1. Project background

(1) Origin

The Aptos project originally originated from Facebook's Libra project. Libra's original goal was to build a world-wide stablecoin project backed by fiat currency. The goal was to become a world currency. Facebook gave up promoting the project due to policy resistance. Later, Facebook reorganized Libra and sold the project and changed its name to Diem. Currently, Diem is an open source project. Anyone can build projects on Diem, while Aptos is a public chain project developed on the basis of Diem, giving up the function of the stable currency part. , the characteristics of other parts are close to Diem.

On February 1, 2022, Diem, a stablecoin project under Meta (formerly Facebook), announced that it was acquired by Silvergate Capital Corporation to acquire the intellectual property rights and other assets of its payment network. These assets include the development and deployment of blockchain-based payment networks. and operational infrastructure and tools, etc.

On February 24, Aptos officially stated in its medium that after Meta confirmed the sale of Diem-related assets, Diem's original team will try to restart the project in the form of Aptos.

The Aptos team will build its new Layer 1 blockchain based on the original Libra white paper. But unlike Libra, the focus of the project will not be on cross-border payments, but on smart contracts.

secondary title

(2) Participating roles

1. Node: hardware that meets certain configuration conditions

3. Ordinary user: ordinary terminal

secondary title

(3) Project Roadmap

Aptos has formulated a two-year, four-round project operation roadmap:

In Q1 of 2022, launch the developer test network, cooperate with the Web3 developer community to collect feedback, and iterate on the development language and some issues;

In Q2 of 2022, the incentive test network will be opened, more testers will be introduced, and a bug bounty program will be launched to reward anyone who finds problems and improves technology;

From Q4 in 2022 to Q1 in 2023, an iterative version will be launched: laying out dynamic verifiers.

secondary title

(4) Project progress

On March 29, Binance Labs announced that it will make a strategic investment in Aptos Labs, the development team of Aptos, and will work closely with Aptos in development, code review, infrastructure construction, and hackathons.

On April 22, Aptos Labs, the development team of Aptos, once again announced a cooperation with Google Cloud. Developers can build Aptos nodes through Google Cloud. This can help developers develop without hardware. The team said that in the future, they will also use Validators join the cloud.

It announced its incentivized testnet roadmap on April 19.

On May 15th, Aptos announced the opening of the incentive testnet registration. Participating users need to use a valid Discord or GitHub account for identity verification, and deploy a validator to join the testnet. This round of registration will end at 5:00 on May 20, 2022, Beijing time.

The second-generation incentive testnet (Aptos Incentive Testnet 2: AIT2) has completed the test on July 22, 2022, and the effect is yet to be evaluated. The third-generation incentive testnet (AIT3) will be the last incentive testnet before the launch of the mainnet. AIT4 and other AITs will happen after Mainnet.

2. Project situation

secondary title

(1) Basic information

Aptos belongs to the first layer (Layer 1, the underlying blockchain), which can verify and complete transactions without the participation of other networks. The Aptos project is equivalent to rebuilding an enterprise similar to WeChat, Taobao, and Pinduoduo.

Official website:https://aptoslabs.com/

Official website:https://community.aptoslabs.com/

Community:https://www.odaily.news/post/5149061

secondary title

(2) Founding Team

The founders of Aptos, Mo Shaikh, Cheng Sicong (Avery Ching) and Mathieu Baudet are members of the founding team of Facebook's blockchain project Diem, of which Cheng Sicong is the founder of the underlying technical specifications.

Mo Shaikh, an entrepreneur and investor with extensive experience in private equity and venture capital focused on blockchain technology, finance and infrastructure, is currently facing a $1 billion lawsuit.

Cheng Sicong (Avery Ching) has worked as a chief software engineer at Facebook for more than 10 years, and was the technical director of the Novi team, an encryption platform under the original Meta, focusing on the development of various aspects of blockchain technology, while also maintaining the Diem blockchain.

Mathieu Baudet previously worked as an engineer at Meta and helped create the Diem blockchain. An expert in BFT consensus protocols, encryption protocols, and formal verification. As the chief researcher and engineer of Novi, he participated in the invention of FastPay and Zef protocols as a core figure. Both protocols speed up transactions by completely removing the mempool and minimizing interactions between validators.

