The blue-chip NFT represented by BAYC is experiencing a chain reaction of liquidation.

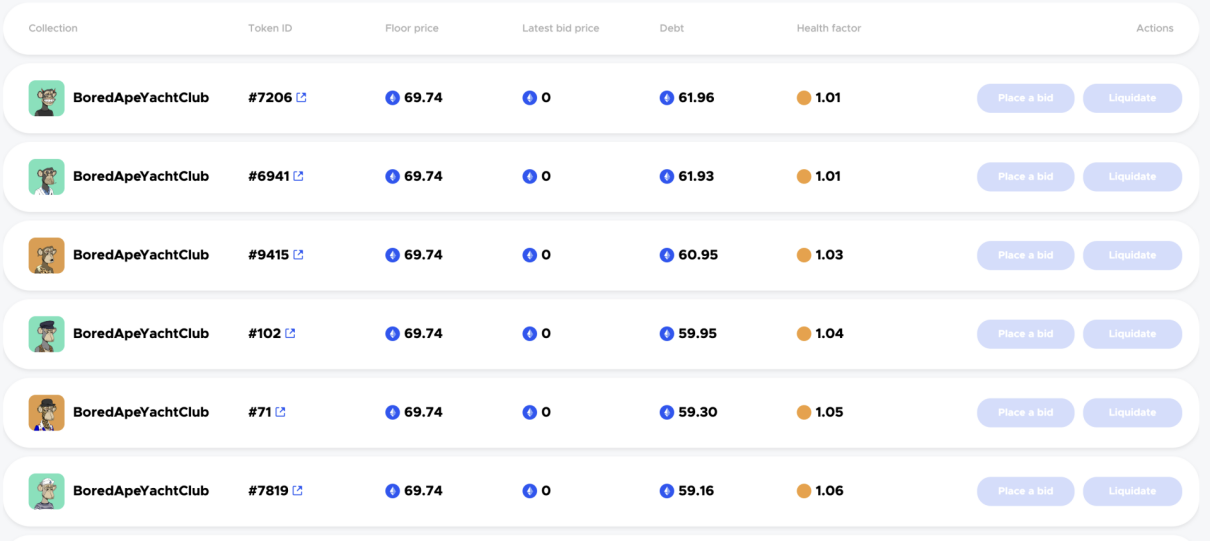

Recently, various targets in the NFT market have continued to decline. On August 19, the NFT mortgage lending platform BendDAO liquidated and auctioned BAYC for the first time. In the last three days, 28 BAYC and 28 MAYC were liquidated, and the liquidation lowered the floor price of NFT and caused other NFT collaterals to approach the liquidation threshold, which triggered a domino effect. On August 22, there were 20 BAYCs on the BendDAO platform with health factors less than 1.1. If they were less than 1, they would enter the auction stage. From the perspective of market dynamics, there are only a handful of users who are willing to participate in the auction.

Why are there currently a large number of mortgaged NFTs that have liquidation risks, but few people participate in liquidation auctions?

From the perspective of the borrower, the data on August 22 shows that the annualized interest rate of the BendDAO agreement loan reached 103.71%, which means that the borrower needs to repay 100% of the interest to get the original NFT, which directly reduces the borrower’s repayment cost. motivation. Instead of facing the risk of NFT assets continuing to decline after redeeming NFT, it is better to completely "suck" and wait for liquidation.

When the craze faded briefly, no one is willing to participate in the auction to take over the hot NFT. On the one hand, the market sentiment is pessimistic, the overall market is down, and NFT assets denominated in ETH have fallen even more. Moreover, according to BendDAO's mechanism, the funds of auction participants need to be locked for 48 hours. Under the current market conditions, no one is willing to "take money out of the fire". On the other hand, according to regulations, the auction bid must be greater than 95% of the NFT floor price. For the auctioneer, it seems that there is not much room for profit. According to the mechanism of BendDAO, if the auction is not completed in the end, the platform will bear the floating loss or the borrower will repay the debt in the future.

