Original Author: Wuhai, TT

"The biggest gain in 10 years of entrepreneurship is the cognitive upgrade. Many entrepreneurs have very bad habits, that is, they are always complaining, but they don't realize that any entrepreneurial ceiling will always be the founder himself." At the ceremony, Li Lin talked about it in an interview with PANews.

first level title

Li Lin’s Sale of Huobi Shares Has Been Settled

On October 8, Huobi Global officially announced that the controlling shareholder company of Huobi Global had transferred all the shares of Huobi Global held by the fund under Baiyu Capital, and the M&A fund under Baiyu Capital became the largest shareholder and actual controller of Huobi Global .

This transaction only involves the change of the controlling shareholder, and will not affect the existing core management and operation team. The details of the transaction between the two parties also include a series of important measures such as ensuring the normal operation of the platform, improving risk management and capital reserves, ensuring the security of user assets, and maintaining the stability of the core team.

The long-rumoured news about Li Lin selling his shares in Huobi has finally been settled, and the final successor is a name unfamiliar to insiders. Earlier in August, Bloomberg reported that Li Lin, the founder of Huobi Group, was in talks with some investors to sell his majority stake in Huobi at a valuation of up to $3 billion, which may be the most since the global cryptocurrency market plummeted. The largest acquisition in the industry.

Huobi has held discussions with various financial personnel to sell about 60% of the company he founded nearly a decade ago, according to people familiar with the matter. Tron founder Justin Sun and crypto billionaire SBF’s FTX both made initial contact with Huobi about the share transfer. Shareholders such as ZhenFund and Sequoia China learned of Li Lin's decision at the shareholders' meeting in July. The transaction may be completed as early as the end of August. Li Lin is seeking a valuation between US$2 billion and US$3 billion, which means a sale The transaction value may reach more than 1 billion US dollars. Both parties subsequently denied contact with FTX and Justin Sun.

first level title

What is the origin of Baiyu Capital, the new actual controller of Huobi?

According to the information on the official website of BEYOND Capital, BEYOND Capital is headquartered in Queen's Road, Hong Kong. It was founded in 2008. At that time, the company was named BEYOND CAPITAL, and it was renamed About Capital in March 2010. Obtained a financial license and became a licensed fund management company in Hong Kong. Its main product is a securities fund investing in the Asia-Pacific market. It reduces market risks for investors through an investment strategy based on fundamental analysis of long-short strategies and supplemented by opportunity trading. , enhancing the absolute return.