Austin, former head of marketing at Solana, will join Aptos in August 2022 as Director of Ecosystem.

secondary title

(3) Core value of the project

The shortcomings of the underlying technology of the blockchain in terms of efficiency and security cannot be ignored. Since each reconstruction of the underlying technology of the blockchain requires the consent of the majority of people, the more and more prosperous applications are born on it, the more difficult it will be. Reach a consensus to resolve these issues.

It is a difficult paradox to form a more prosperous ecological bottom layer but more serious problems.

It is precisely because of this that they are determined to apply the technical research in the Facebook period to transform the bottom layer of Web3 from the three levels of security, reliability, and ease of use:

To improve reliability, Aptos uses the Byzantine Fault Tolerant consensus protocol developed at Facebook to maintain the fastest network speed in the blockchain network at all times.

In order to improve the ease of use, they also improved the data execution efficiency on the blockchain. The built-in Block-STM TPS of the project: the stand-alone performance can theoretically achieve 130,000 transactions per second with 32 cores.

secondary title

(4) Technology

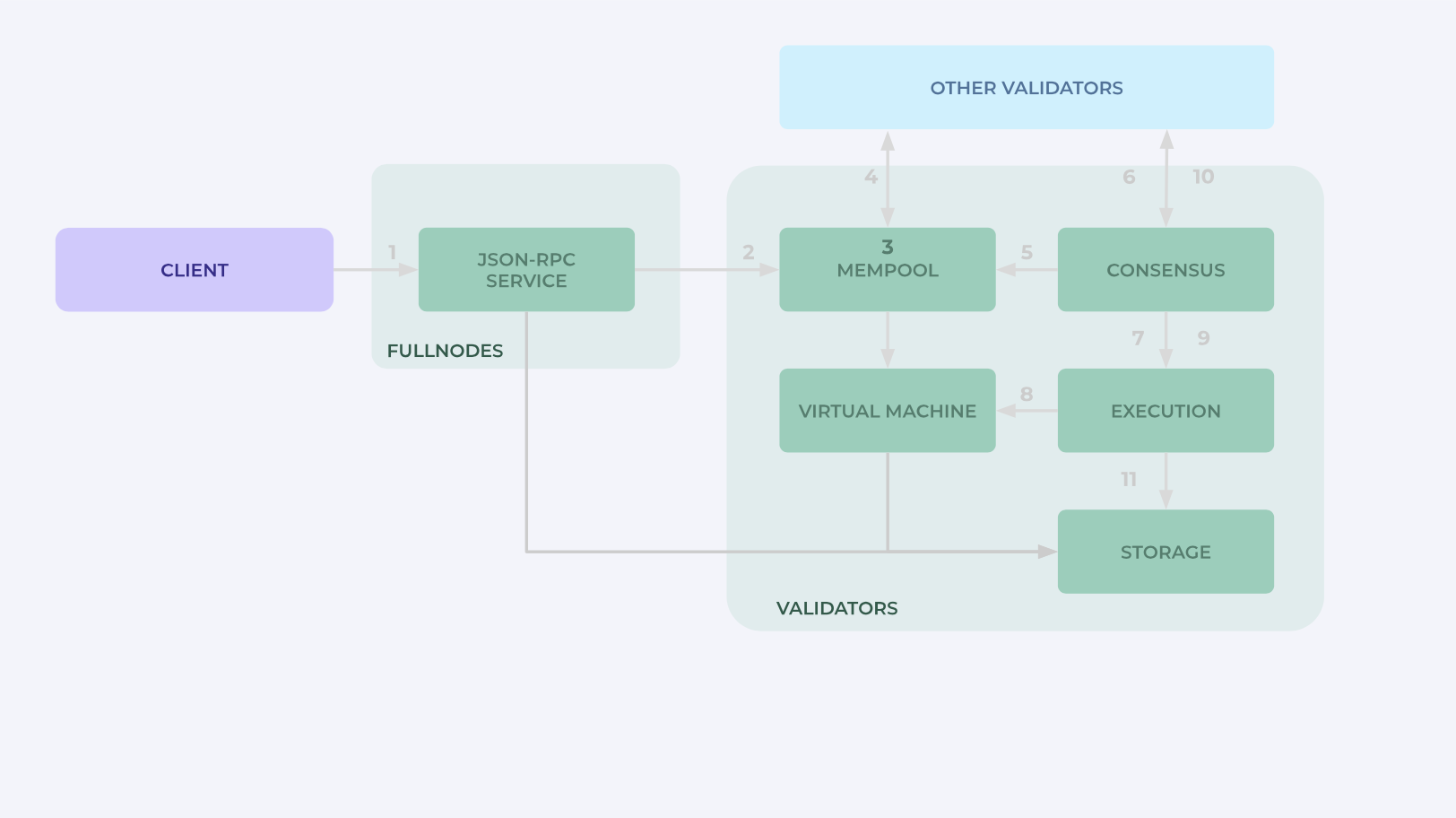

1. Consensus mechanism

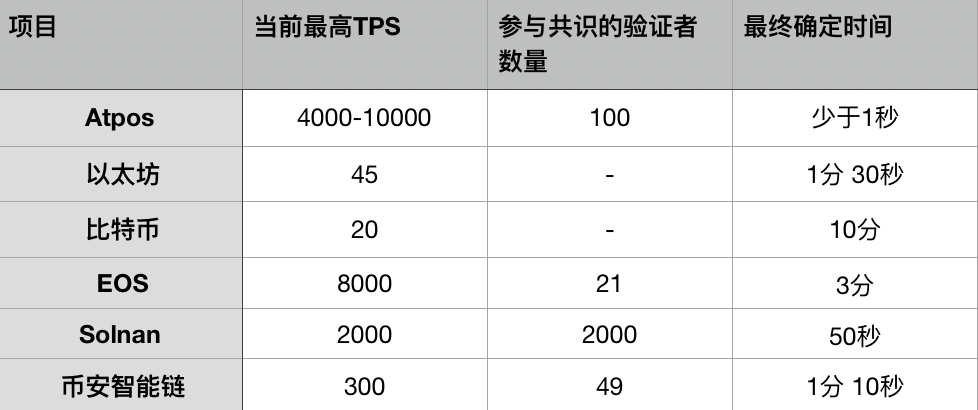

Aptos adopts DiemBFT, an improved Byzantine fault-tolerant consensus algorithm, evolved based on the HotStuff consensus algorithm. Aptos adopts a proof-of-stake consensus mechanism (POS). Currently, there are 100 main verifiers on the test network, which may be expanded later. However, due to the adoption of the proof-of-stake mechanism, it is expected that the number of master validators on the final mainnet will not exceed the range of "hundreds". In terms of execution speed, combined with the experience of other existing projects using the POS mechanism and the characteristics of the consensus algorithm of the HotStuff type, in the real environment, there will be problems such as network bottlenecks. Therefore, it is expected that the limit TPS of the Aptos main network will only Around 10,000 TPS.

