This article comes from milkyeggs, compiled by Odaily translator Katie Koo.

This article comes from, compiled by Odaily translator Katie Koo.

The New York Times published a "whitewashed" article about SBF yesterday

, aroused objections from various insiders. This article will take a peek at the FTX incident from the perspective of Alameda Research, and how SBF, Sam Trabucco (former co-CEO of Alameda Research) and Caroline Ellison (current co-CEO of AlamedaResesrch) burned more than $20 billion in fund profits and FTX user deposits.

To be clear, we don't fully understand what happened to Alameda Research and FTX. However, we have enough information to get the big picture. Through polls of Twitter users, forum anecdotes and official news, the history of the two closely-linked companies began to become clear.

Without witness testimony and a full financial investigation, our allegations are tentative. Any given information may be flawed or even fabricated. However, connecting the information currently available to tease out a credible timeline:

SBF, Trabucco and Caroline (probably) all started with good intentions, but weren't particularly suited to running a trading firm;

In the 2020-2021 bull market, Alameda Research made a lot of paper profits through leveraged long trades and illiquid stock trades;

Although Alameda may initially be profitable as a market maker, their dominance eventually declines and they end up being unprofitable;

Urgent decision to use deposits of FTX users to repay creditors when loans are recovered in early 2022;

This method of repaying debts stimulated increasingly volatile trading operations and gambling, eventually leading to complete bankruptcy.

secondary title

Alameda Research could lose more than $15 billion

Most news reports seemed to paint the bankruptcy as relatively small. The New York Times, for example, argued that user deposits were used to cover venture capital funding.

Likewise, Matt Levine's column seems to imply that the falling value of FTT as collateral has created a large imbalance between assets and liabilities.

Both accounts miss a crucial part of the story. First, FTX lost about $8 billion worth of user collateral. FTX's $8 billion in debt doesn't even make sense, even taking into account the total amount of venture capital invested in FTX and Alameda, and the marginal decline in collateral value caused by the fall in FTT's price. These losses are significant, but they do not in themselves adequately explain FTX's bankruptcy.

Other than that, it is widely believed that FTX and Alameda are highly profitable together due to:

FTX transaction fees are high, coupled with the large volume of user transactions;

Very substantial risky trades in tokens such as SOL, MAPS, OXY, SRM;

While it's difficult to put an exact dollar value on their estimated profits, these outlets, especially the lucrative venture trades, generated at least $10 billion in profits for Alameda and FTX.

Thus, an even bigger mystery remains. It appears that Alameda and FTX managed to squander $15 billion worth of profits (probably more). It's worth noting that a full picture of the accounts hasn't emerged so far. We may never know where all the money went. However, we offer a number of individual assumptions that, taken together, could reasonably explain losses of $15 billion or more.

secondary title

Alameda's market-making advantage wanes, they go long

Alameda is considered to be a very capable and profitable market maker. But is this perception really accurate?

Despite backgrounds in Alameda's inner circle (SBF and Caroline from Jane Street, Trabucco from SIG), a few years' experience in a trading firm doesn't make you a business genius. While this may be considered extremely competitive in the cryptocurrency market in 2019, it is a far cry from the market-making accuracy of forecasting price movements in traditional finance. Alameda slowly lost ground as larger, extremely capable, and well-capitalized market makers like Tower and XTX began trading the cryptocurrency market.

“With the advantage lost, you ignore your market-making situation and become a speculator.” Several statements from Alameda executives also support this theory. For example, Trabucco described a news-based trading strategy in April 2021:

To be clear, he is actually describing leveraged crypto market testing as an emerging narrative of institutional adoption, the exact same reason many retail traders are investing in crypto in 2021.

He also described being bullish on DOGE for months because Elon Musk often talks about DOGE on Twitter.

There is no doubt that they made money on their BTC and DOGE long positions. Some would say it's a pretty smart deal. Perhaps it's not "quantitative trading" at all, and Alameda is clearly expanding into its field, with an advantage over other market players that is hard to quantify and that seems relatively unrelated to their area of expertise. They may have made money on open trades, but what about trades they didn't win?