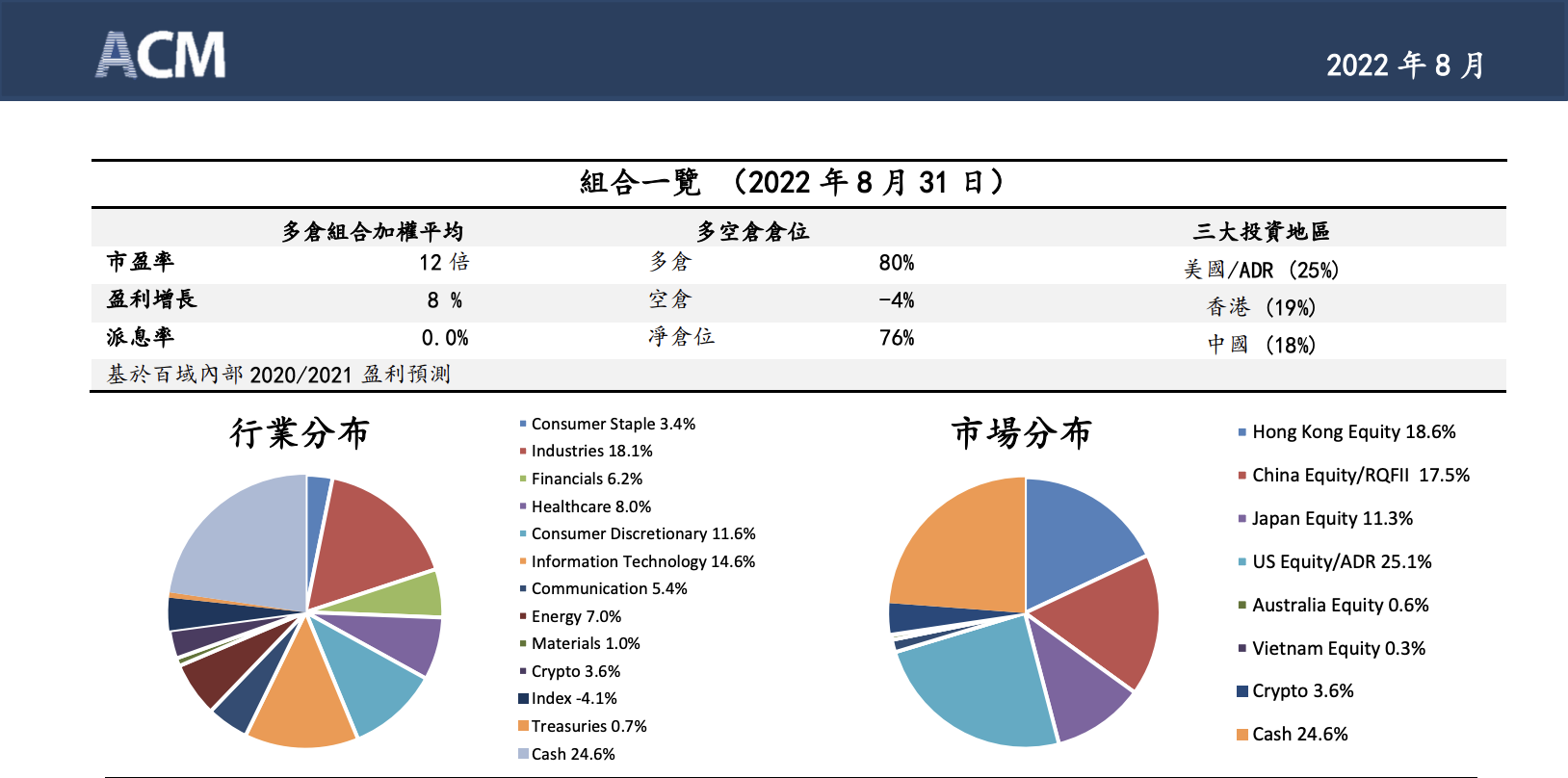

The fund monthly report disclosed on the official website of Baiyu Capital shows that it has already been involved in the investment in the encryption field.In the monthly fund report for January 2021, Baiyu Capital mentioned that its investment in the field of cryptocurrency has achieved good returns, but did not disclose the proportion in the investment portfolio. In the strategy at that time, investing in cryptocurrencies not only had the potential for good long-term returns, but also moderately diversified their investment portfolio, because the correlation coefficient between cryptocurrencies and other assets in the portfolio was very low.

Until March 2021, the fund’s monthly report disclosed that the investment portfolio in the encrypted field accounted for 9.1%, which increased to a maximum of 10.2% in April, and decreased to 4.9% in May. As of August 2022, there are 3.6% of encrypted assets in its portfolio .