Aptos nodes are synchronized to the latest state of the Aptos blockchain through two mechanisms: consensus or state synchronization. Validator nodes will use both consensus and state synchronization to stay up to date, while FullNodes use only state synchronization.

For example, a validator node will invoke state sync when it comes online for the first time or when it restarts (e.g. after being offline for a period of time). Once a validator has the latest state of the blockchain, it will start participating in consensus and rely entirely on consensus to stay up to date. FullNodes, however, continuously rely on state synchronization to get and stay up-to-date with blockchain growth.

Anyone can run a full node (FullNodes) operation, and FullNodes re-executes all transactions in the history of the Aptos blockchain. Full nodes replicate the entire state of the blockchain by synchronizing with upstream participants (e.g., other full nodes or validator nodes). In order to verify the blockchain state, FullNodes need to receive the transaction set signed by the validator and the root hash of the Merkle accumulator.

The full node has the same code as the validator node, but the full node does not participate in the blockchain consensus. (Full nodes do not have the consensus component Consensus)

Consensus (disabled in FullNodes): This component is responsible for ordering transaction blocks and agreeing on the execution results by participating in the consensus protocol with other validator nodes in the network.

Adopting such a consensus mechanism makes Aptos have good scalability, upgradeability and low transaction costs.

2. Programming language

Aptos uses the Move language, which is a Turing-complete smart contract language that provides secure and programmable capabilities for the Aptos blockchain. It is a smart contract development language designed for digital assets.