Caroline strongly hinted a month ago that she prefers to bet on a long position rather than pick up pennies in the algorithmic jungle:

We can surmise that their trading strategy is a combination of (1) negative margin market making and (2) free longs. In fact, the less profitable their algorithmic trades are, the more one can lean on the possibility that they will make up all their losses by going long on BTC and DOGE. On a net basis, they are likely to be very profitable on most of their trades in 2020-2021, but once the market starts to reverse at the end of 2021, their overall economic profit and loss may decline significantly.

Alameda did get a lot of free agency right. Buy Solana at a low price, accumulate a large number of low-floating Solana ecosystem tokens, promote the Solana ecosystem as a whole, buy oversold liquidations, and more. But people have a feeling that maybe they are overconfident from their experience in the bull market and end up overestimating their ability to trade, leading to subsequent losses. Their strategy of borrowing against illiquid ecosystem coins instead of selling them in a consistent manner. They justified market-making because it generated inflated volumes on FTX, which in turn justified a higher risk valuation for the exchange.

secondary title

Alameda is a disorganized and poorly run trading firmA few years at a top trading firm obviously doesn't mean you're a top trader, nor does it mean you're good at organizing business practices.

A former Alameda employee on the "Effective Altruism" forum shared a description of Alameda's internal practices. This comment is merely a narrative based on the reviewer's personal memory /However, some of the details mentioned above are corroborated by personal accounts communicated with me privately,This leads me to believe that the inner workings of Alameda experienced an unbelievably large amount of money lost - poor bookkeeping, arbitrary free trades directed by SBF, internal mismanagement and unbelievably poor organization.

These descriptions are consistent with many of the stories I've heard from reliable sources (both primary and secondary) pointing to SBF's poor capital management. For example, a friend of mine whose company received venture capital from FTX said,When you have only a vague idea of the company's books, especially considering the staggering amount of money FTX spends on advertising, brand deals, and other discretionary expenses, it's likely they didn't realize the seriousness of their situation until they Loans started to be called back after the LUNA storm.

When you really need to raise capital and find yourself short on funds, you have to take huge losses, which may tempt the likes of SBF to use FTX's customer deposits to fund the temporary deficit they hoped for. This, in turn, has spawned more depraved and riskier forms of gambling sex.

secondary title

SBF unstable, reckless, probably incompetentIsn't it surprising that a group of ex-traders acted so recklessly? Although we don't know much about Caroline and Trabucco personally, luckily we have a lot of stories about SBF as stewards.It is clear,

SBF has 'enormous appetite for risk'

, confirmed by a former employee of FTX. SBF also publicly denies the applicability of the Kelly criterion (Kelly criterion: mainly used to determine the optimal bet/investment amount in gambling and investing)) to the betting size.

Why is SBF so persistent in deliberately inflating its bets? Purely because of confusion about the optimal strategy for long-term growth? Another hypothesis is that, in addition to his natural risk-taking tendencies, he may have been taking dopaminergic drugs (prescription drugs for Parkinson's disease) as a kind of hypnotic. These drugs are known to lead to risky behaviors such as compulsive gambling or shopping sprees.

Autism Capital recently shared a former FTX employee's account of how SBF encouraged extreme doping. This is consistent with SBF's self-confessed use of doping as a "performance" enhancer.

FTX's huge spending on advertising and branding partnerships is likely a tactic to attract deposits, but may be partly due to SBF's ongoing abuse of these drugs. FTX secured the naming rights to esports organization TSM for an astounding $210 million, far surpassing similar deals in the esports industry. Even his real estate acquisitions are astounding, with a reported $200 million real estate portfolio in the Bahamas. These don't look like risky bets with positive expected value. Either executive management was incompetent or, as we said, actually took drugs and went on an acquisition spree. SBF has marked deficits in overall ability and cognition.

