach 80%. I think it depends more on the stage of the project, because you really can't see his things in the early projects.

Joanna:Our due diligence generally falls into three categories:

The first is the early projects, which mainly focus on the track and founding team of the project. For projects at this stage, our investment amount will not be large, and there is not a lot of data to track. The track where the project is located and the trend it rides on are more important than the project itself. The other is the team. We will dig more into the character of the founding team, to understand what kind of style the founding team has, what they have done in the past, and their personality traits. People run a long-term race together, and they are willing to share their Revenue and future together.

The second is the mid-to-late stages of equity projects. These projects generally have real Revenue Streams, such as banks, lending institutions, and exchanges. We will look at real data, data reports, and financial statements. The tone is relatively deep.

The third is the mid-to-late stage projects of the Token category. At this stage, they have accumulated a certain amount of users, TVL or number of active addresses. It is supported by real data such as communities, users, locked positions, and wallet addresses. But after the FTX incident, we will do our due diligence on the authenticity of this information. The result is that for some projects that look very good, 80% of the real user addresses may be witch addresses. It is not ruled out that the project party has done a lot of data and created this a false prosperity. In addition, when our team recently conducted on-chain analysis, we found that even those well-known large Defi projects have more than 50% of witch addresses. Of course, if all projects have 50%, I think it is acceptable, but if you are 80% %, it means that you are almost all fake data, and this kind of project must be passed.

The FTX incident will definitely make us pay more attention to due diligence, but unlike before, I will pay more attention to how the team manages the cash flow. I think this is very important. For example, some of the project parties that completed financing in the market switched to UST to Anchor for financial management, some lent the money to Sanjian, and some put it in FTX. This kind of loss is very risky for the subsequent operation of the project. The project party gets the money, how to use the money, you can seek some stable interest-bearing behavior, but it must be transparent to us, and the risk exposure must be controllable.

The proportion of due diligence in our entire investment process is actually quite high, especially for equity projects, I think at least 80% -90%; for early projects, I think the proportion of due diligence is much lower, about 40% -50% % . Our style has never been particularly FOMO. Since the entire bear market, we have not stepped on thunder. On the one hand, we are lucky, and on the other hand, we have our own investment ideas in investment.

Larry:Let's do a summary first:

Finally, let’s ask an open question. From the perspective of the Web3 industry, do you think there are still potential systemic risks in this encryption market, which has a higher primary market risk? Are there any gaps that can be filled through due diligence?

Todd:I think there will still be systemic risks, such as regulatory risks. The Crypto market does not yet have an effective regulatory framework. Before and after the regulation is implemented, the systemic risk of industry reshuffle will be high. As for whether it is possible to use exhaustion to make up for it, first of all, you can avoid regulatory-sensitive projects, and secondly, when conducting due diligence on related projects, check whether the team is fully prepared, whether there are compliant licenses, and so on.

Larry:Which tracks do you think may face regulatory risks?

Todd:I think there are two, the most obvious one is Defi. The closer the board is to money, the more supervision it will be, so the Defi track must be possible.

The other one may be wallet or RPC. I believe you may have seen some news, like Meta Mask jumped out and said, if your RPC uses Infura, then your transaction will be reviewed later.

The underlying infrastructure is threatened by regulation, and the asset layer above is naturally at risk.

Joanna:Several major events this year have eliminated the risk of major deleveraging, but as the macro environment changes, there may still be lower prices. Of course, black swan events cannot be ruled out, leading to continued leverage liquidation. In addition, the risk of small-scale deleveraging will still follow.

Todd:In fact, USDT is always a big pit in my mind. I don't know how the industry will digest it in the end, but the current state may not be safe enough, which may also constitute a factor of systemic risk.

Henry:I think compliance is the process of the Web3 industry fighting wits and courage with regulators. Many projects were banned in China before, and then they went abroad and lived quite well.

In fact, the Web3 project itself is supported by code, and it does not require any compliance at all, but the problem is that the people behind the project have to confront the supervision, which is a problem that Web3 has never been able to escape.

Conclusion:

Conclusion:

about Us

about Us

BinaryDAO is a semi-closed DAO organization that focuses on project research. It originated from the joint investment research of several WEB3 investment institutions. It is mainly for VCs and researchers. It focuses on research projects. Bear markets focus on depth and focus on secondary structural track leaders ; The bull market focuses on breadth and tends to be a first-level trend hotspot.

So far, we have conducted research and discussions on more than 50 projects in DEFI 2.0, derivatives, ZK, NFTFi, SocialFi and other sectors. We plan to conduct relative in-depth research on 200 representative projects in each sector in this bear market. Welcome Researchers and VC friends who are interested in completing these 200 projects with us will join us.