At the code level of smart contracts based on the Move language, the protection level of digital assets will be higher, and the restricted resource type - for users, "digital assets" cannot be copied at will, but can only be transferred. Hence the name.

The most critical new feature of Move is the custom resource type, and Move provides special security guarantees for resources. In Move, resource types are never copied, reused or discarded. The resource type can only be created or destroyed by the module that defines the type, that is, if the token is defined as a resource, then on the underlying virtual machine, it avoids various issues such as the infinite issuance of BUG at the level of the smart contract, the invalidation of the overflow check, etc. kind of loophole. Therefore, Move is very friendly to applications in the financial industry and makes smart contracts more secure.

DeFi may be the main battlefield and main force of Aptos. Of course, the benefits are accompanied by the resulting costs, and the restrictions on developers have increased accordingly.

Aptos chose to adopt a new language, which made it impossible for Ethereum-based projects to migrate directly, and the entire ecosystem needed to be rebuilt from scratch. If a project on Ethereum wants to migrate to Aptos, all the code can only be refactored, which is expected to take a long time to invest in the ecology. For Aptos, it will take a long time to develop the ecology. On the other hand, the result will be that most of the projects on Aptos will be new projects, which also means new tracks and new opportunities for practitioners in the blockchain industry.

Block-STM is a parallel execution engine for smart contracts built around the principles of software transactional memory. Transactions are grouped into blocks, and every execution of a block must produce the same deterministic result. Block-STM further enforces that the results are consistent with the execution of transactions in a preset order, and uses this order to dynamically detect dependencies to avoid conflicts during the execution of speculative transactions. At the heart of Block-STM is a novel, low-overhead cooperative scheduler for execution and verification tasks.

secondary title

(V) Financing

On March 15, 2022, Aptos completed a $200 million financing round led by a16z, Multicoin Capital, Katie Haun, 3 Arrows Capital, ParaFi Capital, IRONGREY, Hashed, Variant, Tiger Global, BlockTower, FTX Ventures, Paxos, Coinbase Ventures and others participated in the investment. In addition to the announced participating institutions, the payment giant PayPal also confirmed on May 31 that its venture capital arm, PayPal Ventures, was one of the participants in Aptos's $200 million financing round. 1 public chain project.

On March 29, Binance Labs announced that it will make a strategic investment in Aptos Labs, the development team of Aptos, and will work closely with Aptos in development, code review, infrastructure construction, and hackathons. On April 22, Aptos Labs, the development team of Aptos, once again announced a cooperation with Google Cloud. Developers can build Aptos nodes through Google Cloud. This can help developers develop without hardware. The team said that in the future, they will also use Validators join the cloud.

$350 million has been raised to date.

(6) Ecological development

text

Basic applications: wallet, blockchain browser

Platform applications: DEX, NFT DEX, mortgage lending, cross-chain bridge

Featured Apps:

1)Pontem Network

Projects that have been officially developed on the chain:

2)Econia

Pontem Network is a product development studio working with Aptos to build foundational dApps and other infrastructure such as dev tools, EVM, AMM, etc. Pontem aims to help developers who want to build projects on Aptos learn the Move programming language and incubate applications native to Move. At the same time, it is also building backend and customer-oriented products for the Aptos ecosystem. The Move VM developed by Pontem can achieve cross-chain Interoperable, compatible with blockchains such as Polkadot and Cosmos. Additionally, Pontem is developing Liquidswap, an automated market maker DEX on Aptos, modeled on Uniswap and Curve.

Econia is an ultra-parallel order book protocol running on the Aptos blockchain, designed for network-scale performance, aiming to provide equal global market access, utilizing Aptos' concurrency performance (Block-STM) to expand transaction pairs and internal transactions. According to its article:

3)Fewcha Wallet

Econia utilizes a key technological innovation of the Aptos blockchain, the so-called optimistic concurrent execution method, called Block-STM, to queue up orders in a single market, so-called paraqueues. In short, Amy's order on pair 1 can be queued at the same time as Bud's order on pair 1, and Econia's matching engine will periodically batch all transactions in all paraqueues, and then reorder and connect the buyers in chronological order. Home and seller, channel funds accordingly.