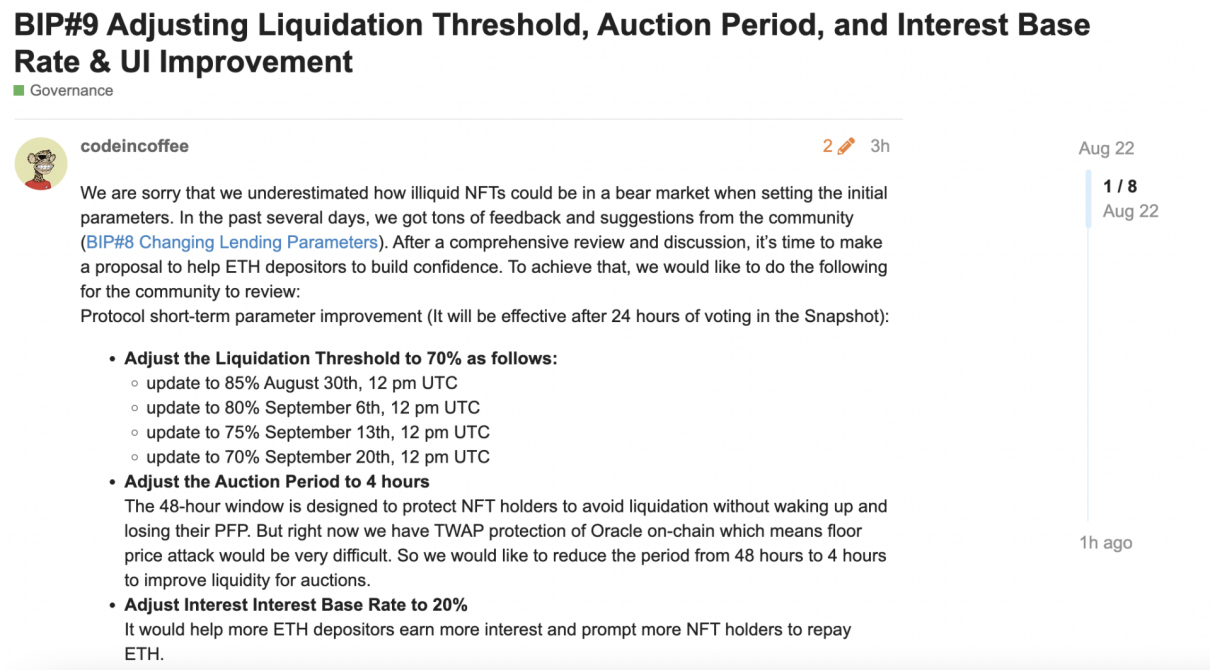

Based on the status quo, the BendDAO community released a new proposal on August 22BIP#9, I want to solve the liquidity crisis by modifying some parameters. Including adjusting the liquidation threshold to 70%, adjusting the auction cycle to 4 hours, adjusting the interest base rate to 20%, and the BendDAO community can vote to decide how to deal with bad debts. Of course, there are also discussions in the community that although the proposal may give depositors some confidence in overcollateralization, it may lead to more NFTs being hastily liquidated.

In addition, the number of ETH floating bad debts will be displayed in the user interface and the total amount of interest will be displayed on the home page. Improvements at the protocol level in the future include support for collateral quotes in BendDAO, contacting as many trading platforms as possible to support collateral pending orders, etc.

Reflect on NFT-Fi, is it a mechanism loophole or a false demand

Compared with the liquidity crisis facing BendDAO at this time, people began to think about whether NFT lending is a fake demand. I think that since the NFT market was popularized by blue chips such as BAYC in the middle of last year, people in the market have been discussing the NFT lending market.

NFT holders can borrow liquidity to improve capital utilization; for users who provide liquidity, they can earn interest and earn extra rewards. The requirements are simple and clear, and many teams have built and launched products. However, due to the peer-to-peer model of lending logic and the uncertainty of liquidation results, lending efficiency is extremely low, and few people care about it.

In response to the liquidity crisis in BendDAO, Mindao, the founder of DForce, tweeted that the loan utilization rate in the BendDAO agreement is almost 100%, pushing both supply and demand to the peak. The fundamental problem with pool-based NFT lending is the mismatch between assets (illiquid NFTs) and liabilities (ETH deposited on demand).

We can imagine a bank that has demand deposits as their only source of funding, and their assets are all real estate loans (or loans to art collectors). In the financial world, such a banking model does not work.

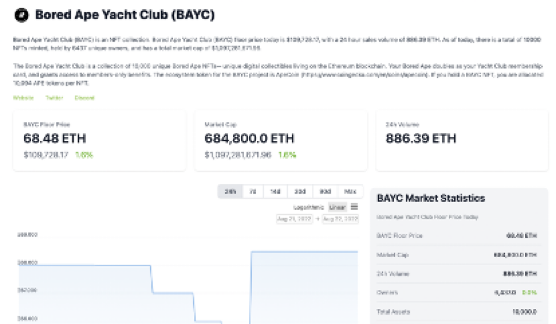

Take the blue-chip NFT BAYC as an example. It is the largest NFT with a market value of US$1 billion, but its daily trading volume is only US$1.4 million, and its turnover rate is only 0.14%. What is the turnover rate? About 5-10%.