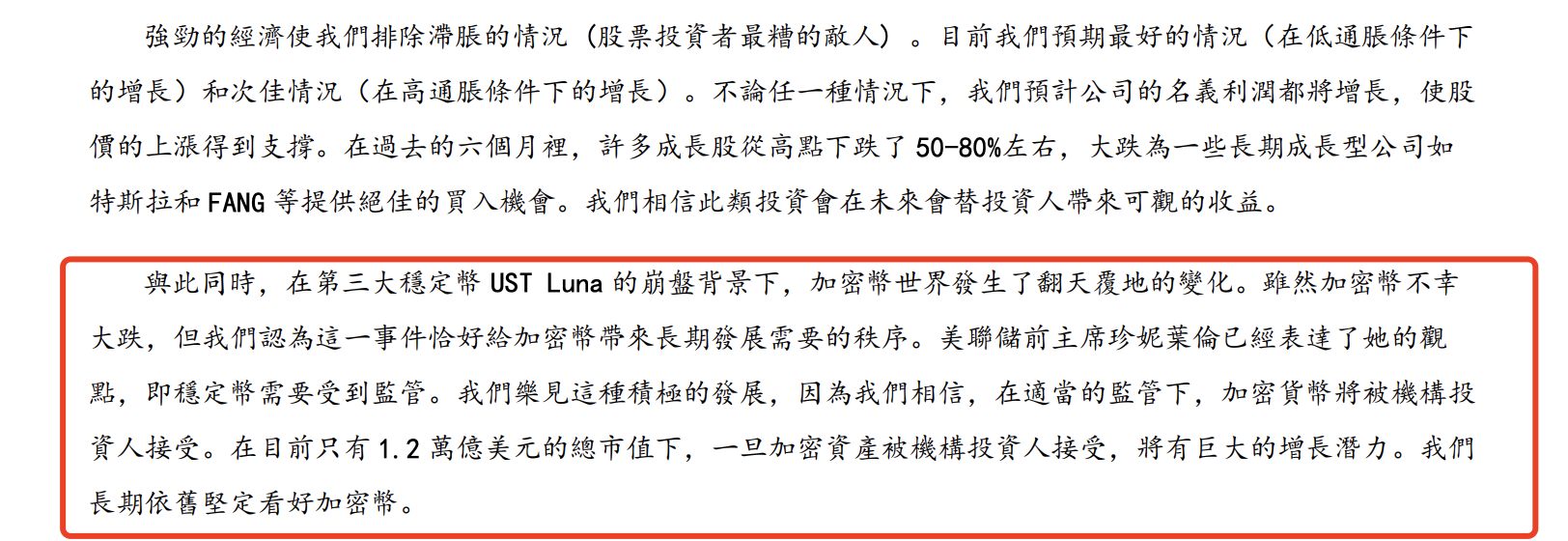

In the monthly fund report for April 2022, Baiyu Capital reviewed the collapse of Luna and analyzed whether stablecoins such as USDT have the possibility of a collapse.And said that under proper supervision, cryptocurrencies will be accepted by institutional investors and will have huge growth potential, saying that they are long-term and firm optimistic about the field of cryptocurrencies.This may be the original intention of Baiyu Capital to take over Huobi.

PANews inquired about its monthly fund report for August, showing that the current fund assets of Baiyu Capital are 52 million US dollars. One can’t help but wonder how such a management scale can swallow Huobi. Earlier market sources said that Li Lin’s shares in Huobi were valued at 2 billion to 3 billion U.S. dollars, and the transaction was at least more than 1 billion U.S. dollars.

In fact, behind Baiyu Capital, there is the shadow of Jinglin Assets, a top domestic private equity company with a scale of 100 billion.

According to the official website of Baiyu Capital and the official website of Hong Kong Broker Encyclopedia, the partners of Baiyu Capital are Chen Yihua (Ted Chen) and Shan Liming. Chen Yihua is responsible for formulating the company's development goals and strategies, as well as major investment decisions. He has more than 20 years of experience in the financial investment industry. He was originally the founding partner of Jinglin Asset Management Company and established its Hong Kong company and operation. Before joining Baiyu Capital, Shan Liming was the fund manager of Shanghai Shenwan Lingxin Fund, managing the investment in the A-share market.

Jinglin Asset Management, which Chen Yihua participated in, is now a well-known private equity company in China, and one of the earliest private equity companies in China to pay attention to US stocks. It has made a lot of profits because of the growth of Chinese concept stocks. Although it has recently apologized to the channel for poor performance The news is on the hot search,Relevant data inquired by PANews shows that as of August this year, Jinglin Assets’ overall cumulative income since 2006 has reached 17.5 times.Before its performance suffered from Waterloo last year, Jinglin Assets has always been a "god-like existence" in the industry, and its performance can rival Buffett.