4)Martian Wallet

Fewcha Wallet is a non-custodial Web3.0 wallet on the Aptos blockchain. Its functions include supporting token listing and trading, as well as NFT minting and transfer. Fewcha Wallet released a beta version of the plug-in wallet in May this year. The plug-in wallet is available for download in the Chrome store and will be available on mobile devices in the third quarter of 2022. According to Fewcha's Twitter, the number of downloads of Fewcha Wallet reached 3,200 as of July 8. The picture below is the development roadmap of Fewcha Wallet.

5)Zaptos Finance

Martian Wallet is also a wallet on the Aptos chain, and its development team, Martian DAO, builds various products on the Aptos chain. Martian Wallet is a crypto wallet the team built using their version of the Aptos web3.js module, and is also building an NFT marketplace called Curiosity. Martian Wallet can be used to manage digital assets and access decentralized applications on the Aptos blockchain. It also supports the development of online minting of NFT on Aptos. Currently, the plug-in wallet on Chrome has been launched, and the ios version will be launched later.

6)Meeiro

Zaptos Finance is a liquid staking platform on the Aptos chain. The project is currently in a very early stage, and there is not much official information. Twitter hinted that Discord will be established.

The Meeiro platform is the first decentralized IDO launchpad on Aptos, which will introduce features such as decentralized fundraising, token staking, and governance voting to the Aptos ecosystem.

1)Protagonist

Aptos ecological members:

Protagonist is a $100 million crypto fund launched by Dylan Macalinao and Ian Macalinao, founders of Saber Labs, Solana's cross-chain decentralized exchange. Headquartered in Miami, Protagonist plans to invest in and incubate early-stage Web3 protocols and startups across verticals, including gaming, infrastructure, security, and privacy. Its current investment portfolio includes Layer 1 public chain Aptos, Solana-based NFT utility protocol Cardinal, and Digital banking platform Cogni et al.

2)Solrise Finance

Paymagic is an automated DAO rewards and payments platform that provides tools for sending bulk transfers, airdrops, vesting schedules, streaming payments, and more. Paymagic is not native to Aptos, but its tools will help Aptos-based DAO and NFT projects, among others.

3)Nutrios

Solrise Finance is a non-custodial digital asset management platform based on Solana. The product line developed by its team includes Solflare, the Solana wallet, and Pulse DEX, the KYC framework on Solana. Previously, the team's development focused on the Solana ecology, and the content built on the Aptos chain has not yet been disclosed.

4)AptosscanAt present, there is no official public information introduction.

5)Topaz.so:: Blockchain explorer by Aptos.

6)Dapptos View:The Aptos NFT marketplace, currently live in beta, is expected to launch in the third quarter of 2022.

7)Aptos Crown Masks:An open source platform aimed at building the Aptos ecosystem with education, news, job opportunities, metrics, and project dashboards. The team consists of four founders who are also coordinators of the Aptos French community. The first version has been delivered, and the platform will be updated in the third quarter, integrating the education part and the indicator part, and performing open source migration on Github.

8)ONTO Wallet:Aiming to be a generative NFT project with an Aptos theme, 100,000 generative free NFTs will be minted on the day of the Aptos mainnet launch.

9)AptoschinaIt is a decentralized cross-chain wallet, hatched by Ontology 4 years ago, and now it is an independent wallet, a multi-chain mobile + network wallet, ONTO helped the community start a project called Ivy Market, A bulk airdrop tool called Anydrop has also been developed.

10)Aptos Egg with Witch:: Aptos blockchain Chinese community, plans to launch Aptos Chinese Blockchain Explorer and Aptos cross-border payment project in the near future.

11) Aptos has not been officially launched yet. At present, there are only 4 ecological applications with more detailed introductions and development roadmaps, Pontem Network, Econia, Fewcha Wallet, and Martian Wallet, focusing on wallet infrastructure and DEX applications. aspect.

3. Economic Model

secondary title

(1) Value capture of the public chain

The industry draws on the OSI model (Open System Interconnection Reference Model, Open System Interconnection Communication Reference Model) of the computer network communication architecture, and divides the blockchain logical architecture into three layers—Layer0, Layer1, and Layer2. Layer 1 roughly includes data layer, consensus layer and incentive layer. The role of layer 1 public chain tokens is to act on the data layer, consensus layer and incentive layer.