Essentially, BYAC is an irreplaceable long-tail asset in the DeFi standard. If you're using on-demand liabilities to fund these assets, you're bound to go wrong one way or another. There are many such failed attempts in DeFi, such as Fuse(Rari)/Kashi (Sushi)/Beta.

Regarding the current problems faced by BendDAO, Mindao stated that there is no easy solution. BendDAO needs to take interim action to shift the interest rate curve and lower the borrowing rate so that the debt does not reach a level where the borrower has no incentive to repay. This one happens to be among the latest proposals put forward by the BendDAO community.

first level title

Explain the mechanism of BendDAO in detail, it has skyrocketed 300 times when it started

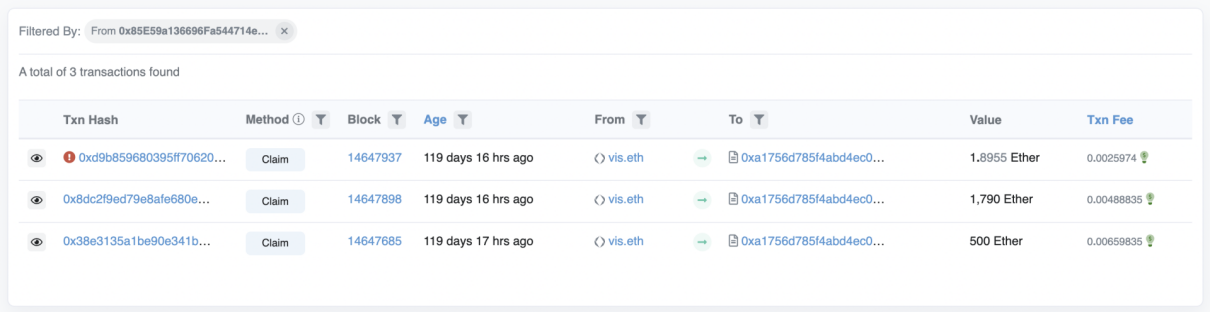

BendDAO’s general entry into the field of view of the encryption circle stems from the FOMO when he started. Because he was booked by a giant whale with 2290ETH during the IFO, the IFO that was originally planned to last for 90 days was brought forward to April 25, and it was the first time that it was widely concerned by the market. . It is reported that the IFO sale price is 1 ETH, and 333,333 BENDs can be obtained. The total planned fundraising is 3,000 ETH. The sale method is a fair sale, everyone can participate, and there is no upper limit. 66% of the raised ETH will be used for the ETH lending pool on Bend, and 34% will be used for the development of the Bend protocol.

On the night when IFO ended, the BEND token skyrocketed, and the price of the currency skyrocketed from a minimum of 0.006 to a maximum of 0.18 USDT, an increase of 3000%. Although such an increase at that time was mainly due to the short-term FOMO in the market due to the fact that the official did not add a liquidity pool, BendDAO also became the focus of the market for a while.

There are different opinions in the encryption community, "the NFT lending market finally has a player who can play", calling Benddao the AAVE of the NFT world, also known as the NFT bank.