Jiang Jinzhi, the founder of Jinglin Assets, has successively served as the manager of the Treasury Bond and Futures Department of Shenzhen Stock Exchange, the assistant to the president of Guosen Securities, and the chairman of Guangdong Securities (Hong Kong). He graduated with a master's degree from the Graduate School of the People's Bank of China. The president and legal representative are Gao Bin. Gao Bin used to be the chief staff member, deputy director, and director of the Market Supervision Department of the China Securities Regulatory Commission, the inspector of the China Securities Regulatory Commission at the Shenzhen Stock Exchange, the assistant to the general manager and the party committee of China Securities Depository and Clearing Corporation. Member, executive deputy general manager, concurrently served as general manager of Shanghai Branch of China Securities Depository and Clearing Corporation.

It is said that among the takeover parties, Li Lin rejected some with the background of the currency circle and chose the one with the cleanest background. From the perspective of Baiyu Capital and its potential affiliate Jinglin Assets, this is indeed a high-quality buyer.

Li Lin, the founder of Huobi, said in the official announcement: "After the exit from the mainland China market at the end of 2021, our global development path is full of challenges. Huobi Global urgently needs shareholders with more international resources and a global vision to lead Huobi to start. The next journey. We believe that Baiyu Capital can bring new impetus to Huobi’s globalization process.”