1、MEV

Generally speaking, the existence of public chain tokens has two values: MEV and revenue.

In order to establish consensus and resist attacks, Layer 1 needs to make this underlying public chain resistant to 51% attacks. Tokens exist to maximize the cost of attacking the network.

We were able to compare the security of blockchains by calculating the implementation cost of a 51% attack. In order to implement a 51% attack, an attacker needs to spend more than the blockchain security budget (Security Budget).

Security budget = total network value * inflation rate + transaction fee.

From this simple numerical calculation we can see that security depends on the market capitalization of the network. Formally due to the concept of security budget, a public chain starts to operate, and the ecology is established, and its tokens must be given a certain value, otherwise it is not enough to resist MEV attacks.

Many of L1's tokens exhibit the characteristics of capital assets, which can continue to generate real income for stakers and holders. Similar to an indefinite bond like ETH pledged - future cash flow is issued in the form of the deflationary currency ETH.

4. Market competition

(1) Status of the track

text

The development of DeFi and NFT has made ETH a great success. At the same time, the rapid development of the ETH network has also aggravated the problem of ETH capacity limitations. The network continues to be congested, and users face high gas fees.

As of today, solutions to Ethereum’s lack of scalability include:

Increase block size: short-term band-aid solution; may compromise security as it makes blockchain node software more resource-intensive.

L2 Rollup: Optimistic (fraud proofs - e.g. Optimism, Arbitrum), zero knowledge ("ZK"; validity proofs - Starkware, Immutable X, LoopRing, zkSync).

L2 sidechain: Polygon (fka Matic Network; note the use of Plasma as well as Optimistic and ZK rollups, but technically runs in parallel with the mainnet, and has its own consensus mechanism and security framework that does not depend on L1, so it is different from the above L2 volume) .

ETH 2.0: Change the architecture of Ethereum from a single chain to a multi-chain, initially by implementing sharding; now data sharing is being considered. The consensus mechanism of Ethereum will also change from Proof of Work to PoS.

With the emergence of a large number of applications, there is a huge demand for eth network overflow, and new layer 1 public chains are born from this, such as BSC, Solana, Avalanche, Algorand, Cosmos, Fantom, Near, Polygon, Terra, etc.