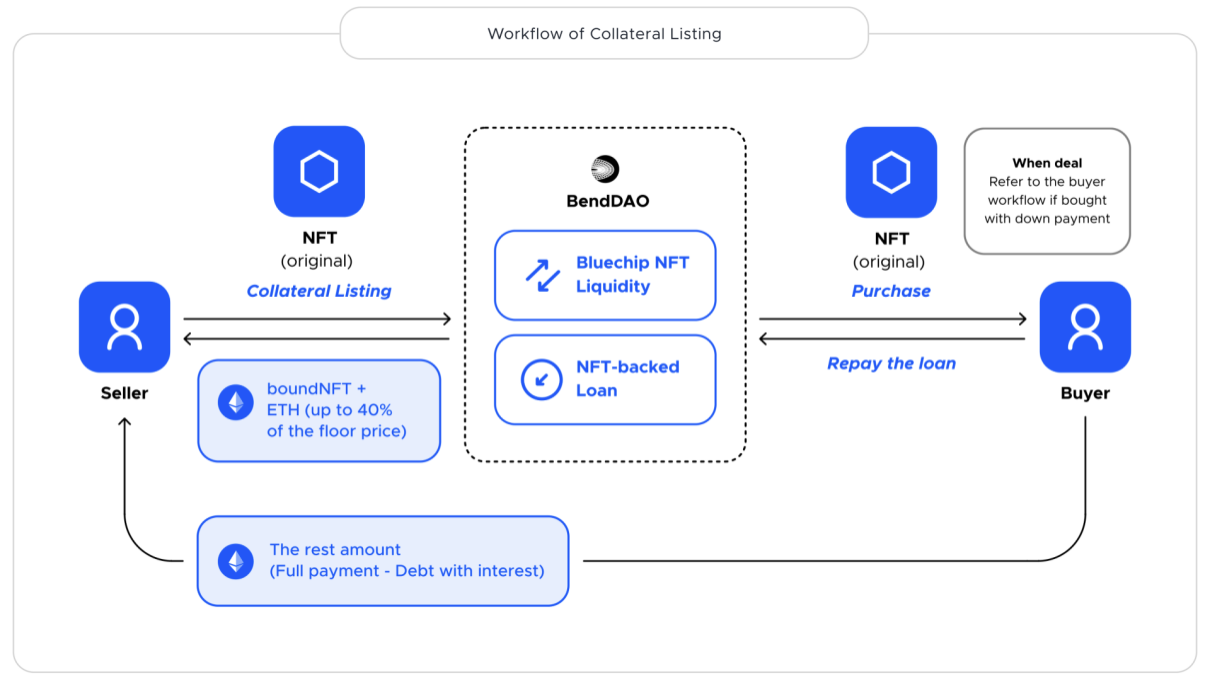

From the business logic, for the seller, blue-chip NFT holders/sellers/borrowers can instantly obtain 40% of the liquidity of the NFT floor price by listing the NFT as a collateral asset. When a borrower deposits an NFT in BendDAO, a boundNFT is minted as a debt NFT. The boundNFT has the same metadata and token ID as the original NFT you own, which means you can use the boundNFT in your wallet and no one can steal your boundNFT as it is non-transferable and non-applicable.