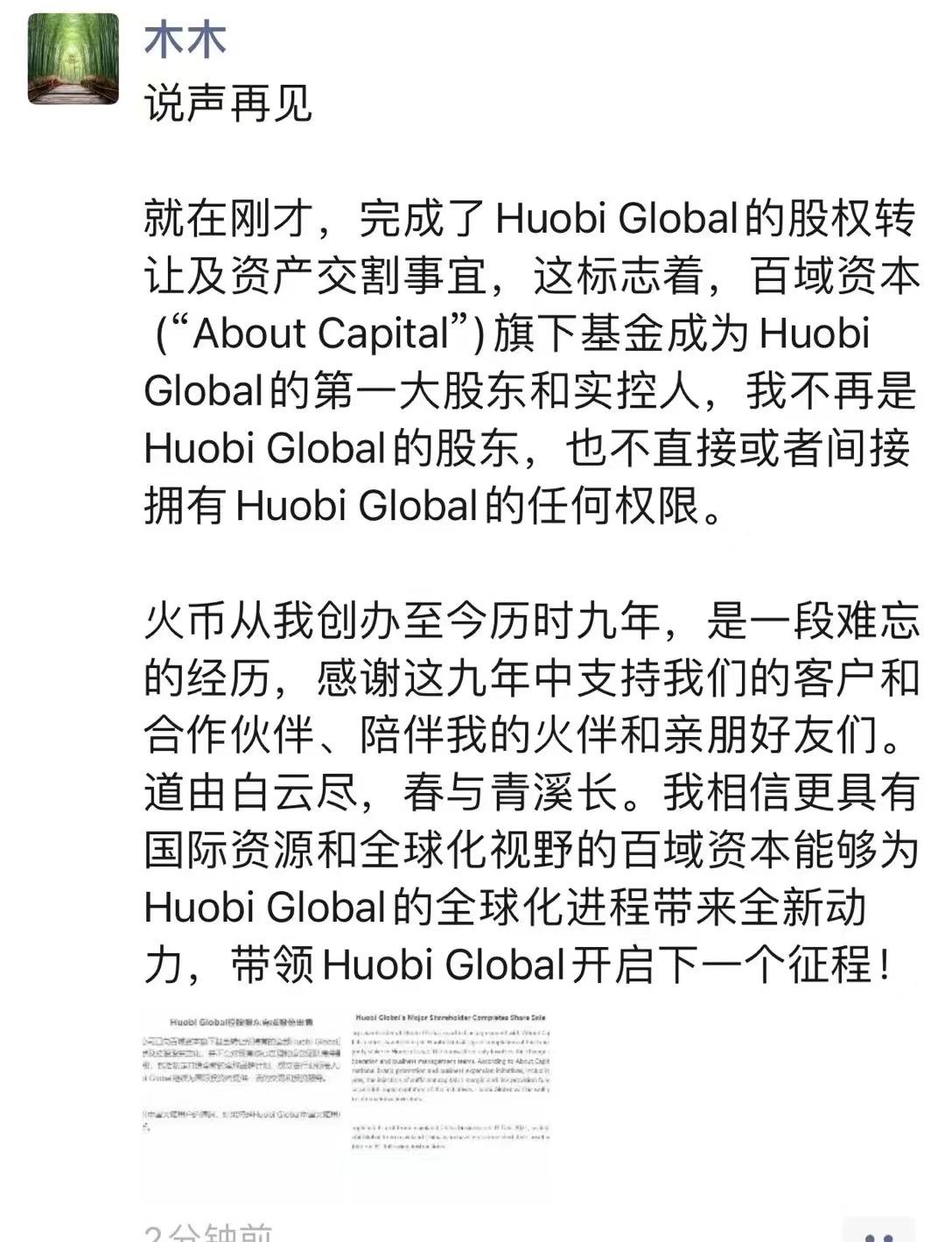

After the transaction was completed, Li Lin also simultaneously published a statement on HuobiGlobal's completion of equity transfer and asset delivery in Moments, recalling the nine-year experience of Huobi's founding and looking forward to the future.

Li Lin's nine-year entrepreneurial history of Huobi

Li Lin, born in 1983, will enter his forties. After graduating from Tsinghua University with a master's degree in 2007, he joined Oracle, a well-known technology company at the time, but Li Lin was not satisfied with such a nine-to-six job. After working for two years, I founded Youyi.com with my friends in April 2009. However, it only got 70,000 registered users in one year and failed to make a profit.

Group buying suddenly exploded in 2010, and Li Lin also seized the opportunity to build a navigation website for group buying, which earned him the first pot of gold in his life. In 2011, because Li Lin was deeply involved in the technical circle, he accidentally paid attention to Bitcoin. Until the spring of 2013, Bitcoin became a topic of discussion among all the technical circles, so Li Lin bought the first bitcoin in his life.

At that time, the domestic Bitcoin exchange was Bitcoin China. Because of the poor user experience in the early days, Li Lin had the idea of creating a cryptocurrency exchange. Thus, Huobi.com was born.

At the end of the third quarter of 2013, Huobi went online. Although there were many exchanges at that time, because it was in the Bitcoin bull market and Huobi used zero transaction fees to attract traffic, Huobi also took advantage of the momentum and became the largest Bitcoin trading platform in China. It is reported that Huobi has been online for 9 days, and the single-day transaction volume has reached 1 million yuan; half a year after the launch, the single-day transaction volume has exceeded 1.5 billion yuan. Subsequently, it received investment from Xu Xiaoping and others, and also received a round A investment of tens of millions of dollars from Sequoia Capital. Huobi has also won the trust of early users because of its great emphasis on user experience and user service. Li Lin will personally deal with some early user problems.

Since then, with the gradual growth of the encryption industry, Huobi, as an industry-leading trading platform, has continued to expand its products and services. The number of employees on the Huobi platform has grown to more than 2,000, and the annual profit is as high as billions of dollars. Li Lin personally ranked 531st in the "2019 Hurun Post-80s Self-made Rich List" released by the Hurun Research Institute on October 28, 2019, with assets of 7.5 billion yuan.

The turning point was on September 4, 2017, when the People's Bank of China, the Central Cyberspace Administration of China, the Ministry of Industry and Information Technology, the State Administration for Industry and Commerce, the China Banking Regulatory Commission, the China Securities Regulatory Commission and the China Insurance Regulatory Commission jointly issued the "Announcement on Preventing Financing Risks of Token Issuance", announcing that Position ICO as an illegal financial activity, prohibit ICO and new projects, and stock projects must be cleared within a limited time, that is, any token issuance and financing activities are clearly prohibited, and all ICO token trading platforms need to clear and close transactions before the end of the month. The September 4th ban allowed the virtual currency, which has been growing wildly, to be included in a strong financial regulatory framework.