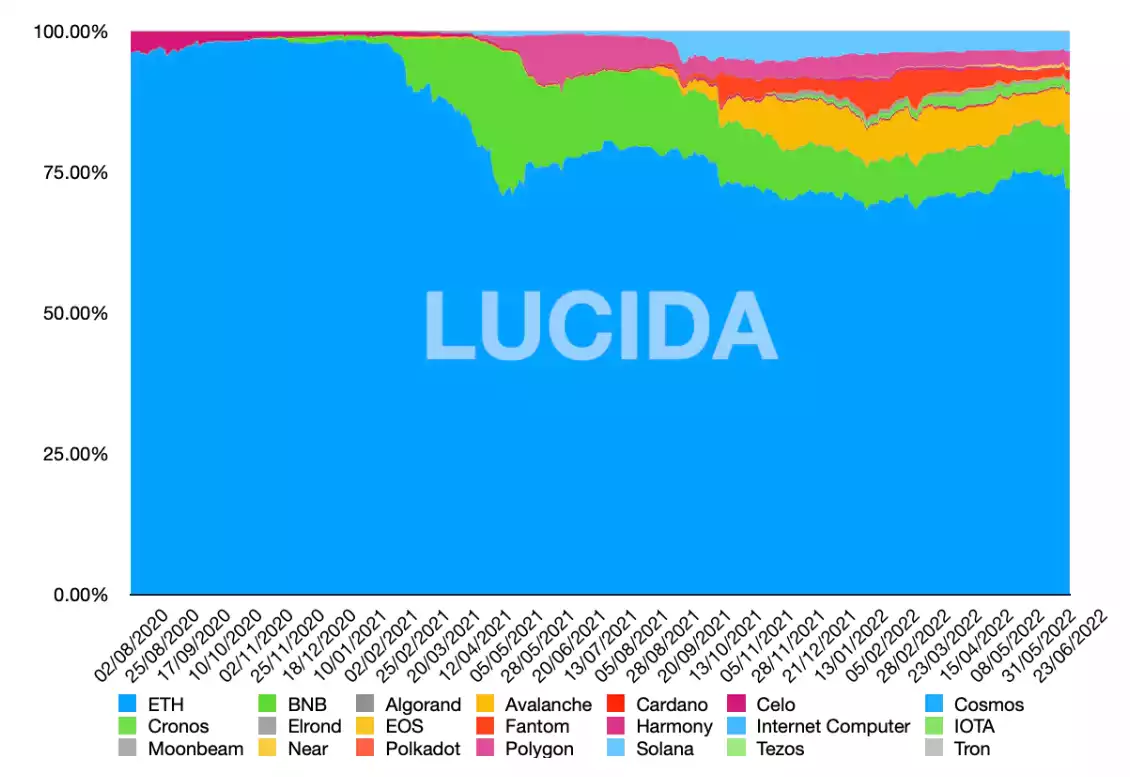

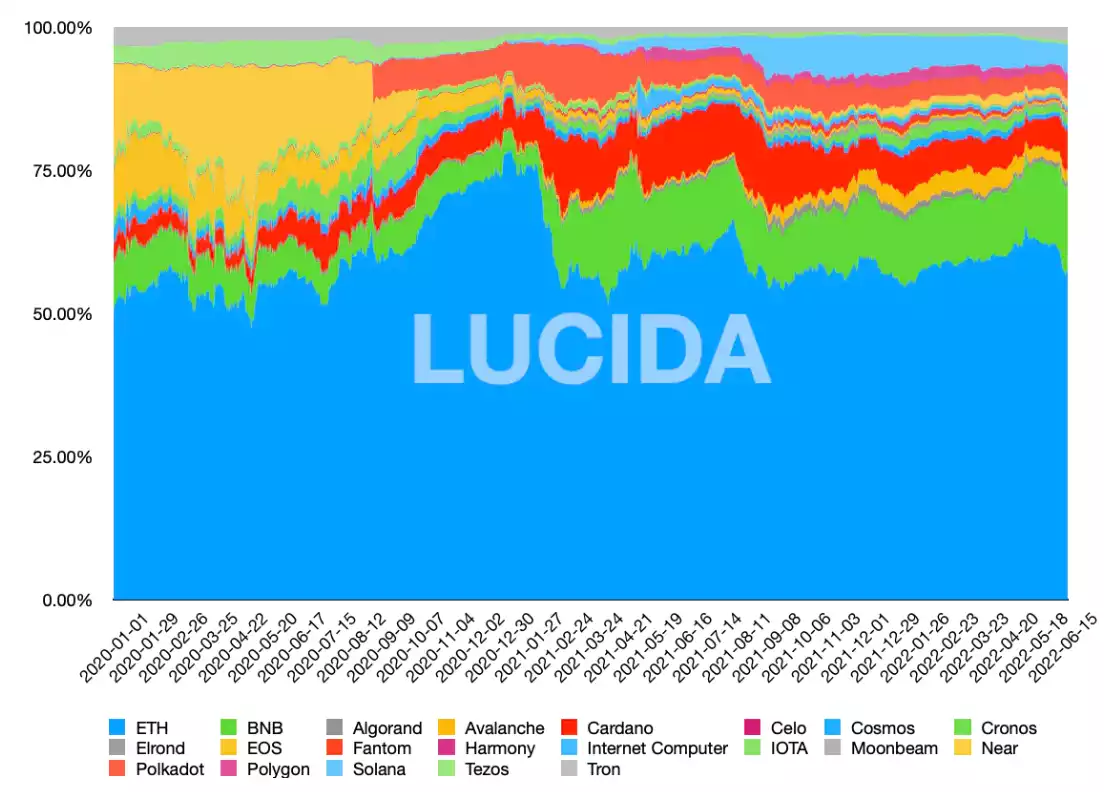

In the public chain track, Ethereum is the well-deserved leader, and has always maintained a share of more than 50%. Starting from February 2021, with the rapid development of BSC, the market capitalization ratio and ecological TVL ratio of ETH in the public chain track will decrease rapidly, and the development of other public chains will continue to squeeze the dominance of Ethereum. Vitalik Buterin also tweeted that "the future will be multi-chain". It can be expected that in the future, the smart contract platform public chain track will have a pattern of one super (Ethereum) and more (BSC, Solana, Avalanche, etc.).