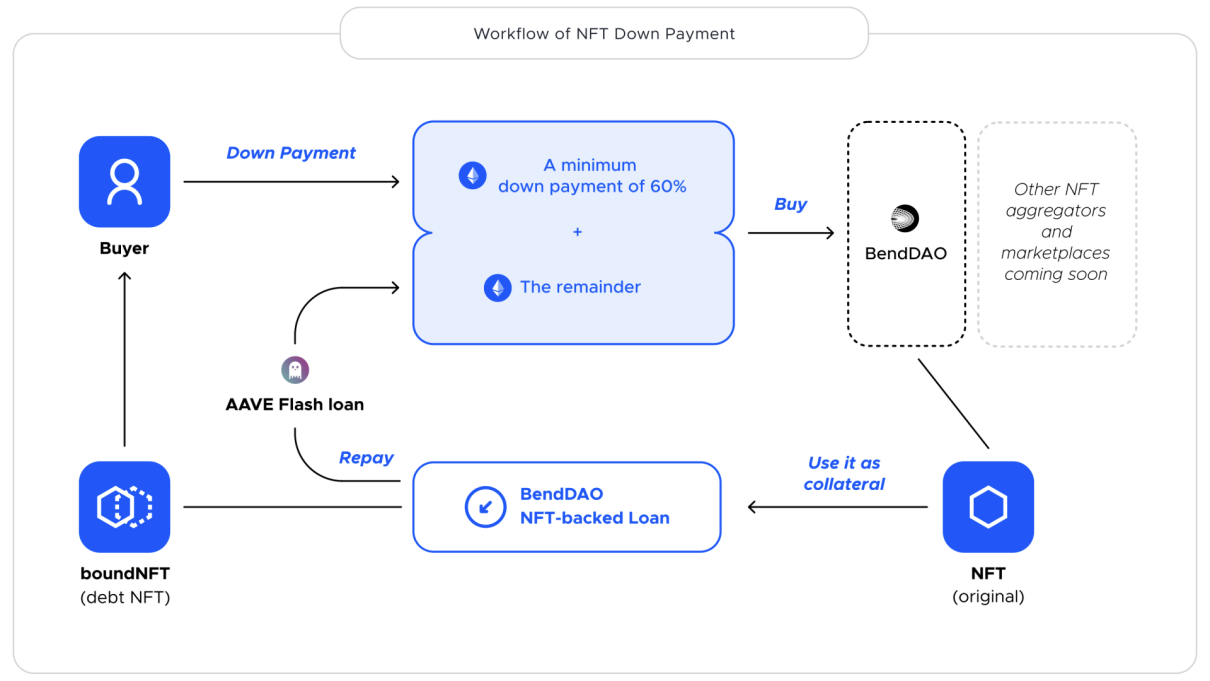

For buyers, it can be understood as NFT down payment. The buyer can pay a minimum down payment of 60% according to the actual price, buy blue chip NFT, and pay the rest from AAVE flash loan at the same time. The borrowed amount of Flash Loans will be repaid through NFT loans on BendDAO. The buyer will automatically become the borrower and make a down payment. Borrowers can also list their mortgaged NFT for sale.

At the same time, the official set a 7-day time lock for all boundNFT agreement contracts, and a 24-hour time lock for all BendDAO lending agreement contracts.

Whether based on marketing or product, BendDAO has received positive feedback from the market after its launch. The NFT market is booming, and holders increase their leverage to the limit, and do not give up every possible liquidity, making BendDAO a favorite of blue chip holders.

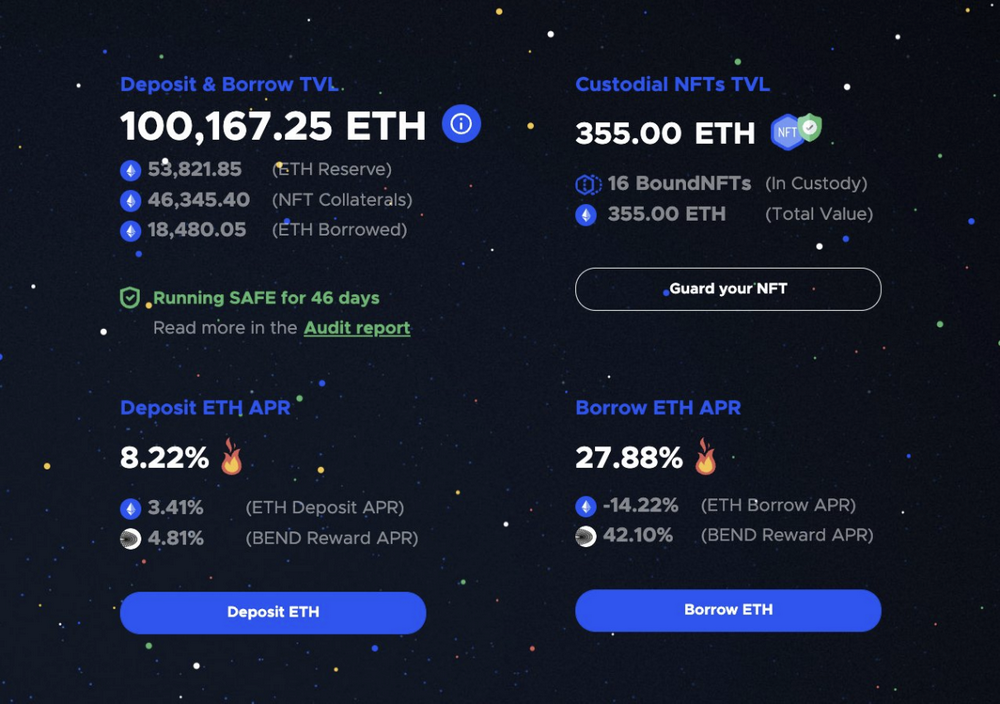

On April 24, BendDAO tweeted that its contract address has become the largest holding address of MAYC and the fifth largest holding address of BAYC. BendDAO has a total of 496 NFT mortgages, and the main positions are MAYC (187) and BAYC (133), whose mortgage value accounts for 22.5% and 60.2% of the total NFT mortgage value respectively. On May 5, that is, 46 days after BendDAO went online, the total lock-up value of the agreement exceeded 100,000 ETH (about 294 million US dollars according to the price of ETH at that time).

Since then, with the sharp decline in the cryptocurrency market, the market value of the USDT standard in the NFT market has declined sharply. The NFT market has encountered a double kill by Davis, and participants have stepped on the market. As a result, very few investors are willing to take over, which also makes BendDAO encounter a liquidity crisis.

As for whether BendDAO can successfully survive this crisis, it is not yet known. But the bear market is just a good time to test whether a product is just needed and whether the protocol design is effective or not. Through BendDAO, we can also observe how the combination of NFT and DeFi should go.