At that time, Binance, which is also an encrypted asset trading platform, will choose to go overseas, and Huobi will also increase its efforts to expand overseas business. In addition to trading and asset management business, Huobi will also provide mining pools, wallets, investment, public welfare and other services for the global market , Build the upstream and downstream ecology of Huobi.

In August 2018, Huobi acquired Tongcheng Holdings, a company listed on the main board of Hong Kong, and later changed its name to Huobi Technology. In September 2018, Huobi obtained the Japanese No. 00007 exchange license through the acquisition of BitTrade, a Japanese licensed encrypted asset exchange, and then changed its name to Huobi Japan. In December of the same year, Huobi obtained Gibraltar's DLT license in Europe to expand the European market. According to previous media disclosures, Huobi also has local sub-stations in Indonesia, Argentina, Thailand and other countries. From 2018 to 2020, at the time of the last crypto winter, various exchanges launched fierce competitions. Binance won the first position relying on its overseas advantages, followed by Huobi. Although it continues to win overseas licenses, Huobi’s overseas business development is not satisfactory, and it has not found an excellent manager to win the local market. The domestic user market has always been the top priority of Huobi.

Regulation is the sword of Damocles hanging over the encryption industry, and risks may come at any time. In November 2020, Zhu Jiawei, COO of Huobi No. 2, was investigated, and then Li Lin was also rumored to be investigated by relevant departments in Shanxi. The turmoil in Shanxi laid the groundwork for Li Lin's retreat from Huobi.

On May 18, 2021, many domestic ministries and commissions issued the "Joint Announcement on Preventing Risks of Virtual Currency Hype and Trading". Issued the "Notice on Further Preventing and Handling the Risk of Hype in Virtual Currency Transactions" to severely crack down on virtual currency transactions and speculation, as well as trading platforms that provide virtual currency transaction services to mainland users.

The continuous tightening of policies and regulations has had a great impact on Huobi, which is dominated by domestic users, and Li Lin is thinking of quitting.

In September 2021, Huobi issued an announcement stating that the orderly withdrawal of users in mainland China will be completed on the premise of ensuring the safety of users' assets. Trading, on December 31, Huobi will delist OTC’s RMB exchange channel for encrypted assets.