Stacked chart of TVL ratio of major public chains Source: Lucida

image description

The stacked chart of the market capitalization of major public chains Source: Lucida

2. Track development driving logic

The emergence of multi-chain competition is caused by two reasons: the growth of demand and the lack of scalability of ETH.

On the one hand, after the DeFi Summer in June 2020, the demand for Ethereum interaction has increased significantly, leading to a surge in Ethereum Gas; in 2021, NFT will relay DeFi, which once again detonated the demand for on-chain transactions on Ethereum.

On the other hand, with the prosperity and development of DeFi and NFT, the gas fee of Ethereum has soared, and there is even a glimpse of congestion. However, Ethereum's 2.0 solution has yet to land. Spillover occurs when Ethereum cannot meet the growing demand.

Except for a few public chains (solana), the subsequent public chains are basically developed along the formula of "compatible with EVM/cross-chain bridge + ecological incentives".

(2) Comparison with the public chain Sui in the same period At present, Aptos' Github code warehouse has obtained 3000+ Stars. Due to the active development period, thousands of commits and hundreds of code contributors have been submitted in the past month. Competitor Sui (1000+ Star) has more attention. Except that the token model has not been released to the outside world, the project is basically in a usable state.

5. Potential risk points

secondary title

The decrease in the number of users is the main reason for the failure of a project. If Aptos fails to capture customer attention in time during the market development process, the project may face the risk of failure. However, Aptos raised funds from multiple parties, and the publicity was strong enough, which made the decline in user popularity less likely.

secondary title

(2) Code implementation risk

But even if there are loopholes, like most POS public chains, they can be repaired in a timely manner through community communication.

secondary title

first level title

6. Conclusion

6. Conclusion

The project has experienced many years of development since Libra and Diem. The technology is mature, the development is stable, and the team members have a strong background. The highlight of the project is that the original Libra/Diem team members are the core team members of the project and have received a lot of capital investment. It is a project with high certainty. After giving up the goal of becoming a stable currency in the world, it turns to focus on smart contract functions.

At present, the financing valuation of Aptos is already relatively high, and according to the current valuation, it can already be ranked in the Top 30. The project is still "replaying the same old tune" and still inseparable from faster smart contract execution. Speed is one of the important selling points, similar to previous projects: Polkadot, Solana, EOS, facing the competition of Ethereum 2.0 and L2, the market direction Not sure yet.

Aptos' position is: to oppose the status quo of centralized enterprises controlling various assets, and to truly let data belong to users, which is a common position of decentralized projects. For example, a person cannot actually own his assets in the game, which is considered a defect. As long as one creates something of value in the context of a virtual world, people will find ways to transact it, preferably explicitly as part of the game, and this may be a core driver of projects like GameFi.

first level title

References

Referenceshttps://aptos.dev/

Cornell University Algorithm White Paper:Block-STM: Scaling Blockchain Execution by Turning Ordering Curse to a Performance Blessing

Cornell University:Aptos financing situation:

Aptos Closes $150M Funding Led by FTX Ventures and Jump CryptoGithub related information (video introduction):

5.3)Aptos2: Running a local test network

5.4)Aptos3: run full node source code mode

5.5)Aptos4: run full node docker mode

5.6)Aptos5: The first transfer transaction Python

5.7)Aptos6: The first Move module

Aptos7: The lifecycle of a transactionWang Yuquan:

Consensus Algorithmshttps://hello2mao.github.io/2019/12/01/libra-chinese-doc/

The latest progress of the Aptos projectLibra_WhitePaperV2_April2020.pdf

white paper

Special thanks

Founder of Block Prophecy Capital: Dr. Wang Huilin

Former editor-in-chief of Lianwen: LIU FENG

Basics Capital:Larry Shi

ChainFeedsxyz: Pan Zhixiong

Freelance investors: EASY RIDER, Alex

This research report comes from KAST Ventures. If you have any comments on this research report, please contact via Telegram: @AndyTernary.