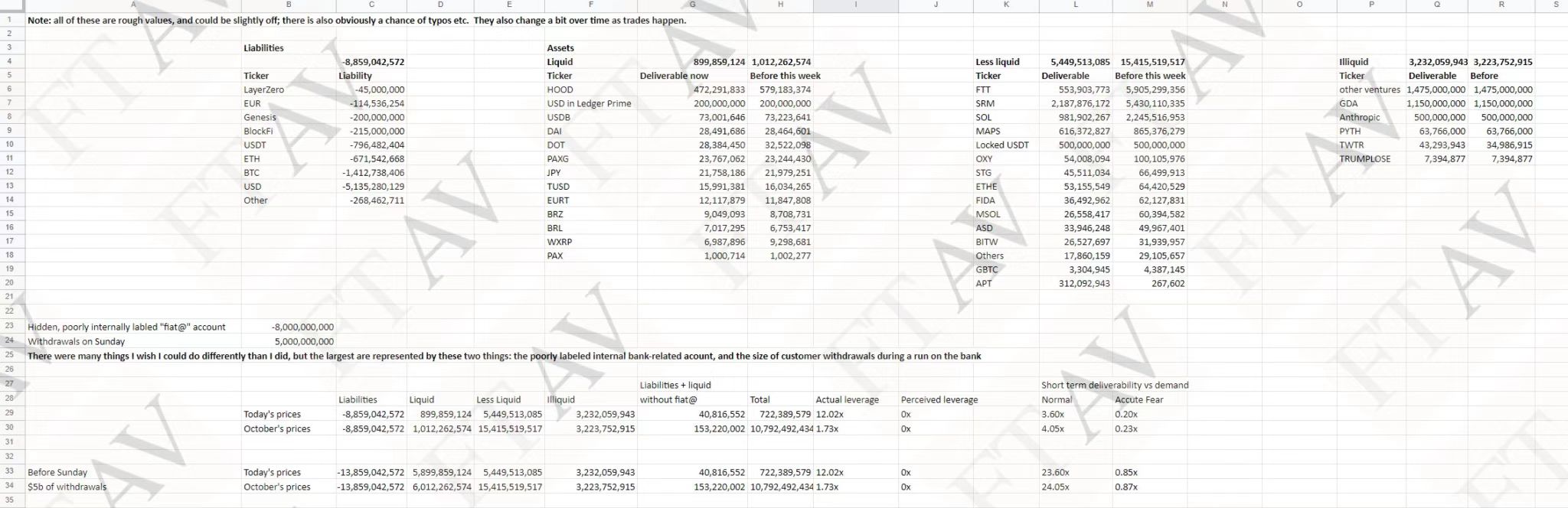

Is this general lack of capability the reason why FTX's balance sheet (courtesy of SBF earlier this week) is so ridiculously simplistic.

If half of the above observations about SBF's character and abilities are true, that would explain a lot of Alameda's loss. (Although he officially resigned as CEO, he certainly maintains a close relationship with Caroline and Trabucco.) In particular, he is likely to try to become more gambler in increasingly desperate attempts once customer deposits are raided. big.

secondary title

Collusion Between Alameda and FTX Leads to Huge Losses in Algorithmic Trading

Doug Colkitt speculates that this may have actually led to an "algorithmic trading crash," similar to the famous Knight Capital Group incident in traditional markets.

Reports that have been communicated privately suggest that the damage may exceed $1 billion. Of course, there may be other things that I don't know about. Without having a full review of FTX records, it's hard to really confirm or deny these claims, although the sources are credible and I'm inclined to believe them. If true, these losses were large enough to be a major contributor to FTX and Alameda's overall losses.

secondary title

Loans secured by FTT/SRM lead to reflexive liquidation

This theory fits well with Caroline's admission that FTX moved customer deposits to pay off recalled loans following the LUNA debacle. In particular, it explains why FTX bailed out insolvent companies like Voyager and BlockFi. This means that the short-term need for cash will be large and unpredictable, in addition to loans being called in by other entities such as Genesis. If Alameda is already operating with poor bookkeeping, and especially if Alameda has significant exposure to the risk of the LUNA crash itself, then it's conceivable that SBF et al feel they have no choice but to dip into their customers' deposits.

Summarize

secondary title

Summarize

We don't actually know exactly how Alameda and FTX squandered billions of dollars. But we can try to roughly estimate their potential losses in USD:

Acquisition of Voyager/BlockFi: 1.5 billion

LUNA exposure: 1 billion

"Knight Capital-Style" Algorithmic Crash: 1 Billion

FTT/SRM collateral maintenance: 2 billion

Venture capital: 2 billion

Property, branding and other non-essential spending: $2 billion

FTT down from 22 billion to 4.4 billion: 4 billion

Bad result for Liberty bulls: 2 billion

I make no representations about the ultimate veracity of the above information. My intention is to compile these into a full narrative and leave the readers to draw their own conclusions.