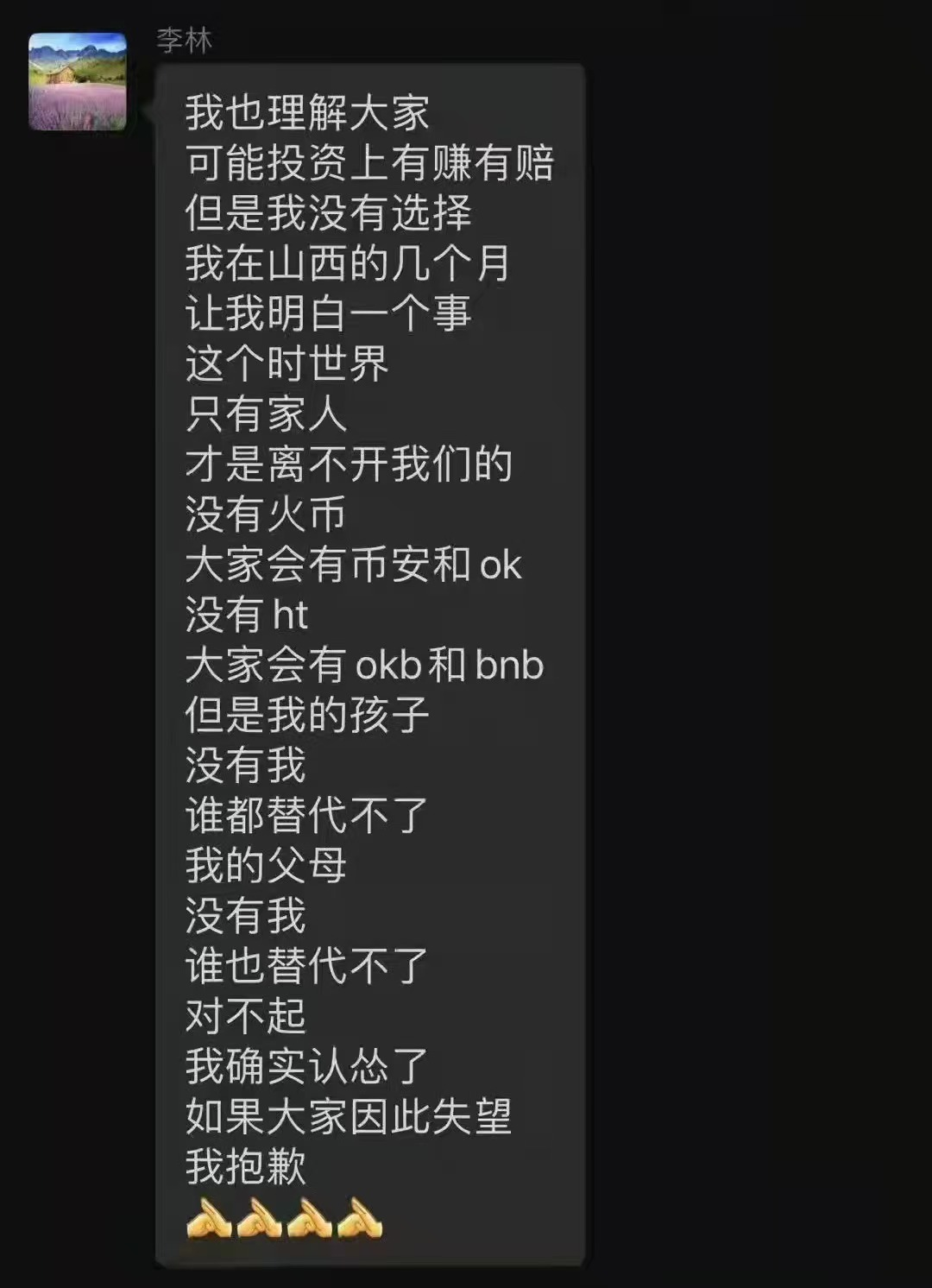

Li Lin also bluntly expressed his heart in the WeChat group of HT big households on October 6, 2021: Only family members cannot do without us. None can replace it. Some Huobi employees said that Li Lin values benevolence and righteousness very much, and it is precisely because of this that Li Lin and the founders of other exchanges made different decisions.

Huobi’s old employees called Li Lin Mu Muge. Today, Mu Mu was also pulled into Huobi’s resignation group. Li Lin said that Huobi’s latest job number is almost 9000. In the minds of many early employees, Li Lin is a trustworthy boss. According to Zhang Li, Brother Mu Mu is rightly called "Brother". Those who work with him, whether they are active or passive in recent years, he has reached out. Pull a hand. An old Huobi colleague next to me said to me: "If I have any major issues that I can't solve, I will ask him for help if I can't hold on. At least I believe that Boss Li can help arrange the funeral." However, as the company grew and the encryption industry developed rapidly, Li Lin also found that the team was not easy to lead. He also publicly stated that he did not understand enough about human nature, and often misjudged people and trusted people. Huobi’s early internal The corruption of executives and the disease of large enterprises have also become important factors restricting the development of Huobi in the later stage.

Today, the era of Li Lin as the top leader of the food chain in the field of encrypted assets has come to an end. According to data from Coinmarketcap, the spot trading volume of the Huobi platform has also dropped from No. 2 to No. 12. Without the "ceiling" restriction of Li Lin'anju's domestic development, Huobi may usher in a new opportunity for development.

Just as each round of bull market has its hot spots, each round of bull market also has its representatives emerging in endlessly. The wheel of history is moving forward, saying goodbye to Li Lin, the number one player in encryption, how Huobi, which is controlled by Baiyu Capital, will use its overseas accumulation to open up the situation, and whether it can return to the throne of the top three in the industry is worth looking forward to.